|

市场调查报告书

商品编码

1838162

地雷探测器的全球市场:2025年~2035年Global Mine Detection Market 2025-2035 |

||||||

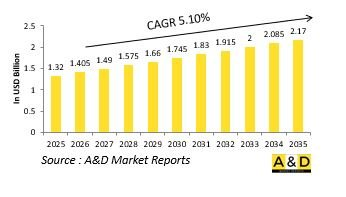

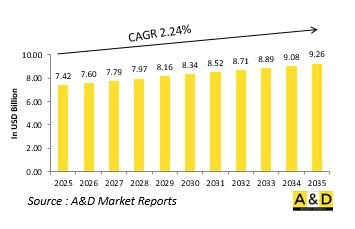

据估计,2025年全球地雷探测市场规模为74.2亿美元,预计到2035年将成长至92.6亿美元,2025年至2035年的复合年增长率(CAGR)为2.24%。

地雷探测市场简介

防御性地雷探测市场是现代军事行动的关键组成部分,其主要功能是识别和消除陆地和海上环境中的隐蔽爆炸物威胁。这些系统对于确保作战和维和任务中人员、车辆和基础设施的安全至关重要。地雷探测技术广泛应用于战场清剿、边境安全和衝突后重建,以降低地雷、简易爆炸装置和水雷带来的风险。该市场涵盖多种设备,包括手持式探测器、探地雷达、无人车辆和机载感测器,旨在定位各种地形中的地雷。随着军事行动日益向非对称和混合战争转变,地雷探测能力的重要性与日俱增。武装部队依靠快速、精准的探测工具来维持机动性并减少作战伤亡。现代地雷探测系统融合了先进的感测、成像和资料处理技术,能够即时提供准确的探测结果。旨在清除长期衝突地区地雷的人道行动也推动了市场扩张。在安全性和效率至上的前提下,防御性地雷探测市场对于确保衝突后和衝突区域作战效能和恢復稳定至关重要。

科技对地雷探测器市场的影响:

技术创新正在重塑国防地雷探测器市场,提高了探测精度、速度和操作人员的安全性。传统的人工探测方法正被整合先进感测器、人工智慧和自动化技术的复杂系统所取代或补充。探地雷达、电磁感应和化学感测器正在不断改进,以探测隐藏在复杂环境中的金属和非金属爆炸物。这些技术提供高解析度影像,从而能够更可靠地识别埋藏地雷的类型、深度和形状。自主地面和空中平台正在革新探测作业,无需人工直接参与即可侦察和绘製危险区域的地图。机器学习演算法的整合实现了自适应探测,随着时间的推移不断改进,最大限度地减少误报并优化任务效率。数据融合技术结合了来自多个感测器的输入,从而建立威胁情势的全面视图。此外,轻巧耐用的材料增强了野外作业的便携性和耐用性。数位通讯网路与即时资料传输的整合确保了更快的决策速度和更有效率的部队间协调。随着国防部队不断追求更高的精准度和安全性,这些技术进步正将地雷探测从劳动密集任务转变为高度自动化、情报驱动的能力,使其成为现代军事任务的关键要素。

地雷探测市场的主要驱动因素:

国防地雷探测市场的发展动力源自于爆炸物威胁的持续存在,这些威胁危及军事机动性和人道主义行动。衝突地区地雷和简易爆炸装置的日益增加凸显了先进探测能力对于保护士兵和平民的必要性。各国政府和国防机构正优先投资于最新的探测系统,这些系统能够提供更高的精度、更快的反应速度以及在各种环境条件下运作的能力。持续的军事现代化和反叛乱行动进一步加速了尖端探测技术的应用。混合战争的日益普遍,即使用隐蔽爆炸物破坏后勤和限制行动,正在推动对便携式、自主式和无人探测平台的需求。人道排雷行动在国际合作的支持下,也为市场成长做出了重大贡献,各国正努力恢復对受战争影响地区的安全通道。另一个关键驱动因素是将人工智慧和感测器融合技术整合到排雷行动中,从而实现自动威胁识别和测绘。这些进步与更广泛的军事目标一致:提高作战安全性、减少风险暴露和保持战术优势。总而言之,这些因素确保了国防排雷市场需求的持续成长和创新。

