|

市场调查报告书

商品编码

1486763

全球无人战场后勤支援市场(2024-2034)Global Unmanned Battlefield Logistics and Support 2024-2034 |

||||||

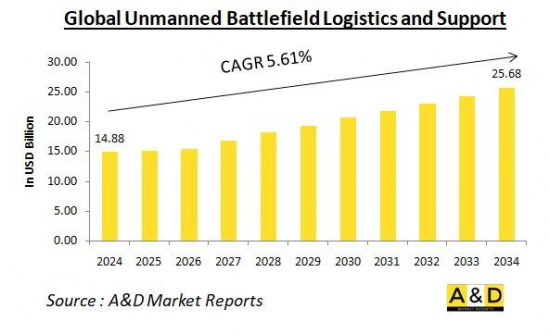

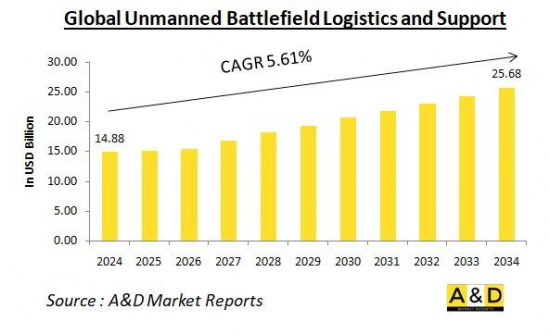

2024年全球无人战场后勤支援市场规模预估为148.8亿美元,2024年至2034年将以5.61%的复合年增长率成长,预计达到256.8亿美元。

无人战场后勤与保障概述

无人战场后勤和支援代表军事行动的变革,利用自动驾驶和远端控制技术来提高战场的效率、安全性和有效性。这些系统包括各种车辆和无人机,旨在运输物资、弹药和医疗设备等重要资源,而不危及人类士兵。无人系统融入后勤旨在简化供应链,减轻部队后勤负担,并提高军事行动的弹性和灵活性。

科技对无人战场后勤与保障的影响

技术进步正在迅速改变无人战场后勤和支援系统。这波科技创新浪潮催生了更复杂、更强大、功能更广泛的平台的开发。

自动驾驶是取得进展的关键领域之一。演算法和感测器技术的进步使无人驾驶车辆能够在复杂且不断变化的环境中行驶,而无需人工干预。这包括侦测障碍物、规划有效路线和做出即时决策的能力。

强大的通讯系统也是一个重要面向。安全宽频网路和卫星通讯等增强技术可以实现远端无人系统的可靠控制和协调。这确保了持续作战以及与战场上其他军事资产的无缝整合。

人工智慧 (AI) 在这些无人系统的运作中发挥着至关重要的作用。从即时数据分析和预测性维护到自适应任务规划,人工智慧演算法具有多种优势。优化运送路线,预测战场补给需求,甚至管理整个无人驾驶车辆车队,进而显着提高营运效率。

现代无人物流车在设计时也考虑了模组化。这允许快速重新配置和适应不同的任务要求。单一平台可以执行多种任务,包括运输物资、疏散伤亡人员和侦察任务。

最后,电池技术、燃料电池和混合动力系统的进步正在扩大无人物流车的续航里程和耐用性。高效的电源管理系统使无人物流车辆能够长时间运行,而无需频繁加油或充电,使它们能够在动态的战场情况下保持运行和响应。

无人战场后勤与支援的关键驱动因素

无人战场后勤和支援市场的主要驱动因素包括部队保护的需求。无人后勤系统减少了人类士兵在前线面临的危险,增强了部队保护。无人驾驶车辆可以执行补给任务、疏散受伤者并运送关键物资,而不会危及人的生命。营运效率也是一个关键因素,因为无人物流系统可以显着提高军事供应链的效率。无人后勤系统持续运行,可依战局变化快速部署,保障后勤支援更加敏捷快速。

