|

市场调查报告书

商品编码

1735757

9mm的全球市场(2025年~2035年)Global 9mm Market 2025-2035 |

||||||

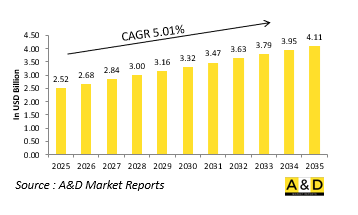

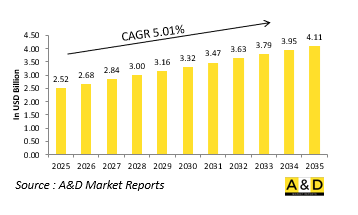

2025 年全球 9 毫米市场规模估计为 25.2 亿美元,预计到 2035 年将达到 41.1 亿美元,在 2025-2035 年预测期内的复合年增长率为 5.01%。

科技对 9 毫米市场的影响

技术进步对 9 毫米枪械在现代国防领域的性能和利用率产生了重大影响。冶金技术和製造精度的提高使这种口径更加耐用和可靠。聚合物和合金结构的进步使其重量更轻,同时保持了结构完整性,使其更易于携带且功能性不受影响。在弹药方面,推进剂化学和子弹设计的进步提高了终端性能、穿透力以及在不同交战距离下的一致性。曾经专属于特种部队的空尖弹和屏障致盲弹如今得到了更广泛的部署,提升了其在实战中的效能。增强的光学系统、模组化附件和人体工学改进也使9毫米平台实现了现代化,使其能够更快地进行目标转换,在压力下获得更好的控制,并与夜视和数位瞄准系统相容。红点瞄准器和枪载照明灯等智慧配件提高了作战效能,尤其是在低光源和城市环境中。在训练方面,模拟技术可以更有效率地发展技能,减少对实战的依赖,同时保持战备状态。所有这些创新都有助于扩展9毫米系统的战术效用,确保其在高度动态和技术驱动的国防环境中仍然有效。最终打造出更先进、性能更强大、更适应性的平台,支援传统和新兴作战模式。

9毫米口径市场的关键推动因素

9毫米口径在国防应用中持续占据主导地位,这得益于战术需求、作战效率和经济实用性的共同作用。 9毫米口径应用的最重要原因之一是其在製动力和机动性之间的平衡,尤其是在快速追击或近距离作战中需要机动性的情况下。该口径的轻量化设计使人员能够携带更多弹药,而不会增加额外的负担。盟军的标准化进一步简化了后勤、采购和培训,并促进了联合作战中的互通性。这种相容性对于跨国联盟尤其重要,因为无缝共享弹药至关重要。 9毫米口径也适用于从手枪到小型自动步枪等各种平台,使其能够灵活地执行战斗和支援任务,以满足各种作战需求。此外,9毫米武器和弹药的生产成本相对较低,也促使9毫米武器在寻求可靠随身武器解决方案的大型和小型国防部队中广受欢迎。非对称威胁和不断变化的城市作战环境持续推动对紧凑、快速和近距离有效武器的需求,这与9毫米平台的优势完美契合。随着军事需求的不断发展,其适应性使其成为实用且具有战略意义的选择。

9毫米市场的区域趋势

9毫米枪枝的区域使用情况反映了战略方向和采购能力,促使整个国防领域的采用模式多种多样。在北美,尤其是美国,由于弹道性能的改进以及向更轻、更大容量的随身武器的转变,9毫米口径再次成为军事和执法部门的焦点。由于北约的标准化以及该地区历史上开发了许多主要的9毫米平台,欧洲长期以来一直偏爱这种口径。欧洲国防军通常优先考虑精密工程和互通性,其国家和多国部队通常配备 9 毫米手枪和衝锋枪。在亚太地区,随着城市化进程的加速和国内安全需求的提升,军警、特种部队和边境巡逻部队广泛采用 9 毫米武器。

本报告概述了全球 9 毫米市场,包括成长动力、十年展望和区域趋势。

目录

9mm市场报告定义

9mm市场区隔

各地区

各类型

各用途

各材料

今后10年的9mm市场分析

9mm市场技术

全球9mm市场预测

地区的9mm市场趋势与预测

北美

促进因素,阻碍因素,课题

PEST

市场预测与情势分析

主要企业

供应商的Tier的形势

企业基准

欧洲

中东

亚太地区

南美

9mm市场分析:各国

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与情势分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

9mm市场机会矩阵

9mm市场报告相关专家的意见

结论

关于Aviation and Defense Market Reports

The Global 9mm Market is estimated at USD 2.52 billion in 2025, projected to grow to USD 4.11 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.01% over the forecast period 2025-2035.

