|

市场调查报告书

商品编码

1714100

变速箱和旋转机构测试 2025-2035Global Gearbox and rotary testing Market 2025-2035 |

||||||

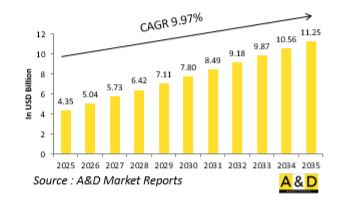

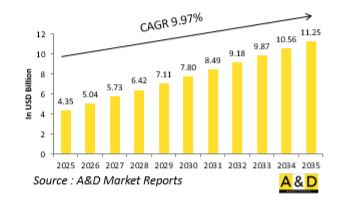

全球变速箱和旋转机构测试市场规模预计将从 2025 年的 43.5 亿美元增长到 2035 年的 112.5 亿美元,预测期内的复合年增长率为 9.97%。

变速箱和旋转机构测试市场:简介

变速箱和旋转机构测试在军用飞机、船舶和陆地车辆的动力传动系统评估中起着至关重要的作用。在国防领域,变速箱和旋转机构是直升机、倾转旋翼机、无人机系统 (UAS)、海军推进系统、装甲车和其他关键任务平台等旋翼机的重要组成部分。这些部件负责在极端运行条件下转换、控制并向各个子系统提供机械能。这些系统处于高扭矩、快速旋转和恶劣的热环境中,对其进行严格测试对于防止任务失败和确保长期运行可靠性至关重要。军用变速箱必须在剧烈振动、衝击和高频负载变化下可靠运行,特别是在作战行动和快速机动期间。旋转机械的测试还包括轴承、轴和联轴器系统,重点是系统的耐久性、噪音水平、齿轮磨损、润滑剂流量、热行为和共振行为(谐波)。随着现代防御系统变得越来越有效率和安静,旋转机制的高精度测试不再是次要的课题,而是任务成功的基本要素。这些测试不仅验证了变速箱的机械耐久性,还验证了其与现代飞行和机动控制系统的集成,并且对于国防平台从开发到维持和运行的整个生命週期都至关重要。

变速箱和旋转机构测试市场:技术的影响

最近的技术进步极大地改变了国防部门对变速箱和旋转机构的测试方式,从而实现了更具预测性、数据驱动和更有效率的评估方法。一个特别值得注意的发展是自动化闭环测试台的引进。这使得即时忠实地再现复杂的负载条件(例如扭力波动、引擎动力循环和环境压力)成为可能。这些系统使用伺服液压执行器来模拟飞行和操作压力,复製长时间的动态功率输入/输出条件。此外,高精度扭矩感测器、声发射监测器和油渣(异物)感测器等先进感测器的引入,实现了组件级的即时健康监测和磨损检测。热成像设备和红外线感测器现在是标准设备,有助于评估摩擦生热和润滑的有效性。另一个重大发展是计算建模和数位孪生技术的应用。这使得在物理测试之前能够虚拟模拟齿轮齿面的应力、振动特性、共振行为等,并且透过将其与实际测试数据相结合,可以非常有效地进行设计验证和改进。此外,人工智慧和机器学习演算法用于分析从测试设备收集的大量感测器数据,从而可以识别齿轮磨损、噪音产生和润滑剂降解等细微模式。这对于预测变速箱故障模式至关重要。此外,模组化测试平台为多种齿轮配置提供快速更换接口,为不同类别的车辆和飞机的测试提供灵活性和更快的周转时间。

