|

市场调查报告书

商品编码

1406087

化合物半导体:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Compound Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

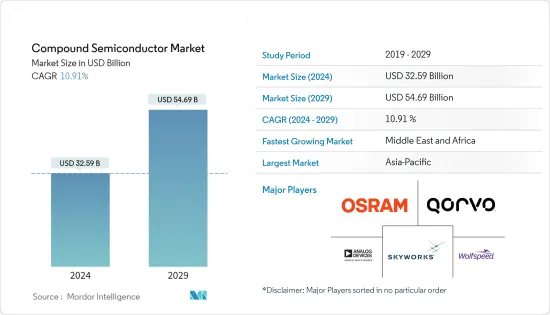

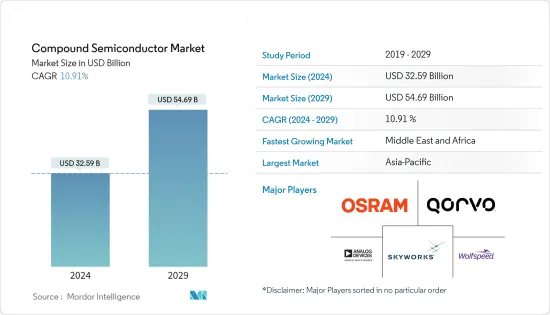

化合物半导体市场规模预计到2024年为325.9亿美元,预计到2029年将达到546.9亿美元,在预测期内(2024-2029年)复合年增长率为10.91%。

COVID-19 大流行已导致化合物半导体製造业的多种产品停止生产。此外,世界各国政府实施的各国封锁进一步打击了各个产业,扰乱了世界各地的供应链和製造业务。大多数製造业务,都受到严重影响,生产力下降。

主要亮点

- 化合物半导体由元素週期表中不同或相同族的两种或多种元素製成。化合物半导体是使用各种沉积技术製造的,例如化学气相沉积和原子层沉积。具有耐高温、增强频率、高磁灵敏度、高速运转和光电功能等独特性能是推动需求的一些关键优势。此外,随着化合物半导体製造成本的下降,其在电子设备和行动装置中的应用正在扩大。

- 进一步推动需求的是化合物半导体以普通照明 (LED)、雷射和光纤接收器的形式发射和感应光的能力。由于LED製造和安装成本的下降,其在各领域照明设备的应用正在扩大。大城市正在大力投资基础设施,以满足不断增长的人口的需求,政府正在帮助客户安装节能光源,以降低电力消耗成本。

- 例如,在大流行期间,EESL(能源效率服务有限公司)庆祝了为期一年的名为「Unnat Jyoti 计画(UJALA)」的政府计划的完成。该计划将超过 1,060 万盏路灯更换为 LED 照明,减少碳排放和电费2,000 万吨。这些倡议进一步提振了所研究的市场。

- 2020年,台积电(TSMC)约31%的零件来自中国,这一比例到2021年将增加至31%。

- 根据美国能源局(DOE) 的数据,LED 照明比传统白炽灯泡消费量约 75% 至 80%,比卤素灯泡节能约 65%。商业设施需要长时间照明,包括长时间工作、仓库和製造设施的安全保障以及其他用途。因此,透过改用 LED 照明,您每年可以节省数百万美元。例如, 美国 能源回收客户透过以现代 LED 照明取代旧照明系统,可以节省约 20% 至 55% 的公用事业费用。因此,采用 LED 的转变正在推动所研究市场的成长。

- 智慧型手机是化合物半导体的主要消费者。近年来,智慧型手机市场竞争异常激烈。行动电话使用量的增加预计将进一步推动全球市场。例如,根据爱立信2022年行动报告,到年终,全球5G用户数将达到44亿,占所有行动电话用户数的48%。

- 物联网应用正在兴起,预计将推动化合物半导体的销售。此外,随着5G网路的发展,无线通讯领域的成长也有望实现。第五代网路也为消费者提供了升级行动手机和设备的潜力,从而促进全球化合物半导体的采用。

- 化合物半导体产业被认为是最复杂的产业之一,因为它面临着恶劣的环境,包括波动的电子市场和不可预测的需求,以及製造和各种产品中涉及的 500 多个加工步骤。

化合物半导体市场趋势

光电器件在预测期内将大幅成长

- 纳入调查范围的光电产品包括光电二极体、光电电晶体、频谱仪、太阳能板和其他光电装置,不包括LED产品。

- 基于 GaN 的电晶体正在寻找新的途径,特别是在光电子领域,因为与基于 SiC 的电晶体相比,它们更快、更有效率。 GaN的电子迁移率比硅高1000倍,即使在高温下也能相对稳定地工作。

