|

市场调查报告书

商品编码

1273420

骨科骨水泥和铸造材料市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Orthopedic Bone Cement and Casting Material Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,骨科骨水泥和铸造材料市场预计将以 8.4% 左右的复合年增长率增长。

COVID-19 对骨科骨水泥和铸造材料市场产生了重大影响。 由于封锁情况,行动限制导致全球骨科手术数量下降。 此外,在大流行初期,世界各地的道路交通事故数量有所减少。 例如,伦斯勒理工学院 2022 年 3 月发布的一项研究发现,在大流行的前两个月,美国的道路交通事故数量几乎减少了一半,当时大多数州的居民被迫呆在家里。。 此外,从 2020 年 3 月到 2020 年 5 月,路易斯安那州的交通事故减少了 47.0%,交通事故伤害减少了 46.0%,事故救护车派遣减少了 41.0%。 然而,随着手术量的增加和全球监管的放鬆,后 COVID-19 的前景可能会出现显着增长。

由于骨科疾病负担的增加以及伤害和事故的增加,全球骨科手术的数量正在增加。 此外,由于老龄化社会的进展,预计治疗数量将增加,这有望促进市场增长。

根据关节炎基金会的统计数据,到 2021 年,全球将有超过 3.5 亿人患有关节炎。 据估计,到 2020 年,将有 3080 万成年人患有关节炎,在美国,已观察到有 1400 万人患有有症状的膝关节骨关节炎。 到 2050 年,被医生诊断为骨关节炎的美国成年人人数预计将增加 49%,达到 7840 万。 据同一消息来源称,到 2040 年,因关节炎而行动不便的成年人人数将增加 52%,达到 3460 万。 随着骨科疾病的增加,例如,关节炎会导致需要使用骨水泥的椎骨骨折,从而增加需求并导致市场增长。 此外,骨水泥在外科手术中的使用预计会增加,这有望在预测期内推动市场增长。