变速箱和旋转机构测试市场:关键推动因素

现代国防平台的复杂性和对更高性能的要求日益增加,推动了对更先进的变速箱和旋转机构测试的需求。最重要的推动因素之一是旋翼机和倾转旋翼机在战术和后勤角色中的使用日益增加。例如,V-22 鱼鹰和下一代垂直起降计画等平台严重依赖高性能变速箱来承受极端机械负载,同时满足严格的重量和尺寸限制。测试这些变速箱的冗余度、容错性和长期运行可靠性是一项策略要务。另一个关键推动因素是向混合电力和分散式推进系统的发展。这促使了非传统机器配置和非传统变速箱设计的引入,这些设计必须在复杂的非线性负载条件下进行验证,因此先进的旋转测试至关重要。此外,对于隐身和低噪音很重要的平台,需要进行精确的旋转测试来识别和消除谐波噪音和振动的来源。近年来,延长使用寿命和提高可维护性也成为国防规划的主要问题。由于军事预算非常重视生命週期成本效率,因此变速箱系统必须经过彻底的测试,以评估可预测的磨损模式、维护间隔和储备需求此外,维护老化的飞机或机队需要持续测试以验证更换的零件和改造配置。此外,战场上自动化和无人系统的兴起推动了对紧凑型高功率变速箱的需求,这需要专注于小型化和热管理的专门测试制度。

本报告研究了全球变速箱和旋转机构测试市场,并概述了当前的市场状况、技术趋势、市场影响因素分析、市场规模趋势和预测、按地区进行的详细分析、竞争格局以及主要公司的概况。

目录

全球国防部门的变速箱和旋转机构测试:目录

全球国防部门的变速箱和旋转机构测试:报告定义

全球国防部门的变速箱和旋转机构测试

按地区

按类型

按用途

按成分

未来十年全球国防领域变速箱与旋转机构测试分析

全球国防齿轮箱和旋转机构测试市场:技术

全球国防齿轮箱和旋转机构测试市场预测

国防趋势与预测

北美

推动因素、阻碍因素与课题

阻碍因素

市场预测与情境分析

主要公司

供应商层级格局

企业标竿管理

欧洲

中东

亚太地区

南美洲

全球国防部门的变速箱和旋转机构测试:国家分析

美国

国防计划

最新消息

专利

目前技术成熟度

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳大利亚

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

全球国防部门的变速箱和旋转机构测试:机会矩阵

全球国防部门的变速箱和旋转机构测试:专家意见

概述

关于航空和国防市场报告

The Global Gearbox and rotary testing market is estimated at USD 4.35 billion in 2025, projected to grow to USD 11.25 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 9.97% over the forecast period 2025-2035.

Introduction to Gearbox and rotary testing Market:

Gearbox and rotary system testing occupy a critical niche in the evaluation of power transmission systems within military aircraft, naval vessels, and land vehicles. In the defense context, gearboxes and rotary mechanisms are integral to rotorcraft (such as helicopters), tiltrotors, unmanned aerial systems (UAS), naval propulsion systems, armored vehicles, and other mission-critical platforms. These components are responsible for converting and managing mechanical power across subsystems under extreme operational conditions. Given the high torque loads, rotational speeds, and thermal stresses involved, rigorous testing of these systems is imperative to prevent mission failure and ensure long-term operational reliability. Military gearboxes must function under intense vibration, shock, and high-frequency load variations, particularly during combat operations or rapid maneuvers. Rotary testing also encompasses bearings, shafts, and coupling systems, with emphasis on durability, noise levels, gear wear, oil flow, thermal behavior, and system harmonics. As defense systems evolve toward higher efficiency and reduced acoustic signatures, precision in rotary testing is no longer a secondary consideration-it is a cornerstone of mission assurance. These tests validate not only the mechanical endurance of gearboxes but also their integration with modern flight and mobility control systems, making them essential throughout the development and sustainment lifecycle of defense platforms.

Technology Impact in Gearbox and rotary testing Market:

