|

市场调查报告书

商品编码

1680169

飞弹与弹药引信市场:2025-2035年Global Missiles & Munition Fuses Market 2025-2035 |

||||||

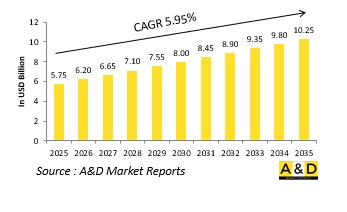

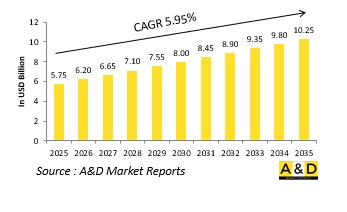

全球飞弹和弹药引信市场预计到2025年将成长至 57.5亿美元,到2035年将成长至 102.5亿美元,2025-2035年预测期内的年复合成长率(CAGR)为 5.95%。

全球飞弹和弹药引信市场是现代军事系统的关键组成部分,确保精确导引弹药和飞弹系统的有效性和可靠性。引信在决定飞弹或弹药何时以及如何爆炸方面发挥关键作用,直接影响其杀伤力、准确性和作战效能。随着世界各国军队不断对其军火库进行现代化改造,对战斗场景中更高精度、适应性和弹性的需求推动了对先进熔断技术的需求。引信分为多种类型,包括撞击引信、近炸引信、延时引信和电子引信,每种类型均根据特定的操作要求量身定制。战争的快速发展,特别是精确导引弹药、网路化作战系统和电子战威胁的使用增加,要求引信技术不断创新。

飞弹和弹药引信市场的技术进步主要集中在提高可靠性、降低过早爆炸的可能性以及增强与最新武器平台的兼容性。其中最重要的发展之一是将微电子技术和感测器整合到引信系统中,可以增强目标识别能力、提高环境适应能力并改善爆炸控制。使用结合近炸、撞击和延时等多种启动机制的多模式引信,可以提高操作的灵活性和有效性。这些引信使得攻击者无需使用多件武器,便可攻击各种目标,从重型装甲车辆到隐藏的敌方阵地。将人工智慧(AI)和机器学习(ML)纳入引信系统也是一个变革趋势,能够根据目标特征和战场条件即时决策调整爆炸参数。在人工智慧的增强下,Fuze 能够评估威胁、规避对策并最佳化爆炸时间,以造成最大伤害,同时最大限度地减少附带伤害。

另一项重大创新是电子安全和驱动机制的开发,透过防止因处理、运输或环境因素造成的意外爆炸,使保险丝更加可靠和安全。先进的安全机制确保引信在到达预定目标之前保持不活动状态,降低意外伤亡或友军误伤事故的风险。此外,改用更小、更低功率的引信可以将先进的导引和触发机制整合到更小的弹药中,提高其操作的多功能性。网路化战争的兴起也影响了引信的发展,智慧弹药具有资料共享功能,可以接收即时目标更新并相应地调整引信设定。

推动飞弹和弹药引信市场成长的关键因素是国防开支的增加、对战场精度提高的需求以及先进飞弹和火炮系统的普及。对精确打击的日益重视导致了对下一代引信的投资增加,以提高目标打击的准确性,同时最大限度地减少附带损害。世界各国都在对其飞弹和火炮能力进行现代化升级,以保持战略优势,因此对先进引信技术的需求也随之增加,以提高弹药的杀伤力和效力。多领域作战是一种集陆、海、空和网路要素于一体的作战策略,其受到的重视程度不断提高,进一步凸显了能够在不同作战环境中发挥作用的高适应性引信系统的重要性。

高超音速和远程飞弹系统的兴起也对引信市场产生了重大影响。随着军队不断研发出能够躲避敌人防御的快速、机动性武器,对能够承受极高速度、高重力和快速环境变化的先进引信的需求也日益成长。这些引信必须能够在极端条件下可靠地运行,同时确保在指定的撞击点精确爆炸。此外,浮动弹药和智慧炮弹的不断发展也推动了对可程式引信的需求,可程式引信可以更佳控製弹药发射后的行为。反无人机和反飞弹解决方案的需求推动了近炸引信的进一步创新,使其能够在进攻和防御行动中更有效地应对空中威胁。

