|

市场调查报告书

商品编码

1664195

电子战的全球市场:2025年~2035年Global Electronic Warfare Market 2025-2035 |

||||||

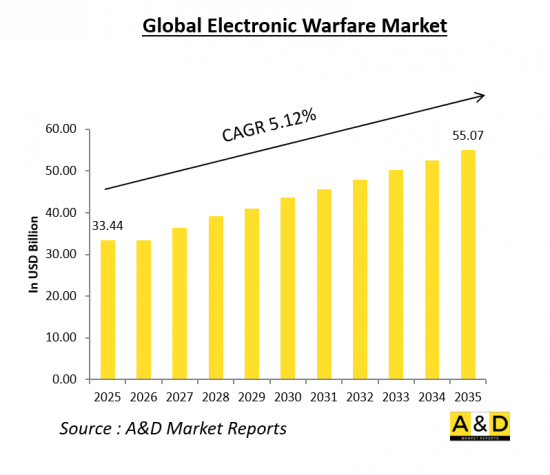

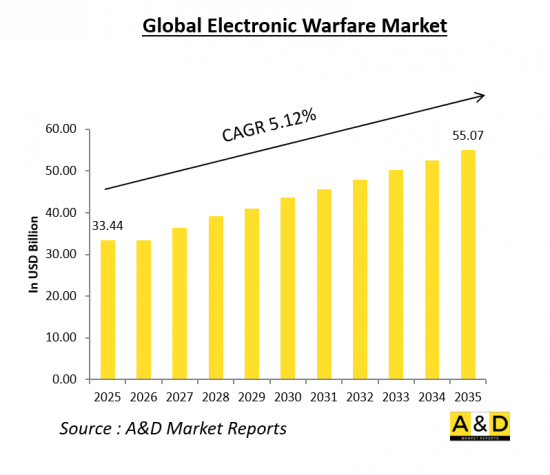

全球电子战市场规模预计在 2025 年达到 334.4 亿美元,在 2035 年达到 550.7 亿美元,预测期内的复合年增长率 (CAGR) 为 5.12%。

电子战 (EW) 市场已成为现代国防战略的重要组成部分,世界各国都在加大对先进能力的投资,以在电磁频谱作战中取得优势。电子战涵盖了广泛的技术和战术,旨在破坏、欺骗或禁用敌人的通讯、雷达和其他电子系统。电子战主要分为三类:电子攻击(EA)、电子防护(EP)和电子支援(ES)。 EA 包括干扰和欺骗等进攻措施,EP 专注于保护友军免受电子威胁,ES 涉及情报收集以提高态势感知能力。随着全球衝突的发展,对复杂电子战解决方案的需求日益增长。电子和网路威胁的激增,加上对网路中心战的日益依赖,正在推动电子战市场的成长。包括国防承包商和科技公司在内的主要产业参与者正在开发具有增强讯号处理、人工智慧 (AI) 和机器学习 (ML) 功能的新一代电子战系统,以缩短威胁侦测和回应时间。

科技进步正大幅改变电子战格局。人工智慧和机器学习正在透过实现即时数据分析和自动化决策过程彻底改变电子战系统。这些技术提高了威胁辨识能力并能够加快对策,从而缩短了军事行动的反应时间。人工智慧驱动的演算法可以更准确地检测和分类电子讯号,使防御者能够有效区分友军和敌军的通讯。

网路战与电子战系统的整合是另一个重要的科技趋势。网路战与电子战的融合使军队能够对敌方网路发动网路攻击,同时干扰或欺骗敌方雷达和通讯系统。这种协同作用将提高电子攻击行动的有效性,并在现代战场上实现多领域优势。

此外,电子元件的小型化正在推动紧凑型便携式电子战系统的发展,这种系统可部署在各种平台上,包括无人机(UAV)、地面车辆、船舶和太空资产。这些系统提供即时态势感知,能够快速适应新的威胁。软体定义无线电(SDR)和认知电子战系统的出现将进一步提高灵活性和弹性,允许电子战资产根据不断变化的敌方战术进行重新配置。

