|

市场调查报告书

商品编码

1433018

仪表板摄影机:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Dashboard Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

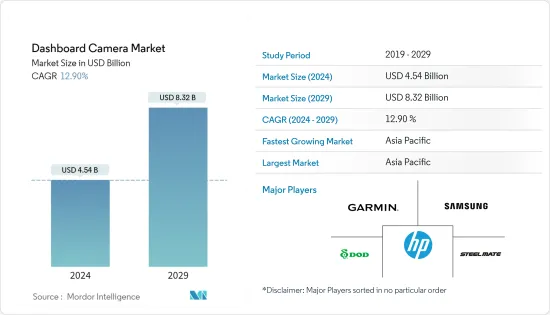

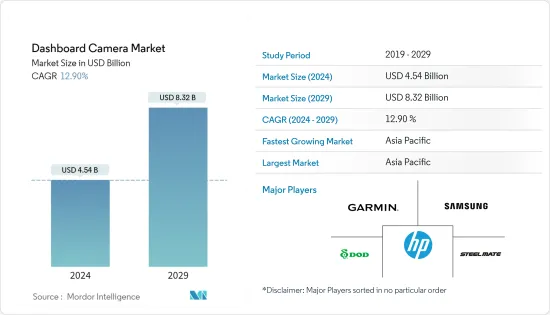

行车记录器市场规模预计2024年为45.4亿美元,预计2029年将达到83.2亿美元,在市场估计和预测期间(2024-2029年)复合年增长率为12.90%,预计将会增长。

过去几年,由于事故和窃盗数量大幅增加,各国政府强制要求安装行车记录仪,整个欧洲市场迅速扩大。

主要亮点

- 仪表板摄影机是从 20 世纪 80 年代末安装在警车上的第一批摄影机发展而来的。当时,没有记忆卡并录製在 VHS 磁带上的类比摄影机是主流。 1990 年代,随着公民开始安装行车记录器并使用它们记录驾驶时发生的情况,该行业发生了重大变化。技术进步为行车记录器带来了许多改进,例如高品质的影像输出和成本效益。

- 全球行车记录器价格的持续下降使得所研究的市场快速成长。 YI Technologies 等公司已开发出成本低至 50 美元的智慧行车记录器。取得该系统的成本低廉,以及与安装相关的好处,正在推动最终用户将其安装在他们的车辆中。

- 由于过去十年报告的事故死亡人数急剧增加,驾驶辅助系统越来越受欢迎。人们对更好的辅助系统的需求不断增长,这些系统可以对即将发生的危险进行分类并指导诱发因素,而这些系统正在成为汽车行业的可行产品。目前,驾驶辅助系统主要应用于豪华车领域。许多联网汽车供应商正在开发驾驶员辅助技术,预计在预测期内将实用化。

- 此外,根据 NCRB(国家犯罪记录局)的数据,2021 年德里报告了 35,019 起车辆失窃案件。德里每天约有 95 辆汽车被盗,是印度所有邦和中央直辖区中被盗数量最多的。

- 例如,据警察厅(NPA)称,2021年2月,自《道路交通法》修订以及「妨碍驾驶」成为处罚措施以来的六个月内,进行了58起路怒调查,其中54起使用了行车记录器。影像证据的使用显示在日本立案的难度很高。根据国家警察厅的资料,在他们调查的 58 起路怒事件中,93.1% 的警察使用了行车记录影像。

- 自2020年第一季以来,随着冠状病毒疫情蔓延,消费行为从购买奢侈品转向购买必需品,工厂停工导致汽车生产停滞,市场停滞。例如,根据丰业银行的数据,全球汽车销售将从2020年的约6,380万辆增加到2021年的约6,670万辆。由于全球经济放缓和主要国家的冠状病毒爆发,该行业一直在下滑。

行车记录器摄影机市场趋势

双通道摄影机大幅成长

- 对于行车记录器製造商来说,多镜头行车记录器是一个利润丰厚的投资领域。与单通道仪表板摄影机相比,人们越来越青睐双通道仪表板摄影机。

- 这些摄影机在私人和商用车车主中越来越受欢迎。双通道仪表板摄影机系统由两个具有高解析度的摄影机组成,用于前后录影。

- 例如,2022年8月,小拍拍推出了Z50行车记录器型号,与Z系列一样,延续了预览萤幕和时尚设计,但在细节上进行了升级,性能强劲。这是一款 4K 双行车记录器。相比Z40,Z50在影像处理和解析度方面更加强大。凭藉先进的色彩增强演算法和 NightVIS 技术,即使在低光源条件下,Z50 也能记录Sharp Corporation的细节、平衡的照明和鲜艳的色彩。

- 此外,公司推出的创新技术应用正在推动市场成长。例如,Thinkware推出了双通道行车记录器F800 Pro,其功能比F800型号有所改进。这款新型行车记录器提供了增强功能,例如更好的电源管理和用于硬布线安装的不同配色方案,同时保持业界最佳的夜间捕捉效果。

