|

市场调查报告书

商品编码

1664191

火炮系统的全球市场(2025年~2035年)Global Artillery Systems Market 2025-2035 |

||||||

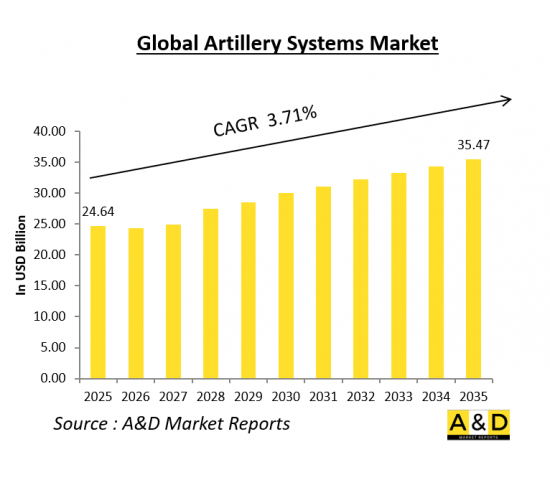

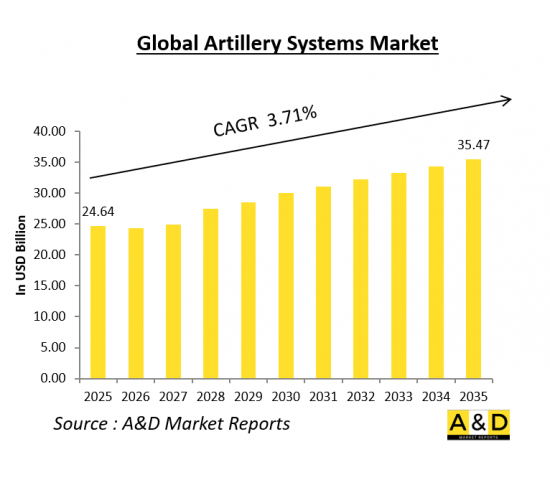

全球炮火系统市场呈现稳定成长,预计 2025 年市场规模为 246.4 亿美元,到 2035 年将达到 354.7 亿美元。预计预测期内市场规模将以 3.71% 的复合年增长率扩张。这一增长反映了各种军事应用对枪炮系统的持续需求,包括陆基火炮、火箭系统和自走榴弹炮。

枪炮系统市场简介

火炮系统市场是现代国防战略的重要组成部分,在战场火力支援、战略威慑和力量投射中发挥关键作用。炮兵系统包括自走榴弹炮和牵引榴弹炮、多管火箭发射系统 (MLRS)、迫击炮和岸防炮等多种武器。这些系统对于向敌方阵地、防御工事和装甲编队发射远程、高衝击力火力至关重要。

由于国防预算的增加、军事理论的不断发展以及对提高精度和火力的需求,全球火炮市场呈现稳步增长。世界各国都在投资最新的枪炮解决方案,以保持竞争力并应对日益复杂的现代战争。日益加剧的地缘政治紧张局势和地区衝突推动了对先进炮兵系统的需求增加,并鼓励对研发进行投资,以提高射程、准确性、机动性和自动化程度。

枪炮系统市场的关键推动因素

不断发展的军事战略、国防现代化计画和新的安全威胁等多种因素正在推动炮兵系统市场的扩张。各国都优先考虑升级枪炮系统,以应对不断变化的战争态势,并提高火力、准确性和作战效能。其中一个主要推动因素是人们越来越关注远程打击能力。军队正在投资先进的枪炮解决方案,以便更准确地击中更远距离的目标。从传统的间接火力支援到精确打击能力的转变正在刺激对导引火炮系统和智慧弹药的需求。地缘政治紧张局势和边界争端进一步加速了火炮采购。面临安全威胁的国家,特别是东欧、中东和印太等地区的国家,正在增强枪械能力,以加强威慑力并确保快速反应能力。此外,北约等多边联盟继续强调火炮现代化作为其集体防御战略的一部分。

另一个重要推动因素是网路中心战的角色日益增强。炮兵系统正在融入数位化作战网络,实现与侦察无人机、卫星监视以及指挥和控制中心等其他军事资产的无缝协调。这种连结增强了态势感知能力,使火力支援任务更有效率。

