|

市场调查报告书

商品编码

1237843

户外太阳能 LED 市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Outdoor Solar Led Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预测期内,全球户外太阳能 LED 市场预计将以 23.32% 的复合年增长率增长。

影响市场增长的关键因素之一是,由于质量和效率的提高,LED 在户外照明环境中越来越受欢迎,尤其是街道照明应用。 此外,各国越来越多地使用太阳能作为可再生照明源,也将刺激市场扩张。

主要亮点

- 室外太阳能 LED 产品的采用预计将受到多个智慧城市发展计划的日益实施的推动,从而为该市场的供应商创造机会。 此外,政府加大力度和投资以提高公众对太阳能灯好处的认识,这为市场提供了在预测期内增长的机会。

- 此外,人们越来越意识到使用可再生能源可以减少污染和全球变暖的影响,这有望推动市场发展。 由于 LED 价格下降和新兴国家越来越多地使用光伏 LED,市场正在扩大。

- 我们还在加快消费者对太阳能照明的采用。 例如,Electric Company (PG&E) 和 Pacific Gas 以无息贷款的形式向拥有确保户外太阳能 LED 灯使用的非住宅项目的客户提供扩展的财务援助。 由于维护需求低,许多国家的政府也正在用太阳能 LED 灯取代过时的传统街道照明。

- COVID-19 疫情对户外太阳能 LED 市场产生了重大影响,但正在进行的太阳能 LED 照明举措数量增加了需求,并帮助市场在疫情过后反弹。。 然而,市场受益于地方政府的举措,以确保在封锁期间继续进行正在进行的项目。

- 此外,电池价格下降、LED 照明成本降低、产品设计创新以及景观照明产品照明效果改善等因素预计会压低太阳能 LED 组件的价格。 欠发达和发展中地区的市政当局预计会选择太阳能 LED,因为它们具有更长的使用寿命、易于安装、更低的维护和运营成本以及更低的价格。

- 然而,初始成本高、对融资和投资回收缺乏了解以及受天气影响是阻碍市场扩张的一些问题。 户外太阳能 LED 产业发展的主要障碍之一是缺乏全球 LED 制度化计划。 为了促进重要发明的应用,一些国家的政府有严格的规定,但尚未制度化。

