|

市场调查报告书

商品编码

1706587

微无人机的全球市场:2025年~2035年Global Microdrones Market 2025-2035 |

||||||

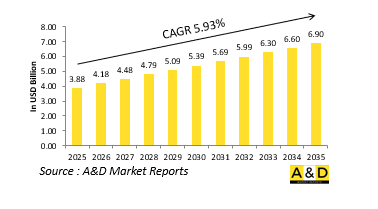

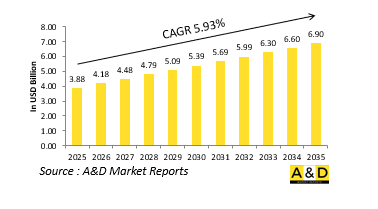

2025 年全球微型无人机市场规模估计为 38.8 亿美元,预计到 2035 年将增长到 69 亿美元,2025-2035 年预测期内的复合年增长率 (CAGR) 为 5.93%。

Microdrone 市场简介

军用微型无人机通常被归类为无人机系统中最小的梯队,并且是国防技术中一个快速成长的利基市场。这些无人机的重量通常不到 2 公斤,设计为便携式或口袋大小,适用于传统无人机和小型无人机过大或无法侦测的环境中进行近距离侦察、战术监视和态势感知。其紧凑的尺寸、不显眼的操作和易于部署使其特别适合城市战、特种作战、反叛乱和边境安全任务。全球军事部门对微型无人机的兴趣源于其能够在视线有限且机动性至关重要的竞争激烈或混乱的空间中作战,例如室内环境、茂密的森林、隧道网路或复杂的城市地形。儘管体积小,但微型无人机越来越能够携带高解析度摄影机、热感应器甚至轻型电子战有效载荷。微型无人机被步兵、特警队和侦察部队使用,作为士兵感官的延伸,增强作战意识,同时最大限度地减少威胁。随着现代战场变得更加分散和多维,微型无人机对于战术边缘作战变得至关重要。微型无人机弥补了人类局限性和战场情报之间的差距,使得扫描角落、屋顶和潜在伏击点成为可能,而不会危及部队安全。它的静音运行和即时回馈使其对于需要速度、隐身和精确度的任务来说非常有价值。

科技对微型无人机市场的影响

科技正在推动军用微型无人机设计、能力和部署的重大转变。微型部件的发展是最重要的驱动力之一,从无刷马达和先进的锂聚合物电池,到超轻复合框架和微型感测器。这些创新可以延长飞行时间、提高有效载荷能力并提高恶劣条件下的续航能力。其中一项重大进步是感测器技术。现代微型无人机配备了多光谱感测器、夜视和热成像系统,而这些系统以前对于如此小的平台来说太大或太耗电。这些感测器提供 360 度可视性,使无人机能够在完全黑暗、烟雾瀰漫的区域以及电子干扰的情况下有效运作。

人工智慧和机载处理正在重新定义微型无人机的自主性。即时物体辨识、人脸侦测、威胁分类和自主导航使这些无人机能够在有限的人工输入下运作。人工智慧使微型无人机能够绘製环境地图、避开障碍物,甚至自动追踪特定目标。这在手动转向困难或危险的复杂地形中尤其有价值。此外,通讯和资料加密也得到了显着改善。微型无人机目前使用安全加密的连结来防止窃听和干扰。有些甚至以网状网路或中继模式运行,即使在 GPS 受阻或讯号中断的环境中,也允许多个单元协作并共享资讯。

群集演算法的整合代表了微型无人机能力的最先进的飞跃。透过群体逻辑,一组微型无人机可以自主协调其运动以包围目标并同时进行多角度监视。人们正在研究它用于兵力倍增、週边监视和区域拒止策略。最后,材料科学正在帮助这些平台变得有弹性且轻盈。碳纤维增强塑胶和奈米涂层可抵御沙、雨和电磁辐射等环境因素,确保在恶劣条件下持续运作。

微型无人机市场的关键推动因素:

有几个关键因素推动了全球军用微型无人机的兴起。首先,需要提高小队层级的态势感知能力。现代步兵作战需要周围环境的即时数据,以避免伏击、穿越陌生地形并发现隐藏的威胁。微型无人机无需复杂的基础设施或专门的培训即可提供这种能力。城市和近距离战斗也是一个强大的驱动力。在人口密集的城市环境和反恐行动中,传统无人机通常体积太大、噪音太大,无法有效运作。另一方面,微型无人机可以在士兵进入之前进入建筑物、扫描房间并评估威胁。另一个重大影响是不对称威胁的日益普遍,例如叛乱组织和非国家行为者使用游击战术和简易爆炸装置。微型无人机可以透过提供精确侦察来帮助消除此类威胁,而不会让部队面临不必要的风险。它们通常用于即时精确定位 IED 位置和隐藏的敌人位置。

