|

市场调查报告书

商品编码

1552528

全球国防遥测市场(2024-2034)Global Defense Telemetry Market 2024-2034 |

||||||

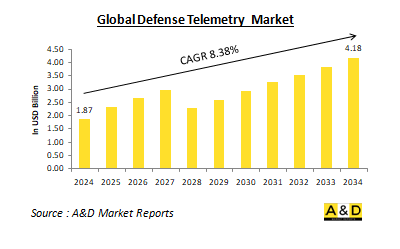

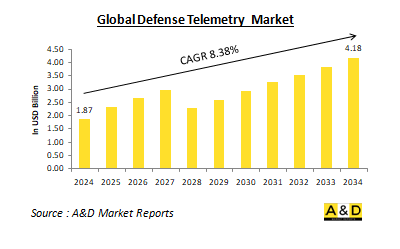

到2024年,全球国防遥测市场估计将达到 18.7亿美元,预计2024年至2034年年复合成长率为 8.38%,到2034年将达到 41.8亿美元。

全球国防遥测市场概况

国防遥测是指用于收集、传输和分析来自国防相关系统和资产的资料(通常是即时的)的流程和技术。它透过实现对关键系统、武器和平台的持续监控,在现代军事行动中发挥关键作用。国防遥测可确保复杂系统(从飞弹测试和无人机(UAV)到潜艇和卫星)高效运行,并向决策者提供关键资料。随着防御系统变得更加复杂和网路化,遥测技术已经发展到满足现代战争的需求。从历史上看,国防部门的遥测技术着重于特定应用,例如追踪飞弹或监控太空船。但如今,它涵盖了广泛的领域,包括战场管理、后勤、网路安全和情报。在数位技术、通讯网路和感测器系统进步的推动下,全球国防遥测市场多年来经历了稳定成长。

科技对全球国防遥测市场的影响

技术彻底改变国防遥测,从简单的资料传输系统转变为可以与人工智慧(AI)、物联网(IoT)和感测器系统等先进技术整合的复杂的多方面网路。人工智慧和机器学习(ML)支援遥测中的预测分析,使国防军能够预测系统故障和潜在威胁,提高任务效率。人工智慧支援的遥测系统可以即时处理大量资料,使军事指挥官能够做出更快、更明智的决策。人工智慧演算法还可以帮助识别人类操作员可能会错过的模式,使他们在战斗情况下具有优势。此外,人工智慧还可以实现资料处理自动化,使人员能够致力于关键任务。现代遥测系统也严重依赖先进的感测器技术,从陆地、海洋、空中和太空平台收集关键资料。这些感测器可侦测速度、温度、压力和位置等各种参数,提供即时态势感知。例如,在无人机(UAV)和无人机中,感测器可以对物体进行分类,这使其对于监视和侦察任务非常重要。将物联网整合到国防遥测网路中,可实现各种国防平台之间的无缝通讯和资料交换,进一步彻底改变了军事行动。例如,地面雷达站可以向飞机和卫星即时传输资料,使所有平台协同工作,提高军事行动的效率和准确性。随着这些遥测系统的互联程度越来越高,它们变得更容易受到网路攻击,使网路安全成为一个关键问题。加密、区块链技术和入侵侦测系统的最新进展使遥测网路更能抵御骇客攻击和资料外洩。此外,卫星透过提供全球覆盖和稳定的通讯通道,在遥测中发挥重要作用,特别是在偏远地区和地面基础设施有限的恶劣环境中。基于卫星的遥测技术可确保远距离安全、即时的资料传输,进而提高国防军的整体能力。