户外太阳能LED市场趋势

太阳能LED路灯有望快速增长

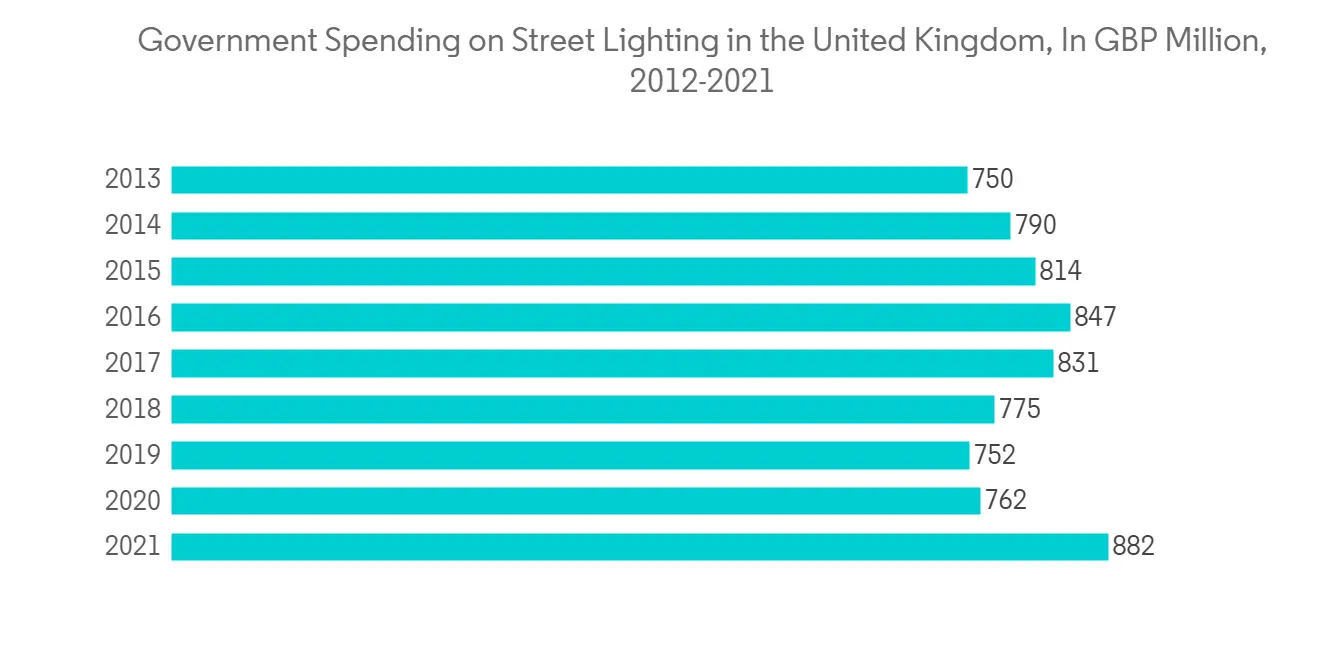

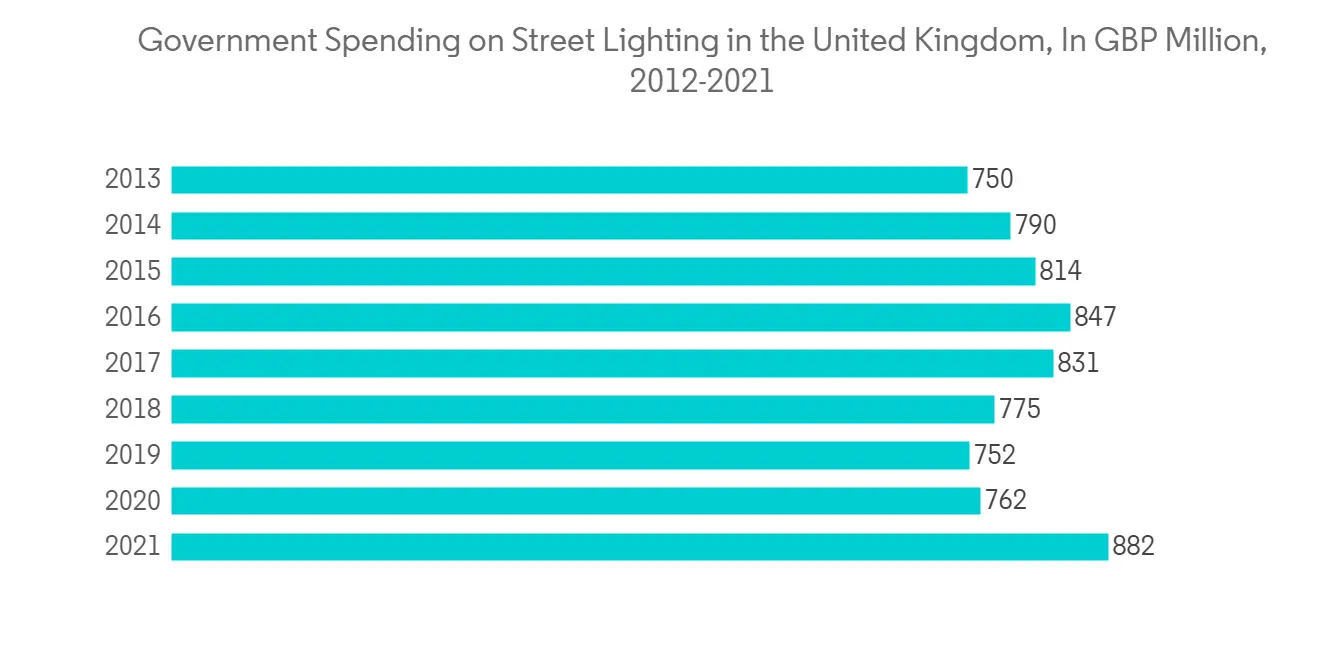

- 太阳能 LED 街道照明是份额最大的细分市场。 这个市场的增长将由各国政府在各个城市安装太阳能 LED 路灯推动,尤其是靠近世界各地的直辖市。

- 此外,每个国家/地区用于改善道路基础设施的项目支出将刺激该细分市场的增长。 多个国家的几个地方政府也在寻求公私合作伙伴关係 (PPP) 来资助太阳能路灯的安装并促进该领域的扩展。

- 随着太阳能路灯基础设施开发计划投资的增加,预计商业领域对太阳能 LED 的需求将会增加。 此外,一些公用事业、联邦政府和地方政府向商业用户提供税收减免和激励计划,以鼓励使用太阳能 LED 照明。 因此,预计在预测期内,商业领域对太阳能 LED 的需求将会增加,从而促进可再生能源系统的采用和能源效率。

- 例如,2022 年 10 月,德克萨斯州普林斯顿市在普林斯顿城市公园的市中心周围安装了 37 盏智能离网太阳能路灯。 该市改善了该地区的基础设施,以提高能源弹性并推广可持续替代品。 总部位于休斯顿的 EnGoPlanet 生产的太阳能 LED 路灯无需电线,完全由太阳能供电。

- 此外,持续的技术创新促成了具有更高照度和更低功耗的产品的开发,预计这将在预测期内推动该细分市场的增长。 用节能照明取代老化街道照明的需求也是该细分市场增长的主要因素。

