|

市场调查报告书

商品编码

1486766

全球海洋雷达市场(2024-2034)Global Ship Radar Market 2024-2034 |

||||||

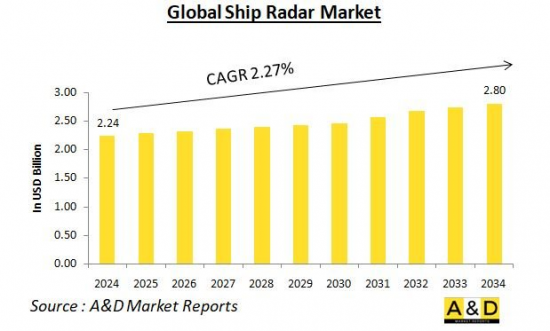

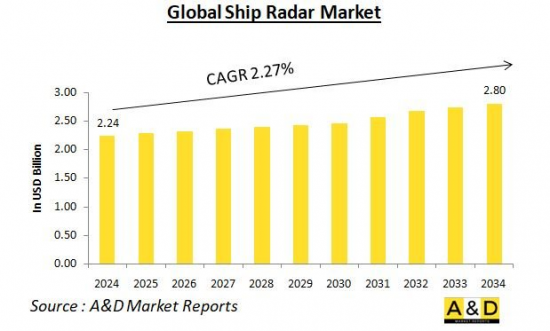

预计2024年全球海事雷达市场规模为22.4亿美元,预测期内(2024-2034年)复合年增长率(CAGR)为2.27%,到2034年将达到28亿美元。

船用雷达市场概况

船用雷达市场是海洋工业的一个重要分支,涵盖用于导航、防撞、天气监测和安全的雷达系统的开发、生产和分销。这些系统对于从小船到大型商船和海军舰队的安全和高效运作至关重要。该市场上有各种类型的雷达,包括 X 波段和 S 波段雷达,每种雷达根据频率和操作特性都有特定的应用。由于海上作业的复杂性不断增加以及对安全和安保的重视程度不断提高,预计海洋雷达市场将显着成长和技术创新。

技术对海洋雷达市场的影响

由于尖端技术的进步,海洋雷达市场正在经历重大转变。这些进步正在创造具有增强功能和更广泛应用的新一代雷达系统。

关键驱动因素之一是从磁控管技术转变为固态雷达的因素。这种转变带来了多种好处,包括提高可靠性、减少维护要求和提高效能。固态雷达具有出色的分辨率和较长的使用寿命,使其成为现代海上导航的可靠选择。

此外,数位讯号处理 (DSP) 的进步显着提高了雷达性能。DSP 可实现更好的杂讯抑制和更清晰的雷达影像,从而提高目标侦测、追踪和识别能力。这对于确保安全航行和避免碰撞起着重要作用。

现代船用雷达也越来越多地与自动识别系统(AIS)整合。AIS 提供附近船隻的即时讯息,大大提高船员的态势感知能力并防止潜在的碰撞。

创新不仅限于雷达的内部结构。天线设计的进步(例如相控阵和电子扫瞄阵列)透过提供卓越的分辨率、更快的目标捕获和更准确的追踪来提高雷达性能。

最后,人工智慧 (AI) 和机器学习 (ML) 的整合正在进一步突破界限。这些技术用于在雷达系统内自动进行目标侦测、分类和追踪。这不仅提高了机组人员的决策能力,还减少了操作员的认知负担,使他能够专注于其他重要任务。

海洋雷达市场的关键驱动因素

海洋雷达市场是由多种因素共同决定的。主要驱动力是始终存在的安全导航和避免碰撞的需求。雷达充当船舶的眼睛,探测其他船隻、障碍物,甚至天气模式,从而实现安全高效的海上作业。

此外,严格的国际法规也扮演着重要角色。国际海事组织 (IMO) 和其他监管机构要求某些类别的船舶使用雷达系统。满足这些监管要求需要投资先进的雷达技术。

技术进步也是重要的推手。固态雷达、改进的讯号处理以及与其他海事系统整合等领域的持续技术创新提高了雷达的性能和可靠性。这些进步使雷达对船舶营运商更具吸引力,进一步推动市场成长。

