|

市场调查报告书

商品编码

1680162

国防资产管理软体市场:全球2025-2035年Global Defense Asset Management Software Market 2025-2035 |

||||||

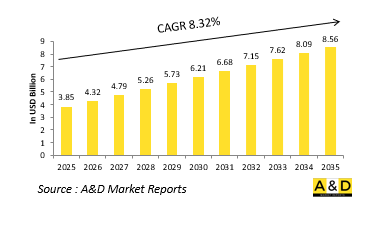

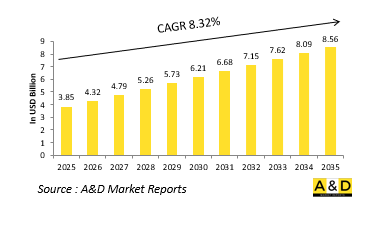

2025年全球国防资产管理软体市场价值为 38.5亿美元,预计到2035年将成长到 85.6亿美元,年复合成长率为 8.32%。

随着各国寻求最佳化其军事资产的生命週期管理,全球国防资产管理软体市场正经历显着成长。国防组织需要先进的工具来追踪、维护和管理大量资产,从武器系统和车辆到基础设施和后勤。随着国防预算的增加和军队的现代化建设,对先进资产管理解决方案的需求只会增加。新技术的整合、地缘政治紧张局势的加剧以及军事供应链的日益复杂化进一步推动这一市场的发展。

科技在塑造国防资产管理软体市场方面发挥着非常重要的作用。人工智慧(AI)和机器学习(ML)彻底改变预测性维护,使军事组织能够预测故障发生,减少停机时间并提高作战准备。云端运算促进了跨多个地点的即时资料共享,改善了不同军队部门和国防承包商之间的协作。区块链技术的使用提高了资产追踪的安全性和透明度,并降低了诈欺和管理不善的风险。此外,物联网(IoT)也日益融入军事装备中,实现持续监控和效能分析,进一步增强资产管理能力。

国防资产管理软体市场的主要驱动力之一是对国防开支成本最佳化和效率的日益关注。世界各国政府都力求最大限度地利用国防预算,有效的资产管理可确保设备在必要时得到有效的维护和更换。透过利用数位解决方案,国防组织可以减少冗余、最佳化供应链并改善物流规划,大幅节省成本。此外,国防行动的可持续性发展也推动了资产管理软体的采用,该软体可监控资源利用率并确保遵守环境法规。推动市场成长的另一个关键因素是国防物流日益复杂。现代军事行动包括陆、海、空、天等多个领域的广泛协调。管理这些领域的资产需要提供即时可视性和预测分析的先进软体。不同军事部门和盟国之间的互通性需求也促进了对标准化和高度整合的资产管理解决方案的需求。此外,自动化系统和无人驾驶汽车的兴起需要新的资产追踪能力,进一步扩大市场范围。

国防资产管理软体市场的区域趋势会根据地缘政治优先事项、国防开支和技术进步而变化。以美国为首的北美地区由于高额的国防开支和对数位转型的巨额投资占据了市场主导地位。美国国防部积极推行物流和资产追踪现代化计划,国防承包商和科技公司在软体开发中发挥关键作用。加拿大还投资了其国防现代化计划,为该地区不断成长的市场做出了贡献。

本报告调查全球国防资产管理软体市场,提供依细分市场的10年市场预测、技术趋势、机会分析、公司概况和49个国家的资料。

目录

国防资产管理软体市场报告定义

国防资产管理软体市场区隔

- 依最终用户

- 依地区

未来 10年国防资产管理软体市场分析

国防资产管理软体市场的市场技术

全球国防资产管理软体市场预测

国防资产管理软体市场趋势及预测(依地区)

- 北美洲

- 驱动因素、限制因素与挑战

- PEST

- 市场预测与情境分析

- 大型公司

- 供应商层级结构

- 企业基准

- 欧洲

- 中东

- 亚太地区

- 南美洲

国防资产管理软体市场国家分析

- 美国

- 国防计划

- 最新消息

- 专利

- 目前该市场的技术成熟度

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳洲

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

国防资产管理软体市场机会矩阵

国防资产管理软体市场报告专家意见

结论

关于航空和国防市场报告

The global defense asset management software market is estimated at USD 3.85 billion in 2025, projected to grow o USD 8.56 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.32% over the forecast period 2025-2035.

