|

市场调查报告书

商品编码

1709977

地面站模拟市场(全球)(2025-2035)Global Ground Station Simulation Market 2025-2035 |

||||||

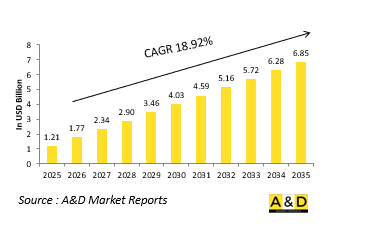

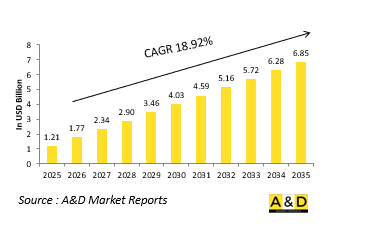

2025 年全球地面站模拟市场规模估计为 12.1 亿美元,预计到 2035 年将达到 68.5 亿美元,在 2025-2035 年预测期内的复合年增长率为 18.92%。

地面站模拟市场介绍

全球国防地面站模拟市场已成为复杂卫星通讯和指挥系统的开发、训练和运作验证的关键推动因素。地面站是地面防御网路和太空资产之间的重要纽带,负责管理资料交换、遥测和作战指挥。模拟器对于复製卫星行为、大气条件、讯号中断和网路入侵以及在受控环境中测试这些交互作用至关重要。随着军队越来越依赖卫星能力,包括通讯、情报、导航和预警,地面系统的准确性和弹性对于作战保障至关重要。地面站模拟器为军队提供了一种经济高效、可重复且安全的方式来培训人员、验证新设备和微调操作协议,而不会危及实际资产。这些系统还支援多国行动的互通性测试,并允许各个指挥单位在部署之前协调通讯。无论是准备应对太空衝突或加强传统的监视和侦察行动,地面模拟已成为现代国防规划的重要组成部分。这个市场的特点是模拟平台日益复杂,迫切需要为技术复杂、策略关键领域不断演变的威胁做好准备。

科技对地面站模拟市场的影响

技术进步正在迅速扩展地面站模拟器的功能,提高其模拟日益复杂的操作环境的能力。高保真模拟平台现在利用先进的处理能力、云端整合和软体定义的架构来复製不同轨道上多颗卫星的动态行为。这包括模拟即时资料传输、讯号干扰、延迟和遗失场景——所有这些对于部署前对地面系统进行压力测试至关重要。机器学习和人工智慧正在整合,以模拟不可预测的卫星行为、网路安全威胁或对手使用的干扰战术。这些功能使工人能够在接近真实的环境中练习情境反应。增强的视觉化工具,例如沉浸式 3D 介面和增强显示,可协助人员从更广泛的情境视角瞭解系统操作。此外,数位孪生也用于镜像真实地面站的配置,提供可用于维护和升级规划的精确建模。随着军事组织转向以网路为中心和太空为依存的行动,模拟工具必须不断发展以反映多域依赖性。这些创新突破了地面测试的界限,使国防机构能够最大限度地降低营运风险,优化回应协议,并提高对地面和外星课题的准备程度。

地面站模拟市场的关键推动因素

国防地面站模拟市场发展的推动因素是,在依赖太空的军事行动时代,对有弹性、反应迅速且可互通的指挥系统的需求日益增加。世界各地的军队越来越多地使用卫星通讯、导航系统和太空情报,这需要能够测试地面卫星相互作用详细情况的模拟工具。随着太空成为激烈争夺的领域,确保地面站即使在网路攻击、电子战和物理威胁下也能生存和运作至关重要。该模拟器无需依赖即时卫星操作即可持续验证防御协议,从而降低成本和风险。

本报告对全球地面站模拟市场进行了深入分析,包括成长动力、10 年展望和区域趋势。

目录

全球航空航太与国防地面站模拟市场报告定义

全球航空航太与国防地面站模拟市场细分

按模拟类型

按技术

按用途

按地区

未来10年全球航空航太与国防地面站模拟市场分析

全球地面站模拟市场市场技术

全球地面站模拟市场预测

全球地面站模拟市场趋势及区域预测

北美

推动因素、阻碍因素与课题

PEST

市场预测与情境分析

主要公司

供应商层级状况

企业基准

欧洲

中东

亚太地区

南美洲

全球地面站模拟市场(按国家)分析

美国

国防计划

最新消息

专利

该市场目前的技术成熟度

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳大利亚

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

全球地面站模拟市场机会矩阵

全球地面站模拟市场专家意见

结论

关于Aviation and Defense Market Reports

The Global Ground Station Simulation market is estimated at USD 1.21 billion in 2025, projected to grow to USD 6.85 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 18.92% over the forecast period 2025-2035.

