|

市场调查报告书

商品编码

1715444

全球线束测试仪市场:2025-2035Global Wire Harness Tester Market 2025-2035 |

||||||

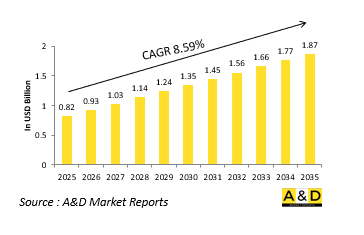

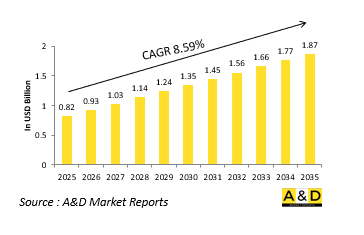

全球线束测试仪市场规模预计将在 2025 年增长至 8.2 亿美元,到 2035 年将增长至 18.7 亿美元,在 2025-2035 年预测期内的复合年增长率 (CAGR) 为 8.59%。

线束测试仪市场介绍:

军用线束测试仪在确保国防平台至关重要的电气互连繫统的完整性、性能和安全性方面发挥关键作用。这些测试仪用于验证飞机、地面车辆、船舶和飞弹系统中关键系统之间传输电力和数据的线束的连续性、绝缘电阻、介电强度和正确结构。在军事装备运作的恶劣和严苛的环境中,即使是最轻微的接线缺陷(例如短路、断路或接线错误)也可能导致任务失败或设备损失。线束测试仪可以帮助在部署之前检测此类问题,从而降低现场故障的风险并提高整体运行可靠性。这些系统支援各种活动,从製造品质检查和仓库级维护到飞行前检查和生命週期监控。随着现代国防平台电气化和数位化程度的提高,线束网路的复杂性也随之增加,需要准确、高效的测试。因此,线束测试仪现在已成为军事维护和品质保证协议的基石,对陆地、空中、海上和太空的战备和任务成功做出了重大贡献。

技术对线束测试仪市场的影响:

军用线束测试仪的发展受到自动化、数据分析和精密电子技术的进步的推动,使其更加有效和用户友好。现代测试仪现在整合了触控萤幕介面、可程式测试序列和高速诊断功能,可以快速识别广泛而复杂的线束中的接线故障。这些系统也适用于混合讯号环境,其中同时存在电源线和数据线,确保每个电路路径都在规格范围内运作。嵌入式软体可实现即时错误记录和自动报告,减少人为错误并提高测试吞吐量。自学习演算法使测试仪能够适应不断变化的线束配置,而无需手动重新编程。此外,坚固耐用的便携式设备还支援现场测试。数位孪生技术也正在集成,使工程师能够模拟线束在不同操作压力下的表现。随着军事系统不断配备更多的感测器、处理器和电子控制单元,线束测试仪必须满足日益增长的可扩展性、准确性和环境稳健性需求。

线束测试仪市场的关键推动因素:

对电子子系统和以数据为中心的战争策略的依赖日益增加,大大增加了对先进军用线束测试仪的需求。随着系统变得越来越复杂,军事平台上的互连数量也不断增加,需要进行严格的测试以防止可能影响任务结果的故障。战斗机、无人系统和海军舰艇等高性能平台需要精确可靠的线束测试来支援先进的航空电子设备、武器控制和通讯系统。此外,国防计画越来越重视优化维护,透过线束测试及早发现故障可以最大限度地减少非计划性停机时间并降低生命週期成本。向模组化和即插即用架构的转变也要求测试人员能够在生产和现场操作中快速验证可互换的线束段。法规遵循和品质保证要求将进一步推动标准化和自动化测试解决方案的采用。随着军队对下一代系统(包括支援人工智慧的平台和电力推进)的电气化和整合进行投资,对全麵线束验证的需求正在增长。综合起来,这些因素凸显了测试在确保现代军事行动中的系统完整性、安全性和准备度方面发挥的关键作用。

线束测试仪市场的区域趋势:

军用线束测试仪的区域趋势由区域国防生产能力、现代化目标和运作要求决定。在北美,尤其是美国,自动化线束测试仪的广泛采用既支援了遗留系统的维护,也支援了空中和海军舰队中下一代技术的整合。对高节奏操作和模组化物流的关注正在推动对便携式和坚固性测试解决方案的投资。与北约的互通性和数位转型目标保持一致,欧洲国家正在推动采用能够处理复杂的多系统布线配置的先进测试仪,特别是在航空航太和装甲车领域。由于印度、中国、日本和韩国等国家本土製造业和平台开发的扩张,亚太地区的需求强劲。这些国家正在建立国内测试能力,以支持更广泛的国防自力更生措施。中东地区正在大力投资测试基础设施,以支援新收购的平台并提高维护自主性,并将线束测试纳入更广泛的维持计画。拉丁美洲和非洲分阶段的国防现代化努力和国际伙伴关係正在引入模组化和移动式线束测试飞机,通常作为更广泛的支援方案的一部分,以提高平台可靠性和本地维护能力。

