|

市场调查报告书

商品编码

1486767

全球海军弹药市场(2024-2034)Global Naval Ammunition Market 2024-2034 |

||||||

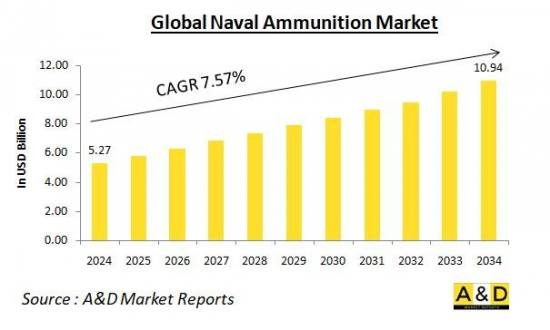

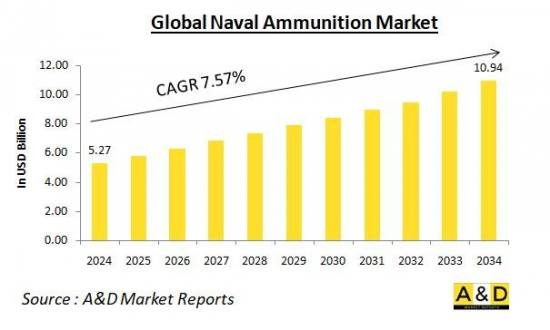

全球海军弹药市场估计为52.7亿美元,预计到2034年将达到109.4亿美元,2024年至2034年的复合年增长率(CAGR)为7.57%。

海军弹药市场概况

海军弹药市场包括海战弹药的开发、生产和供应。这个市场包括鱼雷、水雷、深水炸弹、炮弹和飞弹等广泛的产品,这些产品对海军部队的战备状态和战斗力至关重要。这些弹药对于确保海岸防御、维持海军优势以及向国际水域投射力量至关重要。

海军弹药必须能够承受恶劣的海洋环境并满足严格的标准,以确保可靠性、准确性和杀伤力。海军武库现代化、应对不断变化的海上威胁和保持战略优势的持续需求推动了市场的发展。技术创新、不断变化的地缘政治格局以及不断增加的全球国防预算是影响该市场的关键因素。

技术对海军弹药市场的影响

技术进步极大地影响了海军弹药市场,提高了其能力、有效性和安全性。一项重要的发展是精确导引弹药(PGM)的兴起,它透过高精度打击目标而彻底改变了海战。这些技术结合了 GPS、惯性导航系统和雷射导引,减少了附带损害,提高了任务成功率,并使导引飞弹和高性能鱼雷更加有效。

另一个变革性的进步是将自主和无人系统整合到海军弹药中。配备自主技术的智慧鱼雷和海军无人机可以独立运行,执行复杂的机动,并以最少的人为干预捕获目标。这提高了作战效率,降低了人员风险,并显着增强了海军作战能力。

固体燃料发动机和冲压喷射发动机等推进技术的创新也正在影响海军弹药市场。这些先进的推进系统增加了海军弹药的射程和速度,减少了交战时间并允许在更远的距离上攻击目标。这些能力增强了海军的战略影响力和有效性。

此外,材料科学和小型化的进步促进了更轻、更耐用、更有效率的海军弹药的发展。小型化组件使得弹药更加紧凑和多功能,使船隻能够携带更大、更多样化的武器,而不会影响空间或重量限制。

最后,随着海军弹药变得更加复杂和网路化,确保网路安全变得至关重要。防御电子战、骇客攻击和干扰的技术对于维持现代海军弹药的完整性和功能至关重要。强大的网路安全措施对于保护这些先进系统免受新兴电子战威胁至关重要。

海军弹药市场的主要驱动因素

有几个主要因素正在推动海军弹药市场的成长和发展。地缘政治紧张局势和海上衝突的加剧,特别是在南海和北极圈等地区,正在推动对先进海军弹药的需求。各国正在投资建设海军能力现代化,以确保海洋利益并维护区域稳定。

国防现代化计划也是一个重要的推动力。许多国家正在大规模努力更新老化的海军武库并采用尖端技术。这些现代化努力显着增加了对新型先进海军弹药的需求。持续的技术进步也发挥着重要作用。人工智慧、机器人技术和先进材料的整合使得能够开发出更复杂、更有效率、更有效的海军弹药,推动市场的创新和采用。