人工智慧、机器人和自主系统的持续创新将推动技术进步,从而开发出更强大、更可靠的无人物流平台。这些进步使得在日益复杂和苛刻的操作环境中部署无人系统变得可行。儘管无人系统的初始投资很高,但长期的成本效益是可观的。降低劳动成本、降低人为错误导致的设备损失风险,以及更有效执行维护和补给任务的能力,有助于节省整体成本。

此外,全球衝突的演变和军事行动日益复杂,需要更先进和适应性强的物流解决方案。无人系统提供了支援不同地理区域和威胁环境中的不同任务概况所需的灵活性和弹性。

无人战场后勤保障的区域趋势

在以美国为首的北美地区,庞大的国防预算和对技术优势的重视正在推动无人物流系统的开发和部署。美军对自主地面和空中平台的投资已成为全球无人物流作业的标准。在整个欧洲,特别是在北约成员国中,越来越多地部署无人物流系统,以提高作战能力和互通性。欧洲国防公司之间的合作项目和合资企业正在加速先进无人平台的开发。

在亚太地区,中国、日本、韩国等国家的无人物流技术正快速发展。地区安全动态和军事现代化的需求正在推动对用于后勤和支援作用的自主系统的投资。中东面临持续的安全课题和地区衝突,各国正在采用无人后勤系统来增强军事能力,并部署先进技术以支援沙漠和城市地区等恶劣环境下的行动。

虽然拉丁美洲和非洲的采用速度慢于其他地区,但人们对无人物流系统的兴趣日益浓厚,以解决独特的营运课题。预算限制和现代化需求正在推动这些地区寻找具有成本效益且适应性强的无人解决方案。

主要无人战场后勤支援计画

- 1. ARES(空中可重构嵌入式系统)

- 2. K-MAX无人直升机

- 3.THeMIS(履带式混合模组化步兵系统) 4. SYPAQ

本报告分析了全球无人战场后勤和支援市场,研究了整体市场规模趋势、依地区和国家划分的详细趋势、关键技术概述以及市场机会。

目录

无人战场后勤与支援市场:定义

无人战场后勤与保障市场区隔

- 依类型

- 依地区

- 依尺寸

无人战场后勤与保障市场分析:未来10年

无人战场后勤支援市场的市场技术

全球无人战场后勤支援市场预测

无人战场后勤和支援市场:依地区划分的趋势和预测

- 北美

- 促进/抑制因素和课题

- PEST分析

- 市场预测与情境分析

- 主要公司

- 供应商层级状况

- 企业基准比较

- 欧洲

- 中东

- 亚太地区

- 南美洲

无人战场后勤与保障市场:国家分析

- 美国

- 防御规划

- 最新趋势

- 专利

- 该市场目前的技术成熟度水平

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳大利亚

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

无人战场后勤与保障市场:机会矩阵

无人战场后勤与保障市场:专家观点

结论

关于航空和国防市场报告

The global Unmanned Battlefield Logistic and Support market is estimated at USD 14.88 billion in 2024, projected to grow to USD 25.68 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 5.61% over the forecast period 2024-2034.

Introduction to Unmanned Battlefield Logistics and Support

Unmanned battlefield logistics and support represent a transformative shift in military operations, leveraging autonomous and remotely controlled technologies to enhance efficiency, safety, and effectiveness in warzones. These systems encompass a wide range of vehicles and drones designed to transport supplies, ammunition, medical equipment, and other essential resources without putting human soldiers at risk. The integration of unmanned systems into military logistics aims to streamline supply chains, reduce the logistical burden on troops, and improve the resilience and flexibility of military operations.

Technology Impact in Unmanned Battlefield Logistics and Support

Technological advancements are rapidly transforming unmanned battlefield logistics and support systems. This wave of innovation is leading to the development of more sophisticated and capable platforms with a wider range of functionalities.

One key area of progress is autonomous navigation. Advancements in algorithms and sensor technology allow unmanned vehicles to navigate complex and ever-changing environments without human intervention. This includes the ability to detect obstacles, plan efficient paths, and make real-time decisions - crucial for operating in contested and hazardous areas.

