|

市场调查报告书

商品编码

1546378

特殊任务飞机的全球市场 (2024~2034年)Global Special Mission Aircraft Market 2024-2034 |

||||||

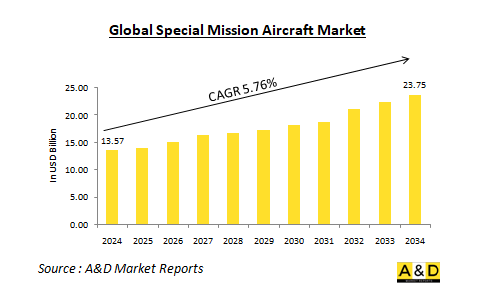

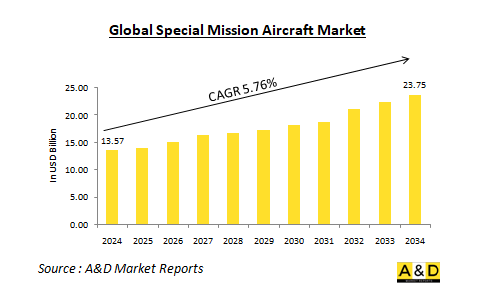

2024 年全球特种任务飞机市场预计为 135.7 亿美元,预计 2024 年至 2034 年复合年增长率为 5.76%,到 2034 年将达到 237.5 亿美元。

全球特种任务飞机市场概况

特殊任务飞机 (SMA) 专为满足特定的作战需求而定制,通常包含先进的感测器、通讯系统和特定任务设备。该飞机执行多种功能,包括 ISR、海上监视、搜救 (SAR) 以及军事行动的医疗后送(医生直升机)。 SMA 的多功能性使其在军事和民用应用中都很有价值,可在各种环境中实现快速部署和操作灵活性。 SMA 市场受到多种趋势的影响,包括舰队现代化、国防支出增加以及对先进监视能力日益增长的需求。随着各国面临新的安全挑战,对能够执行复杂任务的特殊飞机的需求不断增加。这种趋势在地缘政治高度紧张的地区尤其明显,各国正在投资先进技术以加强其防御能力。

科技对全球特种任务飞机市场的影响

技术进步处于 SMA 市场发展的最前线。人工智慧 (AI)、机器学习 (ML) 和先进感测器系统等尖端技术的整合正在改变特种任务飞机的运作方式。人工智慧和机器学习可以分析从各种感测器收集的大量数据,以改善任务期间的态势感知和决策过程。此功能对于及时、准确的资讯至关重要的 ISR 活动尤其有价值。此外,光电和红外线系统等感测器技术的进步显着提高了 SMA 的监测能力。这些感测器可实现高解析度成像和即时数据传输,使操作员能够有效监控大面积的活动。此外,开发支援安全、快速资料交换的通讯系统对于协调涉及多个机构和军事部门的复杂行动至关重要。 SMA市场中无人机(UAV)的崛起也是一个值得注意的趋势。无人机具有独特的优势,例如较低的营运成本以及能够在高风险环境中执行任务而不会让飞行员面临风险。将无人机纳入特种任务行动扩大了监视和侦察的范围,进一步推动了对这些飞机的需求。

