|

市场调查报告书

商品编码

1735753

无人直升机的全球市场(2025年~2035年)Global Unmanned Helicopter Market 2025-2035 |

||||||

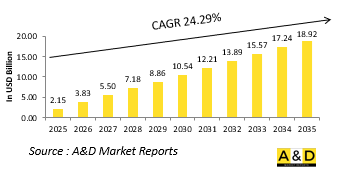

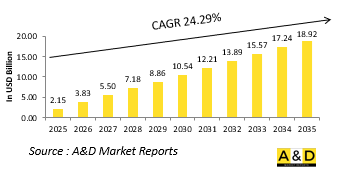

2025年全球无人直升机市场规模估计为21.5亿美元,预计到2035年将达到189.2亿美元,在2025-2035年预测期内的复合年增长率为24.29%。

科技对无人直升机市场的影响

技术的快速发展显着提升了国防无人直升机的能力和作战性能。自主导航、感测器融合和机载运算方面的创新使这些平台能够在动态作战环境中有效作战。它们能够即时处理和回应战场数据,减轻操作员负担,并支援更复杂的作战。高解析度成像系统、合成孔径雷达和电子战有效载荷已成为增强态势感知和威胁侦测的标准配置。人工智慧正在改变决策能力,使无人直升机能够预测性地分析威胁并自主追踪目标。安全的通讯链路确保即使在讯号干扰严重的环境中也能与指挥部和其他军事资产进行协调。此外,节能推进系统有助于延长飞行时间并提高安静度,这对隐形作战至关重要。与其他无人和有人系统的互通性也是一项重要任务,旨在支援联合部队作战和全面防御战略。模组化架构允许快速交换有效载荷,使直升机能够适应从侦察到战术补给等各种作战任务。总体而言,技术进步正在将国防无人直升机转变为适应性强的平台,使其能够在各种作战条件下执行任务,同时降低人员风险并扩大战略覆盖范围。

无人直升机市场的关键推动因素

多种因素推动全球国防领域对无人直升机的采用与发展。其中最重要的是需要将人员从高风险行动中转移出来,以减少人员伤亡。无人直升机为前线侦察、敌方领土搜救以及战火中的后勤支援等行动提供了可靠的解决方案。现代战争日益复杂,需要快速且灵活的反应机制,而这些空中平台正是实现这一目标的理想选择。地缘政治紧张局势和领土争端促使各国加强其监视和情报收集能力,而这些能力往往是在有人驾驶飞机受限的环境中实现的。预算限制和作战效率需求也促使军事规划人员寻求能够透过减少维护和人力投入来提供长期成本优势的平台。此外,网路中心战日益受到重视,使得无人直升机的即时资料共享能力特别宝贵。世界各地的国防现代化计画都优先考虑整合无人系统,以补充传统装备并增强战场感知能力。环境适应性、隐身能力以及与陆海作战的兼容性进一步增强了无人系统的吸引力。随着这些推动因素的融合,无人直升机在国防战略中的作用不断扩大,使其成为现代军事行动中不可或缺的工具。

无人直升机市场的区域趋势

国防用无人直升机的开发和部署在不同地区呈现出不同的模式,这取决于每个地区的战略重点和安全状况。在北美,尤其是美国,正在投入大量资金,打造能够与现有部队结构无缝整合的多任务自主平台。互通性、续航能力和先进的有效载荷能力正在受到重视。在欧洲,各国正致力于加强监视、边境安全和战备行动的联合发展计画。这些努力通常涉及国内公司与国际防务合作伙伴之间的合作,以分担成本和专业知识。

本报告提供全球无人直升机市场相关调查分析,提供今后10年成长促进因素,预测,各地区趋势等资讯。

目录

无人直升机市场报告定义

无人直升机市场区隔

各终端用户

各地区

按有效负载

今后10年的无人直升机市场分析

无人直升机市场技术

全球无人直升机市场预测

地区的无人直升机市场趋势与预测

北美

促进因素,阻碍因素,课题

PEST

市场预测与情势分析

主要企业

供应商层级格局

企业基准

欧洲

中东

亚太地区

南美

无人直升机市场分析:各国

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与情势分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

无人直升机市场机会矩阵

无人直升机市场报告相关专家的意见

结论

关于Aviation and Defense Market Reports

The global Unmanned Helicopter market is estimated at USD 2.15 billion in 2025, projected to grow to USD 18.92 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 24.29% over the forecast period 2025-2035.

