|

市场调查报告书

商品编码

1727190

战斗直升机用电子光学·热像仪的全球市场:2025年~2035年Global Combat Helicopter Electro Optics & Thermal Cameras Market 2025-2035 |

||||||

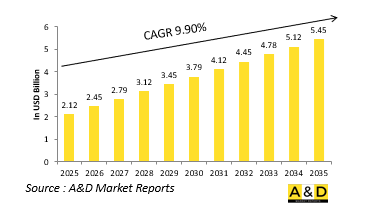

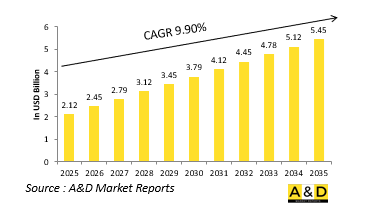

预计2025年全球作战直升机光电和热像仪市场规模将达到22.1亿美元,到2035年将成长至54.5亿美元,预测期内的复合年增长率 (CAGR) 为9.90%。

战斗直升机光电与热像仪市场简介:

光电和红外线热像仪系统是战斗直升机的关键部件,能够增强昼夜瞄准、导航和态势感知能力。这些系统支援各种任务,包括侦察、搜救、近距离空中支援和反装甲作战。光电感测器提供高解析度视觉影像,而热像仪则可侦测热讯号,使飞行员和机组人员能够在各种天气和光照条件下识别隐藏或伪装的目标。这些技术的结合使直升机能够在复杂的作战环境中以更高的精度和安全性进行作战。这些感测器可安装在炮塔上或整合到瞄准系统中,帮助炮手精确瞄准武器系统,并协助飞行员导航地形、避开障碍物和监视。作战直升机经常在低空飞行并面临火力攻击,因此即时可视性和快速目标捕获对于任务成功至关重要。光电和热成像系统无需依赖可能被干扰或侦测到的雷达即可提供这种能力。随着直升机被部署到各种战场,包括城市、山区和茂密的丛林,其角色不断扩大。这些战场需要强大的成像解决方案来确保有效作战和作战优势。

科技对作战直升机光电和热成像仪市场的影响:

技术进步显着扩展了作战直升机光电和热成像仪的功能,使其成为用途广泛且精确的战场工具。最新的系统采用多光谱感测器,将可见光、红外线和微光成像功能集于一身,以实现最佳清晰度,并可在模式之间无缝切换。这些改进增强了对隐藏威胁的侦测能力,即使透过烟雾、浓雾和植被也能有效辨识。高清显示器和影像稳定系统即使在湍流气流中也能确保清晰稳定的视野,而数位变焦和目标追踪演算法则提高了远距离交战的精确度。将这些感测器与火控系统集成,可以使飞行员和炮手更有效率地协同作战,从而更快地做出决策。此外,热像仪和光电摄影机的数据现在可以在平台之间即时共享,从而增强空中和地面部队之间的协作。基于人工智慧的影像辨识技术也开始帮助操作员区分战斗人员、车辆和平民。系统向更小、更坚固和软体驱动的转变意味着新的感测器更轻、更耐用,并且更易于韧体升级。随着作战任务越来越依赖数据和时间,这些光学技术在提高旋翼平台在攻击和防御行动中的战术效能方面发挥关键作用。

作战直升机市场光电和热像仪的关键推动因素:

现代衝突环境日益复杂,是推动战斗直升机对先进光电和红外线热像仪需求的主要因素。这些技术提供夜视、目标识别和全天候侦察等关键任务能力,对于在不可预测的战斗中保持作战效能至关重要。直升机经常用于近距离支援,因此在城市、丛林和沙漠等复杂地形中识别威胁的能力至关重要。对非对称战争和反叛乱行动的日益关注也凸显了对非雷达侦测系统的需求,这些系统不会洩漏飞机的位置。肩扛式飞弹和隐藏敌人的威胁日益增加,进一步凸显了被动感测器在提高瞄准精度和机组人员生存能力方面的价值。现代军事理论强调互通性和即时数据共享,这促使这些成像系统被整合到更广泛的网路中心战框架中。此外,世界各地的国防现代化计画正在推动以支援自动目标探测和多角色适应性的下一代光学系统取代传统系统。对更轻、更节能且不影响飞行性能的系统的需求也推动了这项需求。综合起来,这些因素表明,人们越来越依赖先进的视觉系统来最大限度地提升直升机的作战能力。

