|

市场调查报告书

商品编码

1851645

巨量资料安全:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Big Data Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

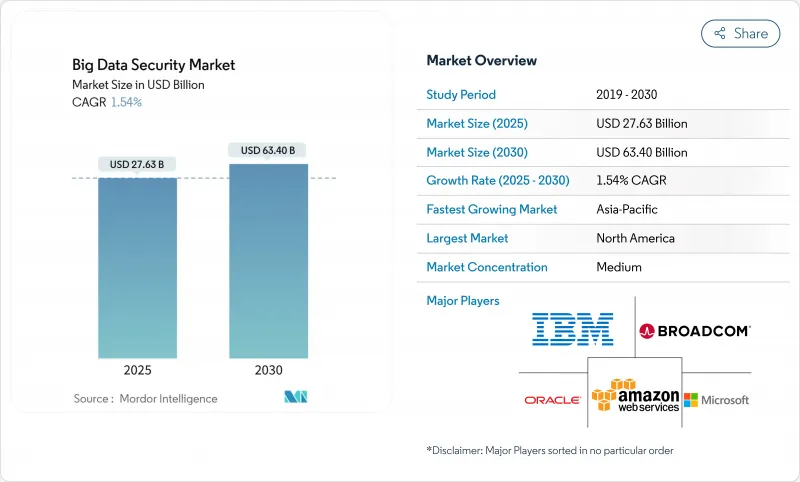

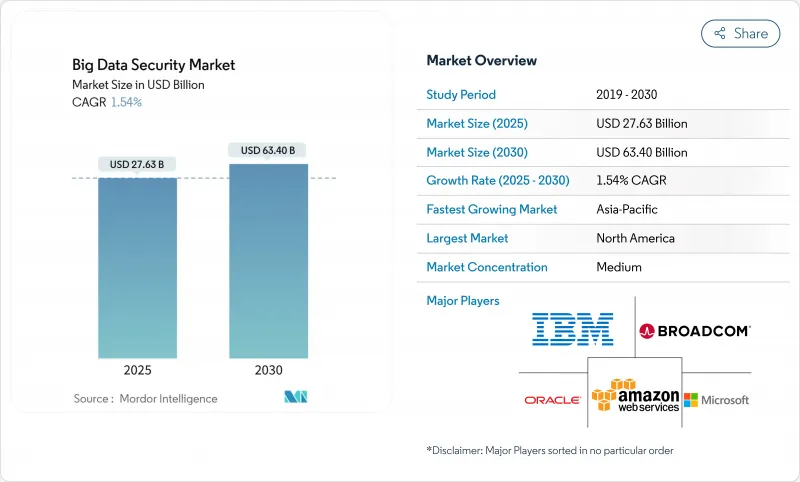

巨量资料安全市场预计到 2025 年价值 276.3 亿美元,预计到 2030 年将达到 634 亿美元,预测期(2025-2030 年)复合年增长率为 1.54%。

由于网路攻击日益频繁、资料保护法律日益严格,以及Petabyte级工作负载迁移到公有公共云端),零信任技术的普及速度正在加快。随着人工智慧驱动的资料外洩、勒索软体攻击和供应链入侵加剧营运和财务风险,企业正将以资料为中心的安全提升至董事会层面的优先事项。医疗保健、製造业和金融服务业面临的资料外洩成本最高,促使它们增加对加密、令牌化和人工智慧分析的投资。同时,平台供应商正在整合各种工具以降低复杂性并填补网路安全人才短缺的空白,而亚太地区的资料主权法规也引发了资料中心投资的空前成长。

全球巨量资料安全市场趋势与洞察

人工智慧引发的安全漏洞促使企业重新分配安全预算

勒索软体集团如今正利用生成式人工智慧发动快速凭证窃取和社交工程宣传活动,绕过传统防御措施。在製造业,重大安全事件造成的停机损失可能超过每分钟 22,000 美元,促使董事会大幅增加安全预算,远超过以往拨款。预计到 2024 年,工业领域资料外洩的成本将达到 556 万美元,超过整体 IT 支出成长速度,并刺激了对即时分析以检测横向移动的需求。金融机构承认,目前只有 13% 的 IT 投资用于安全防御,专家敦促将这一比例提高到 20%,以应对攻击者的自动化攻击。在关键基础设施领域,人工智慧驱动的安全营运中心报告称,当机器学习关联分析取代人工分诊时,事件解决速度提高了 30%。因此,企业正在重新调整资金筹措优先级,推动巨量资料安全市场持续成长。

