|

市场调查报告书

商品编码

1844572

亚太地区服务机器人:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Asia-Pacific Service Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

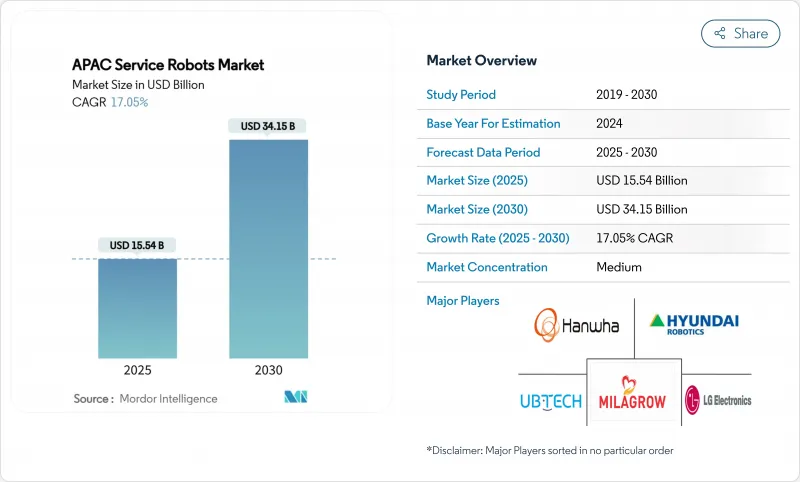

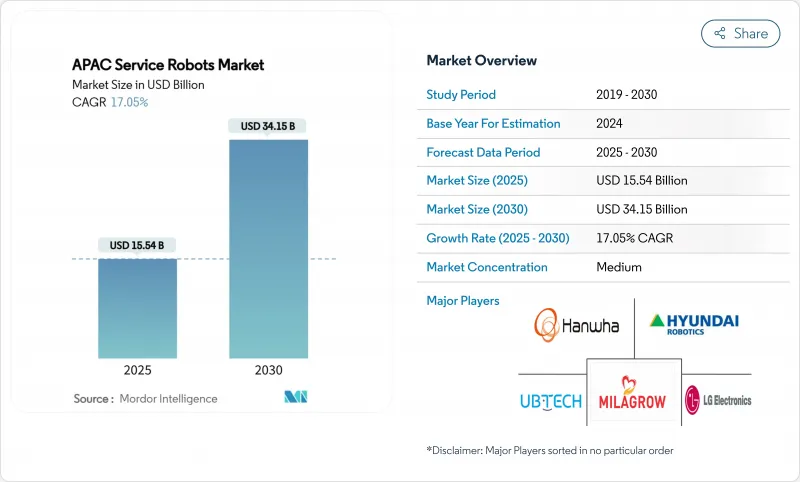

预计2025年亚太服务机器人市场规模将达到155.4亿美元,到2030年将扩大至341.5亿美元,2025年至2030年的复合年增长率为17.05%。

自动化专案在中国、日本和韩国蓬勃发展,重新定义了劳动力策略,而电子商务、医疗保健现代化和政府支持的数位化议程也加速了自动化的普及。随着劳动力市场紧张和「最后一哩路」配送压力的不断增加,物流自动化已不再是一项效率提升措施,而是一项营运必需品。医疗服务提供者如今将机器人视为核心临床资产,旨在改善患者治疗效果并缓解人员短缺。 5G 与车载人工智慧的融合实现了即时远端操作和数据分析,拓展了公共服务和关键基础设施检查的部署选项。虽然高昂的整合成本和碎片化的安全标准阻碍了中小企业的采用,但「机器人即服务」模式正开始缩小可负担性差距。

亚太服务机器人市场趋势与洞察

电子商务繁荣推广物流AMR

随着亚洲各地线上零售额的不断增长,仓库营运商纷纷转向自主移动机器人 (AMR),以缩短履约时间并缓解劳动力短缺。中国供应商 Syrius Robotics 计划每年向其日本基地发货 3,000 台 AMR。 Liviao Robotics 的本地生产展示了近岸生产如何避免供应链摩擦和进口关税。由于 AMR 的投资回收期平均不到 2.5 年,AMR 已成为中型经销商的可行选择。因此,监管变化正在成为需求的催化剂,将 AMR 转变为亚太服务机器人市场必不可少的基础设施。

