|

市场调查报告书

商品编码

1528158

全球防御惯性测量设备市场(2024-2034)Global Defense Inertial Measurement Unit Market 2024-2034 |

||||||

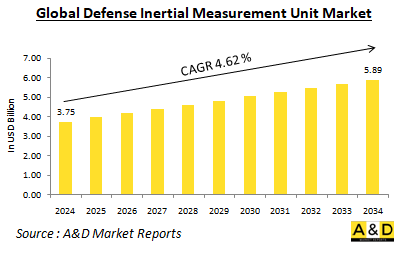

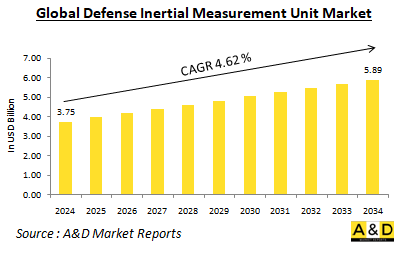

估计到2024年,全球防御惯性测量设备市场规模将达到37.5亿美元,预计到2034年将扩大到 58.9亿美元,预测期内(2024-2034年)年复合成长率为 4.62%。

防御惯性测量设备市场概论

惯性测量装置(IMU)是防御技术中的关键组件,可准确测量平台的速度、航向和重力。这些测量对于导弹、飞机、潜艇和无人驾驶车辆等军事应用的导航和控制非常重要。 IMU 整合来自加速度计、陀螺仪(有时还包括地磁计)的资料来计算位置、姿态和速度。在防御系统中,IMU 确保武器和车辆能够在 GPS 和其他外部导航系统不可用或不可靠的复杂环境中准确有效地运作。多年来,IMU 的开发和整合到防御系统中变得越来越复杂。现代军用 IMU 必须能够在恶劣条件下运行,同时提供高精度、高可靠性和高稳健性。因此,IMU 在确保军事行动的有效性和安全性方面发挥着非常重要的作用,其中精度和弹性非常重要。

防御惯性测量设备市场的技术影响力:

随着微机电系统(MEMS)、光纤陀螺仪(FOG)和环形雷射陀螺仪(RLG)的进步,惯性测量装置(IMU)背后的技术发生了显着发展。这些进步使得 IMU 变得更小、更精确、成本更低,并且日益用于各种防御平台。 MEMS 技术使感测器小型化,使 IMU 发生了革命性的变化,使装置更轻、更紧凑。这对于重量和尺寸是重要考虑因素的无人机(UAV)和行动装置尤其有利。基于 MEMS 的 IMU 能够抵抗衝击和振动,使其适用于恶劣的军事环境。光纤陀螺技术提供高精度和可靠性,非常适合需要关键精度的应用,例如飞弹导引和海军导航。 FOG IMU 具有优异的性能、低漂移率且不受电磁干扰,这在战斗场景中非常重要。 RLG 因其高精度和长期稳定性而成为防御 IMU 的主要产品。常用于需要精确导航和瞄准的飞机和飞弹系统。 RLG 提供能够承受恶劣环境条件的强大解决方案。此外,先进演算法和感测器融合技术的整合提高了IMU的性能。这些演算法结合了来自多个感测器的资料,以提高准确性并减少错误,即使在非 GPS 环境中也能实现可靠的导航和控制。这种能力对于依赖隐形和精确的防御行动非常重要。

防御惯性测量设备市场的主要驱动因素:

有几个因素推动 IMU 在防御领域的采用和进步。关键驱动因素之一是对准确性和可靠性的需求不断成长。随着军事行动变得更加复杂和技术驱动,对精确可靠的导航系统的需求不断增加。 IMU 提供瞄准、监视和侦察任务所需的精确度,确保防御系统在动态环境中有效运作。技术进步也发挥重要作用。感测器技术、讯号处理和小型化的不断改进提高 IMU 性能并降低成本。这些进步使得 IMU 更容易应用于更广泛的防御应用,从大型军事平台到行动系统。 IMU 的另一个重要优势是其能够独立于 GPS 讯号运作。在 GPS 不可用或不可靠的场景中,例如在城市峡谷或水下,IMU 提供导航和控制所需的资料。这种能力在隐形作战和电子战盛行的领域尤其重要。自动驾驶汽车和无人机在防御应用中的兴起增加了对可靠 IMU 的需求。这些系统依靠精确的导航和控制来完成任务,无需人工干预,而强大的 IMU 对于它们的成功非常重要。最后,许多国家投资军事现代化计划,其中还包括升级导航和导引系统。 IMU 是这些升级的关键组成部分,可提供更高的性能并支援先进武器和车辆的部署。

