|

市场调查报告书

商品编码

1432589

云端储存:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Cloud Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

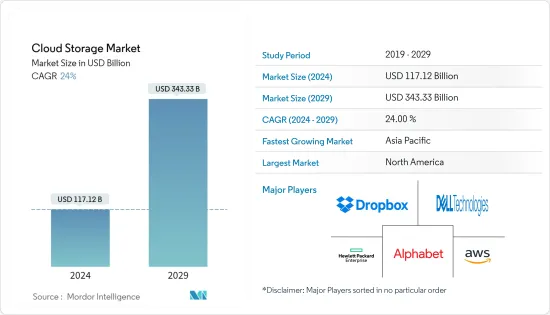

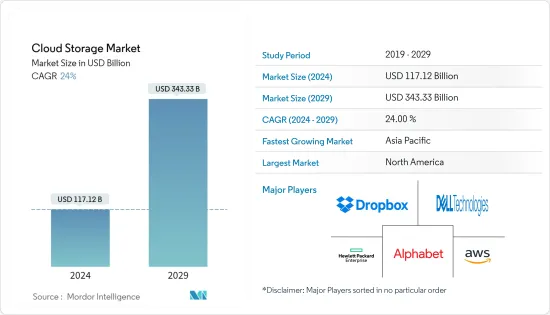

云端储存市场规模预计到2024年为1,171.2亿美元,预计到2029年将达到3,433.3亿美元,在预测期内(2024-2029年)复合年增长率为24%。

所有企业对低成本资料备份、储存和保护的需求不断增长,加上处理行动技术使用增加所产生的资料的需求,正在推动云端储存的采用率。

主要亮点

- 由于企业资料的增加以及为远端工作人员提供对资料和文件的无处不在的存取的需要,云端储存市场预计将增长。例如,根据 Seagate Technologies Holdings PLC 的数据,从 2020 年到 2022 年,企业资料总量预计将从约 1 Petabyte增加到 2.02 Petabyte。这相当于 42.2% 的两年复合年增长率。

- 此外,所有企业对低成本资料备份和资料保护的需求不断增长,以及处理行动技术使用增加所产生的资料的需求不断增加,催生了云端储存。这刺激了云端储存的采用。企业经常寻找降低营运成本和提高报酬率的方法,这可以透过外包或僱用第三方供应商的託管云端服务来实现。

- 透过策略合作、併购和研发,一些市场主要企业已经能够进一步开发云端储存技术。这可能会在预测期内推动云端储存需求。

- 在 COVID-19 大流行期间,许多国家出于公共卫生考虑强制要求在家工作,这增加了对远距工作基础设施的需求。因此,包括政府机构在内的各级组织都需要满足对虚拟服务不断增长的需求以及公民对提供这些服务不断增长的期望,再形成政府劳动力的长期潜力,使其更具适应性和活力。我们预计广泛的潜在影响,包括需要提供监管模型。

云端储存市场趋势

BFSI预计将占较大份额

- 为了提高产生收入,银行可以增加客户洞察、控製成本、快速且有效率地提供与市场相关的产品,并帮助企业资料资产收益。银行已开始透过引入线上入口网站来业务数位化,该入口网站允许用户直接进行业务,而无需银行工作人员的干预。结果,资料产生显着增加,导致这些机构采用云端储存。

- 云端储存解决方案使银行能够同步其企业,打破风险、财务、监管和客户支援方面的业务和资料孤岛,并将大量资料集汇集到一个地方,并与高级分析整合。银行服务采用该解决方案世界各地的提供者以获得更好的见解。

- 技术供应商帮助 BFSI 参与者迁移到云端的措施也推动了该领域的成长。据 Finder 称,到 2021 年,纯专用银行拥有超过 1,400 万英国客户,预计未来几年将成长 1,000 万。这表明将需要云端储存等解决方案来适应这种成长,从而推动云端储存在预测期内的成长。

- 银行业资料外洩事件的增加正在推动银行采用云端储存。云端储存允许资料储存在由银行或第三方管理和拥有的空间中,从而为最终用户提供增强的安全性。因此,云端储存的采用预计在预测期内将会增加。例如,根据身分盗窃资源中心的资料,美国金融服务业的资料外洩数量从 2020 年的 138 起增加到 2022 年的 268 起。

预计北美将占据最大份额

- 由于较早采用新技术、对云端基础的解决方案的研发投入巨大以及IT基础设施的加强,预计北美地区将占据较大份额。此外,廉价且安全的储存选项正在推动产业的快速发展。

- 供应商在北美市场拥有强大的立足点。其中包括 Google LLC、IBM Corporation、Microsoft Corporation、Oracle Corporation、Amazon Web Services Inc. 等。透过研究和开发,该地区的这些主要企业能够进一步开发其技术。预计这将在预测期内推动云端储存的采用并降低云端储存成本。