海盗、走私和非法捕鱼等海上安全问题也扮演了重要角色。为了有效应对这些威胁,先进的监视雷达系统至关重要。增强的雷达功能能够及时发现安全威胁并快速回应。

最后,航运公司和海军的船队现代化努力正在创造对尖端雷达系统的需求。更新至更新、功能更强大的雷达技术将确保您的船舶配备最佳的导航、安全和整体营运效率工具。

海洋雷达市场的区域趋势

全球海洋雷达市场呈现显着的区域差异。北美因其先进雷达技术的高采用率而脱颖而出。这是由对商业海事部门和美国海军的大量投资推动的,美国海军是用于导航和防御目的的先进雷达系统的主要用户。

欧洲正在展现一种独特的运动。该地区是Thales、BAE Systems、Saab等主要海洋雷达製造商的所在地。严格的安全法规和高标准也是欧洲市场的特点,推动了对高性能商用和海军雷达系统的需求。

由于商业航运和海军能力的迅速扩张,亚太地区正在经历快速成长。中国、日本和韩国等国家正大力投资雷达技术,以加强其海洋工业并加强区域安全。

中东也是一个重要的细分市场,阿联酋和沙乌地阿拉伯等国家大力投资先进雷达系统。该地区航运和海防的战略重要性推动了这种集中。这些国家正积极采用尖端雷达技术来增强海上安全态势和作战能力。

拉丁美洲和非洲是海洋雷达系统的新兴市场。儘管采用水准普遍低于其他地区,但对改善海上安全和保障的兴趣正在增长。国际合作和投资在将先进雷达技术引入这些地区方面发挥关键作用,为未来市场成长铺平了道路。

海洋雷达市场的重点项目

- 1. CEA Technologies:总部位于坎培拉的CEA Technologies获得了一份价值数百万美元的国防雷达合约。总部位于坎培拉的 CEA Technologies 获得了一份价值数百万美元的国防合同,用于开发新型、最先进的雷达。作为综合空战管理系统的一部分,CEA Technologies 的任务是生产四种全新的防空雷达系统。这个新的国防项目将获得 27 亿美元的资金,这些资金将分配给各个国防承包商,其中最新的是 CEA Technologies。CEA Technologies 的雷达用于多种澳洲皇家海军舰艇。这项投资将使这家总部位于坎培拉的公司除了海洋雷达之外还能够开发全新的国防地面雷达。

- 2. BAE Systems:该公司已同意为巴西海军旗舰多用途航空母舰NAM Atlantico上的ARTISAN雷达提供五年支援。这份新合约将为部署在 NAM Atlantico 上的 BAE Systems 的 ARTISAN 雷达和相关 DNA2 作战管理系统 (CMS) 提供生命週期支持,确保旗舰产品具有一流的运作可用性。ARTISAN 雷达合约将提供矫正性和预防性维护,以及由 BAE Systems 在英国製造并储存在巴西的备用零件。我们也提供帮助台服务,为我们从英国到巴西的团队提供支援。NAM Atlantico 使用 ARTISAN 海军监视雷达进行地面和空中监视以及空中交通管制。

- 3.韩国:该国即将完成可同时辨识多个目标的AESA(主动电子扫瞄阵列)雷达。目前正在测试的国产化AESA雷达预计将显着提高韩国军方,特别是韩国海军的侦测能力。将于2024年交付韩国海军的首艘未来蔚山级护卫舰(FFX Batch III)将配备AESA雷达。Hanwha Systems的新型雷达将增强防空和反舰作战能力。在武器装备和尺寸方面,蔚山级FFX第三批驱逐舰将与已服役的广开托级(也称为KDX I)驱逐舰相当。除了FFX之外,下一代驱逐舰KDDX还将配备Hanwha Systems的AESA雷达。由于整合桅桿每侧都有四个相控阵,因此可以同时侦测和监控多达 4,000 个目标。