- 光电领域的最新进展,如等离子体奈米结构、钙钛矿晶体管、光学活性量子点、微灯泡、低成本3D成像、雷射驱动3D显示技术和雷射Li-Fi等,大大提高了光电元件的动态性能有望为应用领域带来量子变革。

- 此外,2022 年 6 月,来自美国(中佛罗里达大学)和韩国的研究人员创建了一种多波长光电突触,可在同一装置中进行光学资料检测、储存和处理。由此产生的感测器内人工视觉系统具有显着提高的处理效率和影像辨识精度,在机器人、自动驾驶汽车、机器视觉等领域具有潜在的应用。与人眼类似,视网膜透过视神经突触传输光学资料,光电突触允许将光学资料的感测、储存和处理整合到同一装置中。

- 此外,2022年8月,横河马达推出了两款新型频谱仪(OSA),以满足市场对可测量多种波长的仪器的需求,从而满足独特的光学产品扩展和製造需求。横河马达AQ6375E和AQ6376E是唯一覆盖2μm以上SWIR(短波长红外线)和3μm以上MWIR(中波长红外线)的光栅OSA,具有先进的光学性能。

- 公司正在扩大产品系列,以满足客户的多样化需求。例如,2022年4月,专门生产各种光电元件的亿光生产线推出了多种新产品,包括光电二极体和光电电晶体。这些产品由第三方经销商 Transfer Multisort Elektronik (TME) 提供。

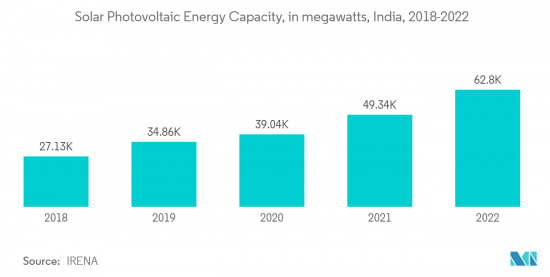

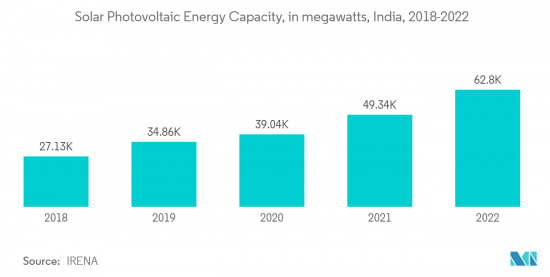

- 对可再生能源的需求不断增长进一步推动了所研究的市场。根据IRENA预测,印度南亚地区太阳能发电容量将在与前一年同期比较达到高峰超过62.8吉瓦,年增21.5%。

中东和非洲正在经历显着的成长

- 中东和非洲的主要国家,包括沙乌地阿拉伯、埃及和阿拉伯联合大公国,都拥有该地区一些最大的可再生能源项目。化合物半导体装置在控制再生能源来源的产生并将其连接到网路方面发挥关键作用。

- 此外,半导体产业在中东和非洲逐渐崛起,创造了可观的市场成长机会。例如,2022年3月,阿卜杜勒阿齐兹国王科技城(KACST)开设了该国第一个沙乌地阿拉伯城市,旨在支援电子晶片设计和在地化领域的研发和专家资格认证。我们的半导体计划的开始。

- 此外,5G 正在中东和北非显着扩张。海湾国家在 5G 发展方面处于领先地位,政府和当局向行动通讯业者进入许可权5G 发射频谱,使他们能够建立世界上第一个、最快的 5G 网路。据 GSMA 称,中东和北非 (MENA) 的多元化经济体将极大地受益于 5G,预计到 2030 年中频段将创造超过 160 亿美元(占该地区 GDP 的 0.35%)的新 GDP。

- 此外,2022年3月,总部位于南非的跨国行动电信业者MTN宣布将投资超过4,225万美元,用于该国最大省份北开普省及其司法中心南非的网路开发和5G推广。自由州宣布他们将投资。这些倡议促进了这些地区整体半导体产业的发展,为所研究市场的成长创造了积极的前景。

- 此外,杜拜预计将花费数百万迪拉姆进行奖励,到 2030 年在路上拥有 42,000 辆电动车。通用汽车预计,随着雪佛兰电动车的推出,中东和非洲的销量将增加。作为「智慧杜拜」计画的一部分,杜拜的电动车绿色充电站数量可能会增加一倍,该计画旨在使杜拜成为世界上最具创新性和最幸福的城市。杜拜水电局宣布在杜拜各地安装 100 个电动车绿色充电站,作为其绿色充电计画第二阶段的一部分。