全球特种任务飞机市场的关键推动因素

几个关键推动因素正在推动特种任务飞机 (SMA) 市场的成长。首先,全球地缘政治紧张衝突加剧,各国军事实力不断增强。随着各国努力加强监视和侦察能力,国防预算不断增加,对特种任务飞机的投资也不断增加。这些飞机越来越被视为在动盪的全球环境中保持战略优势的关键。另一个关键推动因素是 SMA 的多功能性。这些飞机因其执行各种任务的能力而受到认可,使其成为国防和民用应用的经济高效的解决方案。其多功能功能使营运商能够使用单一平台有效地分配资源并应对各种营运挑战,从而提高营运灵活性和有效性。技术进步也是推动 SMA 市场的主要因素。航空航天技术的不断改进,包括增强的感测器系统、先进的通讯设备和尖端的隐形能力,对于满足现代作战要求至关重要。随着这些技术的发展,对能够利用最新创新的现代化 SMA 的需求不断增加,从而推动市场走高。将网路战能力整合到 SMA 中代表了另一个重要趋势。随着网路威胁变得越来越普遍,对配备能够侦测和反击网路攻击的技术的飞机的需求不断增长。各国正投资具有先进网路功能的 SMA,以提高整体营运效率并防范新出现的数位威胁。最后,不断变化的全球安全格局(以新的不对称威胁为特征)正在推动对 SMA 的需求。全球安全挑战的动态性质要求使用专用飞机来增强态势感知并提供快速反应选项。安全环境的这些变化仍然是市场成长的主要驱动力,因为 SMA 在应对复杂且不断变化的威胁方面发挥关键作用。

全球特种任务飞机市场的区域趋势

特种任务飞机 (SMA) 市场呈现出由国防支出、技术采用和地缘政治动态等多种因素影响的独特区域趋势。北美,尤其是美国,由于该国先进的国防工业和庞大的军事预算,占据了SMA市场的很大占有率。美国继续大力投资军事现代化,包括更新现有的特种任务飞机和开发新平台来应对新出现的威胁。波音和洛克希德马丁等主要国防承包商的存在进一步增强了该地区的市场并巩固了其主导地位。在欧洲,由于地缘政治紧张局势加剧以及对增强监控能力的需求不断增长,SMA 市场的特征是高度关注国防和安全。英国、法国和德国等国正大力投资特种任务飞机,以支援军事行动并改善边境安全。此外,欧盟 (EU) 内部的防务合作措施正在推动 SMA 技术的进步,反映出加强区域安全的统一努力。由于中国、印度和日本等国家国防预算的增加,预计亚太地区 SMA 市场将显着成长。这些国家正在投资先进军事技术,以应对区域安全挑战并加强监视和侦察活动。人们对军事应用无人机 (UAV) 的兴趣日益浓厚,也促进了该地区 SMA 市场的扩张,凸显了军队现代化和多样化的趋势。在中东和非洲,SMA 市场受到持续衝突和安全问题的严重影响。这些地区的国家正在投资特种任务飞机,以增强其军事能力并打击恐怖主义和海盗等各种威胁。随着各国寻求确保其海上边界安全并扩大在该地区的行动范围,对海上巡逻机的需求尤其强劲,该地区充满了许多安全挑战。在拉丁美洲,人们越来越认识到 SMA 市场相对较小,需要加强监视和侦察能力。该地区各国正在增加对特种任务飞机的投资,以支持执法和边境安全行动,这反映出人们日益认识到特种航空资产在维护国家安全方面的重要性。

特种任务飞机的主要项目

加拿大波音公司将在不列颠哥伦比亚省投资6,100万加元建设航空航太製造训练中心和研发中心。该声明是美国一家主要航空公司与渥太华达成的价值数十亿美元的购买新型军用侦察机协议的一部分的最新声明。国防部长比尔布莱尔讚扬了波音加拿大不列颠哥伦比亚省里士满工厂的支出,并表示政府将增加国防投资,同时确保这也有利于加拿大的经济和人民。联邦政府去年宣布将购买多达16架波音P-8A海神多任务飞机,以取代已经服役近40年的极光号。

Marshall 获得了 450 万英镑的延期合同,为法国空军的 14 架洛克希德马丁公司 C-130H Hercules 飞机提供持续的工程支援。此次续约是在之前延长两年的四年合约的基础上进行的。授予机构是国家维修公司 SIAe(Service Industriel de l'Aeronautique)。马歇尔将为 C-130H 的维护、修理和大修提供工程支持,主要透过其位于法国克莱蒙的 SIAe 工厂提供。该协议还包括根据洛克希德马丁公司的独家製造许可,继续供应由 Marshall 内部製造的 C-130 零件和维修套件。

