|

市场调查报告书

商品编码

1706586

飞机用LRU的全球市场:2025年~2035年Global Aircraft LRU Market 2025-2035 |

||||||

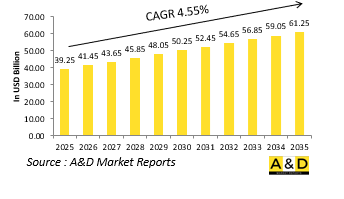

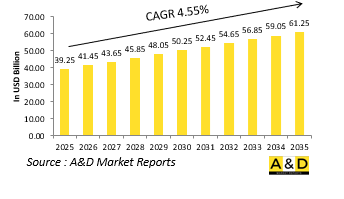

2025 年全球飞机 LRU 市场规模估计为 392.5 亿美元,预计到 2035 年将增长到 612.5 亿美元,在 2025-2035 年预测期内的复合年增长率 (CAGR) 为 4.55%。

飞机 LRU 市场简介:

LRU(线路可更换单元)是模组化组件,可在操作层面快速更换,以保持飞机可用性并减少停机时间。在军事航空中,LRU 是可维护性和准备性的关键,允许机组人员和维护团队更换故障的子系统 - 从雷达模组和航空电子设备箱到液压执行器和通讯设备 - 而无需进行大规模拆卸或仓库级支援。 LRU 对于军用飞机的作战效率至关重要,因为军用飞机必须在通常恶劣且不可预测的环境中保持战斗准备。 LRU 的使用使组织单位能够在现场进行快速维修或更换,支援 "两阶段维护:组织和仓库" 的概念。这种能力显着提高了出动率并最大限度地减少了任务中断。随着军用飞机平台变得越来越先进和系统集成,对基于 LRU 的设计的依赖也越来越强。 LRU 不仅简化了维护物流,而且还使多种飞机类型的组件标准化,从而使军方能够减少库存开销、简化培训并促进更快的升级。在现代战斗机、运输机、直升机和无人系统中,LRU是永续性、生命週期成本管理和战备的隐藏推动因素。

科技对飞机 LRU 市场的影响:

技术的进步正在极大地改变飞机 LRU 的形式、功能和性能。现代 LRU 不再是简单可替换的“黑盒子”,在航空电子、数位化和模组化系统架构趋势的推动下,它变得更加聪明、更轻巧、更加整合。小型化和增强的处理能力使得更多的功能能够被装入更小的空间。这对于现代军用飞机来说至关重要,因为空间和重量都非常宝贵。现今的 LRU 通常包含先进的微处理器、容错电路和整合诊断系统,使它们能够监控自身的健康状况并在故障发生之前预测故障。

模组化开放系统架构(MOSA)也产生了重大影响。许多军队,特别是美国国防部,正在推行航空电子设备和电子产品的开放标准。这种转变意味着 LRU 在设计时考虑了互通性和未来的可升级性。 VITA 标准和 OpenVPX 等标准化介面可实现跨多个平台和供应商的即插即用,从而显着降低系统生命週期成本并简化物流链。网路安全已成为另一个主要关注点。由于 LRU 通常处理关键的飞行、目标和通讯数据,因此确保其免受网路威胁的安全至关重要。这就是为什么 LRU 韧体和硬体包括内建加密、安全启动机制和身份验证协定。可信任平台模组 (TPM) 和入侵侦测感测器等技术正在成为任务关键型 LRU 的标准。

此外,数位孪生和扩增实境 (AR) 工具开始与 LRU 结合使用。这些技术透过为技术人员提供虚拟覆盖来模拟虚拟环境中的 LRU 操作,从而增强了培训和操作规划。此外,与物流系统和数位维护记录的整合可以实现无缝资产追踪和配置管理。

飞机 LRU 市场的关键推动因素:

全球飞机 LRU 市场的成长和发展受到营运、物流和战略因素的共同推动。主要推动因素之一是军用飞机系统日益复杂。第五代战斗机、隐形轰炸机和多用途运输机现在依赖数千个相互连接的电子和机械部件。如果没有模组化 LRU,维护这样的平台将会非常耗时、低效率且成本高昂。对作战准备的要求也是一个强大的驱动力。世界各国的军队都优先考虑飞机的高可用性和任务能力。 LRU 可实现任务之间的快速週转时间,减少前沿部署或高节奏作战期间的飞机停机时间。这对于远征军和舰载航空联队来说尤其重要。此外,对飞机生命週期成本管理的日益重视也推动了 LRU 使用量的增加。军方面临着越来越严格的预算审查,必须延长老化平台的使用寿命,同时整合新技术。 LRU 有助于实现增量升级,而无需更换整个系统。例如,侦察机的传统雷达处理器可以用更新、功能更强大的装置替换,同时仍与原始的雷达阵列介接。