有几个因素推动了电子战市场的成长。其中一个主要推动因素是现代军事行动对电子系统的依赖日益增加。随着军队越来越依赖网络,保护通讯、导航和监视系统免受电子威胁的需求变得至关重要。这促使对于能够应对先进电子攻击并确保营运连续性的电子战解决方案的需求激增。

地缘政治紧张局势和各地区的衝突不断加剧也刺激了电子战市场的扩张。各国都在积极加强国防能力对抗潜在对手,从而增加对电子战技术的投资。世界各地的军事现代化计画正在将先进的电子战能力纳入下一代平台,如战斗机、船舰和飞弹防御系统。

此外,电子干扰和网路战等不对称战争策略的扩散凸显了强大电子战防御的必要性。非国家和敌对行为者越来越多地利用低成本的电子对抗工具,因此有必要製定对抗措施来保护军事和民用基础设施。

市场的另一个驱动力是对太空电子战能力的日益重视。太空军事化正在推动国防机构投资能够探测、拦截和消除敌方讯号的卫星电子战系统。太空电子情报(ELINT)和通讯情报(COMINT)资产在增强全球态势感知和战略威慑方面发挥关键作用。

本报告提供全球电子战市场相关调查,彙整技术趋势,市场趋势与预测,各地区,各国趋势,市场机会等相关资讯。

目录

电子战市场报告定义

电子战市场区隔

- 各类型

- 各地区

今后10年的电子战市场分析

全球电子战市场预测

电子战市场趋势与预测,各地区

- 北美

- 欧洲

- 中东

- 亚太地区

- 南美

电子战市场各国分析

- 美国

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳洲

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

电子战市场机会矩阵

结论

关于调查公司

The global electronic warfare market is valued at an estimated USD 33.44 billion in 2025 and is projected to reach USD 55.07 billion by 2035, growing at a Compound Annual Growth Rate (CAGR) of 5.12% over the forecast period.

Introduction to Electronic Warfare Market

The electronic warfare (EW) market has emerged as a critical component of modern defense strategies, with nations worldwide increasingly investing in advanced capabilities to gain superiority in electromagnetic spectrum operations. Electronic warfare encompasses a broad range of technologies and tactics designed to disrupt, deceive, or disable enemy communications, radar, and other electronic systems. It is divided into three primary categories: electronic attack (EA), electronic protection (EP), and electronic support (ES). EA includes offensive measures such as jamming and deception, EP focuses on safeguarding friendly forces from electronic threats, and ES involves intelligence gathering to enhance situational awareness. As global conflicts evolve, the demand for sophisticated EW solutions is rising. The proliferation of electronic and cyber threats, coupled with the increasing reliance on network-centric warfare, is driving the growth of the electronic warfare market. Key players in the industry, including defense contractors and technology firms, are developing next-generation EW systems with enhanced capabilities in signal processing, artificial intelligence (AI), and machine learning (ML) to improve threat detection and response times.

Technology Impact in Electronic Warfare Market

Advancements in technology are significantly transforming the landscape of electronic warfare. AI and ML are revolutionizing EW systems by enabling real-time data analysis and automated decision-making processes. These technologies enhance threat identification and enable rapid countermeasures, reducing the response time for military operations. AI-driven algorithms can detect and classify electronic signals more accurately, allowing defense forces to differentiate between friendly and hostile communications effectively.

The integration of cyber warfare into electronic warfare systems is another key technological trend. Cyber-EW fusion enables military forces to launch cyber-attacks on adversary networks while simultaneously jamming or deceiving their radar and communication systems. This synergy enhances the effectiveness of electronic attack operations and provides a multi-domain advantage in modern battlefields.

Additionally, the miniaturization of electronic components has led to the development of compact and portable EW systems that can be deployed on a variety of platforms, including unmanned aerial vehicles (UAVs), ground vehicles, naval vessels, and space-based assets. These systems provide real-time situational awareness and enable rapid adaptation to emerging threats. The advent of software-defined radios (SDRs) and cognitive EW systems further improves flexibility and resilience by allowing forces to reconfigure EW assets in response to changing enemy tactics.