对低成本、快速部署的 ISR 解决方案的需求是另一个关键因素。与大型无人机或载人侦察飞行相比,微型无人机价格更实惠,并且可以大量部署。这种成本效益将使其广泛采用,即使是中型或预算受限的军队。在高风险环境中,能够在不影响任务成功的情况下失去无人机至关重要。此外,世界各地的国防现代化措施都集中在数位化、部队机动性和网路中心战。微型无人机符合这一模式,它充当敏捷的数据生成平台,可以无缝连结到指挥和控制网路、任务规划软体和士兵系统。

微型无人机市场的区域趋势:

全球军用微型无人机格局在每个地区都有独特的发展,基于特定的作战需求、技术基础设施和战略重点。

在北美,美国国防部正透过士兵随身感测器 (SBS) 计画等项目引领发展,该计画已部署 FLIR 黑黄蜂等微型无人机来增强小队级侦察能力。五角大厦也正在投资群体技术和自主任务,作为利用人工智慧发动战争的更广泛努力的一部分。美国特种作战司令部和陆军未来司令部正在探索在多领域作战中使用微型无人机,特别是在城市衝突地区和电子战环境中。

欧洲注重远征作战和国土安全,正大力发展微型无人机能力。英国、法国和挪威的北约军队已经将微型无人机用于战术 ISR,Parrot(法国)和 Teledyne FLIR(英国/挪威)等公司也正在提供自己的解决方案。欧盟还资助了一项跨境研发计划,以支持无人机创新和成员国之间互通性的共享标准。

在领土争端和边界紧张局势加剧的亚太地区,该技术正在迅速传播。中国在用于侦察和不对称攻击的微型无人机集群方面投入了大量资金,并经常在军事演习中展示无人机集群。其战略重点在于用低成本、与人工智慧相关的资产压倒对手。同时,印度在 "印度製造" 国防製造计画下,正在加快采购微型无人机,特别是用于在实际控制线(LAC)沿线等山区和叛乱环境中的作战。韩国和日本也在部署微型无人机,作为其监视和国土安全现代化努力的一部分。

主要的 Microdrone 项目

美国特种作战司令部(SOCOM)正在寻求可以在多个领域,特别是空中和水下环境中运作的微型无人机。此招标由美国特种作战司令部远端能力计画执行办公室发布,旨在确定明年可供评估的潜在非舰队系统。美国特种作战司令部采购、技术和后勤局发布了一份特别通知,征求业界的回馈意见,以协助确定适合测试的第一组无人机系统(UAS)。第 1 组无人机是国防部目前使用的最小类型的无人机,通常可以从各种平台部署。

本报告提供全球微无人机市场相关调查,彙整10年的各分类市场预测,技术趋势,机会分析,企业简介,各国资料等资讯。

目录

微无人机市场报告定义

微无人机市场区隔

各类型

各地区

各终端用户

未来 10 年 Microdrone 市场分析

在本章中,十年微型无人机市场分析提供了微型无人机市场成长、变化趋势、技术采用概述和整体市场吸引力的详细概述。

微型无人机市场的市场技术

本部分涵盖预计将影响该市场的十大技术以及这些技术可能对整个市场产生的影响。

全球微型无人机市场预测

上述细分市场详细介绍了该市场 10 年微型无人机市场的预测。

微型无人机市场趋势及各地区预测

本部分涵盖区域微型无人机市场趋势、推动因素、阻碍因素、课题以及政治、经济、社会和技术方面。它还提供了详细的区域市场预测和情境分析。区域分析包括主要公司概况、供应商格局和公司基准测试。目前市场规模是根据正常业务情境估算的。

北美

促进因素,阻碍因素,课题

PEST

市场预测与情势分析

主要企业

供应商阶层的形势

企业基准

欧洲

中东

亚太地区

南美

各国微型无人机市场分析

本章重点介绍该市场的主要防御计划,并介绍该市场的最新新闻和专利。它还提供国家级的 10 年市场预测和情境分析。

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与情势分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

微无人机市场机会矩阵

微无人机市场报告相关专家的意见

结论

关于航空·国防市场报告

The Global Microdrones market is estimated at USD 3.88 billion in 2025, projected to grow to USD 6.90 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.93% over the forecast period 2025-2035.

