|

市场调查报告书

商品编码

1445880

分离半导体 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Discrete Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

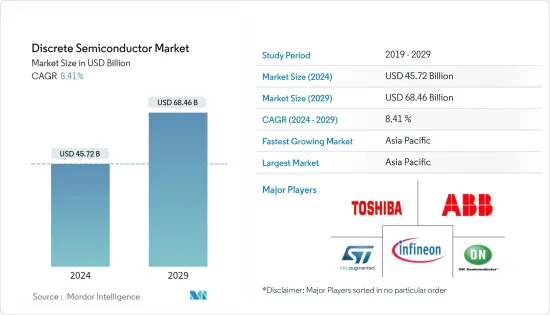

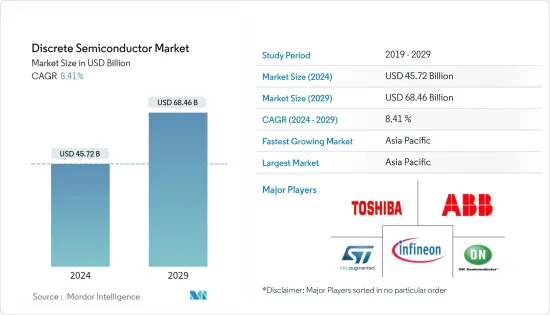

分立半导体市场规模预计到2024年为457.2亿美元,预计到2029年将达到684.6亿美元,在预测期内(2024-2029年)CAGR为8.41%。

分立半导体市场是由电子和小型化领域对电源管理日益增长的需求所推动的。封装尺寸的减小与功耗成反比。例如,恩智浦半导体透过保持相同的功率性能,将其电晶体系列的封装尺寸缩小了 55%。此外,Diodes 公司也推出了采用 DFN2020 封装的 40V 额定值 DMTH4008LFDFWQ 和 60V 额定值 DMTH6016LFDFWQ 汽车级 MOSFET。

主要亮点

- 此外,汽车零件的安全、资讯娱乐、导航和燃油效率等特性,以及工业零件的安全、自动化、固态照明、运输和能源管理等特性预计将推动所研究的市场。例如,绝缘栅双极电晶体(IGBT)是电动车电力电子系统中不可或缺的组件。由于全球电动车销量的增加,预计 IGBT 的需求将会很大。 IEA报告显示,2021年全球电动车销量达660万辆。电动车占全球汽车销量的9%。

- 这些电动车的商业化正在兴起。沃尔沃的目标是到 2025 年其销量的 50% 由纯电动车构成。宝马也放弃了 i5 计划,现在将重点放在 X3 和 4 系列 GT 等其他系列车型的电气化上。后者将直接与特斯拉的Model 3和Model y竞争。

- 此外,各公司正在电源模组领域开发新的解决方案,以扩大其影响力并增加市场份额。例如,2021 年 12 月,为各种电子应用领域的客户提供服务的着名半导体公司意法半导体宣布推出第三代 STPOWER 碳化硅 (SiC) MOSFET1,推动了最先进的用于电动车(EV) 动力系统和其他以功率密度、能源效率和可靠性为关键目标标准的应用的功率元件。

- 相较之下,COVID-19 疫情对全球和各国经济产生了巨大影响。许多最终用户产业都受到了影响,包括分立半导体。电子元件製造的很大一部分包括在工厂车间进行的工作,人们在工厂车间密切接触,协作提高生产力。目前,市场上的企业正在快速评估市场需求、供应链和劳动力三个面向的影响。产品的需求正在 ASICS、记忆体、感测器等方面发生变化,而消费者行为则快速变化且未来波动较大。此外,许多公司也推迟了硬体升级和其他长期迁移项目。例如,印度、日本、波兰、以色列等许多国家5G计画的推出都被推迟,这为5G商用服务的推出带来了不确定性。

- 随着病毒在世界各地传播,全球供应链受到干扰,隔离期限仍存在不确定性。世界各地许多製造工厂被关闭以遏制这种致命病毒。例如,由于马来西亚、中国、马来西亚和菲律宾等国家的政府强制要求,安森美半导体的大部分製造设施被关闭,这影响了其向客户供应产品的能力,并造成了供需缺口。

分立半导体市场趋势

汽车领域预计将推动市场成长

- 汽车应用推动了对分立元件的大部分需求,尤其是功率电晶体和整流器。传统汽车自 20 世纪 50 年代以来一直使用 12V 电池系统,但在当前情况下,它们无法处理下一代汽车更重的电子负载,因此需要提高电源效率。

