|

市场调查报告书

商品编码

1556133

全球防卫无人机市场(2024-2034)Global Defense UAV Market 2024-2034 |

||||||

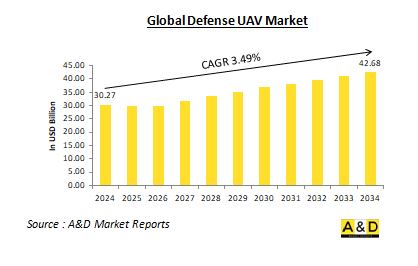

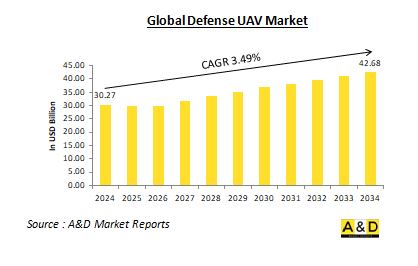

估计2024年全球防卫无人机市场规模为 302.7亿美元,预计到2034年将成长至 426.8亿美元,2024年至2034年年复合成长率为 3.49%。

全球防卫无人机市场概况

无人机(UAV),已成为现代军事行动的基石,彻底改变了世界各地的防御战略和战术。该飞机无需人类飞行员操作,部署用于广泛的防御应用,从侦察和监视到目标攻击和后勤支援。由于技术进步、不断变化的军事需求以及不断加剧的地缘政治紧张局势,全球防卫无人机市场迅速扩大。无人机提供了多功能性、成本效率和操作灵活性的独特组合,使其对现代战争和防御行动非常重要。

科技对全球防卫无人机市场的影响

科技对世界防卫无人机的影响是深远且多方面的,在多个维度上对其开发和部署产生重大影响。最显着的进步之一是先进的感测器技术。现代军用无人机配备了高解析度摄影机、红外线感测器和雷达系统,大幅提高了其侦察和监视能力。这些感测器使无人机能够收集详细情报、进行广泛侦察并执行精确瞄准,提高态势感知和作战效率。

另一个重要的影响领域是自治能力。将人工智慧(AI)和机器学习整合到无人机系统中彻底改变其操作能力。自主无人机现在能够以最少的人为干预执行复杂的任务,包括导航、目标识别和威胁检测。人工智慧驱动的系统提高了无人机的运作效率和准确性,使其能够适应环境的变化并更精确地执行任务。通讯和资料链系统在防卫无人机的有效性方面也发挥关键作用。卫星通讯、安全资料链路和即时资料传输技术的进步确保了无人机和地面控制站之间的持续通讯。这种连接有助于将关键讯息传递给军事指挥部,并支援远端机动和即时任务管理,提高整体作战效率。

此外,防御无人机日益采用隐身和规避技术,以便在衝突环境中成功运作。其中包括减少雷达横断面的设计功能、最大限度地减少红外线特征的先进材料以及扰乱敌方雷达和通讯系统的电子对抗措施。这种技术使无人机能够在敌方领土上执行任务,同时最大限度地降低被敌方部队发现和交战的风险。最后,现代防御战略的重点是集群和网路作战的概念。无人机集群可以透过部署多个协同行动的无人机来集体执行复杂的任务。网路化操作使这些无人机能够即时共享资讯并协调行动,提高其效率并提供更强大的防御和进攻能力。

