|

市场调查报告书

商品编码

1440081

汽车声学材料 - 市场份额分析、行业趋势与统计、成长预测(2024 - 2029)Automotive Acoustic Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

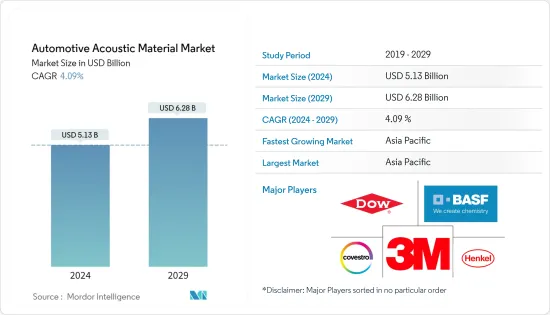

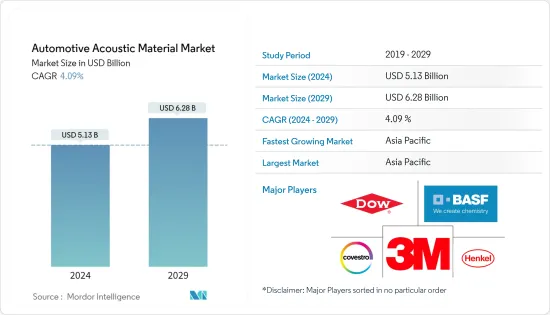

2024年汽车声学材料市场规模预计为51.3亿美元,预计到2029年将达到62.8亿美元,在预测期内(2024-2029年)CAGR为4.09%。

继 COVID-19 大流行造成早期供应和生产中断之后,汽车产业正在经历需求衝击,恢復期未知。由于缺乏最小化固定费用的空间,一些原始设备製造商的流动性收入较差。由于长时间缺乏市值和整合而导致实力下降,如果不获得新的投资,一些参与者可能会面临倒闭的风险。

由于定制和自动驾驶等趋势,汽车内饰正在发生变化,其中驾驶员越来越多地成为乘客。产业参与者正在努力开发包含许多创新功能的汽车内装设计。

汽车声学作为当前汽车的一个品质因素正在慢慢受到欢迎,汽车製造商对此表现出了极大的兴趣。在销售汽车时,乘客的舒适度已成为首要考虑因素。组件必须占用尽可能小的空间,同时提供最佳的舒适度。因此,这一领域正在不断取得进展。

由于它们被用于许多部件,如引擎盖、仪表板绝缘体以及汽车行驶时经常振动的其他部件,因此汽车声学材料的售后市场预计将扩大。对运动型和豪华型汽车的不断增长的需求以及改装古董车的日益流行可能会为汽车声学材料打开一个巨大的市场。

经济放缓,加上对进口声学材料和其他物品征税,以及 COVID-19 疫情,预计将阻碍市场的扩张。另一方面,声学材料的价格波动以及由于环境问题而导致的电动车需求增加预计将推动该行业的发展。

汽车声学材料市场趋势

高檔汽车的需求不断增长

随着对高檔汽车的需求不断增长,豪华和舒适一直是製造商关注的重点领域。主要目标是将车辆的声音保持在可接受的范围内。这些噪音限制在汽车音响系统中需要更多的关注。因此,汽车声学材料市场预计在未来几年将会成长。

由于汽车声学材料提供了内装外观并最大限度地减少了车内的噪音、振动和声振粗糙度 (NVH),因此高檔汽车的扩张可能会刺激全球对汽车声学材料的需求。

易于安装和延伸以完全填充车辆内部空腔的汽车声学材料的出现预计将增加汽车声学材料市场的需求。政府对公共交通的投资预计将推动汽车声学材料的需求。

製造商为提高噪音吸收水平而不断增加的研发支出正在推动汽车声学材料市场的发展。具有吸收低频声音能力的复合材料越来越受欢迎。此外,製造商对为汽车内饰和外观提供卓越色彩饰面的关注预计将有助于整个预测期内的市场成长。

许多製造商正在投资研发以开发具有增强性能的材料。例如:

- 2021 年 11 月,Autoneum 宣布了一项基于毛毡的新型技术 Flexi-Loft,该技术采用再生棉和功能性纤维的独特混合物,可减轻产品重量,甚至可以准确适应复杂的形状。 Autoneum 已在全球范围内使用 Flexi-Loft 作为各种地毯、内部仪表板和其他基于其 Prime-Light 技术的声学组件的绝缘体。

亚太地区占主要市场份额

亚太地区已成为最大的声学材料市场。 2021 年,亚太地区的汽车产量占全球最大。按数量和价值计算,该地区预计将成为汽车声学材料的最大市场。该地区庞大的汽车产量为声学材料市场提供了巨大的成长机会。

中国是全球最大的汽车市场。然而,在过去的几年里,该国的销售额一直在下降。中国汽车工业协会(CAAM)的数据显示,12月,这个全球最大汽车市场的整体销量年增3.8%,使2021年总销量达到2,628万辆。

在过去的几年里,该国已经有多家公司扩大生产设施并开设新设施。例如:

- 2021年10月,戴姆勒全新的「戴姆勒中国研发技术中心」在北京正式开幕。研发技术中心总投资11亿元,建筑面积5.5万平方公尺。测试大楼设有7个测试设施,包括电力驱动实验室、充电实验室、挥发性有机化合物(VOC)实验室、底盘实验室、噪音、振动与声振粗糙度(NVH)实验室、引擎实验室和环境实验室。实验室。新的测试大楼可同时容纳300多辆测试车辆。

欧洲是第二大乘用车市场,尤其是高级汽车市场。预计高檔汽车的销售量在预测期内将呈现线性成长,从而增加欧洲对声学材料的需求。

汽车声学材料产业概况

随着公司建立新的策略合作伙伴关係、主要投资于研发项目以及在市场上推出新产品以领先竞争对手,市场竞争日益加剧。例如:

- 2021年3月,帝人株式会社宣布其聚酯三维成型吸音材料已被丰田汽车公司的燃料电池汽车(FCV)「Mirai」采用。当氢气和空气在燃料电池电堆中发生化学反应时,它将用作降低噪音的材料,产生的水从燃料电池电堆或排水管排出车外。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 市场限制

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 材料

- 聚氨酯

- 纺织品

- 玻璃纤维

- 其他材料

- 车辆类型

- 搭乘用车

- 商务车辆

- 应用

- 阀盖内衬

- 门饰

- 其他应用

- 地理

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太

- 印度

- 中国

- 日本

- 韩国

- 亚太其他地区

- 世界其他地区

- 巴西

- 阿拉伯聯合大公国

- 其他国家

- 北美洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- Dow Chemicals

- 3M Acoustics

- BASF SE

- Covestro

- Henkel Adhesive Technologies

- Lyondellbasell

- Sumitomo Riko

- Sika

- Toray Industries

- Huntsman

- Freudenberg Group

第 7 章:市场机会与未来趋势

The Automotive Acoustic Material Market size is estimated at USD 5.13 billion in 2024, and is expected to reach USD 6.28 billion by 2029, growing at a CAGR of 4.09% during the forecast period (2024-2029).

Following early supply and production interruptions as a result of the COVID-19 pandemic, the auto industry is undergoing a demand shock, with an unknown recovery period. Some OEMs have poor liquidity revenues due to a lack of room to minimize fixed expenses. Decreases in power due to a significant period of time of lacking in market capitalization and consolidation and without acquiring fresh investment, some players may risk going out of business.

Vehicle interiors are changing as a result of trends like customization and autonomous driving, in which the driver is increasingly becoming a passenger. Industry players are hard at work developing designs for car interiors that include a number of innovative features.

Car acoustics is slowly gaining popularity as a quality factor in current automobiles, and automakers are expressing a lot of interest in it. Passenger comfort has risen to the top of the priority list when it comes to selling a car. Components must occupy as little space as possible while providing optimal comfort. As a result, continuous progress is being made in this area.

Since they are used in numerous components such as the engine cover, dash insulator, and other components that are regularly vibrated when the car is driving, the aftermarket for automotive acoustic materials is expected to expand. The ever-increasing demand for sports and luxury vehicles and the growing popularity of modified antique cars may open up a large market for automotive acoustic materials.

The slowing economy, combined with taxes on importing acoustic materials and other items, and the COVID-19 pandemic are projected to hinder the market's expansion. On the other hand, price fluctuations in acoustic materials and the increased demand for electric vehicles due to environmental concerns are expected to drive the industry.

