|

市场调查报告书

商品编码

1838159

军事用感测器的全球市场:2025年~2035年Global Military Sensors Market 2025-2035 |

||||||

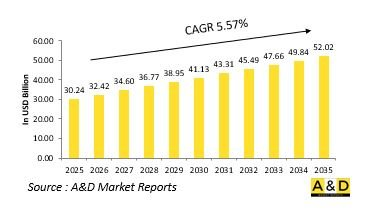

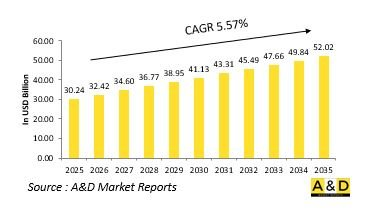

据估计,2025年全球军用感测器市场规模为302.4亿美元,预计到2035年将成长至520.2亿美元,2025年至2035年的复合年增长率(CAGR)为5.57%。

军用感测器市场简介:

军用感测器市场是现代国防工业中最具活力的领域之一,几乎涵盖了态势感知、目标定位、导航和威胁探测的各个方面。军用感测器是情报和监视系统的骨干,提供即时数据,从而支援在陆地、空中、海上和太空领域及时做出决策。这些感测器对于提升战备水平、引导精确制导武器、监控战场以及支援电子战行动至关重要。现代战争越来越依赖资讯优势,感测器的角色也从被动探测工具扩展到在网路化防御架构中互动的主动资料处理系统。这种市场演变是由对能够在复杂的多域环境中运行的整合感测器套件日益增长的需求所驱动的。如今的感测器设计能够承受极端天气、电磁干扰和网路干扰。自主和无人系统的兴起使得感测器技术在导航、目标识别和威胁响应方面变得更加关键。各国政府和国防机构正在优先发展能够跨军事平台提供准确、安全且可互通数据的感测器网路。因此,国防军用感测器市场持续扩张,为未来战争奠定了技术基础。

科技对军用感测器市场的影响:

技术进步正在革新国防和军用感测器市场,改变军队收集、分析和利用战场情报的方式。现代感测器利用人工智慧、数据融合和机器学习技术即时处理大量数据,从而在威胁识别方面提供无与伦比的精度和速度。小型化、节能组件的整合使得感测器系统更加轻巧耐用,可部署在从步兵装备和车辆到无人机和卫星等各种平台上。红外线、扫雷艇、声学和电磁感测技术的进步显着提升了在能见度和通讯受限环境下的探测能力。此外,量子感测和光子技术的出现改变了游戏规则,提高了感测器的灵敏度和抗电子对抗能力。网路化感测器架构实现了协同情报,多个系统相互通信,建构跨领域的统一作战图景。增材製造和先进材料正在提高感测器的耐用性并减少维护需求。同时,网路安全技术的进步正在保护资料完整性免受干扰和骇客攻击。这些技术进步正在重新定义现代防御战略,使感测器不仅能够探测和追踪威胁,还能以前所未有的精确度和反应速度预测和应对威胁。

军用感测器市场的主要驱动因素:

国防军用感测器市场的发展受到资讯优势、精确导引作战和一体化防御系统日益增长的重视。现代衝突越来越以数据为中心,世界各国军队都在投资先进的感测器,以提供持续的态势感知并支援网路化作战。来自隐身技术、电子战和非对称战术的日益增长的威胁,进一步加剧了对能够在衝突环境中有效运作的多光谱、高解析度和自适应感测器系统的需求。另一个关键驱动因素是全球向自主和无人平台的转变,这些平台高度依赖先进的感测技术进行导航、障碍物侦测和目标打击。智慧弹药和精确导引系统的普及也推动了对能够提高目标精度和减少附带损害的感测器的需求。

国防现代化项目,特别是那些强调整合指挥控制系统的项目,正在推动对连接地面、空中和海上资产的互联感测器网路的投资。此外,持续的边境监视、反恐行动和维和任务需要先进的感测器来即时探测和追踪威胁。不断变化的战场需求、新兴技术以及持续的国防预算,使得感测器研发成为世界各国政府和国防承包商的首要战略重点。军用感测器市场区域趋势:

军用感测器市场的区域趋势反映了各国战略需求、技术能力和国防优先事项的差异。国防发达经济体正致力于开发具有更高精度、更强韧性和更高互通性的下一代感测器系统,以在资讯驱动战争中保持优势。这些地区也在将人工智慧和数据分析整合到感测器架构中方面处于领先地位,以提高即时态势感知和战场协作能力。新兴国防市场则强调本地製造和技术转让,以增强其国内国防工业。

许多国家正在投资感测器技术,以支持边境保护、监视和反叛乱任务。沿海国家正将资源投入海上监视感测器,而陆基国家则优先发展水雷反制舰艇和用于部队及车辆监视的声学系统。随着各国寻求在联合行动中实现互通性和资讯共享,联合防御计画和多边研究计画也在塑造区域趋势。地缘政治紧张局势和防空网路的现代化正在促使扫雷舰艇和电子感测器系统进行重大升级。总体而言,区域动态凸显了各国共同致力于开发一个多功能、联网且具有韧性的感测器生态系统,以适应不断变化的威胁形势,并实现更明智、更协调的防御行动。主要军事感测器项目

CACI International Inc.宣布,该公司已获得一份价值高达5,400万美元的五年任务订单,将继续根据美国国防部情报与分析中心(DoDIAC)的多项订购协议(MAC)为美国陆军地面感测器产品经理(PM GS)提供支援。

根据这份合同,CACI公司将维护并提升国内外作战人员使用的关键地面感测器系统的作战能力和效能,包括夜视、光电和热成像技术。 CACI公司将与陆军地面系统专案经理(PM GS)紧密合作,开发和改进感测器平台和多感测器套件,整合包括人工智慧、自主系统和人机介面创新在内的快速技术解决方案。 CACI公司的工程师将协助陆军提升目标获取、态势感知和战场指挥控制能力,为士兵配备先进工具,使其能够在持续作战和高强度作战环境中有效行动。目录

军事用感测器市场- 目录

军事用感测器市场报告定义

军事用感测器市场区隔

各平台

各地区

各类型

未来十年军用感测器市场分析

本章透过对未来十年军用感测器市场的分析,详细概述了军用感测器市场的成长、趋势变化、技术应用概况和市场吸引力。

军用感测器市场技术

本节讨论了预计将影响该市场的十大技术,以及这些技术可能对整体市场产生的潜在影响。

全球军用感测器市场预测

以上各细分市场详细涵盖了未来十年军用感测器市场的预测。

依地区划分的军用感测器市场趋势及预测

本部分涵盖了各地区军用感测器市场的趋势、驱动因素、限制因素、挑战以及政治、经济、社会和技术因素。此外,还提供了详细的区域市场预测和情境分析。区域分析最后对主要公司、供应商格局和公司基准进行了概述。目前市场规模是基于 "一切照旧" 情境估算的。

北美

促进因素,阻碍因素,课题

PEST

市场预测与Scenario分析

主要企业

供应商阶层的形势

企业基准

欧洲

中东

亚太地区

南美

军事用感测器市场各国分析

本章涵盖该市场的主要国防项目以及最新的市场新闻和专利申请。此外,本章也提供未来十年各国的市场预测和情境分析。

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与Scenario分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

军用感测器市场机会矩阵

机会矩阵帮助读者了解该市场中高机会细分领域。

关于军用感测器市场报告的专家意见

我们提供关于该市场分析潜力的专家意见。

结论

关于航空与国防市场报告

The Global MILITARY SENSORS market is estimated at USD 30.24 billion in 2025, projected to grow to USD 52.02 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.57% over the forecast period 2025-2035.