本报告研究了全球飞弹和弹药引信市场,并提供了依细分市场的10年市场预测、技术趋势、机会分析、公司概况和国家资料。

目录

飞弹与弹药引信市场报告定义

飞弹与弹药引信市场细分

- 依地区

- 依保险丝类型

- 依最终用户

飞弹与弹药引信市场的10年分析

飞弹与弹药引信市场技术

全球飞弹与弹药引信市场预测

飞弹与弹药引信市场趋势与预测(依地区)

- 北美洲

- 驱动因素、限制因素与挑战

- PEST

- 大型公司

- 供应商层级结构

- 企业基准

- 市场预测与情境分析

- 欧洲

- 中东

- 亚太地区

- 南美洲

各国飞弹与弹药引信市场分析

- 美国

- 计划地图

- 最新消息

- 专利

- 目前该市场的技术成熟度

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳洲

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

飞弹与弹药引信市场机会矩阵

关于飞弹与弹药引信市场报告的专家意见

结论

关于航空和国防市场报告

The Global missiles and munition fuzes market is estimated at USD 5.75 billion in 2025, projected to grow to USD 10.25 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.95% over the forecast period 2025-2035.

Introduction to Missiles & Munition Fuses Market:

The global missiles and munition fuzes market is a critical component of modern military systems, ensuring the effectiveness and reliability of precision-guided munitions and missile systems. Fuzes play a crucial role in determining the timing and manner in which a missile or munition detonates, directly impacting its lethality, accuracy, and operational effectiveness. As military forces worldwide continue to modernize their arsenals, the demand for advanced fuze technologies is rising, driven by the need for greater precision, adaptability, and resilience in combat scenarios. Fuzes are categorized into various types, including impact fuzes, proximity fuzes, time-delay fuzes, and electronic fuzes, each tailored to specific operational requirements. The rapid evolution of warfare, marked by the increasing use of precision-guided weapons, networked combat systems, and electronic warfare threats, has necessitated continuous innovation in fuze technology.

Technology Impact in Missiles & Munition Fuses Market:

Technological advancements in the missiles and munition fuzes market have focused on improving reliability, reducing the likelihood of premature detonation, and enhancing compatibility with modern weapon platforms. One of the most significant developments is the integration of microelectronics and sensors into fuze systems, allowing for enhanced target discrimination, environmental adaptability, and improved detonation control. The use of multi-mode fuzes, which combine different triggering mechanisms such as proximity, impact, and delayed initiation, has increased operational flexibility and effectiveness. These fuzes enable munitions to engage a wide range of targets, from heavily armored vehicles to concealed enemy positions, without requiring multiple weapon types. The incorporation of artificial intelligence (AI) and machine learning (ML) into fuze systems is another transformative trend, enabling real-time decision-making that adjusts detonation parameters based on target characteristics and battlefield conditions. AI-enhanced fuzes can assess threats, avoid countermeasures, and optimize explosion timing for maximum damage while minimizing collateral effects.

Another key innovation is the development of electronic safety and arming mechanisms, which improve the reliability and security of fuzes by preventing accidental detonation due to handling, transport, or environmental factors. Advanced safety mechanisms ensure that fuzes remain inert until they reach the intended target, reducing the risk of unintended casualties and friendly fire incidents. Additionally, the shift toward miniaturized and low-power fuzes has enabled the integration of sophisticated guidance and triggering mechanisms into smaller munitions, expanding their operational versatility. The increasing use of network-enabled warfare has also influenced fuze development, with smart munitions incorporating data-sharing capabilities that allow them to receive real-time target updates and adjust their fuze settings accordingly.

