|

市场调查报告书

商品编码

1433928

电池能源储存系统-市场占有率分析、产业趋势/统计、成长预测(2024-2029)Battery Energy Storage System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

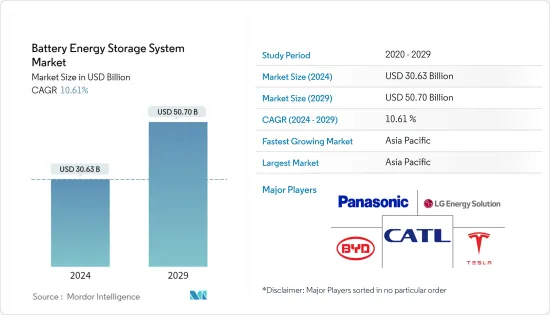

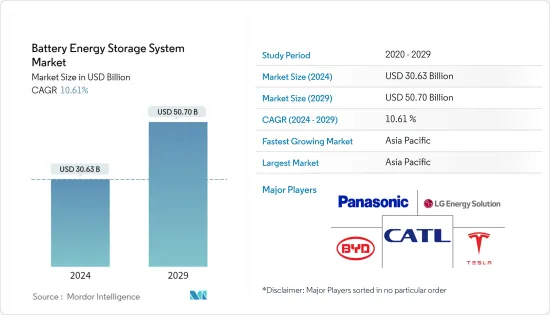

电池能源储存系统市场规模预计到2024年为306.3亿美元,预计到2029年将达到507亿美元,在预测期内(2024-2029年)增长10.61%,复合年增长率增长。

2020 年,市场受到 COVID-19 的负面影响。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,锂离子电池价格下降和可再生能源普及不断提高等因素可能会在预测期内推动电池能源储存系统市场的发展。

- 另一方面,钴、锂和铜等原材料的供需不匹配可能会阻碍研究期间电池能源储存系统(BESS)市场的成长。

- 儘管如此,用于储存能量的新型电池技术的进步可能会在预测期内为 BESS 市场创造有利的成长机会。

- 由于能源需求不断增长,亚太地区是预测期内成长最快的市场。这一增长可归因于该地区国家(包括印度、中国和澳大利亚)的投资增加以及支持性政府政策。

电池能源储存系统係统市场趋势

预计住宅成长最快的领域

- 最近,由于全部区域对可再生能源基础设施的投资增加,能源储存系统(ESS)经历了显着增长,特别是在住宅领域。

- 由于年度可支配所得的增加和全球在家工作趋势的上升,预计在预测期内住宅建筑的电力消耗量将会增加。能源储存系统用于在尖峰时段停电期间为家庭提供持续电力。

- 全球多个政府推出了各种激励计划来支持住宅能源储存市场。例如,加州的自发电奖励计画(SGIP)主要支持住宅储能产业,并为新的和现有的分散式能源提供奖励。

- 随着能源储存技术进步的加速,住宅能源储存领域可能会激增,导致电池价格下降和可再生能源的普及增加。

- 在可再生能源方面,住宅领域的大部分需求来自太阳能领域,这创造了对住宅电池能源储存系统的需求。例如,根据法国Territoire Solaire的数据,2022年第二季法国住宅太阳能发电总容量为1,758兆瓦,较2021年第二季成长13.8%。

- 包括投资公司 Harmony Energy Income Trust 在内的市场相关人员于 2022 年 11 月宣布,位于英国约克郡的 Pillswood计划比计划提前四个月开始运作。 Harmony 表示,98MW/196MWh 设施是欧洲最大的 BESS计划(以兆瓦时计算)。这足以为大约 30 万个英国家庭供电两个小时。该计划将使用特斯拉的 2-Hour Megapack 为英国电网提供平衡服务。 Harmony Energy 开发了计划,特斯拉监督建造。特斯拉的演算法交易平台 Autobidder 将管理计划。

- 2022年6月,丰田发布住宅蓄电池产品“大内急电系统”,进军能源储存市场。丰田发布了额定输出5.5kWh、额定容量8.7kWh的蓄电系统。它利用了该公司的电动车电池技术。当连接到屋顶太阳能发电系统时,该系统可以日夜为您的家供电。该公司最初的目标是在日本销售该储存系统。