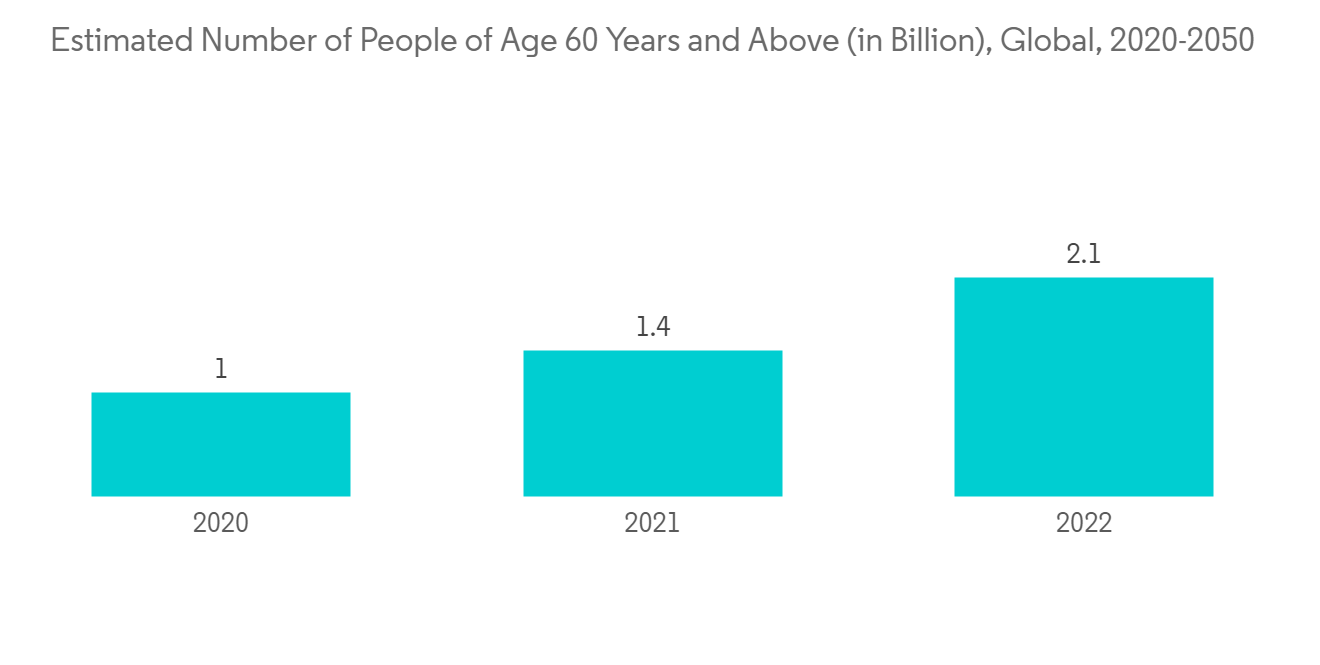

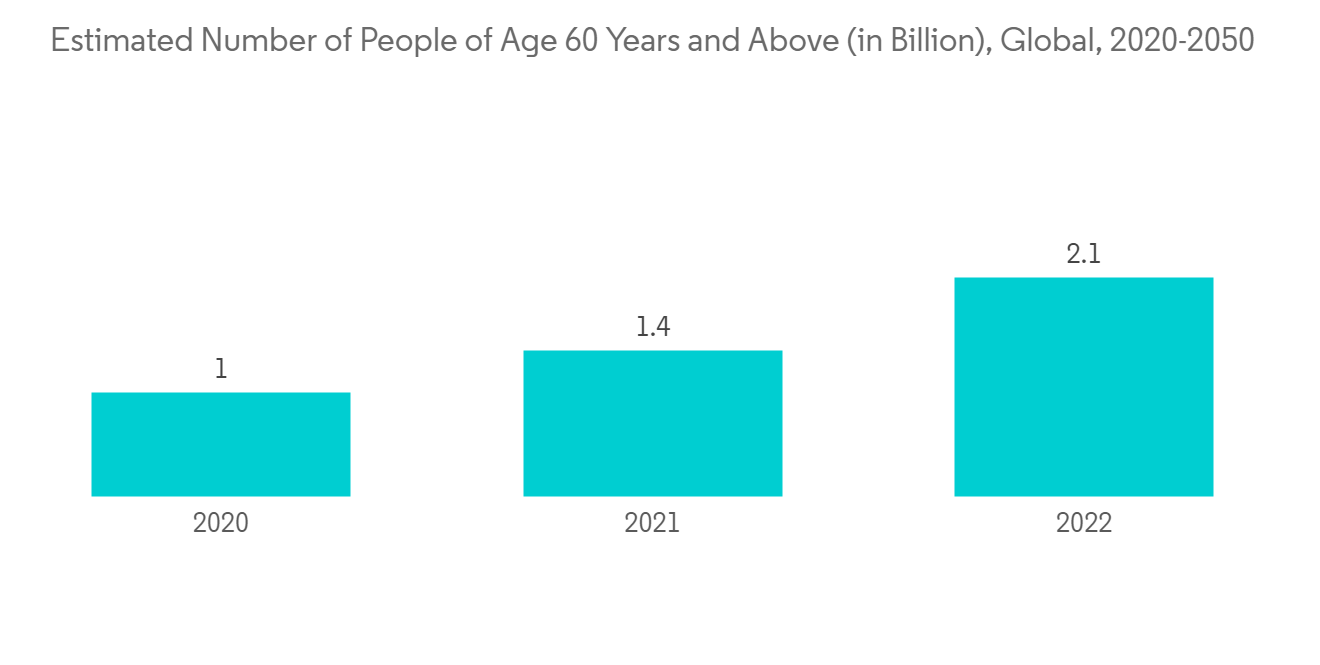

此外,预计在预测期内,老年人口增加和骨科创伤等其他因素也将推动骨科骨水泥和铸造材料市场。 根据《2022 年世界人口展望》报告,撒哈拉以南非洲 65 岁及以上人口的比例预计 2022 年为 3.0,2030 年为 3.3,北非和西亚估计为 5.5。 5,2022年7.0,中亚和南亚2022年6.4,2030年8.1,欧洲和北美2022年18.7,2030年22.0。 不断增长的老年人口正在推动市场增长,因为他们更容易受到骨科损伤,并且需要骨水泥和铸造材料来支撑和加强人工关节和骨折。

