|

市场调查报告书

商品编码

1441681

UCaaS(统一通讯即服务):市场占有率分析、产业趋势与统计、成长预测(2024-2029)Unified Communication-as-a-Service (UCaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

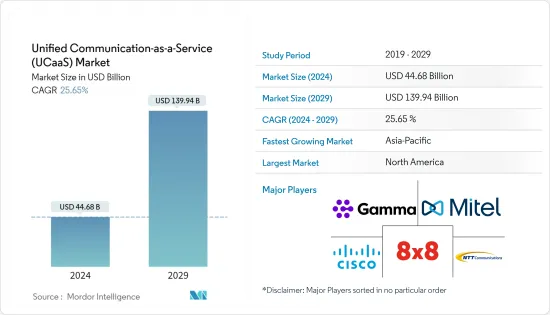

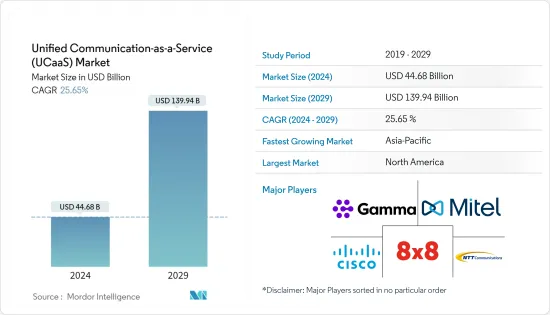

UCaaS(统一通讯即服务)市场规模预计到 2024 年为 446.8 亿美元,预计到 2029 年将达到 1399.4 亿美元,预测期内(2024 年)复合年增长率将达到 25.65% 2029)。

在家工作(WFH) 模式的日益增长趋势迫使雇主重新评估其营运成本并使用 UCaaS 解决方案以避免边际收益递减。根据欧盟统计局的数据,2022 年欧盟定期在家工作的人数比例为 12.4%。在中东欧地区,爱沙尼亚在家工作的工人比例最高,其次是拉脱维亚。在罗马尼亚,只有 1.4% 的员工在家工作。

主要亮点

- UCaaS(统一通讯即服务)是云端基础的服务,它将各种通讯和协作应用程式整合到一个平台中。 UCaaS 让企业能够简化沟通管道、降低成本并提高生产力。

- UCaaS 提供多种通讯工具,包括音讯和视讯会议、通讯、电子邮件和协作软体。该平台允许用户使用网路连线从任何地方、在任何装置上存取这些工具。它消除了昂贵的硬体、软体和维护成本,使其成为各种规模企业的有吸引力的选择。例如,2023 年 5 月,印度政府向网路会议公司 Zoom Video Communications 授予了统一许可证,其中包括涵盖印度全境、国内远距(NLD) 和国际远距(ILD) 的存取权限。这将使我们能够向国内企业提供 Zoom Phone,这是一种云端基础的专用交换机(PBX) 服务。

- 此外,UCaaS 让企业随时随地透过云端管理员工之间的统一协作。例如,TTata Communications 最近推出了 Tata Communications Global Rapide,这是一种面向企业的端到端託管整合通讯即即服务(UCaaS),使企业能够为员工提供数位化的先进智慧协作工具。这款独特的产品使塔塔通讯能够为所有国际企业的数位优先、云端优先整合通讯需求提供一站式解决方案。类似解决方案供应商的创新和努力预计将有助于市场在大流行期间成长。

- 此外,5G 技术和高速互联网的引入预计将在预测期内提振市场,因为视讯和音讯会议需要高速和低延迟的连接,而 5G 网路可以轻鬆提供这些连接。据 5G Americas 称,截至 2023 年,全球第五代 (5G) 用户预计将达到 19 亿。预计到 2024 年,这一数字将增至 28 亿,到 2027 年将增至 59 亿。