- 自动驾驶和全电动汽车需要更高性能的微控制器和微处理器,以及更有效率、高功率的 MOSFET,用于电源管理和电池监控系统。

- 分立半导体在电动车中已广泛应用。空间限制和高效率要求要求设备能够承载高功率并以更高的频率进行开关。它们可以以非常低的损耗和非常高的频率产生高电流,从而为电动车应用创造了对这些设备的巨大需求。

- 此外,随着电动车市场的加速发展,许多汽车製造商现在都采用 800V 驱动系统来提高效率、实现更快的充电并扩大此类车辆的续航里程,同时减轻重量和成本。 SiCMOSFET 等宽频隙元件正在帮助汽车製造商为电动车动力系统和其他此类因素非常重要的应用开发最先进的功率元件。

- 2022年12月,义法半导体推出了新型碳化硅(SiC)高功率模组,旨在提高电动车的性能和续航里程。现代汽车已选择五款基于 SiC MOSFET 的新型功率模组,用于Kia EV6 和多款车型共享的 E-GMP 电动车平台。

- 2022年8月,瑞萨电子公司宣布开发新一代Si-IGBT。透过此次发布,该公司瞄准了下一代电动车逆变器,AE5 代 IGBT 预计将于 2023 年上半年开始在瑞萨位于 Naka 的工厂的 200 毫米和 300 毫米晶圆生产线上进行量产。日本。

- 电动车市场竞争激烈,新厂商正在挑战创新极限。例如,保时捷为其 Taycan 配备了 800 V 系统,而许多当代电动车则使用 400 V 电池。这促使传统汽车零件製造商为汽车产业开发分立半导体产品线。

美洲预计将占据主要市场份额

- 该地区消费电子产业的激增是推动市场成长的主要因素之一。例如,根据美国消费者科技协会(CTA)的预测,2023年美国科技零售收入预计将达到4,850亿美元,虽然较2021年创纪录的5,120亿美元略有下降,但仍将维持在2023年之前的水平以上。 - 根据组织的规定,流行病级别。

- 此外,物联网 (IoT) 等新兴技术在半导体产业掀起了新一轮创新浪潮。该地区每年都有越来越多的电子设备(从笔记型电脑到恆温器)相互连接,使它们与其用户之间能够进行更复杂的通讯和协调。例如,根据 CTA 的数据,到 2021 年,23% 的美国家庭拥有智慧或连网健康监测设备,19% 拥有连网运动或健身设备(比前一年增加 7 个百分点)。不断扩大的物联网市场预计将对该地区对分立半导体的需求产生正面影响。

- 根据汽车研究中心的数据,美国汽车产业是经济成长的重要组成部分,历来对国内生产毛额 (GDP) 的贡献率为 3 - 3.5%。该产业也占该地区半导体元件总需求的很大一部分。

- 汽车产业向电气化的转型也刺激了对复杂半导体元件的需求。例如,根据 IEA 年度《2023 年全球电动车展望》,美国是第三大电动车市场,销量强劲成长 55%。

- 此外,根据阿贡国家实验室的数据,2023财年美国混合动力汽车销量为97,972辆,比2022年4月的销量增长36.4%。本月丰田占混合动力汽车总销量的44.3%。

- 加拿大不断成长的再生能源产业预计也将支持市场成长。根据加拿大再生能源协会(CanREA) 的数据,加拿大的风能和太阳能产业在2022 年将大幅成长。该组织表示,太阳能成长尤其迅速,2022 年新增装置容量占加拿大总装置容量的四分之一以上独自的。

分立半导体产业概况

全球分立半导体市场高度分散,有许多半导体製造商提供产品。这些公司不断投资于产品和技术,以促进永续的环境成长并防止环境危害。这些公司也收购了其他专门经营这些产品的公司,以提高市场占有率。市场的一些最新发展是:

- 2023年1月,日本着名汽车零件製造商日立Astemo有限公司宣布,其电动车逆变器将采用罗姆半导体全新第四代SiCMOSFET和闸极驱动器IC。 ROHM 最新的第四代 SiCMOSFET 提供业界最低的导通电阻,并改善了短路耐受时间,与 IGBT 相比,可将电动车的续航里程增加 6%。

