|

市场调查报告书

商品编码

1744369

策略通讯的全球市场:2025年~2035年Global Tactical Communication Market 2025-2035 |

||||||

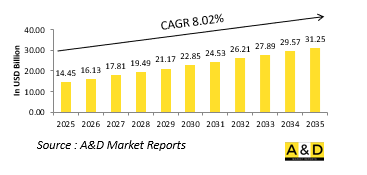

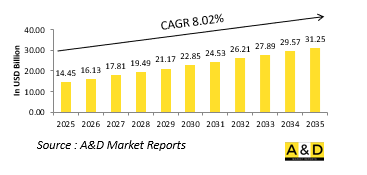

2025年全球战术通讯市场规模估计为144.5亿美元,预计到2035年将成长至312.5亿美元,2025-2035年预测期间的复合年增长率 (CAGR) 为8.02%。

全球战术通讯市场简介:

国防战术通讯是军事行动的支柱,能够在作战环境中实现即时安全的资讯交换。它支援对陆、空、海和网路空间等各部队的指挥和控制。其主要目的是透过在恶劣和不可预测的条件下提供快速可靠的通讯来确保任务成功。与可能用于战略或行政目的的更广泛的国防通讯系统不同,战术系统注重机动性、弹性和适应性。这些网路用于主动部署,无论是在战斗、维和或紧急支援中。随着军事行动的发展,通讯需求的复杂性也不断增加。战术系统必须在传统网路受到威胁或不可用的敌对环境中发挥作用。它们在保持态势感知、协调资源和快速应对威胁方面发挥关键作用。与无人系统和人工智慧等新兴技术的整合进一步扩展了这些通讯平台的重要性。随着多国联合行动的增多,跨境互通性和安全的资讯交换至关重要。有效的战术通讯不仅支援任务完成,还能透过加强协作和降低动态高风险场景下的风险来保障人员安全。

科技对战术通讯市场的影响:

技术进步正在重塑防御性战术通讯格局,为速度、精确度和弹性带来新的可能性。软体定义无线电、网状网路和卫星增强连接等创新改变了部队即时通讯的方式。这些工具使分散式部队即使在远程和电子对抗环境中也能保持连线。人工智慧和机器学习现在透过处理海量战场数据并优先考虑可操作的洞察来支援更快的决策。边缘运算支援本地数据分析,减少对中央指挥的依赖并加快作战响应。加密标准日益复杂,可提供防窃听和网路入侵的保护。基于云端的基础设施和数位孪生技术正在增强规划和模拟能力,提高作战前的准备程度。同时,小型化技术的进步使得更多设备能够整合到个人装备中,从而在不牺牲机动性的情况下提高单兵作战能力。透过将传统系统与下一代技术连接,整合平台正在应对互通性课题,从而实现更顺畅的联军作战。这些技术进步不仅增强了传统军事行动,也拓宽了战术通讯的范围,涵盖网路防御、天基资产和混合战争场景。因此,技术既是催化剂,也是赋能器,确保战术通讯保持敏捷并随时待命。

战术通讯市场的关键推动因素:

有几个关键因素加速了国防战术通讯的发展。日益复杂的作战环境要求分散式部队之间进行无缝协调,这些部队通常以跨国和多域编队作战。这推动了对能够支援陆、空、海、天和网路域一体化作战的系统的需求。日益加剧的地缘政治紧张局势和难以预测的衝突地区需要能够抵御电子战和网路威胁的强大而敏捷的通讯解决方案。城市战和非对称衝突环境也推动了对灵活、适应性强的通讯平台的需求。另一个主要推动因素是军事现代化,各国都在寻求升级旧有系统,以满足当代和未来任务的需求。无人驾驶车辆、自主平台和感测器网路的作用日益增强,这给战术通讯带来了新的复杂性,必须加以应对。此外,向即时资料共享和决策的转变更加强调低延迟、高频宽的通讯通道。预算分配和国防政策也会影响系统的部署和创新,尤其是在各国政府优先考虑数位转型的情况下。最后,盟军之间对互通性的需求仍然是开发标准化通讯协定和设备的主要驱动力。这些共同的压力正在塑造全球战术通讯系统的未来方向。

战术通讯市场的区域趋势:

区域动态对国防战术通讯系统的开发、部署和优先排序有重大影响。在北美,尤其是美国,高度重视将尖端技术与传统平台结合,以保持全球战略优势。其重点在于建构能够在衝突环境中运作的弹性多域通讯能力。在欧洲,联合倡议和多边国防合作正在推动盟军之间的互通性和标准化。战术通讯系统旨在支援国防和集体安全任务。在亚太地区,海上紧张局势加剧和国防预算不断增加,正在推动战术通讯基础设施的快速现代化。该地区各国正在投资于适用于传统战争和混合战争场景的机动性和适应性系统。中东地区长期处于衝突之中,面临内部安全课题,因此优先考虑能够在城市和沙漠环境中运作的安全、快速部署的系统。同时,非洲和拉丁美洲地区专注于维和和灾难应变,优先考虑在预算限制和能力之间取得平衡的经济高效的解决方案。在所有地区,一体化、以网路为中心的作战都已成为一种趋势,这反映了国防规划中战术通讯评估和实施方式普遍的变革。