- 随着世界各地交通事故死亡人数的增加,该市场预计将继续成长。行车记录器的采用率可能会受到隐私问题的影响,例如未经他人许可记录事故情况,这将侵犯隐私。比利时、葡萄牙和奥地利等国家的隐私权法禁止行车记录器在未经同意的情况下进行记录。

北美实现显着成长

- 随着各种美国公司和新兴企业开始大力投资以扩大其影响力并提高在该地区的普及,预计北美地区将显着成长。此外,现有公司创新新产品,扩大产品系列,以获得市场吸引力并增加市场占有率。

- 例如,Garmin International Inc. 在其广受欢迎的行车记录器系列中推出了行车记录器 46/56/66W 和行车记录器 Mini。新系列采用超紧凑设计、高解析度视讯、超宽视角、GPS 和语音控制,让您轻鬆找到适合您特定需求的 Garmin 行车记录器。

- 同样,一群美国新兴企业开发了一种创新的经营模式,透过在汽车中安装仪表板摄影机为驾驶员提供经济奖励。因此,越来越多的北美乘车服务供应商(例如 Lyft 和 Uber)开始部署汽车DVR 来记录他们的乘车情况。

- 此外,目前保险公司对安装行车记录器缺乏直接折扣被认为是导緻美国消费者缺乏兴趣的原因之一。然而,由于美国事故数量不断增加,政府颁布了严格的法规,预计这将推动成长。

行车记录器产业概况

全球行车记录器市场竞争非常激烈。市场高度集中,参与者有大有小。所有主要公司都占有重要的市场份额,并致力于扩大消费群。市场上的一些主要参与者包括 Garmin Ltd.、 Panasonic Corporation、Aiptek Inc.、ABEO Company、Papago Inc.、Steelmate Automotive (UK) Ltd.、HP Development Company LP 和 DOD Tech。公司正在透过建立多个合作伙伴关係和投资新产品发布来扩大市场占有率,以在预测期内获得竞争优势。

- 2022 年 5 月 - Garmin 和 FIAT 合作推出新的 Panda 和 Tipo 特别版。对于需要车辆来探索户外或逃离日常生活的客户来说,这是理想的解决方案。两款车型均采用全新 Garmin 特别系列专用的Foresta Green 涂装,饰有橙细节、专用的哑光浅灰色外观亮点以及凸显 Cross 外观的专用轮圈。车内行车记录器的影像也可用于在公共场合发生事故时帮助其他人。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对仪表板摄影机市场的影响

第五章市场动态

- 市场驱动因素

- 交通事故和窃盗增加

- 优惠的保险政策

- 市场挑战

- 信任和隐私问题

第六章市场区隔

- 依技术

- 基本的

- 聪明的

- 依产品类型

- 单通道

- 双通道

- 后视图

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 阿根廷

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Garmin Ltd

- Panasonic Corporation

- Aiptek Inc.

- Samsung Electronics Co., Ltd.(Harman International Industries, Inc.)

- DOD Tech

- Steelmate Automotive(UK)Ltd

- HP Development Company LP

- Thinkware Dash Cam

- Cobra Electronics Corporation

- LG Electronics Inc.

第八章投资分析

第9章市场的未来

The Dashboard Camera Market size is estimated at USD 4.54 billion in 2024, and is expected to reach USD 8.32 billion by 2029, growing at a CAGR of 12.90% during the forecast period (2024-2029).

The market studied expanded rapidly across the European region over the past few years due to a considerable rise in the number of accidents and thefts, resulting in various governments mandating the installation of dash cams.

Key Highlights

- Dashboard cameras have evolved from the first cameras installed on police cars in the late 1980s. They were primarily analog cameras that did not have memory cards and were recorded on VHS cassettes. The industry transformed drastically in the 1990s when citizens began to install dash cams and use them to record driving instances. The advancements in technology have led to many improvements in the dash cams, such as high-quality video output and cost-effectiveness.

- The consistent drop in the prices of dash cams worldwide enabled the rapid growth of the market studied. Companies, such as YI Technologies, developed smart dash cams that cost as low as USD 50. The low cost of acquiring systems, along with the benefits associated with their installation, encourage end users to install them in their automobiles.

- Driving assistance systems have gained popularity, owing to the drastic rise in the number of accidental fatalities reported in the last decade. The demand for better assistance systems, categorically judging imminent dangers and guide drivers, is increasing, as these systems have emerged as a viable product in the automotive sector. Currently, driver assistance systems are predominantly being used in the luxury cars segment. Many connected car vendors are developing driver assistance technology, which is expected to be commercialized during the forecast period.

- Further, according to the NCRB (National Crime Records Bureau), Delhi reported 35,019 cases of vehicle thefts in 2021. Around 95 vehicles were stolen every day in Delhi, the maximum across all states and Union Territories in India.

- For instance, in February 2021, according to the National Police Agency (NPA), dashcam video evidence was used in 54 of the 58 road rage investigations conducted in the six months since the Road Traffic Act was changed to penalize "obstructive driving," indicating the difficulties of developing such a case in Japan. According to the NPA data, officers used dashcam footage in 93.1% of the 58 road rage cases they investigated.