汉莎技术公司已交付第三架翻新的空中巴士 A350-900,作为德国空军特种空中任务联队机队扩张的一部分。德国国防部于2019年批准购买三架空中巴士A350飞机,以取代特别空中任务中队自2010年代以来服役的两架A340飞机。这项工作已投资约 12 亿欧元(13 亿美元)。空中巴士 A350-900 宽度为 5.9 公尺(19.5 英尺),总长度为 66.8 公尺(219 英尺)。它由罗尔斯·罗伊斯的遄达XWB高涵道比涡轮风扇发动机提供动力,航程超过15,372公里(9,551英里),最高时速为945公里(587英里)。

目录

特殊任务飞机市场:报告定义

特殊任务飞机市场明细

- 各用途

- 各地区

- 按装备

特殊任务飞机市场分析 (今后10年)

特殊任务飞机市场市场科技

全球特殊任务飞机市场预测

特殊任务飞机市场:各地区的趋势与预测

- 北美

- 促进·阻碍因素,课题

- PEST分析

- 市场预测与情势分析

- 主要企业

- 供应商阶层的形势

- 企业的基准

- 欧洲

- 中东

- 亚太地区

- 南美

特殊任务飞机市场:各国分析

- 美国

- 国防计划

- 最新趋势

- 专利

- 这个市场上目前技术成熟等级

- 市场预测与情势分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳洲

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

特殊任务飞机市场:市场机会矩阵

特殊任务飞机市场:调查相关专家的见解

结论

关于Aviation and Defense Market Reports

The Global Special Mission Aircraft market is estimated at USD 13.57 billion in 2024, projected to grow to USD 23.75 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 5.76% over the forecast period 2024-2034

Introduction to the Special Mission Aircraft Market:

Special Mission Aircraft are tailored to meet specific operational needs, often incorporating advanced sensors, communication systems, and mission-specific equipment. These aircraft serve a variety of functions, including ISR for military operations, maritime surveillance, search and rescue (SAR), and medical evacuation (medevac). The versatility of SMAs makes them invaluable for both military and civilian applications, allowing for rapid deployment and operational flexibility in diverse environments. The market for SMAs is influenced by several trends, including the modernization of military fleets, increased defense spending by various countries, and the growing need for advanced surveillance capabilities. As nations face new security challenges, the demand for specialized aircraft capable of performing complex missions is on the rise. This trend is particularly pronounced in regions with heightened geopolitical tensions, where countries are investing in advanced technologies to enhance their defense capabilities.

Technology Impact in the Special Mission Aircraft Market:

Technological advancements are at the forefront of the SMA market's evolution. The integration of cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and advanced sensor systems is transforming how special mission aircraft operate. AI and ML can analyze vast amounts of data collected from various sensors, improving situational awareness and decision-making processes during missions. This capability is particularly beneficial for ISR operations, where timely and accurate information is critical. Moreover, advancements in sensor technology, including electro-optical and infrared systems, have significantly enhanced the surveillance capabilities of SMAs. These sensors allow for high-resolution imaging and real-time data transmission, enabling operators to monitor activities over vast areas effectively. Additionally, the development of communication systems that support secure and rapid data exchange is essential for coordinating complex operations involving multiple agencies or military branches. The rise of unmanned aerial vehicles (UAVs) in the SMA market is another notable trend. UAVs offer unique advantages, such as reduced operational costs and the ability to conduct missions in high-risk environments without putting pilots at risk. The integration of UAVs into special mission operations is expanding the scope of what can be achieved in terms of surveillance and reconnaissance, further driving the demand for these aircraft.