Introduction to Ground Station Simulation Market:

The global defense ground station simulation market is emerging as a critical enabler in the development, training, and operational validation of complex satellite communication and command systems. Ground stations serve as the vital link between terrestrial defense networks and space-based assets, managing data exchange, telemetry, and mission command. Simulators are essential for testing these interactions in a controlled environment, replicating satellite behavior, atmospheric conditions, signal disruptions, and cyber intrusions. As military reliance on satellite-driven capabilities grows-spanning communications, intelligence gathering, navigation, and early warning-the accuracy and resilience of ground station systems become central to mission assurance. Ground station simulators offer armed forces a cost-effective, repeatable, and secure way to train personnel, validate new equipment, and fine-tune operational protocols without placing actual assets at risk. These systems also support interoperability testing for multinational operations, enabling various command units to harmonize communications before deployment. Whether preparing for space-based conflicts or enhancing traditional surveillance and reconnaissance missions, ground station simulation has become indispensable to modern defense planning. The market is defined by the increasing sophistication of simulation platforms and the pressing need to prepare for evolving threats in a domain that is both technically complex and strategically decisive.

Technology Impact in Ground Station Simulation Market:

Technological advancement is rapidly expanding the capabilities of ground station simulators, enhancing their ability to model increasingly complex operational environments. High-fidelity simulation platforms now leverage advanced processing power, cloud integration, and software-defined architectures to recreate the dynamic behavior of multiple satellites across various orbits. This includes the simulation of real-time data transmission, signal interference, latency, and loss scenarios-all vital for stress-testing ground systems before deployment. Machine learning and artificial intelligence are being integrated to emulate unpredictable satellite behaviors, cybersecurity threats, or jamming tactics used by adversaries. These features allow operators to practice adaptive responses in near-realistic settings. Enhanced visualization tools, such as immersive 3D interfaces and augmented displays, help personnel understand system operations from a broader situational perspective. Additionally, digital twins are being used to mirror actual ground station configurations, offering precise modeling for maintenance and upgrade planning. As military organizations shift toward network-centric and space-enabled operations, simulation tools must evolve to reflect multi-domain dependencies. These technological innovations are pushing the boundaries of what can be tested on the ground, allowing defense agencies to minimize operational risk, optimize response protocols, and improve readiness for both terrestrial and extraterrestrial challenges.

Key Drivers in Ground Station Simulation Market:

The defense ground station simulation market is driven by the growing need for resilient, responsive, and interoperable command systems in an era of space-reliant military operations. Armed forces worldwide are expanding their use of satellite communications, navigation systems, and space-based intelligence-creating a demand for simulation tools that can replicate and test ground-satellite interactions in detail. With space becoming a contested domain, ensuring the survivability and functionality of ground stations under cyberattacks, electronic warfare, and physical threats is paramount. Simulators allow for continuous validation of defense protocols without depending on live satellite operations, reducing cost and risk. Another key factor is the need for comprehensive training environments where operators can develop proficiency in both routine and emergency procedures. These platforms support mission rehearsal, software integration checks, and system upgrades-all without disrupting live command-and-control infrastructure. The pace of innovation in satellite technologies and launch capabilities also requires ground stations to adapt quickly, which is only possible with flexible simulation environments. Finally, the increasing push for cross-border and inter-service collaboration calls for tools that support standardization and compatibility across systems. Together, these drivers are elevating simulation from a support function to a strategic necessity in modern defense operations.

Regional Trends in Ground Station Simulation Market:

Regional dynamics in the defense ground station simulation market reflect varied strategic priorities, industrial maturity, and space program development. North America, led by the United States, continues to dominate due to its advanced military satellite infrastructure and emphasis on space as a warfighting domain. The region invests heavily in simulation to train multi-agency personnel, integrate new command technologies, and rehearse cyber-resilient operations. Europe is focused on building autonomy in space-based defense systems through collaborative programs that increasingly incorporate ground simulation as part of their systems engineering lifecycle. Countries such as France, Germany, and the United Kingdom are investing in localized simulation facilities to support new satellite constellations and military space operations centers. In Asia-Pacific, emerging space powers like India, China, and Japan are rapidly expanding ground station simulation capabilities alongside their growing defense space initiatives. These nations are integrating simulation into military education, R&D, and systems acquisition to ensure readiness and self-sufficiency. In the Middle East, defense modernization efforts are leading to partnerships with global simulation technology providers, emphasizing system interoperability and training. Each region's activity is influenced by a mix of geopolitical pressures and technological ambition, making the global landscape both competitive and innovation-driven.