Robust communication systems are another critical aspect. Enhanced technologies like secure, high-bandwidth networks and satellite communications enable reliable control and coordination of unmanned systems over long distances. This ensures continuous operation and seamless integration with other military assets on the battlefield.

Artificial intelligence (AI) is playing a pivotal role in the operation of these unmanned systems. From real-time data analysis and predictive maintenance to adaptive mission planning, AI algorithms offer a range of benefits. They can optimize delivery routes, predict battlefield supply needs, and even manage entire fleets of unmanned vehicles, significantly increasing operational efficiency.

Modern unmanned logistics vehicles are also being designed with modularity in mind. This allows for rapid reconfiguration and adaptation to diverse mission requirements. A single platform can be equipped to perform various tasks, such as transporting supplies, evacuating casualties, or conducting reconnaissance missions.

Finally, advancements in battery technology, fuel cells, and hybrid power systems are extending the operational range and endurance of unmanned logistics vehicles. Efficient power management systems further ensure that these vehicles can operate for extended periods without the need for frequent refueling or recharging, keeping them operational and responsive in dynamic battlefield situations.

Key Drivers in Unmanned Battlefield Logistics and Support

Key drivers in unmanned battlefield logistics and support include the imperative of force protection, as adopting unmanned logistics systems enhances force protection by reducing the exposure of human soldiers to frontline dangers. Unmanned vehicles are capable of performing resupply missions, evacuating casualties, and delivering critical supplies without risking lives. Operational efficiency is also a significant factor, as unmanned logistics systems can markedly improve the efficiency of military supply chains. They operate continuously, without the need for rest, and can be rapidly deployed in response to changing battlefield conditions, leading to more agile and responsive logistics support.

Ongoing innovations in AI, robotics, and autonomous systems drive technological advancements that enable the development of more capable and reliable unmanned logistics platforms. These advancements make it feasible to deploy unmanned systems in increasingly complex and demanding operational environments. Despite the initial high investment in unmanned systems, their long-term cost benefits are substantial. Reduced personnel costs, lower risk of equipment loss due to human error, and the ability to conduct maintenance and resupply missions more efficiently contribute to overall cost savings.

Moreover, the evolving nature of global conflicts and the increasing complexity of military operations necessitate more advanced and adaptable logistics solutions. Unmanned systems offer the flexibility and resilience needed to support diverse mission profiles in various geographic regions and threat environments.

Regional Trends in Unmanned Battlefield Logistics and Support

In North America, led by the United States, the development and deployment of unmanned logistics systems are driven by significant defense budgets and a focus on technological superiority. The U.S. military's investments in autonomous ground and aerial platforms set the standard for global unmanned logistics operations. Across Europe, particularly among NATO members, there is an increasing adoption of unmanned logistics systems to enhance operational capabilities and interoperability. Collaborative projects and joint ventures among European defense firms are accelerating the development of advanced unmanned platforms.

In the Asia-Pacific region, countries like China, Japan, and South Korea are witnessing rapid advancements in unmanned logistics technologies. Regional security dynamics and the need to modernize military forces are driving investments in autonomous systems for logistics and support roles. In the Middle East, facing persistent security challenges and regional conflicts, countries are adopting unmanned logistics systems to enhance military capabilities, focusing on acquiring advanced technologies to support operations in challenging environments such as deserts and urban areas.

While adoption in Latin America and Africa is slower compared to other regions, there is a growing interest in unmanned logistics systems to address unique operational challenges. Budget constraints and the need for modernization are driving these regions to explore cost-effective and adaptable unmanned solutions.

Key Unmanned Battlefield Logistics and Support Programs

1. ARES (Aerial Reconfigurable Embedded System): A DARPA initiative, ARES is a modular and reconfigurable VTOL (Vertical Takeoff and Landing) vehicle designed for autonomous logistics support. It can transport supplies, evacuate casualties, and deliver equipment to remote or contested areas.

