|

市场调查报告书

商品编码

1443966

生质燃料:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Biofuels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

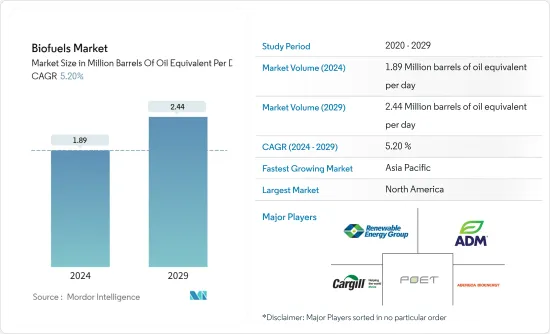

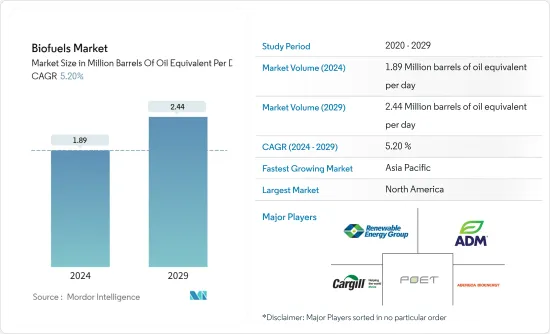

2024年生质燃料市场规模预计为每天189万桶油当量,预计到2029年将达到每天244万桶油当量,预测期内(2024-2029年)复合年增长率为5.20% . 成长于

主要亮点

- 从中期来看,对安全、永续和清洁能源的需求不断增长,加上政府要求提高汽车燃料混合比例,预计将推动全球对生质燃料的需求。

- 另一方面,儘管生质燃料具有许多好处,但生质燃料的高生产成本预计可能会限制市场成长。

- 然而,随着最近的技术进步,生质燃料产量正在增加,预计这将为市场扩张提供机会。

- 北美主导市场,并可能在预测期内实现最高的复合年增长率。该地区的成长是由生产能力的快速成长和生质燃料需求的增加所推动的。

生质燃料市场趋势

乙醇预计将出现显着成长

- 在全球范围内,由于内燃机中石化燃料的燃烧,运输业是最大的温室气体排放。为了限制温室气体排放,世界各国正采用促进可再生能源使用的标准。乙醇等生质燃料是交通运输领域的清洁能源来源,可能会促进未来生质燃料市场的发展。

- 根据可再生燃料协会(RFA)预测,2022年美国将生产1,540亿加仑燃料乙醇,成为全球领先的生质燃料生产国。

- 全球对生质燃料的需求是由北美、印度、巴西、欧洲、印尼和马来西亚等国家的初级混合指令所推动的。例如,印度要求到 2025 年乙醇混合量达到 20%。在印尼,计划于 2023 年开始混合 35% 的生物柴油,而在巴西,现有的乙醇混合指令为 27%。这些措施凸显了各国越来越多地使用生质燃料。

- 此外,2022年3月,巴西经济部宣布取消包括其他产品在内的乙醇进口关税,以缓解通膨压力。预计这将鼓励将乙醇掺入汽油中并刺激市场。

- 2022年,SGP BioEnergy宣布将与巴拿马政府合作,在巴拿马开发全球最大的生质燃料分销和生产中心,预计生质燃料产能为18万桶/日。同样,美国能源局在 2023 年向 17 个计划拨款 1.18 亿美元,用于扩大乙醇和其他生质燃料的生产,以满足美国运输和製造业的需求。预计这些趋势可能会重振生质燃料市场。

- 因此,鑑于上述几点,预计乙醇产业在预测期内生质燃料市场将显着成长。

预计北美将主导市场

- 北美地区拥有以石化燃料为中心的最大航空市场之一,并拥有发达的交通基础设施。北美地区一直处于减少排放以遏制温室效应的最前线。

- 据美国能源情报署称,到 2022 年,美国生物柴油总产量将达到 16 亿加仑。

- 2022年1月,美国环保署宣布了一项新倡议,简化石化燃料的审查,排放生质燃料市场带来重大推动。同样,美国能源局将要求 2022 年 12 月后安装的加油设备减少 30%,其中包括天然气、丙烷、液化氢、电力、E85 或含有 20% 或更多生物柴油的柴油混合物。税额扣抵。此类激励措施可能会促进生质燃料市场的发展。

- 同样,加拿大政府计划从 2022 年 4 月起将每吨排放的碳排放税从 10 加币提高到 50 加元,鼓励普及温室气体排放较低的生质燃料。

- 综上所述,由于政府政策和生产能力,北美地区很可能主导生质燃料市场。

生质燃料产业概况

生质燃料市场是分散的。主要企业包括(排名不分先后)Archer Daniels Midland Company、Abengoa Bioenergy SA、Renewable Energy Group Inc.、Cargill Incorporated 和 POET LLC。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028 年之前生质燃料生产的历史与预测

- 生质燃料消费的历史趋势与 2028 年预测

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 对安全、永续和清洁能源的需求不断增长

- 抑制因素

- 生质燃料生产成本高

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 汽油种类

- 乙醇

- 生质柴油

- 其他燃料类型

- 材料

- 棕榈油

- 麻风树

- 砂糖作物

- 粗粒

- 其他原料

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 丹麦

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 印尼

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Abengoa Bioenergy SA

- Cargill Incorporated

- Shell PLC

- Wilmar International Ltd.