Introduction to Defense Asset Management Software market:

The global defense asset management software market is experiencing significant growth as nations increasingly seek to optimize the lifecycle management of their military assets. Defense organizations require sophisticated tools to track, maintain, and manage a vast array of assets, ranging from weapon systems and vehicles to infrastructure and logistics. As defense budgets expand and militaries modernize their operations, the demand for advanced asset management solutions continues to grow. The integration of new technologies, rising geopolitical tensions, and the increasing complexity of military supply chains further drive this market's evolution.

Technology Impact in Defense Asset Management Software Market:

Technology plays a pivotal role in shaping the defense asset management software market. Artificial intelligence (AI) and machine learning (ML) are revolutionizing predictive maintenance, enabling military organizations to anticipate failures before they occur, thus reducing downtime and enhancing operational readiness. Cloud computing facilitates real-time data sharing across multiple locations, improving collaboration between different branches of the military and defense contractors. The use of blockchain technology enhances security and transparency in asset tracking, reducing the risk of fraud or mismanagement. Additionally, the Internet of Things (IoT) is increasingly embedded in military equipment, allowing for continuous monitoring and performance analysis, further strengthening asset management capabilities.

Key Drivers in Defense Asset Management Software Market:

One of the key drivers of the defense asset management software market is the growing emphasis on cost optimization and efficiency in defense spending. Governments worldwide are striving to maximize their defense budgets, and effective asset management ensures that equipment is maintained efficiently and replaced only when necessary. By leveraging digital solutions, defense organizations can reduce redundancy, optimize supply chains, and improve logistics planning, resulting in significant cost savings. Additionally, the push for sustainability in defense operations is driving the adoption of asset management software that monitors resource utilization and ensures compliance with environmental regulations. Another significant factor fueling market growth is the increasing complexity of defense logistics. Modern military operations involve extensive coordination across different domains, including land, sea, air, and space. Managing assets across these domains requires sophisticated software that provides real-time visibility and predictive analytics. The need for interoperability between different military branches and allied nations also contributes to the demand for standardized and highly integrated asset management solutions. Furthermore, the rise of autonomous systems and unmanned vehicles necessitates new asset tracking capabilities, further expanding the market's scope.

Regional Trends in Defense Asset Management Software Market:

Regional trends in the defense asset management software market vary based on geopolitical priorities, defense spending, and technological advancements. North America, led by the United States, dominates the market due to its high defense expenditure and extensive investments in digital transformation. The U.S. Department of Defense is actively pursuing initiatives to modernize logistics and asset tracking, with defense contractors and technology firms playing a crucial role in software development. Canada is also investing in defense modernization programs, contributing to the regional market's expansion.

In Europe, nations are focusing on strengthening their defense capabilities in response to evolving security threats. The European Union and NATO members are investing in digital solutions to enhance military readiness and improve cross-border collaboration. Countries such as the United Kingdom, Germany, and France are at the forefront of adopting advanced asset management technologies, with an emphasis on cybersecurity and data integration. The ongoing conflicts and geopolitical tensions in Eastern Europe have further accelerated investments in military logistics and asset optimization.

The Asia-Pacific region is witnessing rapid growth in the defense asset management software market, driven by increasing defense budgets and military modernization programs. Countries like China, India, Japan, and South Korea are heavily investing in digital transformation to enhance military efficiency. China's military-industrial complex is integrating AI and big data analytics into its logistics and maintenance systems, while India is focusing on indigenization and automation in defense asset management. Regional tensions in the South China Sea and Indo-Pacific region are also pushing nations to adopt advanced defense technologies, including asset management solutions.

In the Middle East, defense asset management software adoption is being driven by efforts to modernize military infrastructure and optimize resource utilization. Gulf Cooperation Council (GCC) nations, including Saudi Arabia and the United Arab Emirates, are investing in cutting-edge technologies to enhance their defense capabilities. The need for efficient management of military assets is crucial in a region that frequently engages in high-intensity operations. Additionally, collaborations with Western defense contractors are accelerating the integration of advanced asset tracking and predictive maintenance solutions.