Recent technological advancements have transformed the landscape of gearbox and rotary testing in defense, leading to more predictive, data-rich, and efficient evaluation methodologies. One of the most notable developments is the incorporation of automated, closed-loop test benches that replicate complex load conditions in real time, simulating torque fluctuations, engine power cycles, and environmental stressors with high fidelity. These systems often use servo-hydraulic actuators to mimic flight or operational stresses and are capable of replicating dynamic power input/output conditions for extended durations. The advent of advanced sensors, including high-precision torque sensors, acoustic emission monitors, and oil-debris sensors, has enabled real-time health monitoring and wear detection down to the component level. Thermal imaging and infrared sensors are now standard in rotary testing setups, helping engineers assess frictional heating and lubrication efficacy. Another significant leap is the application of computational modeling and digital twin technology, which allows engineers to simulate gear tooth stress, vibration signatures, and resonance behavior before physical testing even begins. When combined with real test data, digital twins offer a powerful tool for validation and design iteration. AI and machine learning algorithms are increasingly being used to interpret large volumes of sensor data from test rigs, identifying subtle patterns in gear wear, noise generation, or lubricant degradation-factors critical for predicting gearbox failure modes. Additionally, modular test platforms now offer quick-change interfaces for multi-gear configurations, improving turnaround time and testing flexibility across different vehicle or aircraft classes.

Key Drivers in Gearbox and rotary testing Market:

The growing complexity and performance demands of modern defense platforms are driving the need for more advanced gearbox and rotary testing. One of the foremost drivers is the increased use of rotorcraft and tiltrotor aircraft in both tactical and logistical military roles. These platforms, such as the V-22 Osprey or next-gen vertical lift programs, rely heavily on robust, high-performance gearboxes that must endure extreme mechanical stress while meeting strict weight and size constraints. Testing these gearboxes for redundancy, fault tolerance, and long-duration reliability is a strategic imperative. Another key driver is the shift toward hybrid-electric and distributed propulsion systems, which introduce novel mechanical layouts and non-traditional gearbox designs. These configurations require validation under complex, non-linear load scenarios, making advanced rotary testing essential. The growing emphasis on stealth and low acoustic signature platforms also demands refined rotary testing to identify and eliminate sources of harmonic noise and vibration. Additionally, longevity and maintainability goals have come to the forefront in defense planning. As military budgets prioritize lifecycle cost efficiency, gearbox systems must be thoroughly tested to predict wear patterns, maintenance intervals, and refurbishment needs. Sustainment of aging fleets-including helicopters and naval vessels that rely on legacy gear systems-further necessitates ongoing testing to validate replacement parts and retrofit configurations. Moreover, increasing automation and unmanned systems in the battlefield push the boundaries of miniature yet powerful gearboxes, necessitating dedicated testing regimes focused on miniaturization and thermal management.

Regional Trends in Gearbox and rotary testing Market:

The regional dynamics in gearbox and rotary testing reflect national defense priorities, industrial base capabilities, and technological investment levels. In North America, particularly in the United States, gearbox testing facilities support cutting-edge military rotorcraft and tiltrotor programs such as the Future Long-Range Assault Aircraft (FLRAA) and Future Attack Reconnaissance Aircraft (FARA). These programs demand high-speed endurance testing, dynamic load replication, and fault-tolerant diagnostics. Major defense contractors and research institutions collaborate closely with the Department of Defense to develop modular and digital testing frameworks that align with advanced aircraft timelines. In Europe, leading aerospace nations like France, Germany, and the UK conduct robust gearbox testing as part of next-generation combat air and naval platforms, including the Tempest and FCAS programs. European test centers often emphasize environmentally responsible lubricant performance, low-noise operation, and standardization for multinational fleet interoperability. Italy and Spain are strengthening their industrial testing capabilities to support increased involvement in NATO-aligned rotorcraft and shipborne systems.

In Asia-Pacific, China is rapidly building indigenous test facilities for high-load gear systems used in helicopters, UAVs, and heavy-lift aircraft. These facilities focus on long-term fatigue resistance and resilience to environmental extremes, particularly for gearboxes used in mountainous or maritime terrains. India, through HAL and DRDO, is expanding its test infrastructure for rotary components supporting aircraft such as the Light Combat Helicopter (LCH) and the Indian Multi Role Helicopter (IMRH). Meanwhile, South Korea and Japan are investing in advanced gearbox testing for stealth aircraft and naval propulsion systems, emphasizing automation, local production, and compact high-efficiency gear units. In the Middle East, countries like the UAE and Saudi Arabia are nurturing indigenous test capabilities as part of broader defense industrialization efforts. These countries often partner with Western OEMs to co-develop test protocols and support region-specific platforms. In South America, defense initiatives are largely focused on localized helicopter production and maintenance, leading to emerging demand for regional rotary test facilities, particularly in Brazil. Africa, while still developing its aerospace infrastructure, sees limited gearbox testing activities, often reliant on external validation through international defense collaborations. Across all regions, the trend is toward smarter, connected, and simulation-supported test environments that ensure the mechanical backbone of defense mobility platforms remains fail-safe and future-ready.

