|

市场调查报告书

商品编码

1493830

全球机载ISR市场(2024-2034)Global Airborne ISR Market 2024-2034 |

||||||

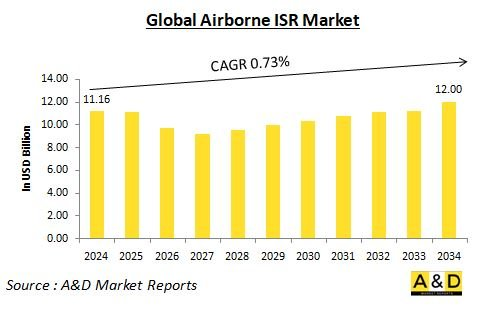

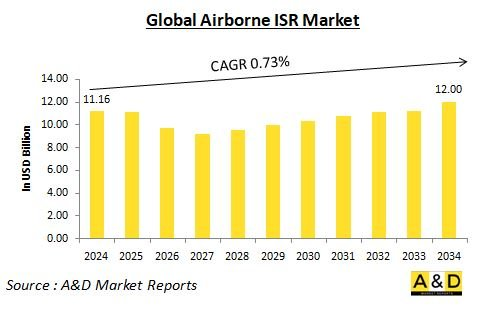

全球机载ISR(侦察、监视和侦察)市场预计到2024年将达到111.6亿美元,在预测期内(2024-2034年)复合年增长率(CAGR)预计将增长0.73%。 120 亿美元。

机载 ISR 市场概览

由于对先进侦察、监视和侦查能力的需求不断增加,机载 ISR 市场是国防工业中快速成长的部分。该市场的特点是重大技术进步推动产业成长。

机载ISR系统旨在为军队提供即时情报、监视和侦察能力。该系统配备了先进的传感器和雷达系统,整合了人工智慧和大数据分析,可提供有效的决策支援、改进的地理定位和识别、网路攻击防护以及态势感知功能。机载ISR市场分为有人系统和无人系统,无人系统预计在预测期内将以最高复合年增长率成长。

科技对机载 ISR 市场的影响

机载ISR市场受到人工智慧、大数据分析和机器人等各领域技术进步的显着影响。这些技术的整合促进了先进机载ISR系统的开发,提高了运作效率。这些系统提供了战场的全面概览,使军事人员能够确保正确的作战规划和资源分配。

机载ISR市场的主要驱动力

机载ISR市场的主要驱动力包括机载ISR应用对无人机的需求不断增长,以及ISR巡逻机和战斗机中使用的人工智慧、大数据分析和机器人技术的进步。恐怖主义和暴力威胁的上升以及安全需求的成长也推动了市场的成长。此外,一些国家国防军侦察设备的现代化也是机载ISR市场的成长机会。

机载ISR市场的区域趋势

机载ISR市场是一个国际产业,具有显着的区域趋势和发展。受国防部门投资增加和通讯产业技术进步的推动,北美在 2020 年引领全球机载 ISR 市场。美国政府将机载情监侦系统用于各种防御和安全目的,包括威胁追踪和侦测、监视、搜索和救援。

欧洲是机载ISR市场的另一个重要地区,英国、法国和德国等国家大力投资机载ISR系统。随着 ISR 任务所用技术的不断发展,欧洲市场预计将以温和的速度成长。

由于中国、印度和日本等国家对机载 ISR 系统的需求不断增加,亚太地区机载 ISR 市场正在快速成长。由于机载ISR应用的无人机复合年增长率不断增加,以及ISR巡逻机和战斗机中使用的人工智慧、大数据分析和机器人技术的进步,预计该地区在预测期内将以最高的复合年成长率增长。

机载 ISR 市场是国防工业中快速成长的一个部分,受到对先进侦察、监视和侦查能力不断增长的需求的推动。市场受到人工智慧、大数据分析和机器人等各领域技术进步的显着影响。主要市场驱动因素包括机载情监侦应用对无人机的需求不断增长,以及人工智慧、大数据分析以及用于情监侦巡逻和战斗机的机器人技术的进步。市场的区域趋势包括北美占据主导地位、欧洲成长以及亚太地区快速成长。