Africa's defense asset management software market is developing at a slower pace compared to other regions but is gaining traction due to the growing need for improved military logistics and resource management. Several African nations are seeking to modernize their armed forces by adopting digital solutions that enhance asset visibility and maintenance efficiency. International partnerships and defense collaborations are playing a vital role in bringing advanced asset management technologies to the region.

Key Defense Asset Management Software Program:

Under the Joint Asset Management and Engineering Solutions (JAMES) contract, SBL will collaborate with Getac, a leading designer and manufacturer of rugged computing technology. This five-year agreement encompasses the provision of encrypted rugged hardware, software, licenses, and a service level agreement, all developed and accredited to meet stringent military security standards. As part of the contract, 12,500 Getac rugged tablet PCs will be supplied for use by frontline commands. Equipped with the CAPS-approved PGP HMG encryption product, the system has undergone rigorous testing to ensure top-tier performance in military environments, enabling secure access to asset management and facilities while on the move.

Table of Contents

Defense Asset Management Software Market Report Definition

Defense Asset Management Software Market Segmentation

By End User

By Region

Defense Asset Management Software Market Analysis for next 10 Years

The 10-year defense asset management software market analysis would give a detailed overview of defense asset management software market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Asset Management Software Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Asset Management Software Market Forecast

The 10-year defense asset management software market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Asset Management Software Market Trends & Forecast

The regional defense asset management software market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Asset Management Software Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Asset Management Software Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Asset Management Software Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 19: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By End User, 2025-2035

List of Figures

- Figure 1: Global Defense Asset Management Software Market Forecast, 2025-2035

- Figure 2: Global Defense Asset Management Software Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Asset Management Software Market Forecast, By End User, 2025-2035

- Figure 4: North America, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 5: Europe, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 6: Middle East, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 7: APAC, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 8: South America, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 9: United States, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 10: United States, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 11: Canada, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 12: Canada, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 13: Italy, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 14: Italy, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 15: France, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 16: France, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 17: Germany, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 18: Germany, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 19: Netherlands, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 20: Netherlands, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 21: Belgium, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 22: Belgium, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 23: Spain, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 24: Spain, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 25: Sweden, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 26: Sweden, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 27: Brazil, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 28: Brazil, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 29: Australia, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 30: Australia, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 31: India, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 32: India, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 33: China, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 34: China, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 35: Saudi Arabia, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 36: Saudi Arabia, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 37: South Korea, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 38: South Korea, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 39: Japan, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 40: Japan, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 41: Malaysia, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 42: Malaysia, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 43: Singapore, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 44: Singapore, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 45: United Kingdom, Defense Asset Management Software Market, Technology Maturation, 2025-2035

- Figure 46: United Kingdom, Defense Asset Management Software Market, Market Forecast, 2025-2035

- Figure 47: Opportunity Analysis, Defense Asset Management Software Market, By Region (Cumulative Market), 2025-2035

- Figure 48: Opportunity Analysis, Defense Asset Management Software Market, By Region (CAGR), 2025-2035

- Figure 49: Opportunity Analysis, Defense Asset Management Software Market, By End User (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Defense Asset Management Software Market, By End User (CAGR), 2025-2035

- Figure 51: Scenario Analysis, Defense Asset Management Software Market, Cumulative Market, 2025-2035

- Figure 52: Scenario Analysis, Defense Asset Management Software Market, Global Market, 2025-2035

- Figure 53: Scenario 1, Defense Asset Management Software Market, Total Market, 2025-2035

- Figure 54: Scenario 1, Defense Asset Management Software Market, By Region, 2025-2035

- Figure 55: Scenario 1, Defense Asset Management Software Market, By End User, 2025-2035

- Figure 56: Scenario 2, Defense Asset Management Software Market, Total Market, 2025-2035

- Figure 57: Scenario 2, Defense Asset Management Software Market, By Region, 2025-2035

- Figure 58: Scenario 2, Defense Asset Management Software Market, By End User, 2025-2035

- Figure 59: Company Benchmark, Defense Asset Management Software Market, 2025-2035