Key Gearbox and rotary testing Program:

Lockheed Martin Corporation's Sikorsky Aircraft division has been awarded an $84.3 million contract to deliver eight gearbox assemblies for the CH-53K helicopters. The work will be conducted in Stratford, Connecticut, with completion expected by December 2028. The contract supports both the U.S. Navy and the Israeli military and was issued by the Naval Supply Systems Command Weapon Systems Support in Philadelphia, Pennsylvania.

Table of Contents

Global Gearbox and rotary testing in defense- Table of Contents

Global Gearbox and rotary testing in defense Report Definition

Global Gearbox and rotary testing in defense Segmentation

By Region

By Type

By Application

By Component

Global Gearbox and rotary testing in defense Analysis for next 10 Years

The 10-year Global Gearbox and rotary testing in defense analysis would give a detailed overview of Global Gearbox and rotary testing in defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Gearbox and rotary testing in defense

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Gearbox and rotary testing in defense Forecast

The 10-year Global Gearbox and rotary testing in defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Gearbox and rotary testing in defense Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Gearbox and rotary testing in defense

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Gearbox and rotary testing in defense

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Gearbox and rotary testing in defense

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Component, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Component, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Gearbox and Rotary Testing Market Forecast, 2025-2035

- Figure 2: Global Gearbox and Rotary Testing Market Forecast, By Region, 2025-2035

- Figure 3: Global Gearbox and Rotary Testing Market Forecast, By Component, 2025-2035

- Figure 4: Global Gearbox and Rotary Testing Market Forecast, By Application, 2025-2035

- Figure 5: Global Gearbox and Rotary Testing Market Forecast, By Type, 2025-2035

- Figure 6: North America, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 7: Europe, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 9: APAC, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 10: South America, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 11: United States, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 12: United States, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 13: Canada, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 15: Italy, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 17: France, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 18: France, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 19: Germany, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 25: Spain, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 31: Australia, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 33: India, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 34: India, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 35: China, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 36: China, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 41: Japan, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Gearbox and Rotary Testing Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Gearbox and Rotary Testing Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Gearbox and Rotary Testing Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Gearbox and Rotary Testing Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Gearbox and Rotary Testing Market, By Component (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Gearbox and Rotary Testing Market, By Component (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Gearbox and Rotary Testing Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Gearbox and Rotary Testing Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Gearbox and Rotary Testing Market, By Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Gearbox and Rotary Testing Market, By Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Gearbox and Rotary Testing Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Gearbox and Rotary Testing Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Gearbox and Rotary Testing Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Gearbox and Rotary Testing Market, By Region, 2025-2035

- Figure 61: Scenario 1, Gearbox and Rotary Testing Market, By Component, 2025-2035

- Figure 62: Scenario 1, Gearbox and Rotary Testing Market, By Application, 2025-2035

- Figure 63: Scenario 1, Gearbox and Rotary Testing Market, By Type, 2025-2035

- Figure 64: Scenario 2, Gearbox and Rotary Testing Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Gearbox and Rotary Testing Market, By Region, 2025-2035

- Figure 66: Scenario 2, Gearbox and Rotary Testing Market, By Component, 2025-2035

- Figure 67: Scenario 2, Gearbox and Rotary Testing Market, By Application, 2025-2035

- Figure 68: Scenario 2, Gearbox and Rotary Testing Market, By Type, 2025-2035

- Figure 69: Company Benchmark, Gearbox and Rotary Testing Market, 2025-2035