- Renewable Energy Group Inc.

- Archer Daniels Midland Company

- BP PLC

- POET LLC

- Neste Oyj

- Verbio Vereinigte BioEnergie AG

第七章 市场机会及未来趋势

- 生质燃料生产的技术进步

简介目录

Product Code: 49858

The Biofuels Market size is estimated at 1.89 Million barrels of oil equivalent per day in 2024, and is expected to reach 2.44 Million barrels of oil equivalent per day by 2029, growing at a CAGR of 5.20% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the increasing demand for secure, sustainable, and clean energy coupled with government mandates for increasing blending in automotive fuels is expected to propel the demand for biofuels across the globe.

- On the other hand, the high cost of production of biofuels, even with all the benefits associated with them, is likely to restrain the growth of the market.

- Nevertheless, with the recent technological advancements, the production of biofuels has increased, which is going to act as an opportunity for the market's expansion.

- North America dominates the market, and it is likely to witness the highest CAGR during the forecast period. The growth is attributed to the rapid increase in production facilities coupled with the increase in demand for biofuels in the region.

Biofuels Market Trends

Ethanol Likely to Experience a Significant Growth

- Globally, the transportation sector is the biggest emitter of greenhouse gases due to the combustion of fossil fuels in its internal combustion engines. To limit the emission of greenhouse gases, countries worldwide have adopted norms to promote the use of renewable energy resources. Biofuels such as ethanol affirm themselves as a cleaner energy source for the transportation sector, which could lead to a developed biofuel market in the future.

- According to the Renewable Fuels Association (RFA), in 2022, the United States produced 15,4 billion gallons of fuel ethanol, making it the leading producer of biofuel in the world.

- Primary blending mandates that drive the global demand for biofuels are set in North America, India, Brazil, Europe, Indonesia, Malaysia, etc. For instance, in India, there is a mandate to begin 20% ethanol blending by 2025. In Indonesia, a commission of 35% biodiesel blending is expected to start in 2023, whereas in Brazil, the existing order for ethanol blending is 27%. Such measures highlight the increase in the use of biofuels across countries.

- Furthermore, in March 2022, Brazil's Ministry of Economy announced the withdrawal of import tariffs on ethanol, including other products, to alleviate inflationary pressures. This is expected to boost the ethanol blend in gasoline and drive the market.

- In 2022, SGP BioEnergy announced the development of the world's most extensive biofuel distribution and production hub in Panama, in association with the country's government, which is estimated to produce 180,000 barrels per day of biofuel. Similarly, in 2023, the US Department of Energy awarded USD 118 million for 17 projects to scale up ethanol and other biofuels to help America's transportation and manufacturing needs. Such trends are likely to ramp up the biofuel market.

- Therefore, owing to the above points, the ethanol segment is expected to experience significant growth in the biofuels market during the forecast period.

North America is Expected to Dominate the Market

- The North American region houses one of the biggest aviation markets, primarily fossil fuels, and a well-established transportation infrastructure. The North American region has been at the forefront of lowering emissions to limit the greenhouse effect.

- According to the U.S. Energy Information Administration, the total production volume of biodiesel production in the United States was 1.6 billion gallons by 2022

- In January 2022, the US Environmental Protection Agency announced a new initiative for streamlining the review of biofuels and chemicals that can significantly replace higher GHG-emitting fossil fuels, providing a significant push to the biofuels market. Similarly, the US Department of Energy announced an Alternative Fuel Infrastructure Tax Credit of 30% for the fueling equipment for natural gas, propane, liquefied hydrogen, electricity, E85, or diesel fuel blends containing a minimum of 20% biodiesel installed on or after December 2022. Such incentive measures would likely promote the biofuel market.

- Similarly, in Canada, the government aimed to increase carbon taxes by CAD 10 to CAD 50 per ton of emissions from April 2022, thereby pushing for wider adoption of biofuels that emit less GHG.

- Hence, owing to the above points, the North American region is likely to dominate the biofuels market due to government policies and production capacity.

Biofuels Industry Overview

The biofuels market is fragmented. Some of the major players include (in no particular order) Archer Daniels Midland Company, Abengoa Bioenergy SA, Renewable Energy Group Inc., Cargill Incorporated, and POET LLC., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Biofuel Production Historic and Forecast, till 2028

- 4.3 Biofuel Consumption Historic and Forecast, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Demand for Secure, Sustainable, and Clean Energy

- 4.6.2 Restraints

- 4.6.2.1 High Cost of Production of Biofuels

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Ethanol

- 5.1.2 Biodiesel

- 5.1.3 Other Fuel Types

- 5.2 Feedstock

- 5.2.1 Palm Oil

- 5.2.2 Jatropha

- 5.2.3 Sugar Crop

- 5.2.4 Coarse Grain

- 5.2.5 Other Feedstock

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Denmark

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Indonesia

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Abengoa Bioenergy SA

- 6.3.2 Cargill Incorporated

- 6.3.3 Shell PLC

- 6.3.4 Wilmar International Ltd.

- 6.3.5 Renewable Energy Group Inc.

- 6.3.6 Archer Daniels Midland Company

- 6.3.7 BP PLC

- 6.3.8 POET LLC

- 6.3.9 Neste Oyj

- 6.3.10 Verbio Vereinigte BioEnergie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Production of Biofuels

02-2729-4219

+886-2-2729-4219