- As the coronavirus pandemic spread since the first quarter of 2020, the market became stagnant due to the shut down of factories, causing a halt in automobile production, and thus changed consumer behavior to buying of essentials over spending on luxuries. For instance, according to Scotiabank, worldwide car sales increased to around 66.7 million automobiles in 2021, up from around 63.8 million units in 2020. The sector experienced a downward trend, along with a global slowdown of economy and the advent of the coronavirus pandemic in all key economies.

Dashboard Camera Market Trends

Dual-channel Cameras to Witness Significant Growth

- Multi-lens dashboard cameras represent a lucrative segment to invest in for dashboard camera manufacturers. There has been an increasing preference for dual-channel dashboard cameras over single-channel dashboard cameras.

- These cameras are gaining popularity among private and commercial vehicle owners. Dual-channel dashcam systems comprise two cameras with high-resolution feed for front and rear video recording.

- For instance, in August 2022, DPPAI launched the Z50 dash cams model, As in Z-series, continuing the preview screen and sleek design but upgraded details with powerful performance. This is a 4K Dual Dash Cam. Compared with Z40, Z50 is more powerful in image processing and resolution. With advanced color boost algorithms and NightVIS technology, Z50 records with sharper details, balanced lighting, and vivid color even in dark conditions.

- Further, the introduction of innovative technology applications by the companies is driving the growth of the market. For instance, Thinkware launched its dual-channel Dash Cam F800 Pro, which has improved features over the F800 model. The new dashcam offers enhancements, such as better power management for hard -wired installations and a different color scheme, while retaining the best -in -the - business night capture

- With the increasing traffic-related fatalities across the globe, the market is expected to witness positive growth. The adoption rate of dash cams can be affected by several concerns regarding privacy issues, such as recording others involved in accidents without their permission, which is a breach of privacy. In countries, such as Belgium, Portugal, and Austria, privacy laws ban recording people without their consent with a dash cam.

North America to Witness Significant Growth

- North America is expected to witness significant growth led by various companies and startups in the United States starting to make substantial investments to increase their presence and aid the region's adoption rate. Moreover, the existing companies are innovating new products to expand the product portfolio to gain market traction and increase their market share.

- For instance, Garmin International Inc. launched the new Dash Cam 46/56/66W and the Dash Cam Mini, the latest additions to its popular dashboard camera lineup. The new series includes an ultra-compact design, high-resolution video, an extra-wide view, GPS, and voice control; the drivers can easily find a Garmin dash cam that is tailored to their specific needs.

- Similarly, a group of startups in the United States have developed an innovative business model wherein the drivers are offered monetary rewards for installing dashboard cameras in their vehicles. As a result, an increasing number of ride service providers across North America, such as Lyft and Uber, have started deploying in-car DVRs to record their rides.

- Besides, the current lack of direct discounts from insurance companies for the installation of dashcams is estimated to impact the low interest of US consumers. However, stringent regulations mandated by the government, due to the growing number of accidents in the United States, are expected to propel the growth.

Dashboard Camera Industry Overview

The Global Dashboard Camera Market is very competitive in nature. The market is highly concentrated due to the presence of various small and large players. All the major players account for a large share of the market and are focusing on expanding their consumer base across the world. Some of the significant players in the market are Garmin Ltd, Panasonic Corporation, Aiptek Inc., ABEO Company Co. Ltd, Papago Inc., Steelmate Automotive (UK) Ltd, HP Development Company LP, DOD Tech, and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

- May 2022 - Garmin and FIAT partnered to launch new Panda and Tipo special editions. The ideal solution for customers who need a car to explore outdoors or to escape everyday routine. Both models feature the new Foresta Green livery, exclusive to the new Garmin special series, embellished with orange details, exclusive matte light grey exterior highlights, and dedicated wheels that accentuate the cross look. The dash cam footage in vehicles can also be used to help others if they meet with an accident in front of people.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Dashboard Camera Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Number of Road Accidents and Thefts

- 5.1.2 Favorable Insurance Policies

- 5.2 Market Challenges

- 5.2.1 Reliability and Privacy Issues

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Basic

- 6.1.2 Smart

- 6.2 By Product Type

- 6.2.1 Single-channel

- 6.2.2 Dual-channel

- 6.2.3 Rear-view

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Russia

- 6.3.2.5 Italy

- 6.3.2.6 Spain

- 6.3.2.7 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Argentina

- 6.3.4.2 Brazil

- 6.3.4.3 Mexico

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 South Africa

- 6.3.5.3 United Arab Emirates

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Garmin Ltd

- 7.1.2 Panasonic Corporation

- 7.1.3 Aiptek Inc.

- 7.1.4 Samsung Electronics Co., Ltd. (Harman International Industries, Inc.)

- 7.1.5 DOD Tech

- 7.1.6 Steelmate Automotive (UK) Ltd

- 7.1.7 HP Development Company LP

- 7.1.8 Thinkware Dash Cam

- 7.1.9 Cobra Electronics Corporation

- 7.1.10 LG Electronics Inc.