国防预算的增加进一步支持了这种成长。世界各国政府都将很大一部分国防预算用于加强国家安全和应对新出现的威胁,其中重点关注海军能力,包括先进弹药的采购。此外,战略日益转向沿海战争,需要专为浅水和狭窄水域作战而设计的弹药。这种转变正在推动能够在这些环境中有效运作的特种海军弹药的开发和采购。

海军弹药市场的区域趋势

受地缘政治动态、防御战略和技术能力的影响,海军弹药市场呈现明显的区域趋势。在北美,市场由美国主导,美国正在大力投资先进海军技术和现代化项目。美国海军对维持海上优势的关注推动了对尖端海军弹药的持续需求。该地区与主要国防公司的合作以及持续的研发工作是显而易见的。

在中东和非洲,海军弹药市场受到持续衝突、海盗和海岸防御需求的影响。该地区国家正在采购先进弹药,以增强海军能力并确保海上安全。与全球国防承包商合作以获得最新技术是很常见的。

海军弹药市场的重点项目

- 1. 西班牙:西班牙武装部队已向 i Rheinmetal Denel Munition 授予了一份提供 40 毫米弹药的框架合约。本合约有效期限为4年。该合约将为训练和战斗提供40毫米×53高速弹药。我们已经收到了 100 万欧元以下的初步询问。西班牙已要求提供 40 毫米 x 53 口径高爆 (HE) 和高爆两用 (HEDP) 训练弹药(有或没有曳光弹)。该弹药设计用于 Mk19 和 SB-40 LAG 榴弹机枪。陆军和海军使用这些。

- 2.荷兰:2018年4月,荷兰政府批准了荷兰皇家海军多年投资计划,并在2018年至2030年期间拨款现金。目前在荷兰皇家海军服役的两艘多用途 M 护卫舰即将于 2018/2023 年完成其设计使用寿命。新型护卫舰预计将承担通用任务,重点是反潜战。不过,由于荷兰海军总共只有六艘护卫舰,因此新舰预计将展现出较高的综合能力。这需要配备配备标准飞弹 2 或 ESSM 投射装置的 VLS(垂直发射)单元形式的防空设备。然而,由于预算限制,更新计画已被推迟,首批船舶预计将于2028-29年交付。

- 3.新加坡:新加坡海军的强大级护卫舰将为下一代新加坡武装部队(SAF)进行翻新,预计于2040年完工。中年改造不仅仅是外观上的改变。更新后,护卫舰的作战能力将得到增强,包括改进的作战管理和通讯系统、现代化的武器系统以及改进的维护程序。该护卫舰于2007年入列,是海上攻击、防空反潜的重要作战平台。未来的新加坡武装部队可能拥有更多的无人能力。到 2040 年,它们可能会变得更加敏捷,能够进行更快、更强大的攻击。

本报告分析了全球海军弹药市场,研究了整体市场规模的前景、依地区和国家划分的详细趋势、关键技术概述和市场机会。

目录

海军弹药市场:定义

海军弹药市场细分

- 依类型

- 依技术

- 依地区

- 依口径

海军弹药市场分析:未来 10 年

海军弹药市场技术

全球海军弹药市场预测

海军弹药市场:依地区划分的趋势和预测

- 北美

- 促进/抑制因素和课题

- PEST分析

- 市场预测与情境分析

- 大公司

- 供应商层级状况

- 企业标竿管理

- 欧洲

- 中东

- 亚太地区

- 南美洲

海军弹药市场:国家分析

- 美国

- 防御计划

- 最新趋势

- 专利

- 该市场目前的技术成熟度水平

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳大利亚

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

海军弹药市场:机会矩阵

海军弹药市场:专家观点

结论

关于航空和国防市场报告

The global Naval Ammunition market is estimated at USD 5.27 billion, projected to grow to USD 10.94 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 7.57% over the forecast period 2024-2034.

Introduction to the Naval Ammunition Market

The naval ammunition market encompasses the development, production, and supply of munitions designed for naval warfare. This market includes a wide range of products such as torpedoes, naval mines, depth charges, naval artillery shells, and guided missiles, which are crucial for the operational readiness and combat effectiveness of naval forces. These munitions are vital for ensuring coastal defense, maintaining naval superiority, and projecting power across international waters.

Naval ammunition must meet stringent standards to withstand the harsh maritime environment and ensure reliability, precision, and lethality. The market is driven by the ongoing need to modernize naval arsenals, address evolving maritime threats, and maintain strategic advantages. Innovations in technology, evolving geopolitical landscapes, and increasing defense budgets worldwide are significant factors influencing this market.