另一个关键推动因素是互通性和联合力量。随着多国军事联盟变得越来越普遍,拥有标准化、易于互换的零件有助于保持联军之间的兼容性。共享 LRU 平台和开放式架构使盟友能够在联合任务和维和行动期间相互支援。此外,供应链弹性和本地製造目标正在鼓励各国投资国内 LRU 製造能力。这减少了对海外供应商的依赖,实现了快速定制,并使国防承包商能够灵活地适应不断变化的任务需求。许多国家正在将远程武器系统发展纳入其更广泛的国防工业战略,以实现自力更生和自主创新。

飞机LRU市场的区域趋势:

飞机 LRU 市场的地理趋势反映了每个地区的战略立场、采购理念和国内工业基础。在北美,尤其是美国,飞机LRU市场高度成熟且由技术驱动。 F-35 Lightning II、B-21 Raider 和下一代空中优势 (NGAD) 等项目都严重依赖以 LRU 为中心的设计,以促进快速零件更换和系统升级。美国军方推动模组化开放系统和数位化工程,为全球树立了标准,LRU 的设计旨在实现长寿命和快速整合人工智慧、电子战和量子通讯等下一代功能。

在欧洲,联合平台开发和 LRU 标准化受到大力推动,尤其是在法国、德国和西班牙参与的 FCAS(未来作战航空系统)等项目中。欧洲国家扩大采用模组化方法来製造飞机系统,以促进共同开发并维持对美国供应商的独立性。空中巴士公司、莱昂纳多公司和泰雷兹公司正在领导开发基于开放标准、专为北约互通性而设计的 LRU 系统。在亚太地区,地缘政治紧张局势加剧以及对自主防御的推动正在刺激远程武器系统的发展。中国、印度、韩国和日本等国家正在透过进口和国产平台扩大其军事航空能力。中国的歼-20和印度的光辉战斗机采用LRU框架,可实现可扩展的升级和维护。该地区也出现了能够生产导航、火控和任务管理系统的本土 LRU 供应商的崛起。

主要飞机 LRU 计画

印度空军总部(Vayu Bhawan)工程 B 局(技术)代表印度国防部,邀请知名印度公司表达意向(EoI),为印度空军的 KIRAN MK-I/IA 机队采购四 (4) 个线路可更换单元 (LRU)。符合条件的公司必须位于印度,并拥有该专案所需的技术专长、财务能力、基础设施和相关经验。工作范围包括在适用的情况下获得适航认证,并确保在规定的期限内交付。

本报告提供全球飞机用LRU市场相关调查,彙整10年的各分类市场预测,技术趋势,机会分析,企业简介,各国资料等资讯。

目录

飞机用LRU市场报告定义

飞机用LRU市场区隔

各平台

各地区

各类型

未来 10 年飞机 LRU 市场分析

本章透过十年的飞机 LRU 市场分析,详细概述了飞机 LRU 市场的成长、变化趋势、技术采用概述和整体市场吸引力。

飞机 LRU 市场的市场技术

本部分涵盖预计将影响该市场的十大技术以及这些技术可能对整个市场产生的影响。

全球飞机 LRU 市场预测

针对上述细分市场,详细介绍了该市场 10 年的飞机 LRU 市场预测。

飞机 LRU 市场趋势及各地区预测

本部分涵盖区域飞机 LRU 市场趋势、推动因素、阻碍因素、课题以及政治、经济、社会和技术方面。它还提供了详细的区域市场预测和情境分析。区域分析的最后阶段包括主要公司概况、供应商格局和公司基准测试。目前市场规模是根据正常业务情境估算的。

北美

促进因素,阻碍因素,课题

PEST

市场预测与情势分析

主要企业

供应商阶层的形势

企业基准

欧洲

中东

亚太地区

南美

飞机LRU市场国家分析

本章重点介绍该市场的主要防御计划,并介绍该市场的最新新闻和专利。它还提供国家级的 10 年市场预测和情境分析。

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与情势分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

飞机用LRU市场机会矩阵

飞机用LRU市场报告相关专家的意见

结论

关于航空·国防市场报告

The Global Aircraft LRU market is estimated at USD 39.25 billion in 2025, projected to grow to USD 61.25 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 4.55% over the forecast period 2025-2035.

