|

市场调查报告书

商品编码

1508614

防空·飞弹防御的全球市场 (2024~2034年)Global Air and Missile Defense Market 2024-2034 |

||||||

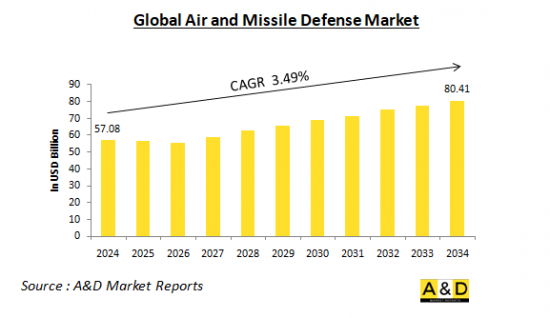

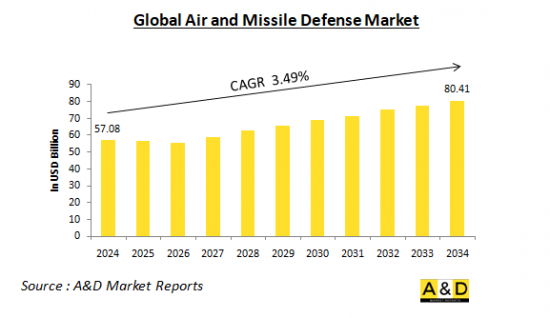

2024年全球防空与飞弹防御市场将达570.8亿美元,2034年将达到804.1亿美元,复合年增长率为3.49%(年均预计将以

全球防空与飞弹防御市场概况

防空和飞弹防御市场是指涉及防御飞机、飞弹和无人机等空中威胁的系统的设计、开发、生产和维护的全球产业。这些系统利用雷达、飞弹拦截器、命令和控制 (C2) 以及其他技术的组合来侦测、追踪和消除传入的威胁。对先进和综合防空能力的需求是推动市场成长的主要趋势。

科技对全球防空与飞弹防御市场的影响

技术进步是塑造防空和飞弹防御市场的关键因素。雷达感测器资料处理技术的创新正在使防空系统能力更强、整合度更高。主要技术发展包括雷达的进步。例如从单波段雷达转向双波段雷达以增强探测和追踪能力,采用AESA(主动电子扫描阵列)雷达以提高性能,以及具有先进目标识别能力的LRDR(远程识别雷达)系统开发,ETC。感测器整合的进步包括融合多个感测器(雷达、光电、红外线)的数据以实现全面的态势感知,以及整合反无人机感测器以检测和消除小型无人机威胁。武器系统的改进,包括飞弹拦截能力,包括增加射程、速度和机动性,以及用于非动能防御的定向能和电磁武器的集成,也是重要的技术影响。指挥和控制方面的进步,例如改进的战斗管理和协调多域作战的指挥和控制系统,以及采用 "网路中心战" 概念进行即时资料共享和决策,正在从飞机和它进一步使防空系统能够更好地侦测、追踪和打击从无人机到高超音速武器等更广泛的空中威胁。

全球防空与飞弹防御市场的主要驱动因素

由于几个关键驱动因素,全球防空和飞弹防御市场正在经历快速成长。一个重要因素是世界各地军事开支的增加,特别是亚太和中东等地区。这些预算的增加促使了新的采购工作,各国正在透过采购先进系统来加强其防空能力。此外,现有系统正在更新,以确保它们能够有效应对不断变化的威胁。

现代化努力在市场成长中扮演另一个重要角色。各国正积极以更先进、整合的系统取代老化的防空装备。这些新系统将提供更强大的功能,使我们能够应对 2030 年及以后不断变化的航空威胁。对现代化的关注确保各国拥有强大且现代化的防空解决方案。