- 此外,随着 BYOD 趋势和其他行动解决方案的采用迅速增加,我们预计 UCaaS 解决方案将进一步采用。自带设备 (BYOD) 已成为这个新时代的主要趋势,为跨组织和全球工作的员工提供弹性和轻鬆存取网路的能力,从而提高职场的生产力。例如,据思科称,采用 BYOD 政策的公司每年可为每位员工平均节省 350 美元。

- 智慧型行动小工具的增加和关联工具的改进正在增强远端工作和劳动力分配策略。同样,企业在其整个营业场所都采用了「自带设备」(BYOD) 规则。这种方法可以帮助组织提高效率、改善内部互动并消除价格差异。预计这将最终推动预测期内整合通讯即服务市场的成长。

- 此外,过去十年对整合通讯的需求有所增加。自大流行爆发以来,这一数字出现了异常增长。 COVID-19 的感染疾病使数位转型成为企业生存、发展和确保市场领导地位的迫切要求。随时随地整合、流畅、安全地存取资料和应用程式的需求呈指数级增长。

UCaaS(统一通讯即服务)市场趋势

医疗保健领域市场预计高成长

- 医疗保健领域的 UCaaS 已被证明是一种交付模式,其中各种通讯和协作服务和应用程式外包给第三方供应商,并透过整个医疗保健行业的网路进行交付。 UCaaS 技术包括线上状态技术、视讯会议、企业通讯和语音通信。

- 经济高效的云端基础的解决方案的出现导致医疗保健提供者以最少的 IT 预算越来越多地采用该解决方案。透过实施基于订阅的联合通讯服务,医疗保健客服中心建立了一个 PBX 系统,可以无缝处理来自不同站点的多个客户请求。

- 云端基础的UCaaS(统一通讯即服务)是一种增强业务分配的数位转型。医疗保健领域的 UCaaS 是一种传输模型,其中各种合作伙伴关係、通讯应用程式和管理被转移到外部供应商,并透过网路在整个医疗保健部门进行通讯。

- 医疗保健产业投资的增加可能会进一步推动对所研究市场的需求。例如,根据 StartUp Health 的数据,2022 年 10 项最大的数位医疗投资中有 8 项是在美国进行的。今年,美国公司Ultima Genomics获得了6亿美元的投资,成为最重要的交易。涉及非美国公司的最大投资是 Doctolib,该公司获得了价值 5.49 亿美元的合约。

- 该领域的云端采用也为统一通讯公司提供了在订阅基础上提供云端服务的空间,例如迁移传统上在客户端伺服器架构上运行的 EHR 系统和其他企业应用程式。该地区的大多数云端通讯供应商为每位客户提供云端基础的高端安全性,消除了障碍并使医疗保健产业成为 UCaaS 的潜在市场。例如,着名的 UCaaS 供应商 8x8 提供的 UC 解决方案使医疗保健组织能够遵守第三方检验的HIPAA、PCI-DSS 3.1、FISMA/FIPS 140-2 和安全港法规。

- 健康保险互通性和责任法案的规定使通讯平台的设计和保护变得复杂。这家领先的云端通讯供应商为每位客户提供云端基础的高端安全性,以保护病患资讯并协助 IT 满足严格的合规性要求。 UCaaS 与组织移动性保持一致,并提供多种优势,例如即时通讯以即时查找和连接看护者、更快的即时连接以及有吸引力的呼叫路由(无论位置如何)。帮助医疗保健组织建立规则,以减少整个急诊室的干扰,直到外科手术。

- 人工智慧的日益普及极大地帮助组织实现了数位转型目标。人工智慧驱动的工具现在允许组织直观地记录通话,方便转录,并智慧追踪发言者以了解用户需求并提供相关服务。

预计北美将占据重要市场占有率

- 该地区对所研究市场的成长做出了重大贡献,这主要是由于最近移动性和 IT 消费化的激增导致 5G 连接的爆炸式增长。这使得企业能够部署IP电话和 UCaaS,使远端员工能够执行内部模拟。有办公室工作经验。