本报告分析了全球海洋雷达市场,研究了整体市场规模的趋势、依地区和国家划分的详细趋势、关键技术概述和市场机会。

目录

海洋雷达市场:分析定义

船用雷达市场细分

- 依类型

- 依地区

海洋雷达市场分析:未来10年

船用雷达市场的市场技术

全球海洋雷达市场预测

海洋雷达市场:依地区划分的趋势和预测

- 北美

- 促进/抑制因素和课题

- PEST分析

- 市场预测与情境分析

- 大公司

- 供应商层级状况

- 企业标竿管理

- 欧洲

- 中东

- 亚太地区

- 南美洲

海洋雷达市场:国家分析

- 美国

- 防御计划

- 最新趋势

- 专利

- 该市场目前的技术成熟度水平

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳大利亚

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

海洋雷达市场:机会矩阵

海洋雷达市场:专家观点

结论

关于航空和国防市场报告

The global Ship Radar market is estimated at USD 2.24 billion in 2024, projected to grow to USD 2.80 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 2.27% over the forecast period 2024-2034.

Introduction to Ship Radar Market

The ship radar market is a critical segment of the maritime industry, encompassing the development, production, and deployment of radar systems used for navigation, collision avoidance, weather monitoring, and security. These systems are essential for the safe and efficient operation of vessels, from small boats to large commercial ships and naval fleets. The market includes a range of radar types, such as X-band and S-band radars, each with specific applications based on their frequency and operational characteristics. With the increasing complexity of maritime operations and the growing emphasis on safety and security, the ship radar market is poised for significant growth and innovation.

Technology Impact in Ship Radar Market

The ship radar market is undergoing a significant transformation driven by cutting-edge technological advancements. These advancements are leading to a new generation of radar systems with enhanced capabilities and a wider range of applications.

One key driver is the shift from magnetron-based technology to solid-state radars. This transition brings several advantages, including improved reliability, reduced maintenance requirements, and enhanced performance. Solid-state radars boast superior resolution and longer operational lifespans, making them a reliable choice for modern maritime navigation.

Furthermore, advancements in Digital Signal Processing (DSP) are significantly improving radar performance. DSP allows for better noise reduction and clearer radar images, leading to improved target detection, tracking, and identification capabilities. This plays a crucial role in ensuring safe navigation and collision avoidance.

Modern ship radars are also witnessing a rise in integration with Automatic Identification Systems (AIS). AIS provides real-time information about nearby vessels, significantly enhancing situational awareness for crews and preventing potential collisions.

Innovation is not limited to the internal workings of radars. Advancements in antenna design, such as phased array and electronically scanned arrays, are improving radar performance by offering superior resolution, faster target acquisition, and more precise tracking.

Finally, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is pushing the boundaries even further. These technologies are being employed to automate target detection, classification, and tracking within radar systems. This not only enhances decision-making capabilities for crews but also reduces the cognitive load on operators, allowing them to focus on other critical tasks.

Key Drivers in Ship Radar Market

The ship radar market is fueled by a confluence of factors. The primary driver remains the ever-present need for safe navigation and collision avoidance. Radars serve as the eyes of a ship, detecting other vessels, obstacles, and even weather patterns, enabling safe and efficient maritime operations.

Furthermore, stringent international regulations play a significant role. The International Maritime Organization (IMO) and other regulatory bodies mandate the use of radar systems for specific vessel classes. Meeting these regulatory requirements necessitates investment in advanced radar technology.

Technological advancements are another key driver. Continuous innovation in areas like solid-state radars, improved signal processing, and integration with other maritime systems enhances radar performance and reliability. These advancements make radars more attractive to ship operators, further propelling market growth.

Concerns over maritime security, including piracy, smuggling, and illegal fishing, also contribute significantly. To effectively counter these threats, advanced radar systems are crucial for surveillance and monitoring purposes. Enhanced radar capabilities allow for the timely detection of security threats, enabling a swift response.

Finally, fleet modernization efforts by shipping companies and naval forces create a demand for cutting-edge radar systems. Upgrading to newer, more capable radar technologies ensures that vessels are equipped with the best tools for navigation, safety, and overall operational efficiency.