老龄化社会的医疗保健需求

日本65岁及以上人口的老化率预计到2025年将达到27.3%,促使医院和养老院部署机器人来协助病人扶起、更换尿布和药物物流。早稻田大学的「AIREC」护理机器人展示了超越基本监护的先进物理辅助功能。机器人整合减少了员工离职率,使员工能够专注于更需要同理心的工作。自动送餐每年还能为诊所节省9,596欧元(约10,356美元)。中国老年护理机器人的全新国际标准使国内供应商在全球应用领域占据领先地位,并加速亚太服务机器人市场向医疗保健价值创造迈进。

实施和整合成本高

儘管硬体价格持续下降,预计到2025年,人形机器人的平均价格将在2万至3万美元之间,但由于场地维修和人员培训,整合总成本往往是购买成本的两到三倍。许多中小企业(SME)的资金限制正在减缓亚太服务机器人产业的采用。 RaaS供应商现在提供涵盖维护和更新的订阅模式,使客户避免了高昂的前期成本。

細項分析

到2024年,商用机器人将占据亚太地区服务机器人市场69%的份额,并占据主要收入来源。其领先地位源自于实际的投资报酬率:AMR机器人车队可将拣货时间缩短50%,动力外骨骼机器人可减少工伤。受全通路零售和当日送达需求的推动,物流系统仍然是收入最高的细分市场。医疗机器人因其手术精准度和医院物流而价格不菲,而外骨骼机器人则解决了组装上的起重和疲劳问题。公关机器人在酒店业提供礼宾服务,但文化接受度和语言差异阻碍了它们的普及。

个人机器人市场正在迅速扩张,预计到2030年复合年增长率将达到22.46%。家用清洁机器人的出货量领先,而科沃斯的销售额在2024年将达到165.4亿元人民币(约23亿美元)。随着老龄化社会的需求成长,老年照护伴侣和穿戴式辅助设备有望成为下一个成长领域。娱乐型机器人(宠物机器人和STEM教育套件)将增强亚太服务机器人市场的长尾销售,从而完善这一细分市场。

到2024年,硬体将占销售额的64%。随着扭矩密度的提高,致动器仍将是最昂贵的元件,而感测器融合将提高雷射雷达和深度摄影机的平均售价。Johnson Electric报告称,亚洲与机器人相关的运动系统需求实现了两位数成长。

软体正在巩固其作为价值引擎的作用,预计到2030年复合年增长率将达到24.21%。云端连线编配、感知演算法和车队管理仪錶板将原始硬体转化为适应性强的解决方案。OMRON计划在2027年实现数据解决方案销售额超过1,000亿日圆(6.82亿美元),这意味着公司将从产品供应商转型为平台编排者。服务——维护、分析和培训——将成为亚太服务机器人产业持续收益的关键。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电子商务繁荣推广物流AMR

- 老龄化社会的医疗保健需求

- 政府奖励和亚太製造计划

- 透过5G/AI融合实现远端自治

- 电动车电池生产线人形机器人(低调)

- 用于老化资产的隐藏基础设施检查机器人

- 市场限制

- 安装和整合成本高

- 安全/认证系统碎片化

- 资料隐私和网路安全问题

- 依赖精密致动器和感测器的进口(秘密)

- 价值链分析

- 技术展望

- 监管状况

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 评估影响市场的宏观经济趋势

第五章 市场规模及成长预测(金额)

- 按机器人类型

- 商用机器人

- 物流系统

- 医疗机器人

- 人外骨骼机器人

- 公共机器人

- 个人机器人

- 家用机器人

- 娱乐

- 为老年人和残障人士提供支持

- 商用机器人

- 按用途

- 军事/国防

- 农业、建筑、采矿

- 运输/物流

- 卫生保健

- 政府机构

- 其他用途

- 按组件

- 硬体

- 致动器

- 感应器

- 控制器

- 软体

- 服务

- 硬体

- 按运转环境

- 地面以上

- 空气

- 海

- 透过移动

- 移动机器人

- 固定式机器人

- 按国家

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- UBTECH Robotics Inc.

- Ecovacs Robotics Co. Ltd.

- SIASUN Robot and Automation Co. Ltd.

- LG Electronics Inc.

- SoftBank Robotics Corp.

- Omron Corp.

- Hyundai Robotics Co. Ltd.

- Panasonic Holdings-Robotics BU

- DJI Innovations

- Geek+Robotics Co. Ltd.

- Milagrow HumanTech

- Reeman Intelligent Tech

- Rainbow Robotics Co. Ltd.