机载 ISR 市场的关键项目

Raytheon获得了一份价值约 1.502 亿美元的合同,用于升级和扩大英国皇家空军使用的情报、监视、目标捕获和侦察飞机的范围。英国国防部週三宣布,除了目前执行 ISTAR 任务的六架飞机外,该公司还将根据其 Shadow Mk2 更新计划再派遣两架飞机。该部门预计英国皇家空军将于 2023 年 6 月接收第一架改装的 "影子" 。作为交易的一部分,Raytheon还将为飞机配备最新的国防支援设备。该公司希望在2025年之前完成订单。工作将在Harlow、Waddington、Broughton进行。该部门表示,该项目将为北威尔斯创造 150 个就业岗位,并有可能为英国各地提供另外 350 个就业机会。

AEC Skyline 已获得荷兰国防部颁发的五年航空服务合约。荷兰国防部表示,当地国防公司 AEC Skyline 已获得最新的多年航空服务合约。这份为期五年的合约范围包括提供机载(JTAC CAS)威胁模拟、干扰和ISR能力,以及为荷兰军事概念开发和测试工作提供建议、指导和支援。AEC Skyline执行长Stef Have和荷兰国防物资组织采购总监Roselinde Wijman签署了合约。大部分服务将在荷兰领空提供,但合约还包括 AEC Skyline 和北约、和平伙伴关係 (PfP) 和和平伙伴关係国家。

本报告分析了全球机载 ISR 市场,研究了整体市场规模的趋势、依地区和国家划分的详细趋势、关键技术概述和市场机会。

目录

机载 ISR 市场:报告定义

机载 ISR 市场细分

- 依用途

- 依地区

- 依型号

机载ISR市场分析(未来10年)

机载ISR市场的市场技术

全球机载ISR市场预测

机载 ISR 市场:依地区划分的趋势和预测

- 北美

- 促进/抑制因素和课题

- PEST分析

- 市场预测与情境分析

- 大公司

- 供应商层级状况

- 企业标竿管理

- 欧洲

- 中东

- 亚太地区

- 南美洲

机载 ISR 市场:国家分析

- 美国

- 防御计划

- 最新趋势

- 专利

- 该市场目前的技术成熟度水平

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳大利亚

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

机载 ISR 市场:市场机会矩阵

机载 ISR 市场:专家对研究的看法

结论

关于Aviation and Defense Market Reports

The Global Airborne ISR market is estimated at USD 11.16 billion in 2024, projected to grow to USD 12.00 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 0.73% over the forecast period 2024-2034.

Introduction to Airborne ISR Market

The Airborne ISR Market is a rapidly growing sector in the defense industry, driven by the increasing demand for advanced intelligence, surveillance, and reconnaissance capabilities. This market is characterized by significant technological advancements, which are driving the growth of the industry.

Airborne ISR systems are designed to provide real-time intelligence, surveillance, and reconnaissance capabilities to military forces. These systems are equipped with advanced sensors and radar systems, which are integrated with artificial intelligence and big data analytics to provide effective decision support, improved geolocation and identification, protection against cyber-attacks, and enhanced situational awareness. The airborne ISR market is segmented into manned and unmanned systems, with unmanned systems expected to grow at the highest CAGR during the forecast period.

Technology Impact on Airborne ISR Market

The airborne ISR market is heavily influenced by technological advancements in various areas, including artificial intelligence, big data analytics, and robotics. The integration of these technologies has contributed to the development of advanced airborne ISR systems with improved operational efficiency. These systems offer a comprehensive overview of the battlefield, enabling military personnel to ensure proper operational planning and allocation of resources.

Key Drivers in Airborne ISR Market

The key drivers in the airborne ISR market include the rising demand for UAVs for airborne ISR applications and advancements in artificial intelligence, big data analytics, and robotics used in patrol and fighter aircraft for ISR. The increasing threat of terrorism and violence, coupled with the rising need to provide safety, is also driving the growth of the market. Additionally, the modernization of reconnaissance equipment by the defense forces of several countries serves as a growth opportunity for the airborne ISR market.

Regional Trends in Airborne ISR Market

The airborne ISR market is a global industry, with significant regional trends and developments. North America dominated the global airborne ISR market in 2020, driven by the rising investment in the field of defense and the technological advancement in the telecommunication industry. The U.S. government has been using airborne ISR systems for various defense and security purposes, including tracking and detection of threats, surveillance, search, and rescue.

Europe is another key region in the airborne ISR market, with countries such as the UK, France, and Germany investing heavily in airborne ISR systems. The European market is expected to grow at a moderate pace as the technologies used for ISR missions constantly evolve.