全球国防遥测市场的关键驱动因素

有几个主要因素推动全球国防遥测市场的成长和发展。主要因素是现代战争的复杂性日益增加、对即时资料的需求以及增强态势感知的需求不断增加。主要因素之一是世界地缘政治紧张局势加剧,特别是东欧、亚太和中东等地区。这种不稳定导致各国增加军事开支并投资于尖端国防技术,包括遥测系统,以便在潜在衝突中获得技术优势。遥测对于飞弹防御系统、预警系统以及先进的指挥和控制结构非常重要。此外,高超音速飞弹、自动驾驶车辆和下一代战斗机等新型防御平台的开发需要遥测技术的进步来处理这些系统产生的大量资料。例如,高超音速武器需要先进的遥测系统来监控高速飞行期间的性能,以确保准确性和有效性。无人机和无人水下航行器(UUV)等无人系统的激增也推动了对先进遥测解决方案的需求。无人系统广泛应用于监视、侦察和战斗任务,遥测技术使这些平台能够与操作员通讯、中继关键任务资料并接收即时指令。另一个关键驱动因素是感测器小型化,这对国防遥测产生重大影响。这些小型轻量感测器可以整合到从车辆到士兵头盔的各种国防资产中,而不会影响移动性。感测器收集大量资料,从战场状况到士兵健康状况,这些资料透过遥测系统传输和分析。最后,许多国家正致力于国防现代化,升级现有遥测系统以适应 5G 网路、人工智慧和量子运算等新技术。这些现代化遥测系统提供更快、更安全的资料传输,显着增强在日益复杂的作战环境中的军事能力。

全球国防遥测市场区域趋势

世界各地对国防遥测的需求成长,但趋势因国防支出、技术采用和战略优先事项的地区差异而异。在北美,美国因其庞大的国防预算和先进的军事能力而成为国防遥测系统的最大消费者。美国国防部(DoD)继续大力投资遥测技术,以保持空中、海上和太空作战的优势。它还致力于将遥测技术与人工智慧(AI)和天基系统相结合,以提高远程打击能力和飞弹防御能力。欧洲,尤其是北约成员国,对国防遥测的投资日益增加。乌克兰持续的衝突以及与俄罗斯不断升级的紧张局势正促使许多欧洲国家对其军事力量进行现代化改造,而遥测更新将有助于加强情报、监视和侦察(ISR)能力,并加强北约盟国之间的联繫。在南海紧张局势升级、北韩飞弹试射和中国军事扩张的推动下,国防遥测在亚太地区蓬勃发展。印度、日本和韩国等国日益增加对遥测技术的投资,以加强其防御系统,并且对天基遥测技术以增强通讯和情监侦测能力也表现出浓厚的兴趣。在中东,沙乌地阿拉伯和阿拉伯联合大公国等国家正大力投资现代防御系统,包括遥测技术。该地区不稳定的安全环境导致人们对飞弹防御和无人系统的关注。遥测和先进雷达系统的整合也是该地区的成长趋势。相较之下,非洲和拉丁美洲的国防遥测技术则较不发达,但人们对取得这些技术的兴趣日益浓厚,特别是出于边境安全和反恐目的。然而,预算限制和有限的技术基础设施对该地区广泛采用国防遥测提出了挑战。

国防遥测主要计画

美国空军授予 RTX 飞弹和防御部门一份价值约 12亿美元的合约。根据美国国防部宣布该合约的声明,RTX 将在亚利桑那州图森生产 AMRAAM 飞弹、遥测系统和替换零件,并提供生产工程支援。根据国防部公告,向包括义大利在内的18个国家的对外军售金额约为4.49亿美元,占合约总额的39%。

Raytheon Technologies Corp正准备为美国空军和海军生产 AIM-120 先进中程空对空飞弹(AMRAAM)。除了 AMRAAM 遥测系统(ATS)、初始备件和现场备件以及其他生产工程支援硬体和操作之外,空军还向 Reythoen 请求 37个 AMRAAM 生产批次。

RTX 的飞弹和国防业务已获得美国空军约 12亿美元的合约。根据国防部宣布该合约的声明,除了提供生产工程支援外,RTX 还将在亚利桑那州图森製造 AMRAAM 飞弹、遥测系统和替换零件。根据五角大厦的公告,RTX 将在图森製造 AMRAAM 飞弹、遥测系统和替换零件,并提供生产工程支援。到2027年1月,该项目计划完成37批导弹的建造。据国防部表示,包括英国在内的18个国家将获得4.49亿美元的对外军售,约占合约总价值的39%。

目录

国防遥测市场:报告定义

国防遥测市场细分

- 依地区

- 依技术

- 依系统

国防遥测市场分析(未来 10年)