- Roborock Technology Co. Ltd.

- UB-Tech(Shanghai)Intelligent

- Yamaha Motor-Robotics BU

- Doosan Robotics Inc.

- Hanwha Robotics

- Keenon Robotics

- TMi Robotics(TMiRob)

第七章 市场机会与未来展望

The Asia Pacific Service Robotics Market was worth USD 15.54 billion in 2025 and is forecast to expand to USD 34.15 billion by 2030, posting a 17.05% CAGR during 2025-2030.

A surge in automation programs across China, Japan and South Korea is redefining workforce strategies, while e-commerce, healthcare modernization and government-backed digital agendas accelerate adoption. Logistics automation is no longer an efficiency play-it has become an operational necessity as tight labor markets and last-mile delivery pressures intensify. Healthcare providers now treat robots as core clinical assets that improve patient outcomes and relieve staff shortages. Convergence of 5G and on-board AI is enabling real-time remote control and data analytics, broadening deployment options into public services and critical infrastructure inspection. Although high integration costs and fragmented safety standards still temper uptake among SMEs, Robotics-as-a-Service models are starting to close the affordability gap.

Asia-Pacific Service Robots Market Trends and Insights

E-commerce boom driving logistics AMRs

Rising online retail volumes across Asia have pushed warehouse operators toward autonomous mobile robots (AMRs) that shrink fulfillment times and mitigate labor shortages. Chinese vendor Syrius Robotics plans to ship 3,000 AMRs annually to Japanese sites-10 times its current run-rate-as local overtime caps restrict driver availability. Localized manufacturing by Libiao Robotics further illustrates how near-shore production sidesteps supply-chain friction and import duties. Payback periods now average under 2.5 years, making AMRs a viable option for mid-sized distributors. Regulatory changes therefore act as a demand catalyst, turning AMRs into essential infrastructure within the APAC Service Robots Market.

Aging-population healthcare demand

Japan's share of citizens aged 65+ reached 27.3% in 2025, prompting hospitals and care homes to deploy robots for patient lifting, diaper changing and medication logistics. The AIREC caregiving robot from Waseda University showcases advanced physical assistance that surpasses basic monitoring. Robot integration has cut staff turnover and freed personnel for empathy-intensive tasks, while automated meal transport yields EUR 9,596 (USD 10,356) in annual savings per clinic. China's new international standard for elderly-care robots positions domestic suppliers for leadership in global applications, accelerating the Asia Pacific Service Robotics Market toward healthcare value creation.

High installation and integration cost

Although hardware prices keep falling-the average humanoid is projected to reach USD 20,000-30,000 in 2025-total integration outlays often run two to three times the purchase cost due to site retrofits and staff training. For many SMEs, capital constraints delay adoption in the APAC Service Robots industry. RaaS vendors now offer subscription models covering maintenance and updates, helping customers bypass large upfront expense.

Other drivers and restraints analyzed in the detailed report include:

- Government incentives and Made-in-APAC programs

- 5G/AI convergence enabling remote autonomy

- Fragmented safety/certification regimes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Professional robots generated the bulk of 2024 revenues, holding 69% of APAC Service Robots market share. Their leadership rests on tangible ROI: AMR fleets cut picking time by 50% while powered exoskeletons reduce workplace injuries. Logistics systems remain the highest-revenue subsegment, propelled by omnichannel retail and same-day delivery obligations. Medical robots command premium prices for surgical precision and hospital logistics, whereas exoskeletons address lifting and fatigue issues on assembly lines. Public-relation robots offer concierge services in hospitality but adoption is moderated by cultural acceptance and language nuance.

Personal robots are scaling quickly, posting a 22.46% CAGR forecast through 2030. Domestic cleaning units lead shipments, illustrated by Ecovacs hitting RMB 16.54 billion (USD 2.3 billion) in 2024 revenue despite margin pressure. Elderly-care companions and wearable assistance devices promise the next leg of growth as aging societies drive demand. Entertainment models-pet-inspired bots and STEM education kits-round out the segment, enhancing long-tail sales across the APAC Service Robots Market.

Hardware captured 64% of 2024 revenue. Actuators remain the costliest element as torque density advances, and sensor fusion raises ASPs for LiDAR and depth cameras. Johnson Electric reported double-digit Asian growth in motion systems linked to robotics demand.