世界各地的地缘政治紧张局势也推动了对更强大的防空系统的需求。随着区域衝突对抗加剧,特别是台海、朝鲜半岛、中东等地区,需要强大的防空能力。这些地区的国家正在优先投资防空,以阻止潜在的攻击并保护关键基础设施。

空中威胁的扩散进一步推动了市场的成长。先进飞机、飞弹和无人机 (UAS) 的激增需要多层防空解决方案。各国需要组合系统来有效应对这些不同的威胁,促使整个防空和飞弹防御市场的需求增加。

技术进步也是推动市场成长的重要因素。雷达技术、感测器、拦截器以及指挥和控制系统的创新正在推动能力更强、更有效的防空系统的发展。这些进步可以实现更早的威胁侦测、改进的追踪能力和更精确的交战,从而形成更强大的防御态势。

最后,市场最新趋势是国内发展备受关注。许多国家都优先考虑国内设计和生产防空和飞弹防御系统。这种自给自足的动力旨在减少对进口系统的依赖,并解决与收购外国平台相关的高成本问题。透过发展自己的能力,各国有可能控製成本并根据其独特的需求和威胁定制防空系统。

全球防空与飞弹防御市场的区域趋势

全球防空反导市场呈现不同的区域趋势,每个区域都有自己的特色和重点。

在美国巨额军费开支的推动下,北美位居榜首。洛克德马丁公司、雷神公司和诺斯罗普格鲁曼公司等大公司处于开发尖端防空和飞弹防御系统的前沿。加拿大也积极升级其防空能力,包括购买爱国者飞弹防御系统。

欧洲有良好的合作体系。德国、法国和英国等国正在集中资源开发下一代防空系统,其中包括雄心勃勃的未来作战空中系统(FCAS)。面对日益严峻的地缘政治形势,东欧国家正在透过增加采购 Patriot 和 IRIS-T 等经过验证的系统来加强防御。

亚太地区正在蓬勃发展,中国、印度、日本和韩国成为主要市场。本土发展是该地区的一个主要焦点,各国都在努力建造专门针对特定地区威胁的防空系统。印度的先进中程空对空飞弹(AMRAAM)和远程地对空飞弹(LR-SAM)计画就是这一趋势的象征。澳洲和日本也积极推动防空能力现代化,包括引进配备宙斯盾的驱逐舰和爱国者飞弹系统。

中东是一个面临持续衝突和弹道飞弹和无人机持续威胁的地区。沙乌地阿拉伯、阿拉伯联合大公国和以色列等国家正大力投资防空系统,以应对这些威胁。以色列的铁穹与大卫吊索系统 因其拦截短程火箭和导弹的有效性而赢得了世界声誉。

拉丁美洲规模虽小,但巴西有一个值得关注的市场。巴西正积极进行现代化建设,获得SAMP/T飞弹防御系统是加强其防空能力的重要一步。这凸显了防空系统在世界不同地区日益增长的重要性。

主要防空与飞弹防御计画

RTX 子公司雷神技术公司 (Raytheon Technologies) 已获得一份价值 12 亿美元的重大合同,为德国提供最新的爱国者防空和飞弹防御系统。爱国者係统是德国、美国、乌克兰等全球19个国家的防空基础设施。爱国者係统是德国、美国、乌克兰等全球19个国家的防空基础设施,其经过实战验证的强大能力不断证明爱国者能够有效应对最先进、最复杂的威胁。爱国者係统经过验证的记录和持续的现代化确保了其保护国家免受不断变化的空中威胁的能力。这份重要合约强调了德国对加强防空能力的承诺以及该国对爱国者体系的信心。它还强调了雷神公司作为先进防空解决方案领先供应商的地位,为寻求保护其领空和人民免受潜在攻击的国家提供服务。爱国者的适应性和持续的技术改进使其成为寻求现代化防空基础设施的国家的首选。随着威胁的不断发展,爱国者係统公司仍然处于防空的最前沿,提供可靠、有效的解决方案来保护我们的国家利益。