- 据气候现实计画称,全球最大的聚光太阳能发电厂将于近期在杜拜附近竣工,预计发电量为1000兆瓦。杜拜的目标是到 2050 年实现 75% 的能源来自清洁能源来源,2030 年的能源结构目标是 25% 是太阳能。这些努力正在推动该地区的研究市场。

化合物半导体产业概况

化合物半导体市场竞争激烈,Broadcom、Skyworks Solutions、Cree、Qorvo、ADI、OSRAM、GaN Systems、Skyworks Solution 和 Infineon Technologies 等主要厂商占据市场主导地位。这些拥有大量市场占有率的大公司正专注于扩大海外基本客群。这些公司正在利用策略合作措施来提高市场占有率和盈利。然而,随着技术进步和产品创新,中小企业正在透过获得独特的合约和开拓新市场来扩大市场。

- 2022 年 6 月 - 艾迈斯欧司朗宣布台湾 Ledtech 已选择 OSLON UV 3636 UV-C LED 用于其新型智慧型空气清净机 BioLED 的消毒功能。 BioLED 的 OSLON UV 3636 LED 可灭活高达 99.99% 的病毒,包括 SARS-CoV-2,照射率为 3.6mJ/cm2。

- 2022 年 5 月 - Qorvo 宣布推出新世代 1200V SiCFET。全新 UF4C/SC 系列 1200V Gen 4 SiCFET(来自最近收购的 UnitedSiC)用于电动车汽车充电器、工业电池充电器、工业电源、DC/DC 太阳能逆变器、焊接机、不断电系统,专为800V设计感应加热应用中的汇流排架构。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 评估宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 电子和行动装置的需求增加

- 工业自动化程度提高

- 市场挑战

- 原料和製造成本高

第六章市场区隔

- 按类型

- 砷化镓 (GaAs)

- 氮化镓(GaN)

- 磷化镓 (GaP)

- 碳化硅(SiC)

- 其他的

- 副产品

- LED

- RF

- 光电子学

- 电力电子

- 其他产品

- 按用途

- 通讯领域

- 资讯和通讯技术

- 国防/航太

- 消费性电子产品

- 卫生保健

- 车

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Skyworks Solutions INC.

- Wolfspeed Inc.

- Qorvo Inc.

- Analog Devices Inc.

- OSRAM GmbH(ams-OSRAM AG)

- GaN Systems Inc.

- Infineon Technologies AG

- NXP Semiconductors NV

- Advanced Wireless Semiconductor Company

- STMicroelectronics NV

- Texas Instruments Inc.

- Microsemi Corporation(Microchip Technology Inc.)

- WIN Semiconductors Corp.

- ON Semiconductor Corp.(Semiconductor Components Industries Llc)

- Mitsubishi Electric Corporation

第八章投资分析

第9章市场的未来

The Compound Semiconductor Market size is estimated at USD 32.59 billion in 2024, and is expected to reach USD 54.69 billion by 2029, growing at a CAGR of 10.91% during the forecast period (2024-2029).

The COVID-19 pandemic halted the manufacturing of several products in the compound semiconductor production industry owing to continued lockdown in critical global regions. In addition, country-wise lockdowns inflicted by governments across the globe further resulted in sectors taking a hit and disrupting supply chains and manufacturing operations worldwide. Most manufacturing operations, including the factory floor work, were significantly affected, resulting in decreased productivity.

Key Highlights

- Compound semiconductors are made from two or more elements of the different or same group of the periodic table. These are manufactured by using various types of deposition techniques, such as chemical vapor deposition, atomic layer deposition, and others. They possess unique properties like high temperature and heat resistance, enhanced frequency, high sensitivity to magnetism, and faster operation and optoelectronic features are some of the key advantages boosting their demand. Moreover, the decrease in the manufacturing cost of compound semiconductors has increased their application in electronic and mobile devices.

- The ability of compound semiconductors to emit and sense light in the form of general lighting (LEDs) and lasers and receivers for fiber optics is further driving the demand. The decrease in manufacturing and installation cost of LEDs has increased its application in lamps and fixtures across all sectors. Mega-cities concentrate on investing in infrastructure development to meet the needs of the growing population, and governments are helping customers to install energy-efficient lighting sources to reduce their electricity consumption costs.

- For instance, during the pandemic, EESL (Energy Efficiency Services Limited) celebrated the completion of its one-year governmental project called the Unnat Jyoti Program (UJALA). Under this program, it substituted more than 10.6 million street light bulbs with LED lights to reduce the carbon dioxide footprint by 20 million tons and the electricity cost. Such initiatives further boost the market studied.

