|

市场调查报告书

商品编码

1444467

敞篷车车顶系统:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Convertible Roof System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

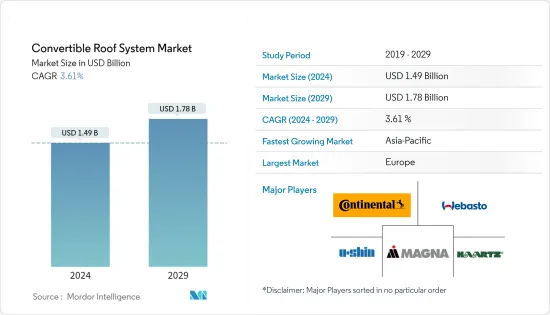

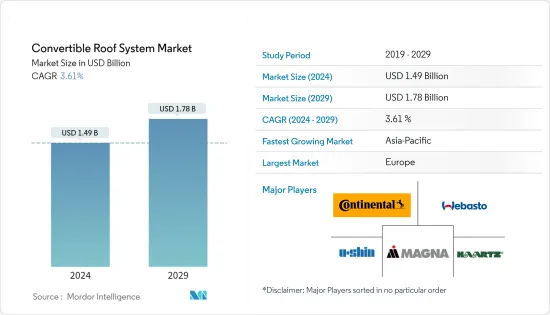

敞篷车车顶系统市场规模预计 2024 年为 14.9 亿美元,预计到 2029 年将达到 17.8 亿美元,在预测期内(2024-2029 年)增长 3.61%,复合年增长率为

由于疫情引发的封锁导致汽车製造业关闭,因此COVID-19大流行对汽车产业的影响是不可避免的。然而,由于豪华车需求不断增长,市场预计将恢復动力。 SUV在新兴市场的普及不断提高,将进一步促进市场发展。

世界各地都在观察玻璃技术的进步,对舒适性、安全性和便利性功能的需求不断增加,以及对车辆表面高美感的需求日益增长。此外,材料技术的创新和新兴国家客户对敞篷车车顶系统日益增长的需求正在推动全球敞篷车车顶系统市场的发展。

敞篷车车顶系统市场趋势

汽车製造商加大敞篷车车顶系统的投资

我们进行了一致的评估和创新,以提高所研究市场的易用性和舒适度。例如,

汽车製造商正在将一些增强功能融入他们的车辆中。几家公司正在推出采用更好的电子和感测器技术的产品线,使乘客能够购买可自订的车辆并减少用户的工作量。例如,

o 2021 年 7 月,威而巴斯特在 Startup Autobahn 展会上展示了与多家Start-Ups合作开发的多项创新成果。该公司展示了由 designLED 开发的汽车车顶整合动态照明概念,designLED 是薄型柔性 LED 照明和智慧表面解决方案的专家。两家公司已经完成了带有轻质瓦片的可转换屋顶元件的原型。

豪华车销售量的增加也是推动敞篷车车顶系统市场成长的另一个因素。在预测期内,亚太地区预计将占豪华汽车销售的大部分,因为中国等主要汽车市场紧随其后的是日本和印度。

大多数主要奢侈品牌都将中国视为成长率最快的市场。儘管中国是全球最大的汽车市场,但对德国豪华汽车品牌来说却异常重要。儘管过去两年行业低迷,但德国豪华汽车製造商梅赛德斯-奔驰、宝马和奥迪在2020年仍创下了销售纪录。 2020年,梅赛德斯-宾士与前一年同期比较增22.4%,而宝马和奥迪等其他汽车製造商的增幅分别为15.4%和10.6%。

儘管受到COVID-19感染疾病,2020与前一年同期比较。这也标誌着由于中国整体汽车市场的下行压力,豪华品牌连续第三年成长。

亚太地区成为豪华车的主要市场

欧洲在整个敞篷车车顶系统市场份额中占据主导地位。然而,预计亚太地区在预测期内将继续保持显着的复合年增长率。

预计可转换市场在预测期内将成长。美国、美国、法国、英国、德国和西班牙等中东和亚太地区国家的豪华车销售量不断成长。美国是世界上最大的汽车市场之一,拥有超过 13 家主要汽车製造商。