- 2023 年 1 月,瑞萨电子公司宣布推出一款新型闸极驱动器 IC,旨在驱动电动车 (EV) 逆变器中的 IGBT 和 SiC MOSFET 等高压功率元件。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

- 产业价值链/供应链分析

- 评估 COVID-19 对市场的影响

- 市场驱动因素

- 汽车和电子领域对高能源效率设备的需求不断增长

- 绿色能源发电需求拉动市场

- 市场限制

- 积体电路需求不断成长

第 5 章:市场细分

- 建筑类型

- 场效管

- MOSFET - 按材料分类

- 硅MOSFET

- 碳化硅MOSFET

- MOSFET - 由最终用户提供

- 消费性电子产品

- 医疗的

- 汽车

- 运算与储存

- 工业的

- 网路与电信

- 其他最终用户

- IGBT - 概述和市场预测

- 汽车

- 能源(生产和分配)

- 运输

- 工业的

- 商业的

- 双极电晶体

- 闸流管

- 整流器

- 其他类型(结型闸极场效电晶体 (JFET)、GaN HEMT、双向可控硅、变容二极体、TVS 二极体和齐纳二极体)

- 场效管

- 最终用户垂直领域

- 汽车

- 消费性电子产品

- 沟通

- 工业的

- 其他最终用户垂直领域

- 地理

- 美洲

- 欧洲

- 亚太地区(中国、日本、台湾)

- 世界其他地区

第 6 章:竞争格局

- 公司简介

- ABB Ltd

- On Semiconductor Corporation (Fairchild Semiconductor)

- Infineon Technologies AG

- STMicroelectronics NV

- Toshiba Electronic Devices & Storage Corporation

- NXP Semiconductors NV (To be Acquired by Qualcomm)

- Diodes Incorporated

- Nexperia BV

- D3 Semiconductor LLC

- Eaton Corporation PLC

- Hitachi Ltd

- Mitsubishi Electric Corp.

- Fuji Electric Corp.

- Taiwan Semiconductor Manufacturing Company Ltd

- Vishay Intertechnology Inc.

- Renesas Electronics Corporation

- ROHM Co. Ltd

- Microsemi Corporation (Microchip Technology)

- Qorvo Inc.

- Cree Inc.

- General Electric Company

- Littelfuse Inc

- United Silicon Carbide Inc.

第 7 章:投资分析

第 8 章:市场机会与未来趋势

The Discrete Semiconductor Market size is estimated at USD 45.72 billion in 2024, and is expected to reach USD 68.46 billion by 2029, growing at a CAGR of 8.41% during the forecast period (2024-2029).

The discrete semiconductor market is driven by the increasing need to manage power across electronics and miniaturization. The reduction in package size is inversely proportional to power dissipation. For instance, NXP semiconductors achieved a 55% reduction in packaging size for their transistors range by retaining the same power performance. Additionally, Diodes Incorporated launched 40V-rated DMTH4008LFDFWQ and 60V-rated DMTH6016LFDFWQ automotive-compliant MOSFETs packaged in DFN2020.

Key Highlights

- Moreover, characteristics like safety, infotainment, navigation, and fuel efficiency in the automotive components, and security, automation, solid-state lighting, transportation, and energy management in industrial components are expected to fuel the market studied. For instance, an insulated gate bipolar transistor (IGBT) is an integral component in the EV power electronics system. IGBTs are expected to witness significant demand due to increasing sales of EVs globally. As per the IEA report, sales of electric cars globally reached 6.6 million in 2021. Electric cars accounted for 9% of global car sales.

- Commercialization of these electric vehicles is on the rise. Volvo is aiming for 50% of its sales to be made up of fully electric cars by 2025. BMW has also dropped its i5 plans and will now focus on electrification of other series models like the X3 and 4 Series GT. The latter will directly compete with Tesla's Model 3 and Model y.

- Furthermore, companies are developing new solutions in the power module segment to expand their presence and increase market share. For instance, In December 2021, STMicroelectronics, a prominent semiconductor company serving customers across the spectrum of electronics applications, has announced the release of its third generation of STPOWER silicon-carbide (SiC) MOSFETs1, advancing the state-of-the-art in power devices for electric-vehicle (EV) powertrains and other applications where power density, energy efficiency, and reliability are key target criteria.