Key Drivers in Electronic Warfare Market

Several factors are driving the growth of the electronic warfare market. One of the primary drivers is the increasing reliance on electronic systems in modern military operations. As armed forces become more network-dependent, the need to protect communication, navigation, and surveillance systems from electronic threats becomes paramount. This has led to a surge in demand for EW solutions that can counter sophisticated electronic attacks and ensure operational continuity.

The rising geopolitical tensions and conflicts across various regions are also fueling the expansion of the EW market. Nations are actively strengthening their defense capabilities to counter potential adversaries, leading to higher investments in EW technologies. Military modernization programs worldwide are incorporating advanced EW capabilities into next-generation platforms, including fighter jets, naval vessels, and missile defense systems.

Furthermore, the proliferation of asymmetric warfare tactics, including electronic jamming and cyber warfare, has underscored the need for robust EW defenses. Non-state actors and hostile entities are increasingly leveraging low-cost electronic disruption tools, necessitating the development of countermeasures to safeguard military and civilian infrastructure.

The growing emphasis on space-based electronic warfare capabilities is another major market driver. The militarization of space has prompted defense agencies to invest in satellite-based EW systems that can detect, intercept, and neutralize adversary signals. Space-based electronic intelligence (ELINT) and communications intelligence (COMINT) assets are playing a crucial role in enhancing global situational awareness and strategic deterrence.

Regional Trends in Electronic Warfare Market

The electronic warfare market exhibits significant regional variations, with major defense-spending nations leading in technological advancements and deployment.

In North America, the United States remains the dominant player in the EW market, driven by extensive defense budgets and continuous technological innovation. The U.S. Department of Defense (DoD) is heavily investing in next-generation EW capabilities through programs such as the Army's Electronic Warfare Planning and Management Tool (EWPMT) and the Navy's Surface Electronic Warfare Improvement Program (SEWIP). The emphasis on countering peer adversaries, such as China and Russia, has led to increased funding for EW research and development.

Europe is also witnessing substantial growth in the EW market, with NATO member states enhancing their EW capabilities to address emerging threats. Countries like the United Kingdom, Germany, and France are integrating EW solutions into their defense strategies to counter potential electronic threats from state and non-state actors. The European Defence Agency (EDA) is actively supporting collaborative EW projects, fostering innovation across the region.

The Asia-Pacific region is experiencing a rapid expansion in the EW sector, driven by rising defense expenditures in China, India, Japan, and South Korea. China is aggressively developing advanced EW capabilities as part of its broader military modernization strategy, including space-based EW assets and cyber-electronic warfare integration. India is also strengthening its EW infrastructure through indigenous programs such as the Defence Research and Development Organisation's (DRDO) Samyukta electronic warfare system.

In the Middle East, increasing geopolitical instability and military conflicts are driving investments in electronic warfare technologies. Countries like Israel, Saudi Arabia, and the United Arab Emirates (UAE) are procuring advanced EW systems to enhance their defense capabilities. Israel, in particular, is a global leader in EW innovation, with companies like Elbit Systems and Rafael Advanced Defense Systems developing cutting-edge electronic warfare solutions.

Africa and Latin America are gradually adopting EW technologies, though at a slower pace compared to other regions. These regions are focusing on strengthening border security and countering asymmetric threats, leading to increased interest in electronic surveillance and jamming systems.

Key Electronic Warfare Programs

V2X Inc. has secured a $21 million firm-fixed-price contract to continue supporting the sustainment of critical avionics and electronic warfare systems for the U.S. Air Force. This contract covers the repair and maintenance of AN/ALQ-172 and AN/ALQ-161 components, ensuring the operational readiness of the B-52 Stratofortress, B-1B, and C-130 aircraft. As global adversaries enhance their electronic warfare capabilities, V2X's work helps U.S. aircraft remain protected in contested environments. The AN/ALQ-172 self-protection RF subsystem provides multi-threat countermeasures against pulse, continuous wave, pulse Doppler, and monopulse radar threats. Likewise, the AN/ALQ-161 system has undergone continuous upgrades since its initial deployment in the 1980s, improving its ability to detect and counter evolving electronic threats. With its expertise in sustaining and enhancing complex avionics, V2X plays a vital role in extending the lifespan and operational effectiveness of these legacy aircraft and their mission-critical systems.

