|

市场调查报告书

商品编码

1744376

练习机的全球市场(2025年~2035年)Global Trainer Aircraft Market 2025-2035 |

||||||

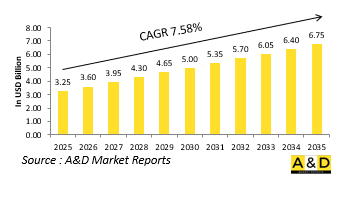

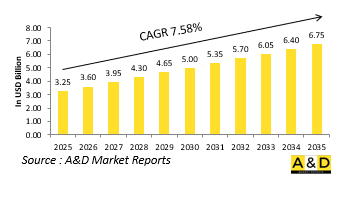

2025年全球教练机市场规模估计为32.5亿美元,预计到2035年将达到67.5亿美元,在2025-2035年的预测期内,复合年增长率为7.58%。

科技对教练机市场的影响

技术的进步正在重新定义教练机的功能,提升训练品质和作战适应性。最新的教练机平台如今整合了数位驾驶舱、触控萤幕介面和与下一代战斗机极为相似的先进航空电子设备。这种协作使受训人员能够在训练的最初阶段熟悉操作。嵌入式模拟系统正变得越来越普遍,允许在同一飞行课程中混合使用真实和虚拟训练。这些功能减少了对外部模拟器的依赖,并允许进行动态操作的演练。增强的安全机制,例如即时数据监控和自动返回系统,允许教练在必要时立即进行干预,从而进一步支持教学。先进的推进系统也提高了性能,并允许重现更广泛的飞行条件。一些平台现在支援资料炼和操作规划软体,可以与其他空中或地面资产一起参与联网训练。此外,材料和空气动力学方面的发展正在延长使用寿命并减少维护需求。这项技术转变使教练机本身成为一项战略资产,而不仅仅是垫脚石,使军事航空教育的各个阶段都能训练飞行员操作先进系统,同时优化训练成本、安全性和作战真实性。

教练机市场的关键推动因素

空战日益复杂以及前线飞机的先进性是塑造国防教练机发展的主要力量。随着空军使用多用途和隐形平台对其机队进行现代化改造,对能够复製类似驾驶舱环境、作战系统和作战动态的教练机的需求也随之增加。预算效率也是一个推动因素,教练机提供了一种经济有效的方法来提高飞行员的技能,而无需花费大量资金部署高性能战斗机进行定期训练。减少训练时间并提高飞行员战备状态的需求也推动了对支援混合学习方法的平台的需求,这些方法将实弹飞行、模拟和作战规划整合到一个统一的框架中。联合和联盟训练工作进一步凸显了对符合盟军标准并支援国际飞行员交流的教练机的需求。无人系统的兴起以及对有人-无人协同能力的需求也影响着训练需求,推动着能够模拟这些不断变化的作战情景的飞机的研发。总体而言,这些因素反映出一种广泛的转变,即发展适应性强、随时待命的机组人员,使其能够从训练环境无缝过渡到应对现代空中作战的多方面课题。

教练机市场的区域趋势

国防教练机计画在不同地区差异很大,并受军事优先事项、产业能力和战略伙伴关係的影响。在欧洲,现代化工作的重点是用与北约前线飞机使用的数位化作战系统相容的教练机平台取代老化的机队。这些项目通常强调互通性和联合训练标准。

本报告提供全球练习机市场相关调查分析,提供成长促进因素,今后10年预测,各地区趋势等资讯。

.

目录

练习机市场报告定义

练习机市场区隔

各地区

各类型

各终端用户

今后10年的练习机市场分析

练习机市场技术

全球练习机市场预测

地区的练习机市场趋势与预测

北美

促进因素,阻碍因素,课题

PEST

与市场预测情势分析

主要企业

供应商的Tier的形势

企业基准

欧洲

中东

亚太地区

南美

练习机市场国的分析

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

与市场预测情势分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

练习机市场机会矩阵

练习机市场报告相关专家的意见

结论

关于Aviation and Defense Market Reports

The Global Trainer Aircraft market is estimated at USD 3.25 billion in 2025, projected to grow to USD 6.75 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.58% over the forecast period 2025-2035.

Introduction to Trainer Aircraft Market:

Trainer aircraft form a foundational element in preparing military pilots for operational duty. These specialized aircraft are used to bridge the gap between basic flight instruction and the complex demands of modern combat aviation. They provide a controlled environment where aspiring aviators can master navigation, maneuvering, and mission-specific skills before transitioning to frontline fighter, bomber, or reconnaissance platforms. Trainer aircraft are typically categorized into basic, intermediate, and advanced levels, each offering progressively complex systems and flight dynamics. These platforms allow air forces to conduct cost-effective training without exposing expensive frontline assets to routine instruction or potential risk. Their design emphasizes safety, reliability, and modularity, enabling both simulated and live training in varied conditions. Beyond pilot development, trainer aircraft are increasingly used for systems familiarization, sensor training, and joint exercises. As air power remains a critical pillar of modern defense strategy, the role of trainer aircraft continues to expand, ensuring that aircrew are proficient, mission-ready, and able to adapt to the evolving dynamics of aerial warfare. Their significance extends beyond the cockpit, contributing to the overall efficiency and readiness of air forces in both peacetime and conflict scenarios.