因此,由于上述因素,该市场有望在分析期内实现增长。 然而,骨水泥的高手术成本和副作用可能会阻碍市场增长。

骨科骨水泥和铸造材料的市场趋势

预测期内聚甲基丙烯酸甲酯有望实现健康增长

聚甲基丙烯酸甲酯是骨科手术中最耐用的材料之一。 除了在关节置换手术的成功中发挥核心作用外,它还用于经皮椎体成形术和股骨成形术等新技术。 在全髋关节置换术中,生物惰性聚甲基丙烯酸甲酯 (PMMA) 骨水泥已成为最常用的骨科植入物快速固定方法。

骨科手术的增加预计将推动该细分市场的增长。 根据美国骨科医师学会的数据,到 2030 年,全膝关节移植手术预计将增加 673%,每年进行 350 万台手术。 因此,在预测期内,需要水泥和铸件的骨科手术的增加预计将推动该部门的增长。

根据 2022 年 7 月更新的 WHO 数据,2021 年全球约有 17.1 亿人患有肌肉骨骼疾病。 在肌肉骨骼疾病中,背痛负担最重,患病人数达 5.68 亿。 肌肉骨骼疾病是全世界残疾的主要原因,背痛是 160 个国家/地区的唯一主要原因。 因此,随着肌肉骨骼疾病的增加,对聚甲基丙烯酸甲酯的需求不断增加,预计将在预测期内推动该细分市场的增长。

此外,根据联合国 2022 年世界人口展望的数据,世界 65 岁及以上人口的比例预计将从 2022 年的 10% 上升到 2050 年的 16%。 到 2050 年,世界 65 岁及以上人口将是 5 岁以下儿童人数的两倍多,与 12 岁以下儿童人数几乎持平。 未来几年,预计易患骨科疾病的老龄化人口将增加,从而增加对骨水泥和铸造材料的需求,预计将在预测期内推动市场增长。