Key Drivers in Missiles & Munition Fuses Market:

Several key drivers are propelling the growth of the missiles and munition fuzes market, including rising defense expenditures, the demand for enhanced battlefield precision, and the proliferation of advanced missile and artillery systems. The growing emphasis on precision strikes has led to increased investments in next-generation fuzes that improve target engagement accuracy while minimizing collateral damage. Nations worldwide are modernizing their missile and artillery capabilities to maintain strategic superiority, driving the need for sophisticated fuze technologies that enhance the lethality and effectiveness of their munitions. The increasing focus on multi-domain operations, where land, sea, air, and cyber elements are integrated into a unified combat strategy, has further highlighted the importance of adaptable fuze systems capable of functioning across diverse operational environments.

The rise of hypersonic and long-range missile systems has also significantly influenced the fuze market. As military forces develop high-speed, maneuverable weapons capable of evading enemy defenses, the demand for advanced fuzes capable of withstanding extreme velocities, high-G forces, and rapid environmental changes has increased. These fuzes must be able to operate reliably under intense conditions while ensuring precise detonation at the designated impact point. The continued development of loitering munitions and smart artillery rounds has also contributed to the demand for programmable fuzes that offer greater control over munition behavior after launch. The need for counter-drone and counter-missile solutions has further driven innovation in proximity fuzes, enabling more effective engagement of aerial threats in both offensive and defensive operations.

Regional Trends in Missiles & Munition Fuses Market:

Regional trends in the missiles and munition fuzes market vary based on military priorities, technological capabilities, and procurement strategies. North America, led by the United States, remains at the forefront of fuze technology development, with major defense contractors such as Raytheon Technologies, Northrop Grumman, and General Dynamics leading research and production efforts. The U.S. Department of Defense has placed a strong emphasis on precision-guided munitions, investing in advanced fuze technologies for a wide range of missile and artillery systems. The U.S. Army and Air Force have been actively upgrading their munitions with next-generation electronic and proximity fuzes to enhance lethality and adaptability. The Canadian defense industry, while smaller in scale, collaborates with U.S. and NATO partners on fuze technology research and procurement.

Europe is another significant player in the missiles and munition fuzes market, with leading defense firms such as MBDA, BAE Systems, Thales, and Rheinmetall contributing to fuze technology advancements. European nations have prioritized indigenous development of advanced missile and artillery systems, driving demand for high-performance fuzes that meet stringent operational requirements. Programs such as the European Future Combat Air System (FCAS) and next-generation missile initiatives have fueled investments in smart fuze technology. European defense manufacturers have also focused on developing multi-role fuzes that enhance the effectiveness of both precision-guided and conventional munitions. Additionally, the European Defence Fund (EDF) has supported collaborative research projects aimed at improving munition safety and reliability through the integration of AI and advanced sensor technologies.

The Asia-Pacific region is experiencing rapid growth in the missiles and munition fuzes market, driven by increasing military expenditures and regional security concerns. China has emerged as a major player in advanced missile and artillery systems, investing heavily in indigenous fuze technologies to reduce reliance on foreign suppliers. The country has focused on developing highly accurate proximity and electronic fuzes for its expanding arsenal of cruise missiles, hypersonic weapons, and guided artillery rounds. India, through the Defence Research and Development Organisation (DRDO), has been actively developing indigenous fuze systems for its missile programs, including the BrahMos and Astra missile systems. Japan and South Korea are also investing in advanced fuze technologies to support their respective missile defense and offensive strike capabilities, with an emphasis on electronic and multi-mode fuzes.

Key Missiles & Munition Fuses Program:

The Ministry of Defence signed a significant contract with Bharat Electronics Limited (BEL), Pune, for the procurement of Electronic Fuzes for the Indian Army over a 10-year period. Valued at ₹5,336.25 crore, this deal aligns with the 'Aatmanirbhar Bharat' initiative and falls under the Government's 'Manufacture of Ammunition for Indian Army by Indian Industry' program, aimed at fulfilling long-term ammunition requirements. The project seeks to build ammunition reserves, reduce reliance on imports, achieve self-sufficiency in manufacturing, acquire critical technologies, and safeguard stockpiles from supply chain disruptions. Electronic Fuzes are crucial components of medium to heavy-caliber artillery guns, ensuring sustained firepower for military operations. These fuzes will be deployed in artillery systems capable of precision strikes across diverse terrains, including high-altitude regions along the Northern Borders. BEL will manufacture the Electronic Fuzes at its Pune facility and the upcoming Nagpur plant. The initiative is expected to generate approximately 1.5 lakh man-days of employment while fostering the participation of Indian industries, including MSMEs. This contract will significantly expand the country's ammunition manufacturing ecosystem, strengthening India's defense self-reliance.