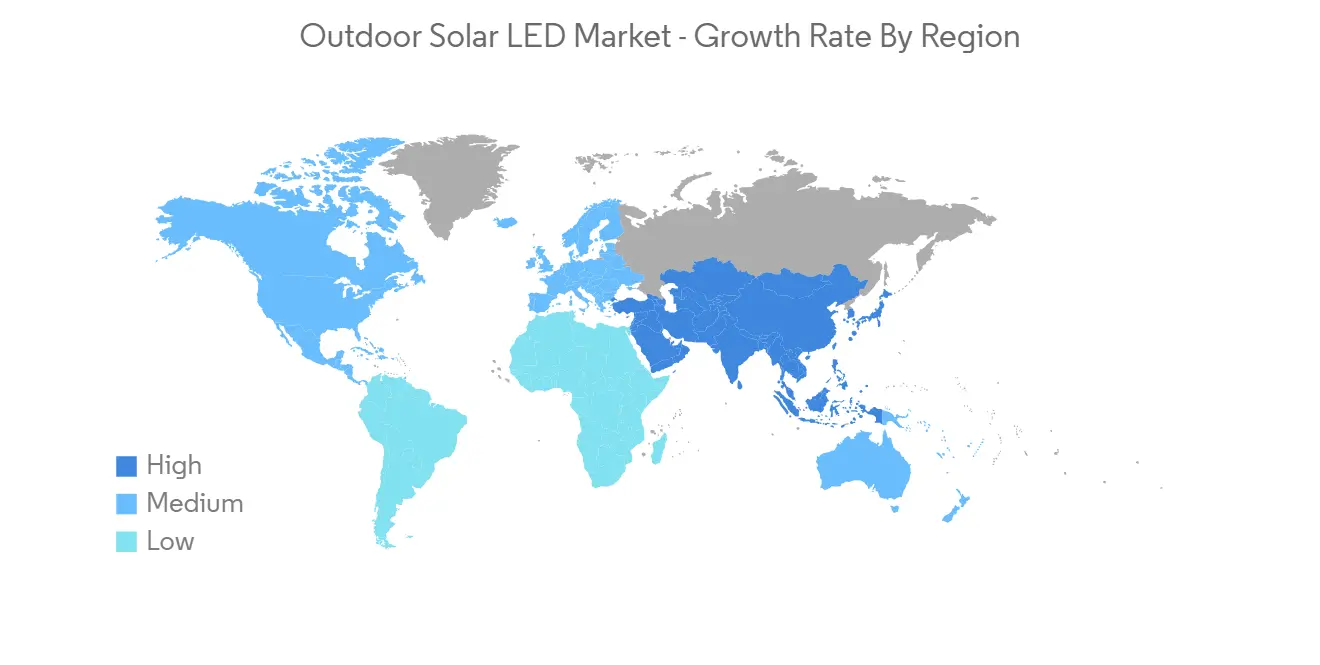

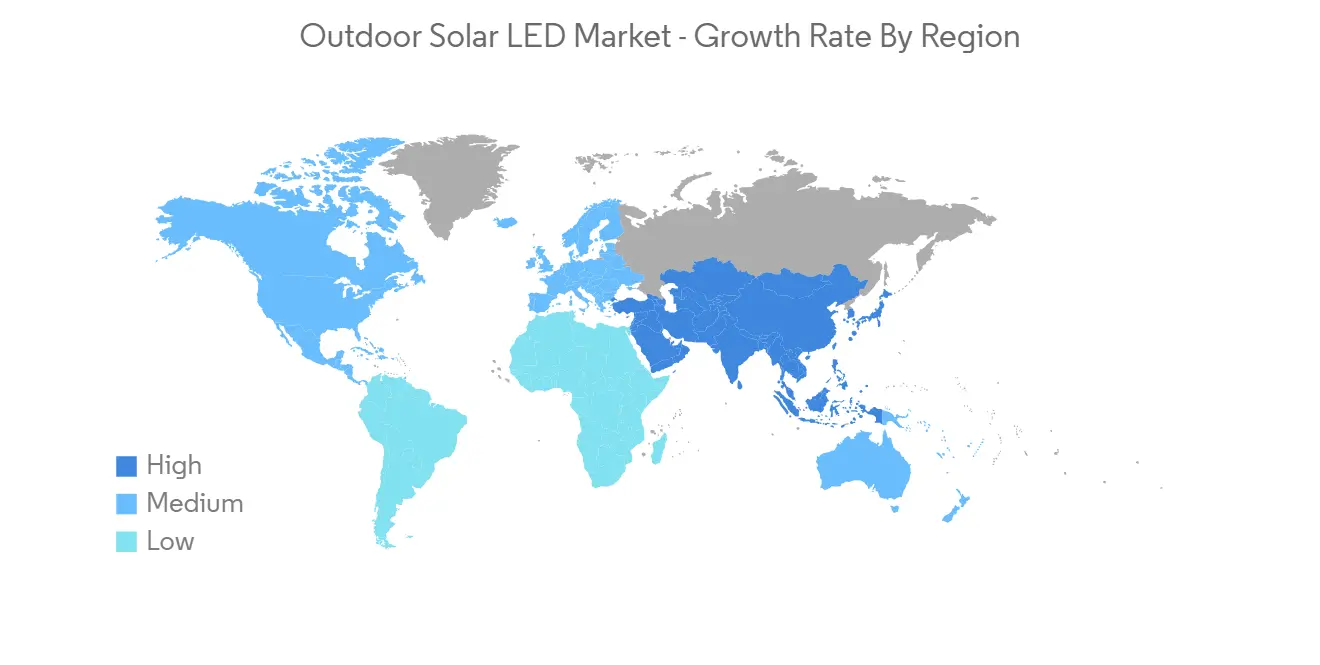

亚太地区将显着增长

- 亚太市场正在蓬勃发展,在全球太阳能户外 LED 照明市场中占有很大份额。 通过增加可再生技术来加强减少二氧化碳排放的努力被认为是亚太地区市场增长的一个因素。 此外,LED 照明解决方案设计方面的技术进步有望推动亚太地区的市场发展。

