|

市场调查报告书

商品编码

1433898

整合通讯(UC) 与协作:市场占有率分析、产业趋势与统计、成长预测(2024-2029 年)Unified Communications and Collaboration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

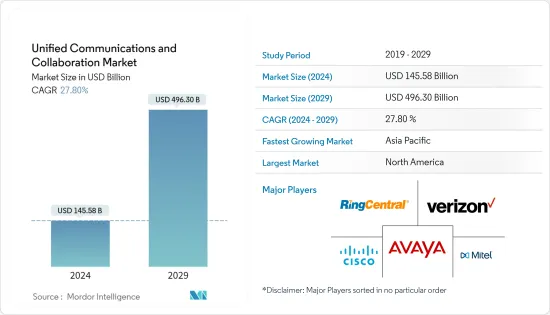

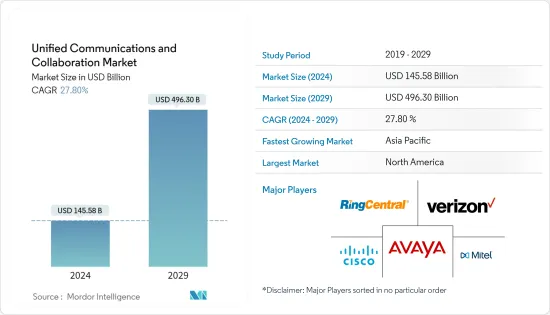

整合通讯(UC)和协作市场规模预计在2024年为1455.8亿美元,预计到2029年将达到4963亿美元,在预测期内(2024-2029年)复合年增长率为27.80%。

整合通讯(UC) 和协作需求传统上围绕着单一产品。过去,公司选择单独的产品来满足特定的需求。例如,一个组织购买了用于通讯的电子邮件伺服器、用于团队合作的团队会议室、用于组织资讯共用的入口网站以及用于语音通信服务的 PBX 和语音邮件。客户正在根据整个协作堆迭的功能、丰富性和整合来制定策略性技术决策,以部署整合通讯(UC) 和协作环境。

主要亮点

- 选择协作和通讯产品的公司通常是根据平台的未来方向来选择的。选择正确的平台可以帮助企业降低 IT 成本、管理开销和整合挑战。此外,整体平台方法在最终用户培训、采用和商业价值方面提供了显着的好处。

- 经济高效的云端基础的解决方案的出现导致 IT 预算最少的医疗保健提供者越来越多地采用该解决方案。透过基于订阅的联合通讯服务,医疗客服中心建立了 PBX(专用交换机)系统,以无缝处理来自不同站点的多个客户请求。

- 对于消费者来说,行动优先的解决方案允许他们透过同一装置透过聊天、语音通话和视讯通话进行通信,可以解决任何客户问题。因此,这些解决方案增强了客户服务协助、产品查询和自助服务。员工也将受益于虚拟培训和产品管理工具的实施。

- 各种个人和 B2B资料密集型应用程式不断涌现,包括 AR、VR 和视讯应用。 IT、电讯、BFSI、医疗保健、零售、媒体和娱乐等产业都有不同类型的视讯会议需求,如高频宽、低功耗、超功耗延迟和高速。

- 此外,5G技术的兴起为云端运算带来了许多变化。 5G的低延迟连线使企业能够提供更流畅的通讯。整合 5G 可实现无缝檔案传输、云端服务的流畅体验以及高品质、不间断的视讯会议解决方案。据 5G Americas 称,截至 2023 年,全球第五代 (5G) 用户预计将达到 19 亿。预计到 2024 年,这一数字将增至 28 亿,到 2027 年将增至 59 亿。

- 此外,根据 GSMA 的数据,到 2040 年,印度製造业将从 5G 网路中受益 20%。此外,消息人士预测,到2023年至2023年,印度经济可能会从5G网路中受益超过4,500亿美国。 2040. 5G 技术的扩展可能会进一步推动所研究市场的成长。

- 远端工作要求正在推动基于软体的通讯成为服务供应商业务永续营运的关键推动因素,透过统一通讯即服务 (UCaaS) 和整合通讯即服务(UCaaS) 进行容量协调和服务交付(无论位于何处)。创造了前所未有的机会来展示云端服务的弹性。预计这一趋势将支持市场成长。