Regional Trends in Ship Radar Market

The global ship radar market exhibits significant regional variations. North America stands out for its high adoption rate of advanced radar technologies. This is fueled by substantial investments in both the commercial maritime sector and the U.S. Navy, a major user of sophisticated radar systems for navigation and defense purposes.

Europe presents a unique dynamic. The region boasts some of the leading ship radar manufacturers, including Thales, BAE Systems, and Saab. Stringent safety regulations and high standards also characterize the European market, driving demand for high-performance radar systems across commercial and naval applications.

The Asia-Pacific region is experiencing a growth surge, fueled by the rapid expansion of both commercial shipping and naval capabilities. Countries like China, Japan, and South Korea are making significant investments in radar technologies to bolster their maritime industries and enhance regional security.

The Middle East is another important market segment, with countries like the UAE and Saudi Arabia investing heavily in advanced radar systems. This focus is driven by the strategic importance of shipping and naval defense in the region. These countries are actively adopting cutting-edge radar technologies to elevate their maritime security posture and operational capabilities.

Latin America and Africa represent emerging markets for ship radar systems. While adoption levels are generally lower compared to other regions, there is a growing interest in improving maritime safety and security. International partnerships and investments are playing a crucial role in introducing advanced radar technologies to these regions, paving the way for future market growth.

Key Ship Radar Market Programs

1.CEA Technologies: CEA Technologies, based in Canberra, has been awarded a multi-million dollar defence radar contract. CEA Technologies, situated in Canberra, has been given a multi-million dollar defence contract to develop fresh new cutting-edge radars. As part of the Joint Air Battle Management System, CEA Technologies has been tasked to manufacture four brand new air defence radar systems. This new defence project involves $2.7 billion in funding, which will be distributed among a number of different defence contractors, the most current of which being CEA Technologies. CEA Technologies radars are used on various Australian navy ships. This investment will enable the Canberra-based company to create completely new ground-based radars for defence in addition to its ship-based radars.

2.BAE Systems: BAE Systems has agreed to support its ARTISAN Radar on the Brazilian Navy's flagship, the multipurpose aircraft carrier NAM Atlantico, for five years. The new contract will provide life-cycle support for the BAE Systems ARTISAN Radar and related DNA2 Combat Management System (CMS) deployed on the NAM Atlantico, ensuring the flagship has class-leading operational availability. The ARTISAN Radar component of the deal will provide corrective and preventative maintenance, as well as spare components made by BAE Systems in the UK and stored in Brazil. It will also provide a help-desk service that will be run remotely from the United Kingdom to assist the team in Brazil. NAM Atlantico will use the ARTISAN naval surveillance radar for surface and air surveillance, as well as air traffic control.

3. South Korea: South Korea is nearing completion of the AESA (Active Electronically Scanned Array) radar, which can identify several targets at the same time. The localised AESA radar, which is now being tested, is projected to significantly increase the detection capabilities of Korean armed forces, particularly the ROK Navy. The future Ulsan-class frigates (FFX Batch III), the first of which will be delivered to the ROK Navy in 2024, will be equipped with the AESA radar. Hanwha Systems' new radar will enhance anti-air and anti-ship operating capabilities. In terms of weaponry and size, the Ulsan-class FFX Batch III destroyers will be equal to the Gwanggaeto the Great-class (also known as KDX I) destroyers already in service. In addition to the FFX, the next-generation Korean destroyers, designated as KDDX, will be equipped with Hanwha Systems' AESA radar. Thanks to the four phased arrays on each side of their integrated mast, they will be able to detect and monitor up to 4,000 targets at the same time.

