|

市场调查报告书

商品编码

1516955

全球军用感测器市场(2024-2034)Global Military Sensors Market 2024-2034 |

||||||

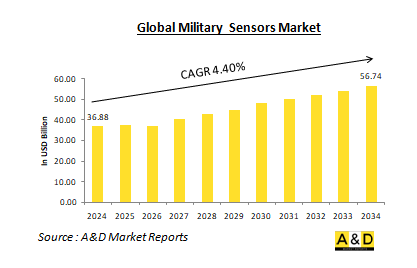

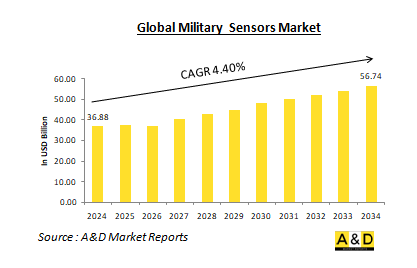

预计2024年全球军用感测器市场规模为368.8亿美元,在预测期内(2024-2034年)复合年增长率(CAGR)为4.40%,到2034年将达到56.7亿美元。

军用感测器市场概况

军事感测器是现代战场态势感知、目标获取和决策的关键组件。这些设备可侦测和测量光、声、热、压力、加速度、磁场和辐射等物理量,并将它们转换成可以处理和分析的电讯号。从无人机 (UAV) 到潜水艇,军用感测器几乎嵌入到每个平台和系统中。

科技对全球军事感测器市场的影响

技术进步彻底改变了军事感测器的功能,实现了前所未有的情报、监视和侦察 (ISR) 水准。这种转变的关键驱动力之一是小型化。对更小、更轻、更节能的感测器的不懈追求促使它们整合到各种平台中,包括可穿戴设备和微型飞行器 (MAV)。这种小型化使得感测器能够部署在以前无法存取的各种环境中,从而提高了操作灵活性和有效性。灵敏度的提升也是一个重要的进步。材料科学和感测器设计的进步带来了更灵敏的感测器,从而能够更早地检测目标和威胁。这种敏感性的提高确保了潜在危险在升级之前就被识别出来,从而使军队在各种情况下都具有决定性的优势。数据融合在军事感测器的进步中也发挥关键作用。结合来自多个感测器和平台的数据的能力极大地提高了态势感知能力。先进的演算法和运算能力有助于融合不同来源的信息,以创建全面、全面的战场图景。这种整体观点对于有效的决策和营运规划至关重要。人工智慧 (AI) 进一步彻底改变了感测器技术。人工智慧驱动的感测器系统可以即时分析大量数据,并识别人类操作员难以检测的模式和异常情况。此功能可加快决策速度,提高目标识别能力,并提高整体任务有效性和营运效率。

军用感测器市场的关键驱动因素

有几个因素正在推动军用感测器的开发和采用。恐怖主义和不对称战争的威胁日益严重,凸显了对能够侦测和追踪隐藏威胁的先进感测器的需求。在这种情况下,先进感测器在识别和消除隐患、提高反恐行动和应对非常规威胁的有效性方面发挥关键作用。对精确打击能力的需求也刺激了感测器技术的进步。具有更高解析度和准确度的感测器对于支援精确打击至关重要。此类先进感测器可以实现更精确的瞄准、减少附带损害并提高军事行动的有效性。

对无人驾驶车辆和机器人等自主系统的日益依赖进一步增加了对先进感测器的需求。自主系统需要先进的感测器来进行导航、避障和目标捕获。这些感测器确保无人平台能够在各种环境下有效、安全地运行,并支援广泛的军事应用。网路安全问题也是影响军事感测器发展的重要因素。保护敏感感测器资料免受网路攻击对于维护感测器系统的完整性和可靠性至关重要。先进的加密和网路安全措施对于保护感测器资料并确保军事行动安全且不间断是必要的。