- 在美国,零售、银行、金融、医疗保健、资讯科技和电讯等终端用户产业无论身在何处,都需要更直接、无缝的通讯、语音、视讯和聊天体验。为了满足这一需求,企业正在寻找来自他们可以信赖的单一供应商的整合部署和管理解决方案来满足其 UCC 要求。 5G 的出现将允许远端连接工具整合到单一 UCaaS 平台中。

- 美国是5G市场的主要创新者和投资者之一,正在增加对5G部署的投资。该国的通讯部门占全球 5G 技术消费的很大一部分。 Verizon、AT&T、T-Mobile等通讯业者也与华为、三星、爱立信、诺基亚、中兴等网路设备供应商签署了数十亿美元的协议,在该国建设5G网路基础设施。例如,爱立信预计,到2026年,美国5G用户预计将超过1.95亿,到2029年,5G可能占美国行动市场总量的约71.5%。

- CTIA称,这种快速成长将为美国5G经济打造平台,带动2,750亿美元投资,创造300万个就业岗位,并为5,000亿美元经济成长做出重大贡献。

- Verizon 为拉斯维加斯、底特律、亚特兰大和旧金山的新消费者提供 10 年价格锁定、无资料限制以及 100 至 400 Mbps 的速率。该公司的主要目标是在全国范围内扩大其 5G 企业互联网业务,并在该国提供全套服务,包括视讯协作功能和边缘运算。

- 此外,2022 年10 月,UCaaS 领先供应商RingLogix 宣布收购MK Capital,以提高其作为成长最快的软体公司之一的地位,使MSP 能够品牌化和转售UCaaS,并获得了一系列3 美元的投资百万来自预计所得收益将加速产品创新、推出新的整合和解决方案、扩大合作伙伴业务并增加收益。

- 而且,随着云端基础的通讯服务的需求不断增加,国内各家公司正透过联盟和联盟的方式进入市场。例如,通讯和先进 IT 网路解决方案的重要提供者和整合商美国 NEC 公司 (NEC) 最近与客服中心即服务 (CCaaS) 的领先供应商 Intermedia Cloud Communications 签订了独家协议。国际伙伴关係的第一个任期。企业及其合作伙伴的UCaaS(统一通讯即服务)应用已从5年延长至10年。

UCaaS(统一通讯即服务)产业概述

由于 8x8 Inc.、Mitel Networks 和 Verizon 等众多主要参与者的存在,整合通讯即服务(UCaaS) 市场适度分散,市场参与者之间竞争激烈。这些公司透过大力投资研发活动来获得创新能力,从而获得竞争优势。透过策略合作伙伴关係、併购和收购,这些公司已经能够占领重要的市场占有率。

2022 年 7 月,Symbio 和思科合作,为思科的 Cloud Connect for Webex Calling 提供整合通讯产品。向新加坡的思科经销商及其消费者提供的产品来自该国的电讯部门。我们为 Webex Calling 提供了一个简单、低成本的云端通讯选项。

2022 年 2 月,Work Anywhere 解决方案的领先国际服务供应商之一的 Evolve IP 宣布与云端基础的协作解决方案的着名供应商 Webex 建立合作伙伴关係,以提供 Evolve IP 的全新整合通讯解决方案。我们使用Webex 建构了Evolve Anywhere 。由思科提供支援的 UCaaS 解决方案将 Evolve IP Global Voice 的企业级呼叫功能和尖端功能与 Webex 强大的通讯和会议功能相结合,所有这些都在一个应用程式中。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业相关人员分析

- 波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- COVID-19 对市场的影响

- 市场驱动因素

- 付费使用制模式的出现增加了对传统统一通讯解决方案的需求

- 员工动态的变化导致新的企业协作型态的出现

- 市场挑战

- 过渡到现代整合通讯的准备度较低

- UC产业主要经营模式

第五章技术概述

第六章市场区隔

- 按公司规模

- 中小企业

- 大公司

- 按最终用户产业

- BFSI

- 零售

- 卫生保健

- 政府和公共部门

- 资讯科技和电信

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- 8X8 Inc.