- 中国是亚太地区市场增长的推动力,预计这一趋势将在预测期内持续下去。 该地区的市场扩张归因于多个地区智慧城市、基础设施和城市扩建项目的兴起。 中国、印度和东南亚国家正在加快政府在农村和城市地区引入街道照明解决方案的努力,这有望推动市场扩张。

- 例如,由于政府对可再生能源的使用实行更严格的监管以及环保技术的日益普及,预计印度太阳能 LED 街道照明市场将显着增长。 根据印度品牌资产基金会(IBEF)的一份报告,印度计划到 2022 年从可再生能源中生产 175GW 的能源,其中 100GW 将来自太阳能。 由于农村电气化的 Deendayal Upadhyaya Gram Jyoti Yojana 等改革和政策,预计太阳能 LED 照明市场也将增长。

- 由于户外太阳能 LED 照明相对于传统户外照明的优势,亚太地区和其他一些国家在疫情后的全球市场前景广阔。

- 此外,该地区的人口增长迅速,这推动了对基础设施发展的投资,增加了对户外太阳能 LED 的需求。 世界各地的製造商和政府都在积极寻求具有成本效益的能源生产,最近以太阳能係统和绿色能源的整合为中心的创新吸引了他们。

户外太阳能LED市场竞争者分析

- 由于存在许多太阳能 LED 照明供应商,户外太阳能 LED 功能市场分散。 对可再生能源需求的增加鼓励市场供应商关注太阳能 LED 产品的国际出口机会。 SOKOYO、Signify Holding 和 Sunna Design SA 等重要参与者参加世界各地的许多展览和交易会以发展业务。

- 2022 年 11 月,Signify为其“超高效”产品线增加了 12 款新灯和灯具,据称其效率比标准 LED 产品高出 50%。 新产品是 2 款室内钻石切割灯具、2 款户外灯桿灯具和 2 款户外太阳能 tyra 灯具。

- 2022 年 6 月,SBM-SolarTech 推出了第四代太阳能道钉,型号为 D-143,可供购买。 道路建设公司正在使用带有闪烁 LED 灯的太阳能道钉来标记道路中心线和边缘。 太阳能路灯内置道钉,大大提高行车安全性和有效性。 通过实际使用,太阳能道钉已被证明可以降低事故率和路线错误的可能性。

其他福利。

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 研究假设和市场定义

- 调查范围

第二章研究方法论

第 3 章执行摘要

第 4 章市场洞察

- 市场概览

- 产业吸引力 - 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 关于 COVID-19 对市场的影响

第 5 章市场动态

- 市场驱动因素

- 太阳能路灯越来越受欢迎

- 增加智慧城市项目的数量以及高速公路和道路基础设施的发展

- 关于太阳能电池板和 LED 的价格下降

- 市场挑战

- 初始安装成本和气候变化的影响

第 6 章市场细分

- 用法

- 太阳能LED路灯

- 太阳能花园 LED 灯

- 太阳能 LED 泛光灯

- 太阳能 LED 区域灯

- 太阳能 LED 聚光灯

- 功率

- 小于 39W

- 40W 至 149W

- 150W 或以上

- 最终用户行业

- 住宅

- 商业

- 工业

- 地区

- 北美

- 欧洲

- 亚太地区

- 世界其他地区

第七章竞争格局

- 公司简介

- CREE Lighting

- Gamasonic

- Hubbell Outdoor

- Ligman

- Greenshine New Energy

- Jiawei

- LEADSUN

- OkSolar

- SBM-SolarTech

- SEPCO Solar Electric Power Company

- Signify Holding

- Sokoyo Solar Lighting Co. Ltd

- Solar Street Lights USA

- Sunna Design SA

第八章投资分析

第九章未来市场展望

简介目录

Product Code: 93101

The Global Outdoor Solar LED market is expected to register a CAGR of 23.32% during the forecast period. One of the main factors influencing market growth is the rising popularity of LEDs for outdoor lighting settings, particularly in street light applications, due to improved quality and efficiency. The growing use of solar energy as a renewable source for lighting across nations is likely to spur market expansion.