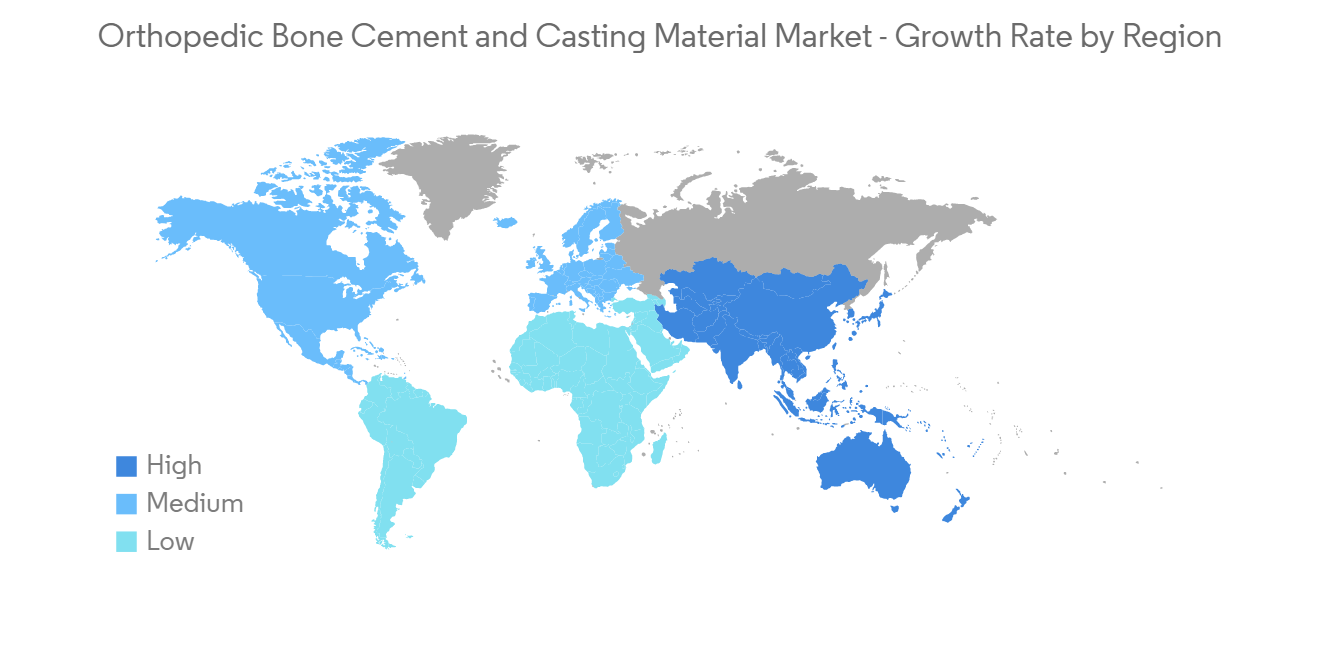

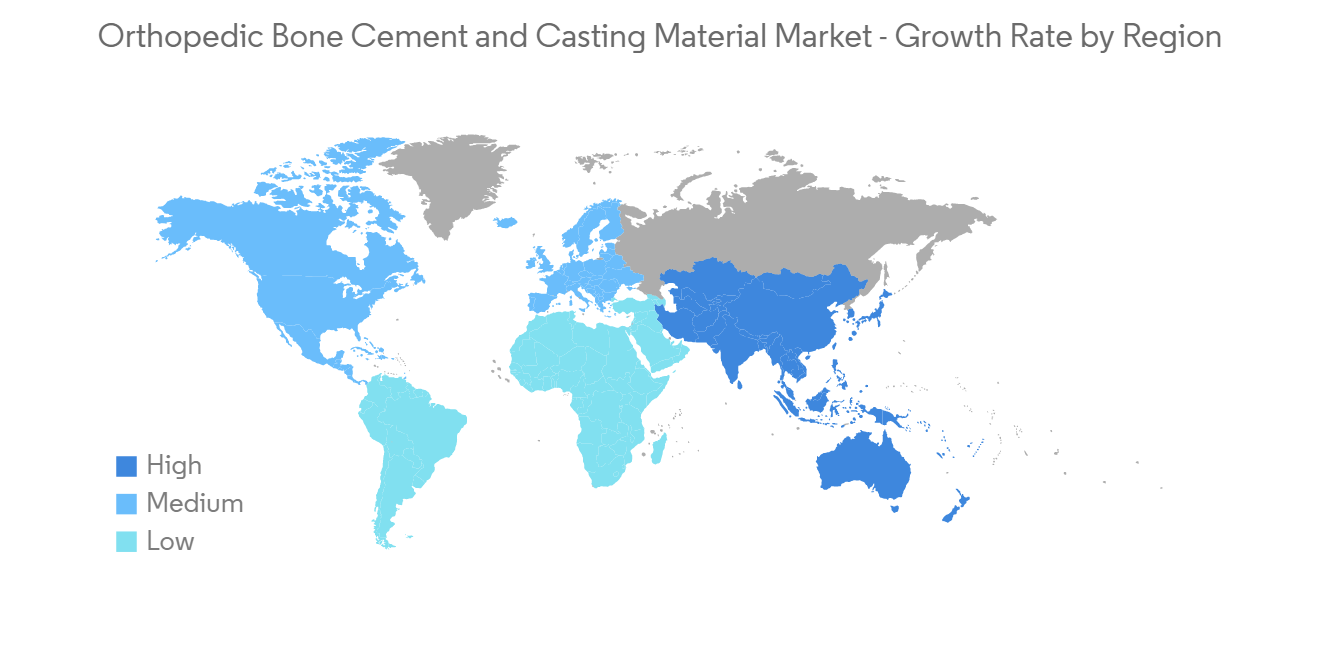

北美主导市场,预计在预测期内将继续保持这一势头

由于肌肉骨骼疾病的高发率、人口老龄化、该地区强大的行业影响力以及出色的医疗保健基础设施,预计北美将主导该市场。

膝盖受伤病例的增加是推动该领域发展的主要因素之一。 例如,根据加拿大健康信息研究所 2021 年 6 月发布的一份报告,膝关节置换手术是加拿大每年进行的前三大住院手术之一。

此外,根据美国国家安全委员会 2021 年的报告,自行车和配件造成的伤害有 425,910 起,运动和健身器材造成的伤害有 377,939 起,全地形车、轻便摩托车、小型自行车等造成的伤害,所有年龄段的人都有 229,974 人受伤被报导。 滑板、踏板车和气垫板报告了 217,646 人受伤。 预计与运动相关的大量伤害将增加对骨科骨水泥的需求,从而导致市场增长。

因此,由于上述因素,预计北美地区的市场增长。

骨科骨水泥及铸造材料行业概况

骨科骨水泥和铸造材料市场与几家大型企业竞争激烈。 市场上的主要参与者正在实施增长战略,例如协议、协作模型、业务扩展和产品开发。 领先的骨科骨水泥公司包括 Stryker Corporation、Smith & Nephew、Depuy Synthes (Johnson & Johnson)、Zimmer Biomet Holdings Inc. 和 Synimed SARL。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 外伤和交通事故案例增加