防御惯性测量设备市场的区域趋势:

全球防御 IMU 市场受到地缘政治因素和防御战略决定的区域趋势和优先事项的影响。每个地区都有独特的驱动因素和关注点,促进 IMU 的整体需求。在北美,美国因其庞大的防御预算和对创新的重视而成为防御IMU市场的主要参与者。美国军方大力投入研发以维持技术优势,因而带动了IMU技术的进步。该地区对自主系统和精确导引弹药的关注进一步增加了对高性能 IMU 的需求。欧洲国家也在投资其防御能力的现代化,重点是成员国之间的联合计画和互通性。欧洲防御 IMU 市场受益于欧洲防御基金等支持先进技术开发的措施。欧洲国家优先考虑为国内和国际任务提供准确性和可靠性、满足各种防御应用高标准的 IMU。由于地缘政治紧张局势加剧和军事现代化努力,亚太地区的防御开支快速成长。中国和印度等国家投资本土防御技术,包括 IMU,以提高其自主性和能力。该地区对开发先进飞弹系统、无人机和海军平台的关注增加了对能够满足这些战略目标的高品质 IMU 的需求。在中东和非洲,防御 IMU 市场受到安全挑战和先进防御系统需求的推动。该地区国家日益对其军事力量现代化进行投资,增加了对可靠导航和导引系统的需求。 IMU 在确保精确导航和控制非常重要的恶劣环境中军事行动的有效性方面发挥着非常重要的作用。拉丁美洲的防御预算普遍低于其他地区,但仍着重于提升军事能力。 IMU 整合到防御系统中以提高操作准确性和有效性。地区衝突和边境安全需求推动对导航和导引系统等防御技术的投资,使 IMU 成为该地区防御战略的关键组成部分。

防御惯性测量装置主要计画

Collins Aerospace已获得一份价值数百万英镑的合约,为英国政府的 WSRF(Weapons Sector Research Framework)做出贡献。该框架由英国防御部的Dstl(Defence Science and Technology Laboratory)监督,目的是透过武器科学与技术的专门研究加速未来武器技术的发展。根据这项新的多年协议,柯林斯航空航太公司将与 Dstl 合作开发惯性测量装置(IMU),以支援新型复杂的武器平台。这种战术级或 A 级惯性感测器是使用微机电系统(MEMS)技术开发的。

目录

防御惯性测量设备市场:分析定义

防御惯性测量设备市场区隔

- 依平台

- 依地区

- 依最终用户

防御惯性测量装置市场前景(未来10年)

防御惯性测量设备市场的市场技术

全球防御惯性测量设备市场预测

防御惯性测量设备市场:依地区划分的趋势与预测

- 北美

- 促进/抑制因素和挑战

- PEST分析

- 市场预测与情境分析

- 主要公司

- 供应商层级状况

- 企业基准比较

- 欧洲

- 中东

- 亚太地区

- 南美洲

防御惯性测量设备市场:国家分析

- 美国

- 防御规划

- 最新趋势

- 专利

- 该市场目前的技术成熟度等级

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳洲

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

市场机会矩阵

专家对调查的意见

结论

关于航空和防御市场报告

The Global Defense Inertial Measurement Unit market is estimated at USD 3.75 billion in 2024, projected to grow to USD 5.89 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 4.62% over the forecast period 2024-2034.

