|

市场调查报告书

商品编码

1528161

全球扫雷舰市场(2024-2034)Global Mine Countermeasure Ships Market 2024-2034 |

||||||

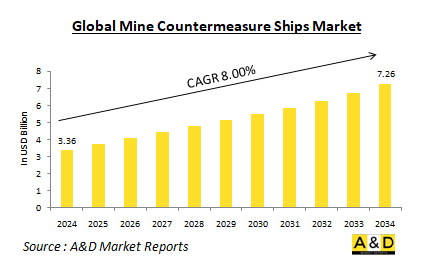

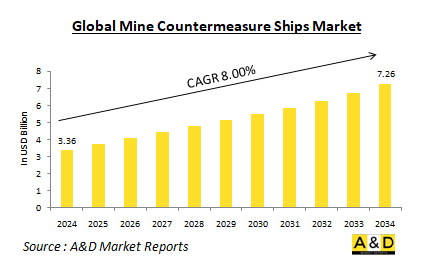

到2024年,全球扫雷舰市场预计将达到 33.6亿美元,在预测期内(2024-2034年)年复合成长率为 8.00%,到2034年将达到 72.6亿美元。

扫雷舰市场概况

扫雷舰(MCM)是能够探测和消除水下水雷、爆炸装置以损坏或摧毁水面舰艇和潜艇的现代海军舰艇,在行动中发挥着重要作用。这些水雷对海军舰艇和商船构成重大威胁,特别是在战略水道和地缘政治高度紧张的地区。水雷的存在可以有效封锁港口、限制海军的行动、危及商业航线,进而影响全球贸易和安全。扫雷舰的设计和装备目的是应对这些挑战并确保船舶和商船队的安全航行。多年来,扫雷舰已经取得了显着的发展,从简单的猎雷舰到具有先进探测和压制技术的复杂平台。这些舰艇专门执行各种任务,包括猎雷、扫雷和排雷。扫雷包括将停泊的水雷拖过水面切割或引爆。扫雷可以透过遥控潜水器(ROV)或潜水员消除或摧毁地雷来完成。

科技对扫雷舰市场的影响:

技术进步对扫雷舰的能力和有效性产生了重大影响,促进了先进感测器、自主系统和武器的发展,以增强水雷探测和消除能力。例如,先进的声纳系统使用声波来探测和分类水雷,使扫雷舰能够更远、更准确地识别威胁。合成孔径声纳(SAS)和高频声纳可提供海底的详细影像,使操作员能够将水雷与其他物件区分开来,并且这些声纳系统不断改进,以增加探测范围并提高解析度。自主系统和无人水下航行器(UUV)的整合也改变了水雷对抗行动。 UUV从扫雷舰上部署并自主执行扫雷任务。这些无人机配备了先进的感测器,可以在载人船舶过于危险的环境中运行,降低人类操作员的风险并提高营运效率。此外,遥控潜水器(ROV)是用于水雷探测和处置的远端操作潜水器,配备摄影机、声纳和操纵器,可在安全距离内识别和消除水雷,最大限度地降低人员风险。能力更强、更可靠的遥控潜水器的开发显着提高了扫雷舰在扫雷行动中的效率。此外,扫雷舰上资料融合和人工智慧(AI)技术的整合改进了决策和威胁分析。资料融合结合来自多个感测器的资讯来创建水下环境的全面图像,人工智慧演算法分析这些资料以识别可能表明水雷存在的模式和异常情况。这些技术可以更快、更准确地识别威胁,使扫雷舰能够更有效地做出反应。

扫雷舰市场的主要驱动因素:

扫雷舰的开发和部署受到几个关键驱动因素的影响,这些驱动因素反映了海上威胁不断变化的性质以及有效对策的需要。主要驱动因素之一是水雷的威胁日益增加,水雷变得越来越复杂且数量显着增加。现代地雷可以配备先进的感测器和隐形功能,使它们更难以被发现和消灭。这种日益复杂的情况,加上国家和非国家行为者在战略水道和衝突地区使用水雷,需要使用高性能的扫雷舰来确保海上安全。另一个重要的驱动因素是对全球贸易和能源供应非常重要的海上枢纽的战略重要性,例如霍尔木兹海峡、苏伊士运河和马六甲海峡。这些水域中水雷的存在扰乱了航道,并产生严重的经济和安全影响。扫雷舰对于维持这些战略水道的安全通行和确保商业自由流动非常重要。此外,持续的技术进步支持了防雷战舰的持续发展。感测器、自主系统和资料分析方面的创新将增强这些船舶的能力,使它们能够更有效地应对不断变化的水雷威胁。采用新技术对于维持扫雷舰的作战效能非常重要。此外,国际合作和联合演习是扫雷能力发展的重要驱动力。世界各国海军在水雷反制行动方面进行合作并分享知识和专业知识,联合演习可提高海军部队之间的互通性和协调性,加强全球海上安全。

扫雷舰市场的区域趋势:

扫雷舰的区域趋势受到地缘政治因素、海上安全挑战和防御战略的影响。在北美,美国海军引领扫雷舰的开发和部署,其舰队配备了先进的水雷探测和压制技术。重点是开发新的自主系统并增强现有平台以应对新出现的威胁。在欧洲,各国都在重点研究反水雷措施,有些国家也拥有专门的扫雷舰。欧盟(EU)和北大西洋公约组织(NATO)进行联合演习和计画,以加强水雷对抗能力,欧洲海军配备了先进的声纳系统和自主技术,投资水雷战的现代化。亚太地区面临严峻的海上安全挑战,包括领土争端和战略位置。中国、日本和韩国等国投资开发和采购反扫雷舰,以保护其海洋利益,重点加强其本土能力并参与区域安全措施。由于持续的衝突和水道的战略重要性,中东地区与水雷相关的威胁很高。该地区各国参与国际努力,采购反扫雷舰并确保海上安全,重点是应对波斯湾和红海等关键地区的水雷威胁。在非洲和拉丁美洲等其他地区,扫雷能力的发展较不明显,但仍然很重要。这些地区面临与海上安全和航道保护有关的挑战,并努力透过区域合作和国际援助来建立扫雷能力。

扫雷舰重大计画

澳洲皇家海军已承诺在 SEA1778 专案中部署扫雷(MCM)能力,以保护海上任务小组免受水雷威胁。澳洲皇家海军已承诺根据 SEA1778 计画部署扫雷能力,以保护海上任务小组免受水雷威胁。作为 1778年计画第一阶段的一部分,澳洲第16 水雷战队(MWT16)受委託操作一系列无人水面舰艇(USV)、消耗性组装系统、扫雷支援船和无人水下航行器(AUV)。澳洲皇家海军表示,他们透过将新的扫雷技术付诸实践来彻底改变其战略。

比利时Naval Group开始建造比利时扫雷舰:比利时海军 12 艘扫雷舰中的第一艘已由法国军事公司海军集团完成。作为比利时-荷兰 rMCM 计划的一部分,Naval Group和 Piriou 的合资企业 Kership 法国Concarneau建造这艘船。这 12 艘船将为比利时和荷兰舰队建造,并将搭载约 100 架无人机。该船还将配备机器人系统来探测、识别和摧毁水下水雷。

目录

扫雷舰市场:报告定义

扫雷舰市场细分

- 依地区

- 依方法

- 依用途

扫雷舰市场分析(未来10年)

扫雷舰市场的市场技术

全球扫雷舰市场预测

扫雷舰市场:区域趋势与预测

- 北美

- 促进/抑制因素和挑战

- PEST分析

- 市场预测与情境分析

- 主要公司

- 供应商层级状况

- 企业基准比较

- 欧洲

- 中东

- 亚太地区

- 南美洲

扫雷舰市场:国家分析

- 美国

- 防御规划

- 最新趋势

- 专利

- 该市场目前的技术成熟度等级

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳洲

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

扫雷舰市场:市场机会矩阵

扫雷舰市场:专家的研究观点

结论

关于航空和国防市场报告

The Global Mine Countermeasure Ships Market is estimated at USD 3.36 billion in 2024, projected to grow to USD 7.26 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 8.00% over the forecast period 2024-2034.

Introduction to Mine Countermeasure Ships Market:

Mine Countermeasure (MCM) ships play a crucial role in modern naval operations by detecting and neutralizing naval mines, which are explosive devices placed in the water to damage or destroy surface ships and submarines. These mines pose significant threats to naval and commercial vessels, especially in strategic waterways and areas of geopolitical tension. The presence of naval mines can effectively block ports, restrict the movement of naval forces, and endanger commercial shipping routes, thereby impacting global trade and security. MCM ships are designed and equipped to address these challenges, ensuring safe passage for naval and commercial fleets. MCM ships have evolved significantly over the years, from simple mine-sweeping vessels to sophisticated platforms equipped with advanced detection and neutralization technologies. These ships are specialized for various tasks, including mine hunting, mine sweeping, and mine disposal. Mine hunting involves locating and identifying mines using sonar and other sensors, while mine sweeping entails dragging equipment through the water to cut or detonate moored mines. Mine disposal can be achieved through remotely operated vehicles (ROVs) or divers that neutralize or destroy mines.

Technology Impact in Mine Countermeasure Ships Market:

Technological advancements have had a profound impact on the capabilities and effectiveness of Mine Countermeasure (MCM) ships, leading to the development of sophisticated sensors, autonomous systems, and weapons that enhance mine detection and neutralization. Advanced sonar systems, for instance, use sound waves to detect and classify mines, allowing MCM ships to identify threats at greater distances and with higher accuracy. Synthetic aperture sonar (SAS) and high-frequency sonar provide detailed images of the seafloor, enabling operators to distinguish mines from other objects, and these sonar systems are continuously improved to increase their range and resolution. The integration of autonomous systems and unmanned underwater vehicles (UUVs) has also transformed mine countermeasure operations, with UUVs being deployed from MCM ships to conduct mine-hunting and mine-sweeping missions autonomously. These drones are equipped with advanced sensors and can operate in environments that are too dangerous for manned vessels, reducing the risk to human operators and increasing operational efficiency. Additionally, Remote Operated Vehicles (ROVs) are remotely controlled submersible vehicles used for mine detection and disposal, equipped with cameras, sonar, and manipulators to identify and neutralize mines from a safe distance, minimizing personnel risk. The development of more capable and reliable ROVs has significantly enhanced the effectiveness of MCM ships in mine disposal operations. Furthermore, the integration of data fusion and artificial intelligence (AI) technologies in MCM ships has improved decision-making and threat analysis. Data fusion combines information from multiple sensors to create a comprehensive picture of the underwater environment, while AI algorithms analyze this data to identify patterns and anomalies that may indicate the presence of mines. These technologies enable faster and more accurate identification of threats, allowing MCM ships to respond more effectively.

Key Drivers in Mine Countermeasure Ships Market:

Several key drivers influence the development and deployment of Mine Countermeasure (MCM) ships, reflecting the evolving nature of maritime threats and the need for effective countermeasures. One major driver is the increasing threat of naval mines, which have become more sophisticated and proliferated significantly. Modern mines can be equipped with advanced sensors and stealth features, making them more difficult to detect and neutralize. This growing sophistication, coupled with the use of mines by state and non-state actors in strategic waterways and conflict zones, necessitates the deployment of capable MCM ships to ensure maritime security. Another critical driver is the strategic importance of maritime chokepoints such as the Strait of Hormuz, the Suez Canal, and the Malacca Strait, which are vital to global trade and energy supply. The presence of mines in these areas can disrupt shipping routes and have severe economic and security implications. MCM ships are essential for maintaining safe passage through these strategic waterways and ensuring the free flow of commerce. Additionally, ongoing technological advancements drive the continuous development of MCM ships. Innovations in sensors, autonomous systems, and data analysis enhance the capabilities of these ships, enabling them to address evolving mine threats more effectively. The adoption of new technologies is crucial for maintaining the operational effectiveness of MCM ships. Furthermore, international cooperation and joint exercises are important drivers for the development of MCM capabilities. Navies around the world collaborate to share knowledge and expertise in mine countermeasure operations, and joint exercises improve interoperability and coordination among naval forces, thereby enhancing global maritime security.

Regional Trends in Mine Countermeasure Ships Market:

Regional trends in Mine Countermeasure (MCM) ships are shaped by geopolitical factors, maritime security challenges, and defense strategies. In North America, the United States Navy leads in developing and deploying MCM ships, operating a fleet equipped with advanced technology for mine detection and neutralization. The focus is on developing new autonomous systems and enhancing existing platforms to address emerging threats. In Europe, countries have a strong focus on mine countermeasures, with several nations operating specialized MCM ships. The European Union and NATO conduct joint exercises and collaborative projects to enhance mine countermeasure capabilities, with European navies investing in modernizing their MCM fleets with advanced sonar systems and autonomous technologies. The Asia-Pacific region faces significant maritime security challenges, including territorial disputes and strategic chokepoints. Countries like China, Japan, and South Korea are investing in the development and acquisition of MCM ships to protect their maritime interests, focusing on enhancing indigenous capabilities and participating in regional security initiatives. In the Middle East, high mine-related threats arise from ongoing conflicts and the strategic importance of its waterways. Countries in the region are acquiring MCM ships and participating in international efforts to ensure maritime security, with a focus on addressing the threat of mines in critical areas such as the Persian Gulf and the Red Sea. In other regions, including Africa and Latin America, the development of MCM capabilities is less pronounced but still important. These regions face challenges related to maritime security and the protection of shipping routes, with efforts being made to build MCM capabilities through regional cooperation and international assistance.

Key Mine Countermeasure Ships Program:

The Royal Australian Navy has declared that Project SEA 1778 will see the deployment of Mine Counter Measures (MCM) capability to safeguard maritime task groups from the threat of sea mines. The Royal Australian Navy has declared that Project SEA 1778 will see the deployment of Mine Counter Measures (MCM) capability to safeguard maritime task groups from the threat of sea mines. Australian Mine Warfare Team 16 (MWT 16) was contracted to operate a variety of unmanned surface vessels (USV), disposable mine neutralisation systems, MCM support craft, and autonomous undersea vehicles as part of Project 1778's Phase I. (AUV). The Royal Australian Navy said that it is revolutionising its strategy by putting new MCM technology into service.

Belgian Counter-Mine Vessel Construction Begins by Naval Group. The first of 12 mine countermeasure vessels destined for the Belgian Navy was keeled over by the French military company Naval Group. As part of the Belgian-Dutch rMCM initiative, Kership, a joint venture between Naval Group and Piriou, is constructing the vessels in the French town of Concarneau. The 12 ships will be constructed for the fleets of Belgium and the Netherlands, together with approximately 100 drones. The ships will also have robotic systems to find, identify, and destroy underwater mines.

Table of Contents

Mine Countermeasure Ships Market Report Definition

Mine Countermeasure Ships Market Segmentation

By Region

By Technique

By Application

Mine Countermeasure Ships Market Analysis for next 10 Years

The 10-year Mine Countermeasure Ships Market analysis would give a detailed overview of Mine Countermeasure Ships Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Mine Countermeasure Ships Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Mine Countermeasure Ships Market Forecast

The 10-year Mine Countermeasure Ships Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Mine Countermeasure Ships Market Trends & Forecast

The regional Mine Countermeasure Ships Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Mine Countermeasure Ships Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Mine Countermeasure Ships Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Mine Countermeasure Ships Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Technique, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Application, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Technique, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Application, 2024-2034

List of Figures

- Figure 1: Global Mine Countermeasure Ships Market Forecast, 2024-2034

- Figure 2: Global Mine Countermeasure Ships Market Forecast, By Region, 2024-2034

- Figure 3: Global Mine Countermeasure Ships Market Forecast, By Technique, 2024-2034

- Figure 4: Global Mine Countermeasure Ships Market Forecast, By Application, 2024-2034

- Figure 5: North America, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 6: Europe, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 8: APAC, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 9: South America, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 10: United States, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 11: United States, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 12: Canada, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 14: Italy, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 16: France, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 17: France, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 18: Germany, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 24: Spain, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 30: Australia, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 32: India, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 33: India, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 34: China, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 35: China, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 40: Japan, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Mine Countermeasure Ships Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Mine Countermeasure Ships Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Mine Countermeasure Ships Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Mine Countermeasure Ships Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Mine Countermeasure Ships Market, By Technique (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Mine Countermeasure Ships Market, By Technique (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Mine Countermeasure Ships Market, By Application (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Mine Countermeasure Ships Market, By Application (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Mine Countermeasure Ships Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Mine Countermeasure Ships Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Mine Countermeasure Ships Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Mine Countermeasure Ships Market, By Region, 2024-2034

- Figure 58: Scenario 1, Mine Countermeasure Ships Market, By Technique, 2024-2034

- Figure 59: Scenario 1, Mine Countermeasure Ships Market, By Application, 2024-2034

- Figure 60: Scenario 2, Mine Countermeasure Ships Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Mine Countermeasure Ships Market, By Region, 2024-2034

- Figure 62: Scenario 2, Mine Countermeasure Ships Market, By Technique, 2024-2034

- Figure 63: Scenario 2, Mine Countermeasure Ships Market, By Application, 2024-2034

- Figure 64: Company Benchmark, Mine Countermeasure Ships Market, 2024-2034