GDPR 与各国资料法要求建立Petabyte级合规基础设施

欧洲的GDPR、加州的CCPA以及亚太地区的类似法规强制要求对日益庞大的资料集进行加密、遮罩和审核追踪。中国2025年的执法计画将对金融和保险公司增加即时合规审核,并加强对监管不力行为的处罚。根据NIS2指令,欧洲企业正在将其资讯安全预算提高到IT总投资的9%,预计到2025年,每个地区的平均资料外洩成本将达到440万欧元。在美国,卫生与公众服务部在其2026年计画中提案1亿美元用于全部门的网路安全协调。随着合规性从政策层面转向技术实施,可扩展加密、令牌化和不可篡改日誌记录(巨量资料安全市场的主要收入驱动因素)的需求将会成长。

网路安全人才短缺限制了市场成长

32%的欧盟组织无法胜任关键的网路安全角色,因此更依赖託管安全服务供应商。日本企业正与Cloudflare合作,提供承包零信任服务,填补中小企业的人才缺口。微软的「安全未来倡议」展示瞭如何利用34,000名工程师进行人工智慧主导的自动化,从而将事件回应速度提升30%,并填补超大规模企业的专业知识缺口。虽然自动化可以减轻工作量,但长期存在的人手不足阻碍了自动化的普及,并限制了巨量资料安全市场的短期扩张。

细分市场分析

到2024年,解决方案将占总收入的63.0%,这主要得益于对加密、令牌化和安全资讯与事件管理(SIEM)套件的强劲需求。同时,随着企业将全天候监控和合规性整合外包,服务业务的复合年增长率将达到19.08%。人才短缺和平台复杂性的增加正促使企业转向託管式检测与回应、咨询和整合服务。供应商正在将这些服务打包到云端订阅中,从而实现可预测的营运支出和快速引进週期。因此,在整个预测期内,巨量资料安全市场将继续体现以服务主导的价值创造。

託管安全服务获得了最大程度的成长,而随着企业在云端平台上重新建构资料湖,咨询和整合专案也激增。受监管要求的推动,资料加密和令牌化软体仍然是解决方案需求的主要驱动力。 SIEM 平台透过人工智慧推理不断发展,以减少警报疲劳,而 IAM 升级则支援零信任部署。平台功能的整合预示着巨量资料安全市场正在整合,各参与者都在寻求端到端的控制点。

大型企业将占据主导地位,预计2024年将占销售额的69.5%。然而,中小企业的复合年增长率预计将达到20.04%,凸显了降低准入门槛的云端订阅模式的必要性。超大规模云端服务供应商目前正将企业级加密、金钥管理和行为分析等功能整合到其基础套餐中,使资源受限的企业也能使用以往只有财富500强企业才能享有的功能。这种转变正在扩大基本客群,并推动巨量资料安全市场保持两位数的成长。

大型机构正将投资重点放在由高阶分析、同构加密试点计画和人工智慧驱动的安全营运中心(SOC)上,以挖掘Petabyte级日誌。有些机构拥有超过1000名安全专家的团队,凸显了其内部专业知识的深度。相比之下,中小企业则优先考虑能够降低复杂性的承包託管服务。随着巨量资料安全产业的日趋成熟,能够提供针对该细分市场量身定制的定价和自动化解决方案的供应商将获得显着的市场份额。

巨量资料安全市场报告按组件(解决方案和服务)、组织规模(中小企业和大型企业)、最终用户垂直行业(银行、金融服务和保险 [BFSI]、IT 和通讯、製造业、医疗保健和生命科学、航太和国防等)、部署类型(本地部署和云端部署)以及地区进行细分。

区域分析

北美地区将占2024年收入的41.3%,这得益于零信任架构的早期应用、密集的供应商生态系统以及成熟的违规通知法律。随着大型企业完成初步的云端迁移,成长速度将放缓,但持续的人工智慧安全测试将维持支出动能。在GDPR实施和NIS2指令的推动下,欧洲的资讯安全支出已达到整体IT预算的9%。儘管经济逆风对可自由支配的IT计划造成压力,但监管的确定性仍在推动需求成长。

预计到2030年,亚太地区将以20.61%的复合年增长率成长,这反映了对主权云的投资和国内技术政策的推动。 AWS承诺到2027年将在日本投资2.26兆日圆(约153亿美元)以扩大业务,象征其对超大规模资料中心的坚定承诺。Oracle也计划投资80亿美元兴建国内资料中心,以符合经济安全准则。到2027年,中国的资讯安全市场规模可能达到37兆元。该地区各国政府正在鼓励本地数据处理并推动安全产品的应用,从而扩大新兴国家巨量资料安全市场的规模。