国防遥测市场的市场技术

全球国防遥测市场预测

国防遥测市场:区域趋势与预测

- 北美

- 促进/抑制因素和挑战

- PEST分析

- 市场预测与情境分析

- 主要公司

- 供应商层级状况

- 企业基准比较

- 欧洲

- 中东

- 亚太地区

- 南美洲

国防遥测市场:国家分析

- 美国

- 防御规划

- 最新趋势

- 专利

- 该市场目前的技术成熟度等级

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳洲

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

国防遥测市场:市场机会矩阵

国防遥测市场:专家对研究的看法

结论

关于航空和国防市场报告

The Global Defense Telemetry Market is estimated at USD 1.87 billion in 2024, projected to grow to USD 4.18 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 8.38% over the forecast period 2024-2034

Introduction to Global Defense Telemetry Market:

Defense telemetry refers to the processes and technologies used to collect, transmit, and analyze data from defense-related systems and assets, often in real-time. It plays a vital role in modern military operations by enabling the continuous monitoring of critical systems, weapons, and platforms. From missile testing and unmanned aerial vehicles (UAVs) to submarines and satellites, defense telemetry ensures that these complex systems operate efficiently and that vital data is available for decision-makers. As defense systems become increasingly sophisticated and networked, telemetry technology has evolved to meet the demands of modern warfare. Historically, telemetry in the defense sector focused on specific applications, such as tracking missiles and monitoring spacecraft. However, today it encompasses a wide array of domains, including battlefield management, logistics, cybersecurity, and intelligence. The global defense telemetry market has grown steadily over the years, driven by advancements in digital technology, communication networks, and sensor systems.

Technology Impact in Global Defense Telemetry Market:

Technology has significantly transformed defense telemetry from simple data transmission systems into sophisticated, multi-faceted networks capable of integrating with advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and sensor systems. AI and machine learning (ML) have enabled predictive analysis in telemetry, allowing defense forces to anticipate system failures or potential threats, thereby enhancing mission effectiveness. AI-powered telemetry systems can process large amounts of data in real-time, allowing military commanders to make quicker and more informed decisions. AI algorithms also help identify patterns that human operators may overlook, providing an edge in combat situations. Furthermore, automating data processing through AI frees personnel to focus on mission-critical tasks. Modern telemetry systems are also heavily reliant on advanced sensor technology, which gathers critical data from platforms across land, sea, air, and space. These sensors detect various parameters like speed, temperature, pressure, and location, offering real-time situational awareness. In unmanned aerial vehicles (UAVs) and drones, for instance, sensors can classify objects, making them essential for surveillance and reconnaissance missions. The integration of IoT into defense telemetry networks has further revolutionized military operations by enabling seamless communication and data exchange between various defense platforms. For example, a ground-based radar station can transmit real-time data to an aircraft or satellite, ensuring all platforms work cohesively to improve the efficiency and accuracy of military operations. As these telemetry systems become increasingly interconnected, they also become more susceptible to cyberattacks, which makes cybersecurity a critical concern. Recent advancements in encryption, blockchain technology, and intrusion detection systems have strengthened the resilience of telemetry networks against hacking and data breaches. Additionally, satellites play a crucial role in telemetry by providing global coverage and stable communication channels, especially in remote or hostile environments where terrestrial infrastructure may be limited. Satellite-based telemetry ensures secure, real-time data transmission across great distances, enhancing the overall capabilities of defense forces.

Key Drivers in Global Defense Telemetry Market:

Several key factors are driving the growth and development of the global defense telemetry market, primarily due to the increasing complexity of modern warfare, the need for real-time data, and the rising demand for enhanced situational awareness. One major factor is the rise in global geopolitical tensions, particularly in regions such as Eastern Europe, the Asia-Pacific, and the Middle East. This instability has prompted nations to increase military spending and invest in cutting-edge defense technologies, including telemetry systems, to gain a technological edge in potential conflicts. Telemetry is crucial in missile defense systems, early warning systems, and advanced command-and-control structures. Additionally, the development of emerging defense platforms, such as hypersonic missiles, autonomous vehicles, and next-generation fighter jets, has necessitated advancements in telemetry to handle the large amounts of data these systems generate. For example, hypersonic weapons require sophisticated telemetry systems to monitor their performance during high-speed flight to ensure accuracy and effectiveness. The proliferation of unmanned systems, such as drones and unmanned underwater vehicles (UUVs), has also increased the demand for advanced telemetry solutions. Unmanned systems are widely used in surveillance, reconnaissance, and combat missions, and telemetry allows these platforms to communicate with their operators, relay mission-critical data, and receive real-time instructions. Another key driver is the miniaturization of sensors, which has had a significant impact on defense telemetry. These smaller, lighter sensors can be embedded in a range of defense assets, from vehicles to soldiers' helmets, without compromising mobility. They collect a wealth of data, from battlefield conditions to soldier health, which is transmitted through telemetry systems for analysis. Lastly, many nations are focusing on defense modernization, upgrading their existing telemetry systems to be compatible with new technologies like 5G networks, artificial intelligence, and quantum computing. These modernized telemetry systems provide faster, more secure data transmission, significantly enhancing military capabilities in increasingly complex battle environments.