排雷市场区域趋势:

国防排雷市场的区域趋势受衝突程度、地形挑战和现代化优先事项的影响。受过去或正在进行的衝突影响的地区继续大力投资于排雷工作,以恢復安全和促进重建。不同地区的军事现代化计画正在推动对能够应对常规和简易爆炸装置(IME)威胁的整合式水雷探测系统的需求。在技术先进的地区,国防机构正致力于开发和部署下一代探测平台,这些平台融合了自动化、机器人技术和人工智慧驱动的数据分析,以实现更快、更准确的探测结果。同时,新兴国防市场正在部署经济高效且可靠的系统,以满足边境安全和反叛乱需求。国防合作计画和国际伙伴关係正在促进技术转移和联合培训,以增强区域能力。海洋地区正着力发展水下水雷探测,以保护航道和沿海基础设施,并日益整合声吶和无人水下航行器,用于深海监视。同时,内陆国家则优先考虑用于战术作战的地面和车载系统。整体而言,区域动态凸显了全球范围内采用先进、适应性强且可互通的地雷探测技术的趋势,以确保在复杂的安全环境中保障安全、机动性和任务连续性。

重大地雷探测项目

诺斯罗普·格鲁曼公司 (NOC) 已获得韩国航空航天工业公司 (KAI) 的合同,为其提供机载地雷探测系统。 KAI 授予该合同,为其提供机载雷射地雷探测系统 (ALMDS) 解决方案,并在韩国扫雷直升机 (KMCH) 项目的工程、製造和设计 (EMD) 阶段提供技术支援。 EMD 阶段计划于 2027 年完成。 ALMDS 可实现昼夜无线作业,并具有高区域搜寻率,从而高效探测地雷。此外,它还能提供精确的目标地理定位数据,以便后续排除已发现的地雷,从而提高扫雷行动的整体效率。

目录

地雷探测器市场报告- 目录

地雷探测器市场报告定义

地雷探测器市场区隔

各地区

各平台

各类型

未来十年地雷探测器市场分析

本章详细概述了地雷探测器市场的成长、趋势变化、技术应用概况和市场吸引力,并对未来十年的地雷探测器市场进行了分析。

地雷探测器市场技术

本节讨论了预计将影响该市场的十大技术,以及这些技术可能对整体市场产生的潜在影响。

全球地雷探测器市场预测

以上各细分市场详细阐述了未来十年地雷探测器市场的预测。

区域地雷探测器市场趋势及预测

本部分涵盖区域地雷探测器市场的趋势、驱动因素、限制、挑战以及政治、经济、社会和技术因素。此外,也提供详细的区域市场预测和情境分析。最终的区域分析包括主要公司概况、供应商格局和公司基准分析。目前市场规模是基于 "一切照旧" 情境估算的。

北美

促进因素,阻碍因素,课题

PEST

市场预测与Scenario分析

主要企业

供应商阶层的形势

企业基准

欧洲

中东

亚太地区

南美

地雷探测器市场各国分析

本章涵盖该市场的主要国防项目以及最新的市场新闻和专利申请。此外,本章也提供国家层级的十年市场预测和情境分析。

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与Scenario分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

地雷探测器市场机会矩阵

机会矩阵帮助读者了解该市场中高机会细分领域。

专家对地雷探测器市场报告的意见

我们提供专家对该市场分析潜力的意见。

结论

关于航空与国防市场报告

The Global Mine Detection market is estimated at USD 7.42 billion in 2025, projected to grow to USD 9.26 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 2.24% over the forecast period 2025-2035.