Introduction to 9mm Market:

The 9mm cartridge holds a central position in global defense arsenals due to its balance of performance, versatility, and logistical practicality. Widely used in handguns and submachine guns, the 9mm round is favored for its manageable recoil, adequate stopping power, and high magazine capacity, making it suitable for military, law enforcement, and security operations. Its widespread adoption is a result of decades of standardization efforts that sought a reliable and universally accessible sidearm solution. Armed forces around the world continue to rely on 9mm platforms for close-quarters engagements, personal defense, and tactical roles. The compact size and ease of handling allow for fast target acquisition, particularly in confined spaces where larger calibers may prove unwieldy. This caliber is also compatible with a variety of modern weapons, from service pistols to compact automatic firearms, enhancing its utility across diverse operational contexts. Military units benefit from the logistical simplicity of a widely supported round, with manufacturers across continents producing compatible ammunition and components. The 9mm's sustained relevance underscores its adaptability in changing combat environments and evolving military doctrines. It remains a key component in the broader ecosystem of defense firearms, valued for its efficiency, reliability, and cross-platform compatibility.

Technology Impact in 9mm Market:

Technological advancements have significantly influenced the performance and application of 9mm firearms in modern defense contexts. Improvements in metallurgy and manufacturing precision have enhanced the durability and reliability of weapons chambered in this caliber. Advancements in polymer and alloy construction have reduced weight while maintaining structural integrity, making weapons easier to carry without compromising functionality. On the ammunition side, developments in propellant chemistry and bullet design have improved terminal performance, penetration, and consistency across various engagement ranges. Hollow-point and barrier-blind projectiles, once limited to special units, are now more commonly deployed, offering increased effectiveness in real-world combat conditions. Enhanced optics, modular attachments, and ergonomic improvements have also modernized 9mm platforms, enabling faster target transitions, better control under stress, and compatibility with night vision and digital targeting systems. Smart accessories, such as red dot sights and weapon-mounted lights, increase operational effectiveness, especially in low-light and urban environments. In training, simulation technologies have allowed more efficient skill development, reducing live-fire dependency while maintaining combat readiness. All these innovations contribute to extending the tactical utility of 9mm systems, ensuring they remain relevant in highly dynamic and technology-driven defense environments. The result is a more refined, capable, and adaptable platform that supports both traditional and emerging mission profiles.

Key Drivers in 9mm Market:

The sustained prominence of 9mm in defense applications is driven by a combination of tactical necessity, operational efficiency, and economic practicality. One of the most compelling reasons for its use is the balance between stopping capability and controllability, especially in scenarios requiring rapid follow-up shots or close-quarters maneuverability. The caliber's lightweight nature allows personnel to carry more ammunition without adding significant burden, an advantage in extended or mobile operations. Standardization across allied forces further simplifies logistics, procurement, and training, promoting interoperability in joint missions. This compatibility is particularly valuable for multinational coalitions where seamless ammunition sharing can be critical. The 9mm's broad platform compatibility-from concealed handguns to compact automatic weapons-also supports varied mission demands, offering flexibility across combat and support roles. Additionally, the relatively low production cost of 9mm weapons and ammunition contributes to its popularity among both large and smaller defense forces seeking reliable sidearm solutions. The evolution of asymmetric threats and urban warfare environments continues to increase the need for weapons that are compact, fast, and effective at short ranges, which aligns perfectly with the strengths of the 9mm platform. As military needs evolve, its adaptability ensures that the 9mm remains a practical and strategic choice.

Regional Trends in 9mm Market:

Regional use of 9mm firearms reflects both strategic doctrines and procurement capabilities, resulting in diverse adoption patterns across the defense landscape. In North America, especially the United States, the 9mm has regained prominence in military and law enforcement circles due to improved ballistics and the shift toward lighter, higher-capacity sidearms. Europe maintains a long-standing preference for this caliber, driven by NATO standardization and the region's historical development of many leading 9mm platforms. European defense forces often prioritize precision engineering and interoperability, with national and multinational units frequently equipping their personnel with 9mm handguns and submachine guns. In the Asia-Pacific region, increasing urbanization and internal security demands have led to broad integration of 9mm weapons for military police, special forces, and border units. Middle Eastern and North African nations tend to source 9mm platforms from both Western and Eastern suppliers, using them across a spectrum of conventional and paramilitary roles. In Latin America, 9mm firearms are widely used in defense and public security, often favored for their cost-effectiveness and ease of use in close-range operations. African nations are adopting 9mm systems at a growing pace, particularly in peacekeeping and counterinsurgency roles, where simple, durable sidearms are essential. This global footprint underscores the caliber's continued strategic relevance.

