|

市场调查报告书

商品编码

1744375

鱼雷的全球市场:2025年~2035年Global Torpedo Market 2025-2035 |

||||||

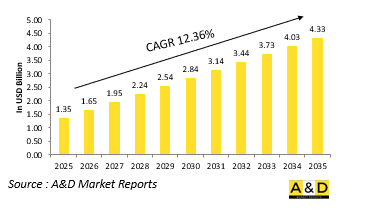

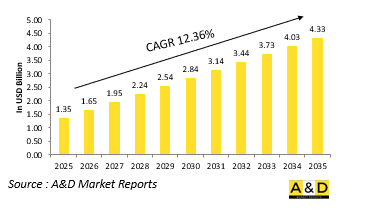

2025年全球鱼雷市场规模估计为13.5亿美元,预计到2035年将成长至43.3亿美元,2025年至2035年的复合年增长率 (CAGR) 为12.36%。

鱼雷市场简介:

鱼雷是潜水艇、水面舰艇和飞机用来打击和化解海上威胁的重要水下武器。这些自航式弹药旨在透过直接撞击或近距离引爆来追踪和摧毁敌方潜艇和水面舰艇。与水雷和深水炸弹不同,鱼雷可以使用机载导引系统主动搜寻目标,使其在海上攻防行动中非常有效。它们的应用范围涵盖和平时期的威慑、战时打击任务和反逼近战略。随着海域争夺日益激烈,鱼雷凭藉其隐身、突袭和杀伤力,在水下战争中发挥核心作用。现代海军战术越来越依赖这种武器来保持水下优势和战略威慑,尤其是在喉咙要道和领海。鱼雷可搭载于从柴电潜舰到远程巡逻机等各种平台,构成海军力量的重要组成部分。鱼雷在保障海上交通线安全以及阻止敌方海军水面入侵方面也发挥关键作用。全球防卫界持续优先发展鱼雷,并认识到鱼雷在非对称和高强度衝突场景中的持久价值。鱼雷的持续发展反映了向水下优势和综合海上战备的广泛转变。

科技对鱼雷市场的影响:

技术进步显着改变了现代鱼雷在海上防御中的能力和作用。推进系统的创新使鱼雷更安静、更快,降低了被发现的风险,同时提高了攻击精准度。热力发动机、先进的电动马达和改进的流体动力学使这些武器能够在更远的距离上作战,并具有更高的隐身性。在导引方面,新型鱼雷整合了先进的声吶、尾流自导感测器和惯性导航系统,使其能够适应复杂的环境并超越对抗措施。人工智慧和自主瞄准演算法也在不断涌现,使鱼雷能够以最少的操作员输入区分诱饵和真实威胁。增强的资料链功能允许在发射后进行中途更新,使操作员的控制更加灵活。弹头设计不断发展,旨在保持紧凑性和安全性的同时,提供更集中、更有效的杀伤力。此外,模组化架构允许快速升级和针对特定任务的配置。这些技术进步不仅提高了杀伤力,也提高了在日益复杂的反潜战系统中的生存能力。现代鱼雷已融入网路中心海军作战,如今在高度竞争的水下环境中既是战略威慑力量,又是精确打击武器,为常规和非对称海上战区的任务成功提供支援。

鱼雷市场的关键推动因素:

几个关键因素正在推动现代海军战略中鱼雷的全球研发和部署。随着各国寻求确保战略水道和海洋资源的安全,对水下领域主导地位的竞争日益激烈,这也扮演着重要角色。潜舰在监视和威慑方面的活动日益增多,凸显了对有效水下攻击方案的需求。海军理论的演变优先考虑分层防御和快速反应能力,这增强了鱼雷在攻防态势中的相关性。无人平台的整合和近海作战的扩展需要能够在浅水和狭窄水域中作业的紧凑、高效的鱼雷。对区域热点地区反潜威胁的担忧推动了对用于对抗各种潜艇和水面对手的鱼雷的进一步投资。此外,对远洋作战力量投射的重视也刺激了远程和多用途鱼雷的研发。现代海军也重视自力更生,促使各国加强了自主鱼雷设计与生产的研究。战备状态和灵活的部署选项仍然是关键目标,这促使人们增强发射系统和储存能力。这些推动因素反映了一种战略转变,即在日益激烈的全球安全环境中保持可靠的威慑力,改善海上战术选择,并确保海上优势。

