|

市场调查报告书

商品编码

1528163

全球监控雷达市场(2024-2034)Global Surveillance Radar Market 2024-2034 |

||||||

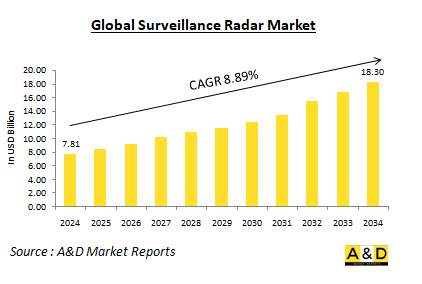

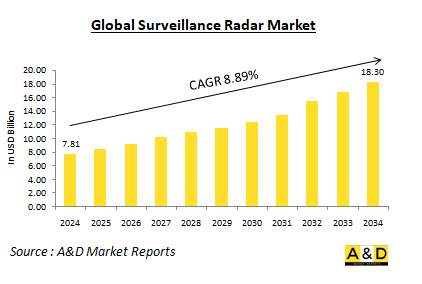

2024年全球监控雷达市场规模预计为78.1亿美元,预计到2034年将成长至183亿美元,年均成长率(CAGR)为8.89%。

全球监控雷达市场概况

监视雷达系统是空中交通管制和军事行动的关键组成部分,为侦测和追踪飞机和其他物体提供重要资料。这些系统的工作原理是发射无线电波并分析从周围物体返回的迴声。监视雷达主要分为两类:一次监视雷达(PSR)和二次监视雷达(SSR)。由于PSR仅使用反射无线电波来检测目标,因此它可以有效地识别不合作的目标,例如没有应答器的飞机。相较之下,SSR 依靠飞机上的应答器来回应雷达讯号,并提供高度和识别码等附加资讯。这种双重方法提高了民用和军用空域的态势感知和作战效率。监视雷达技术的进步显着提高了这些系统的准确性、可靠性和范围,使其对现代航空和国防行动非常重要。

科技对全球监控雷达市场的影响

由于电子、讯号处理和资料整合的进步,技术对监视雷达系统的影响显着变化。一项关键的进步是使用数位讯号处理(DSP)透过改善杂讯和杂波过滤来提高目标检测和追踪能力。这项改进使雷达能够更有效地区分真正的目标和来自地形和天气的不相关反射。相控阵天线是另一个重大技术进步。这些天线无需机械移动即可实现快速波束控制,实现快速目标位置校正。相控阵技术提高了雷达同时追踪多个目标的能力,提高了复杂环境中的搜索范围。自动目标识别(ATR)系统也彻底改变了监视雷达。透过利用机器学习演算法分析雷达资料,ATR 系统可以自动识别目标并对其进行分类。这减少了空中交通管制员和军事操作员的工作量,并能够更快、更准确地做出决策。 与其他系统的整合变得越来越普遍,监视雷达与卫星影像和地面感测器连结。这种多感测器方法提供了作战环境的全面视图,增强了民用航空和军事行动的态势感知能力。最后,资料视觉化的进步显着改善了操作员解释雷达资料的方式。增强的 GUI 和视觉化技术提供即时追踪资讯、历史资料和预测分析,以促进更好的营运规划和回应。

全球监控雷达市场的主要驱动因素

有几个主要因素推动监视雷达系统的开发和部署。安全和保障非常重要,因为准确追踪飞机和其他物体对于防止碰撞和确保空域安全非常重要。监视雷达系统透过提供维护安全所需的信息,在空中交通管制和军事行动中发挥重要作用。全球空中交通的增加也增加了对先进监视系统的需求。随着越来越多的飞机进入天空,有效管理拥挤的空域变得越来越重要,这增加了对可靠、高精度雷达系统来处理日益增加的交通量的需求。

技术进步也是重要的推手。雷达技术的不断创新,包括讯号处理、天线设计和资料整合的增强,导致了更复杂的监视系统的采用。这些进步确保雷达系统始终有效且能够满足当前的需求和挑战。监管要求进一步影响监视雷达系统的部署。国际民航组织(ICAO)等组织制定的国际航空法规和标准强制使用雷达进行空中交通管制。遵守这些法规是推动雷达系统投资的关键因素。军事现代化也是一个重要因素。世界各地的军队更新其监视能力,以提高态势感知和作战效率。这种现代化包括更新现有雷达系统和整合新技术以应对不断变化的防御挑战。

全球监控雷达市场的区域趋势

监视雷达技术的状况因地区而异,并受到地区防御需求、空中交通需求和技术能力的影响。北美,尤其是美国,高度重视民用和军用先进雷达系统。美国联邦航空管理局(FAA)大力投资,采用最新的一次监视雷达(PSR)和二次监视雷达(SSR)技术更新其空中交通管制系统,以提高安全性和效率。此外,美国军方也优先发展用于防空和态势感知的雷达,实施致力于将雷达与其他感测器系统整合的计画。在欧洲,人们齐心协力更新监视雷达功能,以满足严格的安全法规并管理日益成长的空中交通。欧盟(EU)的欧洲单一天空计画目的是提高空中交通管理的效率,并导致对先进雷达系统的投资。欧洲国防军也致力于联合雷达计画,以增强区域安全和成员国之间的互通性。由于空中交通的增加和军事现代化,亚太地区的监视雷达技术迅速发展。中国和印度等国家正大力投资开发自己的雷达,以满足民航和国防需求。支线航空旅行的扩张推动了对改进雷达系统的需求,以确保日益拥挤的空域的安全和效率。在中东,该地区的战略地缘政治格局和不断增加的空中交通推动对监视雷达系统的需求不断成长。该地区各国投资先进雷达技术,以加强国家安全并改善空中交通管理。军事和民用航空部门之间也进行了重要合作,开发了综合雷达系统以满足国防和商业需求。

监视雷达主要程式

Silentium 已获得一份为陆军提供被动雷达设备的合约。澳洲陆军已根据国防部签订的价值 740 万美元的合约要求使用 Silentium Defense 的 MAVERICK M 系列被动雷达系统,用于能力开发和评估活动。 Silentium 的 MAVERICK M 系列是首款高性能、低功耗、士兵携带式隐蔽雷达系统,用于空中、陆地和海上监视。不被发现的能力不仅赋予澳洲陆军及其合作伙伴非常重要的主权能力,而且在空中、陆地和海上拥有无与伦比的优势。

比利时和荷兰舰队将配备 SCANTER 6000 X 波段雷达。比利时海军与机器人联盟在海军集团和 ECA 集团的协调下,已选择 Terma 的 SCANTER 6000 雷达用于比利时和荷兰的 MCMV 更新计画。因此,一月中旬,隶属于海军集团和 Piriou 的法国造船厂 Kership 委託 Terma 为 MCM 战舰交付 12 座 SCANTER 6000 海军雷达。首批交付将于2022年进行,后续交付预计将持续八年。英国皇家海军的新型26型全球战斗舰和T31护卫舰将配备SCANTER 6000海军监视雷达。该雷达目前用于法国海军的大多数大型舰艇,包括戴高乐号航空母舰和丹麦海军的艾弗、惠特费尔特级护卫舰。

目录

监控雷达市场:报告定义

监控雷达市场区隔

- 依用途

- 依平台

- 依地区

监控雷达市场分析(未来10年)

监控雷达市场的市场技术

全球监控雷达市场预测

监控雷达市场:依地区划分的趋势与预测

- 北美

- 促进/抑制因素和挑战

- PEST分析

- 市场预测与情境分析

- 主要公司

- 供应商层级状况

- 企业基准比较

- 欧洲

- 中东

- 亚太地区

- 南美洲

监控雷达市场:国家分析

- 美国

- 防御规划

- 最新趋势

- 专利

- 该市场目前的技术成熟度等级

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳洲

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

监控雷达市场:市场机会矩阵

监控雷达市场:专家对研究的看法

结论

关于航空和国防市场报告

The Global Surveillance Radar is estimated at USD 7.81 billion in 2024, projected to grow to USD 18.30 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 8.89% over the forecast period 2024-2034

Introduction to Surveillance Radar Market:

Surveillance radar systems are critical components in air traffic control and military operations, providing essential data for the detection and tracking of aircraft and other objects. These systems operate by emitting radio waves and analyzing the echoes returned from objects in their vicinity. Surveillance radar can be categorized into two main types: Primary Surveillance Radar (PSR) and Secondary Surveillance Radar (SSR). PSR detects targets based solely on the reflected radio waves, making it effective for identifying non-cooperative targets, such as aircraft without transponders. In contrast, SSR relies on transponders onboard aircraft, which respond to radar signals with additional information, including altitude and identification codes. This dual approach enhances situational awareness and operational efficiency in both civil and military airspace. The evolution of surveillance radar technology has significantly improved the accuracy, reliability, and range of these systems, making them indispensable for modern aviation and defense operations.

Technology Impact in Surveillance Radar Market:

The impact of technology on surveillance radar systems has been transformative, driven by advancements in electronics, signal processing, and data integration. One significant development is the use of Digital Signal Processing (DSP), which enhances target detection and tracking capabilities by allowing for better filtering of noise and clutter. This improvement enables radars to more effectively distinguish between genuine targets and irrelevant reflections from terrain or weather conditions. Phased array antennas represent another major technological advancement. These antennas allow for rapid beam steering without the need for mechanical movement, resulting in quicker updates on target positions. Phased array technology enhances a radar's ability to track multiple targets simultaneously and provides improved coverage in complex environments. Automatic Target Recognition (ATR) systems have also revolutionized surveillance radars. By leveraging machine learning algorithms to analyze radar data, ATR systems can automatically identify and classify targets. This reduces the workload on air traffic controllers and military operators, enabling faster and more accurate decision-making. Integration with other systems has become increasingly common, with surveillance radars being linked to satellite imagery and ground-based sensors. This multi-sensor approach offers a comprehensive view of the operational environment, enhancing situational awareness for both civil aviation and military operations. Lastly, advancements in data visualization have greatly improved how operators interpret radar data. Enhanced graphical user interfaces and visualization techniques provide real-time tracking information, historical data, and predictive analytics, facilitating better operational planning and response.

Key Drivers in Surveillance Radar Market:

Several key factors are driving the development and deployment of surveillance radar systems. Safety and security are paramount, as accurate tracking of aircraft and other objects is essential to prevent collisions and ensure secure airspace. Surveillance radar systems play a crucial role in air traffic management and military operations by providing the necessary information to maintain safety and security. The increasing volume of global air traffic also drives the need for advanced surveillance systems. As more aircraft enter the skies, managing crowded airspace efficiently becomes increasingly important, heightening the demand for reliable and precise radar systems to handle this growing traffic.

Technological advancements are another significant driver. Continuous innovation in radar technology, including enhancements in signal processing, antenna design, and data integration, leads to the adoption of more sophisticated surveillance systems. These advancements ensure that radar systems remain effective and up-to-date with current needs and challenges. Regulatory requirements further influence the deployment of surveillance radar systems. International aviation regulations and standards, set by organizations such as the International Civil Aviation Organization (ICAO), mandate the use of radar for air traffic control. Compliance with these regulations is a key factor driving investment in radar systems. Military modernization is also a crucial factor. Armed forces around the world are upgrading their surveillance capabilities to enhance situational awareness and operational effectiveness. This modernization involves both upgrading existing radar systems and integrating new technologies to address evolving defense challenges.

Regional Trends in Surveillance Radar Market:

The landscape of surveillance radar technology varies significantly across different regions, shaped by local defense needs, air traffic demands, and technological capabilities. In North America, especially in the United States, there is a strong emphasis on advanced radar systems for both civil and military applications. The Federal Aviation Administration (FAA) heavily invests in upgrading air traffic control systems, incorporating modern Primary Surveillance Radar (PSR) and Secondary Surveillance Radar (SSR) technologies to enhance safety and efficiency. Additionally, the U.S. military prioritizes radar advancements for air defense and situational awareness, with programs dedicated to integrating radar with other sensor systems. In Europe, there is a concerted effort to upgrade surveillance radar capabilities to meet stringent safety regulations and manage increasing air traffic. The European Union's Single European Sky initiative aims to improve air traffic management efficiency, leading to investments in advanced radar systems. European defense forces are also engaged in collaborative radar projects to enhance regional security and interoperability among member states. The Asia-Pacific region is witnessing rapid growth in surveillance radar technology due to increasing air traffic and military modernization. Countries like China and India are investing heavily in indigenous radar development, addressing both civil aviation and defense needs. The expansion of regional air travel drives the demand for enhanced radar systems to ensure safety and efficiency in increasingly crowded airspaces. In the Middle East, the growing demand for surveillance radar systems is driven by the region's strategic geopolitical landscape and rising air traffic. Countries in the region are investing in advanced radar technologies to strengthen national security and improve air traffic management. There is also notable collaboration between military and civil aviation sectors, with integrated radar systems being developed to meet both defense and commercial requirements.

Key Surveillance Radar Program:

Silentium is awarded a contract to provide Army with passive radar equipment. The Australian Army has requested Silentium Defence's MAVERICK M-series passive radar system under a (AU) $7.4 million contract from the Department of Defence for use in capabilities development and evaluation activities. The first high-performance, low-power, soldier-portable, covert radar system for air defence, land, and sea surveillance is Silentium's MAVERICK M-series. The ability to see without being seen gives the ADF and its partners a crucial sovereign capability as well as an unbeatable edge in the air, land, and maritime domains.

Belgian and Dutch fleets will be equipped with SCANTER 6000 X-band radar. The Belgium Naval & Robotics consortium, coordinated by Naval Group and ECA Group, has chosen Terma's SCANTER 6000 radar for the replacement MCMV programme for Belgium and the Netherlands. In this context, the French shipyard Kership, a partnership between Naval Group and Piriou, hired Terma in mid-January to deliver 12 pieces of the SCANTER 6000 naval radar for the MCM warships. The first unit will be delivered by Terma in 2022, and subsequent deliveries will continue for an additional eight years. The new Type-26 Global Combat Ships and T31 Frigates of the Royal Navy are receiving the SCANTER 6000 naval surveillance radar. The radar is now in use aboard the majority of the French Navy's large warships, including the aircraft carrier Charles De Gaulle and the Iver Huitfeldt class frigates of the Danish Navy.

Table of Contents

Surveillance Radar Market Report Definition

Surveillance Radar Market Segmentation

By Application

By Platform

By Region

Surveillance Radar Market Analysis for next 10 Years

The 10-year surveillance radar market analysis would give a detailed overview of surveillance radar market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Surveillance Radar Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Surveillance Radar Market Forecast

The 10-year Surveillance Radar Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Surveillance Radar Market Trends & Forecast

The regional surveillance radar market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Surveillance Radar Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Surveillance Radar Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Surveillance Radar Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Application, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Application, 2024-2034

List of Figures

- Figure 1: Global Surveillance Radar Market Forecast, 2024-2034

- Figure 2: Global Surveillance Radar Market Forecast, By Region, 2024-2034

- Figure 3: Global Surveillance Radar Market Forecast, By Platform, 2024-2034

- Figure 4: Global Surveillance Radar Market Forecast, By Application, 2024-2034

- Figure 5: North America, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 6: Europe, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 8: APAC, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 9: South America, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 10: United States, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 11: United States, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 12: Canada, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 14: Italy, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 16: France, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 17: France, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 18: Germany, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 24: Spain, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 30: Australia, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 32: India, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 33: India, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 34: China, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 35: China, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 40: Japan, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Surveillance Radar Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Surveillance Radar Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Surveillance Radar Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Surveillance Radar Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Surveillance Radar Market, By Platform (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Surveillance Radar Market, By Platform (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Surveillance Radar Market, By Application (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Surveillance Radar Market, By Application (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Surveillance Radar Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Surveillance Radar Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Surveillance Radar Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Surveillance Radar Market, By Region, 2024-2034

- Figure 58: Scenario 1, Surveillance Radar Market, By Platform, 2024-2034

- Figure 59: Scenario 1, Surveillance Radar Market, By Application, 2024-2034

- Figure 60: Scenario 2, Surveillance Radar Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Surveillance Radar Market, By Region, 2024-2034

- Figure 62: Scenario 2, Surveillance Radar Market, By Platform, 2024-2034

- Figure 63: Scenario 2, Surveillance Radar Market, By Application, 2024-2034

- Figure 64: Company Benchmark, Surveillance Radar Market, 2024-2034