- 骨科、颅骨和脊柱手术的数量增加

- 骨质疏鬆症患病率上升

- 市场製约因素

- 骨科手术费用高昂

- 骨水泥的副作用

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 按材料

- 聚甲基丙烯酸甲酯 (PMMA)

- 陶瓷

- 亚克力

- 其他材料

- 按产品类型

- 低粘度水泥

- 中粘度水泥

- 高粘度水泥

- 抗菌水泥

- 最终用户

- 医院

- 骨科门诊中心

- 其他最终用户

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章竞争格局

- 公司简介

- Stryker Corporation

- Smith & Nephew

- Johnson & Johnson(Depuy Synthes)

- Zimmer Biomet Holdings Inc.

- Synimed SARL

- Subiton LABORATORIOS SL S.A

- SCANOS

- DJO Global, Inc.

- Arthrex Inc.

- Tecres Spa

第7章 市场机会与将来动向

The orthopedic bone cement and casting material market is expected to register a CAGR of nearly 8.4% over the forecast period.

COVID-19 had a substantial impact on the market for orthopedic bone cement and casting materials. Because of the lockdown situation, there were limitations on mobility and a decline in the number of orthopedic procedures performed globally. Furthermore, during the initial days of the pandemic, the number of road accidents also decreased across the globe. For instance, as per the study published in March 2022, Rensselaer Polytechnic Institute research showed that the number of traffic accidents fell by almost half during the two months at the beginning of the COVID-19 pandemic, when residents of most states were forced to stay at home in the United States. It was also reported that traffic accidents in Louisiana decreased by 47.0%, injuries due to traffic accidents decreased by 46.0%, and ambulance calls for accidents decreased by 41.0% between March and May 2020. However, the post-COVID-19 situation is likely to have huge growth as pending procedures will increase the surgical volume. and the worldwide restrictions have eased.

The growing burden of orthopedic disorders and the growing incidence of trauma and accident cases are contributing to a rise in the number of orthopedic procedures globally. In addition, the rising aging population is expected to increase the procedural count, driving market growth.

According to the statistics of the Arthritis Foundation, in 2021, more than 350 million people worldwide will have arthritis. In 2020, an estimated 30.8 million adults were found to be suffering from arthritis, and 14 million individuals in the United States were observed to be suffering from symptomatic knee osteoarthritis. By 2050, the number of adults in the United States with doctor-diagnosed osteoarthritis is projected to increase by 49% to 78.4 million. The same source as above has stated that the number of adults reporting activity limitations due to arthritis will increase by 52%, to 34.6 million by 2040. With the increasing number of orthopedic diseases, for instance, arthritis can cause spinal fractures requiring the use of bone cement, thereby driving demand and hence leading to market growth. Moreover, the use of bone cement is believed to increase for surgical purposes, which is expected to augment market growth over the forecast period.

Other factors, such as an increasing geriatric population and several orthopedic injuries, are also expected to drive the orthopedic bone cement and casting material market over the forecast period. According to the World Population Prospects 2022 report, the percentage of the population aged 65 years and over in Sub-Saharan Africa is 3.0 in 2022 and projected to be 3.3 in 2030; in Northern Africa and Western Asia, it is estimated to be 5.5 in 2022 and projected to be 7.0 in 2030; in Central and Southern Asia, it is estimated to be 6.4 in 2022 and projected to be 8.1 in 2030; and in Europe and Northern America, it is 18.7 in 2022 and projected to be 22.0 in 2030. Since the geriatric population is more prone to orthopedic injuries, which require bone cement and casting materials in order to support and strengthen prosthetic joints and broken bones, the growing geriatric population is driving the growth of the market.

Therefore, owing to the aforementioned factors, it is anticipated that the studied market will witness growth over the analysis period. However, the high cost of surgeries and side effects of bone cement are likely to impede market growth.

Orthopedic Bone Cement and Casting Material Market Trends

The Polymethyl Methacrylate, is Expected to Witness Healthy Growth Over the Forecast Period

Polymethylmethacrylate is one of the most enduring materials in orthopedic surgery. It has a central role in the success of total joint replacement and is also used in newer techniques such as percutaneous vertebroplasty and kyphoplasty. During hip replacement surgery, bioinert polymethylmethacrylate (PMMA) bone cement is the most common method for quickly fixing the orthopedic implant.