Regional Trends in Global Defense Telemetry Market:

The demand for defense telemetry is widespread across the globe, but regional variations in defense spending, technological adoption, and strategic priorities result in differing trends. In North America, the United States stands as the largest consumer of defense telemetry systems due to its substantial defense budget and advanced military capabilities. The U.S. Department of Defense (DoD) continues to invest heavily in telemetry technologies to maintain its superiority in air, sea, and space operations. There is also a strong focus on integrating telemetry with artificial intelligence (AI) and space-based systems to improve long-range strike capabilities and missile defense. In Europe, particularly among NATO members, investment in defense telemetry is on the rise. The ongoing conflict in Ukraine and escalating tensions with Russia have driven many European nations to modernize their military forces, with telemetry upgrades aimed at enhancing intelligence, surveillance, and reconnaissance (ISR) capabilities and fostering better coordination between NATO allies. The Asia-Pacific region is experiencing rapid growth in defense telemetry, fueled by rising tensions in the South China Sea, North Korea's missile tests, and China's military expansion. Countries such as India, Japan, and South Korea are increasingly investing in telemetry technologies to bolster their defense systems, while there is also significant interest in space-based telemetry to enhance communications and ISR capabilities. In the Middle East, nations like Saudi Arabia and the UAE are making substantial investments in modern defense systems, including telemetry. The region's volatile security environment has led to a focus on missile defense and unmanned systems, both of which depend heavily on telemetry for operational success. The integration of telemetry with advanced radar systems is also a growing trend in this region. In contrast, defense telemetry is less developed in Africa and Latin America, though there is increasing interest in acquiring these technologies, particularly for border security and counter-terrorism purposes. However, budgetary limitations and limited technological infrastructure present challenges to the widespread adoption of defense telemetry in these regions.

Key Defense Telemetry Market Program:

A contract for around $1.2 billion has been given to RTX's missile and defence division by the U.S. Air Force.According to the Pentagon's announcement announcing the contract, RTX will undertake production engineering assistance in addition to producing AMRAAM missiles, telemetry systems, and replacement components in Tucson, Arizona. By the end of January 2027, the corporation hopes to have completed construction on Lot 37 of the missiles.As per the Pentagon, the foreign military sales to eighteen countries, including the Italy, will account for around 449 million, or 39%, of the total contract amount.

Raytheon Technologies Corp is preparing to build improved versions of the AIM-120 Advanced Medium Range Air to Air Missile (AMRAAM) for the U.S. Air Force and Navy. These upgrades will increase the missile's lifespan until the end of this decade.In addition to AMRAAM Telemetry System (ATS), initial and field spares, and other production engineering support hardware and operations, the Air Force is requesting from Raytheon AMRAAM production lot 37.

The RTX missile and defence business has been given a roughly $1.2 billion contract by the U.S. Air Force.According to the Pentagon's announcement announcing the contract, RTX will manufacture AMRAAM missiles, telemetry systems, and replacement components in Tucson, Arizona, in addition to providing production engineering assistance. By the end of January 2027, the business is anticipated to have completed construction on Lot 37 of the missiles.According to the Pentagon, 18 countries, including the United Kingdom, will get foreign military sales of $449 million, or around 39% of the contract's total value.

