|

市场调查报告书

商品编码

1744377

水中通讯的全球市场:2025年~2035年Global Underwater Communication Market 2025-2035 |

||||||

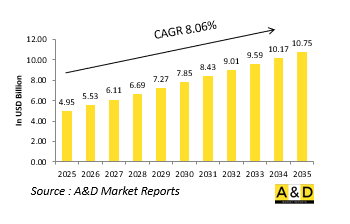

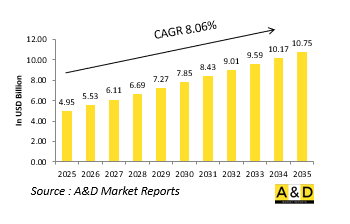

2025年全球水下通讯市场规模估计为49.5亿美元,预计到2035年将成长至107.5亿美元,2025-2035年预测期内的复合年增长率 (CAGR) 为8.06%。

水下通讯市场简介:

水下通讯是海军作战的重要组成部分,它能够在潜艇、无人水下航行器和水面舰艇等水下平台之间实现安全可靠的资讯交换。与陆地和机载网路不同,水下通讯面临独特的课题,因为水的物理特性限制了传统无线电波的有效性。因此,国防部队依靠声学讯号、光通讯和磁导等专门技术来维持水下环境中的通讯。这些方法对于协调秘密行动、进行侦察以及确保水下资产在和平时期巡逻和高风险任务期间的安全移动至关重要。水下通讯网路也透过连接水下感测器、预警系统和指挥结构,支援更广泛的海上态势感知。近年来,随着海军理论日益强调水下优势和隐身能力,水下通讯网路的战略重要性日益增强。如果没有有效的通信,水下平台的作战价值将大大降低。因此,水下通讯系统不仅是指挥和控制的赋能器,也是力量倍增器,使水下部队能够在广阔且充满争议的海域精确、安全和自主地行动。

科技对水下通讯市场的影响:

技术进步正在推动水下通讯的新时代,彻底改变水下防御系统的互动和运作方式。其中最重要的突破之一是声学波形的设计,它能够实现更清晰、更快速、更安全的远距离讯号传输。自适应调变技术使通讯系统能够根据盐度、温度和洋流等环境条件自动调整。蓝绿色雷射系统的发展为水下航行器和水面单位之间的短距离宽频通讯开闢了新的可能性。这些光学方法为传统声学通讯提供了一种低延迟替代方案,尤其是在浅水区或嘈杂水域。组件的小型化也使得更紧凑的通讯模组能够安装在无人水下平台上,从而提高了操作灵活性。机器学习开始在优化讯号处理和增强干扰对抗措施方面发挥作用,使水下通讯更加可靠。加密技术不断发展,以满足海军作战的严格安全需求,即使在动态环境中也能确保敏感资料的保护。这些技术创新使水下通讯更加稳健、快速且适应性更强,使水下舰队能够以网路化编队协同作战,并支援跨域即时决策。

水下通讯市场的关键推动因素:

水下通讯在国防领域日益重要的作用源于不断变化的海上威胁、自主系统的日益普及以及水下领域日益增长的战略价值。潜水艇和无人水下航行器的激增,迫切需要能够在不同深度和距离下工作的可靠指挥和控制链路。水下任务通常需要隐身性和耐久性,因此即时或近即时通讯是作战成功的关键因素。海军陆战队现在需要在复杂的多体环境中作战,其中水下、水面和空中装备之间的同步至关重要。提升海洋感知能力的愿望也推动了感测器阵列和水下监视系统的部署,这些系统利用水下通讯将资料传输到控制中心。随着管道和光纤电缆等海底基础设施成为潜在目标,通讯能力对于监视和快速反应都至关重要。此外,围绕关键水道主导权的战略竞争促使各国发展先进的水下网络,以进行威慑和预警。这些需求将水下通讯定位为海上防御规划的核心要素,使其不仅对任务成功至关重要,而且对于保护水下国家利益也至关重要。

水下通讯市场的区域趋势:

区域优先事项和海军战略对水下通讯系统的开发和部署有重大影响。在印度-太平洋地区,日益增强的海军存在和海上航线日益重要的战略意义正在推动水下通讯网路的大量投资。该地区各国正致力于将先进的声学和光学系统整合到潜水艇和无人驾驶车辆中,以增强深海和沿海水域的协作和态势感知能力。欧洲高度重视多边框架内的互通性,并致力于共同建构统一的水下通讯协议,以支援联合海上防御行动。大西洋和北冰洋水下地形复杂、环境恶劣,正在推动远端声学讯号和弹性感测器连接的创新。在中东,水下通讯被视为更广泛的沿海监视系统的一部分,旨在保护海上基础设施并探测水下威胁。北美的国防战略强调技术优势,因此采用了尖端解决方案,为综合水下舰队提供安全、高速的通讯支援。在其他地区,新兴海军正在透过伙伴关係和区域联盟逐步提升能力。在这些地区,水下通讯系统正在根据特定的作战需求、地理位置和安全课题进行客製化。