Rheinmetall has secured a €1.3 billion framework contract to supply artillery ammunition, including shells and fuses, aimed at replenishing stockpiles depleted by the war in Ukraine. As part of this agreement with the German Armed Forces, Rheinmetall will deliver several hundred thousand 155mm shells, fuses, and propelling charges. A separate €127 million contract has been signed for an initial batch of shells, with deliveries expected soon. Both contracts will run through 2029. Additionally, an existing framework agreement for DM121 ammunition has been expanded, adding an order volume of approximately €137 million. These deals further reinforce Rheinmetall's role in bolstering European defense capabilities amid ongoing geopolitical challenges.

Table of Contents

Missiles And Munition Fuse Market Report Definition

Missiles And Munition Fuse Market Segmentation

By Region

By Type of fuse

By End User

Missiles And Munition Fuse Market Analysis for next 10 Years

The 10-year missiles and munition fuse market analysis would give a detailed overview of missiles and munition fuse market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Missiles And Munition Fuse Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Missiles And Munition Fuse Market Forecast

The 10-year missiles and munition fuse market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Missiles And Munition Fuse Market Trends & Forecast

The regional missiles and munition fuse market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

REST

Key Companies

Supplier Tier Landscape

Company Benchmarking

Market Forecast & Scenario Analysis

Europe

Middle East

APAC

South America

Country Analysis of Missiles And Munition Fuse Market

This chapter deals with the key programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Program Mapping

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Missiles And Munition Fuse Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Missiles And Munition Fuse Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type of fuse, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type of fuse, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By End User, 2025-2035

List of Figures

- Figure 1: Global Missiles & Munition Fuses Market Forecast, 2025-2035

- Figure 2: Global Missiles & Munition Fuses Market Forecast, By Region, 2025-2035

- Figure 3: Global Missiles & Munition Fuses Market Forecast, By Type of fuse, 2025-2035

- Figure 4: Global Missiles & Munition Fuses Market Forecast, By End User, 2025-2035

- Figure 5: North America, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 6: Europe, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 8: APAC, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 9: South America, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 10: United States, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 11: United States, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 12: Canada, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 14: Italy, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 16: France, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 17: France, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 18: Germany, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 24: Spain, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 30: Australia, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 32: India, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 33: India, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 34: China, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 35: China, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 40: Japan, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Missiles & Munition Fuses Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Missiles & Munition Fuses Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Missiles & Munition Fuses Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Missiles & Munition Fuses Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Missiles & Munition Fuses Market, By Type of fuse (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Missiles & Munition Fuses Market, By Type of fuse (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Missiles & Munition Fuses Market, By End User (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Missiles & Munition Fuses Market, By End User (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Missiles & Munition Fuses Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Missiles & Munition Fuses Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Missiles & Munition Fuses Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Missiles & Munition Fuses Market, By Region, 2025-2035

- Figure 58: Scenario 1, Missiles & Munition Fuses Market, By Type of fuse, 2025-2035

- Figure 59: Scenario 1, Missiles & Munition Fuses Market, By End User, 2025-2035

- Figure 60: Scenario 2, Missiles & Munition Fuses Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Missiles & Munition Fuses Market, By Region, 2025-2035

- Figure 62: Scenario 2, Missiles & Munition Fuses Market, By Type of fuse, 2025-2035

- Figure 63: Scenario 2, Missiles & Munition Fuses Market, By End User, 2025-2035

- Figure 64: Company Benchmark, Missiles & Munition Fuses Market, 2025-2035