整合通讯(UC) 与 Collaboron 市场趋势

零售业越来越多地采用 UC&C 解决方案来推动市场成长

- 零售商正在部署云端运算技术来增加销售额、分析客户资讯并透过降低成本和提高网路效能来改善用户体验。例如,用于语音和其他协作工具的整合通讯即服务(UCaaS)、用于跨商店集中资讯服务的支援 Wi-Fi 的网路即服务 (NaaS),以及软体定义的广域网路 (SD-WAN)。增强零售商效益。

- RFID技术在零售业持续发展。 RFID 作为一种近距离技术具有天然的协同效应。作为客户自助服务工具进行了广泛测试,用于结帐处的定价和库存管理。 RFID还有望用作未来行动和手持设备的设备识别和认证机制,例如识别进入商店的顾客并根据顾客的偏好提供客製化体验。如此巨大的客户体验影响力只能透过资讯来发挥。整合通讯技术是零售业务的核心,它将客户、销售和库存业务整合到一部电话、电脑或 POS 系统中。

- 快速变化的客户购买趋势导致零售商从以前的个人化互动动态转变为透过网路和社群媒体进行全通路互动。消费者日益增长的需求正在推动增强所有通路的购物和服务体验的需求,满足对自动化客户服务和零售业务的创新通讯工具的需求。

- 服装零售电子商务网站可以将许多业务切换到混合云端模式,以确保无缝的业务业务。可以操作公共云端资源来履行订单并管理资源可扩充性功能。相较之下,私有云端模型可用于解决涉及需要严格管治的敏感资料的法律法规,例如客户付款详细资讯。

- 此外,根据美国零售联合会的数据,截至 2022 年,日本零售集团 Seven & i 是全球门市数量领先的零售公司,拥有 40,773 个门市网路。此类零售店的增加可能会在所研究的市场中创造进一步的需求。

欧洲获得主要市场占有率

- 英国通讯业者逐步淘汰综合业务数位网路服务的努力正在加速通讯业者和客户转向网际网路通讯协定连接服务。这一重大转变将加速下一代企业通讯解决方案的采用,例如託管专用交换机和 UCaaS 解决方案。

- 2022 年 2 月,云端通讯、协作、视讯会议和客服中心解决方案供应商Vodafone Business 和 RingCentral 宣布推出 Vodafone Business UC 和 RingCentral。该通讯平台将 RingCentral 讯息视讯电话 (MVP) 与沃达丰的行动性和 5G 功能结合。带有 RingCentral 的沃达丰 Business UC 将在英国、德国、香港、义大利、葡萄牙、新加坡、西班牙和瑞典推出。合作伙伴关係在市场上也很突出,有助于提高解决方案的知名度。

- 研究市场中的公司也从事多种策略活动,以保持其在行业中的相关性。例如,Lumen Technologies 和思科最近宣布,他们正在扩大合作伙伴关係,将自己的产品纳入其中。适用于思科统一通讯管理器云端 (UCMC) 的 Lumen 解决方案。该产品将思科云端基础的协作服务与 Lumen 的全球光纤网路结合。

- 2023 年 2 月,TCN, Inc. 是一家为企业、客服中心、BPO 和催收机构提供云端基础客服中心平台的跨国供应商,其新的欧盟总部正式开幕。

- 欧盟委员会开始采取更果断的措施来确保加密通讯的安全。欧盟委员会工作人员需要安全的通讯工具来进行整合通讯,以加强协作、集中资讯并提高整体效率。这为公司提供了推出创新产品的机会。

- 此外,整合通讯解决方案提供商和数位工作场所的先驱者朗视最近宣布与法国通讯分销和商业网路市场参与者 Alliance-Com 签订新的分销协议。该协议强调了两家公司致力于提供更全面的 UC&C 解决方案的承诺,包括为中小型企业提供强大的 UCaaS 选项。此次合作将使法国客户能够利用朗视一流的产品组合和联盟专业Com服务的双重优势,消除连网和协作工作环境的障碍。它也极大地推动了法国的 VoIP通讯业务。在预测期内,此类区域发展可能会进一步推动调查市场的需求。