Introduction to Microdrones Market:

Military microdrones, often classified as the smallest tier within unmanned aerial systems, represent a rapidly growing niche in defense technology. Generally weighing under 2 kg and designed to be man-portable or even pocket-sized, these drones are tailored for close-range reconnaissance, tactical surveillance, and situational awareness in environments where traditional UAVs or even small drones may be too large or detectable. Their compact size, discreet operation, and ease of deployment make them uniquely suited for urban warfare, special operations, counter-insurgency, and border security tasks. The global military interest in microdrones stems from their ability to operate in highly contested or cluttered spaces-indoor environments, dense forests, tunnel networks, or complex urban terrain-where line-of-sight is limited and maneuverability is crucial. Despite their small stature, microdrones are increasingly capable of carrying high-resolution cameras, thermal sensors, and even lightweight electronic warfare payloads. Used by infantry, SWAT teams, and reconnaissance units, they serve as an extension of the soldier's senses, offering enhanced operational awareness with minimal exposure to threat. As modern battlefields become more decentralized and multidimensional, microdrones are proving essential for tactical edge operations. They bridge the gap between human limitations and battlefield intelligence, enabling forces to scan corners, rooftops, and potential ambush points without endangering personnel. Their silent operation and real-time feedback make them invaluable for missions that demand speed, stealth, and precision.

Technology Impact in Microdrones Market:

Technology is driving a significant transformation in the design, capability, and deployment of military microdrones. One of the most crucial enablers has been the development of miniaturized components-from brushless motors and advanced lithium-polymer batteries to ultra-lightweight composite frames and compact sensors. These innovations allow for extended flight times, improved payload capacity, and enhanced durability in harsh conditions. One major advancement is in sensor technology. Modern microdrones are now equipped with multi-spectral sensors, night vision, and thermal imaging systems that were previously too large or power-hungry for such small platforms. These sensors offer 360-degree awareness and enable the drone to function effectively in complete darkness, smoke-filled areas, or during electronic interference.

Artificial intelligence and onboard processing are redefining autonomy in microdrone operations. Real-time object recognition, facial detection, threat classification, and autonomous navigation allow these drones to function with limited human input. AI enables microdrones to map environments, avoid obstacles, and even follow specific targets automatically. This is especially valuable in complex terrain where manual piloting is difficult or dangerous. Moreover, communications and data encryption have improved significantly. Microdrones now use secure, encrypted links to prevent interception and jamming. Some operate in mesh networks or relay mode, enabling multiple units to collaborate and share intelligence even in GPS-denied or signal-contested environments.

The integration of swarming algorithms marks a cutting-edge leap in microdrone capabilities. With swarm logic, groups of microdrones can autonomously coordinate movement, surround targets, or conduct simultaneous multi-angle surveillance. This is being explored for force multiplication, perimeter monitoring, and area denial strategies. Lastly, materials science has contributed to making these platforms more resilient and lightweight. Carbon-fiber-reinforced plastics and nano-coatings provide durability against environmental factors like sand, rain, and electromagnetic exposure-ensuring operational continuity in hostile conditions.

Key Drivers in Microdrones Market:

Several key factors are propelling the rise of military microdrones globally. First and foremost is the need for enhanced situational awareness at the squad level. Modern infantry operations require real-time data about immediate surroundings to avoid ambushes, navigate unfamiliar terrain, and detect hidden threats. Microdrones deliver that capability without requiring complex infrastructure or specialized training. Urban warfare and close-quarters combat are also strong drivers. In dense city environments or during counterterrorism operations, traditional UAVs are often too large or loud to maneuver effectively. Microdrones, on the other hand, can enter buildings, scan rooms, and assess threats before soldiers enter-effectively acting as remote eyes in tight spaces. Another major influence is the increasing prevalence of asymmetric threats, such as insurgent groups and non-state actors using guerrilla tactics or makeshift explosives. Microdrones help neutralize such threats by providing precise reconnaissance without exposing forces to unnecessary risk. In many cases, they are used to identify IED placements or hidden enemy positions in real time.

The demand for low-cost, rapidly deployable ISR solutions is another significant factor. Compared to larger drones or manned reconnaissance flights, microdrones are far more affordable and can be fielded in large numbers. This cost efficiency allows for wide-scale adoption, even by mid-sized or budget-constrained militaries. The ability to lose a drone without compromising mission success is critical in high-risk environments. Moreover, defense modernization initiatives across the globe are placing emphasis on digitization, force mobility, and network-centric warfare. Microdrones fit into this paradigm by serving as agile, data-generating platforms that can link seamlessly into command-and-control networks, mission planning software, and soldier systems.

Regional Trends in Microdrones Market:

The global military microdrone landscape is evolving uniquely across different regions based on specific operational needs, technological infrastructure, and strategic priorities.

In North America, the U.S. Department of Defense is leading development through programs like the Soldier Borne Sensor (SBS) initiative, which has deployed microdrones like the FLIR Black Hornet to enhance reconnaissance capabilities at the squad level. The Pentagon is also investing in swarm technologies and autonomous mission execution as part of the broader push for AI-enabled warfighting. U.S. Special Operations Command and the Army Futures Command are exploring microdrone use in multi-domain operations, particularly for contested urban zones and electronic warfare environments.