成本效率和永续性也在影响枪炮采购趋势。各国政府正在寻求能够提供强大火力同时最大限度减少后勤负担的炮兵解决方案。模组化设计、通用弹药口径和减少的维护要求是军事规划人员寻求在不影响战斗力的情况下优化资源的关键考虑因素。

此外,国内国防製造的成长趋势也刺激了枪炮市场的竞争。各国都重视国内生产,以减少对外国供应商的依赖并振兴国防工业。这导致了研究和开发活动的增加,重点是开发适合特定作战需求的下一代枪炮解决方案。

炮舰系统市场区域趋势

炮火系统市场受到安全课题、军事预算和战略联盟的影响,并呈现出明显的区域趋势。每个地区根据国防需求和地缘政治情况优先考虑特定的炮术进步。

本报告提供全球火炮系统市场相关调查分析,提供促进市场成长的要素,10年的市场预测,各地区趋势等资讯。

目录

火炮系统市场报告定义

火炮系统市场区隔

各地区

各类型

各范围

今后10年的火炮系统市场分析

火炮系统市场市场技术

全球火炮系统市场预测

地区的火炮系统市场趋势与预测

北美

促进因素,阻碍因素,课题

PEST

市场预测与情境分析

主要企业

供应商的Tier的形势

企业基准

欧洲

中东

亚太地区

南美

火炮系统市场国的分析

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

火炮系统市场机会矩阵

火炮系统市场报告相关专家的意见

结论

关于Aviation and Defense Market Reports

The global artillery systems market is poised for steady growth, with an estimated value of USD 24.64 billion in 2025, projected to reach USD 35.47 billion by 2035. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 3.71% over the forecast period. This growth reflects the sustained demand for artillery systems across various military applications, including land-based artillery, rocket systems, and self-propelled howitzers.

Introduction to Artillery Systems Market

The artillery systems market is a vital component of modern defense strategies, playing a critical role in providing firepower support, strategic deterrence, and force projection on the battlefield. Artillery systems encompass a range of weaponry, including self-propelled and towed howitzers, multiple launch rocket systems (MLRS), mortars, and coastal defense artillery. These systems are essential for delivering long-range, high-impact firepower against enemy positions, fortifications, and armored units.

The global artillery market has experienced steady growth due to rising defense budgets, evolving military doctrines, and the need for enhanced precision and firepower. Nations worldwide are investing in modern artillery solutions to maintain a competitive edge and address the growing complexity of modern warfare. Increasing geopolitical tensions and regional conflicts have further driven demand for advanced artillery systems, prompting investments in research and development to enhance range, accuracy, mobility, and automation.

Technology Impact in Artillery Systems Market

Technological advancements have significantly influenced the artillery systems market, leading to greater precision, improved mobility, and enhanced interoperability. Modern artillery platforms are increasingly integrating digital fire control systems, automation, and network-centric capabilities to optimize battlefield effectiveness. One of the most transformative innovations is the development of precision-guided munitions (PGMs), which have revolutionized artillery accuracy and reduced collateral damage. Advanced guidance systems, such as GPS, laser, and inertial navigation, enable artillery shells to strike targets with high precision, reducing the requirement for mass bombardment. Additionally, smart artillery shells, equipped with data-link connectivity, allow real-time target updates and in-flight course correction. Extended-range capabilities have also seen substantial improvements with advancements in rocket-assisted projectiles (RAP) and ramjet-powered munitions. These technologies enable artillery systems to engage targets at distances exceeding 70-100 km, significantly enhancing their strategic reach. The integration of autonomous and AI-driven fire control systems further streamlines targeting processes, ensuring rapid response and reducing human error in combat scenarios.

Another notable advancement is the adoption of modular and multi-role artillery platforms. Modern self-propelled howitzers and MLRS systems are now designed with greater adaptability, enabling quick configuration changes to suit different mission profiles. This flexibility is particularly valuable in multi-domain operations where artillery units must coordinate with air, land, and naval forces seamlessly.