美国陆军已授予洛克希德马丁公司一份价值 45 亿美元的多年期合同,用于采购爱国者防空飞弹系统。这份实质合约涵盖生产870枚PAC-3 MSE拦截飞弹及相关设备。西方国家向乌克兰提供的爱国者係统是该国防御俄罗斯持续入侵的关键要素。西方国家向乌克兰提供的爱国者係统是该国防御俄罗斯持续入侵的关键要素。根据美国陆军预算文件,PAC-3 MSE 是爱国者拦截飞弹的最先进版本,每枚成本约为 400 万美元。这份多年合约强调了陆军对维持和现代化防空能力的承诺。爱国者係统能够拦截多种空中威胁,包括弹道飞弹、巡航飞弹和飞机,在陆军整体防御战略中发挥至关重要的作用。

本报告提供全球防空·飞弹防御市场相关分析,提供整体市场规模趋势预测,及各地区·各国详细趋势,主要技术的概要,市场机会等资讯。

目录

防空·飞弹防御市场:报告定义

防空·飞弹防御市场明细

- 各地区

- 各类型

- 各终端用户

防空·飞弹防御市场分析 (今后10年)

防空·飞弹防御市场市场科技

全球防空·飞弹防御市场预测

防空·飞弹防御市场:各地区的趋势与预测

- 北美

- 促进·阻碍因素,课题

- PEST分析

- 市场预测与情势分析

- 主要企业

- 供应商阶层的形势

- 企业的基准

- 欧洲

- 中东

- 亚太地区

- 南美

防空·飞弹防御市场:各国分析

- 美国

- 防卫计划

- 最新趋势

- 专利

- 这个市场上目前技术成熟等级

- 市场预测与情势分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳洲

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

防空·飞弹防御市场:市场机会矩阵

防空·飞弹防御市场:调查相关专家的见解

结论

关于Aviation and Defense Market Reports

The global Air and Missile Defense market is estimated at USD 57.08 billion in 2024, projected to grow to USD 80.41 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 3.49% over the forecast period 2024-2034

Introduction to Air and Missile Defense Market

The air and missile defense market refers to the global industry involved in the design, development, production, and maintenance of systems that protect against airborne threats such as aircraft, missiles, and drones. These systems utilize a combination of radars, interceptors, command and control, and other technologies to detect, track, and neutralize incoming threats. The demand for advanced, integrated air defense capabilities is a major trend driving market growth.

Technology Impact in Air and Missile Defense Market

Technological advancements are a key factor shaping the air and missile defense market. Innovations in radar, sensor, and data processing technologies are enabling more capable and integrated air defense systems. Some key technological impacts include radar advancements, such as the shift from single-band to dual-band radars, providing enhanced detection and tracking capabilities; the adoption of Active Electronically Scanned Array (AESA) radars for improved performance; and the development of Long Range Discrimination Radar (LRDR) systems with advanced target discrimination. Sensor integration advancements include the fusion of data from multiple sensors (radar, electro-optical, infrared) for comprehensive situational awareness and the integration of counter-UAS sensors to detect and neutralize small drone threats. Improvements in weapon systems, such as missile interceptor capabilities, including increased range, speed, and maneuverability, as well as the integration of directed energy weapons and electromagnetic weapons for non-kinetic defense, are also key technological impacts. Advancements in command and control, such as improvements in battle management and command & control systems for coordinated multi-domain operations and the adoption of network-centric warfare concepts for real-time data sharing and decision-making, are further enabling air defense systems to better detect, track, and engage a wider range of airborne threats, from aircraft and missiles to drones and hypersonic weapons.

Key Drivers in Air and Missile Defense Market

The global air and missile defense market is experiencing a surge, fueled by several key drivers. One significant factor is the rise in military spending across the globe, particularly in regions like the Asia-Pacific and the Middle East. These increased budgets translate to new procurement activities, with nations bolstering their air defense capabilities by acquiring advanced systems. Additionally, existing systems are undergoing upgrades to ensure they remain effective against evolving threats.