- 因此,由于这些因素,预计住宅应用在预测期内将为电池能源储存系统市场产生有利的需求。

预计亚太地区将主导市场

- 预计亚太地区将在未来几年继续引领电池能源储存市场。该地区由两种主要类型的电网组成,每种电网都有不同的特征和能源储存系统係统的机会。一方面,日本、韩国、纽西兰、澳洲等高度发展国家和其他大城市拥有先进的电网,采用现代技术运作良好。

- 发展中地区也正在经历快速的人口成长和都市化,增加了对电力的需求。可再生能源的成本效益越来越高,新兴国家预计将大量可再生能源纳入电网。预计许多地区将采用更分散的电网发展方式,更多地使用本地发电和微电网系统。它正在为区域市场成长创造潜力。

- 由于政府的支持和政策,中国的住宅能源储存市场预计将成长。表现出透过补贴和安装目标刺激国内太阳能设备需求强劲成长的能力。

- 澳洲正在经历能源转型,预计这项转型将在未来几十年持续下去。这种转变包括增加对可再生能源的依赖,以应对气候变迁减缓政策。

- 2022年1月,Woodside Energy向西澳大利亚州环境保护部提交了提案。该设施占地约 975.6 公顷,开发面积为 1,100.3 公顷。根据提案,该太阳能发电厂将包括约100万块太阳能板以及电池能源储存系统和变电站等支援基础设施。

- 可再生能源的成本效益越来越高,新兴国家预计将大量可再生能源纳入电网。预计许多地区将采用更分散的电网发展方式,更多地使用本地发电和微电网系统。

- 因此,由于这些因素,亚太地区预计将在预测期内主导市场。

电池能源储存系统产业概况

电池能源储存系统係统市场较分散。市场主要企业包括(排名不分先后)比亚迪有限公司、松下公司、LG Energy Solution Ltd、特斯拉公司和宁德时代新能源科技有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2028年之前的市场规模和需求预测(金额)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 类型

- 锂离子电池

- 铅蓄电池

- 镍氢电池

- 其他种类(钠硫电池、液流电池)

- 目的

- 住宅

- 商业/工业

- 效用规模

- 按地区分類的市场分析(到 2028 年的市场规模和需求预测(仅按地区))

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 卡达

- 北美洲

第六章 竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Company Limited

- Panasonic Corporation

- LG Energy Solution Ltd

- Contemporary Amperex Technology Co. Limited

- Sony Corp.

- Varta AG

- Tesla Inc.

- Samsung SDI Co. Ltd

- Cellcube Energy Storage System Inc.

第七章 市场机会及未来趋势

The Battery Energy Storage System Market size is estimated at USD 30.63 billion in 2024, and is expected to reach USD 50.70 billion by 2029, growing at a CAGR of 10.61% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Presently the market reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as declining prices of lithium-ion batteries and increased penetration of renewable energy are likely to drive the battery energy storage systems market in the forecast period.

- On the other hand, the demand-supply mismatch of raw materials like cobalt, lithium, copper, etc., will likely hinder the growth of the battery energy storage systems (BESS) market in the studied period.

- Nevertheless, technological advancements in new battery technologies to store energy will likely create lucrative growth opportunities for the BESS market during the forecast period.

- Asia-Pacific is the fastest-growing market during the forecast period due to the rising energy demand. This growth is attributed to increasing investments, coupled with supportive government policies in the countries of this region, including India, China, and Australia.

Battery Energy Storage System Market Trends

Residential Expected to be the Fastest-growing Segment

- Recently, the energy storage system (ESS) experienced significant growth, especially in the residential sector, along with the rising investments in renewable energy infrastructure across the regions.

- Electricity consumption in residential buildings is estimated to increase during the forecast period due to increasing annual disposable incomes and the rising work-from-home trend worldwide. Energy storage systems are used for continuous power supply at homes during power outages at peak hours.

- Various incentive programs initiated by several governments worldwide are in place to support the residential energy storage market. For instance, California's Self-Generation Incentive Program (SGIP) primarily supports the residential storage sector and offers incentives for new and existing distributed energy resources.