作战直升机光电与热像仪市场的区域趋势:

不同地区对作战直升机光电和热像仪的采用情况因战略需求、地形挑战和采购能力而异。在北美,重点是将下一代成像系统与先进的航空电子设备结合,使旋翼平台成为网路化作战行动中的关键节点。在欧洲,重点是感测器融合和模组化,使直升机能够快速切换任务角色并搭载适应性强的有效载荷。山区和森林地形的国家正优先采用热像仪来探测被自然掩体遮蔽的威胁。在亚太地区,地缘政治紧张局势加剧和国防开支增加刺激了对增强型瞄准系统的投资,并努力实现本地生产,以减少对外国供应商的依赖。经常参与反恐和沙漠行动的中东国家青睐针对高温环境和远端监视进行最佳化的系统。在非洲和拉丁美洲,他们正在逐步扩展其边境安全和反走私等任务的能力,通常选择对现有机队进行经济高效的升级。在这些地区,与现有国防製造商的合作在技术转移和客製化方面发挥关键作用。在全球范围内,向多光谱影像和人工智慧增强分析的转变正在重塑作战直升机感知和应对威胁的方式,使这些技术成为面向未来的军队的优先事项。

主要的国防作战直升机电光和热像仪项目:

美国陆军已将特种作战需求融入其未来远程突击机 (FLRAA) 倾转旋翼机的设计中,促使飞机总重量未指定增加。这些改进旨在简化并降低将标准 FLRAA 改装为精锐部队第 160 特种作战航空团 (SOAR) 特种作战直升机的成本。目前,将标准的 UH-60M 黑鹰直升机改装为 MH-60M 特种作战直升机是一个高度复杂且资源密集的过程。

本报告提供全球战斗直升机用电子光学·热像仪市场相关调查,彙整10年的各分类市场预测,技术趋势,机会分析,企业简介,各国资料等资讯。

目录

战斗直升机用电子光学·热像仪市场 - 目录

战斗直升机用电子光学·热像仪市场报告定义

战斗直升机用电子光学·热像仪市场区隔

各地区

类别

用途

各作业平台类型

未来10年战斗直升机用光电热像仪市场分析

本章详细概述了战斗直升机用光电热像仪市场的成长、变化趋势、技术采用概况以及整体市场吸引力。

战斗直升机用光电热像仪市场技术

本部分涵盖了预计将影响该市场的十大技术,以及这些技术可能对整体市场产生的影响。

战斗直升机用光电热像仪全球市场预测

本部分详细介绍了上述各细分市场对战斗直升机用光电热像仪市场的10年预测。

战斗直升机用光电热像仪市场(按地区)的趋势和预测

本部分涵盖了战斗直升机用光电热像仪市场(按地区)的趋势、推动因素、阻碍因素、挑战以及政治、经济、社会和技术方面。此外,还详细涵盖了按地区进行的市场预测和情境分析。区域分析以关键公司概况、供应商格局和公司基准分析作为结尾。目前市场规模是基于常规情境估算。

北美

促进因素,阻碍因素,课题

PEST

市场预测与情势分析

主要企业

供应商阶层的形势

企业基准

欧洲

中东

亚太地区

南美

门禁控制市场国家分析

本章涵盖该市场的主要国防项目,以及该市场的最新资讯和专利申请。此外,也涵盖了各国未来10年的市场预测与情境分析。

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与情势分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

战斗直升机用电子光学·热像仪市场机会矩阵

战斗直升机的电力光学设备和热像仪市场报告相关专家的意见

结论

关于航空·国防市场报告

相关商品

The Global Combat Helicopter Electro Optics & Thermal Cameras market is estimated at USD 2.21 billion in 2025, projected to grow to USD 5.45 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 9.90% over the forecast period 2025-2035.

