|

市场调查报告书

商品编码

1440231

生质柴油:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Biodiesel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

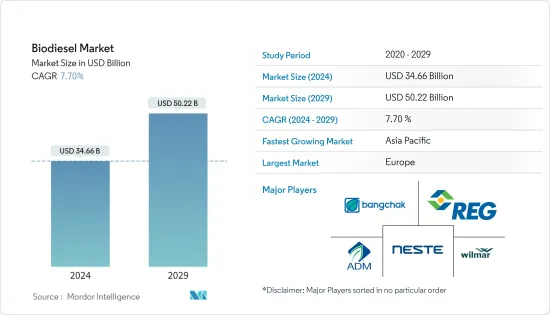

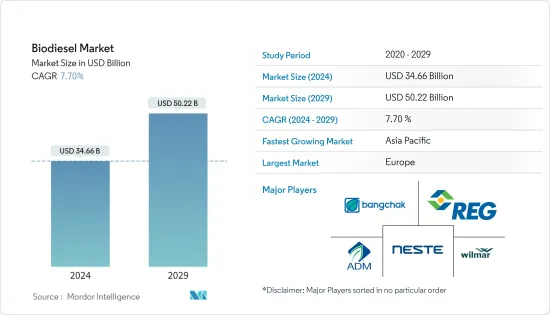

2024年生质柴油市场规模预估为346.6亿美元,预估至2029年将达502.2亿美元,预测期内(2024-2029年)复合年增长率为7.70%。

主要亮点

- 从中期来看,对减少温室气体排放的环保燃料的需求增加以及政府透过补贴支持生物柴油生产等因素预计将在预测期内推动生物柴油市场的发展。

- 另一方面,生物柴油生产所需的更多原料以及全球原油价格的下跌可能会阻碍生物柴油市场的成长。

- 儘管如此,美国、德国和英国国家正在强调生物柴油混合物。印度和中国等更多国家正在采取此类倡议,预计这将在未来几年创造充足的市场机会。

- 由于印尼、泰国、中国和马来西亚的产量增加,亚太地区在预测期内可能会大幅成长。预计这将推动该地区的生物柴油市场。

生质柴油市场趋势

交通运输业预计将主导市场

- 由于对生物柴油等环保燃料的需求不断增加,以减少碳排放,预计交通运输领域将在预测期内引领市场。

- 人们越来越意识到环境安全,因为运输部门将二氧化碳排放大气中,导致空气污染以及呼吸系统和心臟病。生质柴油是一种可再生柴油替代品,可用于现有柴油引擎。这将增加交通运输领域对生质柴油的需求。

- 美国是生物柴油的主要消费国之一。一些地方、州和联邦机构在校车、公车、扫雪机、垃圾车、邮车和军用车辆中使用生物柴油混合物 (B20)。几乎每个州都有向公众出售 B20 或更高等级生物柴油混合物的加油站。

- 根据EIA的数据,2022年美国生质柴油产量预计将达到约16.2亿加仑。生物柴油可用作标准柴油引擎的唯一燃料或与石油结合使用。

- 2023 年 1 月,美国能源局(DOE) 宣布将在 17 项措施中投资 1.18 亿美元,以加速永续生质燃料的开发,以满足美国运输和製造的需求。选定的计划将透过推动生物炼製厂从初步测试到示范的发展,促进国内生质燃料和生物产品的生产,提供永续燃料,最大限度地减少与石化燃料相关的排放。

- 2021年,全球生质柴油消费量约为每天787,000桶油当量。增加生物柴油生产和供应的优惠政策将增加生物柴油在交通运输领域的利用率,并在预测期内促进该产业的成长。

亚太地区将经历显着成长

- 亚太地区在预测期内可能会大幅扩张。该地区是全球最大的生物柴油消费国之一。 2021年,该地区每天消耗约209,000桶石油当量,每天生产239,000桶石油当量。印度、中国、印尼和越南等国家支持使用生质柴油来减少温室气体排放。

- 该地区多个国家的政府已实施支持生物柴油燃料的立法。例如,印尼成为第一个强制使用 B30 棕榈油混合物的国家。政府为 2020 年 B30 义务分配了 959 万千升脂肪酸甲酯 (FAME)。

- 2022年1月,马来西亚计划在年终前实施强制B20棕榈油生质燃料计画。该义务包括为运输部门生产棕榈油含量为 20% 的生质燃料(称为 B20)。

- 增加政府支持可能会增加该地区的生物柴油生产和消费。据印尼能源和矿产资源部称,2021年印尼生质柴油产量达1,024千万公升。

- 该地区生物柴油工厂的数量也在增加。例如,2021年12月,LRE Petroleum收到印度石油公司的意向书(LOI),在印度设立生质柴油製造厂。该工厂位于卡纳塔克邦,每年可生产 400 万公升生物柴油 (B-100)。

- 因此,随着印尼、马来西亚、泰国和印度等国家混合比例的增加,亚太地区预计在预测期内将呈现最高成长率。

生质柴油产业概况

生物柴油市场分散。市场的主要企业包括(排名不分先后)Renewable Energy Group Inc.、Archer-Daniels-Midland Company、Bangchak Corporation Public Company Limited、Wilmar International Ltd 和 Neste Oyj。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 调查先决条件

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2028年之前的市场规模和需求预测(金额)

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 对环保燃料的需求不断成长

- 政府对生质柴油生产的支持

- 抑制因素

- 生质柴油生产需要更多原料

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 材料

- 动物脂肪

- 植物油

- 其他原料

- 目的

- 运输

- 发电

- 其他用途

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 马来西亚

- 印尼

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Renewable Energy Group Inc.