Introduction to Mine Detection Market

The defense mine detection market is a critical component of modern military operations, focusing on identifying and neutralizing hidden explosive threats across land and maritime environments. These systems are essential for ensuring the safety of personnel, vehicles, and infrastructure in both combat and peacekeeping missions. Mine detection technologies are used extensively during battlefield clearance, border security, and post-conflict recovery to mitigate the risks posed by landmines, improvised explosive devices, and naval mines. The market encompasses a wide range of equipment, including handheld detectors, ground-penetrating radars, unmanned vehicles, and airborne sensors designed to locate mines in diverse terrains. As military operations increasingly shift toward asymmetric and hybrid warfare, the importance of mine detection capabilities continues to grow. Armed forces rely on rapid and precise detection tools to maintain mobility and prevent casualties during maneuvers. Modern mine detection systems combine advanced sensing, imaging, and data-processing technologies to provide accurate results in real time. The market's expansion is also driven by humanitarian initiatives aimed at demining regions affected by prolonged conflicts. With safety and efficiency as top priorities, the defense mine detection market remains indispensable to ensuring operational effectiveness and restoring stability in post-conflict and contested environments.

Technology Impact in Mine Detection Market:

Technological innovation is reshaping the defense mine detection market by enhancing accuracy, speed, and operator safety. Traditional manual detection methods are being replaced or supplemented by sophisticated systems that integrate advanced sensors, artificial intelligence, and automation. Ground-penetrating radar, electromagnetic induction, and chemical sensors are being refined to detect both metallic and non-metallic explosive devices concealed in complex environments. These technologies provide high-resolution imaging that allows forces to identify the type, depth, and shape of buried mines with greater reliability. Autonomous ground and aerial platforms are revolutionizing detection operations by performing reconnaissance and mapping in hazardous zones without direct human involvement. The integration of machine learning algorithms enables adaptive detection that improves over time, minimizing false alarms and optimizing mission efficiency. Data fusion technologies combine inputs from multiple sensors, creating a comprehensive understanding of the threat landscape. Moreover, lightweight and ruggedized materials are enhancing portability and durability for field operations. The convergence of digital communication networks and real-time data transmission ensures faster decision-making and improved coordination across units. As defense forces pursue greater precision and safety, these technological advances are transforming mine detection from a labor-intensive task into a highly automated, intelligence-driven capability critical for modern military missions.

Key Drivers in Mine Detection Market:

The defense mine detection market is driven by the persistent threat of explosive hazards that endanger military mobility and humanitarian operations. Increasing use of landmines and improvised explosive devices in conflict zones has underscored the need for advanced detection capabilities to protect soldiers and civilians alike. Governments and defense organizations are prioritizing investments in modern detection systems that offer higher accuracy, faster response times, and the ability to function in diverse environmental conditions. Ongoing military modernization and counter-insurgency efforts have further accelerated the adoption of cutting-edge detection technologies. The growing prevalence of hybrid warfare, where hidden explosives are used to disrupt logistics and restrict movement, reinforces the demand for portable, autonomous, and unmanned detection platforms. Humanitarian demining initiatives supported by international collaborations also contribute significantly to market growth, as nations work toward restoring safe access to war-affected regions. Another key driver is the integration of artificial intelligence and sensor fusion into mine detection operations, enabling automated identification and mapping of threats. These advancements align with the broader military objective of enhancing operational safety, reducing risk exposure, and maintaining tactical advantage. Collectively, these factors ensure sustained demand and innovation within the defense mine detection market.

Regional Trends in Mine Detection Market:

Regional trends in the defense mine detection market are shaped by varying levels of conflict exposure, terrain challenges, and modernization priorities. Regions affected by past or ongoing conflicts continue to invest heavily in demining operations to restore safety and enable reconstruction. Military modernization programs across diverse geographies are driving demand for integrated mine detection systems capable of addressing both traditional and improvised explosive threats. In technologically advanced regions, defense agencies are focusing on developing and deploying next-generation detection platforms that combine automation, robotics, and AI-powered data analytics to achieve faster and more accurate results. Meanwhile, emerging defense markets are adopting cost-effective yet reliable systems to address border security and counter-insurgency requirements. Collaborative defense programs and international partnerships are promoting technology transfer and shared training to enhance regional capabilities. Maritime regions are expanding focus on underwater mine detection to protect naval routes and coastal infrastructure, integrating sonar and unmanned underwater vehicles for deep-sea surveillance. Landlocked nations, on the other hand, emphasize ground-based and vehicle-mounted systems for tactical field operations. Overall, regional dynamics highlight a global movement toward adopting advanced, adaptable, and interoperable mine detection technologies that ensure safety, mobility, and mission continuity in complex security environments.