- Cisco Systems Inc.

- Mitel Networks Corporation

- Gamma Communication PLC

- NTT Communication Corporation

- Vodafone Group PLC

- Telia Company AB

- KPN NV

- BT Group PLC

- Verizon Communications Inc.

- Nextiva

- Soluno(Destiny NV)

- VADS Berhad

- Singapore Telecommunications Limited

- PLDT Enterprise

- Telstra Corporation Limited

- PCCW Global

- Maxis Communications

第 8 章 主要建议

- 关键策略建议

- 分析师对区域需求和定位的看法

- 最常采用的策略分析

第9章市场的未来

The Unified Communication-as-a-Service Market size is estimated at USD 44.68 billion in 2024, and is expected to reach USD 139.94 billion by 2029, growing at a CAGR of 25.65% during the forecast period (2024-2029).

The increasing trend of work from home (WFH) model is compelling employers to use UCaaS solutions as it's beneficial for companies to reevaluate their operational costs and save their marginal revenue from declining. According to Eurostat, in 2022, the percentage of people who usually worked from home in the European Union accounted for 12.4%. Estonia recorded the highest rate of employed persons working from home in the CEE region, followed by Latvia. In Romania, only 1.4% of employees worked from home.

Key Highlights

- Unified Communications as a Service is a cloud-based service that integrates various communication and collaboration applications into a single platform. UCaaS enables businesses to streamline communication channels, reduce costs, and enhance productivity.

- UCaaS offers multiple communication tools, including voice and video conferencing, messaging, email, and collaboration software. The platform allows users to access these tools from anywhere, on any device, using an internet connection. It eliminates the need for expensive hardware, software, and maintenance costs, making it an attractive option for businesses of all sizes. For instance, in May 2023, the Indian government granted Zoom Video Communications, a web conferencing company, a Unified License with access covering all of India, National Long Distance (NLD), and International Long Distance (ILD). This will allow it to offer Zoom Phone, a cloud-based private branch exchange (PBX) service, to enterprises in the country.

- Furthermore, UCaaS enables enterprises to manage unified collaboration among employees anywhere, anytime, over the cloud. For instance, TTata Communications recently launched an end-to-end managed unified communications-as-a-service (UCaaS), Tata Communications GlobalRapide, for businesses to enable them to deliver digitally advanced and intelligent collaboration tools to their employees. With this unique service, Tata Communications becomes a one-stop-shop to address all international businesses' digital-first, cloud-first unified communications requirements. Similar solutions provider innovations and initiatives are expected to aid the market's growth during the pandemic.

- In addition, the introduction of 5G technology and high-speed internet is anticipated to boost the market in the forecasted period, as video and audio conferencing needs high-speed and low latency in the connection, which is easily provided by the 5G network. According to 5G Americas, as of 2023, there are an estimated 1.9 billion fifth-generation (5G) subscriptions worldwide. This figure is forecast to increase to 2.8 billion by 2024 and 5.9 billion by 2027.

- Further, the rapidly increasing adoption of the BYOD trend and other mobility solutions is expected to drive the adoption of UCaaS solutions even further. Bring Your Own Device (BYOD) has emerged as a significant trend in this new era of flexibility and network accessibility for employees working around the globe for various organizations, making the workplace more productive. For instance, according to Cisco, enterprises with a BYOD policy save, on average, USD 350 per year per employee.

- The rising implementation of smart mobile gadgets and association tool improvements empower remote work and dispersed workforce tactics. Similarly, establishments employ a 'bring your device' (BYOD) rule across their business facilities. This approach will likely help organizations upsurge efficiency, refine internal interaction, and eradicate different prices. This is anticipated to eventually bolster the unified communication as a service market growth during the forecast period.

- Moreover, the demand for Unified Communications has grown over the last decade. It witnessed an exceptional rise after the pandemic outbreak. With the emergence of COVID-19, digital transformation became an urgent requirement for businesses to ensure their survival, growth, and market leadership. The need for unified, frictionless, and secure access to data and applications anytime, anywhere exponentially increased.