随着小客车年均产量800万辆,以及豪华、高级汽车日益受到消费者欢迎,中国敞篷车车顶产业前景看好。敞篷车车顶系统产业高度依赖豪华轿车的销售,其销售量取决于国家的人均收入水准。

此外,中国和德国是汽车行业技术进步的主要中心,导致豪华车市场大幅扩张。不断增长的年轻人口是推动亚太地区豪华车销售成长的另一个因素。印度也是豪华车的重要市场。印度政府还降低了(豪华)汽车的商品及服务税、进口税、登记税,并提供银行/非银行金融公司的支持,以便经销商和客户轻鬆获得贷款。我们正在努力恢復销售。它将有助于扩大市场并推动整个行业的发展。

敞篷车车顶系统产业概况

敞篷车车顶系统市场主要由Webasto、Magna International、The Haartz Corporation、U-Shin Ltd、Continental AG等公司主导。公司透过推出新产品和创新来扩展业务。例如:

2021年7月,伟巴斯特宣布新款BMW4係搭载伟巴斯特敞篷车车顶。驾驶时,只需按下按钮即可在 18 秒内打开车顶。在单一的流动运动中,四个屋顶元件彼此堆迭。同时,顶盖向后打开,车顶元件存放在下方。

2020 年 12 月,Webasto 为重新设计的 Stingray 开发了一款新的自订两部分式伸缩式硬顶 (RHT),车顶上安装了总合六个马达,而不是液压系统。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 屋顶系统元件的类型

- 屋顶材料

- 聚氯乙烯(PVC)

- 碳纤维

- 其他屋顶材料

- 车顶驱动系统(马达)

- 其他屋顶系统元件类型(例如支撑框架)

- 屋顶材料

- 屋顶型

- 硬顶

- 软顶

- 车辆类型

- 掀背车

- SUV

- 轿车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 澳洲

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Webasto Group

- Magna International

- Valmet Corp.

- Haartz Corporation

- Continental AG

- Hoerbiger Holding

- U-Shin Ltd

- GAHH LLC

- Aisin Seiki

第七章市场机会与未来趋势

The Convertible Roof System Market size is estimated at USD 1.49 billion in 2024, and is expected to reach USD 1.78 billion by 2029, growing at a CAGR of 3.61% during the forecast period (2024-2029).

The impact of the COVID-19 pandemic on the automotive sector was inevitable with the shut down of automotive manufacturing units due to the pandemic-resultant lockdowns. However, the market is expected to regain its momentum owing to the rise in demand for luxury automobiles. The market's developments will be further aided by the rising penetration of SUVs in emerging markets.

Technological advancements in glass, increased demand for comfort, safety, and convenience features, and increased desire for the high aesthetic appeal of the surface in vehicles is being witnessed across the world. Furthermore, innovations in material technology and growing customer desire for convertible roof systems in emerging countries are driving the global convertible roof system market.

Convertible Roof System Market Trends

Auto Manufacturers Increasing Investments in Convertible Roof Systems

Consistent evaluations and innovations have been undertaken to improve ease and comfort in the market studied. For instance,

Automobile manufacturers are incorporating several enhanced features in their vehicles. Several companies are launching product line-ups with better electronics and sensor technologies, which allow passengers to purchase customizable vehicles and reduce users' effort. For instance,

o In July 2021, Webasto announced multiple innovations developed in collaboration with several startups at the Startup Autobahn exhibition. The company showcased an integrated dynamic lighting concept for automotive roofs developed with designLED, a specialist in thin and flexible LED lighting and smart surface solutions. The two companies completed a prototype for a convertible roof element with light tiles.