Introduction to Aircraft LRU Market:

Line Replaceable Units (LRUs) are modular components that can be quickly replaced at the operational level to maintain aircraft availability and reduce downtime. In military aviation, LRUs are a cornerstone of maintainability and readiness, allowing flight crews and maintenance teams to swap out faulty subsystems-ranging from radar modules and avionics boxes to hydraulic actuators and communication devices-without requiring extensive disassembly or depot-level support. LRUs are essential to the operational efficiency of military aircraft, which must remain combat-ready in often austere and unpredictable environments. Their use supports the "two-level maintenance" concept-organizational and depot level-by allowing organizational units to perform rapid repairs and replacements on-site. This capability significantly increases sortie generation rates and minimizes mission interruptions. As military aircraft platforms become more advanced and system-integrated, the reliance on LRU-based design has grown. Not only do they simplify maintenance logistics, but LRUs also standardize components across multiple aircraft types, helping militaries reduce inventory overhead, streamline training, and facilitate faster upgrades. In modern fighter jets, transport aircraft, helicopters, and unmanned systems, LRUs are the hidden enablers of sustainability, lifecycle cost management, and combat readiness.

Technology Impact in Aircraft LRU Market:

Advancements in technology are dramatically reshaping the form, function, and performance of military aircraft LRUs. Modern LRUs are no longer just replaceable "black boxes"; they are becoming smarter, lighter, and more integrated, aligning with trends in avionics, digitalization, and modular system architecture. Miniaturization and increased processing power allow more functionality to be packed into a smaller footprint. This is crucial for modern military aircraft, where space and weight are at a premium. Today's LRUs often contain advanced microprocessors, fault-tolerant circuitry, and integrated diagnostics systems, allowing them to monitor their own health and predict failures before they occur-an essential element of predictive maintenance.

Modular Open Systems Architecture (MOSA) is having a significant impact as well. Many militaries, particularly the U.S. Department of Defense, are pushing for open standards in avionics and electronics. This shift means LRUs are being designed with interoperability and future upgradeability in mind. Standardized interfaces, like VITA standards or OpenVPX, allow for plug-and-play capabilities across multiple platforms and vendors, drastically reducing system lifecycle costs and simplifying logistics chains. Cybersecurity has become another major area of focus. Since LRUs often handle critical flight, targeting, or communication data, ensuring that they are secure from cyber threats is paramount. This has led to the integration of embedded encryption, secure boot mechanisms, and authentication protocols within LRU firmware and hardware. Technologies like Trusted Platform Modules (TPMs) and intrusion detection sensors are increasingly becoming standard in mission-critical LRUs.

Further, digital twin and augmented reality (AR) tools are beginning to be used alongside LRUs. These technologies provide technicians with virtual overlays for guided maintenance and simulate LRU behaviors in virtual environments, enhancing training and operational planning. Integration with logistics systems and digital maintenance records also allows for seamless asset tracking and configuration control.

Key Drivers in Aircraft LRU Market:

The growth and evolution of the global military aircraft LRU market are driven by a combination of operational, logistical, and strategic factors. One of the primary drivers is the increased complexity of military aircraft systems. Fifth-generation fighter jets, stealth bombers, and multi-role transport aircraft now rely on thousands of interconnected electronic and mechanical components. Without modular LRUs, maintaining such platforms would be slow, inefficient, and prohibitively expensive. Operational readiness requirements are another powerful driver. Military forces worldwide prioritize high availability and mission-capable rates for their aircraft fleets. LRUs enable quick turnaround times between missions, reducing aircraft downtime during forward deployments or high-tempo operations. For expeditionary forces or carrier-based air wings, this is especially vital. The emphasis on fleet lifecycle cost management is also promoting greater use of LRUs. Militaries are under increasing budgetary scrutiny and must extend the operational life of aging platforms while integrating new technologies. LRUs facilitate incremental upgrades without needing to replace entire systems. For instance, a legacy radar processor in a reconnaissance aircraft can be replaced with a newer, more capable unit while maintaining the original radar array and interface.