Europe is embracing microdrone capabilities in line with its focus on expeditionary operations and homeland security. NATO forces in the UK, France, and Norway have already integrated microdrones for tactical ISR, with companies like Parrot (France) and Teledyne FLIR (UK/Norway) offering indigenous solutions. The EU is also funding cross-border R&D programs to support drone innovation and shared standards for interoperability among member states.

In the Asia-Pacific region, rising territorial disputes and border tensions are pushing rapid adoption. China has heavily invested in microdrone swarms for reconnaissance and asymmetric attack purposes, often showcasing swarming drones in military exercises. Its strategy emphasizes overwhelming adversaries with low-cost, AI-coordinated assets. India, meanwhile, is accelerating its microdrone procurement under the "Make in India" defense manufacturing initiative, particularly for operations in mountainous and counterinsurgency environments such as along the Line of Actual Control (LAC). South Korea and Japan are also deploying microdrones as part of surveillance and homeland security modernization efforts.

Key Microdrones Program:

U.S. Special Operations Command (SOCOM) is seeking micro drones capable of operating across multiple domains, specifically in both aerial and underwater environments. The request comes from SOCOM's Program Management Office for Remote Capabilities, which is aiming to identify uncrewed systems for potential evaluation in the coming year. In a special notice issued , the acquisition, technology, and logistics division of SOCOM invited industry feedback to assist in identifying Group 1 uncrewed aerial systems (UAS) suitable for testing. Group 1 drones represent the smallest class of UAS currently utilized by the Department of Defense and are typically deployable from a variety of platforms.

Table of Contents

Microdrones Market Report Definition

Microdrones Market Segmentation

By Type

By Region

By End User

Microdrones Market Analysis for next 10 Years

The 10-year Microdrones Market analysis would give a detailed overview of Microdrones Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Microdrones Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Microdrones Market Forecast

The 10-year Microdrones Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Microdrones Market Trends & Forecast

The regional Microdrones Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Microdrones Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Microdrones Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Microdrones Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By End User, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Microdrones Market Forecast, 2025-2035

- Figure 2: Global Microdrones Market Forecast, By Region, 2025-2035

- Figure 3: Global Microdrones Market Forecast, By End User, 2025-2035

- Figure 4: Global Microdrones Market Forecast, By Type, 2025-2035

- Figure 5: North America, Microdrones Market, Market Forecast, 2025-2035

- Figure 6: Europe, Microdrones Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Microdrones Market, Market Forecast, 2025-2035

- Figure 8: APAC, Microdrones Market, Market Forecast, 2025-2035

- Figure 9: South America, Microdrones Market, Market Forecast, 2025-2035

- Figure 10: United States, Microdrones Market, Technology Maturation, 2025-2035

- Figure 11: United States, Microdrones Market, Market Forecast, 2025-2035

- Figure 12: Canada, Microdrones Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Microdrones Market, Market Forecast, 2025-2035

- Figure 14: Italy, Microdrones Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Microdrones Market, Market Forecast, 2025-2035

- Figure 16: France, Microdrones Market, Technology Maturation, 2025-2035

- Figure 17: France, Microdrones Market, Market Forecast, 2025-2035

- Figure 18: Germany, Microdrones Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Microdrones Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Microdrones Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Microdrones Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Microdrones Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Microdrones Market, Market Forecast, 2025-2035

- Figure 24: Spain, Microdrones Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Microdrones Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Microdrones Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Microdrones Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Microdrones Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Microdrones Market, Market Forecast, 2025-2035

- Figure 30: Australia, Microdrones Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Microdrones Market, Market Forecast, 2025-2035

- Figure 32: India, Microdrones Market, Technology Maturation, 2025-2035

- Figure 33: India, Microdrones Market, Market Forecast, 2025-2035

- Figure 34: China, Microdrones Market, Technology Maturation, 2025-2035

- Figure 35: China, Microdrones Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Microdrones Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Microdrones Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Microdrones Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Microdrones Market, Market Forecast, 2025-2035

- Figure 40: Japan, Microdrones Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Microdrones Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Microdrones Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Microdrones Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Microdrones Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Microdrones Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Microdrones Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Microdrones Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Microdrones Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Microdrones Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Microdrones Market, By End User (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Microdrones Market, By End User (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Microdrones Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Microdrones Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Microdrones Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Microdrones Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Microdrones Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Microdrones Market, By Region, 2025-2035

- Figure 58: Scenario 1, Microdrones Market, By End User, 2025-2035

- Figure 59: Scenario 1, Microdrones Market, By Type, 2025-2035

- Figure 60: Scenario 2, Microdrones Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Microdrones Market, By Region, 2025-2035

- Figure 62: Scenario 2, Microdrones Market, By End User, 2025-2035

- Figure 63: Scenario 2, Microdrones Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Microdrones Market, 2025-2035