The increasing number of orthopedic surgeries is anticipated to boost segment growth. According to the American Academy of Orthopedic Surgeons, by 2030, total knee transplant surgeries are projected to grow by 673% to 3.5 million procedures per year. Thus, the increasing number of orthopedic surgeries requiring cement and casts are expected to boost the growth of the segment over the forecast period.

According to WHO data updated in July 2022, approximately 1.71 billion people worldwide had musculoskeletal conditions in 2021. Among musculoskeletal disorders, low back pain causes the highest burden, with a prevalence of 568 million people. Musculoskeletal conditions are the leading contributor to disabilities worldwide, with low back pain being the single leading cause in 160 countries. Thus, with the increasing number of musculoskeletal disorders, there is an increased demand for polymethyl methacrylate, which is expected to boost the growth of the market segment over the forecast period.

Moreover, as per the United Nations World Population Prospects 2022 data, the share of the global population aged 65 years or older is projected to rise from 10% in 2022 to 16% in 2050. By 2050, the number of persons aged 65 or over worldwide is projected to be more than twice the number of children under age 5 and about the same as the number of children under age 12. An increase in the geriatric population, who are more prone to orthopedic disorders, is expected in the coming years, which can ultimately increase the demand for bone cement and casting materials, which are expected to boost the market's growth in the forecast period.

North America Dominates the Market and is Expected to Follow Similar Trend Over the Forecast Period

North America is expected to dominate the market due to the high prevalence of musculoskeletal disorders, the growing geriatric population, the strong presence of industry players in the region, and better healthcare infrastructure.

The increasing cases of knee injuries are one of the major drivers of segment growth. For instance, as per the report published by the Canadian Institute of Health Information in June 2021, knee replacements in Canada are among the top 3 inpatient surgeries that are performed each year.

Moreover, as per the 2021 report of the National Safety Council, for all ages, injuries from bicycles and accessories were 425,910; injuries reported from exercise and exercise equipment were 377,939; and injuries reported from ATVs, mopeds, minibikes, etc. were 229,974. From skateboards, scooters, and hoverboards, 217,646 injuries were reported. This high prevalence of sports-related injuries in the region is expected to boost demand for orthopedic bone cement and lead the market toward growth.

Therefore, owing to the above-mentioned factors, the growth of the studied market is anticipated in the North American region.

Orthopedic Bone Cement and Casting Material Industry Overview

The orthopedic bone cement and casting material market is moderately competitive, with several major players. Key companies in the market are implementing growth strategies such as agreements, collaborative models, business expansion, and product developments. Some of the major companies in orthopedic bone cement include Stryker Corporation, Smith & Nephew, Depuy Synthes (Johnson & Johnson), Zimmer Biomet Holdings Inc., and Synimed SARL, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Number of Trauma and Road Accidents Cases

- 4.2.2 Increasing Number of Orthopedic, Cranial and Spine Surgery Procedures

- 4.2.3 Rising Prevalence of Osteoporosis

- 4.3 Market Restraints

- 4.3.1 High Cost of Orthopedic Surgeries

- 4.3.2 Side effects of Bone Cements

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size - Value in USD million)

- 5.1 By Material

- 5.1.1 Polymethyl Methacrylate (PMMA)

- 5.1.2 Ceramic

- 5.1.3 Acrylic

- 5.1.4 Other Materials

- 5.2 By Product Type

- 5.2.1 Low Viscosity Cements

- 5.2.2 Medium Viscosity Cements

- 5.2.3 High Viscosity Cements

- 5.2.4 Antibiotic Cements

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Orthopedic Clinics and Centers

- 5.3.3 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Stryker Corporation

- 6.1.2 Smith & Nephew

- 6.1.3 Johnson & Johnson (Depuy Synthes)

- 6.1.4 Zimmer Biomet Holdings Inc.

- 6.1.5 Synimed SARL

- 6.1.6 Subiton LABORATORIOS SL S.A

- 6.1.7 SCANOS

- 6.1.8 DJO Global, Inc.

- 6.1.9 Arthrex Inc.

- 6.1.10 Tecres Spa