Another key driver is interoperability and joint force integration. As multinational military coalitions become more common, having standardized, easily replaceable components helps maintain compatibility across allied forces. Shared LRU platforms and open architectures enable allied nations to support each other logistically during joint missions or peacekeeping operations. In addition, supply chain resilience and local manufacturing goals are encouraging countries to invest in domestic LRU production capabilities. This reduces reliance on foreign suppliers, enables rapid customization, and allows defense contractors to respond more flexibly to changing mission needs. Many nations are incorporating LRU development into broader defense industrial strategies to build self-reliance and indigenous innovation.

Regional Trends in Aircraft LRU Market:

Regional trends in the military aircraft LRU market reflect each region's strategic posture, procurement philosophy, and domestic industrial base. In North America, particularly the United States, the military LRU market is highly mature and technology-driven. Programs such as the F-35 Lightning II, B-21 Raider, and Next Generation Air Dominance (NGAD) all heavily rely on LRU-centric design to facilitate rapid component replacement and system upgrades. The U.S. military's push toward modular open systems and digital engineering is setting the global standard, with LRUs designed for longevity and rapid integration of next-gen capabilities like AI, EW, and quantum communications.

Europe is experiencing a strong push toward joint platform development and LRU standardization, especially under programs like the Future Combat Air System (FCAS) involving France, Germany, and Spain. European nations are increasingly adopting a modular approach to aircraft systems to foster collaboration and maintain independence from U.S. suppliers. Airbus, Leonardo, and Thales are leading efforts to develop LRU systems aligned with open standards and tailored for NATO interoperability. In the Asia-Pacific region, rising geopolitical tensions and a push for indigenous defense production are fueling LRU development. Countries like China, India, South Korea, and Japan are expanding their military aviation capabilities with both imported and domestic platforms. China's J-20 and India's Tejas fighters use LRU frameworks that enable scalable upgrades and maintenance. The region is also witnessing the emergence of local LRU suppliers capable of producing navigation, fire control, and mission management systems.

Key Aircraft LRU Program:

The Directorate of Engineering B (Technical), Air Headquarters (Vayu Bhawan), on behalf of the Ministry of Defence, Government of India, invites Expressions of Interest (EoI) from reputable Indian firms for the procurement of four categories of Line Replaceable Units (LRUs) for the KIRAN MK-I/IA fleet of the Indian Air Force. Eligible firms must be based in India and possess the necessary technical expertise, financial capability, infrastructure, and relevant experience to undertake the project. The scope of work includes obtaining airworthiness certification where applicable and ensuring delivery within defined timelines.

Table of Contents

Aircraft LRU Market Report Definition

Aircraft LRU Market Segmentation

By Platform

By Region

By Type

Aircraft LRU Market Analysis for next 10 Years

The 10-year aircraft LRU market analysis would give a detailed overview of aircraft LRU market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Aircraft LRU Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Aircraft LRU Market Forecast

The 10-year aircraft LRU market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Aircraft LRU Market Trends & Forecast

The regional aircraft LRU market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Aircraft LRU Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Aircraft LRU Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Aircraft LRU Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Aircraft LRU Market Forecast, 2025-2035

- Figure 2: Global Aircraft LRU Market Forecast, By Region, 2025-2035

- Figure 3: Global Aircraft LRU Market Forecast, By Platform, 2025-2035

- Figure 4: Global Aircraft LRU Market Forecast, By Type, 2025-2035

- Figure 5: North America, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 6: Europe, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 8: APAC, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 9: South America, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 10: United States, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 11: United States, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 12: Canada, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 14: Italy, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 16: France, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 17: France, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 18: Germany, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 24: Spain, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 30: Australia, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 32: India, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 33: India, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 34: China, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 35: China, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 40: Japan, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Aircraft LRU Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Aircraft LRU Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Aircraft LRU Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Aircraft LRU Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Aircraft LRU Market, By Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Aircraft LRU Market, By Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Aircraft LRU Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Aircraft LRU Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Aircraft LRU Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Aircraft LRU Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Aircraft LRU Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Aircraft LRU Market, By Region, 2025-2035

- Figure 58: Scenario 1, Aircraft LRU Market, By Platform, 2025-2035

- Figure 59: Scenario 1, Aircraft LRU Market, By Type, 2025-2035

- Figure 60: Scenario 2, Aircraft LRU Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Aircraft LRU Market, By Region, 2025-2035

- Figure 62: Scenario 2, Aircraft LRU Market, By Platform, 2025-2035

- Figure 63: Scenario 2, Aircraft LRU Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Aircraft LRU Market, 2025-2035