- In 2020, the Taiwan Semiconductor Manufacturing Company (TSMC) sourced about 31% of spare parts locally in China, which increased to 31% in 2021.

- According to the US Department of Energy (DOE), LED lights use about 75-80% less energy than traditional incandescent light bulbs and about 65% less energy than halogen bulbs. Commercial enterprises need lighting for an extended period, whether for long working hours, safety and security in a warehouse or manufacturing facility, or other uses. Thus, switching to LED lights can save millions of dollars annually. For example, US Energy Recovery clients can save about 20-55% on their electric utility bills by swapping out old lighting systems for state-of-the-art LED lighting. Therefore, the shift toward LED adoption is driving the growth of the market studied.

- The smartphone is the major consumer of compound semiconductors. The smartphone market has been very competitive in recent years. The increasing usage of mobile phones is further anticipated to drive the global market. For instance, according to the Ericsson Mobility Report, 2022, by the end of 2027, there will be 4.4 billion 5G subscriptions globally, accounting for 48% of all mobile subscriptions.

- The Internet of Things applications are increasing, which is expected to boost the sales of compound semiconductors. Moreover, the wireless communications sector is expected to grow with the growth in 5G networks. Fifth-generation networks also indicate the likelihood of consumers upgrading their mobile handsets or devices to drive global compound semiconductor adoption.

- The compound semiconductor industry is considered one of the most complex industries, not only due to the more than 500 processing steps involved in the manufacturing and various products but also due to the harsh environment it faces, e.g., the volatile electronic market and the unpredictable demand.

Compound Semiconductor Market Trends

Optoelectronics to Have a Significant Growth During the Forecast Period

- Optoelectronic products covered under the study scope include photodiodes, phototransistors, optical spectrum analyzers, solar panels, and other optoelectronic devices, excluding LED products.

- GaN-based transistors are discovering new ways, particularly in optoelectronics, compared to SiC-based, as they are faster and more efficient. GaN has 1,000 times the electron mobility of silicon, along with relatively stable operability at higher temperatures.

- Recent advancements in the field of optoelectronics, such as plasmonic nanostructures, perovskite transistors, optically active quantum dots, microscopic light bulbs, low-cost 3D imaging, laser-powered 3D display technology, and Laser Li-Fi, are expected to cause a quantum shift in the dynamic applicability areas of optoelectronic apparatus.

- Further, in June 2022, a multiwavelength optoelectronic synapse that enables optical data detection, storage, and processing in the same device was created by researchers in the United States (University of Central Florida) and South Korea. The resultant in-sensor artificial visual system, which significantly improves processing effectiveness and picture identification precision, might use robotics, self-driving cars, and machine vision. Like the human eye, where the retina, through the synapse of the optic nerve, carries optical data, optoelectronic synapse allows optical data sensing, memory, and processing to be integrated into the same device.

- Additionally, in August 2022, Yokogawa launched two new optical spectrum analyzers (OSAs) to fulfill the market demand for an instrument capable of measuring a wide range of wavelengths to meet unique optical product expansion and manufacturing needs. The Yokogawa AQ6375E and AQ6376E are the only grating-based OSAs covering SWIR (Short-Wavelength InfraRed) over 2 µm and MWIR (Mid-Wavelength InfraRed) over 3 µm, with advanced optical performance.

- To meet the various needs of the customers, the firms are expanding their product portfolio. For instance, in April 2022, the Everlight line specializes in manufacturing different optoelectronic devices, introduced a wide range of new products in its portfolio, including photodiodes and phototransistors. These products are offered by third-distributor Transfer Multisort Elektronik (TME).

- Growing demands for renewable energy are further driving the studied Market. According to IRENA, the solar photovoltaic energy capability in the South Asian country of India peaked at over 62.8 gigawatts in 2022, up 21.5% from the previous year.

Middle East and Africa to Witness Significant Growth

- Prominent countries across the Middle East and Africa, such as Saudi Arabia, Egypt, and the United Arab Emirates, have some of the region's most extensive renewable energy programs. Compound semiconductor devices play a significant role in controlling the generation and link to the network of renewable energy sources.

- Moreover, the semiconductor industry is slowly gaining momentum in the Middle East and Africa, creating considerable market growth opportunities. For instance, in March 2022, the King AbdulazizCity for Science and Technology (KACST) announced the launch of the Saudi Semiconductor Program, the first of its kind in the province, which is desired to support the research, development, and qualification of professionals in the field of designing and localizing electronic chips.