主要线束测试仪程式

欧盟委员会宣布为 EDIRPA 计划(透过联合采购加强欧洲国防工业)下的通用装甲车系统 (CAVS) 项目提供 6000 万欧元的资金。这项雄心勃勃的计画旨在开发现代化、标准化的装甲车,以增强芬兰、拉脱维亚、瑞典和德国军队的作战能力。 CAVS计画旨在满足日益增长的部队机动性和防护需求,同时促进欧洲国家之间的国防合作和装备标准化。

本报告研究了全球线束测试仪市场,并按细分市场、技术趋势、机会分析、公司概况和国家数据提供了 10 年市场预测。

目录

全球线束测试仪市场 – 目录

全球线束测试仪市场 - 报告定义

全球线束测试仪市场细分

按地区

按类型

依科技

依用途

未来10年全球线束系统市场分析

全球线束系统市场技术

本部分涵盖预计将影响该市场的十大技术以及这些技术可能对整个市场产生的影响。

全球线束系统市场预测

上述部分详细解释了该市场 10 年期间的全球线束系统市场预测。

各地区线束系统市场趋势及预测

本部分涵盖全球线束系统市场的区域趋势、推动因素、阻碍因素、课题以及政治、经济、社会和技术方面。它还提供了详细的区域市场预测和情境分析。区域分析包括主要公司概况、供应商格局和公司基准测试。目前市场规模是根据正常业务情境估算的。

北美

促进因素、阻碍因素与课题

害虫

市场预测与情境分析

主要公司

供应商层级结构

企业基准

欧洲

中东

亚太地区

南美洲

各国门禁市场分析

本章重点介绍该市场的主要防御计划,并介绍该市场的最新新闻和专利。它还提供国家级的 10 年市场预测和情境分析。

美国

国防计画

最新消息

专利

目前该市场的技术成熟度

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

全球线束系统市场机会矩阵

全球线束系统市场报告专家意见

结论

关于航空和国防市场报告

The Global Wire Harness Tester market is estimated at USD 0.82 billion in 2025, projected to grow to USD 1.87 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.59% over the forecast period 2025-2035.

Introduction to Wire Harness Tester Market:

Military wire harness testers play a vital role in ensuring the integrity, performance, and safety of electrical interconnect systems that are essential for defense platforms. These testers are used to validate the continuity, insulation resistance, dielectric strength, and proper configuration of wire harnesses that transmit power and data across critical systems in aircraft, ground vehicles, naval vessels, and missile systems. Given the hostile and demanding environments in which military equipment operates, even minor faults in wiring-such as shorts, opens, or misrouted circuits-can lead to mission failure or equipment loss. Wire harness testers help detect such issues before deployment, reducing the risk of in-field malfunctions and enhancing overall operational reliability. These systems support activities ranging from production quality checks and depot-level maintenance to pre-flight inspections and lifecycle monitoring. With increasing electrification and digital connectivity in modern defense platforms, the complexity of wire harness networks has grown, raising the stakes for accurate and efficient testing. As a result, wire harness testers are now a cornerstone of military maintenance and quality assurance protocols, contributing significantly to readiness and mission success across land, air, sea, and space operations.

Technology Impact in Wire Harness Tester Market:

The evolution of military wire harness testers has been driven by advancements in automation, data analytics, and precision electronics, making them more effective and user-friendly. Modern testers now integrate touch-screen interfaces, programmable test sequences, and high-speed diagnostics, enabling rapid identification of wiring faults across extensive and complex harnesses. These systems are increasingly capable of handling mixed-signal environments, where both power and data lines coexist, ensuring that each circuit path performs to its exact specifications. Embedded software enables real-time error logging and automated reporting, reducing human error and increasing testing throughput. The adoption of self-learning algorithms allows testers to adapt to evolving wire harness configurations without requiring manual reprogramming. In addition, ruggedized and portable units support in-field testing, essential for mobile maintenance crews and forward-deployed forces. Digital twin integration is also emerging, allowing technicians to simulate harness behavior under varying operational stresses. As military systems continue to incorporate more sensors, processors, and electronic control units, wire harness testers must meet rising demands for scalability, accuracy, and environmental resilience, underscoring the role of technology in safeguarding mission-critical interconnections.

Key Drivers in Wire Harness Tester Market:

The growing dependence on electronic subsystems and data-centric warfare strategies is significantly increasing the demand for advanced military wire harness testers. With rising system complexity, the number of interconnections in military platforms has expanded, necessitating rigorous testing to prevent faults that could compromise mission outcomes. High-performance platforms such as fighter jets, unmanned systems, and naval vessels require precise and reliable harness testing to support advanced avionics, weapon control, and communication systems. Additionally, defense programs are increasingly emphasizing maintenance optimization, where early fault detection through harness testing minimizes unscheduled downtimes and lowers lifecycle costs. The shift toward modularity and plug-and-play architectures also calls for testers capable of quickly validating replaceable harness segments during both production and field operations. Regulatory compliance and quality assurance mandates further drive the adoption of standardized and automated testing solutions. As armed forces invest in electrification and integration of next-generation systems, including AI-enabled platforms and electric propulsion, the need for comprehensive wire harness validation grows stronger. These factors collectively highlight the critical role of testing in ensuring system integrity, safety, and readiness in modern military operations.

Regional Trends in Wire Harness Tester Market:

Regional trends in military wire harness testers are shaped by local defense production capabilities, modernization goals, and operational requirements. In North America, particularly in the United States, widespread adoption of automated harness testers supports both legacy system sustainment and integration of next-generation technologies across air and naval fleets. The focus on high-tempo operations and modular logistics encourages investment in portable and ruggedized test solutions. European countries are aligning with NATO's interoperability and digital transformation objectives, driving adoption of advanced testers capable of handling complex multi-system wiring configurations, especially in aerospace and armored vehicle sectors. The Asia-Pacific region is witnessing robust demand, driven by expanding indigenous manufacturing and platform development in countries like India, China, Japan, and South Korea. These nations are building domestic testing capacity to support broader defense self-reliance initiatives. The Middle East is actively investing in test infrastructure to support newly acquired platforms and enhance maintenance autonomy, with wire harness testing being integrated into broader sustainment programs. In Latin America and Africa, gradual defense modernization efforts and international partnerships are introducing modular and mobile harness testers, often as part of broader support packages to enhance platform reliability and local maintenance capabilities.

Key Wire Harness Tester Program:

The European Commission has announced €60 million in funding for the Common Armoured Vehicle System (CAVS) project under the EDIRPA program (European Defense Industry Reinforcement Instrument through Joint Procurement). This ambitious initiative seeks to develop a modern, standardized armored vehicle to strengthen the operational capabilities of the armed forces in Finland, Latvia, Sweden, and Germany. The CAVS project aims to meet increasing demands for troop mobility and protection, while promoting defense collaboration and equipment standardization among European nations.

Table of Contents

Global wire harness systems Market - Table of Contents

Global wire harness systems market Report Definition

Global wire harness systems market Segmentation

By Region

By Type

By Technology

By Application

Global wire harness systems market Analysis for next 10 Years

The 10-year Globalwire harness systems market analysis would give a detailed overview of Globalwire harness systems market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global wire harness systems

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global wire harness systems market Forecast

The 10-year Globalwire harness systems market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional wire harness systems market Trends & Forecast

The regional Globalwire harness systems market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global wire harness systems market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global wire harness systems market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Wire Harness Tester Market Forecast, 2025-2035

- Figure 2: Global Wire Harness Tester Market Forecast, By Region, 2025-2035

- Figure 3: Global Wire Harness Tester Market Forecast, By Technology, 2025-2035

- Figure 4: Global Wire Harness Tester Market Forecast, By Application, 2025-2035

- Figure 5: Global Wire Harness Tester Market Forecast, By Type, 2025-2035

- Figure 6: North America, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 7: Europe, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 9: APAC, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 10: South America, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 11: United States, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 12: United States, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 13: Canada, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 15: Italy, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 17: France, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 18: France, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 19: Germany, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 25: Spain, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 31: Australia, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 33: India, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 34: India, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 35: China, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 36: China, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 41: Japan, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Wire Harness Tester Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Wire Harness Tester Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Wire Harness Tester Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Wire Harness Tester Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Wire Harness Tester Market, By Technology (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Wire Harness Tester Market, By Technology (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Wire Harness Tester Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Wire Harness Tester Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Wire Harness Tester Market, By Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Wire Harness Tester Market, By Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Wire Harness Tester Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Wire Harness Tester Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Wire Harness Tester Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Wire Harness Tester Market, By Region, 2025-2035

- Figure 61: Scenario 1, Wire Harness Tester Market, By Technology, 2025-2035

- Figure 62: Scenario 1, Wire Harness Tester Market, By Application, 2025-2035

- Figure 63: Scenario 1, Wire Harness Tester Market, By Type, 2025-2035

- Figure 64: Scenario 2, Wire Harness Tester Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Wire Harness Tester Market, By Region, 2025-2035

- Figure 66: Scenario 2, Wire Harness Tester Market, By Technology, 2025-2035

- Figure 67: Scenario 2, Wire Harness Tester Market, By Application, 2025-2035

- Figure 68: Scenario 2, Wire Harness Tester Market, By Type, 2025-2035

- Figure 69: Company Benchmark, Wire Harness Tester Market, 2025-2035