儘管中东、非洲和拉丁美洲的市场规模较小,但随着云端运算的普及和金融业现代化政策的推进,这些地区的市场接受度正在不断提高。波湾合作理事会成员国已宣布与其「2030愿景」议程相关的新网路安全法规,巴西的「光导板」也鼓励邻国制定相关法律。虽然基础设施的不足阻碍了市场成长,但数位银行的日益普及创造了巨大的潜在需求,巨量资料安全市场可以藉助不断改善的网路连接来挖掘这些需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 物联网、行动和云端日誌的激增使传统控制方式不堪重负,推动了下一代以资料为中心的安全性的发展。

- 人工智慧驱动的资料外洩、双重勒索软体和供应链攻击推动了巨量资料安全分析预算的成长。

- GDPR、CCPA、PDPA 和数十项新的国家法律要求进行Petabyte级加密、遮罩和审核追踪。

- 资料湖向公共云端迁移加速了对云端原生安全、零信任和责任共用工具的需求

- 各公司正争先恐后地保护用于训练 LLM 的庞大专有资料集,以避免模型外洩和智慧财产权损失。

- 零售媒体、医疗保健和广告科技公司需要加密技术来共用讯息,同时避免洩露原始资料。

- 市场限制

- 资料安全工程师和资料科学家的短缺正在推高MSSP的计划工期和成本。

- 在混合环境中编配加密、SIEM、IAM 和资料管治工具会对资本支出/营运支出预算造成压力。

- 居住法的差异阻碍了统一的全球安全架构的建构。

- 联邦学习和同态加密减少了对集中式资料储存的需求,并降低了在传统巨量资料安全堆迭上的支出。

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 新冠疫情与地缘政治事件的影响

第五章 市场规模与成长预测

- 按组件

- 解决方案

- 资料加密和令牌化

- 安全情报/SIEM

- IAM 和 PAM

- 入侵侦测/防御

- 数据遮罩和混淆

- 服务

- 咨询与整合

- 託管安全服务

- 培训和支持

- 解决方案

- 按组织规模

- 小型企业

- 大公司

- 按最终用户行业划分

- 银行、金融服务和保险(BFSI)

- 资讯科技/通讯

- 製造业

- 医疗保健和生命科学

- 航太/国防

- 政府和公共部门

- 零售与电子商务

- 透过部署模式

- 本地部署

- 云

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 墨西哥

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 亚太其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amazon Web Services

- Broadcom(Symantec)

- Check Point Software Technologies

- Cisco Systems

- Cloudera

- CrowdStrike

- Dell Technologies

- Elastic NV

- Fortinet

- Google Cloud(Alphabet)

- Hewlett Packard Enterprise

- IBM Corporation

- Imperva

- McAfee

- Microsoft Corporation

- Oracle Corporation

- Palo Alto Networks

- RSA Security

- Snowflake Inc.

- Splunk Inc.

- Talend SA

- Thales Group

第七章 市场机会与未来展望

The Big Data Security Market size is estimated at USD 27.63 billion in 2025, and is expected to reach USD 63.40 billion by 2030, at a CAGR of 1.54% during the forecast period (2025-2030).

Accelerated adoption stems from rising cyber-attack frequency, stricter data-protection laws, and the shift of petabyte-scale workloads to public clouds that demand zero-trust controls. Enterprises now treat data-centric security as a board-level priority as AI-enabled breaches, ransomware, and supply-chain intrusions elevate operational and financial risk. Healthcare, manufacturing, and financial services face the highest breach costs, which pushes capital toward encryption, tokenization, and AI-powered analytics. Meanwhile, platform vendors consolidate point tools to reduce complexity and offset the cybersecurity talent shortfall, while data-sovereignty rules in Asia Pacific spark record data-center investment.

Global Big Data Security Market Trends and Insights

AI-enabled breaches drive enterprise security budget reallocations

Ransomware groups now weaponize generative AI for rapid credential theft and social-engineering campaigns that bypass legacy defenses. Manufacturing downtime has surpassed USD 22,000 per minute during major incidents, prompting boards to lift security budgets well above prior allocations. Data-breach costs in industrial domains climbed to USD 5.56 million in 2024, eclipsing general IT-spending growth and fueling demand for real-time analytics that detect lateral movement. Financial institutions concede that current allocations of only 13% of IT spend underfund defenses, with experts urging a shift toward 20% to keep pace with attacker automation. Across critical infrastructure, AI-powered security operations centers report 30% faster incident resolution once machine-learning correlation replaces manual triage. The result is sustained top-line expansion for the big data security market as enterprises reprioritize funding.