整合通讯(UC) 与协作产业概述

整合通讯(UC) 和协作市场见证了快速创新、产业整合以及向团队和工作流程协作的转变。近年来,对完整的 UC&C 平台的需求促使许多供应商进行整合,因为获取客户群是实现这一目标的最快方式。市场上的主要企业正在专注于新产品开发技术,以增强产品系列併增加客户获取。市场的最新发展包括:

2022 年 2 月,法国零售商 Fnac Darty 宣布与 Google 建立新的合作伙伴关係,以改善其线上服务。 Fnac Darty 的网站将由 Google 的云端零售搜寻提供支援,这是一种帮助客户寻找产品的工具。 Fnac Darty 是法国零售商之一,他们利用这项创新的 Google Cloud 服务为网路购物和行动购物树立了新基准。

2022 年 1 月,泛欧经销商 Nuvias UC 收购了德国整合通讯经销商 Alliance Technologies。 Nuvias UC的渠道覆盖范围将扩展到全部区域。 Alliance Technologies 的专业领域包括全 IP 服务、PBX 到 Teams 或 Zoom 迁移、用于个人工作空间、在家工作和会议室的 UC 设备、经过认证的 Zoom Phone 整合以及 Microsoft Azure 云端服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 计量收费模式的出现推动了对传统统一通讯解决方案的需求

- 不断变化的劳动力动态导致新的企业合作的出现

- 中小企业需求增加,促进引进

- 市场挑战

- 管理和整合挑战仍然是传统统一通讯所面临的问题

- 产业吸引力-波特五力分析

- 消费者议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业中的 COVID-19 评估

第五章技术概述

- UC&C 的演变

- 各种UC&C产品成本比较

- 新案例研究- 情境协作、企业社交网络和其他内部沟通工具

第六章市场区隔

- 依部署类型

- 本地/託管

- 云(UCaaS)

- 按类型

- 企业VOIP/UC解决方案

- 企业协作

- 客服中心服务

- 客户互动应用

- 其他类型

- 按最终用户产业

- 零售

- BFSI

- 卫生保健

- 公共部门

- 其他最终用户产业(物流、IT/通讯等)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他地区(拉丁美洲和中东非洲)

第七章 竞争形势

- 公司简介

- Avaya Inc.

- Cisco Systems Inc.

- RingCentral Inc.

- Verizon Communications Inc.

- Mitel Network Communications

- Polycom Inc.(Plantronics)

- NEC Corporation

- AT&T Inc.

- GoToConnect

- 8x8 Inc

- Zoom Video Communications Inc.

- 3CX Ltd.

第八章投资分析

第9章市场的未来

The Unified Communications and Collaboration Market size is estimated at USD 145.58 billion in 2024, and is expected to reach USD 496.30 billion by 2029, growing at a CAGR of 27.80% during the forecast period (2024-2029).

The unified communications and collaboration demand has historically revolved around individual products. In the past, companies chose individual products to meet particular needs. For example, organizations bought email servers for messaging, team rooms for teamwork, portals for organizational information sharing, and PBX and voicemail for telephony services. Customers are making strategic technology decisions to deploy unified communications and collaboration environments based on the entire collaboration stack's capability, richness, and integration.

Key Highlights

- Companies that choose collaboration and communication products often do so based on the platform's future direction. Selecting the right platform helps companies reduce IT costs, management overhead, and integration challenges. Moreover, a holistic platform approach substantially benefits end-user training, adoption, and business value.

- The advent of cost-effective cloud-based solutions has increased healthcare providers' adoption, often categorized as having minimum IT budgets. With the subscription-based united communication services, the healthcare contact centers establish their PBX (Private Branch Exchange) systems and seamlessly address multiple customer requests from various sites.

- For consumers, mobile-first solutions enabling communication through chat, audio, and video call through the same device can address all customer queries. Therefore, these solutions enhance customer service assistance, merchandise inquiries, and self-service. Employees also benefit from deploying virtual training and merchandise management tools.