Introduction to Global Unmanned Helicopter market:

Defense unmanned helicopters are emerging as critical assets in modern military operations due to their ability to conduct missions without risking human life. These systems combine the agility of rotary-wing aircraft with the benefits of autonomy or remote operation, making them well-suited for reconnaissance, target acquisition, logistics, and electronic warfare. Their ability to hover and operate in confined or hostile environments gives military planners greater flexibility compared to traditional aerial platforms. As the nature of warfare evolves, defense forces around the world are increasingly prioritizing systems that can provide persistent surveillance, quick response, and low observable profiles. Unmanned helicopters are particularly valuable in missions that require quiet operation, rapid deployment, and access to complex terrains. Militaries globally are investing in both the development of indigenous platforms and the acquisition of advanced models from established defense contractors. These systems are being integrated into broader defense networks, working in tandem with ground forces, satellites, and other aerial vehicles. Their modular design allows customization based on mission requirements, which enhances their versatility. In an era of asymmetric threats and contested airspaces, the global interest in defense unmanned helicopters continues to grow, reflecting their strategic importance in achieving operational superiority without direct human involvement.

Technology Impact in Unmanned Helicopter Market:

The rapid evolution of technology has significantly enhanced the capabilities and mission profiles of defense unmanned helicopters. Innovations in autonomous navigation, sensor fusion, and onboard computing allow these platforms to operate effectively in dynamic combat environments. They can process and react to battlefield data in real time, reducing the burden on operators and enabling more complex missions. High-resolution imaging systems, synthetic aperture radars, and electronic warfare payloads are now standard features, enhancing situational awareness and threat detection. Artificial intelligence is transforming decision-making capabilities, enabling unmanned helicopters to conduct predictive threat analysis and autonomous target tracking. Secure communication links ensure coordination with command centers and other military assets, even in environments with heavy signal interference. Furthermore, energy-efficient propulsion systems contribute to extended flight durations and quieter operation, which is crucial for stealth missions. Interoperability with other unmanned and manned systems has also become a priority, supporting joint-force operations and integrated defense strategies. Modular architectures allow rapid payload swapping, tailoring the helicopter for missions ranging from surveillance to tactical resupply. Overall, technological advancements are turning defense unmanned helicopters into highly adaptive platforms that can perform under diverse combat conditions while reducing risk to human personnel and increasing strategic reach.

Key Drivers in Unmanned Helicopter Market:

Several key factors are fueling the global adoption and advancement of unmanned helicopters within defense sectors. Foremost among these is the need to reduce casualties by removing personnel from high-risk missions. Unmanned helicopters provide a reliable solution for tasks such as forward reconnaissance, search and rescue in hostile zones, and logistics support under fire. The increasing complexity of modern warfare demands rapid and flexible response mechanisms, which these aerial platforms are well-suited to deliver. Geopolitical tensions and territorial disputes are prompting nations to strengthen surveillance and intelligence-gathering capabilities, often in environments where manned aircraft face limitations. Budget constraints and the demand for operational efficiency are also pushing military planners toward platforms that offer long-term cost advantages through reduced maintenance and personnel requirements. Additionally, the growing emphasis on network-centric warfare makes the real-time data-sharing capabilities of unmanned helicopters particularly valuable. Defense modernization programs worldwide are prioritizing the integration of unmanned systems to complement traditional assets and enhance battlefield awareness. Environmental adaptability, stealth features, and compatibility with land and naval operations further amplify their appeal. As these drivers converge, the role of unmanned helicopters in defense strategy continues to expand, making them essential tools for modern military operations.