Key 9mm Program:

Carl Walther is supplying the Bundeswehr special forces with the new P14 and P14K service pistols, both derived from the successful PPD series of polymer-framed, striker-fired handguns. Meanwhile, attention is shifting to the upcoming P13 service pistol, which is intended to replace the P8-Heckler & Koch's sidearm that has served the German military for roughly 30 years. The procurement process for the new standard-issue service pistol, referred to as the P13 in official terms, is moving into its next phase. According to reports, only three of the original six competing manufacturers remain in the running for the contract, signaling a narrowing field in the competition to supply the next-generation sidearm to regular Bundeswehr forces.

Table of Contents

9mm Market - Table of Contents

9mm market Report Definition

9mm market Segmentation

By Region

By Type

By application

By Material

9mm market Analysis for next 10 Years

The 10-year 9mm market analysis would give a detailed overview of 9mm market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of 9mm market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global 9mm market Forecast

The 10-year 9mm market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional 9mm market Trends & Forecast

The regional 9mm market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for 9mm market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on 9mm market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application Material, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application Material, 2025-2035

List of Figures

- Figure 1: Global 9mm Market Forecast, 2025-2035

- Figure 2: Global 9mm Market Forecast, By Region, 2025-2035

- Figure 3: Global 9mm Market Forecast, By Type, 2025-2035

- Figure 4: Global 9mm Market Forecast, By Application Material, 2025-2035

- Figure 5: North America, 9mm Market, Market Forecast, 2025-2035

- Figure 6: Europe, 9mm Market, Market Forecast, 2025-2035

- Figure 7: Middle East, 9mm Market, Market Forecast, 2025-2035

- Figure 8: APAC, 9mm Market, Market Forecast, 2025-2035

- Figure 9: South America, 9mm Market, Market Forecast, 2025-2035

- Figure 10: United States, 9mm Market, Technology Maturation, 2025-2035

- Figure 11: United States, 9mm Market, Market Forecast, 2025-2035

- Figure 12: Canada, 9mm Market, Technology Maturation, 2025-2035

- Figure 13: Canada, 9mm Market, Market Forecast, 2025-2035

- Figure 14: Italy, 9mm Market, Technology Maturation, 2025-2035

- Figure 15: Italy, 9mm Market, Market Forecast, 2025-2035

- Figure 16: France, 9mm Market, Technology Maturation, 2025-2035

- Figure 17: France, 9mm Market, Market Forecast, 2025-2035

- Figure 18: Germany, 9mm Market, Technology Maturation, 2025-2035

- Figure 19: Germany, 9mm Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, 9mm Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, 9mm Market, Market Forecast, 2025-2035

- Figure 22: Belgium, 9mm Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, 9mm Market, Market Forecast, 2025-2035

- Figure 24: Spain, 9mm Market, Technology Maturation, 2025-2035

- Figure 25: Spain, 9mm Market, Market Forecast, 2025-2035

- Figure 26: Sweden, 9mm Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, 9mm Market, Market Forecast, 2025-2035

- Figure 28: Brazil, 9mm Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, 9mm Market, Market Forecast, 2025-2035

- Figure 30: Australia, 9mm Market, Technology Maturation, 2025-2035

- Figure 31: Australia, 9mm Market, Market Forecast, 2025-2035

- Figure 32: India, 9mm Market, Technology Maturation, 2025-2035

- Figure 33: India, 9mm Market, Market Forecast, 2025-2035

- Figure 34: China, 9mm Market, Technology Maturation, 2025-2035

- Figure 35: China, 9mm Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, 9mm Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, 9mm Market, Market Forecast, 2025-2035

- Figure 38: South Korea, 9mm Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, 9mm Market, Market Forecast, 2025-2035

- Figure 40: Japan, 9mm Market, Technology Maturation, 2025-2035

- Figure 41: Japan, 9mm Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, 9mm Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, 9mm Market, Market Forecast, 2025-2035

- Figure 44: Singapore, 9mm Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, 9mm Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, 9mm Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, 9mm Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, 9mm Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, 9mm Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, 9mm Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, 9mm Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, 9mm Market, By Application Material (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, 9mm Market, By Application Material (CAGR), 2025-2035

- Figure 54: Scenario Analysis, 9mm Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, 9mm Market, Global Market, 2025-2035

- Figure 56: Scenario 1, 9mm Market, Total Market, 2025-2035

- Figure 57: Scenario 1, 9mm Market, By Region, 2025-2035

- Figure 58: Scenario 1, 9mm Market, By Type, 2025-2035

- Figure 59: Scenario 1, 9mm Market, By Application Material, 2025-2035

- Figure 60: Scenario 2, 9mm Market, Total Market, 2025-2035

- Figure 61: Scenario 2, 9mm Market, By Region, 2025-2035

- Figure 62: Scenario 2, 9mm Market, By Type, 2025-2035

- Figure 63: Scenario 2, 9mm Market, By Application Material, 2025-2035

- Figure 64: Company Benchmark, 9mm Market, 2025-2035