Technology Impact in Naval Ammunition Market

Technological advancements are profoundly shaping the naval ammunition market, enhancing the capabilities, effectiveness, and safety of naval munitions. One significant development is the rise of precision-guided munitions (PGMs), which have revolutionized naval warfare by enabling munitions to strike targets with high accuracy. These technologies, incorporating GPS, inertial navigation systems, and laser guidance, reduce collateral damage and improve mission success rates, making guided missiles and advanced torpedoes far more effective.

Another transformative advancement is the integration of autonomous and unmanned systems in naval munitions. Smart torpedoes and naval drones equipped with autonomous technologies can operate independently, perform complex maneuvers, and engage targets with minimal human intervention. This increases operational efficiency and reduces risks to personnel, significantly enhancing naval operations.

Innovations in propulsion technology, such as solid fuel and ramjet engines, are also impacting the naval ammunition market. These advanced propulsion systems improve the range and speed of naval munitions, allowing for faster engagement times and the ability to strike targets at greater distances. Such capabilities enhance the strategic reach and effectiveness of naval forces.

Additionally, advancements in materials science and miniaturization are leading to the development of lighter, more durable, and more efficient naval munitions. Miniaturized components result in more compact and versatile munitions, enabling naval vessels to carry larger and more diverse arsenals without compromising space or weight limitations.

Finally, as naval munitions become more advanced and networked, ensuring their cybersecurity is crucial. Technologies to protect against electronic warfare, hacking, and jamming are essential to maintaining the integrity and functionality of modern naval munitions. Robust cybersecurity measures are paramount to safeguarding these sophisticated systems against emerging threats in electronic warfare.

Key Drivers in the Naval Ammunition Market

Several key drivers are propelling the growth and development of the naval ammunition market. Rising geopolitical tensions and maritime disputes, particularly in regions like the South China Sea and the Arctic, are driving the demand for advanced naval ammunition. Nations are investing in modernizing their naval capabilities to secure maritime interests and maintain regional stability.

Defense modernization programs are another significant driver. Many countries are undertaking extensive initiatives to replace aging naval arsenals and incorporate cutting-edge technologies. These modernization efforts are significantly boosting the demand for new and advanced naval munitions. Continuous technological advancements also play a crucial role. The integration of AI, robotics, and advanced materials is enabling the development of more sophisticated, efficient, and effective naval munitions, driving innovation and adoption in the market.

Increasing defense budgets further support this growth. Governments worldwide are allocating substantial portions of their defense budgets to enhance national security and address emerging threats, with a significant focus on naval capabilities, including the procurement of advanced munitions. Additionally, there is a strategic shift towards littoral (coastal) warfare, necessitating munitions designed for operations in shallow and confined waters. This shift drives the development and procurement of specialized naval ammunition that can operate effectively in these environments.

Regional Trends in the Naval Ammunition Market

The naval ammunition market exhibits distinct regional trends, influenced by geopolitical dynamics, defense strategies, and technological capabilities. In North America, the market is led by the United States, characterized by substantial investments in advanced naval technologies and modernization programs. The U.S. Navy's focus on maintaining maritime superiority drives continuous demand for cutting-edge naval munitions. Collaboration with leading defense contractors and ongoing R&D efforts are prominent in this region.

In the Middle East and Africa, the naval ammunition market is influenced by ongoing conflicts, piracy, and the need for coastal defense. Nations in this region are procuring advanced munitions to bolster their naval capabilities and ensure maritime security. Partnerships with global defense contractors are common to acquire the latest technologies.

Key Naval Ammunition Market Programs

Several significant programs and initiatives are shaping the naval ammunition market:

1. Spain : the Spanish Armed Forces have awarded a framework contract to i Rheinmetall Denel Munition for the delivery of 40mm ammunition. The agreement is valid for four years. It provides for the provision of high-velocity 40mm x 53 ammunition for both training and warfare. There has already been a first call-off in the low one million euro level. Spain has now requested a delivery of training ammunition with and without a tracer in the 40mm x 53 high explosive (HE) and high explosive dual purpose (HEDP) calibres. It is designed to work with the Mk 19 and SB-40 LAG grenade machine guns. The Army and Navy make use of these.