全球防卫无人机市场的关键驱动因素

有几个主要因素推动全球防卫无人机市场的成长和发展。地缘政治紧张局势和地区衝突大幅增加了对先进防御无人机的需求。各国正大力投资无人机技术,以增强军事能力、收集情报并进行精确攻击。中东和东欧等衝突多发地区对战略优势的需求导致了对无人机技术的大量投资。技术进步也是市场成长的主要因素之一。感测器技术、人工智慧(AI)、通讯系统和材料科学的创新扩展防卫无人机的能力,使其更加有效和多功能。随着这些技术的发展,无人机能够执行复杂的任务并在日益恶劣的环境中运作。成本效率在推动无人机的采用方面也发挥着重要作用。与有人驾驶飞机和传统军事资产相比,无人机由于营运和维护成本较低,提供了更具成本效益的解决方案。这使得无人机成为国防部队在保持高作战效率的同时最佳化预算的有吸引力的选择。部署无人机执行各种任务而无需支付有人驾驶飞机相关成本的能力,进一步加速了无人机在各种军事和国防应用中的采用。非对称战争的兴起也是推动无人机需求的因素之一。在小型、敏捷的部队与大型、技术先进的对手的衝突中,无人机透过提供卓越的侦察、监视和精确打击能力来提供战略优势。无人机使小型部队能够有效对抗规模更大的常规对手,并更有效地实现战术和战略目标。最后,国防预算的增加推动对包括无人机在内的先进技术的投资。许多国家日益增加国防开支,以应对新威胁并增强军事能力。国防预算的增加促使各国政府分配资金来开发和采购尖端无人机系统,以便在各种国防场景中获得竞争优势。

全球防卫无人机市场的区域趋势

全球防务无人机市场受到地区防务优先事项、技术进步和地缘政治因素的影响,并呈现出明显的区域趋势:北美,尤其是美国,朝着先进无人机系统大规模投资主导市场的方向发展。美国一直处于开发和部署无人机的最前沿,其重点是侦察、监视和作战行动。General Atomics和Northrop Grumman等主要国防公司在开发尖端无人机技术方面处于领先地位。在大量国防预算的支持下,美国军方广泛使用无人机,巩固了在该地区市场领导者的地位。在欧洲,英国、法国和德国等国家正大力投资无人机技术,以增强其防御能力。欧洲国家重点开发用于情报收集、侦察和战术行动的先进无人机系统。欧洲国防基金(EDF)等措施加速下一代无人机技术的开发并促进欧洲国防工业之间的合作。在国防预算增加和地缘政治紧张局势加剧的推动下,亚太地区的防卫无人机市场快速成长。中国、印度和日本等国家正大力投资无人机技术,以实现军事力量现代化并增强战略能力。特别是中国增强其无人机能力,并致力于进攻性和防御性应用。同时,印度和日本日益扩大其无人机机队,以应对区域安全挑战。中东日益使用防卫无人机来解决区域衝突和安全问题。以色列、沙乌地阿拉伯和阿拉伯联合大公国等国家投资用于情报、监视和攻击任务的无人机技术。在该地区部署无人机凸显了对先进能力的需求,以应对动盪的地缘政治环境中的威胁并保持战略优势。在非洲,防卫无人机市场成长,儘管与其他地区相比成长较慢。南非和埃及等国家探索无人机技术,以增强其防御能力并解决安全问题。非洲采用无人机的原因是需要有效的监视和侦察解决方案来应对持续的衝突和安全挑战。防卫无人机主要计画

美国陆军从 EAGLS 接收了首个雷射导引反无人机系统。这家总部位于北卡罗来纳州的公司表示,这六个系统的合约是为了支援 "前沿部署部队应对不断出现的非载人机载系统威胁" 。根据五角大厦的合约通知,该公司已签订合约,向美国中央司令部责任区提供五架 EAGLS,其中包括中东、中亚和南亚部分地区。

义大利政府已批准以 7.38亿美元购买六架 MQ-9 Reaper 无人机。价值 7.38亿美元的对外军售包括交付三个移动地面控制站和六架 Block 5 Reaper 无人机。 如果交易继续进行,政府还将收到 9 部 AN/APY-8 合成孔径雷达和 12 部多光谱瞄准系统。美国国防安全合作局表示,计画中的军售将 "透过改善北约盟国的安全来支持美国的外交政策和国家安全目标" 。

目录

防卫无人机市场:报告定义

防卫无人机市场区隔

- 依地区

- 依推进方式

- 依最终用户

防卫无人机市场分析(未来10年)