- Various individual and B2B data-intensive applications, such as AR, VR, and video applications, are emerging. The industries such as IT, telecom, BFSI, healthcare, retail, media and entertainment, and many others have different types of video conferencing essentials, including high bandwidth, low power, ultra power latency, and high speed.

- Furthermore, the rise of 5G technology has brought many changes to cloud computing. The low latency connectivity of 5G enables enterprises to provide smoother communication. Integrating 5G would lead to seamless file transfers, a smooth experience for cloud services, and high-quality and uninterrupted video conferencing solutions. According to 5G Americas, as of 2023, there are an estimated 1.9 billion fifth-generation (5G) subscriptions worldwide. This figure is forecast to increase to 2.8 billion by 2024 and 5.9 billion by 2027.

- In addition, according to GSMA, the manufacturing sector in India will get a 20% benefit from the 5G network by 2040. Further, the source predicted that more than 450 billion U.S. dollars will likely benefit the Indian economy from the 5G network between 2023 and 2040. Such expansion in 5G technology may further propel the studied market growth.

- Remote work mandates create an unprecedented opportunity for service providers to promote software-based communications as a critical enabler of business continuity and demonstrate the flexibility of unified communications as a service (UCaaS) and cloud services regarding capacity adjustments and service delivery (irrespective of location). This trend is expected to support market growth.

Unified Communications and Collaboration Market Trends

Growing Adoption of UC&C Solutions in Retail Driving the Market's Growth

- Retailers are adopting cloud computing technologies to boost their sales, analyze customer information, and improve the user experience by reducing costs and improving network performance. For example, unified communications as a service (UCaaS) for voice and other collaborative tools, Wi-Fi-enabled Network as a Service (NaaS) for centralized data services across stores, and Software Defined-Wide Area Networks (SD-WAN) are enhancing the retailer benefits.

- RFID technology continues to grow in the retail sector. RFID provides a natural synergistic effect as a proximity technology. It has been extensively tested as a customer self-service tool for pricing and inventory management in checkout lines. RFID is also expected to be used as a device recognition and authentication mechanism for future mobile and handheld devices, like recognizing the incoming customers to the store and providing customized experiences based on their likes. The impact of a customer experience of that scale can only be leveraged with information. Unified communications technologies are the locus of retail operation, integrating customer, sales, and inventory operations into one telephone, computer, or POS system.

- The rapidly changing customer purchasing trends have resulted in a dynamic shift in the retail enterprise from the earlier individual point of interaction to omnichannel through the web or social media. The increasing demand from consumers has created the need for an enhanced shopping and service experience across all channels, which caters to the requirement for innovative communication tools that automate customer service and retail business operations.

- Apparel retail e-commerce sites can switch to a hybrid cloud model for many operations to ensure seamless work operations in their businesses. Public cloud resources could be operated for processing orders and managing the scalability features of the resources. In comparison, the private cloud model could be used to work on legal regulations, including crucial data, such as payment details of customers, that require strict governance.

- Furthermore, According to the National Retail Federation, as of 2022, the Japanese retail group Seven & I was the leading retail company based on a worldwide number of stores, with a network of 40,773 locations. Such an increase in retail stores may further create demand in the studied market.

Europe to Experience Significant Market Share

- The UK carriers' efforts to discontinue the integrated services digital network services are driving the carrier and customer migration to Internet protocol connectivity services. This huge shift drives the adoption of next-generation enterprise communication solutions, such as hosted private branch exchange and UCaaS solutions.

- In February 2022, Vodafone Business and RingCentral, cloud communications, collaboration, video meetings, and contact center solutions provider, announced Vodafone Business UC with RingCentral. This communications platform combines RingCentral Message Video Phone (MVP) with Vodafone's mobility and 5G capabilities. Vodafone Business UC with RingCentral will be launched in the United Kingdom, Germany, Hong Kong, Italy, Portugal, Singapore, Spain, and Sweden. The market is also witnessing partnerships, helping to increase awareness of the solutions.

- Companies in the market studied also indulge in multiple strategic activities to stay relevant in the industry. For instance, Lumen Technologies and Cisco recently announced expanding the partnership to include a unique offering. Lumen Solutions for Cisco Unified Communications Manager Cloud (UCMC). This product pairs Cisco's cloud-based collaboration services with Lumen's global fiber network.