2. Netherlands: The Dutch government authorised a multi-year investment programme for the Dutch Navy in April 2018, allocating cash for the years 2018-2030. The two versatile M-frigates still in service with the Royal Netherlands Navy are nearing the end of their design life, which was set for 2018/2023. The new frigates is expected to serve in a general-purpose capacity with an emphasis on anti-submarine warfare. However, because the Netherlands Royal Navy only has six frigates in total, the new ships are expected to be capable of performing well across the board. This necessitates the presence of anti-air equipment in the form of VLS (vertical launch) cells armed with Standard Missile 2 or ESSM projectiles. Although, the replacement programme has been delayed due to budget restrictions, and the first ships are expected to be delivered in 2028-29.

3. Singapore: The Formidable-class frigates of the Republic of Singapore Navy are expected to be modified for the next generation of Singapore Armed Forces (SAF), which is expected to be completed by 2040. The mid-life makeover will be more than a cosmetic change. The frigates' combat capabilities will improve as a result of the upgrade, which includes improved combat management and communications systems, modernised weapon systems, and improved maintenance procedures. The ships, which were commissioned in 2007, are significant fighting platforms for maritime attacks, anti-air, and anti-submarine warfare. The SAF of the future will have more unmanned capabilities. The army will be more maneuverable and capable of striking faster and harder by 2040.

Table of Contents

Naval Ammunition Market Report Definition

Naval Ammunition Market Segmentation

By Type

By Technology

By Region

By Caliber

Naval Ammunition Market Analysis for next 10 Years

The 10-year naval ammunition market analysis would give a detailed overview of naval ammunition market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Naval Ammunition Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Naval Ammunition Market Forecast

The 10-year naval ammunition market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Naval Ammunition Market Trends & Forecast

The regional naval ammunition market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Naval Ammunition Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Naval Ammunition Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Naval Ammunition Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Type, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Caliber, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Type, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Caliber, 2022-2032

List of Figures

- Figure 1: Global Naval Ammunition Market Forecast, 2022-2032

- Figure 2: Global Naval Ammunition Market Forecast, By Region, 2022-2032

- Figure 3: Global Naval Ammunition Market Forecast, By Type, 2022-2032

- Figure 4: Global Naval Ammunition Market Forecast, By Technology, 2022-2032

- Figure 5: Global Naval Ammunition Market Forecast, By Caliber, 2022-2032

- Figure 6: North America, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 7: Europe, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 8: Middle East, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 9: APAC, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 10: South America, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 11: United States, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 12: United States, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 13: Canada, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 14: Canada, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 15: Italy, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 16: Italy, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 17: France, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 18: France, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 19: Germany, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 20: Germany, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 21: Netherlands, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 23: Belgium, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 24: Belgium, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 25: Spain, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 26: Spain, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 27: Sweden, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 28: Sweden, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 29: Brazil, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 30: Brazil, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 31: Australia, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 32: Australia, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 33: India, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 34: India, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 35: China, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 36: China, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 39: South Korea, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 40: South Korea, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 41: Japan, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 42: Japan, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 43: Malaysia, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 45: Singapore, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 46: Singapore, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Naval Ammunition Market, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Naval Ammunition Market, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Naval Ammunition Market, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Naval Ammunition Market, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Naval Ammunition Market, By Type (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Naval Ammunition Market, By Type (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Naval Ammunition Market, By Technology (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Naval Ammunition Market, By Technology (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Naval Ammunition Market, By Caliber (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Naval Ammunition Market, By Caliber (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Naval Ammunition Market, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Naval Ammunition Market, Global Market, 2022-2032

- Figure 59: Scenario 1, Naval Ammunition Market, Total Market, 2022-2032

- Figure 60: Scenario 1, Naval Ammunition Market, By Region, 2022-2032

- Figure 61: Scenario 1, Naval Ammunition Market, By Type, 2022-2032

- Figure 62: Scenario 1, Naval Ammunition Market, By Technology, 2022-2032

- Figure 63: Scenario 1, Naval Ammunition Market, By Caliber, 2022-2032

- Figure 64: Scenario 2, Naval Ammunition Market, Total Market, 2022-2032

- Figure 65: Scenario 2, Naval Ammunition Market, By Region, 2022-2032

- Figure 66: Scenario 2, Naval Ammunition Market, By Type, 2022-2032

- Figure 67: Scenario 2, Naval Ammunition Market, By Technology, 2022-2032

- Figure 68: Scenario 2, Naval Ammunition Market, By Caliber, 2022-2032

- Figure 69: Company Benchmark, Naval Ammunition Market, 2022-2032