Table of Contents

Ship Radar Market Report Definition

Ship Radar Market Segmentation

By Type

By Region

Ship Radar Market Analysis for next 10 Years

The 10-year ship radar market analysis would give a detailed overview of ship radar market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Ship Radar Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Ship Radar Market Forecast

The 10-year ship radar market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Ship Radar Market Trends & Forecast

The regional ship radar market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Ship Radar Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Ship Radar Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Ship Radar Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Type, 2022-2032

- Table 19: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 20: Scenario Analysis, Scenario 2, By Type, 2022-2032

List of Figures

- Figure 1: Global Ship Radar Market Forecast, 2022-2032

- Figure 2: Global Ship Radar Market Forecast, By Region, 2022-2032

- Figure 3: Global Ship Radar Market Forecast, By Type, 2022-2032

- Figure 4: North America, Ship Radar Market, Market Forecast, 2022-2032

- Figure 5: Europe, Ship Radar Market, Market Forecast, 2022-2032

- Figure 6: Middle East, Ship Radar Market, Market Forecast, 2022-2032

- Figure 7: APAC, Ship Radar Market, Market Forecast, 2022-2032

- Figure 8: South America, Ship Radar Market, Market Forecast, 2022-2032

- Figure 9: United States, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 10: United States, Ship Radar Market, Market Forecast, 2022-2032

- Figure 11: Canada, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 12: Canada, Ship Radar Market, Market Forecast, 2022-2032

- Figure 13: Italy, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 14: Italy, Ship Radar Market, Market Forecast, 2022-2032

- Figure 15: France, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 16: France, Ship Radar Market, Market Forecast, 2022-2032

- Figure 17: Germany, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 18: Germany, Ship Radar Market, Market Forecast, 2022-2032

- Figure 19: Netherlands, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 20: Netherlands, Ship Radar Market, Market Forecast, 2022-2032

- Figure 21: Belgium, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 22: Belgium, Ship Radar Market, Market Forecast, 2022-2032

- Figure 23: Spain, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 24: Spain, Ship Radar Market, Market Forecast, 2022-2032

- Figure 25: Sweden, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 26: Sweden, Ship Radar Market, Market Forecast, 2022-2032

- Figure 27: Brazil, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 28: Brazil, Ship Radar Market, Market Forecast, 2022-2032

- Figure 29: Australia, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 30: Australia, Ship Radar Market, Market Forecast, 2022-2032

- Figure 31: India, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 32: India, Ship Radar Market, Market Forecast, 2022-2032

- Figure 33: China, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 34: China, Ship Radar Market, Market Forecast, 2022-2032

- Figure 35: Saudi Arabia, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 36: Saudi Arabia, Ship Radar Market, Market Forecast, 2022-2032

- Figure 37: South Korea, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 38: South Korea, Ship Radar Market, Market Forecast, 2022-2032

- Figure 39: Japan, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 40: Japan, Ship Radar Market, Market Forecast, 2022-2032

- Figure 41: Malaysia, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 42: Malaysia, Ship Radar Market, Market Forecast, 2022-2032

- Figure 43: Singapore, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 44: Singapore, Ship Radar Market, Market Forecast, 2022-2032

- Figure 45: United Kingdom, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 46: United Kingdom, Ship Radar Market, Market Forecast, 2022-2032

- Figure 47: Opportunity Analysis, Ship Radar Market, By Region (Cumulative Market), 2022-2032

- Figure 48: Opportunity Analysis, Ship Radar Market, By Region (CAGR), 2022-2032

- Figure 49: Opportunity Analysis, Ship Radar Market, By Type (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Ship Radar Market, By Type (CAGR), 2022-2032

- Figure 51: Scenario Analysis, Ship Radar Market, Cumulative Market, 2022-2032

- Figure 52: Scenario Analysis, Ship Radar Market, Global Market, 2022-2032

- Figure 53: Scenario 1, Ship Radar Market, Total Market, 2022-2032

- Figure 54: Scenario 1, Ship Radar Market, By Region, 2022-2032

- Figure 55: Scenario 1, Ship Radar Market, By Type, 2022-2032

- Figure 56: Scenario 2, Ship Radar Market, Total Market, 2022-2032

- Figure 57: Scenario 2, Ship Radar Market, By Region, 2022-2032

- Figure 58: Scenario 2, Ship Radar Market, By Type, 2022-2032

- Figure 59: Company Benchmark, Ship Radar Market, 2022-2032