军用无人机市场的市场技术

全球防卫无人机市场预测

防卫无人机市场:区域趋势与预测

- 北美

- 促进/抑制因素和挑战

- PEST分析

- 市场预测与情境分析

- 主要公司

- 供应商层级状况

- 企业基准比较

- 欧洲

- 中东

- 亚太地区

- 南美洲

防卫无人机市场:国家分析

- 美国

- 防御规划

- 最新趋势

- 专利

- 该市场目前的技术成熟度等级

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳洲

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

防卫无人机市场:市场机会矩阵

防卫无人机市场:专家对调查的看法

结论

关于航空和国防市场报告

The Global Defense UAV Market is estimated at USD 30.27 billion in 2024, projected to grow to USD 42.68 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 3.49% over the forecast period 2024-2034

Introduction to Global Defense UAV Market:

Unmanned Aerial Vehicles (UAVs), commonly known as drones, have become a cornerstone of modern military operations, revolutionizing defense strategies and tactics across the globe. These aircraft, which operate without onboard human pilots, are increasingly being deployed for a wide range of defense applications, from reconnaissance and surveillance to targeted strikes and logistical support. The global defense UAV market is expanding rapidly, driven by technological advancements, evolving military needs, and increasing geopolitical tensions. UAVs offer a unique combination of versatility, cost-efficiency, and operational flexibility, making them indispensable in contemporary warfare and defense operations.

Technology Impact in Global Defense UAV Market:

Technology's impact on global defense UAVs is both profound and multifaceted, significantly influencing their development and deployment across various dimensions. One of the most notable advancements is in advanced sensor technologies. Modern defense UAVs are outfitted with high-resolution cameras, infrared sensors, and radar systems that greatly enhance their reconnaissance and surveillance capabilities. These sensors allow UAVs to gather detailed intelligence, conduct extensive surveillance, and perform precise targeting, thereby improving situational awareness and operational effectiveness.

Another critical area of impact is autonomous capabilities. The integration of artificial intelligence (AI) and machine learning into UAV systems is revolutionizing their operational functionality. Autonomous UAVs are now capable of executing complex missions with minimal human intervention, such as navigation, target identification, and threat detection. AI-driven systems boost the efficiency and accuracy of UAV operations, enabling them to adapt to changing environments and perform tasks with greater precision. Communication and data link systems also play a crucial role in the effectiveness of defense UAVs. Advances in satellite communication, secure data links, and real-time data transmission technologies ensure continuous communication between UAVs and ground control stations. This connectivity facilitates the relay of critical information back to military command centers and supports remote piloting and real-time mission management, thereby enhancing overall operational effectiveness.

Furthermore, to operate successfully in contested environments, defense UAVs are increasingly incorporating stealth and evasion technologies. These include design features that reduce radar cross-sections, advanced materials that minimize infrared signatures, and electronic countermeasures that disrupt enemy radar and communication systems. Such technologies allow UAVs to carry out missions in hostile areas while minimizing the risk of detection and engagement by enemy forces. Lastly, the concept of swarming and networked operations is gaining prominence in modern defense strategies. UAV swarming involves deploying multiple drones that operate in coordinated groups, allowing for the execution of complex missions collectively. Networked operations enable these UAVs to share information and coordinate actions in real time, thereby enhancing their effectiveness and providing more robust defensive and offensive capabilities.

Key Drivers in Global Defense UAV Market:

Several key factors are driving the growth and development of the global defense UAV market. Geopolitical tensions and regional conflicts are significantly contributing to the increased demand for advanced defense UAVs. Nations are investing heavily in UAV technology to enhance their military capabilities, gather intelligence, and carry out precise strikes. This need for strategic advantages in conflict-prone areas like the Middle East and Eastern Europe is leading to substantial investments in UAV technology. Technological advancements are another major driver of market growth. Innovations in sensor technology, artificial intelligence (AI), communication systems, and materials science are expanding the capabilities of defense UAVs, making them more effective and versatile. As these technologies evolve, UAVs are becoming increasingly capable of executing complex missions and operating in more challenging environments. Cost efficiency also plays a crucial role in driving the adoption of UAVs. Compared to manned aircraft and traditional military assets, UAVs offer a more cost-effective solution due to their lower operational and maintenance costs. This makes them an attractive option for defense forces aiming to optimize their budgets while maintaining high operational effectiveness. The ability to deploy UAVs for a range of missions without the expense associated with manned aircraft is further accelerating their adoption in various military and defense applications. The rise of asymmetric warfare is another factor fueling UAV demand. In conflicts where smaller, agile forces challenge larger, technologically advanced opponents, UAVs provide a strategic advantage by offering superior reconnaissance, surveillance, and precision strike capabilities. They enable smaller forces to effectively counter larger, conventional adversaries and achieve tactical and strategic objectives more efficiently. Finally, increased defense budgets are driving investments in advanced technologies, including UAVs. Many countries are boosting their defense spending to address emerging threats and enhance their military capabilities. This increase in defense budgets is leading governments to allocate funds for the development and acquisition of cutting-edge UAV systems, providing a competitive edge in various defense scenarios.

Regional Trends in Global Defense UAV Market:

The global defense UAV market displays distinct regional trends, influenced by local defense priorities, technological advancements, and geopolitical factors: In North America, particularly the United States, the market is dominated by significant investments in advanced UAV systems. The U.S. has been at the forefront of UAV development and deployment, focusing on reconnaissance, surveillance, and combat operations. Major defense contractors, such as General Atomics and Northrop Grumman, are leading the charge in developing state-of-the-art UAV technologies. The U.S. military's extensive use of UAVs, supported by substantial defense budgets, reinforces the region's position as a market leader. In Europe, countries like the United Kingdom, France, and Germany are making considerable investments in UAV technology to bolster their defense capabilities. European nations are focusing on developing sophisticated UAV systems for intelligence gathering, surveillance, and tactical operations. Initiatives such as the European Defence Fund (EDF) are promoting the development of next-generation UAV technologies and encouraging collaboration among European defense industries. The Asia-Pacific region is witnessing rapid growth in the defense UAV market, fueled by increased defense budgets and escalating geopolitical tensions. Nations such as China, India, and Japan are heavily investing in UAV technology to modernize their military forces and strengthen their strategic capabilities. China, in particular, is advancing its UAV capabilities with a focus on both offensive and defensive applications. Meanwhile, India and Japan are expanding their UAV fleets to address regional security challenges. In the Middle East, defense UAVs are increasingly being utilized to tackle regional conflicts and security issues. Countries including Israel, Saudi Arabia, and the United Arab Emirates are investing in UAV technology for intelligence, surveillance, and strike missions. The deployment of UAVs in this region underscores the need for advanced capabilities to address threats and maintain strategic advantages in a volatile geopolitical environment. In Africa, the defense UAV market is growing, though at a slower pace compared to other regions. Countries such as South Africa and Egypt are exploring UAV technology to enhance their defense capabilities and address security concerns. The adoption of UAVs in Africa is driven by the need for effective surveillance and reconnaissance solutions to manage ongoing conflicts and security challenges.

Key Defense UAV Programs:

US Army Receives First EAGLS Laser-Guided Counter-Drone System.The US Army has received the first EAGLS counter-drone system from MSI Defence Solutions.According to the North Carolina-based company, six systems have been contracted to help "forward deployed forces facing emerging and persistent uncrewed aerial systems threats."The Naval Air Systems Command, acting through the Rapid Acquisition Authority, granted the contract, which included related engineering and maintenance assistance. The business was contracted to provide five EAGLS to the US Central Command Area of Responsibility, which includes the Middle East, Central Asia, and portions of South Asia, according to an earlier US Department of Defence contract notice.

Italy Cleared to Buy Six MQ-9 Reaper Drones for $738M.The prospective foreign military sale, valued at $738 million, includes the delivery of three mobile ground control stations and six Block 5 Reaper drones.Should the deal proceed, Rome will also receive nine AN/APY-8 synthetic aperture radars and twelve multispectral target systems.Additionally, General Atomics will offer staff training, related spare parts, and essential maintenance support services.The planned sale "will support the foreign policy goals and national security objectives of the US by improving the security of a NATO ally," according to the US Defence Security Cooperation Agency.The announcement of the overseas military sale had no timeframe.