军用感测器市场区域趋势

军事感测器的开发和部署因地区而异。北美和欧洲处于感测器创新的前沿,受益于成熟的技术以及对无人系统和网路中心战的关注。这些地区开发的先进感测器能力反映了他们在将尖端技术融入军事行动方面的领导地位。在亚太地区,中国和印度等国家的快速经济成长和国防预算的增加正在促使对感测器技术的大量投资。这些国家致力于发展本土感测器能力,以提高应对区域安全课题和加强国防基础设施的能力。安全环境复杂的中东地区对先进感测器的需求不断增长。这项需求是由有效的边境监视、反恐行动和情报收集的需求所驱动的。在该地区部署先进感测器将有助于解决各国多方面的安全问题和作战需求。儘管面临经济课题,俄罗斯仍持续投资感测器技术,特别关注飞弹防御和预警系统。这项投资反映了俄罗斯保持强大防御能力并确保及早发现和应对潜在威胁的战略重点。因此,军事感测器已成为现代战争中必不可少的工具。技术进步的快速发展正在改变战场,使部队能够比以往更快地收集和处理资讯。随着感测器技术的不断发展,毫无疑问感测器将在塑造未来衝突和提高军事效能方面发挥更重要的作用。

主要军事感测器项目

澳洲政府已同意向退伍军人经营的南澳公司Asension支付435万美元,为其提供天基战术感测器系统供国防部使用。该合约是透过国防创新中心 (Defence Innovation Hub)授予的,表明了政府致力于与国防工业合作并利用澳洲各地的创造力来增强国防部的竞争优势,这表明了政府的积极态度。

联合武器合作组织 (OCCAR) 代表比利时和德国与 HENSOLDT Optronics 和 THEON SENSORS 组成的财团签署了双目夜视镜合约修正案。此次合约修改价值数亿美元,将能够向德国军方额外供应 20,000 副 MIKRON 夜视镜,并加快交付时间。新成立的合资企业 HENSOLDT Theon Night Vision 将执行此后续协议。

法国国务院将以约8,800万美元的价格向法国出售最多8个用于MQ-9无人机的通讯情报感测器吊舱系统。据国防安全合作局称,此次潜在的对外军事销售将增加先前与法国政府签订的价值 7,100 万美元的 5 个吊舱套件和相关设备的合约。还要求法国采购消耗品和配件、工程、技术和物流服务、地面处理设备、出版物、技术文件支援、安全通讯和加密设备、软体和支援服务、备件和维修服务。

目录

军事感测器市场:报告定义

军用感测器市场区隔

- 按平台

- 按地区

- 按类型

军用感测器市场分析(未来10年)

军用感测器市场的市场技术

全球军用感测器市场预测

军用感测器市场:按地区划分的趋势和预测

- 北美

- 促进/抑制因素和课题

- PEST分析

- 市场预测与情境分析

- 大公司

- 供应商层级状况

- 企业标竿管理

- 欧洲

- 中东

- 亚太地区

- 南美洲

军用感测器市场:国家分析

- 美国

- 防御计划

- 最新趋势

- 专利

- 该市场目前的技术成熟度水平

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳大利亚

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

军用感测器市场:市场机会矩阵

军事感测器市场:专家的研究观点

结论

关于Aviation and Defense Market Reports

The global Military Sensors market is estimated at USD 36.88 billion in 2024, projected to grow to USD 56.74 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 4.40% over the forecast period 2024-2034.

Introduction to Military Sensors Market:

Military sensors are the critical components that provide the foundation for situational awareness, target acquisition, and decision-making on the modern battlefield. These devices detect and measure physical quantities such as light, sound, heat, pressure, acceleration, magnetic fields, and radiation, converting them into electrical signals that can be processed and analyzed. From unmanned aerial vehicles (UAVs) to submarines, military sensors are integrated into virtually every platform and system.