Key Drivers in the Special Mission Aircraft Market:

Several key drivers are propelling the growth of the Special Mission Aircraft (SMA) market. First, increasing geopolitical tensions and conflicts around the world are leading nations to bolster their military capabilities. As countries strive to enhance their surveillance and reconnaissance capacities, defense budgets are rising, which in turn boosts investments in special mission aircraft. These aircraft are increasingly seen as crucial for maintaining a strategic advantage in a volatile global environment. Another significant driver is the versatility and multi-role capabilities of SMAs. These aircraft are valued for their ability to perform a wide range of missions, which makes them a cost-effective solution for both defense and civilian applications. Their multi-role functionality allows operators to efficiently allocate resources and respond to various operational challenges using a single platform, enhancing operational flexibility and effectiveness. Technological advancements are also a major factor driving the SMA market. Continuous improvements in aerospace technologies, including enhanced sensor systems, advanced communication equipment, and state-of-the-art stealth capabilities, are crucial for meeting contemporary operational requirements. As these technologies evolve, the demand for modernized SMAs that can leverage the latest innovations grows, pushing the market forward. The integration of cyber warfare capabilities into SMAs represents another important trend. With the increasing prevalence of cyber threats, there is a growing need for aircraft equipped with technologies that can detect and counter cyber attacks. Nations are investing in SMAs with advanced cyber capabilities to improve their overall operational effectiveness and safeguard against emerging digital threats. Finally, the evolving global security landscape, characterized by emerging asymmetric threats, drives the demand for SMAs. The dynamic nature of global security challenges necessitates the use of specialized aircraft to enhance situational awareness and provide rapid response options. This shifting security environment continues to be a significant driver of market growth, as SMAs play a critical role in addressing complex and evolving threats.

Regional Trends in the Special Mission Aircraft Market:

The Special Mission Aircraft (SMA) market exhibits distinct regional trends shaped by various factors such as defense spending, technological adoption, and geopolitical dynamics. In North America, particularly in the United States, the SMA market holds a substantial share due to the country's advanced defense industry and substantial military budget. The U.S. continues to invest heavily in modernizing its military capabilities, which includes upgrading existing special mission aircraft and developing new platforms to address emerging threats. The presence of major defense contractors like Boeing and Lockheed Martin further bolsters the market in this region, reinforcing its dominance. In Europe, the SMA market is characterized by a strong focus on defense and security, driven by rising geopolitical tensions and a growing need for enhanced surveillance capabilities. Countries such as the UK, France, and Germany are making significant investments in special mission aircraft to support military operations and improve border security. Additionally, collaborative defense initiatives within the European Union are fostering advancements in SMA technologies, reflecting a unified effort to strengthen regional security. The Asia-Pacific region is anticipated to experience notable growth in the SMA market, fueled by increasing defense budgets in countries like China, India, and Japan. These nations are investing in advanced military technologies to address regional security challenges and enhance their surveillance and reconnaissance operations. The growing interest in unmanned aerial vehicles (UAVs) for military applications is also contributing to the expansion of the SMA market in this region, highlighting a trend towards modernizing and diversifying military capabilities.In the Middle East and Africa, the SMA market is significantly influenced by ongoing conflicts and security concerns. Countries in these regions are investing in special mission aircraft to bolster their military capabilities and address various threats such as terrorism and piracy. The demand for maritime patrol aircraft is particularly strong, as nations seek to secure their maritime borders and enhance their operational reach in a region fraught with security challenges. In Latin America, although the SMA market is relatively smaller, there is a growing recognition of the need for enhanced surveillance and reconnaissance capabilities. Countries in this region are increasingly investing in special mission aircraft to support law enforcement and border security operations, reflecting a rising awareness of the importance of specialized aviation assets in maintaining national security.

Key Special Mission Aircraft Market Program:

Boeing Canada is to invest $61 million in British Columbia for an aerospace manufacturing training center as well as R&D. The statement is the latest from the American aviation giant as part of a multibillion-dollar agreement with Ottawa to purchase new military surveillance planes. Minister of National Defence Bill Blair applauded the expenditure at the Boeing Canada site in Richmond, British Columbia, stating that while the government invests more in defence, it ensures that it also benefits Canada's economy and people. Last year, the federal government stated that it will buy up to 16 Boeing P-8A Poseidon multi-mission aircraft to replace the Aurora, which has been in service for nearly 40 years.