主要水下通讯项目:

AUKUS 2025 海事创新课题赛是美国国防创新部门 (DIU)、澳洲先进战略能力加速器 (ASCA) 和英国国防与安全加速器 (DASA) 的第二次联合倡议,旨在邀请私营企业提出增强水下指挥、控制和通讯的技术方案。目标是提升战术和作战能力,同时确保海上平台即使在最恶劣的水下环境下也能实现安全可靠的通讯。在科技优势对维护全球海上安全至关重要的时代,AUKUS 的合作伙伴——澳洲、英国和美国——正在不断突破水下作战创新的界限。作为 AUKUS 第二支柱计画的一部分,DIU 正在寻求先进的商业解决方案,透过开发能够增强无人海上作战杀伤力并在水下战场上实现即时、明智决策的系统,增强美国国防部的作战能力。

本报告提供全球水中通讯市场相关调查,彙整10年的各分类市场预测,技术趋势,机会分析,企业简介,各国资料等资讯。

目录

水中通讯市场报告定义

水中通讯市场区隔

各平台

各类型

各地区

未来10年水下通讯市场分析

本章将对10年水下通讯市场进行分析,详细概述水下通讯市场的成长、变化趋势、技术采用概况以及市场吸引力。

水下通讯市场技术

本部分涵盖了预计将影响该市场的十大技术,以及这些技术可能对整体市场产生的影响。

全球水下通讯市场预测

本部分详细讨论了该市场未来10年的水下通讯市场预测,涵盖上述细分领域。

水下通讯市场趋势及各区域预测

本部分涵盖各区域水下通讯市场的趋势、推动因素、阻碍因素、课题以及政治、经济、社会和技术层面。此外,也详细涵盖了各区域的市场预测和情境分析。区域分析包括关键参与者概况、供应商格局和公司基准分析。目前市场规模是基于常规情境估算的。

北美

促进因素,阻碍因素,课题

PEST

市场预测与情势分析

主要企业

供应商阶层的形势

企业基准

欧洲

中东

亚太地区

南美

水下通讯市场国家分析

本章涵盖该市场的主要国防项目,以及该市场的最新资讯和专利申请。此外,也提供了各国未来10年的市场预测和情境分析。

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与情势分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

水中通讯市场机会矩阵

水中通讯市场报告相关专家的意见

结论

关于航空·国防市场报告

The Global Underwater Communication market is estimated at USD 4.95 billion in 2025, projected to grow to USD 10.75 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.06% over the forecast period 2025-2035.

Introduction to Underwater Communication Market:

Underwater communication is a critical component of naval operations, enabling secure and reliable information exchange between submerged platforms such as submarines, unmanned underwater vehicles, and surface vessels. Unlike terrestrial or airborne networks, underwater communication faces unique challenges due to the physical properties of water, which limit the effectiveness of conventional radio waves. As a result, defense forces rely on specialized techniques such as acoustic signaling, optical transmission, and magnetic induction to maintain communication in submerged environments. These methods are essential for coordinating covert operations, conducting reconnaissance, and ensuring the safe movement of underwater assets during both peacetime patrols and high-risk missions. Subsurface communication networks also support broader maritime situational awareness by linking underwater sensors, early-warning systems, and command structures. Their strategic importance has grown in recent years as naval doctrines increasingly emphasize underwater dominance and stealth. Without effective communication, the operational value of submersible platforms is significantly diminished. Therefore, underwater communication systems are not only enablers of command and control but also force multipliers that allow undersea units to operate with precision, safety, and autonomy across vast and contested maritime domains.

Technology Impact in Underwater Communication Market:

Technological advancements are driving a new era in underwater communication, transforming how submerged defense systems interact and operate. One of the most significant breakthroughs has been in acoustic waveform design, allowing for clearer, faster, and more secure signal transmission over greater distances. Adaptive modulation techniques now enable communication systems to adjust automatically based on environmental conditions such as salinity, temperature, and ocean currents. The development of blue-green laser systems has opened new possibilities for short-range, high-bandwidth communication between underwater vehicles and surface units. These optical methods offer low-latency alternatives to traditional acoustics, particularly in shallow or noisy waters. Miniaturization of components has also allowed more compact communication modules to be installed in unmanned underwater platforms, expanding operational flexibility. Machine learning is beginning to play a role in optimizing signal processing and enhancing anti-interference measures, further increasing the reliability of submerged communication. Encryption technologies have evolved to meet the stringent security demands of naval operations, ensuring that sensitive data remains protected even in dynamic environments. These innovations have made underwater communication more robust, faster, and adaptable, enabling underwater fleets to operate in coordinated, networked formations and support real-time decision-making across multiple domains.

Key Drivers in Underwater Communication Market:

The increasing importance of underwater communication in defense stems from evolving maritime threats, expanded use of autonomous systems, and the growing strategic value of the undersea domain. The proliferation of submarines and unmanned underwater vehicles has created an urgent need for reliable command and control links that work across varying depths and distances. Underwater missions often involve stealth and endurance, making real-time or near-real-time communication a critical enabler of operational success. Naval forces are now expected to perform in complex, multi-theater environments where synchronization between undersea, surface, and aerial assets is essential. The desire to extend maritime domain awareness has also driven the deployment of sensor arrays and seabed monitoring systems that rely on underwater communication to transmit data back to control centers. As undersea infrastructure such as pipelines and fiber-optic cables become potential targets, communication capabilities are vital for both surveillance and rapid response. Additionally, the strategic competition for dominance in key waterways has pushed nations to develop sophisticated underwater networks for deterrence and early warning. These demands have positioned underwater communication as a core component of maritime defense planning, essential not only for mission success but also for safeguarding national interests below the ocean's surface.

Regional Trends in Underwater Communication Market:

Regional priorities and naval strategies heavily influence the development and deployment of underwater communication systems. In the Indo-Pacific, expanding naval presence and the strategic importance of contested sea lanes have led to substantial investments in undersea communication networks. Nations in this region are focusing on integrating advanced acoustic and optical systems into their submarines and unmanned vehicles to enhance coordination and situational awareness in deep and littoral waters. In Europe, emphasis is placed on interoperability within multinational frameworks, with joint efforts aimed at creating cohesive underwater communication protocols that support collaborative maritime defense operations. The Atlantic and Arctic regions, with their complex underwater topography and harsh conditions, are driving innovations in long-range acoustic signaling and resilient sensor connectivity. In the Middle East, underwater communication is being explored as part of broader coastal surveillance systems designed to protect maritime infrastructure and detect underwater threats. North American defense strategies emphasize technological superiority, leading to the adoption of cutting-edge solutions that support secure, high-speed communication for integrated underwater fleets. Elsewhere, emerging navies are gradually building capacity through partnerships and regional alliances. Across these regions, underwater communication systems are being tailored to reflect specific operational needs, geographic conditions, and security challenges.

Key Underwater Communication Program:

Marking the second joint initiative between the U.S. Defense Innovation Unit (DIU), Australia's Advanced Strategic Capabilities Accelerator (ASCA), and the UK's Defence and Security Accelerator (DASA), the tri-national AUKUS Maritime Innovation Challenge 2025 is inviting commercial firms to propose technologies that enhance undersea command, control, and communications. The goal is to improve tactical and operational capabilities while ensuring secure and resilient communication for sea-based platforms-even in the most demanding underwater environments. In an age where technological superiority is crucial to safeguarding global maritime security, AUKUS partners-Australia, the United Kingdom, and the United States-are pushing the boundaries of underwater warfare innovation. As part of AUKUS Pillar II, DIU is seeking advanced commercial solutions to bolster the U.S. Department of Defense's warfighting capabilities by developing systems that enhance the lethality of uncrewed maritime operations and enable real-time, informed decision-making across the undersea battlespace.

Table of Contents

Underwater Communication Market Report Definition

Underwater Communication Market Segmentation

By Platform

By Type

By Region

Underwater Communication Market Analysis for next 10 Years

The 10-year underwater communication market analysis would give a detailed overview of underwater communication market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Underwater Communication Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Underwater Communication Market Forecast

The 10-year underwater communication market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Underwater Communication Market Trends & Forecast

The regional underwater communication market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Underwater Communication Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Underwater Communication Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Underwater Communication Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Underwater Communication Market Forecast, 2025-2035

- Figure 2: Global Underwater Communication Market Forecast, By Region, 2025-2035

- Figure 3: Global Underwater Communication Market Forecast, By Platform, 2025-2035

- Figure 4: Global Underwater Communication Market Forecast, By Type, 2025-2035

- Figure 5: North America, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 6: Europe, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 8: APAC, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 9: South America, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 10: United States, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 11: United States, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 12: Canada, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 14: Italy, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 16: France, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 17: France, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 18: Germany, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 24: Spain, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 30: Australia, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 32: India, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 33: India, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 34: China, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 35: China, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 40: Japan, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Underwater Communication Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Underwater Communication Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Underwater Communication Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Underwater Communication Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Underwater Communication Market, By Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Underwater Communication Market, By Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Underwater Communication Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Underwater Communication Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Underwater Communication Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Underwater Communication Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Underwater Communication Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Underwater Communication Market, By Region, 2025-2035

- Figure 58: Scenario 1, Underwater Communication Market, By Platform, 2025-2035

- Figure 59: Scenario 1, Underwater Communication Market, By Type, 2025-2035

- Figure 60: Scenario 2, Underwater Communication Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Underwater Communication Market, By Region, 2025-2035

- Figure 62: Scenario 2, Underwater Communication Market, By Platform, 2025-2035

- Figure 63: Scenario 2, Underwater Communication Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Underwater Communication Market, 2025-2035