Introduction to Defense Inertial Measurement Units Market:

Inertial Measurement Units (IMUs) are critical components in defense technology, providing precise measurements of a platform's velocity, orientation, and gravitational forces. These measurements are essential for navigation and control in military applications such as missiles, aircraft, submarines, and unmanned vehicles. IMUs work by integrating data from accelerometers, gyroscopes, and sometimes magnetometers to calculate position, orientation, and velocity. In defense systems, IMUs ensure that weapons and vehicles can operate accurately and effectively in complex environments where GPS or other external navigation systems may be unavailable or unreliable. The development and integration of IMUs into defense systems have become increasingly sophisticated over the years. Modern defense IMUs are required to provide high accuracy, reliability, and robustness while being capable of operating in extreme conditions. As a result, they play a pivotal role in ensuring the effectiveness and safety of military operations, where precision and resilience are paramount.

Technology Impact in Defense Inertial Measurement Units Market:

The technology underpinning Inertial Measurement Units (IMUs) has evolved significantly, driven by advances in micro-electromechanical systems (MEMS), fiber optic gyroscopes (FOG), and ring laser gyroscopes (RLG). These advancements have allowed IMUs to become smaller, more precise, and more cost-effective, expanding their applications across various defense platforms. MEMS technology has revolutionized IMUs by enabling the miniaturization of sensors, leading to lighter and more compact units. This has been particularly beneficial for unmanned aerial vehicles (UAVs) and portable devices, where weight and size are critical considerations. MEMS-based IMUs are also more resilient to shock and vibration, making them suitable for harsh military environments. FOG technology offers high precision and reliability, making it ideal for applications requiring stringent accuracy, such as missile guidance and naval navigation. FOG IMUs provide excellent performance with low drift rates and are immune to electromagnetic interference, which is crucial in combat scenarios. RLGs have been a staple in defense IMUs due to their high accuracy and stability over time. They are commonly used in aircraft and missile systems where precise navigation and targeting are essential. RLGs offer a robust solution that can withstand extreme environmental conditions. Additionally, the integration of advanced algorithms and sensor fusion techniques has enhanced the performance of IMUs. These algorithms combine data from multiple sensors to improve accuracy and reduce errors, ensuring reliable navigation and control even in GPS-denied environments. This capability is vital for defense operations that rely on stealth and precision.

Key Drivers in Defense Inertial Measurement Units Market:

Several factors drive the adoption and advancement of IMUs in the defense sector. One major driver is the increasing demand for precision and reliability. As military operations become more complex and technology-driven, there is a growing need for precise and reliable navigation systems. IMUs provide the accuracy required for targeting, surveillance, and reconnaissance missions, ensuring that defense systems operate effectively in dynamic environments. Technological advancements also play a crucial role. Continuous improvements in sensor technology, signal processing, and miniaturization are enhancing the performance and reducing the cost of IMUs. These advancements make IMUs more accessible for a wider range of defense applications, from large military platforms to portable systems. Another critical advantage of IMUs is their ability to operate independently of GPS signals. In scenarios where GPS is unavailable or unreliable, such as in urban canyons or underwater, IMUs provide the necessary data for navigation and control. This capability is particularly important for stealth operations and in areas where electronic warfare is prevalent. The rise of autonomous vehicles and drones in defense applications has increased the demand for reliable IMUs. These systems rely on accurate navigation and control to perform missions without human intervention, making robust IMUs essential for their success. Finally, many countries are investing in military modernization programs, which include upgrading navigation and guidance systems. IMUs are a key component of these upgrades, providing enhanced performance and enabling the deployment of advanced weaponry and vehicles.

Regional Trends in Defense Inertial Measurement Units Market:

The global defense IMU market is influenced by regional trends and priorities, shaped by geopolitical factors and defense strategies. Each region has unique drivers and focuses that contribute to the overall demand for IMUs. In North America, the United States is a major player in the defense IMU market, driven by its significant defense budget and focus on technological innovation. The U.S. military invests heavily in research and development to maintain its technological edge, leading to advancements in IMU technology. The region's emphasis on autonomous systems and precision-guided munitions further fuels the demand for high-performance IMUs. European countries are also investing in modernizing their defense capabilities, with a focus on collaborative projects and interoperability among member states. The European defense IMU market benefits from initiatives like the European Defence Fund, which supports the development of advanced technologies. European nations prioritize IMUs that offer precision and reliability for both domestic and international missions, ensuring they meet high standards for various defense applications. The Asia-Pacific region is experiencing rapid growth in defense spending, driven by rising geopolitical tensions and military modernization efforts. Countries such as China and India are investing in indigenous defense technologies, including IMUs, to enhance their self-reliance and capabilities. The region's focus on developing advanced missile systems, UAVs, and naval platforms boosts the demand for high-quality IMUs that can meet these strategic objectives. In the Middle East and Africa, the defense IMU market is driven by security challenges and the need for advanced defense systems. Countries in this region are increasingly investing in modernizing their military forces, leading to a growing demand for reliable navigation and guidance systems. IMUs play a crucial role in ensuring the effectiveness of military operations in challenging environments, where precise navigation and control are essential. While the defense budgets in Latin America are generally smaller compared to other regions, there is still a focus on upgrading military capabilities. IMUs are integrated into defense systems to enhance the precision and effectiveness of operations. Regional conflicts and the need for border security drive investments in defense technology, including navigation and guidance systems, making IMUs a vital component of defense strategies in the region.

Key Defense Inertial Measurement Unit Program:

Collins Aerospace has secured a multimillion-pound contract to contribute to the British Government's Weapons Sector Research Framework (WSRF). This framework is overseen by the UK Ministry of Defence's Defence Science and Technology Laboratory (Dstl) and aims to accelerate the development of future weapons technologies through dedicated research in weapons science and technology. Under this new multi-year contract, Collins Aerospace will collaborate with Dstl to create an Inertial Measurement Unit (IMU) to support emerging complex weapons platforms. This tactical grade or Class A inertial sensor will be developed using micro-electro-mechanical systems (MEMS) technology.

Table of Contents

Market Definition

Market Segmentation

By Platform

By Region

By End - User

10 Year Market Outlook

The 10-year market outlook would give a detailed overview of changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Market Forecast

The 10-year market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Market Trends & Forecast

The regional market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions

Hear from our experts their opinion of the possible outlook for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By End User, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By End User, 2024-2034

List of Figures

- Figure 1: Global Defense Inertial Measurement Unit Market Forecast, 2024-2034

- Figure 2: Global Defense Inertial Measurement Unit Market Forecast, By Region, 2024-2034

- Figure 3: Global Defense Inertial Measurement Unit Market Forecast, By Platform, 2024-2034

- Figure 4: Global Defense Inertial Measurement Unit Market Forecast, By End User, 2024-2034

- Figure 5: North America, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 6: Europe, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 8: APAC, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 9: South America, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 10: United States, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 11: United States, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 12: Canada, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 14: Italy, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 16: France, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 17: France, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 18: Germany, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 24: Spain, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 30: Australia, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 32: India, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 33: India, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 34: China, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 35: China, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 40: Japan, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Defense Inertial Measurement Unit Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Defense Inertial Measurement Unit Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Defense Inertial Measurement Unit Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Defense Inertial Measurement Unit Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Defense Inertial Measurement Unit Market, By Platform (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Defense Inertial Measurement Unit Market, By Platform (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Defense Inertial Measurement Unit Market, By End User (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Defense Inertial Measurement Unit Market, By End User (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Defense Inertial Measurement Unit Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Defense Inertial Measurement Unit Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Defense Inertial Measurement Unit Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Defense Inertial Measurement Unit Market, By Region, 2024-2034

- Figure 58: Scenario 1, Defense Inertial Measurement Unit Market, By Platform, 2024-2034

- Figure 59: Scenario 1, Defense Inertial Measurement Unit Market, By End User, 2024-2034

- Figure 60: Scenario 2, Defense Inertial Measurement Unit Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Defense Inertial Measurement Unit Market, By Region, 2024-2034

- Figure 62: Scenario 2, Defense Inertial Measurement Unit Market, By Platform, 2024-2034

- Figure 63: Scenario 2, Defense Inertial Measurement Unit Market, By End User, 2024-2034

- Figure 64: Company Benchmark, Defense Inertial Measurement Unit Market, 2024-2034