Modernization efforts play another crucial role in market growth. Countries are actively replacing their aging air defense equipment with more advanced and integrated systems. These newer systems offer greater capabilities, allowing them to address the ever-changing nature of aerial threats beyond 2030. This focus on modernization ensures that nations possess robust and up-to-date air defense solutions.

Geopolitical tensions around the world are also pushing the demand for stronger air defense systems. Heightened regional conflicts and rivalries, particularly in areas like the Taiwan Strait, Korean Peninsula, and the Middle East, necessitate robust air defense capabilities. Nations in these regions are prioritizing investments in air defense to deter potential attacks and protect their critical infrastructure.

The proliferation of aerial threats further drives market growth. The increasing number of advanced aircraft, missiles, and unmanned aerial systems (UAS) necessitates multi-layered air defense solutions. Countries require a combination of systems to effectively counter these diverse threats, leading to increased demand across the air and missile defense market.

Technological advancements are another key factor propelling market growth. Innovations in radar technology, sensors, interceptors, and command and control systems are enabling the development of more capable and effective air defense systems. These advancements allow for earlier threat detection, improved tracking capabilities, and more precise engagement, leading to a more robust defense posture.

Finally, a growing trend in the market is the focus on indigenous development. Many nations are prioritizing the domestic design and production of air and missile defense systems. This push for self-sufficiency aims to reduce reliance on imported systems and address the high costs associated with acquiring foreign platforms. By developing their own capabilities, nations can potentially control costs and tailor their air defense systems to their specific needs and threats.

Regional Trends in Air and Missile Defense Market

The global air and missile defense market showcases distinct regional trends, with each region exhibiting unique characteristics and priorities.

North America reigns supreme, driven by the immense military spending of the United States. Major players like Lockheed Martin, Raytheon, and Northrop Grumman are at the forefront of developing cutting-edge air and missile defense systems. Canada is also actively pursuing upgrades to its air defense capabilities, with the procurement of the Patriot missile defense system a prime example.

Europe presents a picture of collaboration. Countries like Germany, France, and the UK are pooling resources to develop next-generation air defense systems, such as the ambitious Future Combat Air System (FCAS). Eastern European nations, facing a heightened geopolitical climate, are bolstering their defenses through increased procurement of proven systems like the Patriot and IRIS-T.

The Asia-Pacific region is experiencing a boom, with China, India, Japan, and South Korea emerging as major markets. Indigenous development is a key focus in this region, with nations striving to build air defense systems tailored to address specific regional threats. India's Advanced Medium-Range Air-to-Air Missile (AMRAAM) and Long-Range Surface-to-Air Missile (LR-SAM) programs exemplify this trend. Australia and Japan are also actively modernizing their air defense capabilities, acquiring Aegis-equipped destroyers and Patriot missile systems.

The Middle East is a region grappling with ongoing conflicts and the constant threat of ballistic missiles and drones. Countries like Saudi Arabia, the United Arab Emirates, and Israel are investing heavily in air defense systems to counter these threats. Israel's Iron Dome and David's Sling systems have garnered global recognition for their effectiveness in intercepting short-range rockets and missiles.

Latin America, while a smaller player, has a noteworthy market in Brazil. Brazil is actively pursuing modernization efforts, with the acquisition of the SAMP/T missile defense system a key step in bolstering its air defense capabilities. This highlights the growing importance of air defense systems in various regions around the world.