Table of Contents

Defense Telemetry Market Report Definition

Defense Telemetry Market Segmentation

By Region

By Technology

By System

Defense Telemetry Market Analysis for next 10 Years

The 10-year Defense Telemetry Market analysis would give a detailed overview of Defense Telemetry Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Telemetry Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Telemetry Market Forecast

The 10-year Defense Telemetry Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Telemetry Market Trends & Forecast

The regional Defense Telemetry Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Telemetry Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Telemetry Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Telemetry Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Type, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Platform, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Component, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Type, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Platform, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Component, 2022-2032

List of Figures

- Figure 1: Global Defense Telemetry Forecast, 2022-2032

- Figure 2: Global Defense Telemetry Forecast, By Region, 2022-2032

- Figure 3: Global Defense Telemetry Forecast, By Type, 2022-2032

- Figure 4: Global Defense Telemetry Forecast, By Platform, 2022-2032

- Figure 5: Global Defense Telemetry Forecast, By Component, 2022-2032

- Figure 6: North America, Defense Telemetry, Market Forecast, 2022-2032

- Figure 7: Europe, Defense Telemetry, Market Forecast, 2022-2032

- Figure 8: Middle East, Defense Telemetry, Market Forecast, 2022-2032

- Figure 9: APAC, Defense Telemetry, Market Forecast, 2022-2032

- Figure 10: South America, Defense Telemetry, Market Forecast, 2022-2032

- Figure 11: United States, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 12: United States, Defense Telemetry, Market Forecast, 2022-2032

- Figure 13: Canada, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 14: Canada, Defense Telemetry, Market Forecast, 2022-2032

- Figure 15: Italy, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 16: Italy, Defense Telemetry, Market Forecast, 2022-2032

- Figure 17: France, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 18: France, Defense Telemetry, Market Forecast, 2022-2032

- Figure 19: Germany, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 20: Germany, Defense Telemetry, Market Forecast, 2022-2032

- Figure 21: Netherlands, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Defense Telemetry, Market Forecast, 2022-2032

- Figure 23: Belgium, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 24: Belgium, Defense Telemetry, Market Forecast, 2022-2032

- Figure 25: Spain, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 26: Spain, Defense Telemetry, Market Forecast, 2022-2032

- Figure 27: Sweden, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 28: Sweden, Defense Telemetry, Market Forecast, 2022-2032

- Figure 29: Brazil, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 30: Brazil, Defense Telemetry, Market Forecast, 2022-2032

- Figure 31: Australia, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 32: Australia, Defense Telemetry, Market Forecast, 2022-2032

- Figure 33: India, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 34: India, Defense Telemetry, Market Forecast, 2022-2032

- Figure 35: China, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 36: China, Defense Telemetry, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Defense Telemetry, Market Forecast, 2022-2032

- Figure 39: South Korea, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 40: South Korea, Defense Telemetry, Market Forecast, 2022-2032

- Figure 41: Japan, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 42: Japan, Defense Telemetry, Market Forecast, 2022-2032

- Figure 43: Malaysia, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Defense Telemetry, Market Forecast, 2022-2032

- Figure 45: Singapore, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 46: Singapore, Defense Telemetry, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Defense Telemetry, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Defense Telemetry, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Defense Telemetry, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Defense Telemetry, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Defense Telemetry, By Type (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Defense Telemetry, By Type (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Defense Telemetry, By Platform (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Defense Telemetry, By Platform (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Defense Telemetry, By Component (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Defense Telemetry, By Component (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Defense Telemetry, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Defense Telemetry, Global Market, 2022-2032

- Figure 59: Scenario 1, Defense Telemetry, Total Market, 2022-2032

- Figure 60: Scenario 1, Defense Telemetry, By Region, 2022-2032

- Figure 61: Scenario 1, Defense Telemetry, By Type, 2022-2032

- Figure 62: Scenario 1, Defense Telemetry, By Platform, 2022-2032

- Figure 63: Scenario 1, Defense Telemetry, By Component, 2022-2032

- Figure 64: Scenario 2, Defense Telemetry, Total Market, 2022-2032

- Figure 65: Scenario 2, Defense Telemetry, By Region, 2022-2032

- Figure 66: Scenario 2, Defense Telemetry, By Type, 2022-2032

- Figure 67: Scenario 2, Defense Telemetry, By Platform, 2022-2032

- Figure 68: Scenario 2, Defense Telemetry, By Component, 2022-2032

- Figure 69: Company Benchmark, Defense Telemetry, 2022-2032