Asia-Pacific is a rapidly growing region in the airborne ISR market, driven by the increasing demand for airborne ISR systems from countries such as China, India, and Japan. The region is expected to grow at the highest CAGR during the forecast period, driven by the rising demand for UAVs for airborne ISR applications and advancements in artificial intelligence, big data analytics, and robotics used in patrol and fighter aircraft for ISR.

The airborne ISR market is a rapidly growing sector in the defense industry, driven by the increasing demand for advanced intelligence, surveillance, and reconnaissance capabilities. The market is heavily influenced by technological advancements in various areas, including artificial intelligence, big data analytics, and robotics. The key drivers in the market include the rising demand for UAVs for airborne ISR applications and advancements in artificial intelligence, big data analytics, and robotics used in patrol and fighter aircraft for ISR. The regional trends in the market include the dominance of North America, the growth of Europe, and the rapid growth of Asia-Pacific.

Key Airborne ISR Market Program

Raytheon has been awarded a contract worth about $150.2 million to upgrade and expand the fleet of intelligence, surveillance, target acquisition, and reconnaissance aircraft used by the British air force. The business will send two aircraft to supplement the current six-aircraft fleet for ISTAR missions under the Shadow Mk2 Upgrade Program, according to the U.K. defence ministry on Wednesday. The ministry anticipates the Royal Air Force receives the first modified Shadow in June 2023. As part of this arrangement, Raytheon will also outfit the aircraft with an updated defensive aids suite. By 2025, the corporation hopes to finish the orders. Work will be done in Harlow, Waddington, and Broughton. The project, according to the ministry, may create 150 employment in North Wales and support 350 more throughout the United Kingdom.

AEC Skyline was awarded with Dutch aerial service contract for five years. The contract was awarded by Netherlands MoD. The Netherlands Ministry of Defense stated that AEC Skyline, a local defence business, had been given its most recent, multi-year aerial services contract. The five-year contract's scope includes providing airborne (JTAC CAS) threat simulation, jamming, and ISR capabilities as well as providing advice, guidance, and support to Dutch military concept development and testing efforts. AEC Skyline's CEO Stef Have and Roselinde Wijman, director of procurement for the Netherlands Defense Materiel Organization, signed the contract. The majority of the services will be provided in Dutch airspace, but the contract also calls for AEC Skyline and within NATO, Partnership for Peace (PfP), and Partnership for Peace countries.

Table of Contents

Airborne ISR Market Report Definition

Airborne ISR Market Segmentation

By Application

By Region

By Aircraft Type

Airborne ISR Market Analysis for next 10 Years

The 10-year Airborne ISR Market analysis would give a detailed overview of Airborne ISR Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Airborne ISR Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Airborne ISR Market Forecast

The 10-year Airborne ISR Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Airborne ISR Market Trends & Forecast

The regional Airborne ISR Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Airborne ISR Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Airborne ISR Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Airborne ISR Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Aircraft Type, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Application, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Aircraft Type, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Application, 2024-2034

List of Figures

- Figure 1: Global Airborne ISR Market Forecast, 2024-2034

- Figure 2: Global Airborne ISR Market Forecast, By Region, 2024-2034

- Figure 3: Global Airborne ISR Market Forecast, By Aircraft Type, 2024-2034

- Figure 4: Global Airborne ISR Market Forecast, By Application, 2024-2034

- Figure 5: North America, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 6: Europe, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 8: APAC, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 9: South America, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 10: United States, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 11: United States, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 12: Canada, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 14: Italy, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 16: France, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 17: France, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 18: Germany, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 24: Spain, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 30: Australia, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 32: India, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 33: India, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 34: China, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 35: China, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 40: Japan, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Airborne ISR Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Airborne ISR Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Airborne ISR Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Airborne ISR Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Airborne ISR Market, By Aircraft Type (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Airborne ISR Market, By Aircraft Type (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Airborne ISR Market, By Application (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Airborne ISR Market, By Application (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Airborne ISR Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Airborne ISR Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Airborne ISR Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Airborne ISR Market, By Region, 2024-2034

- Figure 58: Scenario 1, Airborne ISR Market, By Aircraft Type, 2024-2034

- Figure 59: Scenario 1, Airborne ISR Market, By Application, 2024-2034

- Figure 60: Scenario 2, Airborne ISR Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Airborne ISR Market, By Region, 2024-2034

- Figure 62: Scenario 2, Airborne ISR Market, By Aircraft Type, 2024-2034

- Figure 63: Scenario 2, Airborne ISR Market, By Application, 2024-2034

- Figure 64: Company Benchmark, Airborne ISR Market, 2024-2034