- Furthermore, in the Middle East & North Africa, 5G is expanding significantly. The Gulf nations have taken the lead in developing 5G, and their governments and authorities have given mobile carriers access to the 5G launch spectrum so they may build some of the world's first and fastest 5G networks. According to GSMA, the diversified economies of the Middle East and North Africa (MENA) will significantly benefit from 5G, with the mid-band estimated to provide USD16 billion more in new GDP in 2030, or 0.35% of the region's GDP.

- In addition, in March 2022, MTN, a multinational mobile telecommunications firm based in South Africa, said it would invest more than USD 42.25 million in network development and a 5G push in the nation's largest province, the Northern Cape, and its judicial center, the Free State. Such initiatives to boost the overall semiconductor industry in these regions create a positive outlook for the growth of the studied market.

- Further, Dubai is expected to spend millions of Dirhams on incentives to have 42,000 EVs on its streets by 2030. General Motors expects to boost sales in the Middle East & Africa with the launch of its Chevrolet EV. The number of EV Green Charger stations in Dubai may be doubled as part of the 'Smart Dubai' initiative, which seeks to make Dubai the world's most innovative and happiest city. The Dubai Electricity and Water Authority announced the fulfillment of the second phase of its 'Green Charger' ambition, which contained the installation of additional 100 EV Green Charger stations across Dubai.

- According to the Climate Reality Project, the world's most extensive concentrated solar plant is due to be completed recently near Dubai, and it is expected to have a capacity of 1,000 MW. Dubai aims to produce 75% of its energy from clean sources by 2050, and its target energy mix for 2030 is 25% solar. These initiatives are driving the studied market in the region.

Compound Semiconductor Industry Overview

The Compound Semiconductor Market is highly competitive and is dominated by several major players like Broadcom, Skyworks Solutions, Cree, Qorvo, Analog Devices, OSRAM, GaN Systems, Skyworks Solution, and Infineon Technologies. These prominent players with a significant market share focus on extending their customer base across foreign nations. These companies leverage strategic cooperative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market by securing unique contracts and tapping new markets.

- June 2022 - ams OSRAM announced that Taiwan-based Ledtech had chosen OSLON UV 3636 UV-C LEDs for a sanitization function in its newBioLED intelligent air purifier. The BioLED's OSLON UV 3636 LEDs can inactivate up to 99.99% of viruses, including SARS-CoV-2, at a dosing rate of 3.6mJ/cm2.

- May 2022 - Qorvo introduced a new generation of 1200V SiCFETs. The new UF4C/SC series of 1200V Gen 4 SiCFETs (from recently acquired UnitedSiC) are designed for 800V bus architectures in onboard chargers for electric vehicles, industrial battery chargers, industrial power supplies, DC/DC solar inverters, welding machines, uninterruptible power supplies, and induction heating applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Demand for Electronic and Mobile Devices

- 5.1.2 Increase in Industrial Automation

- 5.2 Market Challenges

- 5.2.1 High Raw Material and Fabrication Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Gallium Arsenide (GaAs)

- 6.1.2 Gallium Nitride (GaN)

- 6.1.3 Gallium Phosphide (GaP)

- 6.1.4 Silicon Carbide (SiC)

- 6.1.5 Others

- 6.2 By Product

- 6.2.1 LED

- 6.2.2 RF

- 6.2.3 Optoelectronics

- 6.2.4 Power Electronics

- 6.2.5 Other Products

- 6.3 By Application

- 6.3.1 Telecommunications

- 6.3.2 Information & Communication Technology

- 6.3.3 Defense & Aerospace

- 6.3.4 Consumer Electronics

- 6.3.5 Healthcare

- 6.3.6 Automotive

- 6.3.7 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 France

- 6.4.2.3 Italy

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of the Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Skyworks Solutions INC.

- 7.1.2 Wolfspeed Inc.

- 7.1.3 Qorvo Inc.

- 7.1.4 Analog Devices Inc.

- 7.1.5 OSRAM GmbH (ams-OSRAM AG)

- 7.1.6 GaN Systems Inc.

- 7.1.7 Infineon Technologies AG

- 7.1.8 NXP Semiconductors NV

- 7.1.9 Advanced Wireless Semiconductor Company

- 7.1.10 STMicroelectronics N.V.

- 7.1.11 Texas Instruments Inc.

- 7.1.12 Microsemi Corporation (Microchip Technology Inc.)

- 7.1.13 WIN Semiconductors Corp.

- 7.1.14 ON Semiconductor Corp. (Semiconductor Components Industries Llc)

- 7.1.15 Mitsubishi Electric Corporation