Technology Impact in Military Sensors Market:

Technological advancements have revolutionized the capabilities of military sensors, enabling unprecedented levels of intelligence, surveillance, and reconnaissance (ISR). One of the key drivers of this transformation is miniaturization. The relentless pursuit of smaller, lighter, and more energy-efficient sensors has led to their integration into a wide range of platforms, including wearable devices and micro air vehicles (MAVs). This miniaturization has made it possible to deploy sensors in diverse and previously inaccessible environments, enhancing operational flexibility and effectiveness. Increased sensitivity is another significant advancement. Progress in materials science and sensor design has resulted in sensors with higher sensitivity, allowing for earlier detection of targets and threats. This heightened sensitivity ensures that potential dangers are identified before they escalate, providing military forces with a critical advantage in various scenarios. Data fusion has also played a crucial role in advancing military sensors. The ability to combine data from multiple sensors and platforms has significantly enhanced situational awareness. Advanced algorithms and computing power facilitate the fusion of information from different sources, creating a comprehensive and integrated picture of the battlefield. This holistic view is essential for effective decision-making and operational planning. Artificial Intelligence (AI) has further revolutionized sensor technology. AI-powered sensor systems can analyze vast amounts of data in real-time, identifying patterns and anomalies that would be difficult for human operators to detect. This capability enables faster decision-making and improves target recognition, enhancing overall mission effectiveness and operational efficiency.

Key Drivers in Military Sensors Market:

Several factors are driving the development and adoption of military sensors. The increasing threat of terrorism and asymmetric warfare has underscored the need for advanced sensors capable of detecting and tracking hidden threats. In such scenarios, sophisticated sensors play a crucial role in identifying and neutralizing concealed dangers, enhancing the effectiveness of counterterrorism operations and responses to unconventional threats. The demand for precision strike capabilities has also spurred advancements in sensor technology. To support precision strikes, sensors with higher resolution and accuracy are essential. These advanced sensors enable more precise targeting, reducing collateral damage and increasing the effectiveness of military operations.

The growing reliance on autonomous systems, such as unmanned vehicles and robots, further drives the need for sophisticated sensors. Autonomous systems require advanced sensors for navigation, obstacle avoidance, and target acquisition. These sensors ensure that unmanned platforms can operate effectively and safely in various environments, supporting a wide range of military applications. Cyber security concerns are another critical factor influencing the development of military sensors. Protecting sensitive sensor data from cyber attacks is vital to maintaining the integrity and reliability of sensor systems. Advanced encryption and cyber security measures are necessary to safeguard sensor data and ensure that military operations remain secure and uninterrupted..

Regional Trends in Military Sensors Market:

The development and deployment of military sensors vary significantly across different regions. In North America and Europe, these regions are at the forefront of sensor innovation, benefiting from mature technologies and a focus on unmanned systems and network-centric warfare. The advanced sensor capabilities developed in these areas reflect their leading positions in integrating cutting-edge technology into military operations. In the Asia-Pacific region, rapid economic growth and increasing defense budgets in countries like China and India have led to substantial investments in sensor technology. These nations are concentrating on developing indigenous sensor capabilities, enhancing their ability to address regional security challenges and bolster their defense infrastructures. The Middle East, characterized by a complex security environment, has seen a growing demand for advanced sensors. This demand is driven by the need for effective border surveillance, counterterrorism efforts, and intelligence gathering. The deployment of sophisticated sensors in this region helps address the multifaceted security concerns and operational requirements of the various nations. In Russia, despite facing economic challenges, there is continued investment in sensor technology, with a particular emphasis on missile defense and early warning systems. This investment reflects Russia's strategic priorities in maintaining robust defense capabilities and ensuring early detection and response to potential threats. Thus, military sensors have become indispensable tools for modern warfare. The rapid pace of technological advancement is transforming the battlefield, enabling forces to gather and process information faster than ever before. As sensor technology continues to evolve, it will undoubtedly play an even more critical role in shaping future conflicts and enhancing military effectiveness.

Key Military Sensor Program:

To provide a space-based tactical sensor system for use by the Defense, the Australian Government has agreed to pay veteran-owned South Australian business Asension $4.35 million. The contract, which was awarded through the Defence Innovation Hub, exemplifies the Government's dedication to working with the defence industry and utilising the creativity found all over Australia to give the Defense Department a competitive advantage.