鱼雷市场区域趋势:

鱼雷的研发和部署因地区而异,并受其独特的海洋战略和威胁认知所影响。在印度-太平洋地区,海军竞争和领土争端日益加剧,促使各国对先进鱼雷系统进行大规模投资,尤其是那些寻求扩大潜舰舰队规模并确立水下主导地位的国家。沿海和群岛国家正在加强反潜能力,并专注于发展适合浅水和拥挤水域的敏捷鱼雷。在欧洲,重点是互通性和现代化,国防计画通常旨在升级传统鱼雷,使其符合北约标准。该地区重视保护海上航线和应对地区不稳定局势,这使得对重型和轻型鱼雷的需求保持稳定。中东拥有战略海上交通枢纽,其广泛的海军防御网络依靠鱼雷,旨在保护沿海设施并遏制水面入侵。北美在技术先进性方面继续保持领先,重点是先进的导引系统和与多域平台的整合。同时,现代化建设和区域合作正在逐步增强南美和非洲部分地区的鱼雷能力。这反映出这些地区普遍认识到,有效的水下武器对于海上威慑、舰队防御和长期战略安全规划至关重要。

主要鱼雷项目

印度国防部签署了两份旨在显着提升该国潜艇能力的重要合约。其中一份是与法国海军集团签订的购买先进电子重型鱼雷 (EHWT) 的合同,价值 87.7 亿卢比。另一份是与位于孟买的马扎冈船坞造船厂签订的一份价值约199亿卢比的重大合同,用于整合一套新的不依赖空气推进系统(AIP)。 AIP技术由印度国防研究与发展组织(DRDO)自主研发,是 "自力更生的印度" (Atmanirbhar Bharat)愿景的重大推动力。合併后的合约价值286.7亿卢比,这是印度在提升潜舰舰队续航力、杀伤力和自主能力方面迈出的重要一步。

本报告提供全球鱼雷市场相关调查,彙整10年的各分类市场预测,技术趋势,机会分析,企业简介,各国资料等资讯。

目录

鱼雷市场报告定义

鱼雷市场区隔

各地区

各启动平台

各类型

未来10年鱼雷市场分析

本章详细概述了鱼雷市场的成长、变化趋势、技术采用概况和市场吸引力,并进行了10年的鱼雷市场分析。

鱼雷市场技术

本部分涵盖了预计将影响该市场的十大技术,以及这些技术可能对整体市场产生的影响。

全球鱼雷市场预测

本部分详细介绍了该市场未来十年的鱼雷市场预测,涵盖了上述各个细分市场。

鱼雷市场趋势及各地区预测

本部分涵盖了各地区鱼雷市场的趋势、推动因素、阻碍因素、课题以及政治、经济、社会和技术层面。此外,也详细介绍了区域市场预测和情境分析。区域分析的最后阶段包括关键公司概况、供应商格局和公司基准分析。目前市场规模是基于正常业务情境估算的。

北美

促进因素,阻碍因素,课题

PEST

市场预测与情势分析

主要企业

供应商阶层的形势

企业基准

欧洲

中东

亚太地区

南美

鱼雷市场国家分析

本章涵盖了该市场的主要国防项目,以及该市场的最新新闻和专利申请。此外,也提供了各国10年市场预测与情境分析。

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与情势分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

鱼雷市场机会矩阵

鱼雷市场报告相关专家的意见

结论

关于航空·国防市场报告

The Global Torpedo market is estimated at USD 1.35 billion in 2025, projected to grow to USD 4.33 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 12.36% over the forecast period 2025-2035.