Marshall has been awarded a £4.5 million contract extension to provide continued engineering support for the French Air Force's fleet of 14 Lockheed Martin C-130H Hercules aircraft. The most recent extension adds on a four-year contract that was previously extended for two years. The granting body is the Service Industriel de l'Aeronautique (SIAe), a state-owned maintenance company. Marshall will offer engineering support for the C-130H's maintenance, repair, and overhaul, with activities centered on the SIAe plant in Clermont, France. The deal also includes the continued provision of C-130 parts and repair kits manufactured in-house by Marshall under Lockheed Martin's exclusive Authority to Manufacture clearances.

Lufthansa Technik has delivered the third modified Airbus A350-900 aircraft to the German Air Force as part of its Special Air Mission Wing fleet expansion. The German Ministry of Defence approved the purchase of three Airbus A350s in 2019 to replace the Special Air Mission Wing's two A340s that had been in service since the 2010s. The endeavor received approximately 1.2 billion euros ($1.3 billion) in funding. The Airbus A350-900 has a fuselage width of 5.9 metres (19.5 feet) and a length of 66.8 metres (219 feet). The vehicle is powered by a Rolls-Royce Trent XWB high-bypass turbofan, with a range of over 15,372 kilometers (9,551 miles) and a top speed of 945 kilometers (587 miles) per hour.

Table of Contents

Special Mission Aircraft Market Report Definition

Special Mission Aircraft Market Segmentation

By Application

By Region

By Fitment

Special Mission Aircraft Market Analysis for next 10 Years

The 10-year special mission aircraft market analysis would give a detailed overview of special mission aircraft market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Special Mission Aircraft Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Special Mission Aircraft Market Forecast

The 10-year special mission aircraft market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Special Mission Aircraft Market Trends & Forecast

The regional special mission aircraft market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Special Mission Aircraft Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Special Mission Aircraft Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Special Mission Aircraft Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Application, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Fitment, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Application, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Fitment, 2024-2034

List of Figures

- Figure 1: Global Special Mission Aircraft Market Forecast, 2024-2034

- Figure 2: Global Special Mission Aircraft Market Forecast, By Region, 2024-2034

- Figure 3: Global Special Mission Aircraft Market Forecast, By Application, 2024-2034

- Figure 4: Global Special Mission Aircraft Market Forecast, By Fitment, 2024-2034

- Figure 5: North America, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 6: Europe, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 8: APAC, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 9: South America, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 10: United States, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 11: United States, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 12: Canada, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 14: Italy, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 16: France, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 17: France, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 18: Germany, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 24: Spain, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 30: Australia, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 32: India, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 33: India, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 34: China, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 35: China, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 40: Japan, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Special Mission Aircraft Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Special Mission Aircraft Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Special Mission Aircraft Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Special Mission Aircraft Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Special Mission Aircraft Market, By Application (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Special Mission Aircraft Market, By Application (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Special Mission Aircraft Market, By Fitment (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Special Mission Aircraft Market, By Fitment (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Special Mission Aircraft Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Special Mission Aircraft Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Special Mission Aircraft Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Special Mission Aircraft Market, By Region, 2024-2034

- Figure 58: Scenario 1, Special Mission Aircraft Market, By Application, 2024-2034

- Figure 59: Scenario 1, Special Mission Aircraft Market, By Fitment, 2024-2034

- Figure 60: Scenario 2, Special Mission Aircraft Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Special Mission Aircraft Market, By Region, 2024-2034

- Figure 62: Scenario 2, Special Mission Aircraft Market, By Application, 2024-2034

- Figure 63: Scenario 2, Special Mission Aircraft Market, By Fitment, 2024-2034

- Figure 64: Company Benchmark, Special Mission Aircraft Market, 2024-2034