Automotive Acoustic Material Market Trends

Growing Demand for Premium Cars

Luxury and comfort have been a significant focus area for manufacturers, as the demand for premium cars has grown. The primary goal is to keep the vehicle's sound within acceptable limits. These noise restrictions need greater attention in the automobile acoustic system. As a result, the market for automotive acoustic materials is expected to grow in the future years.

As automotive acoustic materials provide the interior appearance and minimize noise, vibration, and harshness (NVH) in the cabin, the expansion of the premium cars is likely to fuel the demand for automotive acoustic materials globally.

The advent of automotive acoustic materials that are easy to install and extend to completely fill interior cavities in vehicles is projected to enhance the demand in the automotive acoustic material market. The government's investment in public transportation is expected to boost the demand for vehicle acoustic materials.

The growth in constant R&D spending by manufacturers to enhance noise-absorbing levels is driving the automotive acoustic materials market. Composite materials with the ability to absorb low-frequency sounds are gaining popularity. Furthermore, manufacturers' attention to providing exceptional color finishes for the interior and exterior appearance of cars is expected to contribute to market growth throughout the forecast period.

Many manufacturers are investing in R&D to develop materials with enhanced properties. For instance:

- In November 2021, Autoneum announced a new felt-based technology Flexi-Loft, which due to a unique blend of recycled cotton and functional fibers, reduces product weight and allows for accurate adaptation even to complex shapes. Autoneum is already using Flexi-Loft worldwide as an insulator for various carpets, inner dashes, and other acoustic components based on its Prime-Light technology.

Asia-Pacific Captures the Major Market Share

The Asia-Pacific region has emerged as the largest market for acoustic materials. Asia-Pacific accounted for the largest global vehicle production in 2021. The region is estimated to be the largest market for automotive acoustic materials, by volume and value. The huge vehicle production in the region offers a tremendous growth opportunity for the acoustic materials market.

China is the largest automobile market in the world. However, for the past few years, the country has been witnessing a decline in sales. Overall sales in the world's largest auto market increased by 3.8% year-on-year in December, bringing the total sales for 2021 to 26.28 million, according to figures from the China Association of Automobile Manufacturers (CAAM).

In the past few years, the country has seen various companies expanding their production facilities and opening new facilities. For instance:

- In October 2021, Daimler opened its new 'Daimler R&D Tech Center China' officially in Beijing. With a total investment of CNY 1.1 billion, the R&D tech center has a gross floor area of 55,000 m². The test building is home to seven testing facilities, including an eDrive lab, a charging lab, a volatile organic compounds (VOC) lab, a chassis lab, a noise, vibration and harshness (NVH) lab, an engine lab, and an environmental lab. The new test building can accommodate more than 300 test vehicles at the same time.

Europe is the second-largest market for passenger cars, particularly for premium cars. The sale of premium cars is projected to show linear growth during the forecast period, thereby increasing the demand for acoustic materials in Europe.

Automotive Acoustic Material Industry Overview

The competition in the market is increasing as the companies are making new strategic partnerships, investing majorly in R&D projects, and launching new products in the market to be ahead of their rivals. For instance:

- In March 2021, Teijin Limited announced that its polyester three-dimensional molded sound-absorbing material had been adopted for Toyota Motor Corporation's fuel cell vehicle (FCV) "Mirai." It will be used as a material to reduce noise when hydrogen and air chemically react in the FC stack, and the generated water is discharged from the FC stack or drain pipe outside the vehicle.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Polyurethane

- 5.1.2 Textile

- 5.1.3 Fiberglass

- 5.1.4 Other Materials

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Application

- 5.3.1 Bonnet Liner

- 5.3.2 Door Trim

- 5.3.3 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Dow Chemicals

- 6.2.2 3M Acoustics

- 6.2.3 BASF SE

- 6.2.4 Covestro

- 6.2.5 Henkel Adhesive Technologies

- 6.2.6 Lyondellbasell

- 6.2.7 Sumitomo Riko

- 6.2.8 Sika

- 6.2.9 Toray Industries

- 6.2.10 Huntsman

- 6.2.11 Freudenberg Group