Key Air and Missile Defense Program

Raytheon Technologies, a subsidiary of RTX, has been awarded a substantial $1.2 billion contract to supply Germany with the latest Patriot air and missile defense systems. The contract encompasses the most advanced Patriot Configuration 3+ radars, launchers, command and control stations, as well as necessary spare parts and support services.The Patriot system has become the foundation of air defense for 19 nations worldwide, including Germany, the United States, and Ukraine. Its formidable capabilities, proven in combat, continue to demonstrate the Patriot's effectiveness in countering the most sophisticated and complex threats. The system's proven track record and ongoing modernization ensure its ability to protect nations from evolving aerial threats. This major contract award highlights Germany's commitment to strengthening its air defense capabilities and the country's confidence in the Patriot system. It also underscores Raytheon's position as a leading provider of advanced air defense solutions to nations seeking to safeguard their airspace and populations from potential attacks.The Patriot's adaptability and continuous technological enhancements have made it a preferred choice for nations seeking to modernize their air defense infrastructure. As threats continue to evolve, the Patriot system remains at the forefront of air defense, providing a reliable and effective solution for protecting national interests.

The U.S. Army has awarded Lockheed Martin a multi-year contract valued at $4.5 billion for the procurement of its Patriot air defense missile system. This substantial contract covers the production of 870 PAC-3 MSE interceptor missiles and associated equipment.The Patriot system, which is being supplied by Western nations to Ukraine, is a key component of the country's defense against the ongoing Russian invasion. The PAC-3 MSE is the latest and most advanced version of the Patriot interceptor missiles, with each unit costing approximately $4 million according to U.S. Army budget documents.This multi-year contract underscores the U.S. Army's commitment to maintaining and modernizing its air defense capabilities. The Patriot system, with its ability to intercept a wide range of aerial threats, including ballistic missiles, cruise missiles, and aircraft, plays a crucial role in the Army's overall defense strategy.

Table of Contents

Air and Missile Defense Market Report Definition

Air and Missile Defense Market Segmentation

By Region

By Type

By End User

Air and Missile Defense Market Analysis for next 10 Years

The 10-year air and missile defense market analysis would give a detailed overview of air and missile defense market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Air and Missile Defense Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Air and Missile Defense Market Forecast

The 10-year air and missile defense market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Air and Missile Defense Market Trends & Forecast

The regional air and missile defense market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Air and Missile Defense Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Air and Missile Defense Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Air and Missile Defense Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Type, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By End User, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Type, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By End User, 2024-2034

List of Figures

- Figure 1: Global Air and Missile Defense Market Forecast, 2024-2034

- Figure 2: Global Air and Missile Defense Market Forecast, By Region, 2024-2034

- Figure 3: Global Air and Missile Defense Market Forecast, By Type, 2024-2034

- Figure 4: Global Air and Missile Defense Market Forecast, By End User, 2024-2034

- Figure 5: North America, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 6: Europe, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 8: APAC, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 9: South America, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 10: United States, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 11: United States, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 12: Canada, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 14: Italy, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 16: France, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 17: France, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 18: Germany, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 24: Spain, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 30: Australia, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 32: India, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 33: India, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 34: China, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 35: China, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 40: Japan, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Air and Missile Defense Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Air and Missile Defense Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Air and Missile Defense Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Air and Missile Defense Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Air and Missile Defense Market, By Type (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Air and Missile Defense Market, By Type (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Air and Missile Defense Market, By End User (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Air and Missile Defense Market, By End User (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Air and Missile Defense Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Air and Missile Defense Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Air and Missile Defense Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Air and Missile Defense Market, By Region, 2024-2034

- Figure 58: Scenario 1, Air and Missile Defense Market, By Type, 2024-2034

- Figure 59: Scenario 1, Air and Missile Defense Market, By End User, 2024-2034

- Figure 60: Scenario 2, Air and Missile Defense Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Air and Missile Defense Market, By Region, 2024-2034

- Figure 62: Scenario 2, Air and Missile Defense Market, By Type, 2024-2034

- Figure 63: Scenario 2, Air and Missile Defense Market, By End User, 2024-2034

- Figure 64: Company Benchmark, Air and Missile Defense Market, 2024-2034