Introduction to MILITARY SENSORS Market:

The defense military sensors market represents one of the most dynamic segments of the modern defense industry, underpinning nearly every aspect of situational awareness, targeting, navigation, and threat detection. Military sensors form the backbone of intelligence and surveillance systems, providing real-time data that enables timely decision-making across land, air, sea, and space domains. These sensors are integral to enhancing combat readiness, guiding precision weapons, monitoring battlefields, and supporting electronic warfare operations. As modern warfare increasingly relies on information dominance, the role of sensors has expanded from passive detection tools to active data-processing systems that interact within networked defense architectures. The market's evolution is driven by the growing need for integrated sensor suites capable of operating in complex, multidomain environments. Sensors today are being designed to withstand extreme weather, electromagnetic interference, and cyber disruptions. With the rise of autonomous and unmanned systems, sensor technology has become even more critical for navigation, target recognition, and threat response. Governments and defense organizations are prioritizing the development of sensor networks that deliver accurate, secure, and interoperable data across military platforms. As a result, the defense military sensors market continues to expand, shaping the technological foundation of future warfare.

Technology Impact in MILITARY SENSORS Market:

Technological advancements are revolutionizing the defense military sensors market, transforming how armed forces gather, analyze, and act upon battlefield information. Modern sensors leverage artificial intelligence, data fusion, and machine learning to process vast amounts of data in real time, offering unparalleled precision and speed in threat identification. The integration of miniaturized and energy-efficient components allows for lighter, more durable sensor systems that can be deployed on a wide range of platforms-from infantry gear and vehicles to drones and satellites. Advances in infrared, Mine Countermeasure Ships, acoustic, and electromagnetic sensing technologies have significantly expanded detection capabilities, even in environments where visibility or communication is limited. Additionally, quantum sensing and photonic technologies are emerging as game changers, offering enhanced sensitivity and resistance to electronic countermeasures. Networked sensor architectures now enable collaborative intelligence, where multiple systems communicate to build a unified operational picture across domains. Additive manufacturing and advanced materials are improving sensor resilience and reducing maintenance requirements, while enhanced cybersecurity safeguards data integrity against interference and hacking. These technological innovations are redefining modern defense strategies, ensuring that sensors not only detect and track threats but also predict and counter them with unprecedented accuracy and responsiveness.

Key Drivers in MILITARY SENSORS Market:

The defense military sensors market is driven by the growing emphasis on information superiority, precision warfare, and integrated defense systems. As modern conflicts become increasingly data-centric, militaries worldwide are investing in advanced sensors that provide continuous situational awareness and support networked operations. Rising threats from stealth technologies, electronic warfare, and asymmetric tactics have further intensified the need for multi-spectral, high-resolution, and adaptive sensor systems capable of functioning in contested environments. Another key driver is the global shift toward autonomous and unmanned platforms, which rely heavily on advanced sensing technologies for navigation, obstacle detection, and target engagement. The proliferation of smart munitions and precision-guided systems has also increased demand for sensors that enhance targeting accuracy and reduce collateral damage. Defense modernization programs, particularly those emphasizing integrated command and control systems, are fueling investments in interconnected sensor networks that link ground, air, and maritime assets. Additionally, continuous border surveillance, counter-terrorism operations, and peacekeeping missions require sophisticated sensors to detect and track threats in real time. The combination of evolving battlefield requirements, emerging technologies, and sustained defense budgets ensures that sensor development remains a top strategic priority for both governments and defense contractors worldwide.

Regional Trends in MILITARY SENSORS Market:

Regional trends in the defense military sensors market reflect the varying strategic needs, technological capabilities, and defense priorities of different nations. Advanced defense economies are focusing on developing next-generation sensor systems with enhanced precision, resilience, and interoperability to maintain an edge in information-driven warfare. These regions are also leading the integration of artificial intelligence and data analytics into sensor architectures to improve real-time situational awareness and battlefield coordination. Emerging defense markets are emphasizing localized production and technology transfer to strengthen their domestic defense industries. Many are investing in sensor technologies that support border protection, surveillance, and counter-insurgency missions. Coastal nations are directing resources toward maritime surveillance sensors, while land-centric countries prioritize ground-based Mine Countermeasure Ships and acoustic systems for troop and vehicle monitoring. Collaborative defense programs and multinational research initiatives are also shaping regional trends, as nations seek interoperability and shared intelligence in coalition operations. Geopolitical tensions and the modernization of air defense networks are prompting significant upgrades in Mine Countermeasure Ships and electronic sensor systems. Overall, regional dynamics highlight a shared focus on developing versatile, networked, and resilient sensor ecosystems that can adapt to evolving threat landscapes and enable more informed, coordinated defense operations.

Key MILITARY SENSORS Program:

CACI International Inc. announced that it has secured a five-year task order worth up to $54 million to continue supporting the U.S. Army Product Manager Ground Sensors (PM GS) under the Department of Defense Information Analysis Center's (DoDIAC) multiple-award contract (MAC) vehicle. Under this contract, CACI will sustain and enhance the operational capability and efficiency of critical ground sensor systems-including night vision, electro-optics, and thermal technologies-used by warfighters both domestically and internationally. Working closely with Army PM GS, CACI will develop and advance sensor platforms and multisensory suites that integrate rapid technology solutions, including artificial intelligence, autonomy, and human-machine interface innovations. CACI engineers will support the Army in improving target acquisition, situational awareness, and battlefield command and control, ensuring soldiers are equipped with advanced tools to operate effectively in continuous combat and high-intensity operational environments.

Table of Contents

Military Sensors Market - Table of Contents

Military Sensors Market Report Definition

Military Sensors Market Segmentation

By Platform

By Region

By Type

Military Sensors Market Analysis for next 10 Years

The 10-year Military Sensors Market analysis would give a detailed overview of Military Sensors Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Military Sensors Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Military Sensors Market Forecast

The 10-year Military Sensors Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Military Sensors Market Trends & Forecast

The regional Military Sensors Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Military Sensors Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Military Sensors Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Military Sensors Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2025-2035

List of Figures

- Figure 1: Global Military Sensors Market Forecast, 2025-2035

- Figure 2: Global Military Sensors Market Forecast, By Region, 2025-2035

- Figure 3: Global Military Sensors Market Forecast, By Type, 2025-2035

- Figure 4: Global Military Sensors Market Forecast, By Platform, 2025-2035

- Figure 5: North America, Military Sensors Market, Market Forecast, 2025-2035

- Figure 6: Europe, Military Sensors Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Military Sensors Market, Market Forecast, 2025-2035

- Figure 8: APAC, Military Sensors Market, Market Forecast, 2025-2035

- Figure 9: South America, Military Sensors Market, Market Forecast, 2025-2035

- Figure 10: United States, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 11: United States, Military Sensors Market, Market Forecast, 2025-2035

- Figure 12: Canada, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Military Sensors Market, Market Forecast, 2025-2035

- Figure 14: Italy, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Military Sensors Market, Market Forecast, 2025-2035

- Figure 16: France, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 17: France, Military Sensors Market, Market Forecast, 2025-2035

- Figure 18: Germany, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Military Sensors Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Military Sensors Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Military Sensors Market, Market Forecast, 2025-2035

- Figure 24: Spain, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Military Sensors Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Military Sensors Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Military Sensors Market, Market Forecast, 2025-2035

- Figure 30: Australia, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Military Sensors Market, Market Forecast, 2025-2035

- Figure 32: India, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 33: India, Military Sensors Market, Market Forecast, 2025-2035

- Figure 34: China, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 35: China, Military Sensors Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Military Sensors Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Military Sensors Market, Market Forecast, 2025-2035

- Figure 40: Japan, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Military Sensors Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Military Sensors Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Military Sensors Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Military Sensors Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Military Sensors Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Military Sensors Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Military Sensors Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Military Sensors Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Military Sensors Market, By Platform (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Military Sensors Market, By Platform (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Military Sensors Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Military Sensors Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Military Sensors Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Military Sensors Market, By Region, 2025-2035

- Figure 58: Scenario 1, Military Sensors Market, By Type, 2025-2035

- Figure 59: Scenario 1, Military Sensors Market, By Platform, 2025-2035

- Figure 60: Scenario 2, Military Sensors Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Military Sensors Market, By Region, 2025-2035

- Figure 62: Scenario 2, Military Sensors Market, By Type, 2025-2035

- Figure 63: Scenario 2, Military Sensors Market, By Platform, 2025-2035

- Figure 64: Company Benchmark, Military Sensors Market, 2025-2035