- In contrast, the COVID-19 outbreak has had an enormous impact on the global and national economies. Many end-user industries have been affected, including discrete semiconductors. A large part of the manufacturing of electronic components includes work on the factory floor, where people are in close contact as they collaborate to boost productivity. Currently, companies in the market are quickly evaluating the impacts on three fronts: market demand, supply chain, and workforce. Demand for the product is shifting across ASICS, memory, sensors, etc., while consumer behavior changes rapidly and with future volatility. Also, many companies have delayed their hardware upgrades and other long-term migration projects. For instance, the rollout of the 5G plan has been delayed in many countries, such as India, Japan, Poland, and Israel, which, in turn, caused uncertainty for the launch of commercial 5G services.

- The global supply chains are disrupted as the virus spreads across the world, as still there is uncertainty over quarantine durations. Many manufacturing factories were shut down across the world to contain the deadly virus. For instance, most of the manufacturing facilities of On Semiconductors were shut down due to government mandates in countries like Malaysia, China, Malaysia, and the Philippines, which impacted its ability to supply products to its clients and created a gap in demand and supply.

Discrete Semiconductor Market Trends

The Automotive Segment is Expected to Drive the Market's Growth

- Automotive applications are driving a majority of the demand for discretes, especially for power transistors and rectifiers. Conventional cars have been using 12-V battery systems since the 1950s, but in the current scenario, they cannot handle the heavier electronic loads of next-generation vehicles, thus creating the need for power-efficiency.

- Autonomous driving and fully electric vehicles are demanding higher-performance microcontrollers and microprocessors, with more efficient, high-power MOSFETS, for power management and battery monitoring systems.

- Discrete semiconductors find widespread use in electric vehicles. Space limitations and high-efficiency requirements demand a device that can carry high power and switch at higher frequencies. They can have high currents with very low losses and at a very high frequency, creating significant demand for these devices for EV applications.

- Moreover, with the acceleration of the EV market, many car makers are now embracing 800-V drive systems to increase efficiency, achieve faster charging, and expand the range of such vehicles, all while reducing weight and cost. Wide-bandgap devices, such as SiCMOSFETs, are helping automakers advance state-of-the-art power devices for EV powertrains and other applications where such factors are important.

- In December 2022, STMicroelectronics launched new silicon-carbide (SiC) high-power modules designed to increase electric vehicles' performance and driving range. Five new SiC MOSFET-based power modules have been selected by Hyundai for use in the E-GMP electric vehicle platform shared by the KIA EV6 and multiple models.

- In August 2022, Renesas Electronics Corporation announced the development of a new generation of Si-IGBTs. Through this launch, the company imed at next-generation EV inverters, AE5-generation IGBTs were expected to be mass-produced starting in the first half of 2023 on Renesas' 200- and 300-mm wafer lines at the company's factory in Naka, Japan.

- The EVs market is highly competitive, and new manufacturers are pushing the envelope for innovation. For instance, Porsche equipped its Taycan with an 800 V system, while many contemporary electric cars operate with 400 V batteries. This led traditional automotive component manufacturers to develop their discrete semiconductor lineup for the automotive sector.

The Americas is Expected to Hold a Major Market Share

- The proliferating consumer electronics industry in the region is one of the primary factors driving the growth of the market. For instance, according to the Consumer Technology Association (CTA), U.S. technology retail revenues are expected to reach USD 485 billion in 2023. Though it is slightly down from the record-breaking USD 512 billion in 2021, the revenues will still remain above pre-pandemic levels, as per the organization.

- Further, emerging technologies like the Internet of Things (IoT) have created a new wave of innovation in the semiconductor industry. An increasing number of electronic devices, ranging from laptops to thermostats, are becoming connected each year in the region, allowing for more sophisticated communication and coordination between them and their users. For instance, as per the CTA, 23% of U.S. homes had smart or connected health monitoring devices in 2021, and 19% had connected sports or fitness equipment (up seven points from the previous year). The expanding IoT market is expected to positively influence the region's demand for discrete semiconductors.

- The automotive sector in the United States is a crucial component of economic growth and has historically contributed 3 - 3.5% to the overall Gross Domestic Product (GDP), as per the Center for Automotive Research. The industry also contributes to a significant portion of the region's total demand for semiconductor components.

- The automotive industry's transformation toward electrification is also fueling the demand for sophisticated semiconductor components. For instance, as per IEA's annual Global Electric Vehicle Outlook 2023, the United States is the third largest electric vehicle market, with strong sales growth of 55%.

- Moreover, according to Argonne National Laboratory, in FY2023, 97,972 HEVs were sold in the United States, up 36.4% from the sales in April 2022. Toyota accounted for a 44.3% share of total HEV sales this month.