- 根据 Stormforge 2021 年 4 月发布的报告,18% 的北美受访者表示,他们的组织每月的云端支出在 10 万至 25 万美元之间。此外,44% 的受访者预计明年云端支出将增加,另有 32% 的受访者预计其组织的云端支出将在明年大幅增加。

- 此外,加拿大政府还采取了「云端优先」策略,在启动资讯技术投资、措施、策略和计划时,将云端服务确定为主要交付选项并引用。云端还允许政府利用私人提供者的创新,并使资讯技术更加敏捷。此类措施预计将为混合云市场提供许多机会,因为这种模型可以实现私有云端的安全性和公有云的弹性。

云端储存产业概况

云端储存市场集中度适中,微软、IBM、 Oracle等大公司占有较大份额。每家公司的持续创新能力使他们比其他公司具有竞争优势。透过策略伙伴关係、研发和併购,这些参与者正在市场上留下更大的足迹。

- 2022 年 11 月:作为 Dell APEX 产品组合持续发展势头的一部分,Dell Technologies Inc. 宣布 Dell PowerFlex 现已在 AWS Marketplace 上提供。该产品允许客户在使用现有云端积分的同时,利用 PowerFlex 的关键任务效能、弹性、扩充性和管理。 Dell PowerFlex 是戴尔主要储存软体产品中第一个透过 Project Alpine 在公有云中提供的产品,是 AWS 广泛的资料保护产品组合的补充。

- 2022 年 5 月:红帽公司和Accenture扩大其近 12 年的策略合作伙伴关係,为全球企业推动开放混合云端创新。两家公司将投资共同开发新解决方案,帮助无缝驾驭多重云端和混合云端世界,并将合作制定策略并加快创新步伐,以更快地实现价值。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

- 过去几年的成本/价格趋势分析

第五章市场动态

- 市场驱动因素

- 提高整个组织的云端采用率

- 对更低成本储存和更快资料存取的需求不断增长

- 市场挑战

- 隐私和安全问题

- 技术简介

- 云端储存网关

- 主储存

- 备份存储

- 资料存檔

第六章市场区隔

- 按模式

- 私有云端

- 公共云端

- 混合云端

- 按行业分类

- BFSI

- 零售/消费品

- 卫生保健

- 媒体娱乐

- 资讯科技/通讯

- 製造业

- 政府机关

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Google LLC(Alphabet Inc.)

- Amazon Web Services Inc.

- Dropbox Inc

- Dell EMC(Dell Technologies Inc.)

- Hewlett Packard Enterprise Company

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Rackspace Inc.

- NetApp Inc.

- Alibaba Cloud(Alibaba Group)

第八章投资分析

第九章 市场未来展望

The Cloud Storage Market size is estimated at USD 117.12 billion in 2024, and is expected to reach USD 343.33 billion by 2029, growing at a CAGR of 24% during the forecast period (2024-2029).

The increasing demand for low-cost data backup, storage, and protection across all enterprises, coupled with the need to handle data generated by augmented usage of mobile technologies, favors the adoption rate of cloud storage.

Key Highlights

- The cloud storage market is expected to grow due to rising data volumes across enterprises and the growing need to provide remote workers with ubiquitous access to data and files. For instance, according to Seagate Technologies Holdings PLC, from 2020 to 2022, total enterprise data volume is expected to go from approximately one petabyte (PB) to 2.02 petabytes. This is a 42.2% average annual growth over two years.

- Further, the total volume of data/information created, captured, copied, and consumed worldwide is expected to reach 181 zettabytes in 2025 from 79 zettabytes in 2021. Further, the World Economic Forum estimates that, by 2025, 463 exabytes of data will be created globally, equivalent to 212,765 thousand DVDs per day.

- Moreover, the increasing demand for low-cost data backup and protection across all enterprises, coupled with the necessity of handling the data generated by augmented usage of mobile technologies, favors cloud storage adoption. Companies regularly find ways to mitigate their operating costs and increase profit margins, which can be done by outsourcing or adopting managed cloud services from third-party vendors.

- Through strategic partnerships, mergers and acquisitions, and R&D, some of the prominent players in the market have been able to further develop the cloud storage technology. This may fuel the demand for cloud storage over the forecast period.

- Amid the COVID-19 pandemic, many countries mandated work from home due to public health safety concerns that drove the need for remote working infrastructure. Thus, organizations at all levels, including government bodies, expected a wide range of potential impacts, such as increased demand for virtual services, coupled with rising citizen expectations around the delivery of these services, the long-term potential for reshaping the government workforce, and the need to provide adaptive and dynamic regulatory models.

Cloud Storage Market Trends

BFSI Expected to Hold a Significant Share

- To improve revenue generation, banks increase customer insights, contain costs, deliver market-relevant products quickly and efficiently, and help monetize enterprise data assets; they have started digitizing their work by introducing online portals through which a user can directly meet his work without any requirement for a bank official's intervention. This further results in a substantial increase in data generation, propelling such institutions to adopt cloud storage.