Automation and robotics are also making their way into the artillery domain, with automated loading systems and remote-controlled artillery units improving operational efficiency. Unmanned artillery systems are in development, leveraging AI and machine learning to enhance decision-making, surveillance, and targeting without direct human intervention. These innovations are shaping the future of artillery warfare, making systems more effective, survivable, and adaptable to modern combat environments.

Key Drivers in Artillery Systems Market

Several factors are driving the expansion of the artillery systems market, including evolving military strategies, defense modernization programs, and emerging security threats. Nations are prioritizing artillery upgrades to enhance firepower, precision, and operational effectiveness in response to changing warfare dynamics. One of the primary drivers is the increasing focus on long-range strike capabilities. Military forces are investing in advanced artillery solutions to engage targets at greater distances with enhanced accuracy. The shift from conventional indirect fire support to precision-strike capabilities has spurred demand for guided artillery systems and smart munitions. Geopolitical tensions and border disputes have further accelerated artillery procurements. Countries facing security threats, particularly in regions like Eastern Europe, the Middle East, and the Indo-Pacific, are bolstering their artillery capabilities to strengthen deterrence and ensure rapid response capabilities. Additionally, multinational alliances such as NATO continue to emphasize artillery modernization as part of collective defense strategies.

Another key driver is the increasing role of network-centric warfare. Artillery systems are being integrated into digital battle networks, allowing seamless coordination with other military assets, including reconnaissance drones, satellite surveillance, and command-and-control centers. This connectivity enhances situational awareness and enables more efficient fire support missions.

Cost-efficiency and sustainability are also influencing artillery procurement trends. Governments are seeking artillery solutions that offer high firepower while minimizing logistical burdens. Modular designs, common ammunition calibers, and reduced maintenance requirements are key considerations for military planners looking to optimize resources without compromising combat effectiveness.

Additionally, the growing trend of indigenous defense manufacturing has spurred competition in the artillery market. Countries are emphasizing domestic production to reduce reliance on foreign suppliers and boost national defense industries. This has led to increased research and development initiatives focused on developing next-generation artillery solutions tailored to specific operational needs.

Regional Trends in Artillery Systems Market

The artillery systems market exhibits distinct regional trends, influenced by security challenges, military budgets, and strategic alliances. Different regions are prioritizing specific artillery advancements based on their defense requirements and geopolitical landscapes.

In North America, the United States remains a dominant player in the artillery market, investing heavily in next-generation systems to maintain battlefield superiority. The U.S. Army's Extended Range Cannon Artillery (ERCA) program is a prime example of efforts to enhance range and precision. The U.S. military is also developing advanced MLRS platforms and smart munitions to support multi-domain operations. Canada is also strengthening its artillery capabilities, focusing on interoperability with NATO forces.

Europe is witnessing increased artillery investments due to the evolving security environment, particularly in response to Russia's actions in Ukraine. NATO member states, including Germany, France, and Poland, are modernizing their artillery arsenals to bolster collective defense. European defense companies are actively developing advanced howitzers, MLRS, and smart munitions, with multinational collaborations playing a crucial role in artillery procurement.

The Asia-Pacific region is experiencing significant artillery expansion due to territorial disputes and rising military expenditures. Countries such as India, China, South Korea, and Japan are investing in cutting-edge artillery systems to strengthen their land-based deterrence capabilities. India has been procuring and developing indigenous artillery solutions, including the Dhanush and ATAGS howitzers, while China continues to advance its artillery arsenal with long-range and precision-strike capabilities. South Korea, known for its K9 Thunder self-propelled howitzer, has emerged as a key player in the global artillery export market.

In the Middle East, ongoing conflicts and regional security concerns have driven demand for artillery systems. Nations such as Saudi Arabia, the UAE, and Israel have been procuring modern artillery platforms to enhance their defensive and offensive capabilities. Israel, in particular, has been at the forefront of artillery innovation, incorporating advanced targeting and automation features into its systems.

Africa and Latin America have seen relatively slower artillery procurement, with acquisitions primarily focused on upgrading existing systems rather than large-scale modernization. However, some nations in these regions are exploring new artillery acquisitions to improve border security and counter-insurgency operations.