GDPR and national data laws mandate petabyte-scale compliance infrastructure

Europe's GDPR, California's CCPA, and similar statutes in Asia Pacific now obligate encryption, masking, and audit trails across ever-larger datasets. China's 2025 enhancements add real-time compliance audits for finance and insurance firms, tightening penalties for lax controls. European organizations have raised information-security budgets to 9% of total IT outlays under the NIS2 Directive, while average regional breach costs reached EUR 4.4 million in 2025. In the United States, the Department of Health and Human Services proposed USD 100 million for sector-wide cybersecurity coordination in its FY 2026 plan. As compliance moves from policy to technical enforcement, demand increases for scalable encryption, tokenization, and immutable logging key revenue streams within the big data security market.

Cybersecurity talent shortage constrains market growth

Thirty-two percent of EU organizations cannot fill essential cybersecurity roles, driving reliance on managed security service providers. Japan's operators collaborate with Cloudflare to supply turnkey zero-trust services that offset staffing gaps for SMEs. Microsoft's Secure Future Initiative applies 34,000 engineers to AI-driven automation, improving incident response by 30% and showcasing how hyperscalers compensate for scarce expertise. Although automation eases workloads, chronic shortages slow deployment and limit the near-term scale-up of the big data security market.

Other drivers and restraints analyzed in the detailed report include:

- Cloud data lakes accelerate zero-trust architecture adoption

- LLM training in data protection becomes a strategic imperative

- Tool-orchestration complexity strains enterprise budgets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions held 63.0% of 2024 revenue, driven by robust demand for encryption, tokenization, and SIEM suites. At the same time, Services is set to grow at 19.08% CAGR as organizations outsource 24/7 monitoring and compliance integration. Talent scarcity and platform complexity push enterprises toward managed detection and response, consulting, and integration contracts. Vendors bundle these offerings with cloud subscriptions, enabling predictable OpEx and faster implementation cycles. As a result, the big data security market phrase continues to reflect service-led value creation throughout the forecast horizon.

Managed Security Services show the highest traction, while Advisory and Integration engagements surge as firms re-architect data lakes on cloud foundations. Data encryption and tokenization software remains the volume driver within Solutions, propelled by regulatory mandates. SIEM platforms evolve with AI inference that reduces alert fatigue, and IAM upgrades underpin zero-trust rollouts. The convergence of platform features signals ongoing consolidation in the big data security market as players chase end-to-end control points.

Large Enterprises dominated in 2024 with 69.5% revenue, reflecting multi-region operations and stringent compliance obligations. Yet SMEs are forecast to post a 20.04% CAGR, highlighting cloud subscription models that lower entry barriers. Hyperscalers now embed enterprise-grade encryption, key management, and behavior analytics into baseline plans, letting resource-constrained firms access capabilities once exclusive to Fortune 500 peers. This shift broadens the customer base, sustaining double-digit expansion in the big data security market.

For large organizations, investments focus on advanced analytics, homomorphic encryption pilots, and AI-powered SOCs that mine petabyte-scale logs. Some institutions maintain teams exceeding 1,000 security specialists, underscoring the depth of in-house expertise. SMEs, by contrast, emphasize turnkey managed services that offload complexity. Vendors tailoring price points and automation to this segment stand to capture an outsized share as the big data security industry matures.

The Big Data Security Market Report is Segmented by Component (Solutions and Services), Organization Size (Small and Medium Enterprises and Large Enterprises), End-User Industry (Banking, Financial Services, and Insurance [BFSI], IT and Telecommunication, Manufacturing, Healthcare and Life Sciences, Aerospace and Defense, and More), Deployment Mode (On-Premise and Cloud), and Geography.

Geography Analysis

North America held 41.3% of 2024 revenue, benefiting from early zero-trust adoption, a dense vendor ecosystem, and mature breach-notification laws. Growth moderates as large enterprises complete initial cloud migrations, yet ongoing AI-security pilots maintain spending momentum. Europe follows, propelled by GDPR enforcement and the NIS2 Directive, with information-security allocations now 9% of total IT budgets. Regulatory certainty fuels demand even as economic headwinds weigh on discretionary IT projects.

Asia Pacific is forecast for a 20.61% CAGR through 2030, reflecting sovereign-cloud investments and domestic-technology mandates. AWS's pledge of 2.26 trillion yen (USD 15.3 billion) to expand Japanese regions by 2027 exemplifies its hyperscale commitment. Oracle separately plans USD 8 billion in local data centers to meet economic-security guidelines. China's information-security market could hit 37 trillion yuan by 2027 as state bodies prioritize indigenous tooling. Governments across the region encourage local data processing to spur security product adoption, enlarging the big data security market size in emerging economies.

The Middle East, Africa, and Latin America represent smaller bases but show rising adoption as cloud coverage widens and financial-sector modernization policies advance. Gulf Cooperation Council states issue new cyber regulations tied to Vision 2030 agendas, while Brazil's LGPD inspires neighbouring countries to legislate. Although infrastructure gaps temper growth, rising digital-banking penetration creates latent demand that the big data security market can tap as connectivity improves.

- Amazon Web Services

- Broadcom (Symantec)

- Check Point Software Technologies

- Cisco Systems

- Cloudera

- CrowdStrike

- Dell Technologies

- Elastic NV

- Fortinet

- Google Cloud (Alphabet)

- Hewlett Packard Enterprise

- IBM Corporation

- Imperva

- McAfee

- Microsoft Corporation

- Oracle Corporation

- Palo Alto Networks

- RSA Security

- Snowflake Inc.

- Splunk Inc.

- Talend SA

- Thales Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging IoT, mobile and cloud logs overwhelm legacy controls, driving next-gen data-centric security adoption

- 4.2.2 AI-enabled breaches, double-extortion ransomware and supply-chain attacks force bigger budgets for big-data security analytics

- 4.2.3 GDPR, CCPA, PDPA and dozens of new national laws mandate encryption, masking and audit trails at petabyte scale

- 4.2.4 Shift of data lakes to public cloud accelerates demand for cloud-native security, zero-trust and shared-responsibility tooling

- 4.2.5 Enterprises scramble to secure massive proprietary datasets used for LLM training to avoid model leakage and IP loss

- 4.2.6 Retail-media, healthcare and ad-tech firms require encryption-in-use to share insights without exposing raw data

- 4.3 Market Restraints

- 4.3.1 Scarcity of data-security engineers and data scientists inflates project timelines and MSSP costs

- 4.3.2 Orchestrating encryption, SIEM, IAM and data-governance tools across hybrid estates strains CapEx/OpEx budgets

- 4.3.3 Divergent residency laws block unified global security architectures

- 4.3.4 Federated learning and homomorphic encryption reduce need for centralized data stores, tempering spend on classic big-data security stacks

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of COVID-19 and Geopolitical Events

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Data Encryption and Tokenization

- 5.1.1.2 Security Intelligence/SIEM

- 5.1.1.3 IAM and PAM

- 5.1.1.4 Intrusion Detection/Prevention

- 5.1.1.5 Data Masking and Obfuscation

- 5.1.2 Services

- 5.1.2.1 Consulting and Integration

- 5.1.2.2 Managed Security Services

- 5.1.2.3 Training and Support

- 5.1.1 Solutions

- 5.2 By Organization Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry

- 5.3.1 Banking, Financial Services and Insurance (BFSI)

- 5.3.2 IT and Telecommunication

- 5.3.3 Manufacturing

- 5.3.4 Healthcare and Life Sciences

- 5.3.5 Aerospace and Defense

- 5.3.6 Government and Public Sector

- 5.3.7 Retail and E-commerce

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Mexico

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amazon Web Services

- 6.4.2 Broadcom (Symantec)

- 6.4.3 Check Point Software Technologies

- 6.4.4 Cisco Systems

- 6.4.5 Cloudera

- 6.4.6 CrowdStrike

- 6.4.7 Dell Technologies

- 6.4.8 Elastic NV

- 6.4.9 Fortinet

- 6.4.10 Google Cloud (Alphabet)

- 6.4.11 Hewlett Packard Enterprise

- 6.4.12 IBM Corporation

- 6.4.13 Imperva

- 6.4.14 McAfee

- 6.4.15 Microsoft Corporation

- 6.4.16 Oracle Corporation

- 6.4.17 Palo Alto Networks

- 6.4.18 RSA Security

- 6.4.19 Snowflake Inc.

- 6.4.20 Splunk Inc.

- 6.4.21 Talend SA

- 6.4.22 Thales Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment