|

市场调查报告书

商品编码

1715445

全球电路追踪测试系统市场(2025-2035)Global Ciruit Tracer Test System Market 2025-2035 |

||||||

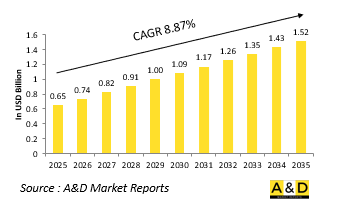

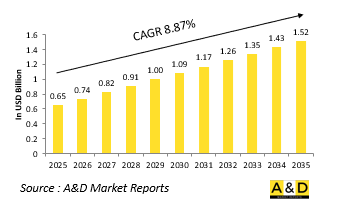

2025 年全球电路追踪测试系统市场规模估计为 6.5 亿美元,预计到 2035 年将达到 15.2 亿美元,在 2025-2035 年预测期内的复合年增长率为 8.87%。

电路追踪测试系统市场简介

军用电路追踪测试系统是识别、诊断和验证复杂防御平台内电路完整性的重要工具。这些系统旨在追踪布线路径、检测开路和短路以及映射电路连接,而无需拆卸组件,这使得它们对于受限或高密度电子环境中的维护和故障排除非常有用。从飞机电子设备到车辆电力系统再到船舶布线,电路追踪系统可协助技术人员快速识别可能影响关键任务操作的故障。在国防应用中,时间敏感的维修和高操作可用性至关重要,电路追踪器有助于减少诊断时间并提高整体系统的准备。它能够在电源和非电源电路上运行,为各种维护场景提供了灵活性。随着军事平台不断发展,包括更先进的电气系统和数位互连,电路追踪的重要性也日益增加。这些系统不仅协助常规诊断,而且还有助于验证新安装、翻新和系统升级,确保所有连接都能按预期运作。在全球范围内,电路追踪测试系统正在成为军用电气工具包的标准元素,有助于实现空中、陆地、海上和网路领域的高效维护工作流程。

科技对电路追踪测试系统市场的影响

军用电路追踪测试系统的进步使得对日益复杂的电气结构进行更准确、更有效率、更直观的诊断成为可能。数位讯号处理和自适应追踪演算法的整合使现代追踪器能够区分讯号类型、透过多层定位故障,并在高电磁干扰的环境中有效运作。无线连接和触控萤幕介面增强了可用性,允许在平板电脑或手持设备上即时显示电路和故障。一些系统现在提供扩增实境 (AR) 覆盖来直观地指导布线布局。微型探头设计和非侵入式检测方法提高了无需拆卸即可进入难以到达的区域的能力。内建记忆体和资料记录功能可实现详细的故障追踪、趋势分析以及与维护管理系统的整合。此外,还内建了安全韧体和加密功能来保护诊断资料。随着国防网路的数位漏洞不断增多,这种需求变得越来越必要。这些技术改进将电路追踪从耗时的手动任务转变为一种快速、智慧的诊断过程,这对于维护进行高压、高节奏操作的现代国防资产的电气完整性至关重要。

电路追踪测试系统市场的关键推动因素

现代军事平台上电气系统的日益复杂是电路追踪测试系统需求不断增长的主要推动因素。随着平台整合更先进的航空电子设备、感测器和控制系统,布线网路的密度和复杂性急剧增加,高效的电路追踪对于故障隔离和系统验证至关重要。

本报告对全球电路追踪测试系统市场进行了深入分析,包括成长动力、未来 10 年的预测和区域趋势。

目录

全球航空航太和国防电路追踪测试系统市场报告定义

全球航空航太和国防电路追踪测试系统市场细分

按地区

按类型

按技术

按用途

未来10年航空航太与国防电路追踪测试系统市场分析

全球航空航太和国防电路追踪测试系统市场技术

全球航空航太和国防电路追踪测试系统市场预测

全球航空航太和国防电路追踪测试系统市场的区域趋势和预测

北美

推动因素、阻碍因素与课题

PEST

市场预测与情境分析

主要公司

供应商层级状况

企业基准

欧洲

中东

亚太地区

南美洲

全球航空航太和国防电路追踪测试系统市场国家分析

美国

国防计划

最新消息

专利

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳大利亚

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

全球航空航太与国防电路追踪测试系统市场机会矩阵

全球航空航太与国防电路追踪测试系统市场报告专家意见

结论

关于Aviation and Defense Market Reports

The Global Circuit Tracer Test System market is estimated at USD 0.65 billion in 2025, projected to grow to USD 1.52 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.87% over the forecast period 2025-2035.

Introduction to Circuit Tracer Test System Market:

Military circuit tracer test systems are essential tools for identifying, diagnosing, and verifying the integrity of electrical circuits within complex defense platforms. These systems are designed to trace wiring paths, detect breaks or shorts, and map circuit connections without disassembling components, making them invaluable for maintenance and troubleshooting in constrained or high-density electronic environments. From aircraft avionics to vehicle power systems and shipboard wiring, circuit tracer systems help technicians quickly locate faults that could impair mission-critical operations. In defense applications, where time-sensitive repairs and high operational availability are paramount, circuit tracers contribute to reducing diagnostic time and enhancing overall system readiness. Their ability to operate on both powered and unpowered circuits offers flexibility in varied maintenance scenarios. As military platforms evolve to include more sophisticated electrical systems and digital interconnects, the importance of circuit tracing grows in tandem. These systems not only support routine diagnostics but also aid in validating new installations, retrofits, and system upgrades, ensuring that every connection functions as intended. Globally, circuit tracer test systems are becoming a standard element of military electrical toolkits, supporting efficient maintenance workflows across the air, land, sea, and cyber domains.

Technology Impact in Circuit Tracer Test System Market:

Advancements in military circuit tracer test systems are enabling more accurate, efficient, and intuitive diagnostics across increasingly complex electrical architectures. The integration of digital signal processing and adaptive tracing algorithms allows modern tracers to differentiate signal types, identify faults through multiple layers, and function effectively in environments with high electromagnetic interference. Wireless connectivity and touchscreen interfaces enhance usability, enabling real-time visualization of circuit paths and fault points on tablets or handheld devices. Some systems now offer augmented reality overlays, guiding technicians visually through wiring layouts, which is particularly beneficial in dense or compartmentalized military systems. Miniaturized probe designs and non-invasive detection methods are improving access to hard-to-reach areas without requiring disassembly. Built-in memory and data logging capabilities enable detailed fault tracking, trend analysis, and integration with maintenance management systems. Additionally, secure firmware and encryption features are being incorporated to protect diagnostic data, a growing necessity as digital vulnerabilities expand across defense networks. These technological enhancements are transforming circuit tracing from a time-consuming manual task into a rapid, intelligent diagnostic process, critical for sustaining the electrical integrity of modern defense assets operating in high-pressure, high-tempo missions.

Key Drivers in Circuit Tracer Test System Market:

The increasing complexity of electrical systems in modern military platforms is a primary driver behind the growing demand for circuit tracer test systems. As platforms integrate more advanced avionics, sensors, and control systems, the density and intricacy of wiring networks have significantly expanded, making efficient circuit tracing critical for fault isolation and system verification. The shift toward condition-based and predictive maintenance strategies further emphasizes the need for accurate, real-time diagnostic tools that reduce downtime and maintenance costs. In fast-paced operational environments, the ability to rapidly locate and repair faults in wiring can directly influence mission success and equipment survivability. Additionally, defense modernization initiatives are incorporating upgrades and retrofits into aging platforms, requiring precise circuit tracing to ensure compatibility and performance. The rise of modular and digital subsystems across land, sea, and air assets also necessitates more adaptable and intelligent testing solutions. Global emphasis on increasing platform availability, improving maintenance efficiency, and ensuring the operational safety of personnel are all reinforcing the critical role of circuit tracer systems. These drivers are making circuit tracing technology a key enabler in the sustainment and operational readiness of next-generation defense systems.

Regional Trends in Circuit Tracer Test System Market:

Regional adoption of military circuit tracer test systems reflects each region's approach to defense modernization, maintenance doctrine, and industrial capabilities. In North America, particularly within the U.S. military and aerospace sectors, circuit tracer systems are widely deployed to support high-readiness requirements and sustainment of complex, multi-domain platforms. The emphasis on rapid diagnostics and electronic health monitoring has spurred investment in advanced, portable tracer systems integrated with digital maintenance ecosystems. Europe is aligning its use of circuit tracing tools with broader goals of electronic system standardization and interoperability, especially for multinational operations under NATO. In the Asia-Pacific region, rapid defense expansion and indigenous platform development in countries like India, China, and South Korea are driving the need for in-house diagnostic capabilities, with circuit tracers playing a central role in field support and logistics. Japan and Australia are also deploying sophisticated tracers as part of upgrades to air and naval fleets. In the Middle East, circuit tracing technology is being integrated into newly acquired systems and defense infrastructure as part of broader sustainment efforts. In Latin America and Africa, adoption is slower but gaining momentum through international military cooperation and technology transfers, enhancing the capabilities of local maintenance personnel in diverse operational environments.

Key Circuit Tracer Test System Program:

The European Commission has announced €60 million in funding for the Common Armoured Vehicle System (CAVS) project under the EDIRPA program (European Defense Industry Reinforcement Instrument through Joint Procurement). This ambitious initiative seeks to develop a modern, standardized armored vehicle to strengthen the operational capabilities of the armed forces in Finland, Latvia, Sweden, and Germany. The CAVS project aims to meet increasing demands for troop mobility and protection, while promoting defense collaboration and equipment standardization among European nations.

Table of Contents

Global Aerospace and defense Circuit Tracer Test System Market - Table of Contents

Global Aerospace and defense Circuit Tracer Test System Market Report Definition

Global Aerospace and defense Circuit Tracer Test System Market Segmentation

By Region

By Type

By Technology

By Application

Global Aerospace and defense Circuit Tracer Test System Market Analysis for next 10 Years

The 10-year Global Aerospace and defense Circuit Tracer Test System market analysis would give a detailed overview of Global Aerospace and defense Circuit Tracer Test System market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Aerospace and defense Circuit Tracer Test System Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Aerospace and defense Circuit Tracer Test System Market Forecast

The 10-year Global Aerospace and defense Circuit Tracer Test System market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Aerospace and defense Circuit Tracer Test System Market Trends & Forecast

The regional Global Aerospace and defense Circuit Tracer Test System market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Aerospace and defense Circuit Tracer Test System Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Aerospace and defense Circuit Tracer Test System Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Aerospace and defense Circuit Tracer Test System Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Circuit Tracer Test Systems Market Forecast, 2025-2035

- Figure 2: Global Circuit Tracer Test Systems Market Forecast, By Region, 2025-2035

- Figure 3: Global Circuit Tracer Test Systems Market Forecast, By Technology, 2025-2035

- Figure 4: Global Circuit Tracer Test Systems Market Forecast, By Application, 2025-2035

- Figure 5: Global Circuit Tracer Test Systems Market Forecast, By Type, 2025-2035

- Figure 6: North America, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 7: Europe, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 9: APAC, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 10: South America, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 11: United States, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 12: United States, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 13: Canada, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 15: Italy, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 17: France, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 18: France, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 19: Germany, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 25: Spain, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 31: Australia, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 33: India, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 34: India, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 35: China, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 36: China, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 41: Japan, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Circuit Tracer Test Systems Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Circuit Tracer Test Systems Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Circuit Tracer Test Systems Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Circuit Tracer Test Systems Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Circuit Tracer Test Systems Market, By Technology (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Circuit Tracer Test Systems Market, By Technology (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Circuit Tracer Test Systems Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Circuit Tracer Test Systems Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Circuit Tracer Test Systems Market, By Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Circuit Tracer Test Systems Market, By Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Circuit Tracer Test Systems Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Circuit Tracer Test Systems Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Circuit Tracer Test Systems Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Circuit Tracer Test Systems Market, By Region, 2025-2035

- Figure 61: Scenario 1, Circuit Tracer Test Systems Market, By Technology, 2025-2035

- Figure 62: Scenario 1, Circuit Tracer Test Systems Market, By Application, 2025-2035

- Figure 63: Scenario 1, Circuit Tracer Test Systems Market, By Type, 2025-2035

- Figure 64: Scenario 2, Circuit Tracer Test Systems Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Circuit Tracer Test Systems Market, By Region, 2025-2035

- Figure 66: Scenario 2, Circuit Tracer Test Systems Market, By Technology, 2025-2035

- Figure 67: Scenario 2, Circuit Tracer Test Systems Market, By Application, 2025-2035

- Figure 68: Scenario 2, Circuit Tracer Test Systems Market, By Type, 2025-2035

- Figure 69: Company Benchmark, Circuit Tracer Test Systems Market, 2025-2035