Key Ground Station Simulation Program:

IonQ and Intellian have announced a partnership to explore the potential of quantum networking in securing satellite communications. IonQ (NYSE: IONQ), a pioneer in quantum computing and networking, signed a memorandum of understanding (MoU) with Intellian Technologies, Inc., a global leader in satellite communication antennas and ground gateway solutions. The collaboration aims to investigate how quantum networking can revolutionize secure satellite connectivity. This agreement also supports IonQ's broader strategy of forming key partnerships across South Korea's enterprise, government, and academic sectors to drive the growth of its quantum ecosystem. Headquartered in Pyeongtaek, South Korea, Intellian is a major provider of satellite, marine radio, terminal, and antenna technologies. As the most widely partnered hardware provider among global network operators, Intellian plays a vital role in global satellite connectivity. The MoU highlights Intellian's ongoing dedication to pushing the boundaries of satellite communications technology.

Table of Contents

Global Ground Station Simulation Market in Aerospace and defense - Table of Contents

Global Ground Station Simulation Market in Aerospace and defense Report Definition

Global Ground Station Simulation Market in Aerospace and defense Segmentation

By Simulation Type

By Technology

By Application

By Region

Global Ground Station Simulation Market in Aerospace and defense Analysis for next 10 Years

The 10-year Global Ground Station Simulation Market in Aerospace and defense analysis would give a detailed overview of Global Ground Station Simulation Market in Aerospace and defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Ground Station Simulation Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Ground Station Simulation Market Forecast

The 10-year Global Ground Station Simulation Market in Aerospace and defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Ground Station Simulation Market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Ground Station Simulation Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Ground Station Simulation Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Ground Station Simulation Market

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Application, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Simulation Type, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Application, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Simulation Type, 2022-2032

List of Figures

- Figure 1: Global Ground Station Simulation Forecast, 2022-2032

- Figure 2: Global Ground Station Simulation Forecast, By Region, 2022-2032

- Figure 3: Global Ground Station Simulation Forecast, By Application, 2022-2032

- Figure 4: Global Ground Station Simulation Forecast, By Technology, 2022-2032

- Figure 5: Global Ground Station Simulation Forecast, By Simulation Type, 2022-2032

- Figure 6: North America, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 7: Europe, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 8: Middle East, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 9: APAC, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 10: South America, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 11: United States, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 12: United States, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 13: Canada, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 14: Canada, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 15: Italy, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 16: Italy, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 17: France, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 18: France, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 19: Germany, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 20: Germany, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 21: Netherlands, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 23: Belgium, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 24: Belgium, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 25: Spain, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 26: Spain, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 27: Sweden, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 28: Sweden, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 29: Brazil, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 30: Brazil, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 31: Australia, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 32: Australia, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 33: India, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 34: India, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 35: China, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 36: China, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 39: South Korea, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 40: South Korea, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 41: Japan, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 42: Japan, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 43: Malaysia, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 45: Singapore, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 46: Singapore, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Ground Station Simulation, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Ground Station Simulation, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Ground Station Simulation, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Ground Station Simulation, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Ground Station Simulation, By Technology (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Ground Station Simulation, By Technology (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Ground Station Simulation, By Application (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Ground Station Simulation, By Application (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Ground Station Simulation, By Simulation Type (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Ground Station Simulation, By Simulation Type (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Ground Station Simulation, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Ground Station Simulation, Global Market, 2022-2032

- Figure 59: Scenario 1, Ground Station Simulation, Total Market, 2022-2032

- Figure 60: Scenario 1, Ground Station Simulation, By Region, 2022-2032

- Figure 61: Scenario 1, Ground Station Simulation, By Application, 2022-2032

- Figure 62: Scenario 1, Ground Station Simulation, By Application, 2022-2032

- Figure 63: Scenario 1, Ground Station Simulation, By Simulation Type, 2022-2032

- Figure 64: Scenario 2, Ground Station Simulation, Total Market, 2022-2032

- Figure 65: Scenario 2, Ground Station Simulation, By Region, 2022-2032

- Figure 66: Scenario 2, Ground Station Simulation, By Application, 2022-2032

- Figure 67: Scenario 2, Ground Station Simulation, By Technology, 2022-2032

- Figure 68: Scenario 2, Ground Station Simulation, By Simulation Type, 2022-2032

- Figure 69: Company Benchmark, Ground Station Simulation, 2022-2032