- In February 2023, TCN, Inc., a multinational provider of a comprehensive cloud-based call center platform for enterprises, contact centers, BPOs, and collection agencies, officially launched its new EU head office.

- The European Commission has begun taking more decisive steps toward secure, encrypted communications. Staff members for the EU Commission need a safe messaging tool for unified communication to ensure greater mobility with collaboration, centralize information, and boost overall efficiency. This offers an opportunity for companies to roll out innovative products.

- Further, Yeastar, a provider of unified communications solutions and a pioneer in the digital workplace, recently announced a new distribution agreement with Alliance-Com, the French market player in telecom distribution and business networks. This agreement highlights both firms' commitment to providing more comprehensive UC&C solutions, including robust UCaaS options for SMEs. The partnership allows French clients to use the dual benefits of Yeastar's top-notch portfolio and Alliance-professional Com's services, removing barriers to a connected and collaborative workplace. It also gives the VoIP communication business in France a lot of traction. Such regional developments may further propel the studied market demand in the forecast period.

Unified Communications and Collaboration Industry Overview

The unified communications and collaboration market witnessed rapid innovation, industry consolidation, and a shift toward team and workstream collaboration. In recent years, the need to have a complete UC&C platform caused many vendors to consolidate because acquiring the customer base was the fastest way to accomplish this. The significant players operating in the market focus on new product development techniques to strengthen their product portfolio and increase customer acquisition. Some of the recent developments in the market are:

In February 2022, Fnac Darty, a French retailer, announced a new partnership with Google to improve its online offerings. Fnac Darty's websites will now employ Google's Cloud Retail Search, a tool that makes it easier for customers to find products. Fnac Darty was one of the retailers in France to use this innovative Google Cloud service to set new benchmarks for online and mobile shopping.

In January 2022, Nuvias UC, a pan-European distributor, purchased German unified communications distributor Alliance Technologies. Nuvias UC's channel reach will be expanded across the DACH (Germany, Austria, and Switzerland) region. Alliance Technologies ' specialties included all-IP services, PBX to Teams or Zoom migration, UC equipment for individual workspaces, home working and conference rooms, certified Zoom Phone integration, and Microsoft Azure cloud services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Emergence of Pay-as-you-go Model Driving the Demand over Legacy UC Solutions

- 4.2.2 Changing Workforce Dynamics Leading to the Emergence of New Forms of Enterprise Collaboration

- 4.2.3 Growing Demand from SME's Expected to Drive Adoption

- 4.3 Market Challenges

- 4.3.1 Management and Integration Challenges Remain a Concern for Traditional UC

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of COVID-19 on the Industry

5 TECHNOLOGY OVERVIEW

- 5.1 Evolution of UC&C

- 5.2 Cost Comparison of Various UC&C Offerings

- 5.3 Emerging Case Studies - Contextual Collaborations, Enterprise Social Networking and Other Internal Communication Tools

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise/Hosted

- 6.1.2 Cloud (UCaaS)

- 6.2 By Type

- 6.2.1 Business VOIP/UC Solutions

- 6.2.2 Enterprise Collaboration

- 6.2.3 Contact Center Services

- 6.2.4 Customer Interaction Applications

- 6.2.5 Other Types

- 6.3 By End-User Industry

- 6.3.1 Retail

- 6.3.2 BFSI

- 6.3.3 Healthcare

- 6.3.4 Public Sector

- 6.3.5 Others End User Industries (Logistics, IT & Telecom, Etc.)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World (Latin America and Middle East & Africa)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avaya Inc.

- 7.1.2 Cisco Systems Inc.

- 7.1.3 RingCentral Inc.

- 7.1.4 Verizon Communications Inc.

- 7.1.5 Mitel Network Communications

- 7.1.6 Polycom Inc. (Plantronics)

- 7.1.7 NEC Corporation

- 7.1.8 AT&T Inc.

- 7.1.9 GoToConnect

- 7.1.10 8x8 Inc

- 7.1.11 Zoom Video Communications Inc.

- 7.1.12 3CX Ltd.