Increasing luxury car sales is another factor driving the market growth for convertible roof systems. Asia-Pacific is expected to dominate luxury car sales during the forecast period due to major automotive markets such as China, followed by Japan and India.

Most major luxury brands see China as the fastest-growing market in terms of growth rate. China is the largest auto market globally, but it is disproportionately important to German premium car brands. German luxury car manufacturers, i.e., Mercedes-Benz, BMW, and Audi, posted record sales in 2020 despite the industry's decline over the previous two years. In 2020, Mercedes-Benz reported a Y-o-Y increase of 22.4%, while other carmakers like BMW and Audi witnessed increases of 15.4% and 10.6%, respectively.

Despite the COVID-19 pandemic, China's luxury vehicle sales in the first 11 months of 2020 exceeded 3 million units with a Y-o-Y increase of 9.3%. This also marked the third consecutive year for luxury brands to register growth in the wake of downward pressure in China's overall automotive market.

Emergence of Asia-Pacific as Major Market for Luxury Vehicles

Europe dominated the overall share of the convertible roof system market. However, the Asia-Pacific region is expected to record a significant CAGR during the forecast period.

The convertible market is expected to grow over the forecast period. Countries like the US, Canada, France, the UK, Germany, Spain, and others in the Middle East and Asia-Pacific regions are witnessing growth in luxury car sales. The US is one of the largest automotive markets globally and is home to over 13 major auto manufacturers.

With an average production of 8 million passenger vehicle units per annum and the growing popularity of luxury and premium cars with consumers, prospects for the convertible roof industry in the country are high. The convertible roof system industry is highly dependent on the sales of luxury and premium cars, which are, in turn, dependent on the per capita income levels of the population.

Additionally, China and Germany are the major hubs for technological advancements in the automotive sector, leading to a significant expansion of the luxury vehicles market. The growing youth population is yet another contributing factor for the growth of luxury car sales in the APAC region. India is another important market for luxury cars. The Indian government is also taking initiatives to recover the sales of luxury cars in the country by reducing GST, import duties, registration taxes on (luxury) cars, and providing support from banks/NBFCs to offer easy access to loans for dealers and customers, which will help expand the market and boost the overall sector.

Convertible Roof System Industry Overview

The convertible roof system market is majorly dominated by Webasto, Magna International, The Haartz Corporation, U-Shin Ltd, and Continental AG, among others. The companies are expanding their businesses by launching new products and innovations. For instance:

In July 2021, Webasto announced that the new BMW 4 Series features a convertible roof from Webasto. The roof can be opened within 18 seconds while driving at the touch of a button. In a single flowing movement, the four roof elements are stacked on top of each other. At the same time, the top cover opens backward, and the roof elements are stored underneath.

In December 2020, Webasto developed the new, custom-made two-part retractable hard top (RHT) for the re-imagined Stingray, with a total of six electric motors fitted in the roof in place of a hydraulic system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Roof System Components Type

- 5.1.1 Roof Material

- 5.1.1.1 Polyvinyl Chloride (PVC)

- 5.1.1.2 Carbon Fiber

- 5.1.1.3 Other Roof Materials

- 5.1.2 Roof Drive System (Motors)

- 5.1.3 Other Roof System Component Types (Supporting Frames, etc.)

- 5.1.1 Roof Material

- 5.2 Roof Top Type

- 5.2.1 Hard Top

- 5.2.2 Soft Top

- 5.3 Vehicle Type

- 5.3.1 Hatchback

- 5.3.2 SUV

- 5.3.3 Sedan

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Australia

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Webasto Group

- 6.2.2 Magna International

- 6.2.3 Valmet Corp.

- 6.2.4 Haartz Corporation

- 6.2.5 Continental AG

- 6.2.6 Hoerbiger Holding

- 6.2.7 U-Shin Ltd

- 6.2.8 GAHH LLC

- 6.2.9 Aisin Seiki