Unified Communication as a Service (UCaaS) Market Trends

Healthcare Segment Expected to Register High Market Growth

- UCaaS in healthcare has proven to be a delivery model wherein various communication and collaboration services and applications are outsourced to a third-party provider and provided over a network across the healthcare sector. UCaaS technologies include presence technology, video conferencing, enterprise messaging, and telephony.

- The advent of cost-effective cloud-based solutions has seen increased adoption from healthcare providers, which often have minimum IT budgets. With the subscription-based United Communication services in place, healthcare contact centers are establishing their PBX systems and seamlessly addressing multiple customer requests from various sites.

- Cloud-based Unified Communication as a Service (UCaaS) is a digital change for fortifying business assignments. UCaaS in healthcare is a conveyance model wherein a diversity of partnerships, communication applications, and administrations are moved to an outsider supplier and conveyed over a network across the healthcare sector.

- Increasing investment in the healthcare sector may further propel the demand in the studied market. For instance, According to StartUp Health, in 2022, eight of the largest ten digital health investment deals were done in the United States. This year, USD 600 million were invested into the U.S. company Ultima Genomics making it the most significant deal. The largest investment involving a company from outside the U.S. concerned Doctolib, which received a contract of USD 549 million.

- Cloud adoption in the sector, including moving EHR systems and other enterprise applications, which traditionally ran on client-server architectures, also provides scope for UC companies to offer their services over the cloud on a subscription basis. Most cloud communication providers across the region offer highend cloud-based security for each customer, eliminating the barriers and making the healthcare sector an addressable market for UCaaS. For instance, 8x8, a prominent UCaaS vendor, offers UC solutions that enable healthcare organizations to meet third-party-verified compliance with HIPAA, PCI-DSS 3.1, FISMA/FIPS 140-2, and Safe Harbor regulations.

- Health Insurance Portability and Accountability Act regulations complicate designing and securing a communications platform. Major cloud communication providers supply highend cloud-based security for each client to ensure patient information and help IT meet stringent compliance requirements. UCaaS is coupled with organizational mobility and provides several advantages, like real-time communications to instantly locate and connect caregivers, faster connections instantly, and compelling call routing, regardless of location, enabling healthcare organizations to establish rules and reduce distractions across ER rooms to surgeries.

- The increasing deployment of artificial intelligence has greatly aided organizations in catering to the digital transformation goal. AI-powered tools have allowed organizations to intuitively record calls, facilitate effortless transcriptions, and intelligently track speakers to understand users' needs and offer relevant services.

North America Expected to Hold a Significant Market Share

- The region is significantly contributing to the studied market growth, primarily due to the recent surge in mobility and the explosion of 5G connections due to the consumerization of I.T., which has aided enterprises in adopting I.P. telephony and UCaaS to allow remote employees to simulate in-office work experiences.

- In the U.S., end-user verticals, such as retail, banking and finance, healthcare, information technology, and telecommunications, seek a more direct and seamless experience for all of their communications, audio, video, and chat, no matter where they are. To fulfill this need, enterprises are looking for a unified deployment and management solution from a single vendor they can rely on to handle their UCC requirements. They'll be able to integrate remote connectivity tools on a single UCaaS platform with the advent of 5G.

- The U.S. is among the foremost innovators and investors in the 5G market, with investments increasing for 5G deployment. The telecom sector in the country accounts for a significant portion of the global consumption of 5G technology. Telecom operators, such as Verizon, AT&T, and T-Mobile, have also signed billion-dollar deals with network equipment vendors, such as Huawei, Samsung, Ericsson, Nokia, and ZTE, to build their 5G network infrastructure in the country. For instance, According to Ericsson, in the U.S., it is expected that there will be more than 195 million 5G subscriptions by 2026, and by 2029, 5G will likely account for about 71.5% of the entire U.S. mobile market.

- This rapid growth will also create a platform for a 5G economy in the U.S., driving USD 275 billion in investment, creating 3 million jobs, and significant to USD 500 billion in economic growth, according to the CTIA.

