|

市场调查报告书

商品编码

1443890

资安管理服务:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Managed Security Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

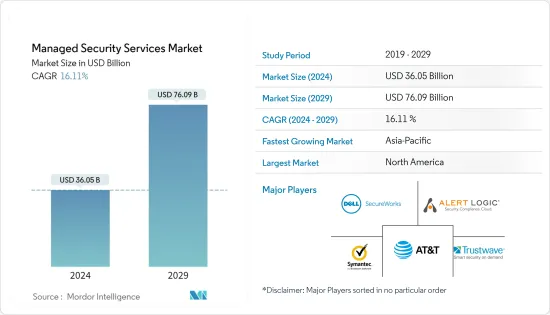

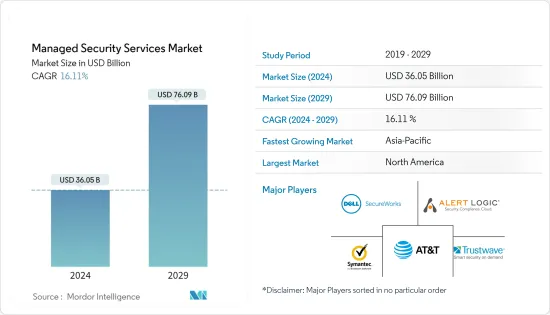

资安管理服务市场规模预计到 2024 年为 360.5 亿美元,预计到 2029 年将达到 760.9 亿美元,在预测期内(2024-2029 年)增长 16.11%,复合年增长率增长。

COVID-19 的疫情预计将对资安管理服务市场占有率的成长产生积极影响。这是因为随着 COVID-19 的出现,资安管理服务被认为可以帮助企业解决安全问题并促进远端工作时的安全资讯存取。大流行后,由于长期在家工作和数数位化的提高,市场正在快速成长。

主要亮点

- 计算中的资安管理服务是外包给服务供应商的网路保全服务。许多组织聘请资安管理服务提供者 (MSSP) 来执行安全监控,因为他们没有必要的专业知识或内部员工。维护安全监控基础设施非常复杂,需要合格的工作人员进行持续评估和采取行动。

- 此外,由于架构过于复杂或扩展或不同系统上的特定实施需求而需要自订安全部署的组织可以从此类服务中受益匪浅。此外,依赖动态资源分配的组织通常需要更好的自动化来监控动态环境以有效运作。这些复杂的自动化需求可以透过 AT&T、Verizon、IBM 和 SecureWorks 等公司提供的服务来管理。

- 根据 HIPAA 的数据,美国医疗保健产业的三大资料外洩事件已导致超过 520 万笔病患记录遗失,其中包括 Accudoc Solutions、UnityPoint Health 和德克萨斯州 Retirement System 等组织。

- 如今,世界的数位化程度比以往任何时候都更加紧密。网路犯罪分子正在利用这种线上转型来攻击线上系统、网路和基础设施的弱点。这对世界各地的政府、企业和个人有重大的经济和社会影响。网路钓鱼、勒索软体和资料外洩只是当前网路威胁的几个例子,但新型网路犯罪一直在出现。网路犯罪分子变得越来越敏捷和有组织,利用新技术、协调攻击并以新方式进行协作。根据FBI《2021年网路犯罪报告》,2021年民众向FBI举报的网路犯罪申诉为847,376起,较2020年增加了7%。

- 网路威胁日益复杂,导致组织外包一项或多项保全行动的趋势日益明显。在选择内部安全营运中心 (SOC) 还是委託安全营运中心 (SOC) 时,需要考虑许多因素。正确的选择可能会产生严重的后果,因为进入您的业务系统的恶意程式码可能会破坏您的整个业务。

资安管理服务市场趋势

云端部署主导市场

- 随着正在进行数位转型的公司面临不可避免但艰鉅的任务,即升级其本地IT基础设施并将部分业务转移到云端,IT 决策者通常面临监管合规性、安全性和风险缓解问题。缺乏熟练的 IT 专业人员以及无法跟上最新的工具、技术和实践,加剧了这些问题。随着网路和资料安全威胁的增加,资安管理服务供应商 (MSSP) 可以帮助企业应对云端配置、风险缓解和法规遵循。

- 部署在云端的资安管理服务具有高度的弹性和扩充性。此外,服务供应商还可以存取、监控和远端修復其云端环境中的问题。持续监控使您能够快速有效地解决问题。人工智慧/机器学习、巨量资料分析、威胁情报和高级自动化平台等新兴技术的日益普及也推动了向云端基础的资安管理服务的转变。一些市场相关人员正在透过创新和协作推出综合服务,以满足行业不断变化的需求。