- The residential energy storage segment will likely proliferate because of increasing technological advancements in energy storage technology, leading to a decline in battery prices and the widespread deployment of renewable power sources.

- In renewable power sources, the majority of demand in the residential sector comes from the solar energy segment, which, in turn, creates demand for residential battery energy storage systems. For instance, according to France Territoire Solaire, in Q2 2022, France's total residential photovoltaic solar energy capacity accounted for 1,758 MW, an increase of 13.8 % compared to Q2 2021.

- Market players like Harmony Energy Income Trust, an investment firm, announced in November 2022 that its Pillswood project in Yorkshire, United Kingdom, had gone live four months earlier than planned. According to Harmony, the 98MW/196MWh facility is Europe's largest BESS project by MWh. It is enough to power approximately 300,000 UK homes for two hours. The project will provide balancing services to the UK electricity grid network using a Tesla two-hour Megapack. Harmony Energy developed the project, with Tesla overseeing construction. Autobidder, Tesla's algorithmic trading platform, will manage the project.

- In June 2022, Toyota entered the energy storage market by launching the O-Uchi Kyuden System, a residential battery product. Toyota launched a rated output of 5.5 kWh and a rated capacity of 8.7 kWh battery storage system. It uses the company's electric vehicle battery technology. When connected to a photovoltaic rooftop system, the system can power a home day and night. Initially, the company aimed to sell the storage system in Japan.

- Therefore, owing to these factors, the residential application is expected to create lucrative demand in the battery energy storage systems market during the forecast period.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific is expected to keep leading the market for battery energy storage over the next few years. The region consists of two main types of power grids, each with different characteristics and opportunities for energy storage systems. On one side are highly developed countries like Japan, South Korea, New Zealand, and Australia, as well as other large cities with advanced grids that work well and use the latest technologies.

- The developing regions are also witnessing rapid population growth and urbanization, increasing the electricity demand. Renewable energy is becoming increasingly cost-effective, and developing countries are expected to include huge amounts of renewable energy into their grid. Many areas are expected to adopt a more distributed approach to grid development, using more local power generation and microgrid systems. It is creating the potential for the regional market's growth.

- China's residential energy storage market is expected to grow due to government support and policies. It showed its ability to stimulate high growth in domestic demand for solar-related equipment through subsidies and installation targets.

- Australia is undergoing an energy transformation, expected to intensify over the coming decades. The transformation includes a greater reliance on renewable energy in response to climate mitigation policies.

- In January 2022, Woodside Energy submitted a proposal for a 500 MW solar facility and 400 MWh of battery storage to the Western Australian Environmental Protection Authority. The facility would cover approximately 975.6 hectares within a development envelope of 1,100.3 hectares. According to the proposal, the solar facility will install approximately 1 million solar panels and support infrastructures such as a battery energy storage system and an electrical substation.

- Renewable energy is becoming increasingly cost-effective, and developing countries are expected to include huge amounts of renewable energy into their grid. Many areas are expected to adopt a more distributed approach to grid development, using more local power generation and microgrid systems.

- Therefore, owing to such factors, Asia-Pacific is expected to dominate the market during the forecast period.

Battery Energy Storage System Industry Overview

The battery energy storage system market is fragmented. Some of the major players in the market (in no particular order) are BYD Company Limited, Panasonic Corporation, LG Energy Solution Ltd, Tesla Inc, and Contemporary Amperex Technology Co. Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, until 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-acid Batteries

- 5.1.3 Nickel Metal Hydride

- 5.1.4 Other Types (Sodium-sulfur Batteries and Flow Batteries)

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility-scale

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Qatar

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Limited

- 6.3.2 Panasonic Corporation

- 6.3.3 LG Energy Solution Ltd

- 6.3.4 Contemporary Amperex Technology Co. Limited

- 6.3.5 Sony Corp.

- 6.3.6 Varta AG

- 6.3.7 Tesla Inc.

- 6.3.8 Samsung SDI Co. Ltd

- 6.3.9 Cellcube Energy Storage System Inc.

![电池储能係统市场 [应用:併网连接系统、离网连接系统、汽车等] - 2023-2031 年全球产业分析、规模、份额、成长、趋势和预测](/sample/img/cover/42/1420890.png)