|

年间契约型资讯服务

商品编码

1585849

全球绿氢计画资料库Global Green Hydrogen Projects Database |

||||||

"全球绿氢能计画资料库" 是Global Insight Services推出的一项新订阅服务,旨在探索绿氢能生产计画的新兴趋势。订阅者会收到最新版本的资料库和总结主要市场趋势的每月通讯。

这个全面的集中式资料库旨在追踪和分析快速发展的绿氢产业。该创新资料库提供有关全球绿色氢技术开发和部署的即时数据、分析和预测,使其成为政策制定者、企业、投资者和研究人员的强大工具。绿氢是利用再生能源透过电解产生的氢,作为全球转型为低碳经济的关键要素而获得了大力支持。已宣布价值数十亿美元的投资,以支持绿地项目的成长和需求成长。透过扩大技术规模,生产绿氢的成本已经降低。

该资料库涵盖全球1,600多个设施,提供有关绿色氢项目产能、投资趋势、电解槽产能、所用电解槽技术和融资方案的信息,它汇总了详细信息、参与者的数据。这项综合资源使客户能够管理其投资、追踪专案趋势并应对快速发展的氢市场。该资料库透过为全球绿色氢气资讯提供一站式解决方案,促进所有利害关係人的决策并加强策略规划。我们透过总结主要市场趋势、识别新机会并追踪技术突破速度,为用户在不断变化的能源格局中提供竞争优势。

- 生产力见解:绿氢工厂的详细生产力数据使利害关係人能够评估效率和可扩展性。

- 全面的製造商资讯:按地区和技术划分的主要电解槽製造商简介

- 绩效指标:有关能力、效率、资金数量和专案成本的详细资料。

- 专案追踪:有关世界各地正在进行和计划中的绿氢专案的数据

- 竞争对手对标:绿氢专案之间的比较(技术、价格、产能等)

- 技术进步:追踪趋势并发现 PEM、碱金属和固体氧化物等新兴技术的趋势和创新。

- 区域分析:我们可以调查每个区域的氢气采用情况,并根据客户资讯瞄准特定市场。

- 业务联盟和合作数据:有关参与绿色氢能计画的各个利害关係人之间的策略联盟和合作的资讯。

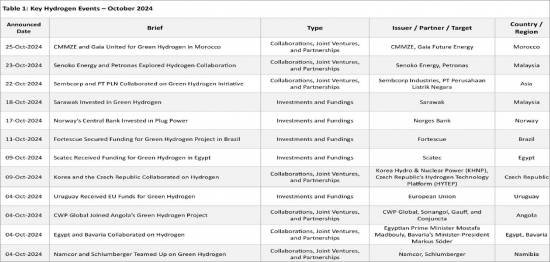

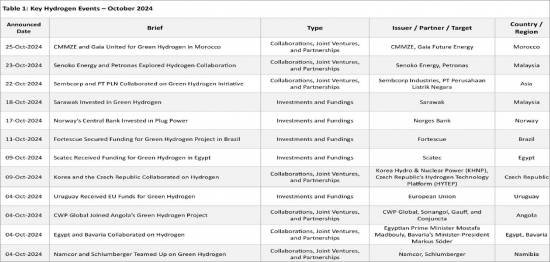

每月通讯

此服务的订阅者还会收到一份每月简讯,概述了该领域的主要发展:

- 专案公告/审核趋势

- 投资/融资趋势

- 业务合作/合资/业务联盟

- 氢能政策

- 电解槽的製造趋势

主要优点

- 12 个月订阅:存取每月通讯和资料库,全年瞭解最新情况。

- 最优惠价格:以市场上最具竞争力的价格存取我们的资料库。

- 独特的产品专门针对绿氢工厂见解的客製化产品功能

- 折扣:绿色氢气专案资料库报告特别折扣

- 24 小时/365 天分析师支持来自产业专家的 24 小时支持

- 咨询服务:获得根据您的需求量身定制的专家咨询服务

- 研究服务:提供一流的分析和客製化资料服务

近期趋势

- 2024 年 10 月 30 日,Avina Clean Hydrogen在加州弗农举行了新的绿氢计画奠基仪式。该最先进的设施每天将透过电解过程生产多达四吨的绿色压缩氢气,该电解过程使用可再生电力将水分解为氢气和氧气。一旦投入运营,它将成为世界上最大的氢气生产和加氢设施之一。该设施预计每年可减少约13万吨二氧化碳排放,有助于清洁空气和改善环境条件。

- 2024年10月28日,河电机宣布,其子公司横河义大利将宣布已获得提供整合自动化和能源控制的合约以及 Baseload Power Hub 的监控系统,这是一个创新的海上绿色氢气生产和储存试点工厂。此专案由壳牌 (80%) 和 Eneco (20%) 的合资企业 CrossWind 开发。订单由义大利 EPCIC 承包商 Rosetti Marino S.p.A. 下订。

- 2024 年10 月23 日,Senoko Energy 和Gentari 签署了一份谅解备忘录探讨从马来西亚进口氢气到新加坡的可行性。在合作的初始阶段,Senoko 和 Gentari 的目标是每年减少 18,000 吨二氧化碳排放量(二氧化碳当量),相当于减少道路上约 4,000 辆汽车。

- 2024 年 10 月,摩洛哥政府与 TotalEnergies H2 及其专案合作伙伴签订 Chbika 土地预留初步协议项目已签署。透过此次合作,Total Energy H2 加入了哥本哈根基础设施合作伙伴(CIP) 和 A.P.我们将与 Moller Capital 合作开始预 FEED(前端工程设计)研究。 Chbika计画旨在开发1GW陆上太阳能和风电,并透过海水电解生产绿色氢气,每年转化为20万吨绿色氨,出口到欧洲市场。

- 10 月 11 日Fortescue 在巴西的 36 亿美元绿氢计画获得巴西塞阿拉州政府的资助。已经获得批准,我们已经取得了重大进展。此次批准对推进绿色氢能计画发挥了重要作用。初始阶段的重点是建立必要的基础设施并启动生产流程。

The "Global Green Hydrogen Projects Database" is a new subscription offering from Global Insight Services that tracks new green hydrogen production projects. Subscribers receive access to updates to the database and a newsletter summarizing key market developments monthly.

This comprehensive, centralized database is designed to track and analyze the rapidly evolving green hydrogen sector. This innovative database serves as a powerful tool for policymakers, businesses, investors, and researchers by providing real-time data, insights, and projections on the global development and deployment of green hydrogen technologies worldwide. Green hydrogen-produced via electrolysis using renewable energy sources-has gained significant traction as a critical component of the global transition to a low-carbon economy. Investments worth billions of dollars have been made public in order to assist the growth of greenfield projects and boost demand. The cost of manufacturing green hydrogen is already being reduced via efforts to scale technologies.

With over 1,600 global facilities, this database aggregates data on green hydrogen projects, production capacity, investment trends, electrolyzer capacity, electrolyzer technology used, funding details, participants, project status, primary energy source, and timelines for efficient hydrogen project planning and analysis across industries. This comprehensive resource enables clients to manage investments, track project developments, and navigate the fast-evolving hydrogen market. This database facilitates better decision-making and enhances strategic planning for all stakeholders by offering a one-stop solution for global green hydrogen intelligence. It highlights key market trends, identifies emerging opportunities, and tracks the pace of technological breakthroughs, providing users with a competitive edge in the evolving energy landscape.

- Production Rate Insights: Details on green hydrogen plant production rates, allowing stakeholders to evaluate efficiency and scalability

- Comprehensive Manufacturer Coverage: Profiles of leading electrolyzer manufacturers across regions and its technologies

- Performance Metrics: In-depth data on capacity, efficiency, funding value, and project costs

- Project Tracking: Data on ongoing and planned green hydrogen projects globally

- Competitive Benchmarking: Comparisons across green hydrogen projects for technology, price, and production capacity

- Technology Advancements: Tracks emerging technologies, such as PEM, Alkaline, and Solid Oxide, to identify trends and innovations

- Geographic Analysis: Regional breakdowns, enabling clients to target specific markets based on hydrogen adoption trends

- Partnership and Collaboration Data: Information on strategic partnerships and collaborations between different stakeholders involved in green hydrogen initiatives

Database Coverage

| Projects | 1,600+ |

| Region | Global |

| Electrolyzer Manufacturers | 80+ |

| Electrolyzer Capacity Range | 0.1 MW to 10+ GW |

| Hydrogen Production Capacity Range | 1 to 300,000+ (Tons per Year) |

| Project Information | Project name, Project location, Project category, Project participants, Plant status, Funding provider, Funding value, Project cost, Type of renewable energy, Electrolyzer manufacturer, Technology, Electrolyzer Capacity, Hydrogen Production Capacity, Hydrogen End-Users, Project Announcement Year, Project Construction Start Year, Project Construction End Year |

| Electrolyzer Technology | Alkaline Water Electrolysis, Proton Exchange Membrane, Solid Oxide Electrolysis Cell, Anion Exchange Membrane, Capillary-fed Electrolysis and Membrane-Free Electrolysis |

| Project Status | Under Construction, Announced, Operational, Planning Phase, Concept, FID, Feasibility Study, DEMO, FEED |

| Hydrogen End-Users | Ammonia, Cement, Chemicals, E-commerce, e-fuels, Electric Vehicles, Energy, Energy Storage, Fertilizer Production, Food Value Chain, Fuel Cells, Heating, Hydrogen Fuelling System, Logistics, Manufacturing, Methanol, Mobility, Refineries, Steel, Synfuels, Telecommunications |

| Key Hydrogen Companies | H2 Energy, orsted, ENGIE, BP, Infinite Green Energy Ltd, Fortescue Future Industries, ScottishPower, Shell Global, Adani Group, Air Products and Chemicals, Inc., CWP Global, Chariot Limited, Hydrogen Solutions AS, Gen2 Energy, Stord Hydrogen, HyCC, Lhyfe, Hive Energy, Orlen Group, NTPC Ltd., JSW Group, Larsen & Toubro Limited |

| Key Electrolyzer Manufacturers | Nel ASA, Siemens, McPhy Energy, ITM Power Plc, Elogen, Green Hydrogen Systems, iGas Energy GmbH, Next Hydrogen, Asahi Kasei, thyssenkrupp, Cummins, Toshiba Corporation, Plug Power, John Cockerill, H2Greem, Sunfire GmbH, Bloom Energy, Air Liquide, H-TEC SYSTEMS, Enapter AG, Greenzo Energy, European Energy A/S, Verdagy, Elcogen, Shuangliang Group, Nordex SE |

Monthly Newsletter

Subscribers to the service also receive a monthly newsletter summarizing key developments in the sector by:

- Project Announcements & Approvals

- Investments and Fundings

- Collaborations, Joint Ventures, and Partnerships

- Hydrogen Policy

- Electrolyzer Manufacturing

Key Benefits

- 12-Month Subscription: Stay informed year-round with monthly updated newsletters and database access

- Best Price: Most competitive price in the market for full database access

- Unique Offering: Exclusive product features for tailored green hydrogen plant insights

- Discounts: Special discounts on green hydrogen projects database and reports

- 24/7 Analyst Support: Round-the-clock assistance from industry experts

- Consulting Services: Access to expert consulting tailored to client needs

- Research Services: Top-tier research and custom data services provided

Recent Developments

- On October 30, 2024, Avina Clean Hydrogen hosted a groundbreaking ceremony for its new green hydrogen project in Vernon, California. The cutting-edge facility is set to produce up to 4 tons per day (tpd) of compressed green hydrogen through an electrolysis process, powered by renewable electricity to split water into hydrogen and oxygen. Once operational, it will become one of the largest integrated hydrogen production and refueling sites globally. The facility is projected to reduce CO2 emissions by approximately 130,000 tons per year (tpy), contributing to cleaner air and improved environmental conditions.

- On October 28, 2024, Yokogawa Electric Corporation announced that its subsidiary, Yokogawa Italia, has secured a contract to provide an integrated automation and energy control and monitoring system for the Baseload Power Hub-a groundbreaking offshore green hydrogen production and storage pilot plant located within a wind farm. This project is being developed by CrossWind, a joint venture between Shell (80%) and Eneco (20%). The order was placed by Rosetti Marino S.p.A. , an Italian EPCIC contractor.

- On October 23, 2024, Senoko Energy and Gentari, signed a memorandum of understanding (MOU) to explore the feasibility of importing hydrogen gas from Malaysia to Singapore. In the initial phase of the collaboration, Senoko and Gentari aimed to reduce carbon emissions by 18,000 tonnes of carbon dioxide equivalent annually, which was equivalent to removing around 4,000 cars from the roads.

- In October 2024, the Moroccan government and TotalEnergies H2 and its project partners signed a Preliminary Land Reservation Agreement for the Chbika project. This partnership enables TotalEnergies H2, along with Copenhagen Infrastructure Partners (CIP) , and A.P. Moller Capital, to begin pre-FEED (Front-End Engineering Design) studies. The Chbika project aims to develop 1 GW of onshore solar and wind capacity to produce green hydrogen via seawater electrolysis, which will be converted into 200,000 tonnes of green ammonia annually for export to European markets.

- On October 11, Fortescue's $3.6 billion green hydrogen project in Brazil made significant progress with the recent approval of its first phase by the Brazilian government in Ceara. The approval played a crucial role in moving the project forward, which aimed to produce green hydrogen. The initial phase is focused on establishing the required infrastructure and initiating production processes.

SAMPLE VIEW