- 2021 年 8 月,Amazon Web Services 为资安管理服务供应商 (MSSP) 推出了新的合作伙伴能力,使其云端软体解决方案和服务在 AWS Marketplace 上提供。 AWS 已试行一年的 AWS 1 级 MSSP 能力为资安管理服务创建了新的基准标准,用于保护、监控和回应关键 AWS 资源上的安全事件,并作为完全託管服务提供给客户。去做。该公司表示,新能力旨在帮助合作伙伴在拥挤的安全市场中脱颖而出,并使客户更容易获得服务。

- 此外,2021 年 7 月,Tech Mahindra 宣布与网路安全公司 Palo Alto Networks资安管理服务供应商 (MSSP) 合作伙伴关係。该协议扩大了 Tech Mahindra 与这家美国跨国公司的全球合作伙伴关係,以提供一整套资安管理服务。作为 MSSP,Tech Mahindra 为其客户提供对网路、端点和云端安全的完整可见性和控制,包括风险评估、状态管理、工作负载保护和编配等附加价值服务。

- 此外,2021 年 7 月,Telus 宣布推出基于 Palo Alto Networks 的 Prisma Access 技术的新託管云端安全解决方案,使加拿大企业能够从任何地方安全地存取其资料和应用程式。此外,为了确保网路安全和保护,新的託管云端安全解决方案提供防火墙服务、威胁防护、恶意软体防护、URL过滤、SSL解密和基于应用程式的策略。消费者还可以连接到 Telus SD-WAN 服务并使用 SASE。

亚太地区将经历最快的成长

- 数位转型已成为该地区的当务之急。随着越来越多的公司实施正式的策略来支持他们的努力并推动市场需求,这项技术正在迅速普及。

- 利用外包託管服务来管理公司的 IT 资源是确保显着节省预算、更具弹性的运算能力以及更安全的网路运作和效能的一种方法。中国电信美洲公司与瞻博网路、微软、思科、FSNetworks、IBM、VMware、华为等领先供应商合作,在全球72个国家提供完整的承包专业ICT服务。

- 该地区不断上升的网路安全威胁,例如 IT 勒索软体攻击、DDoS 攻击和资料洩露,以及媒体对备受瞩目的网路攻击的报告增加,正迫使全国各地的组织采用资安管理服务。此外,传统产业也得到拥抱数位转型和加强IT技术采用的政策支持。因此,对互联网资料中心服务的需求也在增加,进一步推动市场成长。

- 随着人工智慧、5G、物联网、虚拟实境等技术的快速发展以及这些新技术的商用,资料处理和资讯互动的需求不断增加,将加速该地区资料中心的建设。业界预计。

- 随着印度对组织资讯的完整性、保密性和可用性的威胁迅速增加,资讯安全的建立、实施、运作、监控、审查、维护和维护的重点是为组织资讯的完整性、保密性和可用性提供标准化模型。提高客户的整体资讯安全。

- 2022 年 2 月,IBM 宣布进行资源投资,帮助亚太 (APAC) 地区的企业做好准备并管理日益增长的网路攻击风险。新的 IBM 安全指挥中心是该地区第一个,使用高度真实的模拟网路攻击来教育网路安全响应策略,让从高阶主管到技术负责人的每个人都做好准备。这项投资还包括一个新的安全营运中心 (SOC)。这可能成为 IBM 当前全球 SOC 网路的一部分,为全球客户提供 24/7 的安全回应服务。

资安管理服务产业概述

资安管理服务市场被现有的大型参与者和许多即将推出的供应商分割,这些供应商提供保全服务以保护企业免受网路攻击、拒绝服务甚至执行风险评估等攻击。随着组织继续进行策略性投资,我们预计该市场将出现许多合作伙伴关係、合併、服务推出和收购。

- 2022 年 4 月 - 全球应用程式託管和虚拟桌面云端服务供应商Ace Cloud Hosting (ACE) 宣布推出资安管理服务(MSS)。此外,Accenture也收购了赛门铁克的网路安全保全服务业务,以增强保全服务的弹性。此外,Verizon 已将 Blackberry Cylance 基于人工智慧的防毒解决方案整合到其保全服务产品组合中。这种整合表明对基于人工智慧的网路安全解决方案的需求不断增长。这两项发展都凸显了市场提供的成长潜力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场动态

- 市场驱动因素

- 网路犯罪增加、数位破坏和合规要求增加

- 需要早期威胁侦测和情报来推动市场成长

- 市场限制因素

- 保全服务意识缺失限制市场拓展

- MSSP领域的演变和主要趋势

- 评估 COVID-19 对市场的影响

第六章市场区隔

- 依部署类型

- 本地

- 云

- 按解决方案类型

- 入侵侦测与预防

- 威胁预防

- 分散式阻断服务

- 防火墙管理

- 端点安全

- 风险评估

- 由资安管理服务提供者提供

- IT服务供应商

- 管理安全专家

- 电信服务供应商

- 按行业 按最终用户

- BFSI

- 政府和国防

- 零售

- 製造业

- 医疗保健和生命科学

- 资讯科技和电信

- 其他最终用户领域

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- AT&T Inc.

- Secureworks Inc.(Dell Technologies Inc.)

- Symantec(Broadcom Inc.)

- Trustwave Holdings Inc.

- Alert Logic

- IBM Corporation.

- Verizon

- CenturyLink

- BAE Systems

- AtoS

- Capgemini

- Wipro

- Fujitsu

第八章供应商定位分析

第九章投资分析及市场展望

The Managed Security Services Market size is estimated at USD 36.05 billion in 2024, and is expected to reach USD 76.09 billion by 2029, growing at a CAGR of 16.11% during the forecast period (2024-2029).

The COVID-19 outbreak is expected to impact the growth of managed security services market share positively. This is because, with the arrival of COVID-19, the use of managed security services is believed to enable enterprises to address security issues and facilitate secure information access while remote working. After the pandemic, the market is growing rapidly due to permanent work-from-home jobs and increased digitalization.

Key Highlights

- Managed security services in computing are network security services outsourced to any service provider. Many organizations hire managed security service providers (MSSPs) to undertake security monitoring, as they do not have the necessary expertise or staff in-house. Maintaining any security monitoring infrastructure is complex and requires qualified staff to assess and respond continually.

- Moreover, organizations requiring custom security deployments due to overly complex or expansive architecture or specific implementation needs with disparate systems can significantly benefit from such services. Additionally, organizations relying on dynamic resource allocation generally require better automation to monitor the dynamic environments in which they operate effectively. Such complex automation needs can be managed by the services offered by players like AT&T, Verizon, IBM, and SecureWorks.

- According to HIPAA, the top three data breaches in the healthcare sector in the United States witnessed a combined loss of more than 5.2 million patient records, including organizations like AccudocSolutions, UnityPoint Health, and the Employees' Retirement System of Texas.

- Today, the world is more digitally connected than ever before. Cybercriminals use this online transformation to target online systems, networks, and infrastructure weaknesses. There is a massive economic and social impact on governments, businesses, and individuals worldwide. Phishing, ransomware, and data breaches are just a few examples of current cyber threats, while new types of cybercrime are always emerging. Cybercriminals are increasingly agile and organized - exploiting new technologies, tailoring their attacks, and cooperating in new ways. According to the FBI's Internet Crime Report 2021, 847,376 complaints of cybercrime were reported to the FBI by the public in 2021, a 7% increase from 2020.

- The increasing complexity of cyber threats has driven the trend toward outsourcing one or more of an organization's security operations. When deciding between an internal and an outsourced Security Operations Center (SOC), many factors must be considered. The right choice may have critical consequences, as malicious code infiltrating a business system can now destroy an entire business.

Managed Security Services Market Trends

Cloud Deployment to Dominate the Market

- IT decision-makers are typically confronted with issues surrounding regulatory compliance, security, and risk reduction as businesses in the throes of digital transformation undertake the inevitable yet daunting task of upgrading their on-premises IT infrastructure and moving some of their operations to the cloud. The shortage of skilled IT professionals on staff and the inability to stay updated with the recent tools, technologies, and practices exacerbates these corporate concerns. When network and data security threats are rising, managed security service providers (MSSPs) may help overwhelmed enterprises confront cloud configuration, risk reduction, and regulatory compliance.

- The cloud-deployed managed security services are flexible and scalable. Furthermore, it enables the service provider to access, monitor, and even remotely repair any issues within the cloud environment. Continual monitoring ensures the quick and efficient resolution of problems. The shift to cloud-based managed security services is also aided by the increasing penetration of emerging technologies such as AI/ML, big data analytics, threat intelligence, and advanced automation platforms. Several market players are launching comprehensive services through innovation and collaboration to cater to the industry's evolving requirements.

- In August 2021, Amazon Web Services launched a new partner competency for managed security service providers (MSSPs) and made their cloud software solutions and services available in the AWS Marketplace. The AWS Level 1 MSSP Competency, which AWS has been piloting for a year, creates a new baseline standard for managed security services that protect, monitor, and respond to security events of essential AWS resources and are delivered to customers as a fully managed service. According to the company, the new competency is designed to help partners differentiate themselves in a crowded security market and make it easier for customers to procure their services.

- Furthermore, in July 2021, Tech Mahindra announced a managed security services provider (MSSP) partnership with cybersecurity company Palo Alto Networks. The agreement led to the expansion of Tech Mahindra's global partnership with the US-based multinational to provide a full suite of managed security services. As an MSSP, Tech Mahindra would offer complete visibility and control of the network, endpoint, and cloud security, including value-added services like risk assessment, posture management, workload protection, and orchestration to the company's customers.