Regional Trends in Unmanned Helicopter Market:

Different regions are exhibiting distinct patterns in the development and deployment of defense unmanned helicopters, shaped by their strategic priorities and security landscapes. In North America, particularly within the United States, significant investment is directed toward creating multi-mission autonomous platforms that can seamlessly integrate with existing force structures. Emphasis is placed on interoperability, endurance, and advanced payload capabilities. In Europe, nations are focusing on joint development programs aimed at enhancing surveillance, border security, and rapid-response operations. These efforts often involve collaborations between domestic firms and international defense partners to share costs and expertise. Asia-Pacific countries are rapidly expanding their defense capabilities, with unmanned helicopters seen as a critical component for maritime security, territorial monitoring, and asymmetric threat deterrence. Nations with large coastlines or contested borders are especially focused on systems that provide persistent aerial presence. In the Middle East, concerns about insurgency and border infiltration are driving demand for unmanned platforms that can conduct surveillance and precision targeting in harsh environments. Meanwhile, Latin America and Africa are gradually exploring these technologies, often through partnerships or procurement from established producers. Across all regions, the underlying trend is a growing recognition of the value unmanned helicopters bring to modern, tech-enabled defense strategies.

Key Unmanned Helicopter Program:

Dutch unmanned helicopter systems specialist High Eye announced it had secured a contract from the Netherlands Ministry of Defence (MoD) to supply its Airboxer vertical take-off and landing unmanned aerial vehicle (VTOL UAV). The contract was awarded through an open international tender, according to High Eye. While the company did not disclose the number of UAVs ordered or the contract's value, it confirmed that the first unit will be delivered within the year. The Airboxer VTOL UAV features a traditional helicopter configuration with a main and tail rotor and is powered by an air-cooled boxer engine with fuel injection. It can carry a variety of payloads, sensors, and other equipment weighing up to 7 kg. At sea level, the UAV can carry a 7 kg payload for several hours. With a 2 kg payload, it can sustain flight for more than three hours at a cruising speed of 30 knots (55.6 km/h) and reach speeds of up to 70 knots. The aircraft's maximum take-off weight at sea level is 32 kg, which gradually decreases with altitude up to its service ceiling of 10,000 ft (approximately 3,048 meters).

Table of Contents

Unmanned Helicopter Market Report Definition

Unmanned Helicopter Market Segmentation

By End User

By Region

By Payload

Unmanned Helicopter Market Analysis for next 10 Years

The 10-year unmanned helicopter market analysis would give a detailed overview of unmanned helicopter market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Unmanned Helicopter Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Unmanned Helicopter Market Forecast

The 10-year unmanned helicopter market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Unmanned Helicopter Market Trends & Forecast

The regional unmanned helicopter market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Unmanned Helicopter Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Unmanned Helicopter Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Unmanned Helicopter Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Payload, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By End User, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Payload, 2025-2035

List of Figures

- Figure 1: Global Unmanned Helicopter Market Forecast, 2025-2035

- Figure 2: Global Unmanned Helicopter Market Forecast, By Region, 2025-2035

- Figure 3: Global Unmanned Helicopter Market Forecast, By End User, 2025-2035

- Figure 4: Global Unmanned Helicopter Market Forecast, By Payload, 2025-2035

- Figure 5: North America, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 6: Europe, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 8: APAC, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 9: South America, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 10: United States, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 11: United States, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 12: Canada, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 14: Italy, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 16: France, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 17: France, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 18: Germany, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 24: Spain, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 30: Australia, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 32: India, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 33: India, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 34: China, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 35: China, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 40: Japan, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Unmanned Helicopter Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Unmanned Helicopter Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Unmanned Helicopter Market, By End User (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Unmanned Helicopter Market, By End User (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Unmanned Helicopter Market, By Payload (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Unmanned Helicopter Market, By Payload (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Unmanned Helicopter Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Unmanned Helicopter Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Unmanned Helicopter Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Unmanned Helicopter Market, By Region, 2025-2035

- Figure 58: Scenario 1, Unmanned Helicopter Market, By End User, 2025-2035

- Figure 59: Scenario 1, Unmanned Helicopter Market, By Payload, 2025-2035

- Figure 60: Scenario 2, Unmanned Helicopter Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Unmanned Helicopter Market, By Region, 2025-2035

- Figure 62: Scenario 2, Unmanned Helicopter Market, By End User, 2025-2035

- Figure 63: Scenario 2, Unmanned Helicopter Market, By Payload, 2025-2035

- Figure 64: Company Benchmark, Unmanned Helicopter Market, 2025-2035