重大战术通讯项目

莱茵金属公司已获得德国联邦国防军(Bundeswehr)的一项重要合同,该项目将对整个德国武装部队具有重大的横向意义。根据该合同,莱茵金属公司将提供多达19.1万套 "整合式听力保护装置的对讲系统" 。该框架合约为期七年,净价值可能高达4亿欧元。此计画的实施需遵守德国联邦议院预算委员会所设定的条件。首批订单为3万套(含连接线),已确认2024年交付。另有3万套将于2025年交付。这两批订单将由专款资助,净额高达1.4亿欧元。

本报告提供全球策略通讯市场相关调查,彙整10年的各分类市场预测,技术趋势,机会分析,企业简介,各国资料等资讯。

目录

战术性通讯市场报告定义

战术性通讯市场区隔

各类型

各地区

各平台

各技术

未来10年战术通讯市场分析

本章透过对未来10年战术通讯市场的分析,详细概述了战术通讯市场的成长、变化趋势、技术采用概况和市场吸引力。

战术通讯市场的市场技术

本部分涵盖了预计将影响该市场的十大技术,以及这些技术对整体市场可能产生的影响。

全球战术通讯市场预测

本文详细阐述了未来10年战术通讯市场的预测,涵盖了上述细分市场。

战术通讯市场趋势及区域预测

本部分涵盖了战术通讯市场各区域的趋势、推动因素、限制、课题以及政治、经济、社会和技术层面。此外,本文也提供了各区域的市场预测和情境分析。区域分析的最后阶段包括关键参与者分析、供应商格局分析和公司基准分析。目前市场规模是基于常规情境下的估算。

北美

促进因素,阻碍因素,课题

PEST

市场预测与情势分析

主要企业

供应商阶层的形势

企业基准

欧洲

中东

亚太地区

南美

策略通讯市场各国分析

本章涵盖该市场的主要国防项目,以及该市场的最新新闻和专利申请。此外,也涵盖了各国未来10年的市场预测与情境分析。

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与情势分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

战术性通讯市场机会矩阵

战术性通讯市场报告相关专家的意见

结论

关于航空·国防市场报告

The global Tactical Communication market is estimated at USD 14.45 billion in 2025, projected to grow to USD 31.25 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.02% over the forecast period 2025-2035.

Introduction to Global Tactical Communication market:

Defense tactical communication serves as the backbone of military operations by enabling real-time, secure exchange of information in operational environments. It supports command and control across various units including land, air, sea, and cyber domains. The primary aim is to ensure mission success by facilitating fast and reliable communication under harsh and unpredictable conditions. Unlike broader defense communication systems that may serve strategic or administrative purposes, tactical systems are built for mobility, resilience, and adaptability. These networks are used during active deployments, whether in combat, peacekeeping, or emergency support roles. As military operations evolve, so does the complexity of the communication needs. Tactical systems must function in hostile environments where traditional networks may be compromised or unavailable. They play a vital role in maintaining situational awareness, coordinating assets, and responding swiftly to threats. Integration with emerging technologies like unmanned systems and artificial intelligence further extends the importance of these communication platforms. With increasing instances of joint multinational operations, interoperability and secure cross-border information exchange are critical. Effective tactical communication not only supports mission execution but also safeguards personnel by enhancing coordination and reducing risks in dynamic, high-stakes scenarios.

Technology Impact in Tactical Communication Market:

Technological advancement is reshaping the landscape of defense tactical communication, introducing new possibilities for speed, accuracy, and resilience. Innovations such as software-defined radios, mesh networks, and satellite-enhanced connectivity have transformed how forces communicate in real-time. These tools allow decentralized units to stay connected, even in remote or electronically contested environments. Artificial intelligence and machine learning now support faster decision-making by processing vast amounts of battlefield data and prioritizing actionable insights. Edge computing enables local data analysis, reducing reliance on central command structures and speeding up operational responses. Encryption standards have become more sophisticated, offering protection against interception and cyber intrusions. Cloud-based infrastructures and digital twins enhance planning and simulation capabilities, fostering improved pre-mission preparation. Meanwhile, advancements in miniaturization allow more equipment to be integrated into personal gear, increasing individual soldier capabilities without sacrificing mobility. Interoperability challenges are being addressed through unified platforms that link legacy systems with next-generation technologies, enabling smoother coalition efforts. These innovations are not only enhancing traditional military operations but also broadening the scope of tactical communication to include cyber defense, space-based assets, and hybrid warfare scenarios. Technology thus acts as both a catalyst and an enabler, ensuring that tactical communication remains agile and mission-ready.