Technology Impact in Trainer Aircraft Market:

Technological advancement is redefining the capabilities of trainer aircraft, enhancing both instructional quality and mission adaptability. Modern trainer platforms now integrate digital cockpits, touchscreen interfaces, and advanced avionics that closely resemble those of next-generation combat aircraft. This alignment allows trainees to develop operational familiarity early in their progression. Embedded simulation systems are increasingly common, enabling a mix of live flying and virtual training within the same flight session. These features reduce dependency on external simulators and offer dynamic mission rehearsal capabilities. Enhanced safety mechanisms such as real-time data monitoring and automatic recovery systems further support instruction by allowing instructors to intervene instantly when needed. Advanced propulsion systems also improve performance, allowing trainers to replicate a broader spectrum of flight conditions. Some platforms now support data links and mission planning software, enabling participation in networked training exercises alongside other air or ground assets. Additionally, developments in materials and aerodynamics have led to longer service life and reduced maintenance demands. These technological shifts ensure that trainer aircraft are not just stepping stones but strategic assets in themselves, preparing pilots to operate sophisticated systems while optimizing training costs, safety, and operational realism across all phases of military aviation instruction.

Key Drivers in Trainer Aircraft Market:

The growing complexity of aerial warfare and the increasing sophistication of frontline aircraft are major forces shaping the evolution of defense trainer aircraft. As air forces modernize their fleets with multirole and stealth platforms, there is a parallel need for training aircraft that can replicate similar cockpit environments, mission systems, and operational dynamics. Budget efficiency is another driving factor, with trainer aircraft offering a cost-effective means to develop pilot skills without the expense of deploying high-performance combat jets for routine instruction. The requirement to reduce training timelines while increasing pilot readiness has also led to the demand for platforms that support a blended learning approach-integrating live flight, simulation, and mission planning into a unified framework. Joint and coalition training initiatives further underscore the need for trainer aircraft compatible with allied standards and capable of supporting international pilot exchanges. The emergence of unmanned systems and the need for manned-unmanned teaming capabilities have also influenced training requirements, prompting the development of aircraft that can simulate these evolving mission profiles. Taken together, these drivers reflect a broader shift toward creating adaptable, future-ready aircrews who can seamlessly transition from training environments to the multifaceted challenges of modern aerial operations.

Regional Trends in Trainer Aircraft Market:

Defense trainer aircraft programs vary widely by region, shaped by distinct military priorities, industrial capabilities, and strategic partnerships. In Europe, modernization efforts focus on replacing aging fleets with trainer platforms that are compatible with digital mission systems used in frontline NATO aircraft. These programs often emphasize interoperability and joint training standards. In North America, emphasis is placed on advanced jet trainers that can prepare pilots for the complexities of fifth-generation aircraft and integrated combat operations. Training is increasingly networked, reflecting the high-tech nature of the region's broader defense architecture. Asia-Pacific nations are rapidly expanding pilot development capabilities, driven by growing air force modernization and the need to support both indigenous and imported combat platforms. Some countries in this region are also investing in domestic trainer production, reflecting strategic goals of self-reliance and defense industrial growth. The Middle East, facing a dynamic security landscape, prioritizes rapid pilot development and often acquires versatile, export-ready trainers that can support both instruction and light attack roles. Latin America and Africa, while more constrained by budgets, continue to invest in multi-role trainer platforms as part of broader air capability enhancements. Each region's approach reflects its operational needs, threat perceptions, and future air power ambitions.

Key Trainer Aircraft Program:

Textron Aviation has been awarded a $277 million contract to manufacture T-54A next-generation trainer aircraft for the U.S. military. Under procurement lots 2 and 3, the company will supply 26 aircraft to the U.S. Navy, Marine Corps, and Coast Guard. The contract also includes the provision of spare engines and related support equipment. Production will take place in Kansas and Texas, with project completion expected by September 2026. The T-54A is anticipated to enhance pilot training capabilities across U.S. military branches once delivered.

.

Table of Contents

Trainer Aircraft Market Report Definition

Trainer Aircraft Market Segmentation

By Region

By Type

By End User

Trainer Aircraft Market Analysis for next 10 Years

The 10-year trainer aircraft market analysis would give a detailed overview of trainer aircraft market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Trainer Aircraft Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Trainer Aircraft Market Forecast

The 10-year trainer aircraft market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Trainer Aircraft Market Trends & Forecast

The regional Trainer Aircraft Markettrends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Trainer Aircraft Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Trainer Aircraft Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Trainer Aircraft Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By End User, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Trainer Aircraft Market Forecast, 2025-2035

- Figure 2: Global Trainer Aircraft Market Forecast, By Region, 2025-2035

- Figure 3: Global Trainer Aircraft Market Forecast, By End User, 2025-2035

- Figure 4: Global Trainer Aircraft Market Forecast, By Type, 2025-2035

- Figure 5: North America, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 6: Europe, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 8: APAC, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 9: South America, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 10: United States, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 11: United States, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 12: Canada, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 14: Italy, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 16: France, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 17: France, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 18: Germany, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 24: Spain, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 30: Australia, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 32: India, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 33: India, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 34: China, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 35: China, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 40: Japan, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Trainer Aircraft Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Trainer Aircraft Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Trainer Aircraft Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Trainer Aircraft Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Trainer Aircraft Market, By End User (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Trainer Aircraft Market, By End User (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Trainer Aircraft Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Trainer Aircraft Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Trainer Aircraft Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Trainer Aircraft Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Trainer Aircraft Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Trainer Aircraft Market, By Region, 2025-2035

- Figure 58: Scenario 1, Trainer Aircraft Market, By End User, 2025-2035

- Figure 59: Scenario 1, Trainer Aircraft Market, By Type, 2025-2035

- Figure 60: Scenario 2, Trainer Aircraft Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Trainer Aircraft Market, By Region, 2025-2035

- Figure 62: Scenario 2, Trainer Aircraft Market, By End User, 2025-2035

- Figure 63: Scenario 2, Trainer Aircraft Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Trainer Aircraft Market, 2025-2035