- Archer Daniels Midland Company

- Bangchak Corporation Public Company Limited

- Wilmar International Ltd

- Neste Oyj

- Cargill Inc.

- BIOX Corporation

- Ag Processing Inc.

第七章市场机会与未来趋势

- 用于发电应用的生物柴油

简介目录

Product Code: 71476

The Biodiesel Market size is estimated at USD 34.66 billion in 2024, and is expected to reach USD 50.22 billion by 2029, growing at a CAGR of 7.70% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as the increasing demand for environment-friendly fuels that reduce greenhouse gas emissions and government support for biodiesel production by providing subsidies are expected to drive the biodiesel market during the forecast period.

- On the other hand, the need for more feedstock availability for bio-diesel generation and declining crude prices globally may hinder the growth of the bio-diesel market.

- Nevertheless, countries like the United States, Germany, and the United Kingdom are stressing biodiesel blending. More countries, like India and China, are adopting such initiatives, which are expected to create ample market opportunities in the coming years.

- The Asia-Pacific region will likely grow significantly during the forecast period due to growing production in Indonesia, Thailand, China, and Malaysia. It is expected to drive the biodiesel market in the region.

Biodiesel Market Trends

The Transportation Segment Expected to Dominate the Market

- The transportation segment is anticipated to lead the market during the forecast period due to increasing demand for eco-friendly fuels, such as biodiesel, to reduce carbon emissions.

- The awareness among people regarding environmental safety is increasing as the transportation sector emits carbon in the atmosphere that pollutes the air and causes breathing problems and heart diseases. Biodiesel is a renewable diesel replacement utilized in existing diesel engines without modification. It increases the demand for biodiesel in the transportation segment.

- The United States is one of the significant consumers of biodiesel. Some local, state, and federal government agencies use biodiesel blends (B20) with fleets of school and transit buses, snowplows, garbage trucks, mail trucks, and military vehicles. Fuelling stations that sell biodiesel blends of B20 or higher to the public are available in almost every state.

- According to EIA, biodiesel production in the United States was expected to reach approximately 1,620 million gallons in 2022. Biodiesel can be used in standard diesel engines as a standalone fuel or in combination with petroleum.

- In January 2023, the US Department of Energy (DOE) announced that it would invest USD 118 million in 17 initiatives to accelerate the development of sustainable biofuels for America's transportation and manufacturing requirements. The selected projects will boost domestic production of biofuels and bioproducts by pushing biorefinery development from pre-pilot to demonstration to provide sustainable fuels that minimize emissions associated with fossil fuels.

- The global biodiesel consumption was around 787 thousand barrels of oil equivalent per day in 2021. The growing favorable policies for the production and supply of biodiesel increase biodiesel utilization in the transportation segment thus driving growth in the segment during the forecast period.

Asia-Pacific to Witness a Significant Growth

- The Asia-Pacific region is likely to expand significantly during the forecast period. The region is one of the largest consumers of biodiesel across the world. In 2021, the region consumed around 209 thousand barrels of oil equivalent daily and produced 239 thousand barrels daily. Countries such as India, China, Indonesia, and Vietnam support using biodiesel to reduce greenhouse gas emissions.

- The governments of several countries in this region are implementing laws to support biodiesel fuel. For instance, Indonesia became the first country to mandate a B30 blend of palm-based fuel. The government allocated 9.59 million kiloliters of fatty acid methyl ester (FAME) for the B30 mandate in 2020.

- In January 2022, Malaysia planned to implement a mandate to adopt the B20 palm oil biofuel program by the year-end. The mandate involves manufacturing biofuel with a 20% palm oil component known as B20 for the transport sector.

- Increasing government support will likely boost the production and consumption of biodiesel in the region. According to the Ministry of Energy and Mineral Resources (Indonesia), Indonesia's biodiesel production reached 10.24 million kiloliters in 2021.

- The number of biodiesel plants is also increasing in the region. For instance, in December 2021, LRE Petroleum received a letter of intent (LOI) from Indian Oil to set up a biodiesel manufacturing plant in India. The plant is in Karnataka and can produce 4 million L of biodiesel (B-100) annually.

- Hence, with the increasing blend percentage in countries such as Indonesia, Malaysia, Thailand, and India, the Asia-Pacific region is expected to witness the highest growth rate during the forecast period.

Biodiesel Industry Overview

The biodiesel market is fragmented. Some key players in this market (not in a particular order) include Renewable Energy Group Inc., Archer-Daniels-Midland Company, Bangchak Corporation Public Company Limited, Wilmar International Ltd, and Neste Oyj.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Demand for Eco-friendly Fuels

- 4.5.1.2 Government Support for Biodiesel Production

- 4.5.2 Restraints

- 4.5.2.1 The Need for More Feedstock Availability for Biodiesel Generation

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Feedstock

- 5.1.1 Animal Fat

- 5.1.2 Vegetable Oil

- 5.1.3 Other Feedstocks

- 5.2 Application

- 5.2.1 Transportation

- 5.2.2 Power Generation

- 5.2.3 Other Applications

- 5.3 Geogrpahy

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Malaysia

- 5.3.3.4 Indonesia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Renewable Energy Group Inc.

- 6.3.2 Archer Daniels Midland Company

- 6.3.3 Bangchak Corporation Public Company Limited

- 6.3.4 Wilmar International Ltd

- 6.3.5 Neste Oyj

- 6.3.6 Cargill Inc.

- 6.3.7 BIOX Corporation

- 6.3.8 Ag Processing Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Biodiesel for Power Generation Applications

02-2729-4219

+886-2-2729-4219