Key Mine Detection Program:

Northrop Grumman Corporation (NYSE: NOC) has been awarded a contract by Korea Aerospace Industries, Ltd. (KAI) to supply Airborne Laser Mine Detection System (ALMDS) solutions and provide technical support during the Engineering, Manufacturing, and Design (EMD) phase of the Republic of Korea's Korean Mine Countermeasures Helicopter (KMCH) program. The EMD phase is scheduled for completion in 2027. The ALMDS enables untethered operations both day and night, achieving high-area search rates for efficient mine detection. In addition, it delivers precise target geo-location data to facilitate the subsequent neutralization of identified mines, enhancing the overall effectiveness of mine countermeasure operations.

.

Table of Contents

Mine Detection Market Report - Table of Contents

Mine Detection Market Report Definition

Mine Detection Market Segmentation

By Region

By Platform

By Type

Mine Detection Market Analysis for next 10 Years

The 10-year Mine Detection Market analysis would give a detailed overview of Mine Detection Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Mine Detection Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Mine Detection Market Forecast

The 10-year Mine Detection Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Mine Detection Market Trends & Forecast

The regional Mine Detection Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Mine Detection Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Mine Detection Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Mine Detection Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Mine Detection Market Forecast, 2025-2035

- Figure 2: Global Mine Detection Market Forecast, By Region, 2025-2035

- Figure 3: Global Mine Detection Market Forecast, By Platform, 2025-2035

- Figure 4: Global Mine Detection Market Forecast, By Type, 2025-2035

- Figure 5: North America, Mine Detection Market, Market Forecast, 2025-2035

- Figure 6: Europe, Mine Detection Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Mine Detection Market, Market Forecast, 2025-2035

- Figure 8: APAC, Mine Detection Market, Market Forecast, 2025-2035

- Figure 9: South America, Mine Detection Market, Market Forecast, 2025-2035

- Figure 10: United States, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 11: United States, Mine Detection Market, Market Forecast, 2025-2035

- Figure 12: Canada, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Mine Detection Market, Market Forecast, 2025-2035

- Figure 14: Italy, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Mine Detection Market, Market Forecast, 2025-2035

- Figure 16: France, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 17: France, Mine Detection Market, Market Forecast, 2025-2035

- Figure 18: Germany, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Mine Detection Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Mine Detection Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Mine Detection Market, Market Forecast, 2025-2035

- Figure 24: Spain, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Mine Detection Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Mine Detection Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Mine Detection Market, Market Forecast, 2025-2035

- Figure 30: Australia, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Mine Detection Market, Market Forecast, 2025-2035

- Figure 32: India, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 33: India, Mine Detection Market, Market Forecast, 2025-2035

- Figure 34: China, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 35: China, Mine Detection Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Mine Detection Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Mine Detection Market, Market Forecast, 2025-2035

- Figure 40: Japan, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Mine Detection Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Mine Detection Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Mine Detection Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Mine Detection Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Mine Detection Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Mine Detection Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Mine Detection Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Mine Detection Market, By Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Mine Detection Market, By Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Mine Detection Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Mine Detection Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Mine Detection Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Mine Detection Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Mine Detection Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Mine Detection Market, By Region, 2025-2035

- Figure 58: Scenario 1, Mine Detection Market, By Platform, 2025-2035

- Figure 59: Scenario 1, Mine Detection Market, By Type, 2025-2035

- Figure 60: Scenario 2, Mine Detection Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Mine Detection Market, By Region, 2025-2035

- Figure 62: Scenario 2, Mine Detection Market, By Platform, 2025-2035

- Figure 63: Scenario 2, Mine Detection Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Mine Detection Market, 2025-2035