Key Highlights

- The adoption of outdoor solar LED products is likely driven by the increased implementation of several smart city development plans, opening up opportunities for vendors in this market. Additionally, the government's expanding initiatives and investments to raise public awareness of the advantages of solar lights present a chance for the market to grow over the forecast period.

- Moreover, the market is anticipated to grow due to increasing awareness about the benefits of using renewable energy sources to reduce pollution and the effects of global warming. The market is expanding due to the falling price of LEDs and the growing use of solar-powered LEDs in developing nations.

- It also accelerates consumer adoption of solar lighting. For instance, Electric Company (PG&E) and Pacific Gas offer customers in non-residential projects who ensure to use Outdoor Solar LED lights extended financial assistance in the form of interest-free loans. Governments in numerous nations are also replacing outdated, conventional streetlights with solar LED lights due to their low maintenance requirements.

- The COVID-19 pandemic had a significant effect on the outdoor solar LED market, but a number of ongoing solar LED lighting initiatives also increased demand and helped the market bounce back after the pandemic. The market, however, benefited from regional government initiatives to guarantee the continuation of ongoing projects during lockdowns.

- Additionally, it is anticipated that factors like falling battery prices, LED lighting costs, product design innovations, and increases in the lighting efficacy of landscape lighting products will lower the price of solar LED components. Municipalities in underdeveloped and developing regions are anticipated to choose solar LEDs due to the price decline and additional advantages, including solar LEDs' increased lifespan, simplicity of installation, and low maintenance and operating costs.

- However, the problems impeding the market's expansion are the high initial costs, the lack of understanding regarding financing and payback, and the reliance on the weather. One of the leading obstacles to the growth of the outdoor solar LED industry is the absence of institutionalization plans for LEDs worldwide. To promote the use of significant inventions, governments in some nations have put in place strict regulations; however, they have refrained from institutionalizing their actions.

Outdoor Solar LED Market Trends

Solar LED Street Lights are Anticipated to Grow at the Robust Pace

- Solar LED streetlights are the market segment with the largest share. The market's growth is fueled by the government's installation of Solar LED street lights in various cities, particularly close to local municipalities worldwide.

- Additionally, expenditures in projects to upgrade the road infrastructure in various countries will stimulate segment growth. In order to finance the installation of solar street lights and promote segment expansion, several local governments from various countries also look at Public-Private Partnerships (PPP).

- The demand for solar LEDs in the commercial sector is anticipated to rise as investments in infrastructure development initiatives for solar street lighting increase. Additionally, several utilities, the federal government, and local governments provide tax breaks and incentive programs to commercial users to encourage the use of solar LED lights. Thus, the demand for solar LEDs is anticipated to increase in the commercial sector over the forecast period to facilitate the adoption of renewable energy systems and energy efficiency.

- For instance, in October 2022, the City of Princeton, Texas, installed 37 smart off-grid solar street lights in the Princeton Municipal Park, located around the Municipal Center. The city has improved its local infrastructure in an effort to increase energy resilience and promote sustainable alternatives. EnGoPlanet, a Houston-based manufacturer, makes solar-powered LED streetlights that don't need any wiring and are powered entirely by solar energy.

- Furthermore, products with increased lighting intensity and low power consumption have been developed as a result of ongoing innovation, and this is what is anticipated to fuel the segment's growth over the forecast period. The demand for replacing outdated street lighting systems with energy-efficient lighting solutions is also a major factor in the segment's growth.

Asia Pacific to Witness the Significant Growth

- The Asia Pacific market is proliferating and holds a significant share of the global solar outdoor LED lighting market. The increased efforts to reduce carbon emissions by increasing renewable technologies can be attributed to the market growth in the Asia Pacific region. Additionally, it is anticipated that technological advancement in LED lighting solution design will fuel the market in the Asia Pacific.