2. K-MAX Unmanned Helicopter: A collaborative effort between Lockheed Martin and Kaman Aerospace, the K-MAX is an unmanned cargo helicopter designed for autonomous resupply missions. It has been successfully used by the U.S. Marine Corps for delivering supplies in Afghanistan.

3. THeMIS (Tracked Hybrid Modular Infantry System): Developed by Milrem Robotics, THeMIS is an unmanned ground vehicle with a modular design, allowing it to perform multiple roles such as logistics support, reconnaissance, and explosive ordnance disposal. It is used by several NATO countries for various operational tasks.

4.SYPAQ :SYPAQ, an innovative engineering and systems integration company, was contracted to create and demonstrate a new generation of tiny unmanned aerial systems (UAS) for combat logistics that will be used by Australian soldiers. The contract, worth more than $1 million USD, was awarded as part of Army Innovation Day 2018 using the Defence Innovation Hub's Special Notice solicitation process, according to Defence Industry Minister Linda Reynolds.

Table of Contents

Unmanned Battlefield Logistics and Support Market Report Definition

Unmanned Battlefield Logistics and Support Market Segmentation

By Type

By Region

By Size

Unmanned Battlefield Logistics and Support Market Analysis for next 10 Years

The 10-year unmanned battlefield logistics and support market analysis would give a detailed overview of unmanned battlefield logistics and support market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Unmanned Battlefield Logistics and Support Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Unmanned Battlefield Logistics and Support Market Forecast

The 10-year unmanned battlefield logistics and support market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Unmanned Battlefield Logistics and Support Market Trends & Forecast

The regional unmanned battlefield logistics and support market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Unmanned Battlefield Logistics and Support Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Unmanned Battlefield Logistics and Support Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Unmanned Battlefield Logistics and Support Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Type, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Size, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Type, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Size, 2024-2034

List of Figures

- Figure 1: Global Unmanned Battlefield Logistics and Support Market Forecast, 2024-2034

- Figure 2: Global Unmanned Battlefield Logistics and Support Market Forecast, By Region, 2024-2034

- Figure 3: Global Unmanned Battlefield Logistics and Support Market Forecast, By Type, 2024-2034

- Figure 4: Global Unmanned Battlefield Logistics and Support Market Forecast, By Size, 2024-2034

- Figure 5: North America, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 6: Europe, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 8: APAC, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 9: South America, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 10: United States, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 11: United States, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 12: Canada, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 14: Italy, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 16: France, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 17: France, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 18: Germany, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 24: Spain, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 30: Australia, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 32: India, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 33: India, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 34: China, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 35: China, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 40: Japan, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Unmanned Battlefield Logistics and Support Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Unmanned Battlefield Logistics and Support Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Unmanned Battlefield Logistics and Support Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Unmanned Battlefield Logistics and Support Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Unmanned Battlefield Logistics and Support Market, By Type (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Unmanned Battlefield Logistics and Support Market, By Type (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Unmanned Battlefield Logistics and Support Market, By Size (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Unmanned Battlefield Logistics and Support Market, By Size (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Unmanned Battlefield Logistics and Support Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Unmanned Battlefield Logistics and Support Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Unmanned Battlefield Logistics and Support Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Unmanned Battlefield Logistics and Support Market, By Region, 2024-2034

- Figure 58: Scenario 1, Unmanned Battlefield Logistics and Support Market, By Type, 2024-2034

- Figure 59: Scenario 1, Unmanned Battlefield Logistics and Support Market, By Size, 2024-2034

- Figure 60: Scenario 2, Unmanned Battlefield Logistics and Support Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Unmanned Battlefield Logistics and Support Market, By Region, 2024-2034

- Figure 62: Scenario 2, Unmanned Battlefield Logistics and Support Market, By Type, 2024-2034

- Figure 63: Scenario 2, Unmanned Battlefield Logistics and Support Market, By Size, 2024-2034

- Figure 64: Company Benchmark, Unmanned Battlefield Logistics and Support Market, 2024-2034