- Banking service providers worldwide are adopting cloud storage solutions as it enables banks to synchronize the enterprise, break down operational and data silos across risk, finance, regulatory, and customer support, and allow institutions to combine massive data sets in one place for advanced analytics and integrated insights.

- Increasing initiatives from technology vendors to help the BFSI players transition into the cloud also fuel this segment's growth. According to Finder, in 2021, digital-only banks had more than 14 million customers from Britain, which is expected to grow by 10 million in the next few years. This indicates that such an increase would require solutions like cloud storage to handle the surge, thereby boosting the growth of cloud storage over the forecast period.

- The rising data breaches in the banking sector are driving the banks to adopt cloud storage that enables them to store data in a space managed and owned by the bank or a third party, providing enhanced security to the end-user. This is expected to increase cloud storage adoption over the forecast period. For instance, according to the data from the Identity Theft Resource Center, the number of data compromises in the financial services sector in the United States reached 268 in 2022, up from 138 such incidents in 2020.

North America Expected to Hold the Largest Share

- North America is predicted to hold a major share owing to the early adoption of new technologies, huge investments in R&D for cloud-based solutions, and enhanced IT infrastructure. Moreover, cheap and secure storage options result in rapid industrial development.

- The North American region has a strong foothold of vendors in the market. Some of them include Google LLC, IBM Corporation, Microsoft Corporation, Oracle Corporation, and Amazon Web Services Inc. Through research and development, these prominent players in the region have been able to develop the technology further. This is expected to boost the adoption of cloud storage and reduce the cost of cloud storage throughout the forecast period.

- According to a report published by Stormforge in April 2021, 18% of respondents from North America stated that their organization has a monthly cloud spend that ranges between USD 100,000 and USD 250,000. Further, 44% expect cloud spending to increase over the next 12 months, while another 32% indicate that they expect their organization's cloud spending to increase significantly over the next 12 months.

- Moreover, the government of Canada has adopted a "cloud-first" strategy, whereby cloud services are identified and estimated as the principal delivery option when initiating information technology investments, initiatives, strategies, and projects. The cloud will also let the government harness the innovation of private-sector providers and thus make its information technology more agile. Such initiatives are expected to offer plenty of opportunities to the hybrid cloud market, as this model enables private cloud security and public cloud flexibility.

Cloud Storage Industry Overview

The cloud storage market is moderately concentrated owing to some major players, such as Microsoft, IBM, and Oracle, holding significant market share. Their ability to continually innovate their offerings has allowed them to gain a competitive advantage over others. Through strategic partnerships, research and developments, and mergers & acquisitions, these players have gained a more significant footprint in the market.

- November 2022: As part of continuing Dell APEX portfolio momentum, Dell Technologies Inc. announced that Dell PowerFlex is available in the AWS Marketplace. This offer provides customers with the mission-critical performance, resilience, scale, and management of PowerFlex with the ability to use existing cloud credits. Dell PowerFlex is the first of Dell's leading storage software offerings to be available in the public cloud via Project Alpine and compliments its broad AWS data protection portfolio.

- May 2022: Red Hat and Accenture expanded their nearly 12-year strategic partnership to advance power-open hybrid cloud innovation for enterprises worldwide. The companies are partnering to invest in the co-development of new solutions to help in the seamless navigation of a multi- and hybrid cloud world, define their strategy, and accelerate their pace of innovation to get to value faster.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Cost/Price Trend Analysis for the Past Few Years

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Cloud Adoption Across Organizations

- 5.1.2 Growing Demand for Low-cost Storage and .Faster Data Accessibility

- 5.2 Market Challenges

- 5.2.1 Privacy and Security Concerns

- 5.3 TECHNOLOGY SNAPSHOT

- 5.3.1 Cloud Storage Gateway

- 5.3.2 Primary Storage

- 5.3.3 Backup Storage

- 5.3.4 Data Archiving

6 MARKET SEGMENTATION

- 6.1 By Mode

- 6.1.1 Private Cloud

- 6.1.2 Public Cloud

- 6.1.3 Hybrid Cloud

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 Retail and Consumer Goods

- 6.2.3 Healthcare

- 6.2.4 Media and Entertainment

- 6.2.5 IT and Telecom

- 6.2.6 Manufacturing

- 6.2.7 Government

- 6.2.8 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Google LLC (Alphabet Inc.)

- 7.1.2 Amazon Web Services Inc.

- 7.1.3 Dropbox Inc

- 7.1.4 Dell EMC (Dell Technologies Inc.

- 7.1.5 Hewlett Packard Enterprise Company

- 7.1.6 IBM Corporation

- 7.1.7 Microsoft Corporation

- 7.1.8 Oracle Corporation

- 7.1.9 Rackspace Inc.

- 7.1.10 NetApp Inc.

- 7.1.11 Alibaba Cloud (Alibaba Group)