- China led the regional market's growth, and the trend is anticipated to last throughout the forecast period. The regional market expansion can be attributed to the rising number of smart cities, infrastructure, and city expansion projects in several regional nations. Government efforts to implement street lighting solutions in rural and urban markets in China, India, and Southeast Asian countries have accelerated; this is expected to support market expansion.

- For instance, India's solar LED street lighting market will expand significantly due to strict government rules regarding the use of renewable energy sources and the rising popularity of environmentally friendly technologies. According to a report by the India Brand Equity Foundation (IBEF), India intends to produce 175 GW of energy from renewable sources by 2022, of which 100 GW will come from solar energy. The solar LED lighting market will also grow due to reforms and policies, such as the Deendayal Upadhyaya Gram Jyoti Yojana for rural electrification.

- Due to the advantages of outdoor solar LED lights over traditional outdoor lights, the post-pandemic global market appears promising in Asia-Pacific and several other nations.

- Additionally, as the area's population is expanding quickly, investments are being made in infrastructure development, which raises demand for outdoor solar LEDs. Manufacturers and governments from many nations actively seeking cost-effective energy production are drawn to the recent innovations that revolve around integrating solar systems with greener energy sources.

Outdoor Solar LED Market Competitor Analysis

- The market for outdoor solar LED features is fragmented because there are many solar LED lighting vendors in this market. The increasing demand for renewable energy sources encourages market vendors to concentrate on opportunities for the international export of their solar LED products. Important players like SOKOYO, Signify Holding, and Sunna Design SA participate in numerous trade shows and exhibitions worldwide to grow their businesses.

- In November 2022, Signify added twelve new lamps and luminaires to its "Ultra Efficient" line of LEDs that it claims are up to 50% more efficient than its standard LED offerings. The new products include two indoor diamond cut luminaires, two outdoor arbor luminaires, and two outdoor solar-powered Tyla luminaires.

- In June 2022, SBM-SolarTech made available for purchase the Model D-143, the fourth generation of solar road studs. Road construction companies use solar road studs flashing LED lighting to mark centerlines and edges of roads. Road studs with embedded solar lights significantly increase traffic safety and effectiveness. Through actual use, solar-powered road studs have been shown to reduce accident rates and the likelihood of route errors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness -Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Solar Street Lighting is becoming More and More Popular

- 5.1.2 Rise in Number of Smart City Projects and Highway and Road Infrastructure

- 5.1.3 The decline in Prices of Solar Panels and LEDs

- 5.2 Market Challenges

- 5.2.1 Initial Deployment Costs and Impact due to Climate Change

6 MARKET SEGMENTATION

- 6.1 Application

- 6.1.1 Solar LED Street Lights

- 6.1.2 Solar Garden LED Lights

- 6.1.3 Solar LED Floodlights

- 6.1.4 Solar LED Area Lights

- 6.1.5 Solar LED Spot Lights

- 6.2 Wattage

- 6.2.1 Less than 39W

- 6.2.2 40W to 149W

- 6.2.3 More than 150W

- 6.3 End User Industry

- 6.3.1 Residential

- 6.3.2 Commercial

- 6.3.3 Industrial

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of The World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CREE Lighting

- 7.1.2 Gamasonic

- 7.1.3 Hubbell Outdoor

- 7.1.4 Ligman

- 7.1.5 Greenshine New Energy

- 7.1.6 Jiawei

- 7.1.7 LEADSUN

- 7.1.8 OkSolar

- 7.1.9 SBM-SolarTech

- 7.1.10 SEPCO Solar Electric Power Company

- 7.1.11 Signify Holding

- 7.1.12 Sokoyo Solar Lighting Co. Ltd

- 7.1.13 Solar Street Lights USA

- 7.1.14 Sunna Design SA

8 INVESTMENT ANALYSIS

9 FUTURE MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219