- The growing renewable energy sector in Canada is also expected to support market growth. According to the Canadian Renewable Energy Association (CanREA), Canada's wind and solar energy sectors grew significantly in 2022. As per the organization, solar is growing particularly quickly, with more than one-quarter of all the installed capacity in Canada being added in 2022 alone.

Discrete Semiconductor Industry Overview

The global discrete semiconductor market is highly fragmented, with numerous semiconductor manufacturers providing the product. The companies are continuously investing in product and technology to promote sustainable environmental growth and prevent environmental hazards. The companies are also acquiring other companies that specifically deal with these products to boost the market's share. Some of the recent developments in the market are:

- In January 2023, Hitachi Astemo, Ltd., a renowned Japanese manufacturer of automotive components, announced that its electric vehicle inverters would use ROHM Semiconductor's new fourth-generation SiCMOSFETs and gate driver ICs. The newest fourth-generation SiCMOSFETs from ROHM offer the lowest ON-resistance in the industry and improved short-circuit withstand time, allowing for an increase in the cruising range of electric vehicles by 6% when compared to IGBTs.

- In January 2023, Renesas Electronics Corporation announced the introduction of a new gate driver IC designed to drive high-voltage power devices such as IGBTs and SiC MOSFETs for electric vehicle (EV) inverters.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics Segment

- 4.5.2 Demand for Green Energy Power Generation Drives the Market

- 4.6 Market Restraints

- 4.6.1 Rising Demand for Integrated Circuits

5 MARKET SEGMENTATION

- 5.1 Construction Type

- 5.1.1 MOSFET

- 5.1.1.1 MOSFET - BY MATERIAL

- 5.1.1.1.1 Si MOSFET

- 5.1.1.1.2 SiC MOSFET

- 5.1.1.2 MOSFET - BY END USER

- 5.1.1.2.1 Consumer Electronics

- 5.1.1.2.2 Medical

- 5.1.1.2.3 Automotive

- 5.1.1.2.4 Computing and Storage

- 5.1.1.2.5 Industrial

- 5.1.1.2.6 Network and Telecom

- 5.1.1.2.7 Other End Users

- 5.1.2 IGBT - Overview and Market Estimates

- 5.1.2.1 Automotive

- 5.1.2.2 Energy (Production and Distribution)

- 5.1.2.3 Transportation

- 5.1.2.4 Industrial

- 5.1.2.5 Commercial

- 5.1.2.6 Bipolar Transistor

- 5.1.2.7 Thyristor

- 5.1.2.8 Rectifier

- 5.1.2.9 Other Types (Junction Gate Field Effect Transistor (JFET), GaN HEMT, Triacs, Varactor Diodes, TVS Diodes, and Zener Diodes)

- 5.1.1 MOSFET

- 5.2 End-user Vertical

- 5.2.1 Automotive

- 5.2.2 Consumer Electronics

- 5.2.3 Communication

- 5.2.4 Industrial

- 5.2.5 Other End-user Verticals

- 5.3 Geography

- 5.3.1 Americas

- 5.3.2 Europe

- 5.3.3 Asia-Pacific (China, Japan, Taiwan)

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 On Semiconductor Corporation (Fairchild Semiconductor)

- 6.1.3 Infineon Technologies AG

- 6.1.4 STMicroelectronics NV

- 6.1.5 Toshiba Electronic Devices & Storage Corporation

- 6.1.6 NXP Semiconductors NV (To be Acquired by Qualcomm)

- 6.1.7 Diodes Incorporated

- 6.1.8 Nexperia BV

- 6.1.9 D3 Semiconductor LLC

- 6.1.10 Eaton Corporation PLC

- 6.1.11 Hitachi Ltd

- 6.1.12 Mitsubishi Electric Corp.

- 6.1.13 Fuji Electric Corp.

- 6.1.14 Taiwan Semiconductor Manufacturing Company Ltd

- 6.1.15 Vishay Intertechnology Inc.

- 6.1.16 Renesas Electronics Corporation

- 6.1.17 ROHM Co. Ltd

- 6.1.18 Microsemi Corporation (Microchip Technology)

- 6.1.19 Qorvo Inc.

- 6.1.20 Cree Inc.

- 6.1.21 General Electric Company

- 6.1.22 Littelfuse Inc

- 6.1.23 United Silicon Carbide Inc.