Introduction to Combat Helicopter Electro Optics & Thermal Cameras Market:

Electro-optics and thermal imaging systems are vital components of combat helicopters, enabling enhanced targeting, navigation, and situational awareness in both day and night operations. These systems support a wide range of missions, including reconnaissance, search and rescue, close air support, and anti-armor engagements. Electro-optical sensors provide high-resolution visual imagery, while thermal cameras detect heat signatures, allowing pilots and crew to identify hidden or camouflaged targets in various weather and lighting conditions. The combination of these technologies allows helicopters to operate in complex combat environments with increased precision and safety. Mounted on turrets or integrated into targeting systems, these sensors assist gunners in aiming weapon systems accurately and pilots in navigating terrain, avoiding obstacles, and conducting surveillance. As combat helicopters often operate at low altitudes and under fire, real-time visibility and rapid target acquisition are crucial for mission success. Electro-optic and thermal systems deliver this capability without relying solely on radar, which can be jammed or detected. Their role continues to expand as helicopters are deployed in diverse theaters, including urban warfare, mountainous terrain, and dense forests, all of which demand robust imaging solutions for effective engagement and operational superiority.

Technology Impact in Combat Helicopter Electro Optics & Thermal Cameras Market:

Technological advancements have significantly expanded the capabilities of electro-optics and thermal imaging in combat helicopters, transforming them into highly versatile and precise battlefield tools. Modern systems now feature multispectral sensors that combine visual, infrared, and low-light imaging into a single unit, offering seamless switching between modes for optimal clarity. These improvements enhance detection of concealed threats, even through smoke, fog, or vegetation. High-definition displays and image stabilization provide sharp, steady views under turbulent flight conditions, while digital zoom and target tracking algorithms improve engagement accuracy at extended distances. The integration of these sensors with fire control systems allows for more efficient coordination between pilot and gunner, facilitating faster decision-making. Additionally, data from thermal and electro-optical cameras can now be shared across platforms in real time, enhancing coordination between air and ground forces. AI-based image recognition is also beginning to assist operators in distinguishing between combatants, vehicles, and civilians. The shift toward miniaturized, ruggedized, and software-driven systems means newer sensors are lighter, more durable, and easier to upgrade through firmware. As combat missions grow increasingly data-driven and time-sensitive, these optical technologies play a critical role in elevating the tactical effectiveness of rotary-wing platforms in both offensive and defensive operations.

Key Drivers in Combat Helicopter Electro Optics & Thermal Cameras Market:

The growing complexity of modern conflict environments is a primary factor driving the demand for advanced electro-optics and thermal imaging in combat helicopters. These technologies provide mission-critical capabilities such as night vision, target recognition, and all-weather surveillance, which are essential for maintaining effectiveness during unpredictable engagements. As helicopters are frequently used in close support roles, the ability to distinguish threats in challenging terrain-whether urban, jungle, or desert-has become indispensable. Increased focus on asymmetric warfare and counter-insurgency operations has also highlighted the need for non-radar-based detection systems that do not compromise the aircraft's position. The rising threat of shoulder-fired missiles and hidden adversaries further underscores the value of passive sensors that enhance both targeting accuracy and crew survivability. Modern military doctrines emphasize interoperability and real-time data sharing, prompting integration of these imaging systems into broader network-centric warfare frameworks. Additionally, defense modernization programs around the world are pushing for the replacement of legacy systems with next-generation optics that support automated target detection and multi-role adaptability. Demand is also being driven by the need for more lightweight and power-efficient systems that do not compromise flight performance. Collectively, these drivers underscore the increasing reliance on sophisticated vision systems to maximize helicopter combat capabilities.

Regional Trends in Combat Helicopter Electro Optics & Thermal Cameras Market:

Regional adoption of electro-optics and thermal cameras in combat helicopters varies based on strategic needs, terrain challenges, and procurement capabilities. In North America, there is a strong focus on integrating next-generation imaging systems with advanced avionics, enabling rotary-wing platforms to function as key nodes in networked combat operations. Europe emphasizes sensor fusion and modularity, allowing helicopters to switch mission roles quickly using adaptable payloads. Countries with mountainous or forested regions are prioritizing thermal imaging to detect threats obscured by natural cover. In the Asia-Pacific, rising geopolitical tensions and increased defense spending are fueling investments in enhanced targeting systems, with local production efforts aimed at reducing reliance on foreign suppliers. Middle Eastern nations, often engaged in counter-terrorism and desert operations, favor systems optimized for high-heat environments and long-range surveillance. Africa and Latin America are gradually expanding their capabilities, driven by border security and anti-smuggling missions, often opting for cost-effective upgrades to existing fleets. In these regions, partnerships with established defense manufacturers play a key role in technology transfer and customization. Across the globe, the shift toward multi-spectral imaging and AI-enhanced analytics is reshaping how combat helicopters perceive and react to threats, making these technologies a priority for forward-looking military forces.

Key Defense Combat Helicopter Electro Optics & Thermal Cameras Program:

The U.S. Army has integrated special operations-specific requirements into the design of its Future Long-Range Assault Aircraft (FLRAA) tiltrotor, resulting in an unspecified increase in the aircraft's gross weight. These modifications aim to simplify and reduce the cost of converting standard FLRAAs into special operations variants for the elite 160th Special Operations Aviation Regiment (SOAR). Currently, converting standard UH-60M Black Hawks into MH-60M special operations helicopters is a highly complex and resource-intensive process.

Table of Contents

Combat Helicopter Electro Optics & Thermal Cameras Market - Table of Contents

Combat Helicopter Electro Optics & Thermal Cameras market Report Definition

Combat Helicopter Electro Optics & Thermal Cameras market Segmentation

By Region

By Type

By Application

By Platform Type

Combat Helicopter Electro Optics & Thermal Cameras market Analysis for next 10 Years

The 10-year Combat Helicopter Electro Optics & Thermal Cameras market analysis would give a detailed overview of Combat Helicopter Electro Optics & Thermal Cameras market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Combat Helicopter Electro Optics & Thermal Cameras market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Combat Helicopter Electro Optics & Thermal Cameras market Forecast

The 10-year Combat Helicopter Electro Optics & Thermal Cameras market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Combat Helicopter Electro Optics & Thermal Cameras market Trends & Forecast

The regional Combat Helicopter Electro Optics & Thermal Cameras market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Combat Helicopter Electro Optics & Thermal Cameras market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Combat Helicopter Electro Optics & Thermal Cameras market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

Related product

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Platform Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Platform Type, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Combat Helicopter Electro Optics and Thermal Cameras Market Forecast, 2025-2035

- Figure 2: Global Combat Helicopter Electro Optics and Thermal Cameras Market Forecast, By Region, 2025-2035

- Figure 3: Global Combat Helicopter Electro Optics and Thermal Cameras Market Forecast, By Type, 2025-2035

- Figure 4: Global Combat Helicopter Electro Optics and Thermal Cameras Market Forecast, By Platform Type, 2025-2035

- Figure 5: Global Combat Helicopter Electro Optics and Thermal Cameras Market Forecast, By Application, 2025-2035

- Figure 6: North America, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 7: Europe, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 9: APAC, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 10: South America, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 11: United States, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 12: United States, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 13: Canada, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 15: Italy, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 17: France, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 18: France, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 19: Germany, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 25: Spain, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 31: Australia, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 33: India, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 34: India, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 35: China, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 36: China, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 41: Japan, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Platform Type (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Platform Type (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Application (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Application (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Combat Helicopter Electro Optics and Thermal Cameras Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Combat Helicopter Electro Optics and Thermal Cameras Market, By Region, 2025-2035

- Figure 61: Scenario 1, Combat Helicopter Electro Optics and Thermal Cameras Market, By Type, 2025-2035

- Figure 62: Scenario 1, Combat Helicopter Electro Optics and Thermal Cameras Market, By Platform Type, 2025-2035

- Figure 63: Scenario 1, Combat Helicopter Electro Optics and Thermal Cameras Market, By Application, 2025-2035

- Figure 64: Scenario 2, Combat Helicopter Electro Optics and Thermal Cameras Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Combat Helicopter Electro Optics and Thermal Cameras Market, By Region, 2025-2035

- Figure 66: Scenario 2, Combat Helicopter Electro Optics and Thermal Cameras Market, By Type, 2025-2035

- Figure 67: Scenario 2, Combat Helicopter Electro Optics and Thermal Cameras Market, By Platform Type, 2025-2035

- Figure 68: Scenario 2, Combat Helicopter Electro Optics and Thermal Cameras Market, By Application, 2025-2035

- Figure 69: Company Benchmark, Combat Helicopter Electro Optics and Thermal Cameras Market, 2025-2035