- Furthermore, in July 2021, Telus launched a new managed cloud security solution based on Palo Alto Networks' Prisma Access technology, allowing Canadian businesses to access data and apps from anywhere securely. Additionally, to assure network security and protection, the new managed cloud security solution offers firewall services, threat prevention, malware prevention, URL filtering, SSL decryption, and application-based policies. It also allows consumers to use SASE by connecting to Telus SD-WAN services.

Asia-Pacific to Witness the Fastest Growth

- Digital transformation has become a top priority in the region. It is spreading rapidly as more companies implement formal strategies to support their efforts, driving the market demand.

- Engaging outsourced managed services for a company's IT resources can be a way to ensure substantial budget savings, more resilient computing capacity, and more secure network uptime and performance. China Telecom Americas Corporation gives complete turnkey professional ICT services in 72 countries globally in partnership with major vendors, such as Juniper, Microsoft, Cisco, FSNetworks, IBM, VMware, and Huawei, among many more.

- The increasing threats to cybersecurity in the region, including IT ransomware attacks, DDoS attacks, data exfiltration, and the increasing media coverage of high-profile cyberattacks, are compelling organizations in the country to adopt managed security services. Moreover, conventional industries are supported by policies to embrace digital transformation and enhance their adoption of IT technologies. Hence, their demand for internet data center services is also rising, further driving the market growth.

- With the rapid development of AI, 5G, IoT, virtual reality, and the commercial application of these new technologies, the demand for data processing and information interaction is increasing, which may speed up the construction of data centers in the region and lead to the explosive growth of the industry.

- Threats to the integrity, confidentiality, and obtainability of organization information are increasing exponentially in India, hence emphasizing the focus on providing a standardized model for information security based on a business risk approach to establish, implement, operate, monitor, review, maintain, and improve overall information security for customers.

- In February 2022, IBM announced an investment in its resources to help businesses in the Asian-Pacific (APAC) region prepare for and manage the growing danger of cyberattacks. The new IBM Security Command Center, the first in the region, is expected to educate cybersecurity response strategies using extremely realistic, simulated cyberattacks to prepare everyone from the C-suite to technical personnel. The investment also includes a new Security Operation Center (SOC), which may be part of IBM's current global SOC network, providing security response services to clients globally 24/7.

Managed Security Services Industry Overview

The managed security services market is fragmented due to existing giants and many upcoming vendors who provide security services to prevent companies from attacks like network attacks, Denial of services, or even performing a risk assessment. This market is anticipated to encounter many partnerships, mergers, service launches, and acquisitions as organizations continue to invest strategically.

- April 2022 - Ace Cloud Hosting (ACE), the global cloud services provider of application hosting and virtual desktops, announced the launch of Managed Security Services (MSS). Furthermore, Accenture acquired Symantec's cybersecurity services business to incorporate flexibility into security services. Additionally, Verizon integrated Blackberry Cylance's AI-based anti-virus solution into its security services portfolio. This integration is indicative of the increasing demand for AI-based cybersecurity solutions. Both these developments underscore the growth potential that the market offers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Cyber Crime, Digital Disruption, and Increased Compliance Demands

- 5.1.2 Need for Threat Detection and Intelligence at an Early Stage Driving the Market Growth

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness of Security Services is Discouraging the Market Expansion

- 5.3 Evolution and Key Trends in the MSSP Space

- 5.4 Assessment of the Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-Premise

- 6.1.2 Cloud

- 6.2 By Solution Type

- 6.2.1 Intrusion Detection and Prevention

- 6.2.2 Threat Prevention

- 6.2.3 Distributed Denial of Services

- 6.2.4 Firewall Management

- 6.2.5 End-Point Security

- 6.2.6 Risk Assesment

- 6.3 By Managed Security Service Provider

- 6.3.1 IT Service Providers

- 6.3.2 Managed Security Specialist

- 6.3.3 Telecom Service Provider

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 Government and Defense

- 6.4.3 Retail

- 6.4.4 Manufacturing

- 6.4.5 Healthcare and Life Sciences

- 6.4.6 IT and Telecom

- 6.4.7 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T Inc.

- 7.1.2 Secureworks Inc. (Dell Technologies Inc.)

- 7.1.3 Symantec (Broadcom Inc.)

- 7.1.4 Trustwave Holdings Inc.

- 7.1.5 Alert Logic

- 7.1.6 IBM Corporation.

- 7.1.7 Verizon

- 7.1.8 CenturyLink

- 7.1.9 BAE Systems

- 7.1.10 AtoS

- 7.1.11 Capgemini

- 7.1.12 Wipro

- 7.1.13 Fujitsu