|

年间契约型资讯服务

商品编码

1504282

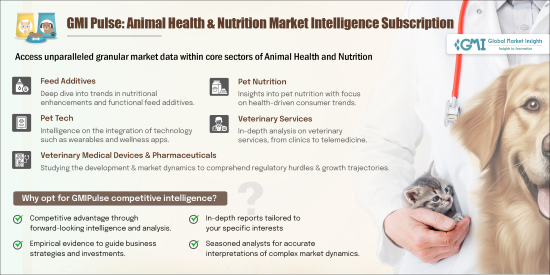

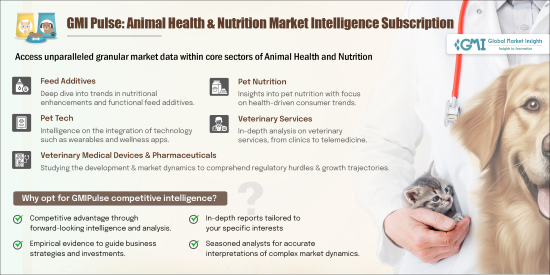

GMIPulse - 动物健康与营养市场情报订阅GMIPulse - Animal Health & Nutrition Market Intelligence Subscription |

|||||||

Global Market Insights Inc. 提供 GMIPulse,这是一个支援商业智慧 (BI) 的尖端平台,旨在提供最佳的策略价值。 GMIPulse 提供适应性强的订阅服务,可根据您的独特需求进行客製化,提供全面而细緻的市场资料、竞争格局洞察以及对行业生态系统的深入了解。该平台是满足所有市场研究需求的首选解决方案,确保您保持领先地位,并了解最新趋势和技术进步。

GMI脉衝的优点

- 1. 轻鬆取得准确的市场数据:GMIPulse 可即时取得细緻、真实的市场资料,为您提供准确、最新的策略决策资讯。

- 2. 全面的市场研究解决方案:GMIPulse作为您全方位的市场研究工具,涵盖广泛的行业,提供详细的分析和预测,帮助您有效驾驭市场动态。

- 3. 深度竞争格局:平台提供全面的竞争格局和公司概况洞察,让您全面了解竞争对手和产业标竿。

- 4.了解产业生态系统:GMIPulse让您深入了解产业生态系统,追踪技术进步及其对产业趋势的影响。

- 5. 客製化客户檔案:量身订製的客户檔案可协助您识别最新的成长机会并了解特定的市场需求,从而增强您的策略规划。

- 6. 技术追踪 随时了解最新的技术趋势及其对市场的影响,确保您为未来的发展做好充分准备。

- 7. 存取最新报告:订阅者可以存取先前发布的报告和即将发布的报告,让您随时了解最新的市场情报。

- 8. 互动式且使用者友善的介面:此平台的互动式介面可确保无缝的使用者体验,让您轻鬆浏览资料并有效地获得有意义的见解。

- 9. 延长分析师工作时间:受益于更好地获得分析师的策略帮助和深入解释,确保您做出明智的决策。

- 10. 安全登入:所有报告均受密码保护,确保您的资料安全保密。

GMIPulse 的卓越优势

- 1. 即时存取报告:GMIPulse 为客户提供即时存取全面市场报告的直接存取权限,协助客户及时做出明智的决策。

- 2. GMI Pulse 隆重推出 MyraAI 辅助功能:这项突破性功能让每个人都能以任何语言取得资料洞察。 MyraAI 支援多语言,可无缝翻译复杂的报告并即时解答疑问。

- 3. 互动式仪錶板:所有 GMI Pulse 使用者均可使用互动式仪錶板,彻底改变您与资料互动的方式。您可以轻鬆按地区、细分市场等筛选数据,从而专注于最重要的事项。简洁的介面让您即使没有技术技能也能轻鬆调整,即时更新功能能让您随时随地获得洞察。

- 4. 客製化报告:存取由行业领袖根据您的需求量身定制的详细市场趋势、技术发展和创新报告。

- 5. 优先销售支援:提供快速、一流的销售支援与协助,提升客户服务体验。

- 6. 市场追踪:有效率取得所有市场趋势和动态,随时了解最新动态,为策略规划和决策提供参考。

- 7. 价格优势:全面、经济高效的报告,满足您的预算和需求。

产业焦点:动物健康与营养

动物健康和营养产业正在快速发展,在饲料添加剂、宠物营养、兽医技术和药品创新的推动下实现显着成长。 GMIPulse 提供对该产业内以下关键集群的深入见解:

饲料添加剂

在对高品质动物产品的需求不断成长以及改善动物健康和性能的需求的推动下,饲料添加剂市场预计从 2023 年到 2030 年将以 5.3% 的复合年成长率成长。主要细分市场包括胺基酸、维生素、酵素和益生菌。例如,由于益生菌有助于增强牲畜肠道健康和免疫力,因此预计对益生菌的需求将强劲成长。

宠物营养

在宠物拥有率不断上升以及人们对宠物健康和保健意识不断增强的推动下,宠物营养市场正在经历显着成长,预计 2023 年至 2030 年复合年成长率为 6.8%。主要细分市场包括优质宠物食品、功能性零食和膳食补充品。例如,随着宠物主人对宠物饮食的健康意识越来越强,对无谷物和有机宠物食品的需求正在上升。

宠物科技

在宠物健康监测设备、智慧餵食器和宠物追踪系统进步的推动下,宠物技术市场正在快速成长,预计未来十年复合年成长率为 9.2%。诸如宠物穿戴式健康追踪器之类的创新越来越受欢迎,它们为宠物主人和兽医提供即时健康资料,这可以为宠物带来更好的健康结果。

兽医医疗器材

由于兽医实践中扩大采用先进的诊断和治疗设备,预计从 2023 年到 2030 年,兽医医疗设备市场将以 7.1% 的复合年成长率成长。主要例子包括诊断影像系统、手术器械和监测设备。 MRI 和 CT 扫描仪等先进影像系统的使用在兽医诊断中变得越来越普遍,提高了诊断和治疗动物复杂病症的能力。

兽药

由于动物疾病发生率上升和对有效治疗的需求,预计2023年至2030年兽药市场将以6.5%的复合年成长率扩张。主要领域包括抗生素、疫苗和抗发炎药物。例如,开发针对牲畜疾病的新疫苗对于预防疾病爆发和确保粮食安全至关重要。

兽医服务

在预防性护理、诊断和专业治疗需求不断成长的推动下,兽医服务市场正在经历强劲成长,预计 2023 年至 2030 年复合年成长率为 5.8%。例行检查、牙科护理和紧急护理等服务变得更加全面和广泛,改善了动物的整体健康和福祉。

TGMIPulse 透过其支援 BI 的平台提供无与伦比的策略价值。凭藉其可自订的互动式介面、准确的资料和全面的市场洞察,GMIPulse 是您在竞争激烈的市场格局中保持领先地位的重要工具。立即订阅,释放您的市场研究和策略规划能力的全部潜力。

Global Market Insights Inc. offers GMIPulse, a cutting-edge, Business Intelligence (BI)-enabled platform designed to deliver the finest strategic value. GMIPulse offers an adaptable subscription service, customizable to meet your unique needs, providing comprehensive and granular market data, competitive landscape insights, and an in-depth understanding of industry ecosystems. This platform is your go-to solution for all market research needs, ensuring you stay ahead with the latest trends and technological advancements.

Advantages of GMIPulse

- 1. Easy Access to Accurate Market Data: GMIPulse provides instant access to granular and authentic market data, empowering you with precise and up-to-date information for strategic decision-making.

- 2. Comprehensive Market Research Solution: As your all-encompassing market research tool, GMIPulse covers a wide array of industries, offering detailed analyses and forecasts to help you navigate market dynamics effectively.

- 3. In-Depth Competitive Landscape: The platform offers comprehensive insights into competitive landscapes and company profiles, enabling you to understand your competitors and industry benchmarks thoroughly.

- 4. Understanding Industry Ecosystems: GMIPulse allows you to gain a profound understanding of industry ecosystems, tracking technological advancements and their impact on industry trends.

- 5. Customized Client Profiles: Tailor-made client profiles help you identify the latest growth opportunities and understand specific market needs, enhancing your strategic planning.

- 6. Technology Tracking Stay informed about the latest technological trends and their implications on the market, ensuring you are well-prepared for future developments.

- 7. Access to Latest Reports: Subscribers receive access to previously published reports and upcoming releases, keeping you updated with the most recent market intelligence.

- 8. Interactive and User-Friendly Interface: The platform's interactive interface ensures a seamless user experience, allowing you to navigate through data effortlessly and derive meaningful insights efficiently.

- 9. Enhanced Analyst Hours: Benefit from improved access to analysts for strategic assistance and in-depth explanations, ensuring you make well-informed decisions.

- 10. Secure Login: Enjoy password-protected access to all reports, ensuring your data security and confidentiality.

Exceptional Benefits of GMIPulse

- 1. Instant Report Access GMIPulse offers clients direct access to comprehensive market reports instantly, facilitating timely and informed decision-making.

- 2. PulseAI, Introducing PulseAI Assistance within GMI Pulse: a game-changing feature that makes data insights accessible to everyone, in any language. With multilingual support, PulseAI seamlessly translates complex reports and answers your questions in real-time, breaking down language barriers for effortless, intuitive data exploration.

- 3. Interactive Dashboard We're excited to announce that the Interactive Dashboard is now available to all GMI Pulse users, changing the way you interact with your data. With easy data filtering by region, segment, and more, you can focus on what matters most. The simple interface lets you make adjustments without technical skills, and real-time updates provide live insights as you work.

- 4. Tailor-Made Reports Access customized reports detailing market trends, technological developments, and innovations by industry leaders, tailored to your specific needs.

- 5. Priority Sales Support Receive best-in-class sales support and assistance promptly, enhancing your customer service experience.

- 6. Market Tracker Stay updated with streamlined access to all market trends and happenings, aiding in strategic planning and decision-making.

- 7. Pricing Benefits Obtain reports that are not only comprehensive but also cost-effective, tailored to fit your budget and needs.

Industry Focus: Animal Health & Nutrition

The animal health and nutrition industry is rapidly advancing with significant growth driven by innovations in feed additives, pet nutrition, veterinary technology, and pharmaceuticals. GMIPulse provides in-depth insights into the following key clusters within this industry:

Veterinary Medical Devices Market Category Description

Veterinary Medical Devices is an emerging and developing industry, benefitting from higher rates of pet ownership, improved expectations of animal healthcare and improvements in diagnostic and therapeutic devices. The rise of sophisticated diagnostic imaging technologies, surgical devices, and monitoring devices, is providing veterinarians with greater capacity and improves the quality of care and treatment for both companion and livestock animals (MDPI).

The use of long-acting injectable drug delivery systems by veterinary medicine has become prominent, and products based on microsphere formulations and biodegradable polymers can improve patient compliance and therapeutic effectiveness.

Our extensive veterinary medical devices report covers varied equipment types, revolutionizing animal healthcare. Veterinary equipment and supplies market was projected to be valued at USD 2.1 billion in 2022 and will reach USD 4.5 billion by 2032, at a rate of 8.2% CAGR. Enhanced imaging technology is a key impetus for growth as the veterinary CT imaging market was estimated at USD 281.7 million in 2024, growing at an estimated CAGR of 7% over 2025-2034. Diagnostic devices are growing tremendously, especially in the veterinary point of care diagnostics market which had an estimated market value of USD 2.4 billion in 2024, and is expected to grow at 10.2% CAGR from 2025 to 2034.

Supporting device categories include specific endoscopic devices for minimal invasiveness, advanced critical care monitoring devices, and ultrasound devices showing widespread acceptance by veterinary clinics. Adoption of technology, including AI, portable diagnostics, and advanced imaging are reshaping veterinary medical device use and enabling evidence-based veterinary medicine by allowing improved diagnostics, the specificity of treatment, and patient outcomes.

Veterinary Services Market Category Description

The Veterinary Services sector is a fast-evolving and essential healthcare market that is driven by increased pet ownership, increased awareness of animal welfare, and the evolution of service delivery. The number of veterinary practices grew from 32,634 in 2021 to 34,000 in 2022, or 18.5% growth since 2009, with larger hospital formats becoming more prevalent. Companion animal practices generate significantly more revenue than the other practice categories, and 67.2% of veterinarians focus on companion animals.

Our extensive analysis of veterinary services covers varied service types, reshaping the delivery of animal healthcare. General veterinary services represented USD 46.9 billion in 2023 and illustrate explosive growth fueled by preventive care, routine needs, wellness checks, and core healthcare requirements. Specialty services segments provide extraordinary possibilities for growth, such as emergency and critical care services, specialized surgery procedures, and diagnostics that mirror the functioning of the immensely complex human healthcare market.

Growth in distribution channels shows Veterinary hospitals as the pre-slicing and dominating channel in terms of market share and projected growth rate of 6.7% CAGR (compound annual growth rate) from 2025-2034, offering veterinarian-specific pharmaceuticals and medications formulated entirely for the unique, one-of-a-kind autopomorphic nature of the veterinary patient. New models of services such as telemedicine consultation, mobile animal veterinary services, and preventive care initiatives are widening access while responding to workforce constraints. Technology integration, regulatory compliance, and evidence-based practice treatment guidelines are enhancing service delivery, operational efficiencies, and patient outcomes across the various types of veterinary services.

Pet Nutrition Market Category Description

Pet Nutrition is a rapidly growing field, driven by increasing pet humanization trends, upgraded nutritional awareness, and high-end products. The pet nutrition industry is thriving, and dog and cat food sales are projected to reach $51.7 billion in 2024, which demonstrates pets' consumer loyalty to premium pet nutrition, based on PetFood Industry estimates.

In conducting our pet nutrition study, we surveyed the broadening sectors that are changing how we care for animal diets. The pet dietary supplements sector has good growth momentum. The veterinary dietary supplements stood at USD 4.4 billion sector in 2023 and is likely to experience a CAGR of 6.8% from 2024 to 2032, reflecting an accelerating interest in preventive care and targeted nutritional support that is enhancing animal wellness. The pet herbal supplements sector reported USD 935.5 million in 2023, with strong growth anticipated at a 10.5% CAGR from 2024 to 2032, driven by interest in holistic and natural pet care.

Local market trends show the U.S. pet food and treat sector valued at USD 47.7 billion in 2024, with around 55% represented via alternative formats such as canned, semi-moist, refrigerated pet food, and treats, which is demonstrating consumer shifts away from the classic kibble formats. Supporting nutritional ingredients include animal feed protein projected at over USD 309 billion in 2023, growing at 4.9% CAGR from 2024 to 2032.

Emerging trends target intestinal health supplements, also known as digestive health supplements, with interest regarding high quality protein sources, functional ingredients, and personalized nutrition solutions. Integration of technology, sustainability practices, and regulatory compliance is lifting product quality, safety standards, and consumer trust in all pet nutrition categories.

Pet Tech Market Category Description

The Pet Tech industry is a groundbreaking intersection of technology and animal health, fueled by rising pet humanization, digital monitoring of health needs, and integrating smart home trends. Zoetis states that the growth of telemedicine in veterinary medicine is improving access and convenience for pet owners, and wearables for pets are gaining much attention, enabling owners to track health indicators and transfer real-time data to veterinarians.

Our in-depth pet technology research includes cutting-edge solutions revolutionizing the delivery of companion animal care. The pet wearable category illustrates outstanding growth, with the smart pet collar industry worth USD 1.9 billion in 2023 and projected to achieve 12% CAGR from 2024 to 2032, fueled by growing awareness of pet health and safety. The North American region accounted for the largest share of the pet wearable industry with more than 58% market share in 2023, as pets are being viewed as family members, raising investments in their technological well-being.

Premium device types consist of fitness trackers, allowing pet owners to monitor activity levels, caloric expenditure, and exercise regimens, thus helping in weight control and obesity avoidance. Home automation integration devices in the form of microchip-based pet doors, self-cleaning litter boxes, and automatic feeders are turning into standard household equipment. IoT (Internet of Things) based solutions can provide real-time health monitoring with their associated connected mobile applications. These devices are able to track important health indicators such as heart rate, body temperature, activity, and GPS location.

New technologies also incorporate artificial intelligence developed algorithms to help detect diseases early, provide customized care recommendations, and assist with predictive analysis and health indicators. Building this infrastructure can be supported with funding strategies and regulatory initiatives that promote technological advancements that empower companies to create high-tech pet care solutions that enhance the pet-human relationship through digital communication and automation management systems for care.

Veterinary Pharmaceuticals Market Category Description

Veterinary Pharmaceuticals is an essential health care industry affected largely by rising incidence of zoonotic diseases, increasing pet ownership, and higher standards in animal care, and the industry is reacting to the new disease conditions threatening livestock production through DVM360, with the development of specialty therapeutics like the H5N1 pharmaceutical vaccine for dairy cattle from Elanco Animal Health and Medgene.

In our full report on veterinary pharmaceuticals, we highlight many therapeutic segments worthy of discussion that are changing the delivery of animal health care. The market size of the animal vaccines industry achieved USD 9.9 billion in 2024 and is set to grow from USD 10.4 billion in 2025 to USD 19 billion by 2034, fueled by the adoption of preventive healthcare and regulation compliance needs. The market for animal parasiticides was worth USD 12.9 billion in 2024, expected to grow from USD 13.7 billion in 2025 to USD 21.8 billion in 2034, growing at a CAGR of 5.3%, meeting the essential demand for parasite management in both companion animals and livestock.

Supporting market segments are veterinary regenerative medicine worth USD 344.9 million in 2024 to reach USD 1.1 billion by 2034 at 12.3% CAGR and veterinary CRO and CDMO services worth USD 6.2 billion in 2023 with 8.7% CAGR. New therapeutic areas, niche formulations, and custom veterinary medicine are transforming treatment methodologies in all the animal healthcare segments.

Feed Additives Market Category Description

The Feed Additives market provides the backbone of international livestock nutrition and is realizing the potential demand for high-quality animal protein, better feed efficiency, and better practices for sustainable agriculture. World feed production produced strong results. It increased from 1.380 billion metric tons in 2023 to 1.396 billion metric tons in 2024, while the continuation of aquaculture consumption, along with the continued expectation of livestock consumption, remained significantly demanding. This broad survey of 142 countries and 28,235 feed mills illustrates that the growth remains steady until 2034.

In our detailed feed additives survey, we have examined the wide variety of nutritional categories, thereby revolutionizing live sustainable aquaculture and livestock farming efficiency. The global feed amino acids market was USD 7.69 billion in 2023 and is expected to advance at a 5.8% compound annual growth rate (CAGR) from 2024 through 2032, primarily due to the need for more animal protein and consistent dietary feed conversion ratios. The size of the animal feed probiotics market was USD 248.2 million in 2024 and is growing at an expected 6.8% CAGR from 2025 to 2034, chiefly because of rising compound feed production and the importance of gut health optimization in livestock.

The specialty segments continue to demonstrate dynamic potential and growth. For instance, the animal feed acidifiers market was valued at USD 2.2 billion in 2023, and with a heightened interest in animal health and nutrition, it is expected to grow at a 6.4% CAGR from 2024 to 2032. The aquafeed and aquaculture additives market reached more than USD 1.11 billion in 2023 and is set to grow at a 4.2% CAGR from 2024 to 2032, driven by growing demand for sustainable seafood and the advancement of aquaculture technology.

Regional dynamics reflect North America's leadership through mass livestock production, and dry additives continue to be predominantly used owing to ease of storage and mixing. Trends emerging include the integration of probiotics, natural substitutes, and technology-based precision nutrition solutions. Regulatory compliance, sustainability goals, and improved feed conversion efficiency are compelling innovations in the areas of vitamins, minerals, enzymes, antioxidants, and specialty nutritional solutions.

GMIPulse offers unparalleled strategic value through its BI-enabled platform. With its customizable and interactive interface, accurate data, and comprehensive market insights, GMIPulse is your essential tool for staying ahead in the competitive market landscape. Subscribe today to unlock the full potential of your market research and strategic planning capabilities.