Table of Contents

Defense UAV Market Report Definition

Defense UAV Market Segmentation

By Region

By Propulsion

By End-User

Defense UAV Market Analysis for next 10 Years

The 10-year Defense UAV Market analysis would give a detailed overview of Defense UAV Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense UAV Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense UAV Market Forecast

The 10-year Defense UAV Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense UAV Market Trends & Forecast

The regional Defense UAV Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense UAV Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense UAV Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense UAV Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Propulsion, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By End User, 2022-2032

- Table 20: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Propulsion, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By End User, 2022-2032

List of Figures

- Figure 1: Global Defense UAV Market Market Forecast, 2022-2032

- Figure 2: Global Defense UAV Market Market Forecast, By Region, 2022-2032

- Figure 3: Global Defense UAV Market Market Forecast, By Propulsion, 2022-2032

- Figure 4: Global Defense UAV Market Market Forecast, By End User, 2022-2032

- Figure 5: North America, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 6: Europe, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 7: Middle East, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 8: APAC, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 9: South America, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 10: United States, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 11: United States, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 12: Canada, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 13: Canada, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 14: Italy, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 15: Italy, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 16: France, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 17: France, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 18: Germany, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 19: Germany, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 20: Netherlands, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 21: Netherlands, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 22: Belgium, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 23: Belgium, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 24: Spain, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 25: Spain, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 26: Sweden, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 27: Sweden, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 28: Brazil, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 29: Brazil, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 30: Australia, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 31: Australia, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 32: India, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 33: India, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 34: China, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 35: China, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 36: Saudi Arabia, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 37: Saudi Arabia, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 38: South Korea, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 39: South Korea, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 40: Japan, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 41: Japan, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 42: Malaysia, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 43: Malaysia, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 44: Singapore, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 45: Singapore, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 46: United Kingdom, Defense UAV Market Market, Technology Maturation, 2022-2032

- Figure 47: United Kingdom, Defense UAV Market Market, Market Forecast, 2022-2032

- Figure 48: Opportunity Analysis, Defense UAV Market Market, By Region (Cumulative Market), 2022-2032

- Figure 49: Opportunity Analysis, Defense UAV Market Market, By Region (CAGR), 2022-2032

- Figure 50: Opportunity Analysis, Defense UAV Market Market, By Propulsion (Cumulative Market), 2022-2032

- Figure 51: Opportunity Analysis, Defense UAV Market Market, By Propulsion (CAGR), 2022-2032

- Figure 52: Opportunity Analysis, Defense UAV Market Market, By End User (Cumulative Market), 2022-2032

- Figure 53: Opportunity Analysis, Defense UAV Market Market, By End User (CAGR), 2022-2032

- Figure 54: Scenario Analysis, Defense UAV Market Market, Cumulative Market, 2022-2032

- Figure 55: Scenario Analysis, Defense UAV Market Market, Global Market, 2022-2032

- Figure 56: Scenario 1, Defense UAV Market Market, Total Market, 2022-2032

- Figure 57: Scenario 1, Defense UAV Market Market, By Region, 2022-2032

- Figure 58: Scenario 1, Defense UAV Market Market, By Propulsion, 2022-2032

- Figure 59: Scenario 1, Defense UAV Market Market, By End User, 2022-2032

- Figure 60: Scenario 2, Defense UAV Market Market, Total Market, 2022-2032

- Figure 61: Scenario 2, Defense UAV Market Market, By Region, 2022-2032

- Figure 62: Scenario 2, Defense UAV Market Market, By Propulsion, 2022-2032

- Figure 63: Scenario 2, Defense UAV Market Market, By End User, 2022-2032

- Figure 64: Company Benchmark, Defense UAV Market Market, 2022-2032