- For new consumers in Las Vegas, Detroit, Atlanta, and San Francisco, Verizon provides a 10-year price lock, no data limitations, and rates ranging from 100 to 400 Mbps. The company's primary goal is to expand its 5G corporate internet presence nationwide, bringing its entire array of services, including video collaboration capabilities and edge computing, to the country.

- Further, in October 2022, RingLogix, a significant provider of UCaaS, secured a USD 3 million series of investments from M.K. Capital to improve its position as one of the swiftest-growing software firms allowing MSPs to brand and resell UCaaS. The proceeds were expected to speed up product innovation, deploy new integrations and solutions, expand partners' businesses, and increase their earnings.

- Moreover, with the growing demand for cloud-based communication services, various enterprises in the country are entering the market via partnerships and alliances. For example, NEC Corporation of America (NEC), a significant provider and integrator of communications and advanced I.T. Networking Solutions, recently announced the initial term of its exclusive international partnership with Intermedia Cloud Communications, a leading provider of Contact Center as a Service (CCaaS) and Unified Communications as a Service (UCaaS) applications to businesses and their partners, has been extended from five to ten years.

Unified Communication as a Service (UCaaS) Industry Overview

The competitive rivalry between market players is high owing to some major players like 8x8 Inc., Mitel Networks, Verizon, and many others, and the Unified Communication-as-a-Service (UCaaS) Market is moderately fragmented. These companies can gain a competitive advantage due to their ability to bring about innovations by investing heavily in research and development activities. Strategic partnerships, mergers, and acquisitions have allowed these companies to occupy a substantial market share.

In July 2022, Symbio and Cisco collaborated to provide a unified communications product for Cisco's Cloud Connect for Webex Calling. The product offered to Cisco distributors and their consumers in Singapore is in the country's telecoms sector. It delivered a simple, low-cost cloud communication option for Webex Calling.

In February 2022, Evolve IP, one of the leading international service providers of Work Anywhere solutions, announced a partnership with Webex, a prominent supplier of cloud-based collaboration solutions, to create Evolve Anywhere with Webex, Evolve IP's new unified communications solution. The Cisco-powered UCaaS solution combined enterprise-grade calling and cutting-edge features from Evolve IP Global Voice with Webex's powerful messaging and meetings capabilities, all within a single app.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Emergence of Pay-as-you-go Model Driving Demand over Legacy UC Solutions

- 4.5.2 Changing Workforce Dynamics Leading to the Emergence of New Forms of Enterprise Collaboration

- 4.6 Market Challenges

- 4.6.1 Low Readiness to Move to Modern Unified Communications

- 4.7 Key Business Models in the UC Industry

5 TECHNOLOGY OVERVIEW

6 MARKET SEGMENTATION

- 6.1 By Size of Enterprise

- 6.1.1 Small and Medium Enterprises

- 6.1.2 Large Enterprises

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 Healthcare

- 6.2.4 Government and Public Sector

- 6.2.5 IT and Telecom

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 8X8 Inc.

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Mitel Networks Corporation

- 7.1.4 Gamma Communication PLC

- 7.1.5 NTT Communication Corporation

- 7.1.6 Vodafone Group PLC

- 7.1.7 Telia Company AB

- 7.1.8 KPN NV

- 7.1.9 BT Group PLC

- 7.1.10 Verizon Communications Inc.

- 7.1.11 Nextiva

- 7.1.12 Soluno (Destiny NV)

- 7.1.13 VADS Berhad

- 7.1.14 Singapore Telecommunications Limited

- 7.1.15 PLDT Enterprise

- 7.1.16 Telstra Corporation Limited

- 7.1.17 PCCW Global

- 7.1.18 Maxis Communications

8 KEY RECOMMENDATIONS

- 8.1 Key Strategic Recommendations

- 8.2 Analyst's View on Regional Demand and Positioning

- 8.3 Analysis of Most Adopted Strategies