Introduction to Torpedo Market:

Torpedoes are essential underwater weapons used primarily by submarines, surface ships, and aircraft to engage and neutralize naval threats. These self-propelled munitions are designed to track and destroy enemy submarines and surface vessels through direct impact or proximity detonation. Unlike naval mines or depth charges, torpedoes can actively seek out targets using onboard guidance systems, making them highly effective in both offensive and defensive maritime operations. Their relevance spans peacetime deterrence, wartime strike missions, and anti-access strategies. As maritime domains become more contested, torpedoes play a central role in undersea warfare by offering stealth, surprise, and lethality. Modern naval tactics increasingly depend on these weapons to maintain underwater superiority and strategic deterrence, especially in choke points and territorial waters. Equipped on a variety of platforms-from diesel-electric submarines to long-range patrol aircraft-torpedoes form a critical layer of naval capability. They are also instrumental in securing sea lines of communication and in deterring surface incursions by hostile navies. The global defense community continues to prioritize torpedo development, recognizing their enduring value in asymmetric and high-intensity conflict scenarios. Their continued evolution reflects a broader shift toward undersea dominance and integrated maritime combat readiness.

Technology Impact in Torpedo Market:

Technological advancements have profoundly reshaped the capabilities and roles of modern torpedoes in maritime defense. Innovations in propulsion systems have led to quieter and faster torpedoes, reducing detection risk while improving strike precision. Thermal engines, advanced electric motors, and improved hydrodynamics enable these weapons to operate over longer distances with greater stealth. In terms of guidance, newer models integrate advanced sonar, wake-homing sensors, and inertial navigation systems, allowing them to adapt to complex environments and outmaneuver countermeasures. Artificial intelligence and autonomous targeting algorithms are also emerging, enabling torpedoes to distinguish between decoys and legitimate threats with minimal operator input. Enhanced data-link capabilities provide mid-course updates, giving operators more control and flexibility after launch. Warhead design has evolved to deliver more focused and effective damage while maintaining compactness and safety. Additionally, modular architecture allows for rapid upgrades and mission-specific configurations. These technological gains are not only boosting lethality but also improving survivability against increasingly sophisticated anti-submarine warfare systems. Combined with integration into network-centric naval operations, modern torpedoes now serve as both strategic deterrents and precision tools in highly contested undersea environments, supporting mission success across both conventional and asymmetric maritime theaters.

Key Drivers in Torpedo Market:

Several critical factors are propelling the global development and deployment of torpedoes in contemporary naval strategies. The growing competition for dominance in undersea domains is a major influence, as nations seek to secure strategic waterways and maritime resources. Increased submarine activity-both for surveillance and deterrence-has underscored the need for effective underwater strike options. Evolving naval doctrines that prioritize layered defense and rapid-response capabilities reinforce the relevance of torpedoes in both offensive and defensive postures. The integration of unmanned platforms and the expansion of littoral operations require compact, efficient torpedoes capable of operating in shallow and confined waters. Concerns over anti-submarine threats in regional hotspots further drive investment in torpedoes designed to counter a variety of submersible and surface adversaries. Additionally, a focus on force projection in blue-water operations encourages the development of long-range and multi-role variants. Modern navies are also emphasizing self-reliance, prompting increased research into indigenous torpedo design and production. Operational readiness and flexible deployment options remain key goals, leading to enhancements in launch systems and storage capabilities. These drivers collectively reflect a strategic shift toward maintaining credible deterrence, improving tactical options at sea, and ensuring maritime superiority in an increasingly contested global security environment.

Regional Trends in Torpedo Market:

Torpedo development and deployment vary by region, shaped by distinct maritime strategies and threat perceptions. In the Indo-Pacific, heightened naval competition and territorial disputes have led to significant investments in advanced torpedo systems, particularly by nations aiming to expand their submarine fleets and assert undersea dominance. Coastal and archipelagic states are enhancing their anti-submarine capabilities, emphasizing agile torpedoes suited for shallow and congested waters. In Europe, the focus is on interoperability and modernization, with defense programs often aimed at upgrading legacy torpedoes to align with NATO standards. The region's emphasis on protecting sea lanes and responding to regional instability contributes to steady demand for both heavy and lightweight variants. The Middle East, with its strategic maritime chokepoints, relies on torpedoes as part of broader naval defense networks aimed at securing coastal installations and deterring surface incursions. North America continues to lead in terms of technological sophistication, emphasizing advanced guidance systems and integration with multi-domain platforms. Meanwhile, in South America and parts of Africa, torpedo capabilities are expanding gradually through modernization efforts and regional cooperation. Across these regions, the trajectory reflects a broader recognition that effective undersea weaponry is central to maritime deterrence, fleet defense, and long-term strategic security planning.

Key Torpedo Program:

India's Ministry of Defence has signed two major contracts aimed at significantly strengthening the country's submarine capabilities. One agreement, valued at ₹877 crore, was signed with France's Naval Group for the acquisition of advanced Electronic Heavy Weight Torpedoes (EHWT). The second and larger contract, worth approximately ₹1,990 crore, was signed with Mumbai-based Mazagon Dock Shipbuilders for the integration of a new Air Independent Propulsion (AIP) system. The AIP technology, developed indigenously by the Defence Research and Development Organisation (DRDO), is a major boost under the 'Atmanirbhar Bharat' (self-reliant India) initiative. Together, the contracts total ₹2,867 crore and mark a significant step forward in enhancing the endurance, lethality, and self-reliance of India's submarine fleet.

Table of Contents

Torpedo Market Report Definition

Torpedo Market Segmentation

By Region

By Launch Platform

By Type

Torpedo Market Analysis for next 10 Years

The 10-year torpedo market analysis would give a detailed overview of torpedo market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Torpedo Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Torpedo Market Forecast

The 10-year torpedo market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Torpedo Market Trends & Forecast

The regional torpedo market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Torpedo Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Torpedo Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Torpedo Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Launch Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Launch Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Torpedo Market Forecast, 2025-2035

- Figure 2: Global Torpedo Market Forecast, By Region, 2025-2035

- Figure 3: Global Torpedo Market Forecast, By Launch Platform, 2025-2035

- Figure 4: Global Torpedo Market Forecast, By Type, 2025-2035

- Figure 5: North America, Torpedo Market, Market Forecast, 2025-2035

- Figure 6: Europe, Torpedo Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Torpedo Market, Market Forecast, 2025-2035

- Figure 8: APAC, Torpedo Market, Market Forecast, 2025-2035

- Figure 9: South America, Torpedo Market, Market Forecast, 2025-2035

- Figure 10: United States, Torpedo Market, Technology Maturation, 2025-2035

- Figure 11: United States, Torpedo Market, Market Forecast, 2025-2035

- Figure 12: Canada, Torpedo Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Torpedo Market, Market Forecast, 2025-2035

- Figure 14: Italy, Torpedo Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Torpedo Market, Market Forecast, 2025-2035

- Figure 16: France, Torpedo Market, Technology Maturation, 2025-2035

- Figure 17: France, Torpedo Market, Market Forecast, 2025-2035

- Figure 18: Germany, Torpedo Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Torpedo Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Torpedo Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Torpedo Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Torpedo Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Torpedo Market, Market Forecast, 2025-2035

- Figure 24: Spain, Torpedo Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Torpedo Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Torpedo Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Torpedo Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Torpedo Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Torpedo Market, Market Forecast, 2025-2035

- Figure 30: Australia, Torpedo Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Torpedo Market, Market Forecast, 2025-2035

- Figure 32: India, Torpedo Market, Technology Maturation, 2025-2035

- Figure 33: India, Torpedo Market, Market Forecast, 2025-2035

- Figure 34: China, Torpedo Market, Technology Maturation, 2025-2035

- Figure 35: China, Torpedo Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Torpedo Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Torpedo Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Torpedo Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Torpedo Market, Market Forecast, 2025-2035

- Figure 40: Japan, Torpedo Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Torpedo Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Torpedo Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Torpedo Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Torpedo Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Torpedo Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Torpedo Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Torpedo Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Torpedo Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Torpedo Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Torpedo Market, By Launch Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Torpedo Market, By Launch Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Torpedo Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Torpedo Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Torpedo Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Torpedo Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Torpedo Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Torpedo Market, By Region, 2025-2035

- Figure 58: Scenario 1, Torpedo Market, By Launch Platform, 2025-2035

- Figure 59: Scenario 1, Torpedo Market, By Type, 2025-2035

- Figure 60: Scenario 2, Torpedo Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Torpedo Market, By Region, 2025-2035

- Figure 62: Scenario 2, Torpedo Market, By Launch Platform, 2025-2035

- Figure 63: Scenario 2, Torpedo Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Torpedo Market, 2025-2035