Key Drivers in Tactical Communication Market:

Several core factors are accelerating the evolution of defense tactical communication. Increasingly complex combat environments demand seamless coordination between dispersed units, often operating in multinational and multi-domain formations. This creates a growing need for systems that can support integrated operations across land, air, maritime, space, and cyber domains. Rising geopolitical tensions and unpredictable conflict zones require communication solutions that are both robust and agile, capable of withstanding electronic warfare and cyber threats. Urban warfare and asymmetric conflict settings also contribute to the demand for flexible and adaptive communication platforms. Another major driver is the modernization of armed forces, as countries seek to upgrade legacy systems to meet the requirements of contemporary and future missions. The growing role of unmanned vehicles, autonomous platforms, and sensor networks introduces new layers of complexity that tactical communication must address. Additionally, the shift toward real-time data sharing and decision-making places greater emphasis on low-latency, high-bandwidth communication channels. Budget allocations and defense policies also influence system adoption and innovation, especially as governments prioritize digital transformation. Finally, the need for interoperability among allied forces continues to be a major force behind the development of standardized communication protocols and equipment. These combined pressures are shaping the future direction of tactical communication systems globally.

Regional Trends in Tactical Communication Market:

Regional dynamics significantly influence how defense tactical communication systems are developed, deployed, and prioritized. In North America, particularly the United States, there is a strong emphasis on integrating cutting-edge technologies with legacy platforms to maintain global strategic advantage. The focus is on building resilient, multi-domain communication capabilities that can operate in contested environments. In Europe, joint initiatives and multinational defense collaborations drive the push for interoperability and standardization among allied forces. Here, tactical communication systems are designed to support both national defense and collective security missions. In the Asia-Pacific region, growing maritime tensions and expanding defense budgets have led to a surge in the modernization of tactical communication infrastructure. Countries in this area are investing in mobile, adaptable systems suited for both traditional and hybrid warfare scenarios. The Middle East, facing persistent conflict and internal security challenges, prioritizes secure, rapid-deployment systems that can function in both urban and desert terrains. Meanwhile, regions in Africa and Latin America focus on cost-effective solutions that balance capability with budget constraints, often emphasizing peacekeeping and disaster response roles. Across all regions, the trend is moving toward integrated, network-centric operations, reflecting a universal shift in the way tactical communication is valued and implemented in defense planning.

Key Tactical Communication Program:

Rheinmetall has been awarded a major contract by the Bundeswehr for a key tactical communications project that holds cross-cutting significance for the entire German armed forces. Under this agreement, the technology group will supply up to 191,000 units of its "intercom system with integrated hearing protection." The framework contract spans seven years and has a potential net value of up to €400 million. The project is subject to conditions set by the Budget Committee of the German Bundestag. An initial order of 30,000 units, including connection cables, has been firmly placed for delivery in 2024. An additional 30,000 units are expected to be called off for delivery in 2025. These two batches, financed through the special fund, are valued at up to €140 million net.

Table of Contents

Tactical Communication Market Report Definition

Tactical Communication Market Segmentation

By Type

By Region

By Platform

By Technology

Tactical Communication Market Analysis for next 10 Years

The 10-year tactical communication market analysis would give a detailed overview of tactical communication market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Tactical Communication Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Tactical Communication Market Forecast

The 10-year tactical communication market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Tactical Communication Market Trends & Forecast

The regional tactical communication market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Tactical Communication Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Tactical Communication Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Tactical Communication Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Platform, 2025-2035

List of Figures

- Figure 1: Global Tactical Communication Market Forecast, 2025-2035

- Figure 2: Global Tactical Communication Market Forecast, By Region, 2025-2035

- Figure 3: Global Tactical Communication Market Forecast, By Type, 2025-2035

- Figure 4: Global Tactical Communication Market Forecast, By Technology, 2025-2035

- Figure 5: Global Tactical Communication Market Forecast, By Platform, 2025-2035

- Figure 6: North America, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 7: Europe, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 9: APAC, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 10: South America, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 11: United States, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 12: United States, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 13: Canada, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 15: Italy, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 17: France, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 18: France, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 19: Germany, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 25: Spain, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 31: Australia, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 33: India, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 34: India, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 35: China, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 36: China, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 41: Japan, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Tactical Communication Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Tactical Communication Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Tactical Communication Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Tactical Communication Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Tactical Communication Market, By Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Tactical Communication Market, By Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Tactical Communication Market, By Technology (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Tactical Communication Market, By Technology (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Tactical Communication Market, By Platform (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Tactical Communication Market, By Platform (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Tactical Communication Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Tactical Communication Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Tactical Communication Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Tactical Communication Market, By Region, 2025-2035

- Figure 61: Scenario 1, Tactical Communication Market, By Type, 2025-2035

- Figure 62: Scenario 1, Tactical Communication Market, By Technology, 2025-2035

- Figure 63: Scenario 1, Tactical Communication Market, By Platform, 2025-2035

- Figure 64: Scenario 2, Tactical Communication Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Tactical Communication Market, By Region, 2025-2035

- Figure 66: Scenario 2, Tactical Communication Market, By Type, 2025-2035

- Figure 67: Scenario 2, Tactical Communication Market, By Technology, 2025-2035

- Figure 68: Scenario 2, Tactical Communication Market, By Platform, 2025-2035

- Figure 69: Company Benchmark, Tactical Communication Market, 2025-2035