The global artillery systems market is set for continued growth, driven by technological advancements, evolving military doctrines, and regional security dynamics. As countries seek to enhance their artillery capabilities with longer ranges, greater precision, and improved mobility, the industry is expected to witness further innovation and collaboration among defense manufacturers and military stakeholders. The increasing role of digital integration, automation, and indigenous manufacturing will shape the future of artillery warfare, ensuring that modern forces remain well-equipped to address emerging threats and operational challenges.

Key Artillery Systems Programs

On December 20, 2024, the Defence Ministry signed a ₹7,629 crore contract with Larsen & Toubro (L&T) for the procurement of 100 additional 155mm/52 calibre K9 Vajra-T self-propelled tracked artillery guns for the Indian Army. According to the Ministry, these advanced guns, equipped with cutting-edge technology, are capable of delivering long-range, highly accurate, and rapid fire. Additionally, they are designed to operate at peak efficiency even in sub-zero temperatures in high-altitude regions. The project is expected to generate over nine lakh man-days of employment over four years, with active participation from various Indian industries, including MSMEs. During heightened tensions in Eastern Ladakh, the Army deployed a regiment of K9 Vajra self-propelled howitzers to strengthen its long-range firepower in response to a significant Chinese military buildup. Developed by L&T with technology transfer from South Korean defense giant Hanwha Defence, the K9 Vajra has demonstrated exceptional performance. As a result, the Army is now considering acquiring an additional 200 guns in two phases. Originally intended for desert operations, the K9 Vajra was adapted for deployment in mountainous terrain due to the ongoing standoff with China.

Elbit Systems announced that it has secured a contract valued at approximately $102 million to supply artillery systems to an international customer. The contract will be executed over a period of eight years. As part of the agreement, Elbit Systems will deliver a full battalion of ATMOS (Autonomous Truck Mounted Howitzer) 155mm/52 caliber truck-mounted howitzers. The ATMOS is a combat-proven, modular wheeled artillery system capable of firing all NATO-certified 155mm projectiles. It has an effective range exceeding 40 km with standard munitions and can achieve even greater distances using Rocket-Assisted Projectiles (RAP). Designed for rapid deployment and high mobility, the ATMOS provides versatile fire support for a wide range of operational missions.

Table of Contents

Artillery Systems Market Report Definition

Artillery Systems Market Segmentation

By Region

By Type

By Range

Artillery Systems Market Analysis for next 10 Years

The 10-year Artillery Systems Market analysis would give a detailed overview of Artillery Systems Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Artillery Systems Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Artillery Systems Market Forecast

The 10-year Artillery Systems Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Artillery Systems Market Trends & Forecast

The regional Artillery Systems Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Artillery Systems Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Artillery Systems Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Artillery Systems Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Range, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Range, 2025-2035

List of Figures

- Figure 1: Global Artillery Systems Market Forecast, 2025-2035

- Figure 2: Global Artillery Systems Market Forecast, By Region, 2025-2035

- Figure 3: Global Artillery Systems Market Forecast, By Type, 2025-2035

- Figure 4: Global Artillery Systems Market Forecast, By Range, 2025-2035

- Figure 5: North America, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 6: Europe, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 8: APAC, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 9: South America, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 10: United States, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 11: United States, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 12: Canada, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 14: Italy, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 16: France, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 17: France, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 18: Germany, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 24: Spain, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 30: Australia, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 32: India, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 33: India, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 34: China, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 35: China, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 40: Japan, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Artillery Systems Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Artillery Systems Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Artillery Systems Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Artillery Systems Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Artillery Systems Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Artillery Systems Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Artillery Systems Market, By Range (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Artillery Systems Market, By Range (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Artillery Systems Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Artillery Systems Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Artillery Systems Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Artillery Systems Market, By Region, 2025-2035

- Figure 58: Scenario 1, Artillery Systems Market, By Type, 2025-2035

- Figure 59: Scenario 1, Artillery Systems Market, By Range, 2025-2035

- Figure 60: Scenario 2, Artillery Systems Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Artillery Systems Market, By Region, 2025-2035

- Figure 62: Scenario 2, Artillery Systems Market, By Type, 2025-2035

- Figure 63: Scenario 2, Artillery Systems Market, By Range, 2025-2035

- Figure 64: Company Benchmark, Artillery Systems Market, 2025-2035