On behalf of Belgium and Germany, the Organisation for Joint Armament Cooperation (OCCAR) signed a contract amendment with a consortium consisting of HENSOLDT Optronics and THEON SENSORS for binocular night vision goggles. This contract adjustment, valued in the mid-three-digit million range, will enable the provision of an additional 20,000 MIKRON Night Vision Goggles to the German Armed Forces and accelerate the delivery schedule. The newly formed joint venture, HENSOLDT Theon Night Vision, will execute the follow-up contract.

Up to eight communications intelligence sensor pod systems for MQ-9 unmanned aerial vehicles will be sold to France by the French State Department for about $88 million. According to the Defense Security Cooperation Agency, the potential foreign military sale will increase a prior deal with the French government for five pod suites and associated equipment valued at $71 million. The purchase of consumables and accessories, engineering, technical, and logistical support services, ground handling equipment, publications, technical documentation support, secure communications and cryptographic equipment, software and support services, spare parts, and repair services were also requested by France.

Table of Contents

Military Sensors Market Report Definition

Military Sensors Market Segmentation

By Platform

By Region

By Type

Military Sensors Market Analysis for next 10 Years

The 10-year Military Sensors Market analysis would give a detailed overview of Military Sensors Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Military Sensors Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Military Sensors Market Forecast

The 10-year Military Sensors Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Military Sensors Market Trends & Forecast

The regional Military Sensors Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Military Sensors Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Military Sensors Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Military Sensors Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Type, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Type, 2024-2034

List of Figures

- Figure 1: Global Military Sensors Market Forecast, 2024-2034

- Figure 2: Global Military Sensors Market Forecast, By Region, 2024-2034

- Figure 3: Global Military Sensors Market Forecast, By Platform, 2024-2034

- Figure 4: Global Military Sensors Market Forecast, By Type, 2024-2034

- Figure 5: North America, Military Sensors Market, Market Forecast, 2024-2034

- Figure 6: Europe, Military Sensors Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Military Sensors Market, Market Forecast, 2024-2034

- Figure 8: APAC, Military Sensors Market, Market Forecast, 2024-2034

- Figure 9: South America, Military Sensors Market, Market Forecast, 2024-2034

- Figure 10: United States, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 11: United States, Military Sensors Market, Market Forecast, 2024-2034

- Figure 12: Canada, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Military Sensors Market, Market Forecast, 2024-2034

- Figure 14: Italy, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Military Sensors Market, Market Forecast, 2024-2034

- Figure 16: France, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 17: France, Military Sensors Market, Market Forecast, 2024-2034

- Figure 18: Germany, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Military Sensors Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Military Sensors Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Military Sensors Market, Market Forecast, 2024-2034

- Figure 24: Spain, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Military Sensors Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Military Sensors Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Military Sensors Market, Market Forecast, 2024-2034

- Figure 30: Australia, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Military Sensors Market, Market Forecast, 2024-2034

- Figure 32: India, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 33: India, Military Sensors Market, Market Forecast, 2024-2034

- Figure 34: China, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 35: China, Military Sensors Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Military Sensors Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Military Sensors Market, Market Forecast, 2024-2034

- Figure 40: Japan, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Military Sensors Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Military Sensors Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Military Sensors Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Military Sensors Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Military Sensors Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Military Sensors Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Military Sensors Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Military Sensors Market, By Platform (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Military Sensors Market, By Platform (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Military Sensors Market, By Type (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Military Sensors Market, By Type (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Military Sensors Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Military Sensors Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Military Sensors Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Military Sensors Market, By Region, 2024-2034

- Figure 58: Scenario 1, Military Sensors Market, By Platform, 2024-2034

- Figure 59: Scenario 1, Military Sensors Market, By Type, 2024-2034

- Figure 60: Scenario 2, Military Sensors Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Military Sensors Market, By Region, 2024-2034

- Figure 62: Scenario 2, Military Sensors Market, By Platform, 2024-2034

- Figure 63: Scenario 2, Military Sensors Market, By Type, 2024-2034

- Figure 64: Company Benchmark, Military Sensors Market, 2024-2034