The Ministry of Defence signed a contract with Bharat Electronics Limited (BEL), Hyderabad, for the procurement of two Integrated Electronic Warfare Systems under 'Project Himshakti' at a total cost of approximately ₹3,000 crore. The project falls under the Buy {Indian - IDMM (Indigenously Designed, Developed, and Manufactured)} category and incorporates advanced and specialized technologies. 'Project Himshakti' is expected to boost the participation of Indian electronics and related industries, including MSMEs that serve as sub-vendors to BEL. It will also create approximately three lakh man-days of employment over the next two years. This initiative represents a significant step in strengthening indigenous defense capabilities, aligning with the government's Make-in-India initiative and furthering the vision of 'Aatmanirbhar Bharat' (self-reliant India).

Table of Contents

Electronic Warfare Market Report Definition

Electronic Warfare Market Segmentation

By Type

By Region

Electronic Warfare Market Analysis for next 10 Years

The 10-year electronic warfare market analysis would give a detailed overview of electronic warfare market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Electronic Warfare Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Electronic Warfare Market Forecast

The 10-year electronic warfare market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Electronic Warfare Market Trends & Forecast

The regional electronic warfare market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Electronic Warfare Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Electronic Warfare Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Electronic Warfare Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Electronic warfare Market Forecast, 2025-2035

- Figure 2: Global Electronic warfare Market Forecast, By Region, 2025-2035

- Figure 3: Global Electronic warfare Market Forecast, By Type, 2025-2035

- Figure 4: North America, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 5: Europe, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 6: Middle East, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 7: APAC, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 8: South America, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 9: United States, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 10: United States, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 11: Canada, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 12: Canada, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 13: Italy, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 14: Italy, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 15: France, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 16: France, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 17: Germany, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 18: Germany, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 19: Netherlands, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 20: Netherlands, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 21: Belgium, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 22: Belgium, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 23: Spain, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 24: Spain, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 25: Sweden, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 26: Sweden, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 27: Brazil, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 28: Brazil, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 29: Australia, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 30: Australia, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 31: India, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 32: India, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 33: China, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 34: China, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 35: Saudi Arabia, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 36: Saudi Arabia, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 37: South Korea, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 38: South Korea, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 39: Japan, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 40: Japan, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 41: Malaysia, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 42: Malaysia, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 43: Singapore, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 44: Singapore, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 45: United Kingdom, Electronic warfare Market, Technology Maturation, 2025-2035

- Figure 46: United Kingdom, Electronic warfare Market, Market Forecast, 2025-2035

- Figure 47: Opportunity Analysis, Electronic warfare Market, By Region (Cumulative Market), 2025-2035

- Figure 48: Opportunity Analysis, Electronic warfare Market, By Region (CAGR), 2025-2035

- Figure 49: Opportunity Analysis, Electronic warfare Market, By Type (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Electronic warfare Market, By Type (CAGR), 2025-2035

- Figure 51: Scenario Analysis, Electronic warfare Market, Cumulative Market, 2025-2035

- Figure 52: Scenario Analysis, Electronic warfare Market, Global Market, 2025-2035

- Figure 53: Scenario 1, Electronic warfare Market, Total Market, 2025-2035

- Figure 54: Scenario 1, Electronic warfare Market, By Region, 2025-2035

- Figure 55: Scenario 1, Electronic warfare Market, By Type, 2025-2035

- Figure 56: Scenario 2, Electronic warfare Market, Total Market, 2025-2035

- Figure 57: Scenario 2, Electronic warfare Market, By Region, 2025-2035

- Figure 58: Scenario 2, Electronic warfare Market, By Type, 2025-2035

- Figure 59: Company Benchmark, Electronic warfare Market, 2025-2035