Software is cementing its role as the value engine, set to post 24.21% CAGR to 2030. Cloud-connected orchestration, perception algorithms and fleet-management dashboards convert raw hardware into adaptable solutions. OMRON intends to surpass JPY 100 billion (USD 682 million) in data-solution sales by 2027, symbolizing the transition from product vendor to platform orchestrator. Services-maintenance, analytics, training-unlock recurring revenue in the APAC Service Robots industry.

The Asia-Pacific Service Robots Market Report is Segmented by Type (Professional Robots, Personal Robots), Application (Military and Defense, Agriculture, Construction and Mining, and More), Component (Hardware, Software, and Services), Operating Environment (Ground, Aerial, and Marine), Mobility (Mobile Robots, and Stationary Robots), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- UBTECH Robotics Inc.

- Ecovacs Robotics Co. Ltd.

- SIASUN Robot and Automation Co. Ltd.

- LG Electronics Inc.

- SoftBank Robotics Corp.

- Omron Corp.

- Hyundai Robotics Co. Ltd.

- Panasonic Holdings - Robotics BU

- DJI Innovations

- Geek+ Robotics Co. Ltd.

- Milagrow HumanTech

- Reeman Intelligent Tech

- Rainbow Robotics Co. Ltd.

- Roborock Technology Co. Ltd.

- UB-Tech (Shanghai) Intelligent

- Yamaha Motor - Robotics BU

- Doosan Robotics Inc.

- Hanwha Robotics

- Keenon Robotics

- TMi Robotics (TMiRob)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom driving logistics AMRs

- 4.2.2 Aging-population healthcare demand

- 4.2.3 Government incentives and Made-in-APAC programs

- 4.2.4 5G/AI convergence enabling remote autonomy

- 4.2.5 Humanoid robots for EV-battery lines (under-the-radar)

- 4.2.6 Infrastructure-inspection robots for aging assets (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 High installation and integration cost

- 4.3.2 Fragmented safety / certification regimes

- 4.3.3 Data-privacy and cyber-security concerns

- 4.3.4 Import dependence on precision actuators and sensors (under-the-radar)

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Robots Type

- 5.1.1 Professional Robots

- 5.1.1.1 Logistic Systems

- 5.1.1.2 Medical Robots

- 5.1.1.3 Powered Human Exoskeletons

- 5.1.1.4 Public-Relation Robots

- 5.1.2 Personal Robots

- 5.1.2.1 Domestic

- 5.1.2.2 Entertainment

- 5.1.2.3 Elderly and Handicap Assistance

- 5.1.1 Professional Robots

- 5.2 By Application

- 5.2.1 Military and Defense

- 5.2.2 Agriculture, Construction and Mining

- 5.2.3 Transportation and Logistics

- 5.2.4 Healthcare

- 5.2.5 Government

- 5.2.6 Other Applications

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.1.1 Actuators

- 5.3.1.2 Sensors

- 5.3.1.3 Controllers

- 5.3.2 Software

- 5.3.3 Services

- 5.3.1 Hardware

- 5.4 By Operating Environment

- 5.4.1 Ground

- 5.4.2 Aerial

- 5.4.3 Marine

- 5.5 By Mobility

- 5.5.1 Mobile Robots

- 5.5.2 Stationary Robots

- 5.6 By Country

- 5.6.1 China

- 5.6.2 India

- 5.6.3 Japan

- 5.6.4 South Korea

- 5.6.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 UBTECH Robotics Inc.

- 6.4.2 Ecovacs Robotics Co. Ltd.

- 6.4.3 SIASUN Robot and Automation Co. Ltd.

- 6.4.4 LG Electronics Inc.

- 6.4.5 SoftBank Robotics Corp.

- 6.4.6 Omron Corp.

- 6.4.7 Hyundai Robotics Co. Ltd.

- 6.4.8 Panasonic Holdings - Robotics BU

- 6.4.9 DJI Innovations

- 6.4.10 Geek+ Robotics Co. Ltd.

- 6.4.11 Milagrow HumanTech

- 6.4.12 Reeman Intelligent Tech

- 6.4.13 Rainbow Robotics Co. Ltd.

- 6.4.14 Roborock Technology Co. Ltd.

- 6.4.15 UB-Tech (Shanghai) Intelligent

- 6.4.16 Yamaha Motor - Robotics BU

- 6.4.17 Doosan Robotics Inc.

- 6.4.18 Hanwha Robotics

- 6.4.19 Keenon Robotics

- 6.4.20 TMi Robotics (TMiRob)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment