|

市场调查报告书

商品编码

1472348

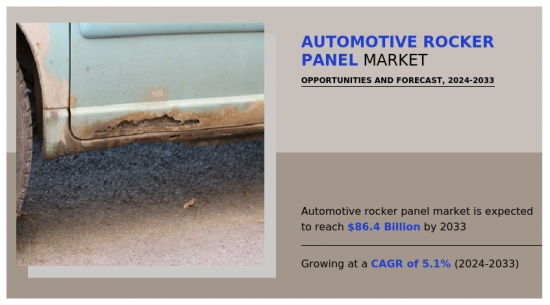

全球汽车户定板市场:按产品类型、车型和销售管道:机会分析和产业预测(2024-2033)Automotive Rocker Panel Market By Product Type (Steel, Plastic, Rubber), By Vehicle Type (Passenger Car, Commercial Vehicle), By Sales Channel (OEM, Aftermarket): Global Opportunity Analysis and Industry Forecast, 2024-2033 |

||||||

汽车户定板是位于车辆下方并连接轮圈舱的重要结构元件。

户定板提供结构支撑。此外,户定板的位置在塑造汽车侧面轮廓方面发挥着重要作用,有助于增强其整体美感,同时受到车门设计的影响。

车辆的户定板透过吸收部分力量来帮助缓衝碰撞的影响。此外,它还可以防止碰撞时车身损坏。除了其结构功能外,户定板还具有改善汽车空气动力学性能的优点。此面板的特殊设计最大限度地减少了空气阻力,有助于提高燃油效率。缺少户定板会影响汽车的结构完整性。如果没有这个,事故产生的力量将影响汽车的其他部件。

消费者对豪华车偏好的变化、更严格的排放气体法规以及技术进步正在推动个人交通习惯发生重大变化。人们逐渐采用不同的交通途径来满足自己的交通需求。毕竟,传统的汽车销售模式随着各种按需出行解决方案而蓬勃发展,尤其是在私家车普及的人口稠密的都市区。因此,随着需求和开拓的增加,产量也会增加,对市场成长产生正面影响。

此外,由于豪华和高端汽车领域投资的增加,汽车户定板市场正在显着成长。这些豪华车配备了顶级功能,已成为汽车製造商的标准产品。例如,专注豪华车的德国着名汽车公司奥迪公布,2022财年收益成长16.4%,总收益达618亿美元。豪华车通常价格昂贵,但由于多种原因,此类汽车的消费群正在稳步扩大。开发中国家收入的增加和获得金融支持的机会的增加意味着更多的人有能力投资豪华汽车。豪华汽车的生产需要开发由碳纤维、钢和橡胶製成的轻量化零件,这就是为什么这些汽车中采用户定板的原因。

在中国和印度等新兴经济体,对轻型汽车不断增长的需求正在推动製造商不断探索和寻找最好的建筑材料。这样做的目的是在预测期内减轻车辆重量并影响车辆性能。这项发展预计将为市场成长创造新的机会,因为这项技术创新与汽车产业优化车辆效率和性能的努力一致。

全球汽车户定板市场按产品类型、车辆类型、销售管道和地区细分。依产品类型划分,市场分为钢铁、塑胶和橡胶。依车型划分,分为小客车和商用车。销售管道可分为OEM和售后市场。按地区划分,调查涵盖北美、欧洲、亚太地区和拉丁美洲/中东/非洲。

本报告涵盖的主要企业包括 C2C Fabrication、Putco、Smittybilt、Innovative Creations、Rugged Ridge、B&I、QMI Sharp、Willmore Manufacturing、Nor/Am Auto Body Parts 和 Auto Metal Direct。

相关人员的主要利益

- 本报告定量分析了 2023 年至 2033 年汽车户定板市场的细分市场、当前趋势、估计/趋势和动态,以确定汽车户定板市场的强大机会。

- 我们提供市场研究以及与市场驱动因素、市场限制和市场机会相关的资讯。

- 波特的五力分析揭示了买方和供应商的潜力,可帮助相关人员做出以利润为导向的业务决策并加强供应商和买方网络。

- 对汽车户定板市场细分的详细分析有助于识别市场机会。

- 每个地区的主要国家都根据其对全球市场的收益贡献绘製了地图。

- 市场公司定位有助于基准化分析并提供对市场公司当前地位的清晰了解。

- 它包括区域和全球汽车户定板市场趋势、主要企业、细分市场、应用领域、市场成长策略等的分析。

使用此报告可以进行报告客製化(请联络销售人员以了解额外费用和时间表)

- 製造能力

- 投资机会

- 产品生命週期

- 科技趋势分析

- 打入市场策略

- 品牌占有率分析

- 按世界/地区/国家分類的企业市场占有率分析

- SWOT分析

- 销售市场规模及预测

目录

第一章 简介

第 2 章执行摘要

第三章市场概况

- 市场定义和范围

- 主要发现

- 影响因素

- 主要投资机会

- 波特五力分析

- 市场动态

- 促进因素

- 抑制因素

- 机会

第四章汽车户定板市场:依产品类型

- 概述

- 钢

- 塑胶

- 橡皮

第五章汽车户定板市场:依车型分类

- 概述

- 小客车

- 商用车

第六章汽车户定板市场:依销售管道分类

- 概述

- OEM

- 售后市场

第七章汽车户定板市场:依地区

- 概述

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他的

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 印尼

- 马来西亚

- 其他的

- 拉丁美洲/中东/非洲

- 拉丁美洲

- 中东

- 非洲

第八章 竞争格局

- 介绍

- 关键成功策略

- 10家主要企业产品图谱

- 竞争对手仪表板

- 竞争热图

- 主要企业定位(2023年)

第九章 公司简介

- Classic 2 Current Fabrication

- Putco

- Smittybilt Inc.

- ICI-Innovative Creations Industries

- Rugged Ridge

- B&I Trim Products, Inc.

- QMI

- Will-Mor Manufacturing, Inc.

- Nor/Am Auto Body Parts

- Auto Metal Direct(AMD)

Automotive Rocker Panel Market by Product Type (Steel, Plastic, and Rubber), Vehicle Type (Passenger Car and Commercial Vehicle), and Sales Channel (OEM and Aftermarket): Global Opportunity Analysis and Industry Forecast, 2024-2033

Rocker panel in vehicles is an integral structural element that is deployed below the vehicle, connecting the front and rear wheel wells. Rocker panels provide structural support. In addition, the positioning of rocker panels plays a crucial role in shaping the vehicle's side profile and contributes to its overall aesthetic appeal, influenced by the design of the car doors.

Rocker panel of a vehicle plays a role in mitigating the impact of collisions by absorbing a portion of the force. It further prevents the vehicle body from damaging during a collision. Beyond their structural function, rocker panels have the added benefit of enhancing the car's aerodynamics. The specific design of these panels aids in minimizing drag, thereby contributing to improved fuel efficiency. Lack of rocker panels impacts the structural integrity of the car. Without this, the force from an accident affects other parts of the vehicle.

Shifts in consumer preferences toward luxury vehicles, stringent regulations to reduce emissions, and advancements in technology have led to significant transformation in personal mobility habits. People are progressively incorporating various modes of transportation to fulfill their travel needs. Ultimately, the conventional model of selling cars are surged by a variety of on-demand mobility solutions, particularly in densely populated urban areas where there is widespread use of private cars. Thus, as the demand and development is increasing, the production is increasing, thereby impacting the market growth positively.

Moreover, the automotive rocker panel market is witnessing significant growth due to rising investments in the luxury and high-end car segments. These premium vehicles are equipped with a range of top-tier features, which have become a standard offering for automotive manufacturers. For instance, Audi, a prominent German automotive company specializing in luxury vehicles, reported a revenue increase of 16.4% in the fiscal year 2022, reaching a total revenue of $61.8 billion. While luxury cars are often expensive, the consumer base for such vehicles is steadily expanding for several reasons. These include growing income in both developing and developed nations as well as increased access to financial assistance, enabling more people to invest in luxury automobiles. The production of luxury vehicles involves the development of lightweight components made from carbon fiber, steel, rubber due to which the rocker panels are finding applications in these vehicles.

In developing economies such as China and India, rise in demand for lightweight vehicles is driving manufacturers to consistently explore and identify the optimal composition materials. This aims to decrease vehicle weight and influence vehicle performance during the forecast period. This development is anticipated to create new opportunities in the market growth as this innovation aligns with the automotive industry's efforts to optimize vehicle efficiency and performance.

The global automotive rocker market is segmented into product type, vehicle type, sales channel, and region. On the basis of product type, the market is categorized into steel, plastic, rubber. By vehicle type, it is segregated into passenger car and commercial vehicle. Depending on sales channel, it is divided into OEM and Aftermarket. Region wise, it is studied across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

The key players covered in the report include C2C Fabrication, Putco, Smittybilt, Innovative Creations, Rugged Ridge, B&I, QMI sharp, Willmore Manufacturing, Nor/Am Auto Body Parts, and Auto Metal Direct.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive rocker panel market analysis from 2023 to 2033 to identify the prevailing automotive rocker panel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive rocker panel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive rocker panel market trends, key players, market segments, application areas, and market growth strategies.

Additional benefits you will get with this purchase are:

- Quarterly Update and* (only available with a corporate license, on listed price)

- 5 additional Company Profile of client Choice pre- or Post-purchase, as a free update.

- Free Upcoming Version on the Purchase of Five and Enterprise User License.

- 16 analyst hours of support* (post-purchase, if you find additional data requirements upon review of the report, you may receive support amounting to 16 analyst hours to solve questions, and post-sale queries)

- 15% Free Customization* (in case the scope or segment of the report does not match your requirements, 15% is equivalent to 3 working days of free work, applicable once)

- Free data Pack on the Five and Enterprise User License. (Excel version of the report)

- Free Updated report if the report is 6-12 months old or older.

- 24-hour priority response*

- Free Industry updates and white papers.

Possible Customization with this report (with additional cost and timeline, please talk to the sales executive to know more)

- Manufacturing Capacity

- Investment Opportunities

- Product Life Cycles

- Technology Trend Analysis

- Go To Market Strategy

- Brands Share Analysis

- Market share analysis of players at global/region/country level

- SWOT Analysis

- Volume Market Size and Forecast

Key Market Segments

By Product Type

- Steel

- Plastic

- Rubber

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Malaysia

- Rest of Asia-Pacific

- Latin America

- Latin America

- Middle East

- Africa

Key Market Players:

- Classic 2 Current Fabrication

- Putco

- Smittybilt Inc.

- B&I Trim Products, Inc.

- QMI

- Will-Mor Manufacturing, Inc.

- Nor/Am Auto Body Parts

- Auto Metal Direct (AMD)

- Rugged Ridge

- ICI - Innovative Creations Industries

TABLE OF CONTENTS

CHAPTER 1: INTRODUCTION

- 1.1. Report description

- 1.2. Key market segments

- 1.3. Key benefits to the stakeholders

- 1.4. Research methodology

- 1.4.1. Primary research

- 1.4.2. Secondary research

- 1.4.3. Analyst tools and models

CHAPTER 2: EXECUTIVE SUMMARY

- 2.1. CXO perspective

CHAPTER 3: MARKET OVERVIEW

- 3.1. Market definition and scope

- 3.2. Key findings

- 3.2.1. Top impacting factors

- 3.2.2. Top investment pockets

- 3.3. Porter's five forces analysis

- 3.4. Market dynamics

- 3.4.1. Drivers

- 3.4.2. Restraints

- 3.4.3. Opportunities

CHAPTER 4: AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE

- 4.1. Overview

- 4.1.1. Market size and forecast

- 4.2. Steel

- 4.2.1. Key market trends, growth factors and opportunities

- 4.2.2. Market size and forecast, by region

- 4.2.3. Market share analysis by country

- 4.3. Plastic

- 4.3.1. Key market trends, growth factors and opportunities

- 4.3.2. Market size and forecast, by region

- 4.3.3. Market share analysis by country

- 4.4. Rubber

- 4.4.1. Key market trends, growth factors and opportunities

- 4.4.2. Market size and forecast, by region

- 4.4.3. Market share analysis by country

CHAPTER 5: AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE

- 5.1. Overview

- 5.1.1. Market size and forecast

- 5.2. Passenger Car

- 5.2.1. Key market trends, growth factors and opportunities

- 5.2.2. Market size and forecast, by region

- 5.2.3. Market share analysis by country

- 5.3. Commercial Vehicle

- 5.3.1. Key market trends, growth factors and opportunities

- 5.3.2. Market size and forecast, by region

- 5.3.3. Market share analysis by country

CHAPTER 6: AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL

- 6.1. Overview

- 6.1.1. Market size and forecast

- 6.2. OEM

- 6.2.1. Key market trends, growth factors and opportunities

- 6.2.2. Market size and forecast, by region

- 6.2.3. Market share analysis by country

- 6.3. Aftermarket

- 6.3.1. Key market trends, growth factors and opportunities

- 6.3.2. Market size and forecast, by region

- 6.3.3. Market share analysis by country

CHAPTER 7: AUTOMOTIVE ROCKER PANEL MARKET, BY REGION

- 7.1. Overview

- 7.1.1. Market size and forecast By Region

- 7.2. North America

- 7.2.1. Key market trends, growth factors and opportunities

- 7.2.2. Market size and forecast, by Product Type

- 7.2.3. Market size and forecast, by Vehicle Type

- 7.2.4. Market size and forecast, by Sales Channel

- 7.2.5. Market size and forecast, by country

- 7.2.5.1. U.S.

- 7.2.5.1.1. Market size and forecast, by Product Type

- 7.2.5.1.2. Market size and forecast, by Vehicle Type

- 7.2.5.1.3. Market size and forecast, by Sales Channel

- 7.2.5.2. Canada

- 7.2.5.2.1. Market size and forecast, by Product Type

- 7.2.5.2.2. Market size and forecast, by Vehicle Type

- 7.2.5.2.3. Market size and forecast, by Sales Channel

- 7.2.5.3. Mexico

- 7.2.5.3.1. Market size and forecast, by Product Type

- 7.2.5.3.2. Market size and forecast, by Vehicle Type

- 7.2.5.3.3. Market size and forecast, by Sales Channel

- 7.3. Europe

- 7.3.1. Key market trends, growth factors and opportunities

- 7.3.2. Market size and forecast, by Product Type

- 7.3.3. Market size and forecast, by Vehicle Type

- 7.3.4. Market size and forecast, by Sales Channel

- 7.3.5. Market size and forecast, by country

- 7.3.5.1. UK

- 7.3.5.1.1. Market size and forecast, by Product Type

- 7.3.5.1.2. Market size and forecast, by Vehicle Type

- 7.3.5.1.3. Market size and forecast, by Sales Channel

- 7.3.5.2. Germany

- 7.3.5.2.1. Market size and forecast, by Product Type

- 7.3.5.2.2. Market size and forecast, by Vehicle Type

- 7.3.5.2.3. Market size and forecast, by Sales Channel

- 7.3.5.3. France

- 7.3.5.3.1. Market size and forecast, by Product Type

- 7.3.5.3.2. Market size and forecast, by Vehicle Type

- 7.3.5.3.3. Market size and forecast, by Sales Channel

- 7.3.5.4. Italy

- 7.3.5.4.1. Market size and forecast, by Product Type

- 7.3.5.4.2. Market size and forecast, by Vehicle Type

- 7.3.5.4.3. Market size and forecast, by Sales Channel

- 7.3.5.5. Spain

- 7.3.5.5.1. Market size and forecast, by Product Type

- 7.3.5.5.2. Market size and forecast, by Vehicle Type

- 7.3.5.5.3. Market size and forecast, by Sales Channel

- 7.3.5.6. Russia

- 7.3.5.6.1. Market size and forecast, by Product Type

- 7.3.5.6.2. Market size and forecast, by Vehicle Type

- 7.3.5.6.3. Market size and forecast, by Sales Channel

- 7.3.5.7. Rest of Europe

- 7.3.5.7.1. Market size and forecast, by Product Type

- 7.3.5.7.2. Market size and forecast, by Vehicle Type

- 7.3.5.7.3. Market size and forecast, by Sales Channel

- 7.4. Asia-Pacific

- 7.4.1. Key market trends, growth factors and opportunities

- 7.4.2. Market size and forecast, by Product Type

- 7.4.3. Market size and forecast, by Vehicle Type

- 7.4.4. Market size and forecast, by Sales Channel

- 7.4.5. Market size and forecast, by country

- 7.4.5.1. China

- 7.4.5.1.1. Market size and forecast, by Product Type

- 7.4.5.1.2. Market size and forecast, by Vehicle Type

- 7.4.5.1.3. Market size and forecast, by Sales Channel

- 7.4.5.2. Japan

- 7.4.5.2.1. Market size and forecast, by Product Type

- 7.4.5.2.2. Market size and forecast, by Vehicle Type

- 7.4.5.2.3. Market size and forecast, by Sales Channel

- 7.4.5.3. India

- 7.4.5.3.1. Market size and forecast, by Product Type

- 7.4.5.3.2. Market size and forecast, by Vehicle Type

- 7.4.5.3.3. Market size and forecast, by Sales Channel

- 7.4.5.4. South Korea

- 7.4.5.4.1. Market size and forecast, by Product Type

- 7.4.5.4.2. Market size and forecast, by Vehicle Type

- 7.4.5.4.3. Market size and forecast, by Sales Channel

- 7.4.5.5. Indonesia

- 7.4.5.5.1. Market size and forecast, by Product Type

- 7.4.5.5.2. Market size and forecast, by Vehicle Type

- 7.4.5.5.3. Market size and forecast, by Sales Channel

- 7.4.5.6. Malaysia

- 7.4.5.6.1. Market size and forecast, by Product Type

- 7.4.5.6.2. Market size and forecast, by Vehicle Type

- 7.4.5.6.3. Market size and forecast, by Sales Channel

- 7.4.5.7. Rest of Asia-Pacific

- 7.4.5.7.1. Market size and forecast, by Product Type

- 7.4.5.7.2. Market size and forecast, by Vehicle Type

- 7.4.5.7.3. Market size and forecast, by Sales Channel

- 7.5. Latin America

- 7.5.1. Key market trends, growth factors and opportunities

- 7.5.2. Market size and forecast, by Product Type

- 7.5.3. Market size and forecast, by Vehicle Type

- 7.5.4. Market size and forecast, by Sales Channel

- 7.5.5. Market size and forecast, by country

- 7.5.5.1. Latin America

- 7.5.5.1.1. Market size and forecast, by Product Type

- 7.5.5.1.2. Market size and forecast, by Vehicle Type

- 7.5.5.1.3. Market size and forecast, by Sales Channel

- 7.5.5.2. Middle East

- 7.5.5.2.1. Market size and forecast, by Product Type

- 7.5.5.2.2. Market size and forecast, by Vehicle Type

- 7.5.5.2.3. Market size and forecast, by Sales Channel

- 7.5.5.3. Africa

- 7.5.5.3.1. Market size and forecast, by Product Type

- 7.5.5.3.2. Market size and forecast, by Vehicle Type

- 7.5.5.3.3. Market size and forecast, by Sales Channel

CHAPTER 8: COMPETITIVE LANDSCAPE

- 8.1. Introduction

- 8.2. Top winning strategies

- 8.3. Product mapping of top 10 player

- 8.4. Competitive dashboard

- 8.5. Competitive heatmap

- 8.6. Top player positioning, 2023

CHAPTER 9: COMPANY PROFILES

- 9.1. Classic 2 Current Fabrication

- 9.1.1. Company overview

- 9.1.2. Key executives

- 9.1.3. Company snapshot

- 9.1.4. Operating business segments

- 9.1.5. Product portfolio

- 9.1.6. Business performance

- 9.1.7. Key strategic moves and developments

- 9.2. Putco

- 9.2.1. Company overview

- 9.2.2. Key executives

- 9.2.3. Company snapshot

- 9.2.4. Operating business segments

- 9.2.5. Product portfolio

- 9.2.6. Business performance

- 9.2.7. Key strategic moves and developments

- 9.3. Smittybilt Inc.

- 9.3.1. Company overview

- 9.3.2. Key executives

- 9.3.3. Company snapshot

- 9.3.4. Operating business segments

- 9.3.5. Product portfolio

- 9.3.6. Business performance

- 9.3.7. Key strategic moves and developments

- 9.4. ICI - Innovative Creations Industries

- 9.4.1. Company overview

- 9.4.2. Key executives

- 9.4.3. Company snapshot

- 9.4.4. Operating business segments

- 9.4.5. Product portfolio

- 9.4.6. Business performance

- 9.4.7. Key strategic moves and developments

- 9.5. Rugged Ridge

- 9.5.1. Company overview

- 9.5.2. Key executives

- 9.5.3. Company snapshot

- 9.5.4. Operating business segments

- 9.5.5. Product portfolio

- 9.5.6. Business performance

- 9.5.7. Key strategic moves and developments

- 9.6. B&I Trim Products, Inc.

- 9.6.1. Company overview

- 9.6.2. Key executives

- 9.6.3. Company snapshot

- 9.6.4. Operating business segments

- 9.6.5. Product portfolio

- 9.6.6. Business performance

- 9.6.7. Key strategic moves and developments

- 9.7. QMI

- 9.7.1. Company overview

- 9.7.2. Key executives

- 9.7.3. Company snapshot

- 9.7.4. Operating business segments

- 9.7.5. Product portfolio

- 9.7.6. Business performance

- 9.7.7. Key strategic moves and developments

- 9.8. Will-Mor Manufacturing, Inc.

- 9.8.1. Company overview

- 9.8.2. Key executives

- 9.8.3. Company snapshot

- 9.8.4. Operating business segments

- 9.8.5. Product portfolio

- 9.8.6. Business performance

- 9.8.7. Key strategic moves and developments

- 9.9. Nor/Am Auto Body Parts

- 9.9.1. Company overview

- 9.9.2. Key executives

- 9.9.3. Company snapshot

- 9.9.4. Operating business segments

- 9.9.5. Product portfolio

- 9.9.6. Business performance

- 9.9.7. Key strategic moves and developments

- 9.10. Auto Metal Direct (AMD)

- 9.10.1. Company overview

- 9.10.2. Key executives

- 9.10.3. Company snapshot

- 9.10.4. Operating business segments

- 9.10.5. Product portfolio

- 9.10.6. Business performance

- 9.10.7. Key strategic moves and developments

LIST OF TABLES

- TABLE 01. GLOBAL AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 02. AUTOMOTIVE ROCKER PANEL MARKET FOR STEEL, BY REGION, 2023-2033 ($MILLION)

- TABLE 03. AUTOMOTIVE ROCKER PANEL MARKET FOR PLASTIC, BY REGION, 2023-2033 ($MILLION)

- TABLE 04. AUTOMOTIVE ROCKER PANEL MARKET FOR RUBBER, BY REGION, 2023-2033 ($MILLION)

- TABLE 05. GLOBAL AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 06. AUTOMOTIVE ROCKER PANEL MARKET FOR PASSENGER CAR, BY REGION, 2023-2033 ($MILLION)

- TABLE 07. AUTOMOTIVE ROCKER PANEL MARKET FOR COMMERCIAL VEHICLE, BY REGION, 2023-2033 ($MILLION)

- TABLE 08. GLOBAL AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 09. AUTOMOTIVE ROCKER PANEL MARKET FOR OEM, BY REGION, 2023-2033 ($MILLION)

- TABLE 10. AUTOMOTIVE ROCKER PANEL MARKET FOR AFTERMARKET, BY REGION, 2023-2033 ($MILLION)

- TABLE 11. AUTOMOTIVE ROCKER PANEL MARKET, BY REGION, 2023-2033 ($MILLION)

- TABLE 12. NORTH AMERICA AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 13. NORTH AMERICA AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 14. NORTH AMERICA AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 15. NORTH AMERICA AUTOMOTIVE ROCKER PANEL MARKET, BY COUNTRY, 2023-2033 ($MILLION)

- TABLE 16. U.S. AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 17. U.S. AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 18. U.S. AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 19. CANADA AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 20. CANADA AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 21. CANADA AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 22. MEXICO AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 23. MEXICO AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 24. MEXICO AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 25. EUROPE AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 26. EUROPE AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 27. EUROPE AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 28. EUROPE AUTOMOTIVE ROCKER PANEL MARKET, BY COUNTRY, 2023-2033 ($MILLION)

- TABLE 29. UK AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 30. UK AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 31. UK AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 32. GERMANY AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 33. GERMANY AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 34. GERMANY AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 35. FRANCE AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 36. FRANCE AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 37. FRANCE AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 38. ITALY AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 39. ITALY AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 40. ITALY AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 41. SPAIN AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 42. SPAIN AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 43. SPAIN AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 44. RUSSIA AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 45. RUSSIA AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 46. RUSSIA AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 47. REST OF EUROPE AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 48. REST OF EUROPE AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 49. REST OF EUROPE AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 50. ASIA-PACIFIC AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 51. ASIA-PACIFIC AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 52. ASIA-PACIFIC AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 53. ASIA-PACIFIC AUTOMOTIVE ROCKER PANEL MARKET, BY COUNTRY, 2023-2033 ($MILLION)

- TABLE 54. CHINA AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 55. CHINA AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 56. CHINA AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 57. JAPAN AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 58. JAPAN AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 59. JAPAN AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 60. INDIA AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 61. INDIA AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 62. INDIA AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 63. SOUTH KOREA AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 64. SOUTH KOREA AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 65. SOUTH KOREA AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 66. INDONESIA AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 67. INDONESIA AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 68. INDONESIA AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 69. MALAYSIA AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 70. MALAYSIA AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 71. MALAYSIA AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 72. REST OF ASIA-PACIFIC AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 73. REST OF ASIA-PACIFIC AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 74. REST OF ASIA-PACIFIC AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 75. LATIN AMERICA AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 76. LATIN AMERICA AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 77. LATIN AMERICA AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 78. LATIN AMERICA AUTOMOTIVE ROCKER PANEL MARKET, BY COUNTRY, 2023-2033 ($MILLION)

- TABLE 79. LATIN AMERICA AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 80. LATIN AMERICA AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 81. LATIN AMERICA AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 82. MIDDLE EAST AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 83. MIDDLE EAST AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 84. MIDDLE EAST AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 85. AFRICA AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023-2033 ($MILLION)

- TABLE 86. AFRICA AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023-2033 ($MILLION)

- TABLE 87. AFRICA AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023-2033 ($MILLION)

- TABLE 88. CLASSIC 2 CURRENT FABRICATION: KEY EXECUTIVES

- TABLE 89. CLASSIC 2 CURRENT FABRICATION: COMPANY SNAPSHOT

- TABLE 90. CLASSIC 2 CURRENT FABRICATION: PRODUCT SEGMENTS

- TABLE 91. CLASSIC 2 CURRENT FABRICATION: SERVICE SEGMENTS

- TABLE 92. CLASSIC 2 CURRENT FABRICATION: PRODUCT PORTFOLIO

- TABLE 93. CLASSIC 2 CURRENT FABRICATION: KEY STRATERGIES

- TABLE 94. PUTCO: KEY EXECUTIVES

- TABLE 95. PUTCO: COMPANY SNAPSHOT

- TABLE 96. PUTCO: PRODUCT SEGMENTS

- TABLE 97. PUTCO: SERVICE SEGMENTS

- TABLE 98. PUTCO: PRODUCT PORTFOLIO

- TABLE 99. PUTCO: KEY STRATERGIES

- TABLE 100. SMITTYBILT INC.: KEY EXECUTIVES

- TABLE 101. SMITTYBILT INC.: COMPANY SNAPSHOT

- TABLE 102. SMITTYBILT INC.: PRODUCT SEGMENTS

- TABLE 103. SMITTYBILT INC.: SERVICE SEGMENTS

- TABLE 104. SMITTYBILT INC.: PRODUCT PORTFOLIO

- TABLE 105. SMITTYBILT INC.: KEY STRATERGIES

- TABLE 106. ICI - INNOVATIVE CREATIONS INDUSTRIES: KEY EXECUTIVES

- TABLE 107. ICI - INNOVATIVE CREATIONS INDUSTRIES: COMPANY SNAPSHOT

- TABLE 108. ICI - INNOVATIVE CREATIONS INDUSTRIES: PRODUCT SEGMENTS

- TABLE 109. ICI - INNOVATIVE CREATIONS INDUSTRIES: SERVICE SEGMENTS

- TABLE 110. ICI - INNOVATIVE CREATIONS INDUSTRIES: PRODUCT PORTFOLIO

- TABLE 111. ICI - INNOVATIVE CREATIONS INDUSTRIES: KEY STRATERGIES

- TABLE 112. RUGGED RIDGE: KEY EXECUTIVES

- TABLE 113. RUGGED RIDGE: COMPANY SNAPSHOT

- TABLE 114. RUGGED RIDGE: PRODUCT SEGMENTS

- TABLE 115. RUGGED RIDGE: SERVICE SEGMENTS

- TABLE 116. RUGGED RIDGE: PRODUCT PORTFOLIO

- TABLE 117. RUGGED RIDGE: KEY STRATERGIES

- TABLE 118. B&I TRIM PRODUCTS, INC.: KEY EXECUTIVES

- TABLE 119. B&I TRIM PRODUCTS, INC.: COMPANY SNAPSHOT

- TABLE 120. B&I TRIM PRODUCTS, INC.: PRODUCT SEGMENTS

- TABLE 121. B&I TRIM PRODUCTS, INC.: SERVICE SEGMENTS

- TABLE 122. B&I TRIM PRODUCTS, INC.: PRODUCT PORTFOLIO

- TABLE 123. B&I TRIM PRODUCTS, INC.: KEY STRATERGIES

- TABLE 124. QMI: KEY EXECUTIVES

- TABLE 125. QMI: COMPANY SNAPSHOT

- TABLE 126. QMI: PRODUCT SEGMENTS

- TABLE 127. QMI: SERVICE SEGMENTS

- TABLE 128. QMI: PRODUCT PORTFOLIO

- TABLE 129. QMI: KEY STRATERGIES

- TABLE 130. WILL-MOR MANUFACTURING, INC.: KEY EXECUTIVES

- TABLE 131. WILL-MOR MANUFACTURING, INC.: COMPANY SNAPSHOT

- TABLE 132. WILL-MOR MANUFACTURING, INC.: PRODUCT SEGMENTS

- TABLE 133. WILL-MOR MANUFACTURING, INC.: SERVICE SEGMENTS

- TABLE 134. WILL-MOR MANUFACTURING, INC.: PRODUCT PORTFOLIO

- TABLE 135. WILL-MOR MANUFACTURING, INC.: KEY STRATERGIES

- TABLE 136. NOR/AM AUTO BODY PARTS: KEY EXECUTIVES

- TABLE 137. NOR/AM AUTO BODY PARTS: COMPANY SNAPSHOT

- TABLE 138. NOR/AM AUTO BODY PARTS: PRODUCT SEGMENTS

- TABLE 139. NOR/AM AUTO BODY PARTS: SERVICE SEGMENTS

- TABLE 140. NOR/AM AUTO BODY PARTS: PRODUCT PORTFOLIO

- TABLE 141. NOR/AM AUTO BODY PARTS: KEY STRATERGIES

- TABLE 142. AUTO METAL DIRECT (AMD): KEY EXECUTIVES

- TABLE 143. AUTO METAL DIRECT (AMD): COMPANY SNAPSHOT

- TABLE 144. AUTO METAL DIRECT (AMD): PRODUCT SEGMENTS

- TABLE 145. AUTO METAL DIRECT (AMD): SERVICE SEGMENTS

- TABLE 146. AUTO METAL DIRECT (AMD): PRODUCT PORTFOLIO

- TABLE 147. AUTO METAL DIRECT (AMD): KEY STRATERGIES

LIST OF FIGURES

- FIGURE 01. AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033

- FIGURE 02. SEGMENTATION OF AUTOMOTIVE ROCKER PANEL MARKET,2023-2033

- FIGURE 03. TOP IMPACTING FACTORS IN AUTOMOTIVE ROCKER PANEL MARKET

- FIGURE 04. TOP INVESTMENT POCKETS IN AUTOMOTIVE ROCKER PANEL MARKET (2024-2033)

- FIGURE 05. BARGAINING POWER OF SUPPLIERS

- FIGURE 06. BARGAINING POWER OF BUYERS

- FIGURE 07. THREAT OF SUBSTITUTION

- FIGURE 08. THREAT OF SUBSTITUTION

- FIGURE 09. COMPETITIVE RIVALRY

- FIGURE 10. GLOBAL AUTOMOTIVE ROCKER PANEL MARKET:DRIVERS, RESTRAINTS AND OPPORTUNITIES

- FIGURE 11. AUTOMOTIVE ROCKER PANEL MARKET, BY PRODUCT TYPE, 2023 AND 2033(%)

- FIGURE 12. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE ROCKER PANEL MARKET FOR STEEL, BY COUNTRY 2023 AND 2033(%)

- FIGURE 13. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE ROCKER PANEL MARKET FOR PLASTIC, BY COUNTRY 2023 AND 2033(%)

- FIGURE 14. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE ROCKER PANEL MARKET FOR RUBBER, BY COUNTRY 2023 AND 2033(%)

- FIGURE 15. AUTOMOTIVE ROCKER PANEL MARKET, BY VEHICLE TYPE, 2023 AND 2033(%)

- FIGURE 16. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE ROCKER PANEL MARKET FOR PASSENGER CAR, BY COUNTRY 2023 AND 2033(%)

- FIGURE 17. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE ROCKER PANEL MARKET FOR COMMERCIAL VEHICLE, BY COUNTRY 2023 AND 2033(%)

- FIGURE 18. AUTOMOTIVE ROCKER PANEL MARKET, BY SALES CHANNEL, 2023 AND 2033(%)

- FIGURE 19. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE ROCKER PANEL MARKET FOR OEM, BY COUNTRY 2023 AND 2033(%)

- FIGURE 20. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE ROCKER PANEL MARKET FOR AFTERMARKET, BY COUNTRY 2023 AND 2033(%)

- FIGURE 21. AUTOMOTIVE ROCKER PANEL MARKET BY REGION, 2023 AND 2033(%)

- FIGURE 22. U.S. AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 23. CANADA AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 24. MEXICO AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 25. UK AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 26. GERMANY AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 27. FRANCE AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 28. ITALY AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 29. SPAIN AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 30. RUSSIA AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 31. REST OF EUROPE AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 32. CHINA AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 33. JAPAN AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 34. INDIA AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 35. SOUTH KOREA AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 36. INDONESIA AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 37. MALAYSIA AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 38. REST OF ASIA-PACIFIC AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 39. LATIN AMERICA AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 40. MIDDLE EAST AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 41. AFRICA AUTOMOTIVE ROCKER PANEL MARKET, 2023-2033 ($MILLION)

- FIGURE 42. TOP WINNING STRATEGIES, BY YEAR

- FIGURE 43. TOP WINNING STRATEGIES, BY DEVELOPMENT

- FIGURE 44. TOP WINNING STRATEGIES, BY COMPANY

- FIGURE 45. PRODUCT MAPPING OF TOP 10 PLAYERS

- FIGURE 46. COMPETITIVE DASHBOARD

- FIGURE 47. COMPETITIVE HEATMAP: AUTOMOTIVE ROCKER PANEL MARKET

- FIGURE 48. TOP PLAYER POSITIONING, 2023